Asia Pacific Depression Screening Market

Размер рынка в млрд долларов США

CAGR :

%

USD

747.72 Million

USD

1,673.01 Million

2024

2032

USD

747.72 Million

USD

1,673.01 Million

2024

2032

| 2025 –2032 | |

| USD 747.72 Million | |

| USD 1,673.01 Million | |

|

|

|

Asia-Pacific Depression Screening Market Segmentation, By Depression Type (Major Depressive Disorder (MDD), Persistent Depressive Disorder (PDD), and Others), Diagnosis (Screening and Lab Tests), End-User (Hospital, Specialty Clinics, Medical Research Centers, and Others) – Industry Trends and Forecast to 2031

Depression Screening Market Analysis

Asia-Pacific depression screening market is rapidly growing due to increased mental health awareness, expanding healthcare infrastructure, and supportive government policies. The rising prevalence of depression across the region, especially in countries such as Japan, China, and India, is driving demand for early detection and screening tools. Technological advancements, including telehealth and AI-driven screening tools, have enhanced access and scalability, allowing for more effective outreach, particularly in rural or underserved areas. Furthermore, mental health is receiving greater recognition within workplaces, educational institutions, and healthcare programs, spurring initiatives for routine depression screening and early intervention.

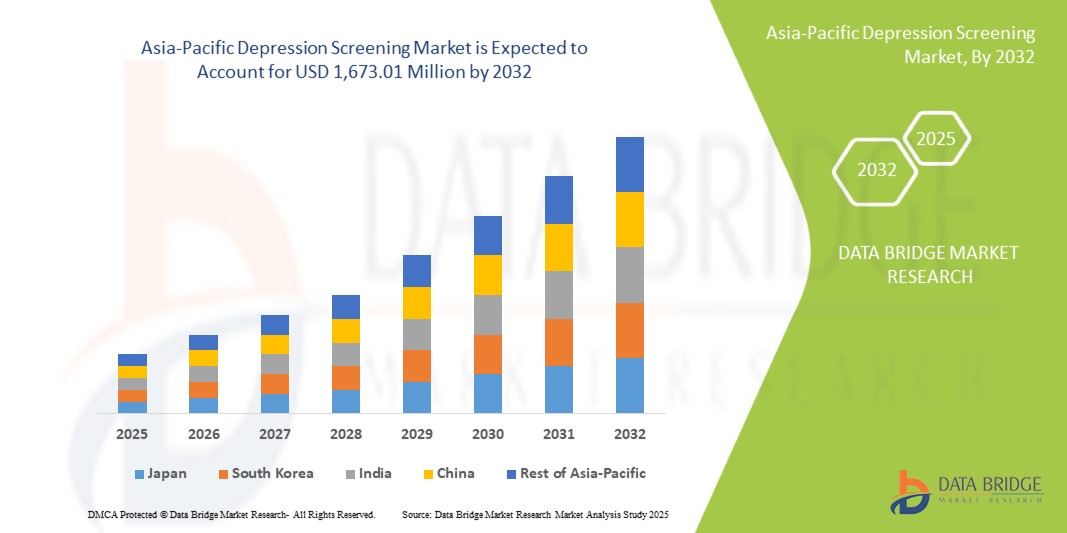

Depression Screening Market Size

Asia-Pacific depression screening market size was valued at USD 679.81 million in 2023 and is projected to reach USD 1,512.79 million by 2031, with a CAGR of 10.6% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Depression Screening Market Trends

“Rise in Focus on Integration of Digital and Mobile Health Screening Tools”

The prominent trend in the Asia-Pacific depression screening market is the growing integration of digital and mobile health screening tools to increase accessibility and early diagnosis. With the rising penetration of smartphones and internet access across the region, digital health platforms are offering mental health screening tools that make it easier for individuals to access resources without visiting a clinical setting. This trend is particularly relevant in countries where mental health stigma remains a barrier to seeking in-person care. By providing online questionnaires and self-assessment tools, digital platforms are empowering users to evaluate their mental health status confidentially and take the first step toward seeking professional help if needed. The convenience and privacy offered by digital screening tools are significantly expanding the reach of mental health services, especially among younger, tech-savvy populations.

Governments and healthcare organizations in countries such as Japan, China, and India are increasingly recognizing the potential of these tools and are partnering with digital health companies to support awareness campaigns and broaden mental health service delivery. The COVID-19 pandemic has further accelerated this shift, highlighting the importance of accessible mental health resources. Various mobile applications and telemedicine services have emerged, incorporating depression screening as a core feature. This trend not only aligns with the region’s digital health initiatives but also provides a scalable solution to address the growing mental health crisis, facilitating early intervention and potentially reducing the burden on healthcare systems.

Report Scope and Depression Screening Market Segmentation

|

Attributes |

Depression Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

China, Japan, India, South Korea, Australia, Indonesia, Thailand, Singapore, Taiwan, Malaysia, Vietnam, Philippines, and Rest of Asia-Pacific |

|

Key Market Players |

Koninklijke Philips N.V. (Netherlands), Apple Inc. (U.S.), Google (U.S.), Lifetrack Medical Systems (Singapore), Genetic Technologies Limited (Australia), Headspace Inc. (U.S.), Pankhtech India Private Limited (India), and Pearson (India) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Depression Screening Market Definition

Depression screening is a brief, standardized process used to identify individuals who may be experiencing symptoms of depression. It typically involves questionnaires or checklists, such as the PHQ-9, to assess mood, behavior, and emotional well-being, helping healthcare providers determine if further evaluation or treatment is needed.

Depression Screening Market Dynamics

Drivers

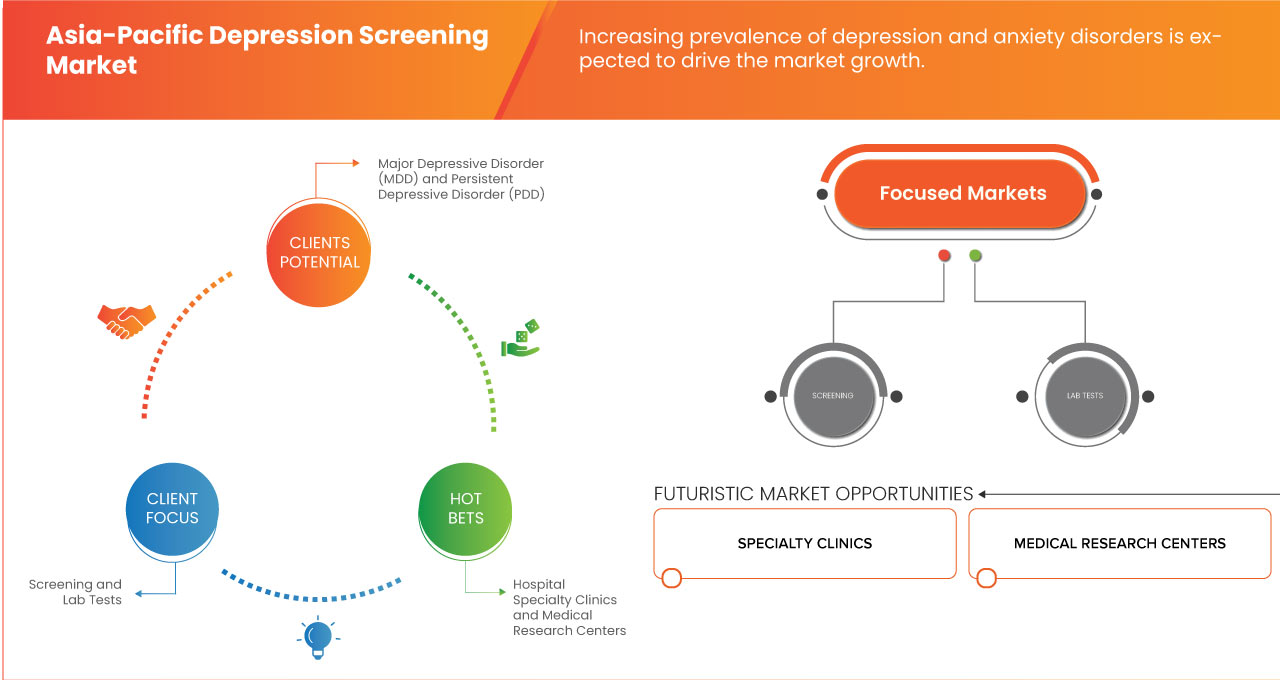

- Increasing Prevalence of Depression and Anxiety Disorders

The increasing prevalence of depression and anxiety disorders across the Asia-Pacific region is a significant driver for the depression screening market, as rising cases of mental health issues amplify the need for accessible and effective diagnostic solutions. Socioeconomic stressors, rapid urbanization, and the ongoing pressures of modernization are contributing factors to the growing incidence of these disorders. In addition, changing social dynamics and increased awareness about mental health encourage individuals to seek diagnosis and support, thus driving demand for depression screening services. Governments and healthcare organizations in countries such as Japan, South Korea, and India are recognizing the mental health crisis, integrating depression screening into public health initiatives and policies to support early intervention and treatment. With advancements in digital health technologies, screening has become more accessible via mobile applications, telehealth platforms, and online consultations, expanding reach even to remote or underserved areas. As a result, the depression screening market in Asia-Pacific is experiencing growth driven by both public health mandates and rising mental health literacy, addressing the increasing need for timely and effective depression diagnosis.

For instance,

В марте 2024 года, согласно статье, опубликованной в Nature, анализ «Бремя психических расстройств в странах Азии, 1990–2019» показывает, что психические расстройства заняли восьмое место среди основных причин бремени болезней в Азии, составив 5% от общего числа лет жизни с поправкой на инвалидность (DALY) в 2019 году. Депрессия и тревожные расстройства являются важными факторами, при этом депрессивные расстройства составляют 37,1% DALY психических расстройств, а тревожные расстройства — 21,5%. Эти расстройства также демонстрируют высокие показатели распространенности: тревожные расстройства — 3258,72 на 100 000 населения и депрессивные расстройства — 3196,16 на 100 000. Результаты указывают на острую необходимость в ресурсах в области психического здоровья и стратегиях вмешательства в Азии для решения растущего бремени этих состояний.

- Достижения в технологии скрининга депрессии

Достижения в области технологий скрининга депрессии в значительной степени стимулируют рынок скрининга депрессии в Азиатско-Тихоокеанском регионе за счет повышения точности, доступности и эффективности оценок психического здоровья. Такие инновации, как искусственный интеллект (ИИ) и алгоритмы машинного обучения, интегрируются в инструменты скрининга для более эффективного анализа данных пациентов, что позволяет ставить более быстрые и точные диагнозы. Более того, развитие цифровых платформ и мобильных приложений сделало скрининг более доступным, позволяя людям проводить оценки, не выходя из дома. Эти технологии могут охватить малообеспеченные слои населения в отдаленных районах, снижая барьеры для доступа и побуждая больше людей обращаться за помощью. Кроме того, все чаще используются услуги телемедицины, облегчающие виртуальные консультации, которые объединяют скрининг с профессиональной поддержкой, тем самым способствуя раннему вмешательству. Удобство сбора и анализа данных в реальном времени не только оптимизирует процесс скрининга, но и позволяет поставщикам медицинских услуг отслеживать прогресс пациента с течением времени. Поскольку эти технологические достижения продолжают развиваться, они играют решающую роль в преобразовании ландшафта скрининга депрессии в Азиатско-Тихоокеанском регионе, в конечном итоге улучшая результаты в области психического здоровья и увеличивая потенциал роста рынка.

Например,

В сентябре 2024 года, согласно статье, опубликованной JMIR Publications, достижения в технологии скрининга депрессии посредством применения больших языковых моделей (LLM). Это исследование подтверждает использование LLM для анализа записей в дневниках, созданных пользователями, демонстрируя их способность эффективно определять симптомы депрессии. Подход использует обработку естественного языка для интерпретации нюансов в текстовых данных, предоставляя новый масштабируемый метод цифрового скрининга психического здоровья. Предлагая более доступную и оперативную оценку депрессии, эта технология улучшает стратегии раннего выявления и вмешательства, в конечном итоге улучшая результаты в области психического здоровья. Эффективность ведущих LLM, таких как ChatGPT с GPT-3.5 и GPT-4, оценивалась с тонкой настройкой GPT-3.5 и без нее на обучающем наборе данных. Тонкая настройка GPT-3.5 продемонстрировала превосходную эффективность в обнаружении депрессии, достигнув точности 0,902 и специфичности 0,955.

Возможности

- Интеграция скрининга депрессии с первичной медико-санитарной помощью

Интеграция скрининга депрессии в обычную первичную медицинскую помощь представляет собой значительную возможность для рынка скрининга депрессии в Азиатско-Тихоокеанском регионе, преобразуя ландшафт психиатрической помощи в регионе. Встраивая оценки психического здоровья в регулярные медицинские осмотры, поставщики медицинских услуг улучшают раннее выявление и вмешательство, что имеет решающее значение для эффективного управления депрессией. Такой подход не только нормализует дискуссии о психическом здоровье, но и гарантирует, что люди получают комплексную помощь, которая касается как физического, так и эмоционального благополучия. Существующая сеть учреждений первичной медико-санитарной помощи обеспечивает доступную платформу для скрининга, охватывая различные группы населения, в том числе в отдаленных или недостаточно обслуживаемых районах. Поскольку системы здравоохранения все больше признают важность психического здоровья, сотрудничество между поставщиками первичной медико-санитарной помощи, специалистами по психическому здоровью и политиками становится необходимым. Эта синергия способствует созданию благоприятной среды для пациентов, побуждая их обращаться за помощью без стигматизации. Сосредоточение внимания на моделях интегрированной помощи в регионе еще больше усиливает эту возможность, позиционируя учреждения первичной медико-санитарной помощи как важные точки соприкосновения для улучшения результатов в области психического здоровья и расширения доступа к необходимым службам поддержки. В целом, эта интеграция открывает путь к более целостному подходу к здравоохранению, что в конечном итоге принесет пользу отдельным людям и сообществам во всем Азиатско-Тихоокеанском регионе.

Например,

Согласно статье, опубликованной NCBI, в сентябре 2021 года исследование с участием 5138 пациентов из 85 австралийских клиник общей практики показало, что у 1 из 16 пациентов были неопознанные или нелеченные симптомы депрессии или тревоги. Это подчеркивает критическую необходимость скрининга психического здоровья в первичной медицинской помощи, позиционируя его наряду с другими регулярно скрининговыми заболеваниями. Такие выводы представляют собой ценную возможность для интеграции скрининга депрессии на рынке Азиатско-Тихоокеанского региона, стимулируя рост и улучшение ухода.

- Растет популярность услуг телемедицины для удаленного скрининга депрессии

Растущее внедрение услуг телемедицины предлагает преобразующую возможность для рынка скрининга депрессии в Азиатско-Тихоокеанском регионе. Поскольку поставщики медицинских услуг внедряют технологии для улучшения предоставления психиатрической помощи, удаленный скрининг депрессии становится как практичным, так и необходимым. Этот сдвиг устраняет значительные барьеры, особенно для людей в отдаленных или недостаточно обслуживаемых районах, которые в противном случае могут не иметь доступа к ресурсам психического здоровья. С помощью телемедицины пациенты могут получать своевременные скрининги и поддержку, не выходя из дома, что снижает стигму, часто связанную с личными визитами. Кроме того, гибкость телемедицинских приемов позволяет лучше планировать прием, что облегчает людям поиск помощи в удобное для них время. Такая доступность имеет решающее значение для раннего выявления и вмешательства, которые жизненно важны для эффективного лечения психического здоровья. Кроме того, поскольку все больше систем здравоохранения интегрируют скрининг депрессии в платформы телемедицины, появляется возможность для инноваций в инструментах и методологиях скрининга, что повышает общую эффективность лечения. Компании, которые разрабатывают индивидуальные решения телемедицины, ориентированные на психическое здоровье, могут стратегически позиционировать себя на этом растущем рынке. Поскольку спрос на комплексные и доступные услуги в области психического здоровья продолжает расти, потенциал расширения рынка скрининга депрессии в Азиатско-Тихоокеанском регионе является значительным, что обещает улучшение результатов для сообществ по всему региону.

Например,

В ноябре 2023 года, согласно статье, опубликованной Science Direct, удаленная когнитивно-поведенческая терапия (КПТ), проводимая посредством видеоконференции, эффективно улучшает симптомы депрессии, достигая при этом высокой удовлетворенности пациентов и прочного терапевтического альянса. Эти результаты свидетельствуют о том, что удаленная КПТ является жизнеспособным вариантом в японских клинических условиях для лечения тяжелой депрессии, подчеркивая значительную возможность удаленного скрининга депрессии на рынке Азиатско-Тихоокеанского региона.

Ограничения/Проблемы

- Устойчивая стигма вокруг психического здоровья

Устойчивая стигма вокруг психического здоровья представляет собой значительную проблему для роста рынка скрининга депрессии в Азиатско-Тихоокеанском регионе. Несмотря на растущую осведомленность, многие люди продолжают сталкиваться с общественными предрассудками, которые отговаривают их от обращения за помощью. Эта стигма может привести к занижению данных о симптомах депрессии и нежеланию участвовать в программах скрининга, что в конечном итоге препятствует раннему выявлению и лечению. В культурах, где проблемы с психическим здоровьем часто воспринимаются как слабость, люди могут бояться осуждения или дискриминации, что влияет на их готовность взаимодействовать со службами психического здоровья. Кроме того, поставщики медицинских услуг также могут иметь предубеждения, которые влияют на их подход к диагностике и лечению депрессии, еще больше увековечивая цикл стигмы. Эта сложная среда может создавать барьеры для эффективной коммуникации между пациентами и поставщиками, ограничивая внедрение и эффективность инструментов и вмешательств скрининга. В результате устойчивая стигма вокруг психического здоровья остается серьезным препятствием для роста рынка в Азиатско-Тихоокеанском регионе.

Например,

В ноябре 2022 года, согласно статье, опубликованной Департаментом премьер-министра и кабинета министров Австралии, «По оценкам, более четырех миллионов австралийцев столкнулись со стигмой и дискриминацией, связанными с психическим здоровьем, за последний год. Эта всепроникающая стигма не только влияет на готовность людей обращаться за помощью, но и ограничивает эффективность инициатив по скринингу депрессии. Такое широко распространенное негативное отношение к психическому здоровью представляет собой значительную проблему для роста рынка скрининга депрессии в Азиатско-Тихоокеанском регионе».

- Обеспечение конфиденциальности и безопасности конфиденциальных данных о психическом здоровье

Обеспечение конфиденциальности и безопасности конфиденциальных данных о психическом здоровье представляет собой серьезную проблему для рынка скрининга депрессии в Азиатско-Тихоокеанском регионе. Поскольку услуги телемедицины и цифровые платформы становятся все более распространенными, объем собираемой и передаваемой личной медицинской информации существенно вырос. Этот рост влечет за собой повышенную обеспокоенность по поводу утечек данных и несанкционированного доступа, что может серьезно подорвать конфиденциальность данных пациентов и доверие к службам охраны психического здоровья. Во многих культурах региона, где стигма, окружающая психическое здоровье, остается постоянной проблемой, люди могут быть особенно неохотно раскрывать свою личную информацию, если они опасаются, что она может быть раскрыта или использована не по назначению. Такие опасения могут удерживать людей от участия в программах скрининга, в конечном итоге влияя на эффективность инициатив в области психического здоровья. Кроме того, возможность ненадлежащего использования данных усложняет соблюдение нормативных требований для поставщиков медицинских услуг, создавая дополнительные препятствия для внедрения эффективных мер скрининга. Переплетение проблем конфиденциальности и культурной стигмы не только создает риски для отдельных пациентов, но и может препятствовать общему росту рынка скрининга депрессии

Например,

В январе 2024 года, согласно статье, опубликованной Law.asia Limited, кибератаки на AIIMS Delhi, ведущее индийское учреждение здравоохранения, подчеркнули острую необходимость в сильных законах о конфиденциальности данных для защиты медицинской информации и содействия инновациям. В настоящее время в Индии нет всеобъемлющего закона, специально регулирующего обработку медицинских данных. Этот пробел в законодательстве создает значительные проблемы для защиты конфиденциальных данных о психическом здоровье, в конечном итоге влияя на рост рынка скрининга депрессии в Азиатско-Тихоокеанском регионе.

В этом отчете о рынке содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши приложений и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Сфера применения скрининга депрессии на рынке

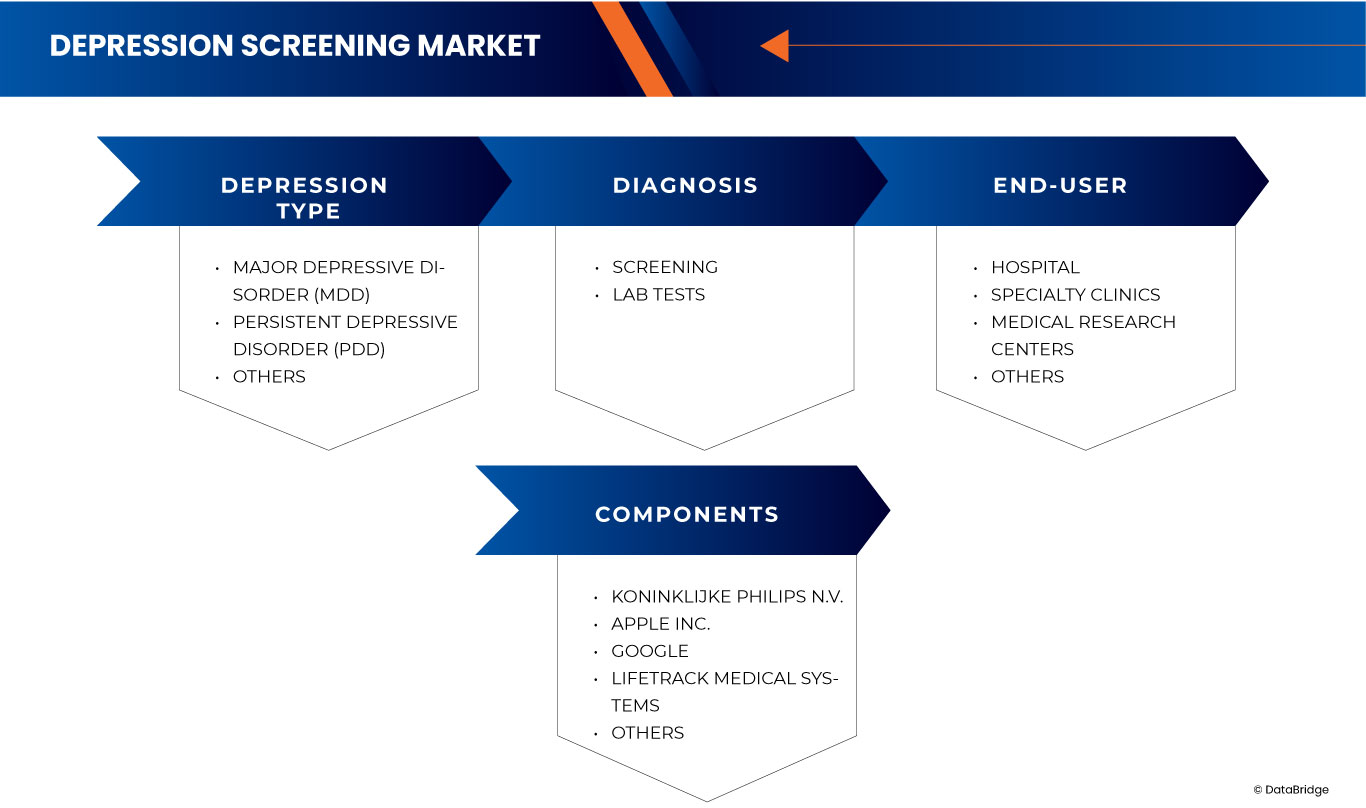

Рынок сегментирован на основе типа депрессии, диагноза и конечного пользователя. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип депрессии

- Большое депрессивное расстройство (БДР)

- Стойкое депрессивное расстройство (СДР)

- Другие

Диагноз

- Скрининг

- Клинический

- Телемедицинские платформы

- Инструменты оценки мозговых волн

- Другие

- Неклинические

- PHQ-9 (Опросник здоровья пациента-9)

- Опросник депрессии Бека (BDI)

- Психологический тест

- Шкала гериатрической депрессии (GDS)

- Клинический

- Лабораторные тесты

- Генетический тест

- Тест биомаркера

- Другие

Конечный пользователь

- Больница

- По типу

- Частный

- Публичный

- По размеру

- Крупные больницы

- Больницы среднего размера

- Больницы малого размера

- По типу

- Специализированные клиники

- Медицинские исследовательские центры

- Другие

Региональный анализ рынка скрининга депрессии

Проводится анализ рынка и предоставляются сведения о его размерах и тенденциях по странам, типу депрессии, диагнозу и конечному пользователю, как указано выше.

Страны, охваченные рынком: Китай, Япония, Индия, Южная Корея, Австралия, Индонезия, Таиланд, Сингапур, Тайвань, Малайзия, Вьетнам, Филиппины и остальные страны Азиатско-Тихоокеанского региона.

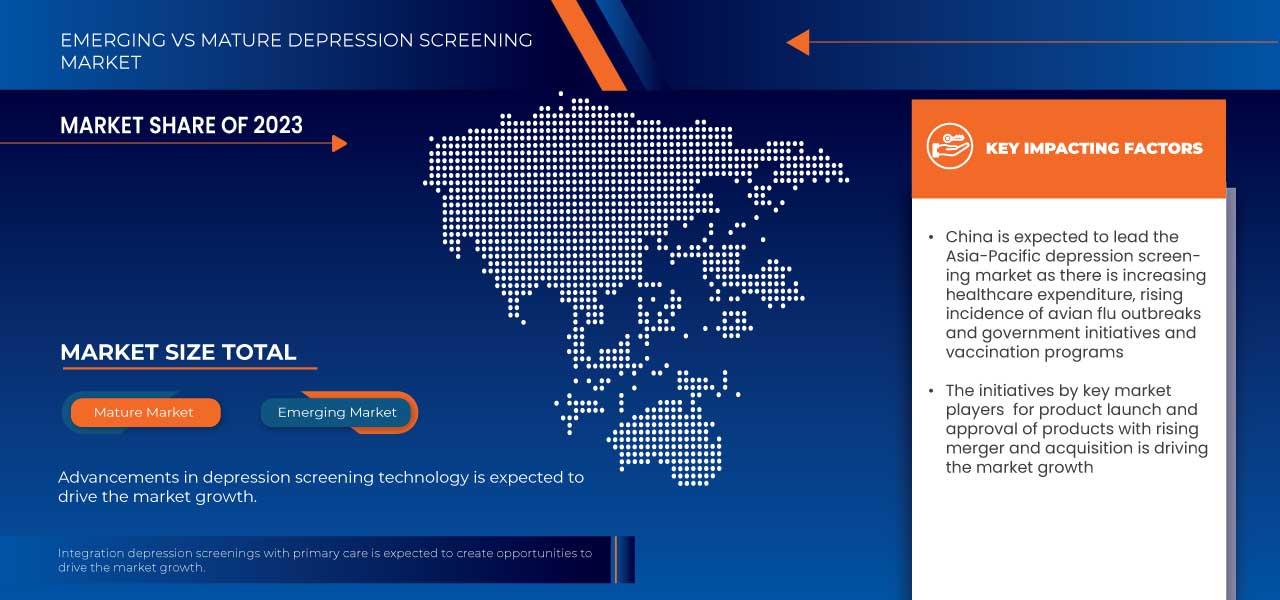

Ожидается, что Китай будет доминировать на рынке из-за большой численности населения, растущей распространенности психических расстройств и растущих государственных инициатив, направленных на повышение осведомленности о психическом здоровье и доступа к услугам скрининга.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования — вот некоторые из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Азиатско-Тихоокеанского региона и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Доля рынка скрининга депрессии

Конкурентная среда рынка содержит сведения о конкурентах. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Азиатско-Тихоокеанском регионе, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование приложений. Приведенные выше данные относятся только к фокусу компаний на рынке.

Лидерами рынка скрининга депрессии, работающими на рынке, являются:

- Конинклийке Philips NV (Нидерланды)

- Apple Inc. (США)

- Google (США)

- Lifetrack Medical Systems (Сингапур)

- Genetic Technologies Limited (Австралия)

- Headspace Inc. (США)

- Pankhtech India Private Limited (Индия)

- Пирсон (Индия)

Последние разработки на рынке скрининга депрессии в Азиатско-Тихоокеанском регионе

- В ноябре 2023 года Koninklijke Philips NV и NYU Langone Health объединились для внедрения передовых решений в области медицинских технологий, направленных на повышение безопасности пациентов, качества и результатов на протяжении многих лет. Это сотрудничество позволит Philips продемонстрировать свои инновационные технологии в известных медицинских учреждениях, что может привести к повышению узнаваемости, авторитетности и расширению рынка в секторе здравоохранения.

- В мае 2021 года Headspace Inc. предлагает бесплатную годовую подписку медицинским работникам в Индии в условиях кризиса COVID-19. Эта инициатива направлена на борьбу со стрессом и выгоранием путем предоставления доступа к инструментам осознанности и направляемым медитациям, поддерживающим психическое благополучие работников на передовой

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.