Asia Pacific Compressed Natural Gas Cng Market

Размер рынка в млрд долларов США

CAGR :

%

USD

41.10 Billion

USD

55.47 Billion

2024

2032

USD

41.10 Billion

USD

55.47 Billion

2024

2032

| 2025 –2032 | |

| USD 41.10 Billion | |

| USD 55.47 Billion | |

|

|

|

|

Сегментация рынка сжатого природного газа (СПГ) в Азиатско-Тихоокеанском регионе по источнику (попутный и свободный газ), комплектам (последовательные и Вентури), типу распределения (баллоны/резервуары, аккумуляторы, композитные коллекторы и другие), конечному использованию (легковые автомобили, средние автомобили и тяжелые автомобили) — тенденции отрасли и прогноз до 2032 года

Размер рынка сжатого природного газа в Азиатско-Тихоокеанском регионе

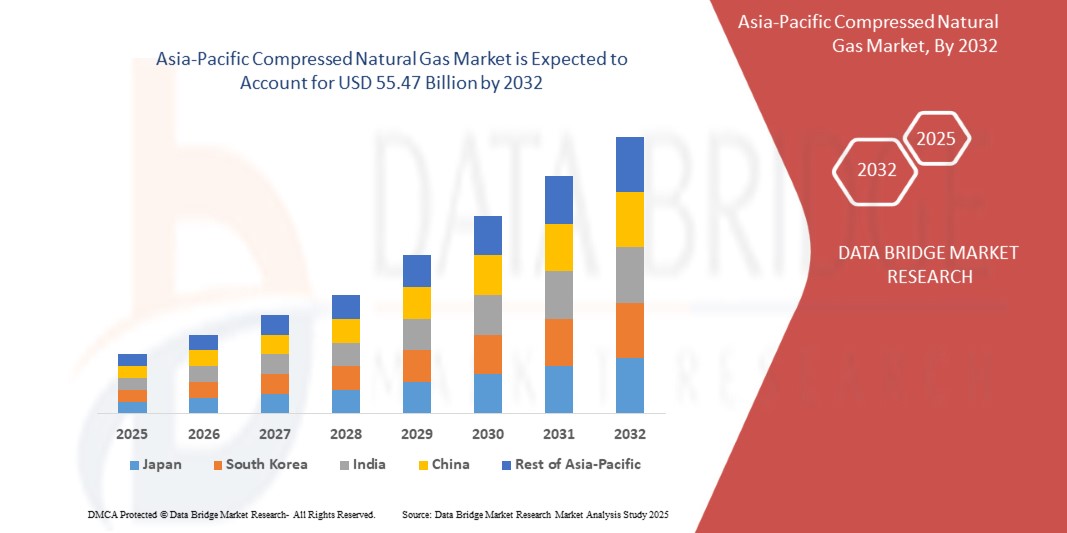

- Объем рынка сжатого природного газа (СПГ) в Азиатско-Тихоокеанском регионе оценивался в 41,1 млрд долларов США в 2024 году и, по прогнозам, достигнет 55,47 млрд долларов США к 2032 году , что соответствует среднегодовому темпу роста в 3,8% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен быстрой урбанизацией, растущим спросом на экологически чистое транспортное топливо и государственными инициативами по сокращению выбросов парниковых газов. Такие страны, как Китай, Индия и Пакистан, лидируют в области внедрения сжатого природного газа благодаря мощной политической поддержке и растущему автопарку.

- Кроме того, рост стоимости традиционных видов топлива, таких как бензин и дизельное топливо, побудил как отдельных потребителей, так и операторов автопарков переходить на сжатый природный газ как более экономичную и экологически чистую альтернативу.

- В совокупности эти факторы позиционируют сжатый природный газ как ключевой вид топлива для перехода к чистой энергетике в Азиатско-Тихоокеанском регионе, особенно в транспортном секторе, где спрос на доступные и устойчивые решения для мобильности продолжает расти.

Анализ рынка сжатого природного газа в Азиатско-Тихоокеанском регионе

- Рынок сжатого природного газа в Азиатско-Тихоокеанском регионе демонстрирует уверенный рост благодаря сильной зависимости региона от автомобильного транспорта, а также поддерживаемым правительством инициативам в области чистого топлива и финансовым стимулам для потребителей и производителей.

- Китай и Индия совместно доминируют на региональном рынке, осуществляя масштабные инвестиции в распределительные сети сжатого природного газа, программы переоборудования транспортных средств и политику, предписывающую использование чистого топлива в парках общественного транспорта.

- Растущее распространение легковых автомобилей (LMV), работающих на сжатом природном газе, таких как легковые автомобили и трехколесные транспортные средства, является ключевым фактором роста, поддерживаемым доступностью, низкими эксплуатационными расходами и расширением сети заправочных станций.

- Индия является самым быстрорастущим рынком, где, по прогнозам, спрос на сжатый природный газ вырастет на 8,9% (2025–2032 гг.), чему способствуют быстрое расширение инфраструктуры заправок, субсидии на транспортные средства, работающие на КПГ, и растущий спрос со стороны легковых и коммерческих автопарков.

- В 2024 году Китай будет доминировать на рынке сжатого природного газа Азиатско-Тихоокеанского региона, оцениваемом в 13,6 млрд долларов США, благодаря своим огромным запасам природного газа, его широкому внедрению в общественном транспорте и поддерживаемой государством политике сокращения выбросов.

- Сегмент природного газа доминировал на рынке в 2024 году, занимая самую большую долю выручки, чему способствовали огромные запасы в таких странах, как Китай, Индия и Индонезия.

Область применения отчета и сегментация рынка сжатого природного газа в Азиатско-Тихоокеанском регионе

|

Атрибуты |

Ключевые данные о рынке сжатого природного газа в Азиатско-Тихоокеанском регионе |

|

Охваченные сегменты |

|

|

Страны действия |

Азиатско-Тихоокеанский регион

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо рыночной стоимости, темпов роста, сегментации, регионального охвата и основных игроков, отчет включает в себя углубленный экспертный анализ, анализ ценообразования и затрат, моделей потребительского спроса, политическую и нормативную базу, тенденции внедрения технологий, информацию о цепочке поставок и цепочке создания стоимости, а также анализ пяти сил PESTLE & Porter. |

Тенденции рынка сжатого природного газа в Азиатско-Тихоокеанском регионе

Растущее использование транспортных средств на КПГ обусловлено инициативами по использованию чистой энергии

- Важной тенденцией на рынке сжатого природного газа в Азиатско-Тихоокеанском регионе является растущее внедрение транспортных средств, работающих на сжатом природном газе, чему способствуют правительственные инициативы в области чистой энергии, более строгие нормы выбросов и растущие преимущества в стоимости топлива по сравнению с бензином и дизельным топливом.

- Например, Индия и Китай быстро расширяют свои сети заправочных станций сжатым природным газом, при этом индийские компании GAIL и Indraprastha Gas Limited активно инвестируют в развитие городских и автомагистральных коридоров. Аналогичным образом, китайские CNPC и Sinopec расширяют инфраструктуру сжатого природного газа, чтобы соответствовать целям по сокращению выбросов углерода.

- Автопроизводители выпускают больше автомобилей, совместимых с компримированным природным газом, в лёгких, средних и тяжёлых классах, чтобы удовлетворить растущий спрос, особенно в городских парках общественного транспорта и секторах коммерческой логистики. Такие компании, как Maruti Suzuki в Индии и Hyundai в Южной Корее, расширяют свои портфели автомобилей с компримированным природным газом.

- Экологические преимущества, такие как снижение выбросов парниковых газов и уменьшение количества твердых частиц, пользуются значительной поддержкой со стороны регулирующих органов, что делает сжатый природный газ предпочтительным переходным видом топлива в энергетическом переходе в Азиатско-Тихоокеанском регионе.

- Кроме того, доступность сжатого природного газа по сравнению с традиционными видами топлива стимулирует спрос среди потребителей и предприятий, чувствительных к цене. Субсидии, налоговые льготы и стимулы для операторов автопарков дополнительно ускоряют внедрение.

- Растущее внимание к устойчивому транспорту, подкрепленное технологическими достижениями в области последовательных комплектов сжатого природного газа и систем хранения большой емкости, меняет потребительские предпочтения и способствует масштабному развертыванию по всему региону.

Динамика рынка сжатого природного газа в Азиатско-Тихоокеанском регионе

Водитель

Государственные стимулы и расширение инфраструктуры способствуют внедрению КПГ

- Рынок компримированного природного газа в Азиатско-Тихоокеанском регионе в значительной степени обусловлен мощной государственной поддержкой в виде субсидий, стимулов и благоприятных мер, направленных на снижение зависимости от традиционных ископаемых видов топлива и сокращение выбросов углерода. Такие страны, как Индия, Китай и Пакистан, активно инвестируют в инфраструктуру заправок компримированным природным газом, делая его более доступным для потребителей и операторов автопарков.

- Например, проекты расширения Национальной газовой сети Индии и городского газораспределения (CGD) способствуют широкому внедрению сжатого природного газа как в легковых, так и в грузовых автомобилях. Аналогичным образом, Китай отдаёт приоритет природному газу в рамках своего перехода к чистой энергетике, подкреплённого масштабными инвестициями в трубопроводы и инфраструктуру хранения.

- Доступность сжатого природного газа по сравнению с бензином и дизельным топливом — ещё один важный фактор. В условиях роста мировых цен на сырую нефть потребители, чувствительные к расходам, и операторы коммерческих автопарков всё чаще переходят на автомобили, работающие на сжатом природном газе, чтобы снизить эксплуатационные расходы.

- Более того, снижение углеродного следа сжатого природного газа соответствует глобальным и региональным климатическим целям. Экологические преимущества, включая снижение выбросов парниковых газов и твердых частиц, стимулируют его внедрение в общественном транспорте, логистике и личном транспорте.

- Технологические достижения в области последовательных комплектов для сжатого природного газа, хранения в композитных баллонах и двухтопливных системах еще больше повышают производительность и безопасность, повышая доверие потребителей и распространение на рынке Азиатско-Тихоокеанского региона.

Сдержанность/Вызов

Пробелы в инфраструктуре и высокие первоначальные затраты на преобразование

- Несмотря на высокие перспективы роста, рынок компримированного природного газа в Азиатско-Тихоокеанском регионе сталкивается с трудностями из-за неразвитой инфраструктуры в ряде развивающихся стран. В то время как в крупных городах наблюдается быстрый рост числа заправочных станций с компримированным природным газом, доступ к ним в сельской местности и пригородах по-прежнему ограничен, что препятствует широкому внедрению.

- Например, высокие первоначальные затраты на переоборудование автомобилей для работы на сжатом природном газе также являются сдерживающим фактором, особенно на рынках, чувствительных к цене. Для многих потребителей долгосрочная экономия на топливе сводится на нет значительными первоначальными инвестициями, необходимыми для переоборудования.

- Проблемы безопасности, связанные с хранением и обращением с баллонами со сжатым природным газом, остаются проблемой в некоторых регионах. Несмотря на то, что технологические достижения снизили риски, общественное мнение и недостаточная осведомлённость продолжают влиять на сомнения потребителей.

- Кроме того, колебания цен на природный газ и неопределенность в цепочке поставок могут повлиять на его доступность и доступность, ограничивая потенциал рынка. Страны, сильно зависящие от импорта природного газа, сталкиваются с рисками волатильности, что может препятствовать реализации долгосрочных стратегий внедрения.

- Преодоление этих проблем требует скоординированных усилий правительств и заинтересованных сторон отрасли по расширению инфраструктуры, предоставлению субсидий на модернизацию и инвестированию в информационные кампании, подчеркивающие как экономию средств, так и экологические преимущества сжатого природного газа.

Объем рынка сжатого природного газа в Азиатско-Тихоокеанском регионе

Рынок сегментирован по признаку источника, комплектов, типа распространения и конечного использования.

• По источнику

В зависимости от источника поставки, рынок компримированного природного газа Азиатско-Тихоокеанского региона сегментируется на попутный газ, свободный газ и газ из нетрадиционных источников. Сегмент свободного газа доминировал на рынке в 2024 году, занимая наибольшую долю выручки, чему способствовали огромные запасы в таких странах, как Китай, Индия и Индонезия. Обширные объёмы добычи в сочетании с государственной политикой, направленной на максимальное использование внутренних запасов, сделали свободный газ основным источником поставок КПГ в регионе.

Ожидается, что сегмент нетрадиционных источников будет демонстрировать самые быстрые темпы роста в период с 2025 по 2032 год, чему будет способствовать увеличение инвестиций в проекты по добыче сланцевого газа и метана угольных пластов, особенно в Китае и Австралии. Развитие технологий добычи, а также растущий спрос на диверсифицированные источники природного газа ускоряют внедрение нетрадиционного газа для производства КПГ.

• По комплектам

По типу комплектов рынок сжатого природного газа (КПГ) в Азиатско-Тихоокеанском регионе сегментируется на комплекты, устанавливаемые производителями оригинального оборудования (OEM), и комплекты для модернизации. Сегмент комплектов, устанавливаемых производителями оригинального оборудования (OEM), обеспечил наибольшую долю выручки в 2024 году благодаря растущему использованию автомобилей с заводской установкой КПГ, предлагаемых ведущими автопроизводителями, такими как Maruti Suzuki, Hyundai и Toyota. Растущий спрос потребителей на надежные решения с гарантией укрепил доминирование этого сегмента.

Ожидается, что сегмент комплектов для модернизации будет демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год, чему будут способствовать повышение доступности, большой объём существующих бензиновых автомобилей и высокий спрос в развивающихся странах, таких как Индия, Пакистан и Бангладеш. Комплекты для модернизации становятся экономически выгодным решением для индивидуальных владельцев и операторов автопарков, особенно на рынках с высокой волатильностью цен на топливо.

• По типу распространения

По принципу распределения рынок компримированного природного газа в Азиатско-Тихоокеанском регионе сегментируется на трубопроводное распределение и каскадную доставку/доставку автотранспортом. Сегмент трубопроводного распределения доминировал на рынке в 2024 году, занимая наибольшую долю благодаря значительным инвестициям в газопроводные сети в Китае, Индии и Австралии. Наличие трубопроводов обеспечивает надежное и экономичное снабжение городских заправочных станций, способствуя масштабному внедрению КПГ.

Прогнозируется, что сегмент каскадных систем/доставки грузовым транспортом будет расти самыми быстрыми темпами в период с 2025 по 2032 год, что обусловлено ростом спроса в отдаленных и сельских районах, где трубопроводная инфраструктура остается недостаточно развитой. Расширение использования мобильных каскадных систем и виртуальных трубопроводов устраняет инфраструктурные пробелы, делая сжатый природный газ более доступным для регионов с недостаточным уровнем обслуживания.

• По конечному использованию

По принципу конечного использования рынок компримированного природного газа в Азиатско-Тихоокеанском регионе сегментируется на транспорт, промышленность и электроэнергетику. В 2024 году транспортный сегмент доминировал на рынке, занимая более 70% от общей доли рынка, что обусловлено масштабным внедрением компримированного природного газа в легковых автомобилях, такси, автобусах и логистических автопарках. Эффективные государственные стимулы, программы по снижению загрязнения городской среды и растущее понимание важности экономии средств укрепили позиции транспорта как ведущего сектора конечного потребления.

Ожидается, что сектор электроэнергетики будет демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год, особенно в Пакистане и Бангладеш, где правительства активно продвигают производство электроэнергии на основе природного газа. Растущий спрос на чистые, надежные и доступные источники энергии в сочетании с усилиями по снижению зависимости от импортного топлива ускоряют переход на КПГ в энергетическом секторе.

Региональный анализ рынка сжатого природного газа в Азиатско-Тихоокеанском регионе

- Азиатско-Тихоокеанский регион доминировал на мировом рынке сжатого природного газа с наибольшей долей выручки, превышающей 55% в 2024 году, чему способствовал высокий спрос на альтернативные виды топлива в транспорте и промышленности, а также активные государственные инициативы по сокращению выбросов углерода.

- Обширные запасы природного газа в регионе, быстрое расширение инфраструктуры заправки сжатым природным газом и широкомасштабное внедрение сжатого природного газа в общественном транспорте и логистических парках ускоряют проникновение на рынок.

- Рост урбанизации, экономическая эффективность сжатого природного газа по сравнению с традиционными видами топлива, а также поддерживающая политика, такая как субсидии и налоговые льготы, способствуют значительному росту потребления в ключевых экономиках, включая Китай, Индию, Пакистан и Таиланд.

- Рост инвестиций в проекты по биокомпрессированному природному газу и возобновляемому природному газу в сочетании с присутствием крупных игроков отрасли и быстро растущим автопарком еще больше укрепляют доминирующее положение Азиатско-Тихоокеанского региона на мировом рынке компримированного природного газа.

Обзор рынка сжатого природного газа в Китае

Китай занимает значительную долю рынка компримированного природного газа Азиатско-Тихоокеанского региона, оцениваемую в 13,6 млрд долларов США, что обусловлено его активной позицией в сокращении выбросов углерода и зависимостью от импорта нефти. Крупные секторы логистики и общественного транспорта страны лидируют в плане внедрения компримированного природного газа: автобусы, такси и грузовики всё чаще используют природный газ. Региональные власти стимулируют переоборудование автопарков, а отечественные производители наращивают производство транспортных средств и инфраструктуру заправки. Более того, инвестиции Китая в передовые системы хранения и распределения компримированного природного газа в сочетании с обширными внутренними ресурсами природного газа обеспечивают стабильные поставки и конкурентоспособные цены.

Обзор рынка сжатого природного газа в Индии

Индия является одним из крупнейших и наиболее быстрорастущих рынков сжатого природного газа в Азиатско-Тихоокеанском регионе со среднегодовым темпом роста 8,9%. Твердая приверженность правительства расширению чистой мобильности, включая субсидии для транспортных средств на сжатом природном газе и быстрое развертывание коридоров для заправки сжатым природным газом, стимулирует расширение рынка. Рост уровня загрязнения воздуха в городах и рост цен на топливо также подталкивают как потребителей, так и операторов автопарков к использованию доступных альтернатив сжатому природному газу. Отечественные автопроизводители, такие как Maruti Suzuki, Tata Motors и Hyundai, расширяют свои портфели сжатого природного газа, устанавливаемого на заводе, что делает внедрение сжатого природного газа более массовым. Индийский рынок выигрывает от постоянного развития трубопроводной инфраструктуры и расширения партнерских отношений между государственными и частными игроками для удовлетворения растущего спроса.

Обзор рынка сжатого природного газа в Японии

Рынок сжатого природного газа в Японии, хотя и меньше по сравнению с Индией и Китаем, постепенно растёт благодаря акценту страны на устойчивое развитие и сокращение выбросов парниковых газов. Правительство Японии поощряет внедрение альтернативных видов топлива наряду с водородом и электромобилями. Внедрение КПГ особенно активно в некоторых коммерческих автопарках, таких как муниципальный транспорт и логистика. Передовые технологии баллонов, системы безопасности и интеграция с интеллектуальными системами заправки характеризуют японский рынок, отражая его инновационный подход.

Обзор рынка сжатого природного газа в Южной Корее

Южная Корея зарекомендовала себя как активный участник рынка КПГ в Азиатско-Тихоокеанском регионе, особенно в секторе общественного транспорта. Правительство продвигает использование автобусов и такси, работающих на сжатом природном газе, для решения проблем с качеством воздуха в городах. Местные производители, включая Hyundai и Kia, расширяют ассортимент автомобилей, работающих на сжатом природном газе, что способствует их внедрению в стране. Южная Корея также выигрывает от высокой готовности инфраструктуры и доверия потребителей к экологически чистым транспортным решениям.

Доля рынка сжатого природного газа в Азиатско-Тихоокеанском регионе

В Азиатско-Тихоокеанской отрасли сжатого природного газа лидируют в основном хорошо зарекомендовавшие себя компании, в том числе:

- Индрапрастха Газ Лимитед (Индия)

- GAIL (Индия) Limited (Индия)

- Китайская национальная нефтяная корпорация (Китай)

- Sinopec (Китай)

- PTT Public Company Limited (Таиланд)

- Tokyo Gas Co., Ltd. (Япония)

- SK E&S (Южная Корея)

- ENN Energy Holdings Limited (Китай)

- Петронас (Малайзия)

- Osaka Gas Co., Ltd. (Япония)

Последние события на рынке сжатого природного газа в Азиатско-Тихоокеанском регионе

- В марте 2024 года компания Indraprastha Gas Limited (Индия) объявила о строительстве более 150 новых заправочных станций сжатого природного газа (КПГ) в ключевых городах Индии для удовлетворения растущего спроса со стороны легковых и коммерческих автомобилей. Эта инициатива соответствует цели Индии по увеличению проникновения КПГ по всей стране.

- В январе 2024 года Китайская национальная нефтегазовая корпорация (CNPC) модернизировала свой крупный заправочный центр сжатого природного газа (КПГ) в Пекине для обслуживания большегрузных автомобилей. Это расширение является частью более широкой стратегии диверсификации энергетики Китая и его обязательства по сокращению выбросов в транспортном секторе.

- В декабре 2023 года компания PT Pertamina (Индонезия) запустила государственно-частное партнёрство, направленное на создание современных хранилищ и распределительных станций для сжатого природного газа (КПГ). Этот проект призван расширить его применение в логистических автопарках и снизить зависимость от импортного топлива.

- В октябре 2023 года Корейская газовая корпорация (KOGAS) заключила партнерское соглашение с Hyundai Motor Group по развитию инфраструктуры КПГ для общественных автобусов и муниципальных автопарков. Сотрудничество направлено на внедрение более безопасных композитных баллонов и систем заправки нового поколения.

- В сентябре 2023 года компания Tokyo Gas Co., Ltd. (Япония) запустила пилотную программу по созданию интеллектуальных АГНКС, оснащенных цифровыми платежными системами и мониторингом в режиме реального времени для повышения удобства и безопасности потребителей.

- В августе 2023 года компания PTT Public Company Limited (Таиланд) объявила об инвестициях в строительство новых заправочных станций сжатого природного газа (КПГ) в Бангкоке и близлежащих регионах, ориентируясь на более широкое внедрение в таксомоторные парки и парки совместных поездок.

- В июле 2023 года Филиппинская национальная нефтяная компания (PNOC) объявила о стратегическом плане по созданию коридоров для автобусов на сжатом природном газе в Манильском метрополитене в рамках усилий по решению проблем ухудшения качества городского воздуха и роста цен на дизельное топливо.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.