Asia Pacific Biologics Market

Размер рынка в млрд долларов США

CAGR :

%

USD

73.52 Billion

USD

175.63 Billion

2024

2032

USD

73.52 Billion

USD

175.63 Billion

2024

2032

| 2025 –2032 | |

| USD 73.52 Billion | |

| USD 175.63 Billion | |

|

|

|

|

Сегментация рынка биологических препаратов в Азиатско-Тихоокеанском регионе по классу (ингибиторы фактора некроза опухоли-Α (ФНО), ингибиторы В-клеток, ингибиторы интерлейкина, селективные модуляторы костимуляции (абатацепт) и другие), типу (моноклональные антитела (МАТ), терапевтические белки, вакцины, клеточные биопрепараты, генные биопрепараты и другие), способу введения (инъекции и инфузии), применению (онкология, аутоиммунные заболевания, диабет, инфекционные заболевания, сердечно-сосудистые заболевания, офтальмологические состояния, дерматологические заболевания и другие), исходному материалу (люди, культура клеток птиц, дрожжи, бактерии, культура клеток насекомых, трансгеника и другие), конечному потребителю (больницы, специализированные клиники, учебные заведения и научно-исследовательские институты и другие), каналу сбыта (прямой тендер, Розничные продажи и дистрибуция третьими лицами: тенденции отрасли и прогноз до 2032 года

Размер рынка биопрепаратов в Азиатско-Тихоокеанском регионе

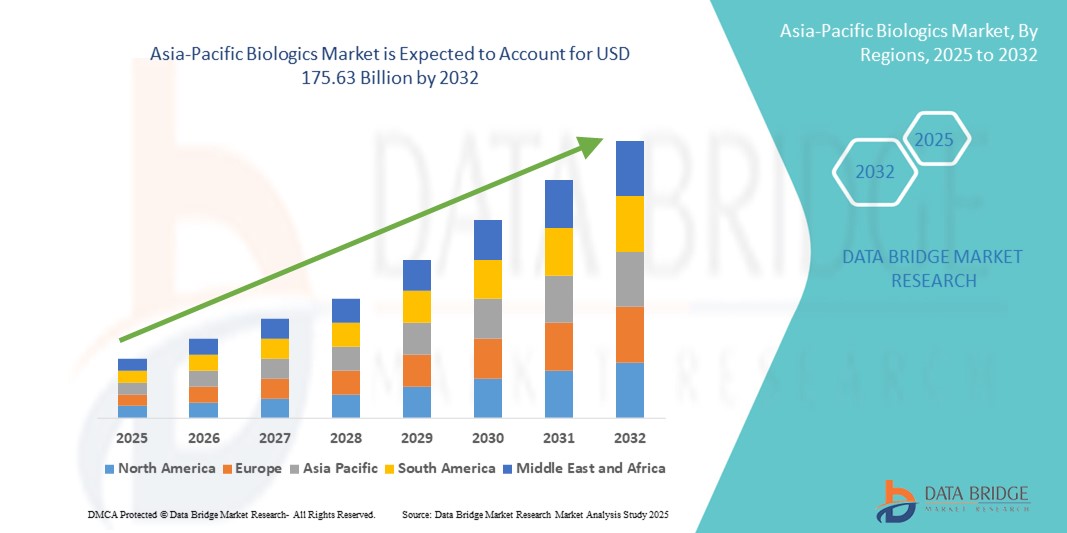

- Объем рынка биологических препаратов в Азиатско-Тихоокеанском регионе оценивался в 73,52 млрд долларов США в 2024 году и, как ожидается , достигнет 175,63 млрд долларов США к 2032 году при среднегодовом темпе роста 11,5% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен увеличением инвестиций в биофармацевтические исследования, ростом распространенности хронических заболеваний и расширением инфраструктуры здравоохранения в развивающихся экономиках региона.

- Кроме того, растущая государственная поддержка биотехнологий , растущее внедрение персонализированной медицины и технологические достижения в разработке биологических препаратов способствуют быстрому расширению рынка биологических препаратов в Азиатско-Тихоокеанском регионе. В совокупности эти факторы повышают доступность и популярность биологических методов лечения, тем самым ускоряя рост рынка.

Анализ рынка биологических препаратов в Азиатско-Тихоокеанском регионе

- Биопрепараты, включающие сложные лекарственные средства, полученные из живых клеток для лечения хронических и редких заболеваний, становятся важнейшим компонентом сектора здравоохранения Азиатско-Тихоокеанского региона благодаря быстрому развитию биотехнологий и растущему спросу на таргетную терапию.

- Рост распространенности хронических заболеваний, расширение инфраструктуры здравоохранения и увеличение расходов на здравоохранение в странах с развивающейся экономикой обуславливают высокий спрос на биологические препараты в регионе.

- Китай доминировал на рынке биологических препаратов Азиатско-Тихоокеанского региона с долей выручки в 39,2% в 2024 году, чему способствовали активные государственные инициативы, расширение базы пациентов и рост внедрения как инновационных биологических препаратов, так и биоаналогов.

- Ожидается, что Индия станет самой быстрорастущей страной на рынке биологических препаратов Азиатско-Тихоокеанского региона в течение прогнозируемого периода благодаря активизации клинических исследований, улучшению нормативно-правовой среды и росту возможностей производства биофармацевтических препаратов.

- Сегмент моноклональных антител доминировал на рынке биологических препаратов Азиатско-Тихоокеанского региона с долей 46,1% в 2024 году, что обусловлено широким применением в онкологии, аутоиммунных заболеваниях и постоянными инновациями, направленными на повышение эффективности и безопасности лечения.

Область применения отчета и сегментация рынка биологических препаратов в Азиатско-Тихоокеанском регионе

|

Атрибуты |

Ключевые данные о рынке биологических препаратов в Азиатско-Тихоокеанском регионе |

|

Охваченные сегменты |

|

|

Страны действия |

Азиатско-Тихоокеанский регион

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка биопрепаратов в Азиатско-Тихоокеанском регионе

Быстрое расширение, обусловленное биотехнологическими инновациями и персонализированной медициной

- Заметной и быстрорастущей тенденцией на рынке биологических препаратов Азиатско-Тихоокеанского региона является всплеск биотехнологических инноваций в сочетании с растущим внедрением персонализированных медицинских подходов, учитывающих генетические и молекулярные профили пациентов.

- Например, такие компании, как Biocon (Индия) и Shanghai Fosun Pharmaceutical, разрабатывают биоаналоги и новые биологические препараты, предназначенные для лечения рака, аутоиммунных заболеваний и редких расстройств, повышая доступность и эффективность лечения во всем регионе.

- Достижения в области клеточной и генной терапии, поддерживаемые улучшением производственных возможностей и сотрудничеством между местными биотехнологическими компаниями и глобальными фармацевтическими компаниями, стимулируют развитие инновационных разработок и расширяют портфели биологических препаратов.

- Регулирующие органы Азиатско-Тихоокеанского региона, включая PMDA (Япония) и NMPA (Китай), оптимизируют процессы утверждения биологических препаратов и биоаналогов, способствуя более быстрому выходу на рынок и внедрению.

- Эта тенденция к прецизионной терапии и передовым биологическим препаратам меняет модели ухода за пациентами, увеличивая их интеграцию в национальные программы здравоохранения и схемы возмещения расходов на страхование, особенно в Китае, Японии и Южной Корее.

- Спрос на передовые биологические методы лечения стремительно растет благодаря их превосходным показателям безопасности и эффективности по сравнению с традиционными низкомолекулярными препаратами, что способствует активному расширению рынка как в развитых, так и в развивающихся странах Азиатско-Тихоокеанского региона.

Динамика рынка биопрепаратов в Азиатско-Тихоокеанском регионе

Водитель

Рост бремени хронических заболеваний и расширение инфраструктуры здравоохранения

- Растущая распространенность хронических заболеваний, таких как рак, диабет и аутоиммунные заболевания, в Азиатско-Тихоокеанском регионе в сочетании с расширением инфраструктуры здравоохранения и повышением уровня диагностики заболеваний является ключевым фактором роста рынка биологических препаратов.

- Например, в марте 2024 года компания Samsung Biologics объявила о значительном расширении производственных мощностей в Южной Корее с целью удовлетворения растущего спроса на услуги по производству биофармацевтической продукции, что подчеркивает приверженность отрасли потребностям рынка.

- Повышение осведомленности пациентов и улучшение доступа к здравоохранению ускорили внедрение биологических методов лечения, чему способствовали правительственные инициативы и улучшения в страховании в таких странах, как Китай и Индия.

- Более того, инвестиции в НИОКР и производство как со стороны местных, так и многонациональных компаний повышают доступность и финансовую доступность биологических методов лечения, способствуя проникновению на рынок.

- Растущее сотрудничество и партнерство между биотехнологическими компаниями Азиатско-Тихоокеанского региона и глобальными фармацевтическими компаниями ускоряют инновации, передачу технологий и коммерциализацию биологических препаратов в регионе.

- Расширение рынков биоаналогов создает экономически эффективные альтернативы брендовым биологическим препаратам, тем самым повышая доступность лечения и стимулируя общий рост рынка.

Сдержанность/Вызов

Высокие затраты на лечение и сложная нормативно-правовая среда

- Относительно высокая стоимость биологических методов лечения остается существенным препятствием для их широкого внедрения на чувствительных к цене рынках Азиатско-Тихоокеанского региона, ограничивая доступность для пациентов с низким уровнем дохода.

- Например, несмотря на то, что биоаналоги обеспечивают экономию средств, строгие и разнообразные нормативные требования в разных странах создают задержки и увеличивают затраты на соблюдение требований при выходе на рынок.

- Различия в защите прав интеллектуальной собственности и отсутствие гармонизированных правил создают дополнительные проблемы для производителей и препятствуют более быстрому доступу к биоаналогам.

- Кроме того, логистические сложности при хранении и распределении биологических препаратов, особенно в сельских или слаборазвитых районах, влияют на непрерывность и масштабируемость лечения.

- Нехватка квалифицированной рабочей силы и неадекватная инфраструктура в некоторых развивающихся странах Азиатско-Тихоокеанского региона замедляют клинические испытания и масштабирование производства биологических препаратов.

- Опасения по поводу иммуногенности и долгосрочной безопасности новых биологических продуктов также способствуют осторожному их принятию среди поставщиков медицинских услуг и пациентов.

Охват рынка биопрепаратов в Азиатско-Тихоокеанском регионе

Рынок сегментирован по классу, типу, способу введения, применению, исходному материалу, конечному пользователю и каналу сбыта.

- По классу

По классу препаратов рынок биологических препаратов Азиатско-Тихоокеанского региона сегментирован на ингибиторы фактора некроза опухоли-α (ФНО), ингибиторы В-клеток, ингибиторы интерлейкинов, селективные модуляторы костимуляции (абатацепт) и другие. Сегмент ингибиторов фактора некроза опухоли-α (ФНО) доминировал на рынке с наибольшей долей выручки в 37,5% в 2024 году, главным образом благодаря его прочно зарекомендовавшей себя роли в лечении аутоиммунных заболеваний, таких как ревматоидный артрит и воспалительные заболевания кишечника. Этот сегмент пользуется большим спросом в клинической практике и хорошо знаком врачам.

Напротив, ожидается, что сегмент ингибиторов интерлейкина продемонстрирует самые быстрые темпы среднегодового роста на уровне 22,3% в период с 2025 по 2032 год, что будет обусловлено расширением терапевтических показаний при дерматологических заболеваниях, таких как псориаз и другие аутоиммунные заболевания, а также постоянными инновациями и разрешениями регулирующих органов.

- По типу

По типу рынок биологических препаратов Азиатско-Тихоокеанского региона сегментируется на моноклональные антитела (мАТ), терапевтические белки, вакцины, клеточные биопрепараты, генные биопрепараты и другие. Сегмент моноклональных антител доминировал на рынке с долей 46,1% в 2024 году, что объясняется их широким спектром применения в онкологии и аутоиммунных заболеваниях, а также постоянными технологическими усовершенствованиями, повышающими специфичность и безопасность.

Между тем, ожидается, что сегмент клеточных биопрепаратов продемонстрирует самые быстрые темпы роста — среднегодовой темп роста составит 23,1%. За ним следуют генные биопрепараты, рост которых составит 24,5%. Оба этих фактора обусловлены прорывами в генной терапии и персонализированной медицине, а также ростом числа одобрений клинических испытаний в Азиатско-Тихоокеанском регионе.

- По способу введения

По способу введения рынок биологических препаратов Азиатско-Тихоокеанского региона сегментируется на инъекционные и инфузионные. Сегмент инъекционных препаратов доминировал с долей выручки 62,8% в 2024 году, что обусловлено удобством и возможностью амбулаторного лечения и самостоятельного введения, особенно при хронических заболеваниях.

Сегмент инфузий, хотя и меньше, по прогнозам, будет стабильно расти в течение прогнозируемого периода, поскольку он по-прежнему имеет решающее значение для введения в условиях стационара сложных биологических препаратов, таких как химиотерапия и иммунотерапия, требующих контролируемой доставки, особенно при онкологических и аутоиммунных показаниях.

- По применению

По областям применения рынок биологических препаратов Азиатско-Тихоокеанского региона сегментирован на следующие направления: онкология, аутоиммунные заболевания, диабет, инфекционные заболевания, сердечно-сосудистые заболевания, офтальмологические заболевания, дерматологические заболевания и другие. В 2024 году онкология занимала лидирующие позиции на рынке, занимая 39,7% выручки. Это обусловлено ростом заболеваемости раком и доступностью таргетных биологических препаратов, предназначенных для лечения различных типов опухолей.

Ожидается, что сегмент аутоиммунных заболеваний продемонстрирует самые высокие темпы роста — среднегодовой темп роста составит 21,4% в течение прогнозируемого периода, что обусловлено ростом показателей диагностики заболеваний и растущим предпочтением биологических препаратов по сравнению с традиционными методами лечения из-за более высоких профилей эффективности и безопасности.

- По исходному материалу

По типу исходного материала рынок биологических препаратов Азиатско-Тихоокеанского региона сегментирован на следующие группы: препараты человека, культуры клеток птиц, дрожжи, бактерии, культуры клеток насекомых, трансгенные препараты и другие. В 2024 году биопрепараты человеческого происхождения доминировали на рынке, занимая 41,3% рынка. Они пользуются спросом благодаря доказанной безопасности и совместимости с физиологией человека.

Ожидается, что дрожжевые и бактериальные системы экспрессии продемонстрируют самые высокие темпы роста при среднегодовом темпе роста 19,8% и 18,5% соответственно в течение прогнозируемого периода, что обусловлено их экономической эффективностью и масштабируемостью при производстве биоаналогов и новых биологических препаратов на развивающихся рынках Азиатско-Тихоокеанского региона.

- Конечный пользователь

По типу конечного потребителя рынок биологических препаратов Азиатско-Тихоокеанского региона сегментирован на больницы, специализированные клиники, академические и исследовательские институты и другие организации. Больницы занимали лидирующие позиции, на их долю пришлось 52,1% выручки в 2024 году, что обусловлено их ролью основных центров применения сложных биологических препаратов и проведения клинических испытаний.

Прогнозируется, что специализированные клиники продемонстрируют самые быстрые темпы роста — среднегодовой темп роста составит 20,3% в течение прогнозируемого периода, что обусловлено повышением доступности биологических препаратов в амбулаторных условиях и растущим предпочтением пациентов удобным вариантам лечения.

- По каналу распространения

По каналам сбыта рынок биологических препаратов Азиатско-Тихоокеанского региона сегментирован на прямые торги, розничные продажи и дистрибуцию через сторонних поставщиков. Прямые торги доминировали на рынке с долей 48,6% в 2024 году, чему способствовали оптовые закупки государственными и частными больницами, обеспечивающие стабильные поставки биологических препаратов.

Ожидается, что розничные продажи покажут самый быстрый среднегодовой темп роста в 18,7% в прогнозируемый период, чему будут способствовать расширение аптечных сетей, рост самостоятельного приема лекарств пациентами и повышение осведомленности. Дистрибуция через сторонних дистрибьюторов остается критически важной для проникновения в отдаленные и слабообеспеченные регионы, способствуя более широкому охвату рынка.

Региональный анализ рынка биопрепаратов в Азиатско-Тихоокеанском регионе

- Китай доминировал на рынке биологических препаратов Азиатско-Тихоокеанского региона с долей выручки в 39,2% в 2024 году, чему способствовали активные государственные инициативы, расширение базы пациентов и рост внедрения как инновационных биологических препаратов, так и биоаналогов.

- Страна получает выгоду от политики поддержки, стимулирующей производство биофармацевтических препаратов, ускорения процесса получения разрешений регулирующих органов и растущего внедрения инновационных биологических препаратов и биоаналогов.

- Рост распространенности хронических заболеваний, увеличение расходов на здравоохранение и расширение клинических исследований в Китае еще больше ускоряют рост рынка, делая страну региональным лидером в разработке и потреблении биологических препаратов.

Обзор рынка биологических препаратов в Китае

Китайский рынок биопрепаратов доминировал на рынке Азиатско-Тихоокеанского региона, достигнув 42,5% выручки в 2024 году благодаря активным государственным инициативам, стимулирующим биотехнологические инновации, упрощению процесса получения разрешений регулирующих органов и увеличению расходов на здравоохранение. Растущая база пациентов в стране и растущий спрос на экономически эффективные биоаналоги вносят значительный вклад в рост рынка. Китай также становится центром производства биопрепаратов, привлекая как местные, так и международные компании к расширению возможностей в области исследований, разработок и производства.

Обзор рынка биологических препаратов в Японии

Рынок биологических препаратов в Японии стабильно растёт благодаря развитой системе здравоохранения, высоким инвестициям в НИОКР и старению населения, что приводит к повышению спроса на биологические препараты для лечения хронических и возрастных заболеваний. Страна получает выгоду от надёжной нормативно-правовой поддержки и раннего внедрения инновационных биологических препаратов, включая клеточную и генную терапию. Интеграция биологических препаратов в национальные системы медицинского страхования облегчает доступ пациентов к ним, способствуя устойчивому расширению рынка.

Обзор рынка биологических препаратов в Южной Корее

Южнокорейский рынок биопрепаратов стремительно превращается в ключевого игрока на рынке биопрепаратов Азиатско-Тихоокеанского региона благодаря мощной государственной поддержке, значительным инвестициям в НИОКР и растущему сектору производства биофармацевтической продукции. Страна уделяет большое внимание разработке инновационных биопрепаратов и биоаналогов, увеличивая число клинических испытаний и одобрений. Развитая инфраструктура и квалифицированная рабочая сила Южной Кореи укрепляют её конкурентоспособность, способствуя росту рынка как на внутреннем, так и на экспортных рынках.

Обзор рынка биологических препаратов в Индии

Индийский рынок биопрепаратов занимает значительную долю на рынке биопрепаратов Азиатско-Тихоокеанского региона, что обусловлено большой численностью населения, ростом среднего класса и ростом расходов на здравоохранение. Рынок выигрывает от увеличения производства биоаналогов отечественными компаниями, что улучшает доступ к биологическим препаратам по более доступным ценам. Государственные инициативы, стимулирующие стартапы в области биотехнологий и развитие инфраструктуры, стимулируют инновации и коммерциализацию новых биопрепаратов, что дополнительно ускоряет рост рынка.

Обзор рынка биологических препаратов в Австралии

Рынок биологических препаратов в Австралии стабильно растёт благодаря развитой инфраструктуре здравоохранения и растущим инвестициям в биофармацевтические исследования. Рост заболеваемости хроническими заболеваниями и повышение осведомлённости пациентов о передовых методах лечения способствуют их внедрению. Нормативно-правовая база страны развивается, способствуя ускорению процесса регистрации биоаналогов и новых биологических препаратов, что способствует росту рынка как в государственном, так и в частном секторе здравоохранения.

Доля рынка биологических препаратов в Азиатско-Тихоокеанском регионе

В Азиатско-Тихоокеанской биологической отрасли лидируют в основном хорошо зарекомендовавшие себя компании, в том числе:

- Biocon Limited (Индия)

- Samsung Biologics (Южная Корея)

- Celltrion, Inc. (Южная Корея)

- Takeda Pharmaceutical Company Limited (Япония)

- АстраЗенека (Великобритания)

- Fujifilm Diosynth Biotechnologies (Япония)

- Wuxi Biologics (Китай)

- GenScript Biotech Corporation (Китай)

- Zhejiang Hisun Pharmaceutical Co., Ltd. (Китай)

- Suzhou Hengrui Pharmaceuticals Co., Ltd. (Китай)

- Лаборатории доктора Редди (Индия)

- LG Chem Life Sciences (Южная Корея)

- Лилли (США)

- Chugai Pharmaceutical Co., Ltd. (Япония)

- Jubilant Life Sciences Limited (Индия)

- Harbin Pharmaceutical Group Co., Ltd. (Китай)

- Mabpharm Inc. (Южная Корея)

- Hualan Biological Engineering Inc. (Китай)

- Шанхайская фармацевтическая группа Фосун (Китай)

- Sino Biopharmaceutical Limited (Китай)

Каковы последние события на рынке биологических препаратов в Азиатско-Тихоокеанском регионе?

- В августе 2025 года Индия одобрила подкожную версию противоракового препарата атезолизумаб компании Roche, выпускаемого под торговой маркой Tecentriq. Этот новый метод позволяет сократить время введения препарата до семи минут, предлагая более удобную альтернативу традиционным внутривенным инфузиям. Одобрение было выдано техническим комитетом, курирующим клинические испытания новых химических соединений. Однако оно зависит от завершения испытаний IV фазы в Индии, которые обычно оценивают эффективность и безопасность препарата после его выхода на рынок.

- В августе 2025 года компания Biocon Biologics объявила о планах сосредоточиться на терапии для снижения веса на основе GLP-1 как на ключевом направлении будущего роста. Компания видит значительный потенциал в растущем рынке терапии на основе GLP-1, которая привлекает внимание во всем мире благодаря своей эффективности в контроле веса. Этот стратегический поворот предполагает, что Biocon следует новым тенденциям в здравоохранении и лечении ожирения, диверсифицируя и расширяя свой портфель продуктов.

- В августе 2025 года компания Agilent Technologies открыла новый биофармацевтический опытный центр в Хайдарабаде, Индия. Центр призван ускорить разработку жизненно важных лекарственных средств, предлагая передовые технологии в области хроматографии, масс-спектрометрии, клеточного анализа и лабораторной информатики. Его цель – способствовать сотрудничеству между промышленностью и научным сообществом, моделировать реальные лабораторные условия и способствовать ускорению исследований и разработок с соблюдением международных нормативных стандартов.

- В июле 2025 года Южная Корея объявила о планах инвестировать 100 миллиардов вон в течение следующих 3–5 лет в развитие разработки лекарственных препаратов на основе ИИ. Эта инициатива направлена на ускорение открытия и разработки новых биологических методов лечения, что позволит Южной Корее занять лидирующие позиции в области инновационных биофармацевтических исследований.

- В июле 2025 года компания Aragen объявила о планах начать производство в соответствии с надлежащей производственной практикой (GMP) на своем биологическом предприятии в Бангалоре. На предприятии будет использоваться интенсифицированная платформа периодического производства с подпиткой и производительностью более 25 г/л. Этот шаг направлен на обеспечение гибкого производства с использованием одноразовых биореакторов объёмом 2000 л и интегрированных возможностей для последующего этапа производства, что позволит быстро масштабировать производство или выполнять проекты с участием нескольких клиентов, удовлетворяя растущий мировой спрос на биопрепараты.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.