Asia Pacific Biodegradable Paper Plastic Packaging Market

Размер рынка в млрд долларов США

CAGR :

%

USD

1.14 Billion

USD

2.66 Billion

2024

2032

USD

1.14 Billion

USD

2.66 Billion

2024

2032

| 2025 –2032 | |

| USD 1.14 Billion | |

| USD 2.66 Billion | |

|

|

|

|

Сегментация рынка биоразлагаемой бумажной и пластиковой упаковки в Азиатско-Тихоокеанском регионе по типу (пластик и бумага), материалу (пластик и бумага), конечному пользователю (упаковка, продукты питания и напитки, товары для общественного питания, средства личной гигиены и домашнего хозяйства, здравоохранение и другие) — тенденции отрасли и прогноз до 2032 года

Объем рынка биоразлагаемой бумажной и пластиковой упаковки

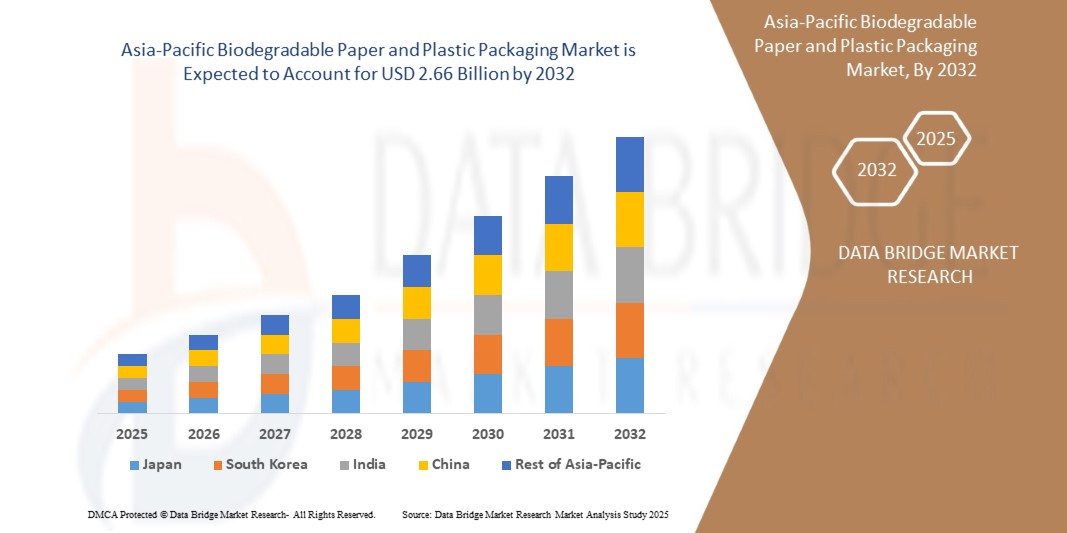

- Объем рынка биоразлагаемой бумажной и пластиковой упаковки в Азиатско-Тихоокеанском регионе оценивается в 1,14 млрд долларов США в 2024 году и, как ожидается, достигнет 2,66 млрд долларов США к 2032 году при среднегодовом темпе роста 11,2% в прогнозируемый период .

- Рост рынка во многом обусловлен повышением осведомленности о материалах с меньшим выбросом углерода.

- Кроме того, ожидается, что рост урбанизации в Индии и Китае, который повышает спрос на биоразлагаемую бумажную и пластиковую упаковку среди потребителей, будет способствовать дальнейшему росту рынка биоразлагаемой бумажной и пластиковой упаковки.

Анализ рынка биоразлагаемой бумажной и пластиковой упаковки

- Растущий спрос в индустрии средств личной гигиены, а также доступность сырья для производства биоразлагаемой бумажной и пластиковой упаковки являются движущей силой рынка биоразлагаемой бумажной и пластиковой упаковки.

- Китай доминирует на рынке биоразлагаемой бумажной и пластиковой упаковки с самой большой долей выручки в 42,1% в 2024 году. Для страны характерна жесткая государственная политика, направленная на сокращение пластиковых отходов и продвижение альтернатив на биологической основе.

- Ожидается, что Индия станет самым быстрорастущим регионом на рынке биоразлагаемой бумажной и пластиковой упаковки в течение прогнозируемого периода из-за быстрой урбанизации, бурно развивающегося сектора товаров повседневного спроса и усиления внимания со стороны регулирующих органов к одноразовому пластику.

- Ожидается, что сегмент пластика будет доминировать на рынке биоразлагаемой бумажной и пластиковой упаковки с долей рынка 54,2% в 2024 году, что обусловлено его универсальностью, простотой обработки и применением в различных форматах упаковки, таких как пакеты.

Объем отчета и сегментация рынка биоразлагаемой бумажной и пластиковой упаковки

|

Атрибуты |

Основные сведения о рынке композитных материалов из стекловолокна |

|

Охваченные сегменты |

|

|

Страны, охваченные |

Азиатско-Тихоокеанский регион

|

|

Ключевые игроки рынка |

|

|

Возможности рынка |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка биоразлагаемой бумажной и пластиковой упаковки

« Интеграция технологий интеллектуальной упаковки для повышения устойчивости и прослеживаемости »

- Важной тенденцией на рынке биоразлагаемой упаковки в Азиатско-Тихоокеанском регионе является внедрение технологий интеллектуальной упаковки, включая RFID, QR-коды и датчики Интернета вещей, для улучшения прослеживаемости и устойчивости продукции.

- Например, компании в Китае все чаще внедряют решения для интеллектуальной упаковки с поддержкой RFID в логистике, повышая эффективность цепочки поставок и взаимодействие с потребителями.

- В Южной Корее интеграция технологий NFC и IoT в упаковочные решения набирает обороты, чему способствуют передовая технологическая инфраструктура страны и инновационно-ориентированный отраслевой ландшафт.

- Внедрение интеллектуальной упаковки соответствует растущему спросу на прозрачность и эффективность в цепочках поставок, особенно в таких секторах, как электронная коммерция, продукты питания и здравоохранение.

Динамика рынка биоразлагаемой бумажной и пластиковой упаковки

Водитель

«Растущий спрос со стороны электронной коммерции и индустрии упаковки пищевых продуктов»

- Экспоненциальный рост электронной коммерции и индустрии упаковки пищевых продуктов в Азиатско-Тихоокеанском регионе является основным драйвером рынка биоразлагаемой бумажной и пластиковой упаковки.

- Интернет-магазины и поставщики услуг общественного питания инвестируют в экологически чистые и экономически эффективные упаковочные решения, чтобы соответствовать предпочтениям потребителей и нормативным требованиям.

- Потребность в эффективной, защитной и экологичной упаковке в электронной коммерции и службах доставки продуктов питания привела к росту спроса на биоразлагаемые материалы.

- Эта тенденция дополнительно подкрепляется растущим вниманием к экологической устойчивости, что приводит к повышению спроса на варианты упаковки, поддающиеся вторичной переработке и компостированию.

Сдержанность/Вызов

« Ограниченная доступность сырья и инфраструктуры для биоразлагаемой упаковки »

- Ограниченная доступность сырья, в частности сельскохозяйственного сырья, например кукурузы и сахарного тростника, представляет собой серьезную проблему для рынка.

- Эти материалы могут быть ограничены конкурирующим спросом на производство продуктов питания или биотоплива, что повлияет на бесперебойность поставок для производства упаковки.

- Кроме того, отсутствие надлежащей инфраструктуры, например промышленных предприятий по компостированию, во многих регионах препятствует эффективному разложению биоразлагаемых материалов.

- Этот инфраструктурный пробел в сочетании с потенциальным загрязнением потоков переработки при смешивании биоразлагаемых пластиков с обычными пластиками создает неопределенность для производителей и потребителей.

Объем рынка биоразлагаемой бумажной и пластиковой упаковки

Рынок сегментирован по типу, материалу и конечному пользователю.

- По типу

На основе типа рынок биоразлагаемой бумажной и пластиковой упаковки Азиатско-Тихоокеанского региона сегментируется на пластик и бумагу. Пластиковый сегмент доминирует в самой большой доле выручки рынка в 54,2% в 2025 году, что обусловлено его универсальностью, простотой обработки и применения в различных форматах упаковки, таких как пакеты, пленки и контейнеры. Биоразлагаемые пластики, такие как PLA, PHA и PBS, набирают обороты благодаря своей компостируемости, производительности и растущему внедрению в секторах FMCG и доставки продуктов питания. Правительственные запреты на одноразовый пластик еще больше стимулируют спрос.

Ожидается, что сегмент бумаги продемонстрирует самые высокие темпы роста в 8,7% с 2025 по 2032 год, что будет обусловлено растущим экологическим сознанием и предпочтением потребителей возобновляемых, перерабатываемых материалов. Биоразлагаемая упаковка на основе бумаги пользуется популярностью из-за низкого углеродного следа и возможности вторичной переработки, особенно в сухих продуктах питания, средствах личной гигиены и розничной торговле. Расширение электронной коммерции и зеленой розничной торговли также стимулирует спрос.

- По материалу

На основе материала рынок сегментирован на пластик и бумагу. Пластиковый сегмент занимал самую большую долю рынка выручки в 2025 году благодаря широкому использованию биополимеров, таких как PLA и крахмальные смеси. Эти материалы обеспечивают паритет производительности с обычными пластиками, поддерживая при этом экологические цели. Их использование в гибких и жестких упаковочных решениях делает их подходящими для различных применений в розничной торговле, личной гигиене и промышленной упаковке.

Сегмент бумаги, как ожидается, будет демонстрировать самые быстрые темпы среднегодового роста с 2025 по 2032 год, что обусловлено растущим спросом на альтернативы на основе волокон и внедрением требований по замене пластика в странах Азиатско-Тихоокеанского региона. Бумажные материалы обладают высокой пригодностью для печати и биоразлагаемостью, что делает их идеальными для инициатив по устойчивому брендингу и экомаркировке.

- Конечным пользователем

На основе конечного пользователя рынок биоразлагаемой бумажной и пластиковой упаковки Азиатско-Тихоокеанского региона сегментируется на упаковку, продукты питания и напитки, кейтеринговые принадлежности, средства личной гигиены и ухода за домом, здравоохранение и другие. Сегмент продуктов питания и напитков занимает самую большую долю рынка в 42,1% в 2025 году, что обусловлено спросом на устойчивую упаковку в фастфуде, готовых к употреблению блюдах и напитках. Бренды внедряют биоразлагаемые форматы, чтобы соответствовать зеленому потреблению и снизить зависимость от пластика.

Ожидается, что сегмент здравоохранения продемонстрирует самые высокие темпы роста в 9,8% с 2025 по 2032 год, что обусловлено усилением контроля со стороны регулирующих органов за утилизацией отходов и потребностью в безопасных одноразовых биоразлагаемых материалах. Применение в фармацевтических блистерных упаковках, медицинских лотках и диагностических наборах способствует быстрому внедрению в региональных секторах здравоохранения.

Региональный анализ рынка биоразлагаемой бумажной и пластиковой упаковки

- Китай доминирует на рынке биоразлагаемой бумажной и пластиковой упаковки с самой большой долей выручки в 42,1% в 2024 году, что обусловлено жесткой государственной политикой, направленной на сокращение пластиковых отходов и продвижение альтернатив на биологической основе.

- Ключевыми факторами роста являются расширение производственных мощностей и повышение осведомленности потребителей об устойчивой упаковке.

Обзор рынка биоразлагаемой бумажной и пластиковой упаковки в Индии

Рынок биоразлагаемой бумажной и пластиковой упаковки в Индии растет быстрыми темпами с самым высоким среднегодовым темпом роста в 6,7%, что обусловлено быстрой урбанизацией, бурно развивающимся сектором FMCG и повышенным вниманием к одноразовому пластику со стороны регулирующих органов. Правительственные правила управления пластиковыми отходами 2023 года ускоряют внедрение биоразлагаемой упаковки.

Обзор рынка биоразлагаемой бумажной и пластиковой упаковки в Японии

Рынок биоразлагаемой бумажной и пластиковой упаковки в Японии, как ожидается, будет расширяться со значительным среднегодовым темпом роста в течение прогнозируемого периода, в первую очередь за счет потребительского предпочтения экологичной упаковки и сильных корпоративных обязательств по устойчивому развитию. Технологические достижения в области формул биоразлагаемых материалов и государственные стимулы способствуют более широкому использованию устойчивых упаковочных решений.

Доля рынка биоразлагаемой бумажной и пластиковой упаковки

Отрасль производства композитных материалов из стеклопластика в основном представлена хорошо зарекомендовавшими себя компаниями, среди которых:

- SmartSolve Industries (Индия)

- STOROPACK HANS REICHENECKER GMBH (Германия)

- Shanghai Disoxidation Enterprise Development Co. Ltd (Китай)

- Stora Enso (Финляндия)

- Tekpak Solutions (Индия)

- International Paper (США)

- Штаб-квартира Be Green Packaging (Индия)

- Hsing Chung Paper Ltd. (Тайвань)

- Ecoware (Индия)

Последние разработки на рынке биоразлагаемой бумажной и пластиковой упаковки в Азиатско-Тихоокеанском регионе

- В октябре 2024 года австралийский стартап Earthodic привлек $6 млн начального финансирования для продвижения своего инновационного перерабатываемого защитного покрытия для бумажной и картонной упаковки. Покрытие, изготовленное из лигнина — побочного продукта целлюлозно-бумажной промышленности — укрепляет коробки и делает их водонепроницаемыми, предлагая экологичную альтернативу неперерабатываемым покрытиям. Финансирование пойдет на создание штаб-квартиры в США и дальнейшие исследования и разработки, включая сертификацию FDA для термосвариваемых кофейных стаканчиков.

- В 2024 году компания Nestlé инициировала пилотную программу в Австралии, внедрив перерабатываемую бумажную упаковку для своих упаковок KitKat Four-Finger весом 45 г. Этот эксперимент, проводимый исключительно с супермаркетами Coles в Западной Австралии, Южной Австралии и Северной территории, направлен на получение отзывов общественности для усовершенствования упаковки. Несмотря на включение тонкой металлической барьерной пленки для сохранения свежести шоколада, эта инициатива знаменует собой значительный шаг в стремлении Nestlé сократить использование первичного пластика на треть к 2025 году

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.