Азиатско-Тихоокеанский рынок автомобильных DC-DC-преобразователей по типу продукта (изолированные, неизолированные), входному напряжению (ниже 40 В, 40 В - 70 В, выше 70 В), выходному напряжению (10,1 В - 15 В, 5 В и ниже, 5,1 В - 10 В, 15,1 В - 20 В, выше 20 В), выходной мощности (0,25 Вт - 250 Вт, 251 Вт - 500 Вт, 501 Вт - 1000 Вт, выше 1000 Вт), типу тяги (гибридный и подключаемый гибридный электромобиль (HEV и PHEV), электромобиль на аккумуляторах (BEV), электромобиль на топливных элементах (FCEV)), типу транспортного средства (легковой автомобиль, коммерческий автомобиль) - тенденции отрасли и прогноз до 2029 года.

Анализ и размер рынка автомобильных DC-DC-преобразователей в Азиатско-Тихоокеанском регионе

Внедрение силовых полупроводников и интегральных схем сделало его экономически выгодным за счет использования техники. Хотя к 1976 году транзисторные автомобильные радиоприемники не требовали высокого напряжения, некоторые операторы радиосвязи продолжали использовать вибрационные источники питания и динамо-моторы для мобильных приемопередатчиков, требующих высокого напряжения, хотя транзисторные источники питания были доступны. С тех пор рыночный спрос на повышенную плотность мощности привел к разработке многих преобразователей постоянного тока для преобразования источника постоянного тока (DC) с одного уровня напряжения на другой. Внедрение преобразователей постоянного тока увеличилось за последние три года с ростом внедрения Интернета вещей , ростом спроса на повышенную плотность мощности и растущим внедрением интеллектуальных сетей, систем хранения энергии и электромобилей . Ожидается, что внедрение и реализация передовых технологий будут стимулировать спрос на преобразователи постоянного тока. В результате ожидается, что рынок преобразователей постоянного тока будет демонстрировать более высокие темпы роста в прогнозируемый период 2022–2029 годов.

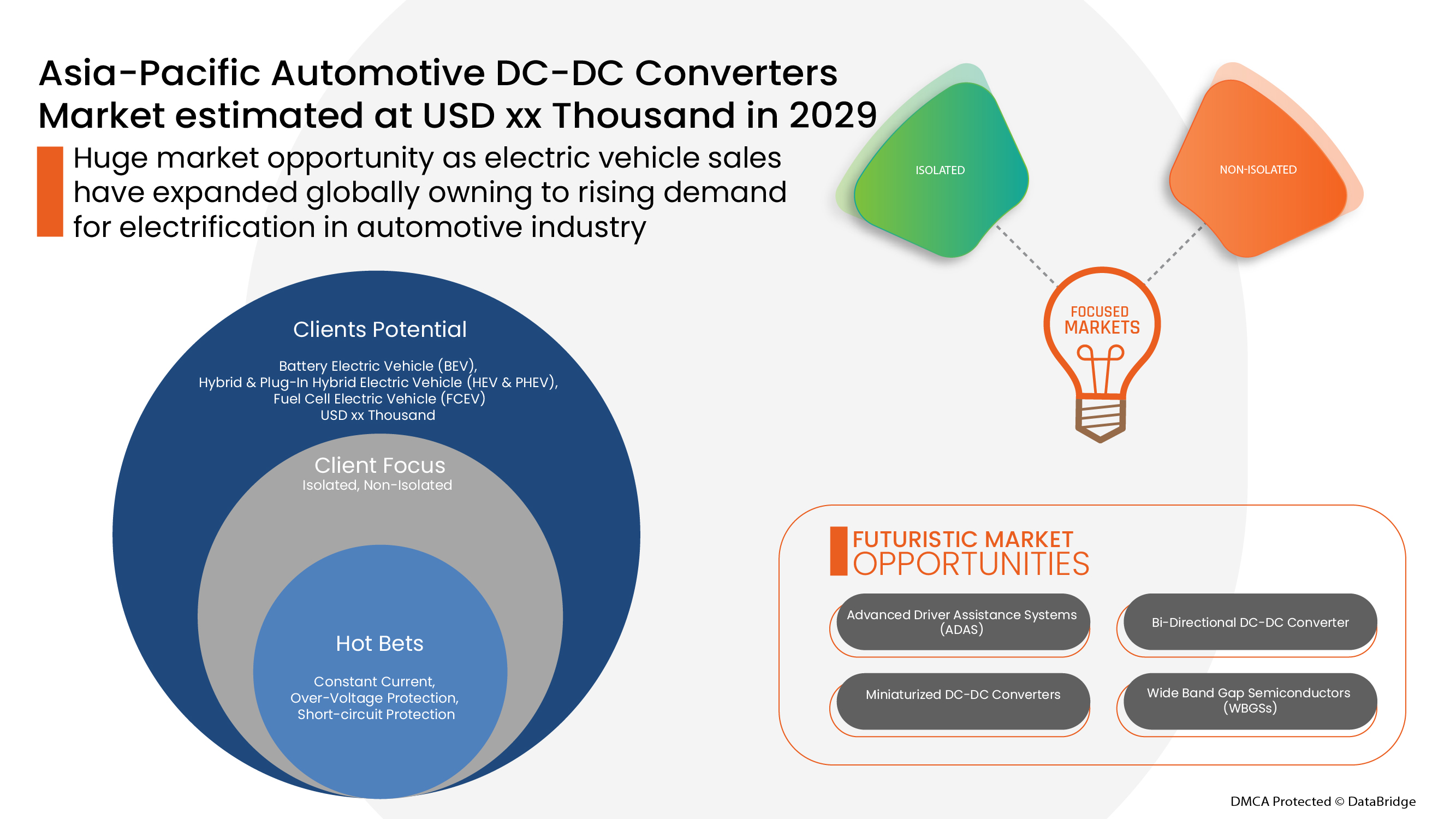

Data Bridge Market Research анализирует, что рынок автомобильных DC-DC-преобразователей в Азиатско-Тихоокеанском регионе, как ожидается, достигнет значения 7 979 317,08 тыс. долларов США к 2029 году, увеличившись на CAGR 30,5% в прогнозируемый период 2022-2029 годов. Отчет о рынке автомобильных DC-DC-преобразователей также охватывает анализ цен, патентный анализ и углубленный технологический прогресс.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 |

|

Количественные единицы |

Доход в тыс. долл. США, цены в долл. США |

|

Охваченные сегменты |

По типу продукта (изолированный, неизолированный), входному напряжению (ниже 40 В, 40 В - 70 В, выше 70 В), выходному напряжению (10,1 В - 15 В, 5 В и ниже, 5,1 В - 10 В, 15,1 В - 20 В, выше 20 В), выходной мощности (0,25 Вт - 250 Вт, 251 Вт - 500 Вт, 501 Вт - 1000 Вт, выше 1000 Вт), типу тяги (гибридный и подключаемый гибридный электромобиль (HEV и PHEV), электромобиль на аккумуляторах (BEV), электромобиль на топливных элементах (FCEV)), типу транспортного средства (легковой автомобиль, коммерческий автомобиль) |

|

Страны, охваченные |

Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины и остальные страны Азиатско-Тихоокеанского региона (APAC) |

|

Охваченные участники рынка |

MORNSUN Guangzhou Science & Technology Co., Ltd, Robert Bosch GmbH, Continental AG, Sinpro Electronics Co., Ltd, Texas Instruments Incorporated, Infineon Technologies AG, DENSO CORPORATION, Vicor Corporation, RECOM Power GmbH, TDK Corporation, Vitesco Technologies, Deutronic Elektronik GmbH, Murata Manufacturing Co., Ltd, STMicroelectronics, Semiconductor Components Industries, LLC, TOYOTA INDUSTRIES CORPORATION, Inmotion, SHINDENGEN ELECTRIC MANUFACTURING CO., LTD, BorgWarner Inc., & Skyworks Solutions Inc. и другие. |

Определение рынка

Автомобильный DC-DC-преобразователь состоит из индукторов, микроконтроллеров (MCU) и компонентов магнитного сердечника, которые заключены в блочную конструкцию для интеграции в транспортные средства. DC-DC-преобразователь присоединяется к системе зажигания автомобиля для эффективного управления перезапуском и выключением двигателя с целью сокращения выбросов. DC-DC-преобразователь работает в заданном диапазоне напряжения для питания множества бортового электронного оборудования, поскольку интегрированная информационно-развлекательная система на борту автомобиля требует постоянного электропитания примерно 12 В, подаваемого силовым агрегатом.

DC-DC-преобразователи в основном играют важную роль в изоляции и преобразовании напряжения. Распространение усовершенствованных систем помощи водителю (ADAS) и внутрисалонных информационно-развлекательных систем превратило транспортные средства в сложные электронные системы на колесах, которым требуются многоуровневые и бесшумные DC-DC-преобразователи, в определенной степени подпитывающие рост рынка.

Динамика рынка автомобильных DC-DC-преобразователей

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

- Рост продаж электромобилей в регионе

Автомобильная промышленность демонстрирует колоссальный рост на протяжении многих лет из-за растущего спроса на роскошные электромобили. Некоторые из факторов, стимулирующих продажи электромобилей, включают строгие государственные правила в отношении выбросов транспортных средств, растущий спрос на высокую производительность и низкий уровень выбросов. По данным МЭА (Международное энергетическое агентство), потребители потратили 120 миллиардов долларов США на покупку электромобилей в 2020 году, что на 50% больше, чем в 2019 году, что приводит к росту продаж электромобилей на 41%. Это привело к увеличению спроса на преобразователи постоянного тока в постоянный ток в электромобилях.

- Рост популярности модели «Мобильность как услуга» (MaaS)

Концепция Mobility as a Service (MaaS) набирает популярность в секторе электромобилей. Все больше производителей, поставщиков услуг, компаний, политиков и общественности сосредотачивают свое внимание на электрической мобильности для удобства.

Мобильность как услуга описывает переход от личных средств передвижения к мобильности, предоставляемой как услуга, в связи с различными факторами, такими как рост уровня загрязнения, быстрая урбанизация, стоимость обслуживания транспортных средств, а также нехватка и ограничения парковочных мест в крупных городах по всему миру.

- Научно-исследовательские и опытно-конструкторские работы по интеграции DC-DC-преобразователей в коммерческие транспортные средства

Глобальное принятие строгих норм выбросов для электромобилей мотивирует автопроизводителей (OEM) интегрировать передовые технологии в свои предложения по автомобилям для повышения их топливной экономичности. Это привело к разработке электрической трансмиссии для средних и тяжелых коммерческих автомобилей (M&HCV). Электрическая трансмиссия требует интеграции DC-DC-преобразователя для обеспечения более высокой эффективности и лучших характеристик автомобиля. Кроме того, рост продаж коммерческих автомобилей побудил производителей компонентов обновить свои предложения по продукции.

- Более высокая стоимость электронных компонентов в электромобилях

Электромобили лучше всего подходят для транспортировки, а также для окружающей среды, поскольку они помогают контролировать давление на загрязнение воздуха. Но первоначальная стоимость электромобилей выше по сравнению с автомобилями с бензиновым двигателем, поскольку они включают в себя технологически усовершенствованные компоненты, которые не наносят вреда окружающей среде, однако эксплуатационные расходы электромобилей ниже, чем у автомобилей с бензиновым двигателем.

- Сложности проектирования DC-DC-преобразователей

В целом, электрификация транспортных средств сосредоточена на силовой установке, работающей на электричестве, и ее вспомогательных системах, таких как бортовые и внешние зарядные системы. Кроме того, растущее электрическое содержание и сложность в сочетании с более короткими циклами проектирования требуют оптимальной команды проектировщиков для постоянного совершенствования методов проектирования.

Влияние COVID-19 на рынок автомобильных DC-DC-преобразователей

COVID-19 оказал сильное влияние на рынок автомобильных DC-DC-преобразователей, поскольку почти каждая страна решила закрыть все производственные мощности, за исключением тех, которые занимаются производством товаров первой необходимости. Правительство приняло ряд строгих мер, таких как закрытие производства и продажи неосновных товаров, блокировка международной торговли и многое другое, чтобы предотвратить распространение COVID-19. Единственный бизнес, который работает в этой пандемической ситуации, — это основные услуги, которым разрешено открываться и запускать процессы.

Рост рынка автомобильных DC-DC-преобразователей объясняется растущим принятием электрификации автомобильной промышленности во всех регионах и странах. Хотя автомобильная промышленность столкнулась с серьезными проблемами во время пандемии, продажи электромобилей подскочили до более высоких уровней в постпандемическом сценарии.

Производители принимают различные стратегические решения, чтобы оправиться после COVID-19. Игроки проводят многочисленные исследования и разработки для улучшения технологии, используемой в преобразователях постоянного тока. Благодаря этому компании выведут на рынок передовые технологии. Кроме того, правительственные инициативы по использованию электромобилей привели к росту рынка

Недавнее развитие

- В феврале 2022 года компания RECOM Power GmbH представила новую линейку продукции, включающую полностью индивидуальные, полуиндивидуальные и модифицированные стандартные преобразователи переменного тока в постоянный и постоянного тока в постоянный, от малой мощности до киловатта.

- В январе 2022 года компания Continental AG улучшила пользовательский опыт в новом BMW iX с помощью высокой вычислительной мощности и масштабного дисплейного ландшафта в автомобиле. Это еще больше помогло компании преодолеть разрыв между интегрированной и централизованной архитектурой автомобиля будущего

Масштаб рынка автомобильных DC-DC-преобразователей в Азиатско-Тихоокеанском регионе

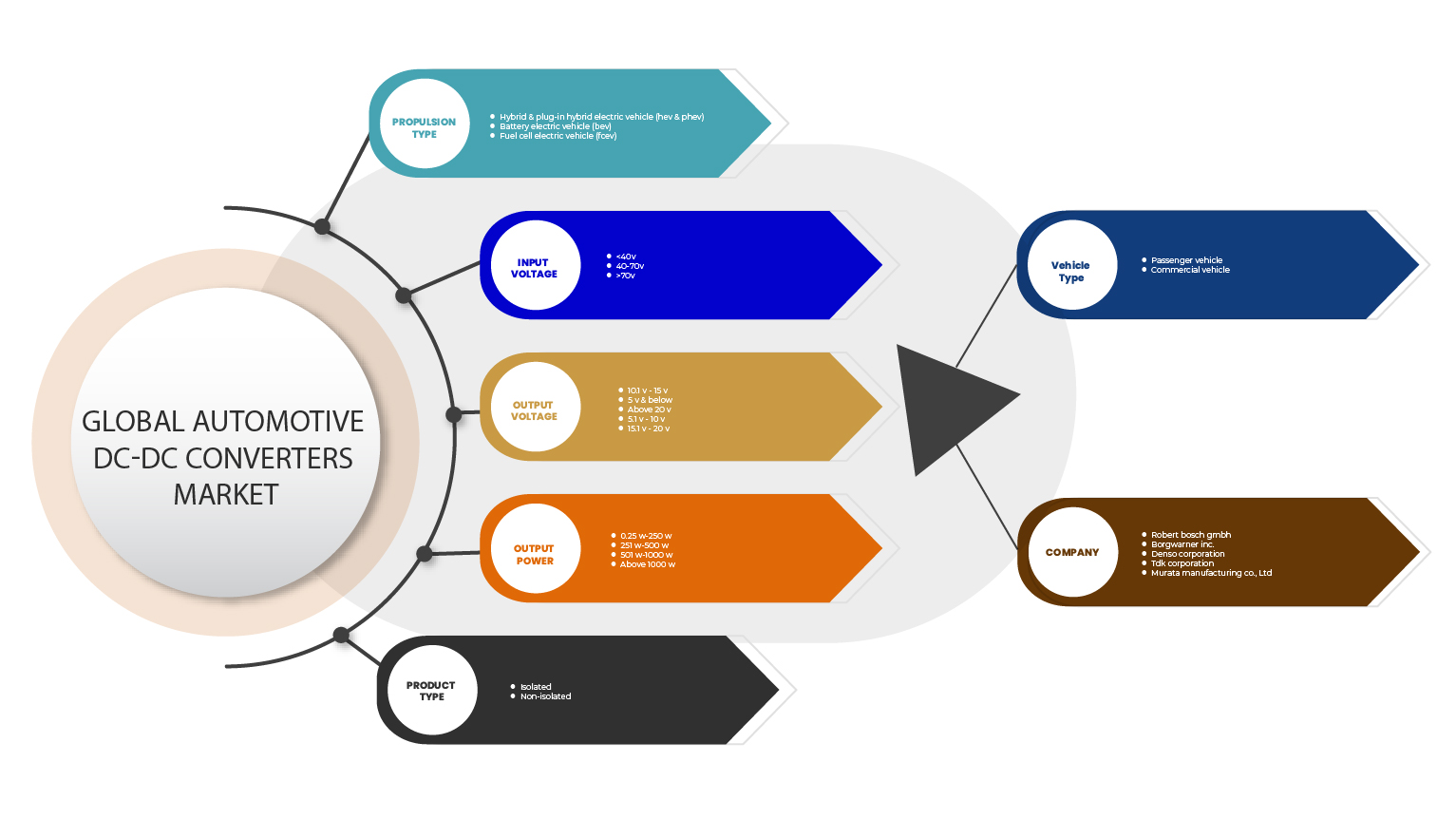

Рынок автомобильных DC-DC-преобразователей сегментирован на основе типа продукта, входного напряжения, выходного напряжения, выходной мощности, типа тяги и типа транспортного средства. Рост среди этих сегментов поможет вам проанализировать сегменты роста в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип продукта

- Изолированный

- Неизолированный

По типу продукции рынок автомобильных DC-DC-преобразователей в Азиатско-Тихоокеанском регионе сегментируется на изолированные и неизолированные.

Входное напряжение

- Ниже 40 В

- 40 В - 70 В

- Выше 70 В

На основе входного напряжения рынок автомобильных DC-DC-преобразователей в Азиатско-Тихоокеанском регионе сегментирован на следующие категории: ниже 40 В, 40 В - 70 В, выше 70 В.

Выходное напряжение

- 10,1 В - 15 В

- 5 В и ниже

- 5,1 В - 10 В

- 15,1 В - 20 В

- Выше 20 В

На основе выходного напряжения рынок автомобильных DC-DC-преобразователей в Азиатско-Тихоокеанском регионе сегментирован на 10,1 В - 15 В, 5 В и ниже, 5,1 В - 10 В, 15,1 В - 20 В, выше 20 В.

Выходная мощность

- 0,25 Вт - 250 Вт

- 251 Вт - 500 Вт

- 501 Вт - 1000 Вт

- Более 1000 Вт

По выходной мощности рынок автомобильных DC-DC-преобразователей в Азиатско-Тихоокеанском регионе сегментирован на 0,25 Вт - 250 Вт, 251 Вт - 500 Вт, 501 Вт - 1000 Вт и свыше 1000 Вт.

Тип движителя

- Гибридные и подключаемые гибридные электромобили (HEV и PHEV)

- Электромобиль на аккумуляторной батарее (BEV)

- Электромобиль на топливных элементах (FCEV)

На основе типа тяги рынок автомобильных DC-DC-преобразователей в Азиатско-Тихоокеанском регионе сегментирован на гибридные и подключаемые гибридные электромобили (HEV и PHEV), электромобили на аккумуляторных батареях (BEV), электромобили на топливных элементах (FCEV).

Тип транспортного средства

- Пассажирский автомобиль

- Коммерческий автомобиль

В зависимости от типа транспортного средства рынок автомобильных DC-DC-преобразователей в Азиатско-Тихоокеанском регионе сегментирован на легковые автомобили и коммерческие автомобили.

Региональный анализ/информация о рынке автомобильных DC-DC-преобразователей

Проведен анализ рынка автомобильных DC-DC-преобразователей, а также предоставлены сведения о размерах рынка и тенденциях по странам, типам продукции, входному напряжению, выходному напряжению, выходной мощности, типу тяги и типу транспортного средства, как указано выше.

В отчете о рынке автомобильных DC-DC-преобразователей Азиатско-Тихоокеанского региона рассматриваются следующие страны: Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины и остальные страны Азиатско-Тихоокеанского региона (APAC).

Китай доминирует на рынке автомобильных DC-DC-преобразователей в Азиатско-Тихоокеанском регионе. Китай, вероятно, станет самой быстрорастущей страной на рынке автомобильных DC-DC-преобразователей в Азиатско-Тихоокеанском регионе. Основной причиной этого является растущее принятие электромобилей и инициатив правительства Китая в области зеленой энергетики. Китай доминирует на рынке производства электромобилей и их компонентов, на долю которого приходится половина мировых продаж электромобилей.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования — вот некоторые из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Азиатско-Тихоокеанского региона и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и доли рынка автомобильных DC-DC-преобразователей

Конкурентная среда рынка автомобильных DC-DC-преобразователей содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Азиатско-Тихоокеанском регионе, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком автомобильных DC-DC-преобразователей Азиатско-Тихоокеанского региона.

Некоторые из основных игроков, работающих на рынке автомобильных DC-DC-преобразователей Азиатско-Тихоокеанского региона, включают Robert Bosch GmbH, BorgWarner Inc., DENSO Corporation, TDK Corporation, Murata Manufacturing Co., Ltd., TOYOTA INDUSTRIES CORPORATION, Vitesco Technologies Group AG, Infineon Technologies AG, STMicroelectronics, Skyworks Solutions, Inc., MORNSUN Guangzhou Science & Technology Co. Ltd., SHINDENGEN ELECTRIC MANUFACTURING CO., LTD., Vicor Corporation, Texas Instruments Incorporated, Continental AG, Semiconductor Components Industries, LLC, Inmotion Technologies AB, Deutronic Elektronik GmbH, Sinpro Electronics Co., Ltd., RECOM Power GmbH и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MARKET CHALLENGE MATRIX

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 MARKET PRODUCT TYPE COVERAGE GRID

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN SALES OF ELECTRIC VEHICLES WORLDWIDE

5.1.2 RISE IN POPULARITY OF MOBILITY AS A SERVICE (MAAS) MODEL

5.1.3 GROWING ADOPTION OF ENERGY-EFFICIENT VEHICLES TO PROMOTE LOW CO2 EMISSION

5.1.4 RISE IN EXPANSION OF ADVANCED DRIVING ASSISTANCE SYSTEMS (ADAS)

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATORY COMPLIANCE AND SAFETY STANDARDS FOR AUTOMOBILE INDUSTRIES

5.2.2 HIGHER COST OF ELECTRONIC COMPONENTS IN ELECTRIC VEHICLE

5.3 OPPORTUNITIES

5.3.1 RISE IN ACQUISITION AND PARTNERSHIP FOR VARIOUS PRODUCT DEVELOPMENT AMONG ORGANIZATIONS

5.3.2 R&D EFFORTS TO INTEGRATE DC-DC CONVERTERS INTO COMMERCIAL VEHICLES

5.3.3 HIGHER FLUCTUATION IN FUEL PRICES IS INSISTING CONSUMERS TO OPT FOR ELECTRIC VEHICLE

5.3.4 DEVELOPMENT OF MINIATURIZED LIGHT WEIGHT DC-DC CONVERTERS

5.4 CHALLENGES

5.4.1 DESIGN COMPLICATIONS IN DC-DC CONVERTERS

5.4.2 AVAILABILITY OF LOW QUALITY OF DC-DC CONVERTERS ON GREY MARKET

6 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 ISOLATED

6.3 NON-ISOLATED

7 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE

7.1 OVERVIEW

7.2 40 V-70 V

7.3 BELOW 40 V

7.4 ABOVE 70 V

8 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE

8.1 OVERVIEW

8.2 10.1 V - 15 V

8.3 5 V & BELOW

8.4 ABOVE 20 V

8.5 5.1 V-10 V

8.6 15.1 V-20 V

9 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT POWER

9.1 OVERVIEW

9.2 0.25 W-250 W

9.3 251 W-500 W

9.4 501 W-1000 W

9.5 ABOVE 1000 W

10 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE

10.1 OVERVIEW

10.2 HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV)

10.3 BATTERY ELECTRIC VEHICLE (BEV)

10.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

11 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER VEHICLE

11.2.1 HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV)

11.2.2 BATTERY ELECTRIC VEHICLE (BEV)

11.2.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

11.3 COMMERCIAL VEHICLE

11.3.1 BY TYPE

11.3.1.1 LIGHT COMMERCIAL VEHICLE

11.3.1.2 MEDIUM & HEAVY COMMERCIAL VEHICLE

11.3.2 BY PROPULSION TYPE

11.3.2.1 HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV)

11.3.2.2 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

12 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 SOUTH KOREA

12.1.3 JAPAN

12.1.4 INDIA

12.1.5 AUSTRALIA

12.1.6 THAILAND

12.1.7 INDONESIA

12.1.8 SINGAPORE

12.1.9 PHILIPPINES

12.1.10 MALAYSIA

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ROBERT BOSCH GMBH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SOLUTION PORTFOLIO

15.1.5 RECENT DEVLOPMENT

15.2 BORGWARNER INC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVLOPMENTS

15.3 DENSO CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 TDK CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 MURATA MANUFACTURING CO., LTD

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 CONTINENTAL AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 DEUTRONIC ELEKTRONIK GMBH

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 INFINEON TECHNOLOGIES AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 INMOTION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 MORNSUN GUANGZHOU SCIENCE & TECHNOLOGY CO., LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 RECOM POWER GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 SHINDENGEN ELECTRIC MANUFACTURING CO., LTD

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 SINPRO ELECTRONICS CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SKYWORKS SOLUTIONS INC

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVLOPMENTS

15.16 STMICROELECTRONICS

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 TEXAS INSTRUMENTS INCORPORATED

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TOYOTA INDUSTRIES CORPORATION

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 VICOR CORPORATION

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 VITESCO TECHNOLOGIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 ASIA PACIFIC ISOLATED IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 ASIA PACIFIC NON-ISOLATED IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC 40 V-70 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC BELOW 40 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC ABOVE 70 V IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC 10.1 V - 15 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC 5 V & BELOW IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC ABOVE 20 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC 5.1 V - 10 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC 15.1 V - 20 V IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC 0.25 W-250 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC 251 W-500 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC 501 W-1000 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC ABOVE 1000 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV) IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC BATTERY ELECTRIC VEHICLE (BEV) IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 CHINA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 CHINA AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 41 CHINA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 42 CHINA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 43 CHINA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 CHINA AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 CHINA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 CHINA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 CHINA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 SOUTH KOREA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 SOUTH KOREA AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 50 SOUTH KOREA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 51 SOUTH KOREA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 52 SOUTH KOREA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 SOUTH KOREA AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 SOUTH KOREA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 SOUTH KOREA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 SOUTH KOREA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 JAPAN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 JAPAN AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 59 JAPAN AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 60 JAPAN AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 61 JAPAN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 JAPAN AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 JAPAN PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 JAPAN COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 JAPAN COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 INDIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 INDIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 68 INDIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 69 INDIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 70 INDIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 INDIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 72 INDIA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 INDIA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 INDIA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 AUSTRALIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 AUSTRALIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 77 AUSTRALIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 78 AUSTRALIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 79 AUSTRALIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 AUSTRALIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 AUSTRALIA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 AUSTRALIA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 AUSTRALIA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 84 THAILAND AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 THAILAND AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 86 THAILAND AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 87 THAILAND AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 88 THAILAND AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 THAILAND AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 THAILAND PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 THAILAND COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 THAILAND COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 INDONESIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 INDONESIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 95 INDONESIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 96 INDONESIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 97 INDONESIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 INDONESIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 INDONESIA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 INDONESIA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 INDONESIA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 SINGAPORE AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 SINGAPORE AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 104 SINGAPORE AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 105 SINGAPORE AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 106 SINGAPORE AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 SINGAPORE AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 SINGAPORE PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 SINGAPORE COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 SINGAPORE COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 PHILIPPINES AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 PHILIPPINES AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 113 PHILIPPINES AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 114 PHILIPPINES AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 115 PHILIPPINES AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 116 PHILIPPINES AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 PHILIPPINES PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 PHILIPPINES COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 PHILIPPINES COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 MALAYSIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 MALAYSIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 122 MALAYSIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 123 MALAYSIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 124 MALAYSIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 MALAYSIA AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 MALAYSIA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 MALAYSIA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 128 MALAYSIA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 REST OF ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

Список рисунков

FIGURE 1 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: PRODUCT TYPE COVERAGE GRID

FIGURE 7 G ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: SEGMENTATION

FIGURE 11 INCREASE IN SALES OF ELECTRIC VEHICLES ACROSS THE REGION IS EXPECTED TO DRIVE THE ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE IN THE ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET IN THE FORECAST PERIOD OF 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES OF ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET

FIGURE 15 NUMBER OF PLUG-IN ELECTRIC PASSENGER CAR SALES IN 2020 IN UNITS

FIGURE 16 CHANGES IN VEHICLE DATA IN-LINE WITH THE MOBILITY SERVICES

FIGURE 17 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: BY INPUT VOLTAGE, 2021

FIGURE 19 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: BY OUTPUT VOLTAGE, 2021

FIGURE 20 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: BY OUTPUT POWER, 2021

FIGURE 21 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: BY PROPULSION TYPE, 2021

FIGURE 22 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: BY VEHICLE TYPE, 2021

FIGURE 23 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC AUTOMOTIVE DC-DC CONVERTER MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 28 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.