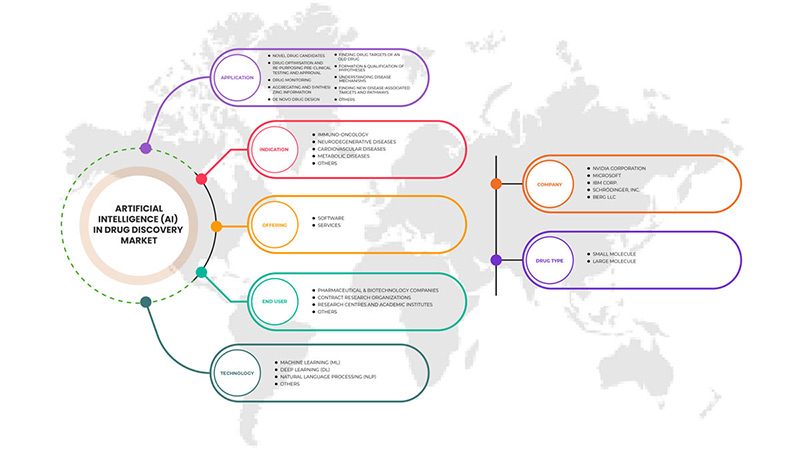

Искусственный интеллект (ИИ) на рынке разработки лекарств в Азиатско-Тихоокеанском регионе по сферам применения (новые кандидаты на лекарства, оптимизация лекарств и повторное использование доклинических испытаний и одобрений, мониторинг лекарств, поиск новых целей и путей, связанных с заболеваниями, понимание механизмов заболеваний, агрегация и синтез информации, формирование и квалификация гипотез, разработка новых лекарств, поиск целей для старых лекарств и другие), технология (машинное обучение, глубокое обучение, обработка естественного языка и другие), тип лекарства (малая молекула и большая молекула), предложение (программное обеспечение и услуги), показание (иммуноонкология, нейродегенеративные заболевания, сердечно-сосудистые заболевания, метаболические заболевания и другие), конечное использование (контрактные исследовательские организации (CRO), фармацевтические и биотехнологические компании, исследовательские центры и академические институты и другие) Тенденции отрасли и прогноз до 2029 года.

Искусственный интеллект (ИИ) в Азиатско-Тихоокеанском регионе: анализ и понимание рынка разработки лекарств

Ожидается, что искусственный интеллект (ИИ) станет прибыльной технологией в сфере здравоохранения. Внедрение ИИ сокращает разрыв в НИОКР в процессе производства лекарств и помогает в целевом производстве лекарств. Поэтому биофармацевтические компании обращаются к ИИ, чтобы увеличить свою долю на рынке. ИИ для открытия лекарств — это технология, которая использует машины для имитации человеческого интеллекта с целью решения сложных задач в процессе разработки лекарств.

Внедрение решений ИИ в процесс клинических испытаний устраняет возможные препятствия, сокращает время цикла клинических испытаний и повышает производительность и точность процесса клинических испытаний. Технологические достижения в области ИИ для открытия лекарств и сокращение общего времени, затрачиваемого на процесс открытия лекарств, являются другими факторами, способствующими росту рынка в прогнозируемый период. Однако низкое качество и непоследовательность имеющихся данных будут препятствовать росту рынка. Кроме того, высокие затраты, связанные с технологией и техническими ограничениями, будут сдерживать рост рынка.

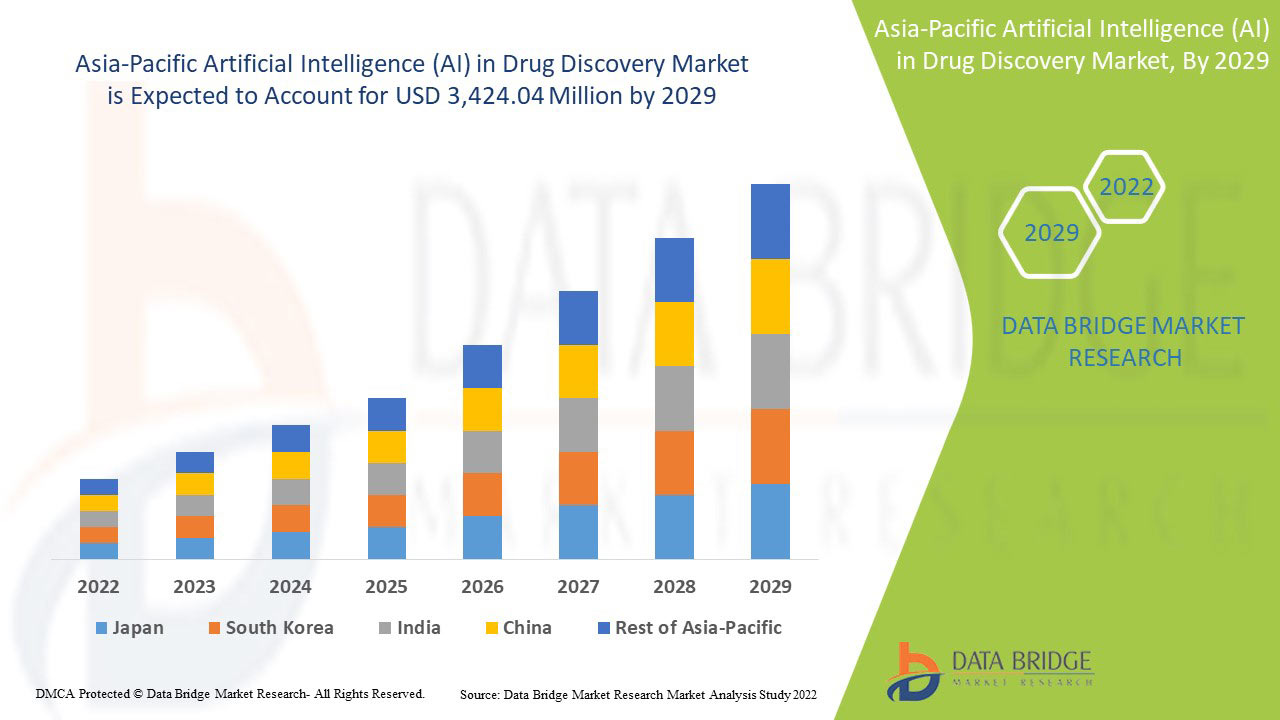

Data Bridge Market Research анализирует, что ожидается, что Азиатско-Тихоокеанский искусственный интеллект (ИИ) на рынке разработки лекарств достигнет значения 3 424,04 млн долларов США к 2029 году при среднегодовом темпе роста 50,9% в течение прогнозируемого периода. Программное обеспечение составляет крупнейший технологический сегмент на рынке из-за быстрого развития технологических достижений для коммерциализации использования ИИ на рынке разработки лекарств. Этот рыночный отчет также подробно охватывает анализ цен, патентный анализ и технологические достижения.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019-2014) |

|

Количественные единицы |

Доход в млн. долл. США, цены в долл. США |

|

Охваченные сегменты |

По применению (новые кандидаты на лекарственные препараты, оптимизация и повторное использование лекарственных препаратов, доклинические испытания и одобрение, мониторинг лекарственных препаратов, поиск новых мишеней и путей, связанных с заболеваниями, понимание механизмов заболеваний, агрегация и синтез информации, формирование и квалификация гипотез, разработка новых лекарственных препаратов, поиск мишеней для старых лекарственных препаратов и другие), технология (машинное обучение, глубокое обучение, обработка естественного языка и другие), тип препарата (малые молекулы и большие молекулы), предложение (программное обеспечение и услуги), показание ( иммуноонкология , нейродегенеративные заболевания, сердечно-сосудистые заболевания, метаболические заболевания и другие), конечное использование (контрактные исследовательские организации (CRO), фармацевтические и биотехнологические компании, исследовательские центры и академические институты и другие) |

|

Страны, охваченные |

Китай, Япония, Индия, Южная Корея, Сингапур, Таиланд, Малайзия, Австралия и Новая Зеландия, Филиппины, Индонезия, остальные страны Азиатско-Тихоокеанского региона |

|

Охваченные участники рынка |

Некоторые из ключевых игроков, работающих на рынке, включают NVIDIA Corporation, IBM Corp., Atomwise Inc., Microsoft, Benevolent AI, Aria Pharmaceuticals, Inc., DEEP GENOMICS, Exscientia, Cloud, Insilico Medicine, Cyclica, NuMedii, Inc., Envisagenics, Owkin Inc., BERG LLC, Schrödinger, Inc., XtalPi Inc. и BIOAGE Inc. и другие. |

Определение рынка искусственного интеллекта (ИИ) в Азиатско-Тихоокеанском регионе для разработки лекарственных препаратов

За последние несколько лет ИИ привлек внимание и умы специалистов по медицинским технологиям, поскольку несколько компаний и крупных исследовательских лабораторий работали над совершенствованием этих технологий для клинического использования. Теперь доступны первые коммерческие демонстрации того, как ИИ (также известный как глубокое обучение (DL), машинное обучение (ML) или искусственные нейронные сети (ANN)) может помочь врачам. Эти системы могут привести к смене парадигмы в рабочем процессе врачей и повысить производительность, одновременно улучшая лечение и пропускную способность пациентов. ИИ для открытия лекарств — это технология, которая использует машины для имитации человеческого интеллекта для решения сложных задач в процедуре разработки лекарств. Внедрение решений ИИ в процесс клинических испытаний устраняет возможные препятствия, сокращает время цикла клинических испытаний и повышает производительность и точность процесса клинических испытаний. Поэтому внедрение этих передовых решений ИИ в процессы открытия лекарств набирает популярность среди заинтересованных сторон в отрасли биологических наук. В фармацевтическом секторе он помогает в открытии новых соединений, идентификации терапевтических целей и разработке индивидуальных лекарств. Платформы искусственного интеллекта, используемые для разработки лекарственных препаратов, могут оказаться реальным вариантом для получения информации о разработке препаратов для лечения и минимизации тяжести различных хронических заболеваний.

Динамика рынка искусственного интеллекта (ИИ) в Азиатско-Тихоокеанском регионе

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Рост заболеваемости хроническими заболеваниями обусловливает необходимость использования ИИ для разработки лекарств

Заболеваемость хроническими заболеваниями стремительно растет по всему миру. По данным Центров по контролю и профилактике заболеваний (CDC), шесть из десяти взрослых в США имеют хронические заболевания. Кроме того, CDC также подчеркивает, что хронические заболевания, такие как болезни сердца и диабет, являются основными причинами смерти в США. Такая статистика проливает свет на растущую распространенность хронических заболеваний и необходимость снижения уровня смертности, вызванной этими заболеваниями.

Платформы ИИ, используемые для открытия лекарств, могут оказаться приемлемым вариантом для получения информации об открытии лекарств для лечения и минимизации тяжести различных хронических заболеваний. Таким образом, ожидается, что эти факторы будут выступать в качестве драйвера роста рынка в прогнозируемый период.

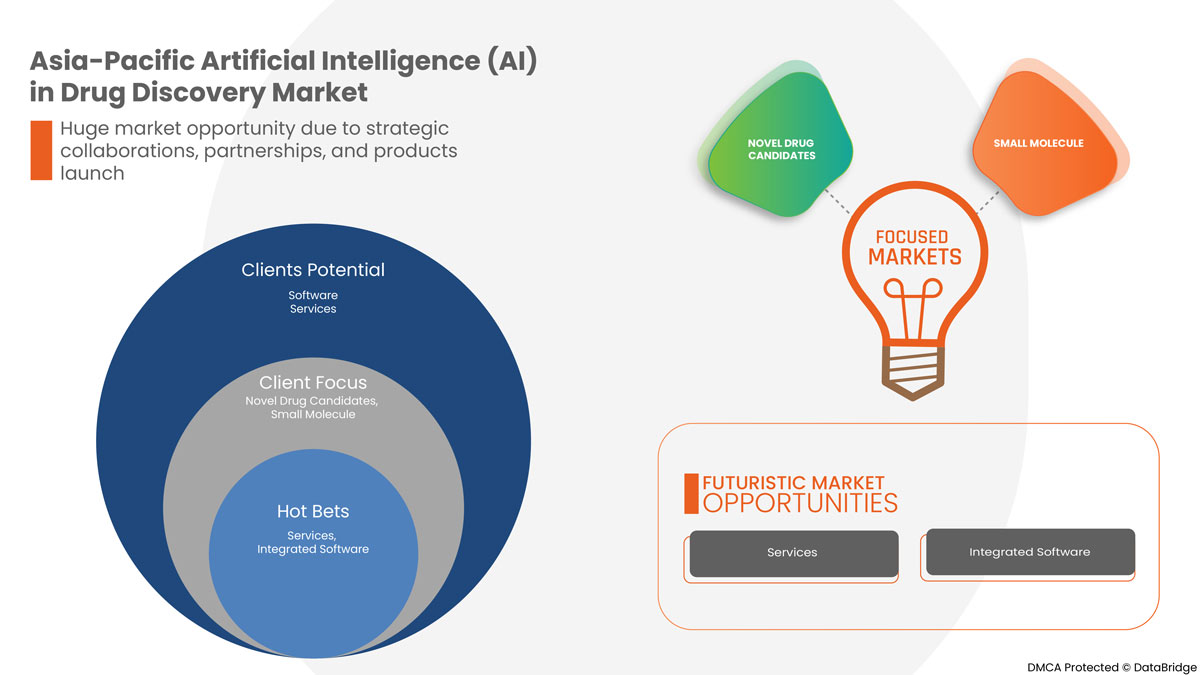

- Стратегическое сотрудничество, партнерство и запуск продуктов

ИИ имеет потенциал для трансформации процесса открытия лекарств за счет быстрого ускорения сроков НИОКР, что делает разработку лекарств дешевле и быстрее, а также повышает вероятность одобрения. ИИ также может повысить эффективность исследований по перепрофилированию лекарств.

Рост межотраслевых альянсов и сотрудничества движет рынком. Рост значимости ИИ в разработке и поиске лекарств, а также рост финансирования НИОКР, включая технологии ИИ в области исследования лекарств, по прогнозам, будут способствовать росту мирового рынка. Таким образом, рост межотраслевого сотрудничества и партнерства движет рынком.

Сдержанность

- Высокая стоимость, связанная с технологией и техническими ограничениями

Современный сектор здравоохранения сталкивается с рядом сложных проблем, таких как рост стоимости лекарств и методов лечения, и обществу необходимы конкретные существенные изменения в этой области. Весь успех ИИ зависит от доступности значительного объема данных, поскольку эти данные используются для последующего обучения, предоставляемого системе. Доступ к данным от различных поставщиков баз данных может повлечь за собой дополнительные расходы для компании. Клинические испытания направлены на установление безопасности и эффективности лекарственного продукта у людей при определенном заболевании и требуют от шести до семи лет вместе со значительными финансовыми вложениями. Однако только одна из десяти молекул, поступающих в эти испытания, получает успешное разрешение, что является огромной потерей для отрасли. Эти неудачи могут быть результатом неправильного отбора пациентов, нехватки технических требований и плохой инфраструктуры. Таким образом, увеличение затрат на технологию действует как сдерживающий фактор для роста рынка.

Возможность

-

Рост инвестиций в НИОКР

Рост активности в области НИОКР и все более широкое внедрение облачных сервисов и приложений откроют благоприятные возможности для роста рынка.

Индустрия ИИ в биофармацевтике продолжает расти после длительного периода сепсиса. Это отражается в продолжающемся потоке инвестиций и увеличении числа коллабораций между фармацевтическими корпорациями и компаниями ИИ в 2021 году по сравнению с предыдущими годами. Рост биофармацевтической отрасли во многом обусловлен активным участием ведущих фармацевтических корпораций в инвестициях, связанных с ИИ. Количество научных публикаций в области ИИ в биофармацевтике и исследовательское сотрудничество между фармацевтическими компаниями и поставщиками экспертных знаний в области ИИ быстро растут, однако некоторые фармацевтические корпорации по-прежнему критически относятся к приложениям ИИ. Приложения МО и ИИ в фармацевтической и медицинской отраслях приводят к формированию новой междисциплинарной области разработки лекарств на основе данных в здравоохранении. Таким образом, рост инвестиций в научно-исследовательскую деятельность выступает в качестве возможности для роста рынка.

Испытание

- Нехватка квалифицированных специалистов

Ожидается, что нехватка квалифицированных специалистов будет сдерживать рост рынка. Сотрудникам придется переучиваться или приобретать новые навыки для эффективной работы на сложных машинах ИИ, чтобы получить желаемые результаты для препарата. Эта проблема, которая препятствует полноценному внедрению ИИ в фармацевтической промышленности, включает в себя нехватку квалифицированного персонала для работы с платформами на основе ИИ, ограниченный бюджет для небольших организаций, опасения замены людей, приводящие к потере работы, скептицизм в отношении данных, генерируемых ИИ, и феномен черного ящика (то есть того, как платформа ИИ приходит к выводам). Нехватка навыков является основным препятствием для открытия лекарств с помощью ИИ, отговаривая компании от внедрения машин на основе ИИ для открытия лекарств.

Поскольку требования к навыкам слишком высоки, это проявилось в виде проблемы удержания и управления профессионалами с определенными навыками. Более того, технологический прогресс является еще одним аспектом, который приводит к увеличению спроса на квалифицированных специалистов. Существует острая необходимость в обучении профессионалов для технологий на основе ИИ. Нехватка обученных и опытных специалистов и сохраняющиеся пробелы в навыках ограничивают перспективы трудоустройства и доступ к качественным рабочим местам. Поэтому очевидно, что наличие профессионалов, обладающих адекватными навыками, бросает вызов росту рынка.

Влияние COVID -19 на искусственный интеллект (ИИ) в Азиатско-Тихоокеанском регионе на рынке разработки лекарственных препаратов

Вспышка COVID-19 оказала благотворное влияние на расширение ИИ в индустрии разработки лекарств из-за его широкого использования различными организациями для идентификации, а также скрининга существующих лекарств, используемых при лечении COVID-19. ИИ полезен для обнаружения активных химических веществ для профилактики SARS-CoV, ВИЧ, SARS-CoV-2, вируса гриппа и других. Во время пандемии экономики по всему миру полагались на открытие лекарств на основе ИИ, а не на традиционные процессы обнаружения вакцин, на создание которых уходят годы и которые столь же дороги, что способствовало росту рынка.

Производители принимают различные стратегические решения, чтобы оправиться после COVID-19. Игроки проводят многочисленные НИОКР-мероприятия для улучшения технологии, используемой в беспроводном микрофоне. Благодаря этому компании выведут на рынок передовое и точное программное обеспечение ИИ.

Последние события

- В марте 2022 года корпорация NVIDIA запустила Clara Holoscan MGX для разработки и развертывания приложений ИИ в реальном времени. Clara Holoscan MGX расширяет платформу Clara Holoscan, предоставляя комплексную эталонную архитектуру медицинского уровня, а также долгосрочную поддержку программного обеспечения для ускорения инноваций в индустрии медицинских устройств. Это поможет компании повысить производительность ИИ в секторе здравоохранения для хирургии, диагностики и разработки лекарств.

- В мае 2022 года Benevolent AI, ведущая компания по разработке лекарств с использованием ИИ на клинической стадии, объявила, что AstraZeneca выбрала дополнительную новую цель для идиопатического легочного фиброза (ИЛФ) для своего портфеля разработок лекарств, что привело к знаменательному платежу в пользу Benevolent AI. Это третья новая цель в рамках сотрудничества, которая была определена с помощью Benevolent Platform в двух областях заболеваний, ИЛФ и хронической болезни почек, и впоследствии проверена и выбрана для внесения в портфель AstraZeneca. Это основано на недавнем расширении сотрудничества с AstraZeneca для включения двух новых областей заболеваний, системной красной волчанки и сердечной недостаточности, подписанном в январе 2022 года. Это помогло компании укрепить свое сотрудничество.

Искусственный интеллект (ИИ) в Азиатско-Тихоокеанском регионе на рынке разработки лекарств

Искусственный интеллект (ИИ) в Азиатско-Тихоокеанском регионе на рынке разработки лекарств сегментируется по применению, технологии, типу препарата, предложению, показанию и конечному использованию. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии для выхода на рынок и определять основные области применения и разницу в ваших целевых рынках.

ПРИЛОЖЕНИЕ

- Новые кандидаты на лекарственные препараты

- Оптимизация и перепрофилирование лекарственных средств. Доклинические испытания и одобрение.

- Мониторинг наркотиков

- Поиск новых целей и путей, связанных с заболеваниями

- Понимание механизмов заболевания

- Агрегирование и синтез информации

- Формирование и квалификация гипотез

- Разработка лекарств De Novo

- Поиск целей для старого препарата

- Другие

Based on application, the market is segmented into novel drug candidates, drug optimization and repurposing preclinical testing and approval, drug monitoring, finding new diseases associated targets and pathways, understanding disease mechanisms, aggregating and synthesizing information, formation & qualification of hypotheses, de novo drug design, finding drug targets of an old drug, and others.

TECHNOLOGY

- Machine Learning (ML)

- Deep Learning (DL)

- Natural Language Processing (NLP)

- Others

Based on technology, the market is segmented into Machine Learning (ML), Deep Learning (DL), Natural Language Processing (NLP), and others.

DRUG TYPE

- Small Molecule

- Large Molecule

Based on drug type, the market is segmented into small molecule and large molecule.

OFFERING

- Software

- Services

Based on offering, the market is segmented into software and services.

INDICATION

- Immuno-Oncology

- Neurodegenerative Diseases

- Cardiovascular Diseases

- Metabolic Diseases

- Others

Based on indication, the market is segmented into immuno-oncology, neurodegenerative diseases, cardiovascular diseases, metabolic diseases, and others.

END USE

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Research Centres And Academic Institutes

- Others

Based on end use, the market is segmented into pharmaceutical & biotechnology companies, Contract Research Organizations (CROs), research centers and academic institutes, and others.

Asia-Pacific Artificial Intelligence (AI) in Drug Discovery Market Regional Analysis/Insights

The Asia-Pacific Artificial Intelligence (AI) in drug discovery market is analyzed and market size information is provided by application, technology, drug type, offering, indication, and end use.

The countries covered in this market report are China, Japan, India, South Korea, Singapore, Thailand, Malaysia, Australia & New Zealand, Philippines, Indonesia, rest of Asia-Pacific.

- In 2022, Asia-Pacific is the third most dominating region due to the higher demand for infectious diseases diagnostic kits due to increasing patient pool and rising awareness among people. China is expected to grow due to rise in technological advancements in AI for drug discovery.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Artificial Intelligence (AI) in Drug Discovery Market Share Analysis

Искусственный интеллект (ИИ) в конкурентной среде рынка разработки лекарств в Азиатско-Тихоокеанском регионе содержит подробную информацию по конкурентам. Включены следующие сведения: обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в НИОКР, новые рыночные инициативы, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, испытания продуктов, одобрения продуктов, патенты, широта и диапазон продукта, доминирование приложений, кривая жизненного цикла технологий. Приведенные выше данные относятся только к фокусу компании на искусственном интеллекте (ИИ) в Азиатско-Тихоокеанском регионе на рынке разработки лекарств.

Среди ключевых игроков, работающих на рынке, можно назвать NVIDIA Corporation, IBM Corp., Atomwise Inc., Microsoft, Benevolent AI, Aria Pharmaceuticals, Inc., DEEP GENOMICS, Exscientia, Cloud, Insilico Medicine, Cyclica, NuMedii, Inc., Envisagenics, Owkin Inc., BERG LLC, Schrödinger, Inc., XtalPi Inc. и BIOAGE Inc. и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORETSR’S FIVE FORCES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE RISE IN INCIDENCE OF CHRONIC DISEASES PROPELS NEED FOR ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY

5.1.2 STRATEGIC COLLABORATIONS, PARTNERSHIPS, AND PRODUCTS LAUNCH

5.1.3 REDUCTION IN TOTAL TIME INVOLVED IN DRUG DISCOVERY PROCESS

5.1.4 ADVANCEMENT OF ARTIFICIAL INTELLIGENCE IN THE HEALTHCARE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH TECHNOLOGY AND TECHNICAL LIMITATIONS

5.2.2 DISADVANTAGES AND RISKS ASSOCIATED WITH AI IN DRUG DISCOVERY

5.2.3 LACK OF AVAILABLE QUALITY DATA

5.3 OPPORTUNITIES

5.3.1 RISE IN THE INVESTMENTS FOR R&D

5.3.2 RISING HEALTHCARE INFRASTRUCTURE

5.3.3 DEVELOPMENT OF NOVEL TOOLS

5.4 CHALLENGES

5.4.1 THE ASIA PACIFIC SHORTAGE OF AI TALENT

5.4.2 ETHICAL, LEGAL, AND REGULATORY ISSUES FOR AI ADOPTION IN THE PHARMACEUTICAL SCIENCES

6 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 INTEGRATED

6.2.2 STANDALONE

6.3 SERVICES

7 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MACHINE LEARNING (ML)

7.2.1 SUPERVISED LEARNING

7.2.2 UNSUPERVISED LEARNING

7.2.3 REINFORCEMENT LEARNING

7.3 DEEP LEARNING

7.4 NATURAL LANGUAGE PROCESSING (NLP)

7.5 OTHERS

8 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET , BY DRUG TYPE

8.1 OVERVIEW

8.2 SMALL MOLECULE

8.3 LARGE MOLECULE

9 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NOVEL DRUG CANDIDATES

9.2.1 PREDICT BIOACTIVITY OF SMALL MOLECULE

9.2.2 IDENTIFY BIOLOGICS TARGET

9.2.3 OTHERS

9.3 DRUG OPTIMISATION AND RE-PURPOSING PRE-CLINICAL TESTING AND APPROVAL

9.4 DRUG MONITORING

9.5 AGGREGATING AND SYNTHESIZING INFORMATION

9.6 DE NOVO DRUG DESIGN

9.7 FINDING DRUG TARGETS OF AN OLD DRUG

9.8 FORMATION & QUALIFICATION OF HYPOTHESES

9.9 UNDERSTANDING DISEASE MECHANISMS

9.1 FINDING NEW DISEASE-ASSOCIATED TARGETS AND PATHWAYS

9.11 OTHERS

10 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION

10.1 OVERVIEW

10.2 IMMUNE-ONCOLOGY

10.2.1 BREAST CANCER

10.2.2 LUNG CANCER

10.2.3 COLORECTAL CANCER

10.2.4 PROSTATE CANCER

10.2.5 PANCREATIC CANCER

10.2.6 BRAIN CANCER

10.2.7 LEUKEMIA

10.2.8 OTHERS

10.3 NEURODEGENERATIVE DISEASES

10.4 CARDIOVASCULAR DISEASES

10.5 METABOLIC DISEASES

10.6 OTHERS

11 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET , BY END USE

11.1 OVERVIEW

11.2 CONTRACT RESEARCH ORGANIZATIONS

11.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

11.4 RESEARCH CENTERS AND ACADEMIC INSTITUTES

11.5 OTHERS

12 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA & NEW ZEALAND

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 NVIDIA CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 MICROSOFT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 IBM CORP

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 SCHRÖDINGER, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BERG LLC

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ARDIGEN

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 EXSCIENTIA

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 ARIA PHARMACEUTICALS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ATOMWISE INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 BENEVOLENT AI

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 BIOAGE INC.,

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 CLOUD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 CYCLICA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 DEEP GENOMICS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ENVISAGENICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INSILICO MEDICINE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 NUMEDII, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 OWKIN INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 XTALPI INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SERVICES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC DEEP LEARNING IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC NATURAL LANGUAGE PROCESSING (NLP) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC SMALL MOLECULE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC LARGE MOLECULE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC DRUG OPTIMISATION AND RE-PURPOSING PRE-CLINICAL TESTING AND APPROVAL IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC DRUG MONITORING IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC AGGREGATING AND SYNTHESIZING INFORMATION IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC DE NOVO DRUG DESIGN IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC FINDING DRUG TARGETS OF AN OLD DRUG IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC FORMATION & QUALIFICATION OF HYPOTHESES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC UNDERSTANDING DISEASE MECHANISMS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC FINDING NEW DISEASE-ASSOCIATED TARGETS AND PATHWAYS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC NEURODEGENERATIVE DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC CARDIOVASCULAR DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC METABOLIC DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOB ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC RESEARCH CENTRES AND ACADEMIC INSTITUTES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 49 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 CHINA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 52 CHINA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 CHINA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 57 CHINA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 58 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 59 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 60 JAPAN SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 JAPAN MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 63 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 64 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 JAPAN NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 67 JAPAN IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 68 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 79 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 80 INDIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 82 INDIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 84 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 INDIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 87 INDIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 88 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA & NEW ZEALAND SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA & NEW ZEALAND MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA & NEW ZEALAND NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA & NEW ZEALAND IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 99 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 104 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 107 SINGAPORE IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 108 SINGAPORE AARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 109 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 THAILAND SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 THAILAND MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 114 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 THAILAND NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 117 THAILAND IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 118 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 119 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 120 MALAYSIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 124 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 139 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 149 REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 11 THE GROWING NEED TO CURB DRUG DISCOVERY COSTS AND REDUCE TIME INVOLVED IN THE DRUG DEVELOPMENT PROCESS, THE RISING ADOPTION OF CLOUD-BASED APPLICATIONS AND SERVICES, AND THE IMPENDING PATENT EXPIRY OF BLOCKBUSTER DRUGS ARE EXPECTED TO DRIVE THE GROWTH OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SOFTWARE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET IN 2022 AND 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET

FIGURE 14 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, 2021

FIGURE 15 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, 2021

FIGURE 19 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, 2021

FIGURE 23 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, 2021

FIGURE 27 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, 2021

FIGURE 31 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, 2020-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 34 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY END USE, 2021

FIGURE 35 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY END USE, 2022-2029 (USD MILLION)

FIGURE 36 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY END USE, CAGR (2022-2029)

FIGURE 37 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY END USE, LIFELINE CURVE

FIGURE 38 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SNAPSHOT (2021)

FIGURE 39 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2021)

FIGURE 40 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING (2022-2029)

FIGURE 43 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.