>Рынок кормов для животных Азиатско-Тихоокеанского региона по типу (аминокислоты, минералы, витамины, подкислители , детоксиканты микотоксинов, ферменты, фосфаты, каротиноиды, антиоксиданты, ароматизаторы и подсластители, антибиотики, небелковый азот и другие), животноводство (свиньи, птица, жвачные, водные животные и другие), форма (сухие и жидкие), – тенденции отрасли и прогноз до 2029 г.

Анализ и размер рынка

Чтобы удовлетворить потребности меняющихся моделей питания населения, производство скота увеличилось в нескольких странах мира, особенно на развивающихся рынках. Сектор животноводства на рынке Азиатско-Тихоокеанского региона, особенно в Азиатско-Тихоокеанском регионе, становится все более промышленным, несмотря на то, что большое количество фермеров в таких странах, как Индия и Китай, остаются мелкими и маргинальными.

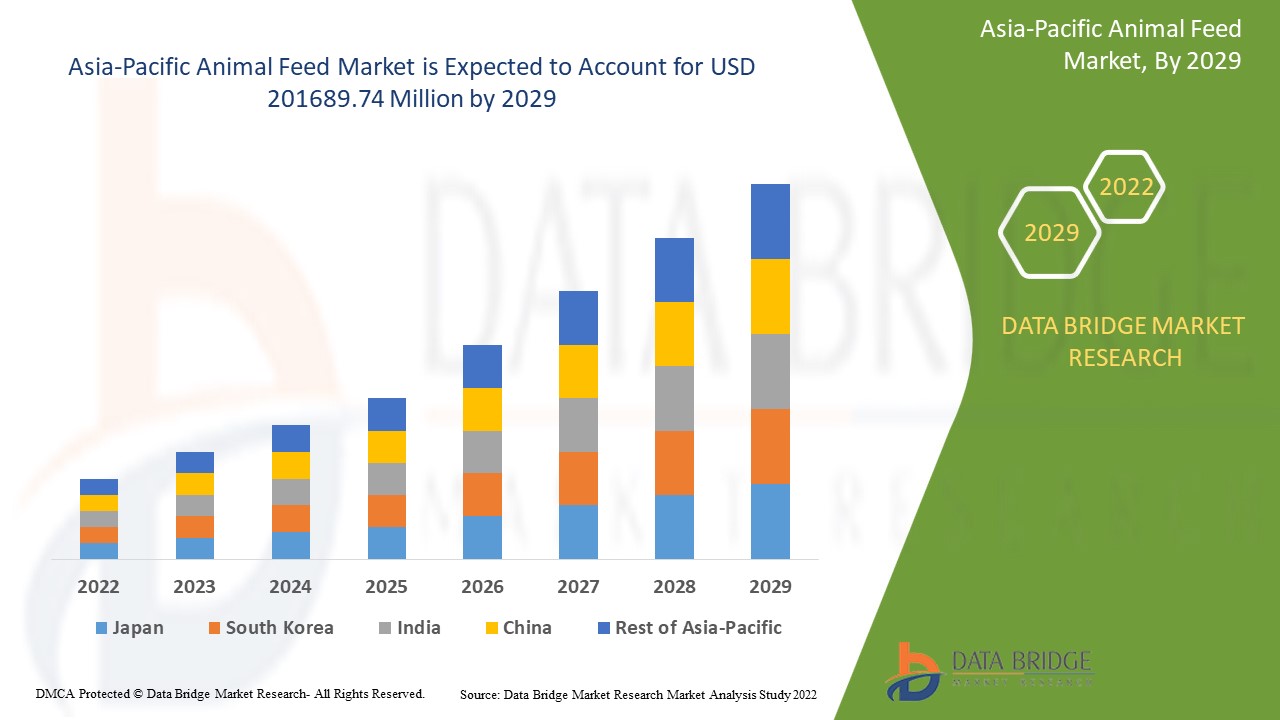

Компания Data Bridge Market Research анализирует, что рынок кормов для животных, который в 2021 году вырос на 140 744,14 млн долларов США, как ожидается, достигнет 201 689,74 млн долларов США к 2029 году при среднегодовом темпе роста 4,6% в прогнозируемый период с 2022 по 2029 год.

Определение рынка

Корм для животных — это питательная пища с высоким содержанием белков, минералов и витаминов, которую дают домашним животным, сельскохозяйственным и водным животным. Он в основном потребляется домашними животными в виде корма, сена, силоса, гранулированных кормов, масличных семян, пророщенных зерен и фуража, среди прочего. Корм для животных — важный компонент животноводства, и он различается в зависимости от того, выращиваются ли животные для мяса, яиц или молока.

Область отчета и сегментация рынка

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2014 - 2019) |

|

Количественные единицы |

Доход в млн. долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

По типу (аминокислоты, минералы, витамины, подкислители, детоксиканты микотоксинов, ферменты, фосфаты, каротиноиды, антиоксиданты, ароматизаторы и подсластители, антибиотики, небелковый азот и другие), домашний скот (свиньи, птица, жвачные, водные животные и другие), форма (сухие и жидкие) |

|

Страны, охваченные |

Китай, Индия, Япония, Австралия, Южная Корея, Сингапур, Индонезия, Таиланд, Филиппины, Малайзия и остальные страны Азиатско-Тихоокеанского региона |

|

Охваченные участники рынка |

CHR. Hansen Holdings A/S (Дания), Lallemand Inc. (Канада), Novus International (США), DSM (Нидерланды), BASF SE (Германия), Alltech (США), ADM (США), Charoen Popkphand Foods PCL (Таиланд), Associated British Foods Plc (Великобритания), Cargill Incorporated (США), Purina Animal Nutrition LLC (США), Zinpro Corp (США), Dallas Keith (Великобритания), Balchem Inc., (США), Kemin Industries, Inc. (США) |

|

Возможности |

|

Динамика рынка кормов для животных

Драйверы

- Растущее внимание к здоровью животных

Increased focus on animal health will also drive market expansion. Increased cattle farming will almost certainly increase demand for animal feed. The growing demand for animal-based products by humans will drive up market demand. Natural growth supporters are expected to be active in the market as their momentum grows. Consumer awareness of the advantages of using feed additives to reduce disease has increased market demand.

- Increase in the demand for organic meat

Concerns about food safety have increased the demand for high-quality animal feed to ensure the safety of meat. Another factor driving the growth of the animal feed market is increasing farm owner awareness of the importance of maintaining a healthy animal diet. As a result, they are shifting from standard animal feed to functional and premium variants that help improve enzootic disease immunity while also minimising the risk of metabolic disorders, acidosis, injuries, and infections.

Furthermore, an increase in demand for organic meat from consumers in developed countries, as well as the adoption of new animal rearing practises and the upholding of high farming standards, has created a positive outlook for the industry.

Opportunity

Rising meat consumption in developing economies such as China, India, and Brazil is expected to drive Asia-Pacific demand. Australia is a major pork exporting country that is expected to drive product demand during the forecast period.

Restraints

During the forecast period, high raw material prices, as well as an increasing number of restrictions and regulatory bans, will act as market restraints for animal feed growth. Product awareness will be a restraint on the growth of the animal feed market during the forecast period.

This animal feed market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the animal feed market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Animal Feed Market

During the COVID-19 situation, agriculture and food production have been identified as critical sectors in Asia-Pacific. As a result, farmers have continued to provide high-quality nutrition to farm animals in order to feed an increasing number of Asia-Pacific consumers. However, supply chain disruption has become the most significant factor affecting the animal feed market. China is a major producer and exporter of animal feed, and it stockpiled enough product for 2-3 months' supply during the emergence of the COVID-19 situation while businesses were closed for the Lunar New Year. Additionally, logistics issues have hampered the supply of containers and vessels, as well as the transportation of certain micro-ingredients.

Recent Development

- In October 2021, Cargill and BASF announced a partnership in the animal nutrition business, adding research and development capabilities and new markets to the partners' existing feed enzymes distribution agreements. This collaboration aided in the creation, manufacture, marketing, and sale of customer-focused enzyme products and solutions for animals, including swine.

- In July 2021, De Heus acquired Coppens Diervoeding, a Dutch feed manufacturing company specialising in the pig farming sector. With this acquisition, the company was able to double its production capacity and increase its regional presence by 400k.

Asia-Pacific Animal Feed Market Scope

The animal feed market is segmented on the basis of type, livestock and form. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Amino acid

- Minerals

- Vitamins

- Acidifiers

- Mycotoxin detoxifiers

- Enzymes

- Phosphate

- Carotenoids

- Antioxidants

- Flavors & sweeteners

- Antibiotics

- Non-protein nitrogen

- Others

Based on type, the market is segmented into amino acids, minerals, vitamins, acidifiers, mycotoxin detoxifiers, enzymes, phosphate, carotenoids, antioxidants, flavors & sweeteners, antibiotics, non-protein nitrogen and others.

Livestock

- Swine

- Poultry

- Ruminants

- Aquatic animals

- Others

Based on livestock, the market is segmented into swine, poultry, ruminants, aquatic animals and others.

Form

- Dry

- Liquid

Based on form, the market is segmented into dry and liquid.

Animal Feed Market Regional Analysis/Insights

The animal feed market is analysed and market size insights and trends are provided by country, type, livestock and form as referenced above.

The countries covered in the animal feed market report are China, India, Japan, Australia, South Korea, Singapore, Indonesia, Thailand, Philippines, Malaysia and Rest of Asia-Pacific.

На Азию приходится примерно половина производства Азиатско-Тихоокеанского региона, и она является самым важным рынком потребления и производства свинины. Из-за высокого потребления свинины Азиатско-Тихоокеанский регион является крупнейшим рынком для продуктов кормов для животных. Юго-Восточная Азия является крупнейшим в мире производителем и экспортером свинины. Китай является самым важным рынком для производителей свинины, за ним следуют Вьетнам, Таиланд, Южная Корея, Япония и Филиппины. Рынки потребления свинины в Японии, Южной Корее и Тайване насыщены, тогда как Вьетнам и Филиппины только развиваются.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования — вот некоторые из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Азиатско-Тихоокеанского региона и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и доли рынка кормов для животных

Конкурентная среда рынка кормов для животных содержит подробную информацию по конкурентам. Включены следующие сведения: обзор компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Азиатско-Тихоокеанском регионе, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные относятся только к фокусу компании на рынке кормов для животных.

Некоторые из основных игроков, работающих на рынке кормов для животных:

- CHR. Hansen Holdings A/S (Дания)

- Lallemand Inc. (Канада)

- Novus International (США)

- DSM (Нидерланды)

- BASF SE (Германия)

- Оллтек (США)

- АДМ (США)

- Charoen Popkphand Foods PCL (Таиланд)

- Associated British Foods Plc (Великобритания)

- Cargill Incorporated (США)

- Purina Animal Nutrition LLC (США)

- Zinpro Corp (США)

- Даллас Кит (Великобритания)

- Balchem Inc., (США)

- Kemin Industries, Inc. (США)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC ANIMAL FEED MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TECHNOLOGY LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.1.1 GROWING DEMAND OF EDIBLE MEAT

3.1.2 MODERNIZATION AND GROWTH OF AQUACULTURE & LIVESTOCK FEED SECTORS

3.1.3 OUTBURSTS OF DISEASES VIA ANIMALS IS CONTRIBUTING TO THE INCREASE IN ADOPTION FOR ANIMAL FEED

3.1.4 BAN ON THE USE OF ANTIBIOTIC GROWTH PROMOTERS (AGPS) ON ANIMALS

3.1.5 RAPID INCREASING POPULATION OF PETS AND DOMESTICATED ANIMALS

3.2 RESTRAINTS

3.2.1 INCREASING VEGAN POPULATION IS HINDERING THE SALES OF MEAT AND MEAT-BASED PROTEINS

3.2.2 LOW QUALITY OF NUTRITION CHEMICALS IS A MAJOR DETERRENT FOR THE MARKET GROWTH

3.2.3 HIGH COST OF RAW MATERIALS

3.3 OPPORTUNITIES

3.3.1 IMPLEMENTING ALTERNATIVE FEEDING STRATEGIES THAT FOSTER EFFICIENCY IN MODERN ANIMAL NUTRITION

3.3.2 UREA MOLASSES MINERAL BLOCK (UMMB) LICKS USAGE IN CROP RESIDUE FOR ENHANCEMENT OF LIVESTOCK PRODUCTIVITY

3.3.3 BYPASS PROTEIN (UDP) DIET FOR CROSSBRED COWS CAN PAVE THE WAY FOR HIGH YIELD

3.4 CHALLENGES

3.4.1 REGULATIONS ON DIFFERENT FEED ADDITIVES AT COUNTRY LEVEL ESPECIALLY IN EUROPE AND THE U.S.

3.4.2 OUTBREAK OF EPIDEMIC CONTAGIOUS DISEASES THAT AFFECTS THE ANIMAL HEALTH IS LEADING TO LOSS OF LIVESTOCKS

3.4.3 AVAILABILITY OF LIMITED OPTIONS FOR SHRIMP FEED PRODUCTS IN PLANT-BASED MEALS

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL PRICING IN ASIA-PACIFIC, 2019 (USD/KG)

5.2 PRODUCTION AND CONSUMPTION PATTERN

5.3 MARKETING STRATEGIES

5.4 LIST OF SUBSTITUTES

6 REGULATORY FRAMEWORK

7 BRAND ANALYSIS

7.1 TOP BRANDS OF ANIMAL FEED AND THEIR COMPANY

8 ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE

8.1 OVERVIEW

8.2 AMINO ACID

8.2.1 METHIONINE

8.2.2 LYSINE

8.2.3 THREONINE

8.2.4 OTHERS

8.3 MINERALS

8.3.1 CALCIUM

8.3.2 POTASSIUM

8.3.3 MAGNESIUM

8.3.4 OTHERS

8.4 VITAMINS

8.4.1 WATER-SOLUBLE

8.4.2 FAT-SOLUBLE

8.5 ACIDIFIERS

8.5.1 PROPIONIC ACID

8.5.2 FUMARIC ACID

8.5.3 FORMIC ACID

8.5.4 OTHERS

8.6 MYCOTOXIN DETOXIFIERS

8.6.1 BINDERS

8.6.2 MODIFIERS

8.7 ENZYMES

8.7.1 PHYTASE

8.7.2 PROTEASE

8.7.3 OTHERS

8.8 PHOSPHATE

8.8.1 DICALCIUM

8.8.2 MONOCALCIUM

8.8.3 OTHERS

8.9 CAROTENOIDS

8.9.1 ASTAXANTHIN

8.9.2 BETA-CAROTENE

8.9.3 OTHERS

8.1 ANTIOXIDANTS

8.10.1 ETHOXYQUIN

8.10.2 BHA

8.10.3 BHT

8.10.4 OTHERS

8.11 FLAVORS & SWEETENERS

8.11.1 SWEETENERS

8.11.2 FLAVORS

8.12 ANTIBIOTICS

8.12.1 TETRACYCLINE

8.12.2 PENICILLIN

8.12.3 OTHERS

8.13 NON-PROTEIN NITROGEN

8.13.1 UREA

8.13.2 AMMONIA

8.13.3 OTHERS

8.14 OTHERS

9 ASIA-PACIFIC ANIMAL FEED MARKET, BY LIVESTOCK

9.1 OVERVIEW

9.2 SWINE

9.2.1 GROWER

9.2.2 STARTER

9.2.3 SOW

9.3 POULTRY

9.3.1 BROILERS

9.3.2 LAYERS

9.3.3 BREEDERS

9.4 RUMINANTS

9.4.1 DAIRY CATTLE

9.4.2 BEEF CATTLE

9.4.3 CALVES

9.4.4 OTHERS

9.5 AQUATIC ANIMALS

9.6 OTHERS

10 ASIA-PACIFIC ANIMAL FEED MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.2.1 PELLETS

10.2.2 CRUMBLES

10.2.3 MASH

10.2.4 OTHERS

10.2.4.1 GRAIN MIX

10.2.4.2 CRUSHED GRAIN OR SCRATCH

10.2.4.3 OTHERS

10.3 LIQUID

11 ASIA-PACIFIC ANIMAL FEED MARKET: COUNTRY

11.1 ASIA- PACIFIC

11.1.1 CHINA

11.1.2 INDIA

11.1.3 JAPAN

11.1.4 AUSTRALIA

11.1.5 SOUTH KOREA

11.1.6 SINGAPORE

11.1.7 INDONESIA

11.1.8 THAILAND

11.1.9 PHILIPPINES

11.1.10 MALAYSIA

11.1.11 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC ANIMAL FEED MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.2 MERGERS & ACQUISITIONS

12.3 NEW PRODUCT DEVELOPMENT & APPROVALS

12.4 EXPANSIONS

12.5 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

13.1 SWOT ANALYSIS

13.1.1 STRENGTH: - ENHANCING PRODUCT PORTFOLIO FOR VARIOUS TYPES OF ANIMAL FEED

13.1.2 WEAKNESS: - LOW LABOR EFFICIENCY OF POOR FARMERS

13.1.3 OPPORTUNITY: - HIGH RATE OF AGRICULTURAL DIVERSIFICATION AND ANIMAL WELFARE

13.1.4 THREAT: - SEVERE CLIMATIC CHANGES AFFECTS THE FARM ANIMALS

13.2 DATA BRIDGE MARKET RESEARCH ANALYSIS

14 COMPANY PROFILES

14.1 NEW HOPE GROUP

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENT

14.2 BASF SE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 AMBOS STOCKFEEDS

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.4 GUANGDONG HAID GROUP CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENT

14.5 ALLTECH.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 CHAROEN POKPHAND GROUP

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 GEORGE WESTON FOODS LIMITED

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 AJINOMOTO CO., INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 ARCHER DANIELS MIDLAND COMPANY

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 AUSTRALIAN PREMIUM FEEDS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMEN

14.11 CARGILL, INCORPORATED

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 CHR. HANSEN HOLDING A/S

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 DSM

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 DUPONT

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 EVONIK INDUSTRIES AG

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 INVIVO

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 KEMIN INDUSTRIES, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 NUTRECO (A SUBSIDIARY OF SHV HOLDINGS N.V.)

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SOLVAY

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 TYSON FOODS, INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO - TYSON INGREDIENT SOLUTIONS

14.20.4 PRODUCT PORTFOLIO-NUDGES

14.20.5 RECENT DEVELOPMENT

15 CONCLUSION

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT DATA OF OF PREPARATIONS OF A KIND USED IN ANIMAL FEEDING; HS CODE: 2309 (USD MILLION)

TABLE 2 EXPORT DATA OF OF PREPARATIONS OF A KIND USED IN ANIMAL FEEDING; HS CODE: 2309 (USD MILLION)

TABLE 3 ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 4 ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 5 ASIA-PACIFIC AMINO ACID IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 6 ASIA-PACIFIC AMINO ACID IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 7 ASIA-PACIFIC AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 8 ASIA-PACIFIC MINERALS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 9 ASIA-PACIFIC MINERALS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 10 ASIA-PACIFIC MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 11 ASIA-PACIFIC VITAMINS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 12 ASIA-PACIFIC VITAMINS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 13 ASIA-PACIFIC VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 14 ASIA-PACIFIC ACIDIFIERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 15 ASIA-PACIFIC ACIDIFIERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 16 ASIA-PACIFIC ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 17 ASIA-PACIFIC MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 18 ASIA-PACIFIC MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 19 ASIA-PACIFIC MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 20 ASIA-PACIFIC ENZYMES IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 21 ASIA-PACIFIC ENZYMES IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 22 ASIA-PACIFIC ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 23 ASIA-PACIFIC PHOSPHATE IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 24 ASIA-PACIFIC PHOSPHATE IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 25 ASIA-PACIFIC PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 26 ASIA-PACIFIC CAROTENOIDS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 27 ASIA-PACIFIC CAROTENOIDS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 28 ASIA-PACIFIC CAROTENOIDS IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 29 ASIA-PACIFIC ANTIOXIDANTS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 30 ASIA-PACIFIC ANTIOXIDANTS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 31 ASIA-PACIFIC ANTIOXIDANTS IN ANIMAL FEED MARKET, BY ANTIOXIDANTS TYPE, 2018-2027 (USD MILLION)

TABLE 32 ASIA-PACIFIC FLAVOURS & SWEETENERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 33 ASIA-PACIFIC FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 34 ASIA-PACIFIC FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVOURS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 35 ASIA-PACIFIC ANTIBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 36 ASIA-PACIFIC ANTIBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 37 ASIA-PACIFIC ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 38 ASIA-PACIFIC NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 39 ASIA-PACIFIC NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 40 ASIA-PACIFIC NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 41 ASIA-PACIFIC OTHERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 42 ASIA-PACIFIC OTHERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 43 ASIA-PACIFIC ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 44 ASIA-PACIFIC SWINE IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 45 ASIA-PACIFIC SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 46 ASIA-PACIFIC POULTRY IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 47 ASIA-PACIFIC POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 48 ASIA-PACIFIC RUMINANTS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 49 ASIA-PACIFIC RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 50 ASIA-PACIFIC RUMINANTS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 51 ASIA-PACIFIC OTHERS IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 52 ASIA-PACIFIC ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 53 ASIA-PACIFIC DRY IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 54 ASIA-PACIFIC DRY IN ANIMAL FEED MARKET, BY DRY FROM, 2018-2027 (USD MILLION)

TABLE 55 ASIA-PACIFIC OTHERS IN ANIMAL FEED MARKET, BY OTHERS DRY FROM, 2018-2027 (USD MILLION)

TABLE 56 ASIA-PACIFIC LIQUID IN ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 57 ASIA- PACIFIC ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (THOUSAND TONS)

TABLE 58 ASIA-PACIFIC ANIMAL FEED MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 59 ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 60 ASIA- PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 61 ASIA-PACIFIC AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 62 ASIA-PACIFIC PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 63 ASIA-PACIFIC VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 64 ASIA-PACIFIC ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 65 ASIA-PACIFIC CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 66 ASIA-PACIFIC ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 67 ASIA-PACIFIC MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 68 ASIA-PACIFIC FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 69 ASIA-PACIFIC ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 70 ASIA-PACIFIC MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 71 ASIA-PACIFIC ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 72 ASIA-PACIFIC NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 73 ASIA-PACIFIC ANIMAL FEED MARKET, BY LIVESTOCK,2018-2027 (USD MILLION)

TABLE 74 ASIA-PACIFIC RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 75 ASIA-PACIFIC POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK,2018-2027 (USD MILLION)

TABLE 76 ASIA-PACIFIC SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 77 ASIA-PACIFIC ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 78 ASIA-PACIFIC DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 79 ASIA-PACIFIC OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 80 CHINA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 81 CHINA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 82 CHINA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 83 CHINA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 84 CHINA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 85 CHINA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 86 CHINA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 87 CHINA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 88 CHINA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 89 CHINA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 90 CHINA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 91 CHINA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 92 CHINA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 93 CHINA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 94 CHINA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 95 CHINA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 96 CHINA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 97 CHINA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 98 CHINA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 99 CHINA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 100 CHINA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 101 INDIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 102 INDIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 103 INDIA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 104 INDIA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 105 INDIA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 106 INDIA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 107 INDIA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 108 INDIA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 109 INDIA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 110 INDIA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 111 INDIA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 112 INDIA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 113 INDIA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 114 INDIA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 115 INDIA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 116 INDIA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 117 INDIA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 118 INDIA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 119 INDIA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 120 INDIA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 121 INDIA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 122 JAPAN ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 123 JAPAN ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 124 JAPAN AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 125 JAPAN PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 126 JAPAN VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 127 JAPAN ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 128 JAPAN CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 129 JAPAN ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 130 JAPAN MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 131 JAPAN FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 132 JAPAN ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 133 JAPAN MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 134 JAPAN ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 135 JAPAN NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 136 JAPAN ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 137 JAPAN RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 138 JAPAN POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 139 JAPAN SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 140 JAPAN ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 141 JAPAN DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 142 JAPAN OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 143 AUSTRALIA ANIMAL FEED MARKET , BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 144 AUSTRALIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 145 AUSTRALIA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 146 AUSTRALIA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 147 AUSTRALIA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 148 AUSTRALIA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 149 AUSTRALIA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 150 AUSTRALIA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 151 AUSTRALIA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 152 AUSTRALIA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 153 AUSTRALIA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 154 AUSTRALIA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 155 AUSTRALIA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 156 AUSTRALIA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 157 AUSTRALIA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 158 AUSTRALIA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 159 AUSTRALIA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 160 AUSTRALIA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 161 AUSTRALIA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 162 AUSTRALIA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 163 AUSTRALIA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 164 SOUTH KOREA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 165 SOUTH KOREA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 166 SOUTH KOREA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 167 SOUTH KOREA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 168 SOUTH KOREA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 169 SOUTH KOREA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 170 SOUTH KOREA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 171 SOUTH KOREA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 172 SOUTH KOREA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 173 SOUTH KOREA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 174 SOUTH KOREA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 175 SOUTH KOREA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 176 SOUTH KOREA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 177 SOUTH KOREA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 178 SOUTH KOREA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 179 SOUTH KOREA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 180 SOUTH KOREA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 181 SOUTH KOREA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 182 SOUTH KOREA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 183 SOUTH KOREA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 184 SOUTH KOREA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 185 SINGAPORE ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 186 SINGAPORE ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 187 SINGAPORE AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 188 SINGAPORE PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 189 SINGAPORE VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 190 SINGAPORE ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 191 SINGAPORE CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 192 SINGAPORE ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 193 SINGAPORE MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 194 SINGAPORE FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 195 SINGAPORE ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 196 SINGAPORE MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 197 SINGAPORE ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 198 SINGAPORE NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 199 SINGAPORE ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 200 SINGAPORE RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 201 SINGAPORE POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 202 SINGAPORE SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 203 SINGAPORE ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 204 SINGAPORE DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 205 SINGAPORE OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 206 INDONESIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 207 INDONESIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 208 INDONESIA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 209 INDONESIA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 210 INDONESIA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 211 INDONESIA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 212 INDONESIA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 213 INDONESIA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 214 INDONESIA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 215 INDONESIA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 216 INDONESIA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 217 INDONESIA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 218 INDONESIA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 219 INDONESIA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 220 INDONESIA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 221 INDONESIA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 222 INDONESIA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 223 INDONESIA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 224 INDONESIA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 225 INDONESIA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 226 INDONESIA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 227 THAILAND ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 228 THAILAND ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 229 THAILAND AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 230 THAILAND PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 231 THAILAND VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 232 THAILAND ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 233 THAILAND CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 234 THAILAND ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 235 THAILAND MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 236 THAILAND FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 237 THAILAND ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 238 THAILAND MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 239 THAILAND ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 240 THAILAND NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 241 THAILAND ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 242 THAILAND RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 243 THAILAND POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 244 THAILAND SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 245 THAILAND ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 246 THAILAND DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 247 THAILAND OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 248 PHILIPPINES ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 249 PHILIPPINES ANIMAL FEED MARKET , BY TYPE, 2018-2027 (USD MILLION)

TABLE 250 PHILIPPINES AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 251 PHILIPPINES PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 252 PHILIPPINES VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 253 PHILIPPINES ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 254 PHILIPPINES CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 255 PHILIPPINES ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 256 PHILIPPINES MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 257 PHILIPPINES FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 258 PHILIPPINES ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 259 PHILIPPINES MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 260 PHILIPPINES ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 261 PHILIPPINES NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 262 PHILIPPINES ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 263 PHILIPPINES RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 264 PHILIPPINES POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 265 PHILIPPINES SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 266 PHILIPPINES ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 267 PHILIPPINES DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 268 PHILIPPINES OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 269 MALAYSIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 270 MALAYSIA ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 271 MALAYSIA AMINO ACID IN ANIMAL FEED MARKET, BY AMINO ACID TYPE, 2018-2027 (USD MILLION)

TABLE 272 MALAYSIA PHOSPHATE IN ANIMAL FEED MARKET, BY PHOSPHATE TYPE, 2018-2027 (USD MILLION)

TABLE 273 MALAYSIA VITAMINS IN ANIMAL FEED MARKET, BY VITAMINS TYPE, 2018-2027 (USD MILLION)

TABLE 274 MALAYSIA ACIDIFIERS IN ANIMAL FEED MARKET, BY ACIDIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 275 MALAYSIA CAROTENOIDS IN ANIMAL FEED MARKET, BY CAROTENOIDS TYPE, 2018-2027 (USD MILLION)

TABLE 276 MALAYSIA ENZYMES IN ANIMAL FEED MARKET, BY ENZYMES TYPE, 2018-2027 (USD MILLION)

TABLE 277 MALAYSIA MYCOTOXIN DETOXIFIERS IN ANIMAL FEED MARKET, BY MYCOTOXIN DETOXIFIERS TYPE, 2018-2027 (USD MILLION)

TABLE 278 MALAYSIA FLAVORS & SWEETENERS IN ANIMAL FEED MARKET, BY FLAVORS & SWEETENERS TYPE, 2018-2027 (USD MILLION)

TABLE 279 MALAYSIA ANTIBIOTICS IN ANIMAL FEED MARKET, BY ANTIBIOTICS TYPE, 2018-2027 (USD MILLION)

TABLE 280 MALAYSIA MINERALS IN ANIMAL FEED MARKET, BY MINERALS TYPE, 2018-2027 (USD MILLION)

TABLE 281 MALAYSIA ANTIOXIDENTS IN ANIMAL FEED MARKET, BY ANTIOXIDENTS TYPE, 2018-2027 (USD MILLION)

TABLE 282 MALAYSIA NON-PROTEIN NITROGEN IN ANIMAL FEED MARKET, BY NON-PROTEIN NITROGEN TYPE, 2018-2027 (USD MILLION)

TABLE 283 MALAYSIA ANIMAL FEED MARKET, BY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 284 MALAYSIA RUMINANTS IN ANIMAL FEED MARKET, BY RUMINANTS LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 285 MALAYSIA POULTRY IN ANIMAL FEED MARKET, BY POULTRY LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 286 MALAYSIA SWINE IN ANIMAL FEED MARKET, BY SWINE LIVESTOCK, 2018-2027 (USD MILLION)

TABLE 287 MALAYSIA ANIMAL FEED MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 288 MALAYSIA DRY IN ANIMAL FEED MARKET, BY DRY FORM, 2018-2027 (USD MILLION)

TABLE 289 MALAYSIA OTHERS IN DRY FORM IN ANIMAL FEED MARKET, BY OTHERS DRY FORM, 2018-2027 (USD MILLION)

TABLE 290 REST OF ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (THOUSAND TONS)

TABLE 291 REST OF ASIA-PACIFIC ANIMAL FEED MARKET, BY TYPE, 2018-2027 (USD MILLION)

Список рисунков

FIGURE 1 ASIA-PACIFIC ANIMAL FEED MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC ANIMAL FEED MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC ANIMAL FEED MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC ANIMAL FEED MARKET : REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC ANIMAL FEED MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC ANIMAL FEED MARKET: THE TECHNOLOGY LIFE LINE CURVE

FIGURE 7 ASIA-PACIFIC ANIMAL FEED MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC ANIMAL FEED MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC ANIMAL FEED MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC ANIMAL FEED MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC ANIMAL FEED MARKET

FIGURE 12 PROJECTED DEMAND GROWTH FOR DIFFERENT TYPES OF MEAT AND EGGS BY ASIAN SUBREGIONS FROM 2000 TO 2030

FIGURE 13 FEED CONVERSION RATION (FCR), BY LIVESTOCK TYPE (KILOGRAM PER ANIMAL)

FIGURE 14 INCIDENCE OF LIVESTOCK DISEASES IN INDIA (JAN TO OCT 2016)

FIGURE 15 PERCENTAGE SHARES IN NO. OF DAIRY COWS IN THAILAND, BY DAIRY FARM SIZE

FIGURE 16 PERCENTAGE SHARES IN NO. OF SWINES IN THAILAND, BY SWINE FARM SIZE

FIGURE 17 PERCENTAGE SHARES IN NO. OF CHICKENS IN THAILAND, BY CHICKEN FARM SIZE

FIGURE 18 PERCENTAGE SHARE OF VEGAN DIET FOLLOWERS WORLDWIDE IN 2016

FIGURE 19 PHYSICAL COMPOSITION OF UREA MOLASSES MINERAL SUPPLEMENTS

FIGURE 20 SOUTH KOREA ANNUAL INCIDENCE OUTBREAKS OF VECTOR-BORNE DISEASES, 2002-2006 (IN PERCENTAGE)

FIGURE 21 ASIA-PACIFIC ANIMAL FEED MARKET: SEGMENTATION

FIGURE 22 GROWING CONSUMPTION OF EDIBLE MEAT AND RAPIDLY INCREASING POPULATION OF PETS, AND DOMESTICATED ANIMALS IS DRIVING ASIA-PACIFIC ANIMAL FEED MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 23 AMINO ACID IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC ANIMAL FEED MARKET IN 2020 & 2027

FIGURE 24 ASIA-PACIFIC ANIMAL FEED MARKET: BY TYPE, 2019

FIGURE 25 ASIA-PACIFIC ANIMAL FEED MARKET: BY LIVESTOCK, 2019

FIGURE 26 ASIA-PACIFIC ANIMAL FEED MARKET: BY FORM, 2019

FIGURE 27 ASIA-PACIFIC ANIMAL FEED MARKET: SNAPSHOT (2019)

FIGURE 28 ASIA- PACIFIC ANIMAL FEED MARKET: BY COUNTRY (2019)

FIGURE 29 ASIA-PACIFIC ANIMAL FEED MARKET: BY COUNTRY (2020 & 2027)

FIGURE 30 ASIA-PACIFIC ANIMAL FEED MARKET : BY COUNTRY (2019 & 2027)

FIGURE 31 ASIA-PACIFIC ANIMAL FEED MARKET : BY TYPE (2020-2027)

FIGURE 32 ASIA-PACIFIC ANIMAL FEED MARKET: COMPANY SHARE 2018 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.