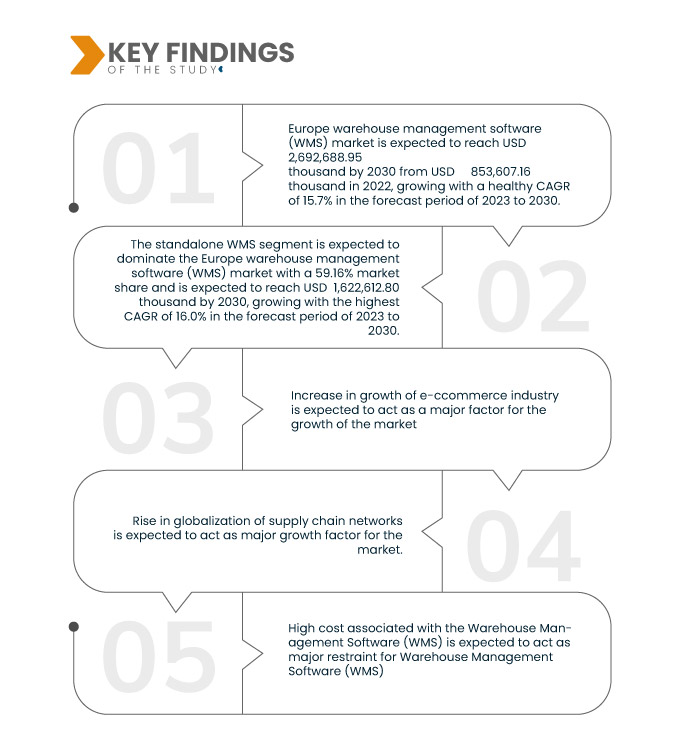

Ожидается, что рост в отрасли электронной коммерции будет стимулировать рост рынка. Кроме того, внедрение облачного программного обеспечения для управления складом (WMS) стимулирует рост рынка. Однако ожидается, что высокие первоначальные инвестиции будут сдерживать рост рынка, а рост внедрения IoT в складировании, как ожидается, станет возможностью для роста рынка. Однако ожидается, что недостаточная осведомленность о преимуществах WMS среди предприятий малого бизнеса станет проблемой для роста рынка.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/europe-warehouse-management-software-wms-market

Компания Data Bridge Market Research анализирует, что ожидается, что рынок программного обеспечения для управления складом (WMS) в Европе будет расти среднегодовыми темпами на 15,7% в прогнозируемый период с 2023 по 2030 год и достигнет 2 692 688,95 млн долларов США к 2030 году. Прогнозируется, что сегмент программного обеспечения будет способствовать росту рынка за счет таких факторов, как низкая стоимость рабочей силы, надлежащая коммуникация, легкий доступ к высококвалифицированной рабочей силе, качественное обслуживание и другие.

Основные выводы исследования

Увеличение роста индустрии электронной коммерции

Рост электронной коммерции и многоканальной розничной торговли значительно увеличил сложность складских операций. Программное обеспечение для управления складом (WMS) обеспечивает эффективное управление запасами, выполнение заказов и отслеживание отгрузок, что имеет решающее значение для удовлетворения ожиданий клиентов в эпоху электронной коммерции. Электронная коммерция (электронная коммерция) — это процесс купли-продажи товаров и услуг или передачи средств или данных по электронной сети, в первую очередь через Интернет. В настоящее время потребители могут просматривать целые каталоги магазинов, не выходя из дома, и многие предприятия выходят на онлайн-бизнес. Складирование является важным компонентом организации электронной коммерции. Оно включает управление спросом и предложением, отслеживание запасов, ввод заказов, управление заказами, управление трудовыми ресурсами, распределение и доставку клиенту.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2023-2030

|

Базовый год

|

2022

|

Исторический год

|

2021 (Можно настроить на 2015-2020)

|

Количественные единицы

|

Доход в тыс. долл. США, объемы в единицах, цены в долл. США

|

Охваченные сегменты

|

Тип (автономная WMS, интегрированная и облачная WMS), функция (управление запасами, комплектация заказов, упаковка и выполнение, отгрузка, приемка и процесс размещения, управление трудовыми ресурсами, управление двором и доком, показатели и аналитика склада и другие), количество складов (отдельный склад и несколько складов), развертывание (локальное и облачное), тип уровня (промежуточный WMS, расширенный WMS и базовый WMS), конечное использование (производство, розничная торговля и электронная коммерция, продукты питания и напитки, автомобилестроение, здравоохранение и фармацевтика, электротехника и электроника, химия и другие)

|

Страны, охваченные

|

Германия, Великобритания, Франция, Италия, Испания, Швейцария, Россия, Бельгия, Нидерланды, Швеция, Турция, Дания, Польша, Австрия, Норвегия, Финляндия и остальные страны Европы

|

Охваченные участники рынка

|

Mecalux SA (Испания), AEB SE (Германия), PSI Logistics GmbH (Германия), Consafe Logistics, Deposco, Inc. (Швеция), THE DESCARTES SYSTEMS GROUP INC (Канада), Made4net (США), Hardis Group (Франция), Ehrhardt Partner Group (EPG) (Германия), Generix Group (Германия), increff.com (Германия), Mantis Informatics SA (Польша), Blue Yonder Group, Inc. (дочерняя компания Panasonic Corporation) (США), Oracle (США), SAP SE (Германия), Infor (дочерняя компания Koch Industries) (Германия), Manhattan Associates (США), Tecsys Inc. (Канада), Microsoft (США), Kober AG (Германия) и Reply (Италия)

|

Данные, отраженные в отчете

|

Помимо таких рыночных данных, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, рыночный отчет, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции и анализ пестицидов.

|

Анализ сегмента

Европейский рынок программного обеспечения для управления складом (WMS) разделен на шесть основных сегментов в зависимости от типа, функции, количества складов, развертывания, типа уровня и конечного использования.

- По типу рынок сегментируется на автономные WMS, интегрированные и облачные WMS.

Ожидается, что в 2023 году сегмент автономных WMS будет доминировать на европейском рынке программного обеспечения для управления складом (WMS).

В 2023 году автономные WMS-решения будут доминировать на рынке с долей рынка 59,28%, поскольку автономные WMS-решения часто предлагают большую гибкость и возможности настройки, чем интегрированные или основанные на ERP-системах.

- На основе функций рынок сегментируется на управление запасами, комплектацию заказов, упаковку и выполнение заказов, доставку, приемку и размещение, управление трудовыми ресурсами, управление складскими помещениями и доками, складские показатели и аналитику и другие.

Ожидается, что в 2023 году сегмент управления запасами будет доминировать на европейском рынке программного обеспечения для управления складом (WMS).

В 2023 году сегмент управления запасами будет доминировать на рынке с долей рынка 33,93%, поскольку эффективное управление запасами имеет решающее значение для оптимизации складских операций и обеспечения наличия нужных товаров в нужный момент.

- На основе количества складов рынок сегментируется на один склад и несколько складов. В 2023 году сегмент одного склада доминирует на рынке с долей рынка 78,18%.

- На основе развертывания рынок сегментируется на on–premise и cloud. В 2023 году on–premise сегмент доминирует на рынке с долей рынка 78,78%

- На основе типа уровня рынок сегментируется на промежуточные WMS, продвинутые WMS и базовые WMS. В 2023 году промежуточный сегмент WMS доминирует на рынке с долей рынка 68,55%

- На основе конечного использования рынок сегментирован на производство, розничную торговлю и электронную коммерцию, продукты питания и напитки, автомобилестроение, здравоохранение и фармацевтику, электротехнику и электронику, химию и др. В 2023 году производственный сегмент доминировал на рынке с долей рынка 31,48%.

Основные игроки

Data Bridge Market Research выделяет следующие компании в качестве основных игроков на европейском рынке программного обеспечения для управления складом (WMS): Mecalux SA (Испания), AEB SE (Германия), PSI Logistics GmbH (Германия), Consafe Logistics, Deposco, Inc. (Швеция), THE DESCARTES SYSTEMS GROUP INC (Канада), Made4net (США), Hardis Group (Франция), Ehrhardt Partner Group (EPG) (Германия), Generix Group (Германия), increff.com (Германия), Mantis Informatics SA (Польша), Blue Yonder Group, Inc. (дочерняя компания Panasonic Corporation) (США), Oracle (США), SAP SE (Германия), Infor (дочерняя компания Koch Industries) (Германия), Manhattan Associates (США), Tecsys Inc. (Канада), Microsoft (США), Kober AG (Германия) и Reply (Италия) среди прочих.

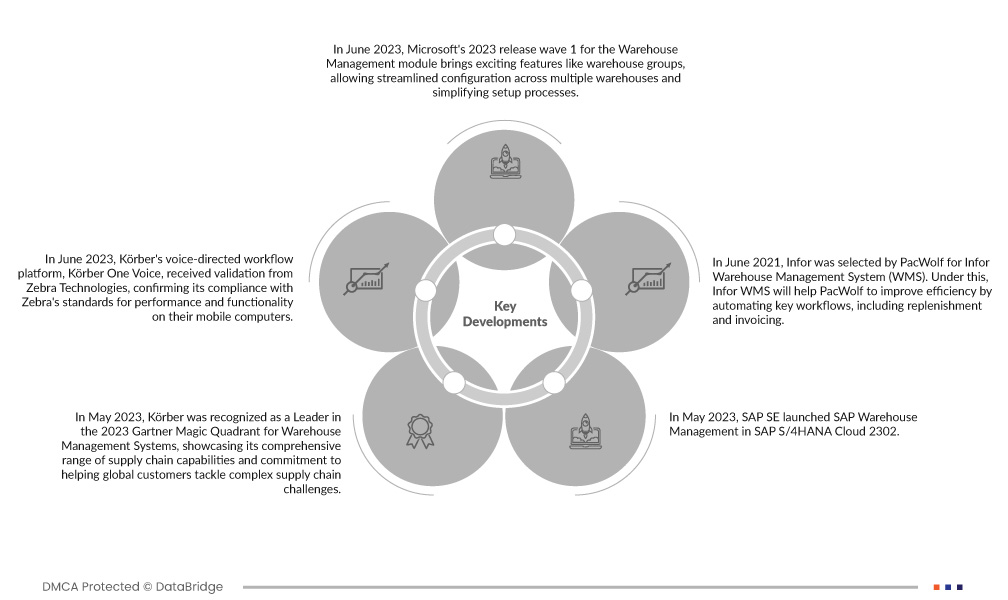

Развитие рынка

- В мае 2023 года SAP SE запустила SAP Warehouse Management в SAP S/4HANA Cloud 2302. С этим последним выпуском Cloud SAP SE внесла несколько изменений в основные функции, пользовательский опыт и возможности расширения. Такие инновации помогают компании обслуживать больше клиентов по всему миру

- В июне 2023 года голосовая платформа рабочего процесса Körber One Voice от Körber получила валидацию от Zebra Technologies, подтверждающую ее соответствие стандартам Zebra по производительности и функциональности на мобильных компьютерах. Валидация от Zebra Technologies укрепляет позиции Körber на рынке и дает клиентам уверенность в принятии Körber One Voice, что приводит к повышению эффективности и оптимизации складских операций.

- В мае 2023 года компания Körber была признана лидером в отчете Gartner Magic Quadrant 2023 года по системам управления складом, продемонстрировав свой широкий спектр возможностей в области цепочек поставок и приверженность оказанию помощи глобальным клиентам в решении сложных задач в области цепочек поставок. Это признание в качестве лидера в отчете Gartner Magic Quadrant по системам управления складом укрепляет репутацию компании Körber и позиционирует ее как надежного партнера для предприятий, стремящихся создать гибкие, эффективные и устойчивые цепочки поставок.

- В июне 2023 года Microsoft выпустит волну релизов 2023 года 1 для модуля Warehouse Management, которая принесет захватывающие функции, такие как группы складов, что позволит оптимизировать конфигурацию на нескольких складах и упростить процессы настройки. Внедрение групп складов обеспечивает эффективное управление конфигурацией и повышает масштабируемость для предприятий, использующих несколько складов.

- В июне 2021 года компания Infor была выбрана компанией PacWolf для использования системы управления складом Infor Warehouse Management System (WMS). В рамках этого решения Infor WMS поможет компании PacWolf повысить эффективность за счет автоматизации ключевых рабочих процессов, включая пополнение запасов и выставление счетов. Это поможет компании расширить свою клиентскую базу на рынке

Региональный анализ

Проведен анализ европейского рынка программного обеспечения для управления складом (WMS), а также предоставлены сведения о размерах рынка и тенденциях по типу, функции, количеству складов, развертыванию, типу уровня и конечному использованию.

В отчете по европейскому рынку программного обеспечения для управления складом (WMS) рассматриваются следующие страны: Германия, Великобритания, Франция, Италия, Испания, Швейцария, Россия, Бельгия, Нидерланды, Швеция, Турция, Дания, Польша, Австрия, Норвегия, Финляндия и остальные страны Европы.

Согласно анализу Data Bridge Market Research:

Ожидается, что Германия будет доминировать, а Великобритания станет страной с самыми быстрыми темпами роста на европейском рынке программного обеспечения для управления складом (WMS) в прогнозируемый период 2023–2030 гг.

Ожидается, что Германия будет доминировать на европейском рынке программного обеспечения для управления складом (WMS) благодаря запуску множества продуктов на основных рынках региона и повышению осведомленности потребителей. Германия имеет давнюю репутацию благодаря своему технологическому опыту и инженерному мастерству. Страна известна своими передовыми производственными возможностями и высокими стандартами качества. Этот опыт трансформируется в разработку надежных и инновационных решений для программного обеспечения для управления складом.

Великобритания, как ожидается, будет самой быстрорастущей страной в Европе, поскольку она испытала значительный рост в электронной коммерции, с сильным сектором онлайн-ритейла. Существует более высокий спрос на эффективные складские операции для поддержки выполнения заказов, поскольку все больше предприятий и потребителей переходят на онлайн-покупки. Этот возросший спрос на решения для программного обеспечения для складов, возможно, способствовал росту рынка в Великобритании

Для получения более подробной информации об отчете по рынку нажмите здесь – https://www.databridgemarketresearch.com/reports/europe-warehouse-management-software-wms-market