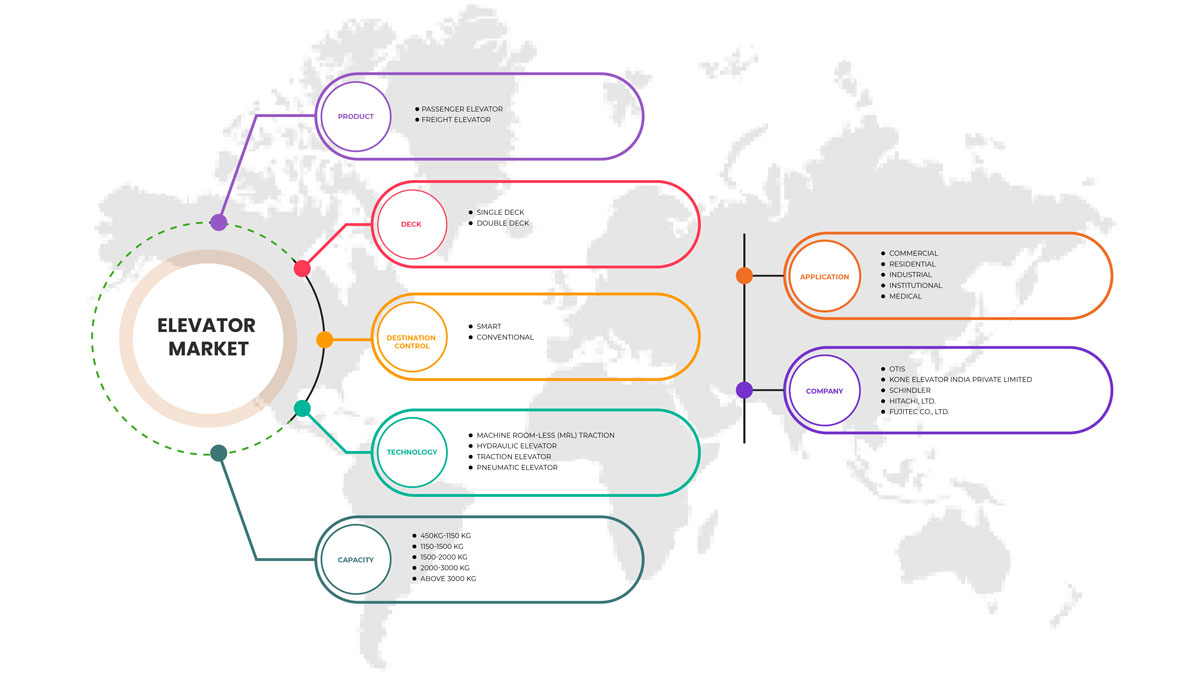

India Elevator Market, By Product (Passenger Elevator, and Freight Elevator), Technology (Machine Room-Less (MRL)Traction, Hydraulic Elevator, Traction Elevator, and Pneumatic Elevator), Deck (Single Deck, and Double Deck), Capacity (450KG-1150 KG, 1150-1500 KG, 1500-2000 KG, 2000-3000 KG, and Above 3000 KG), Destination Control (Smart, Conventional), Application (Commercial, Residential, Industrial, Institutional, and Medical) – Industry Trends and Forecast to 2029.

India Elevator Market Analysis and Size

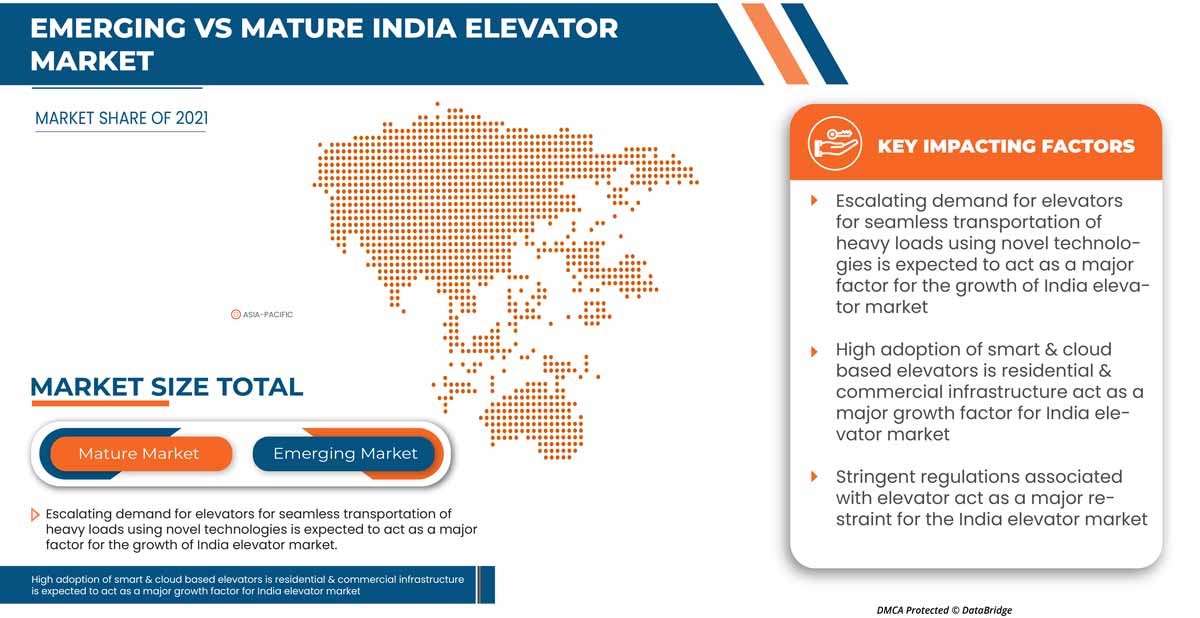

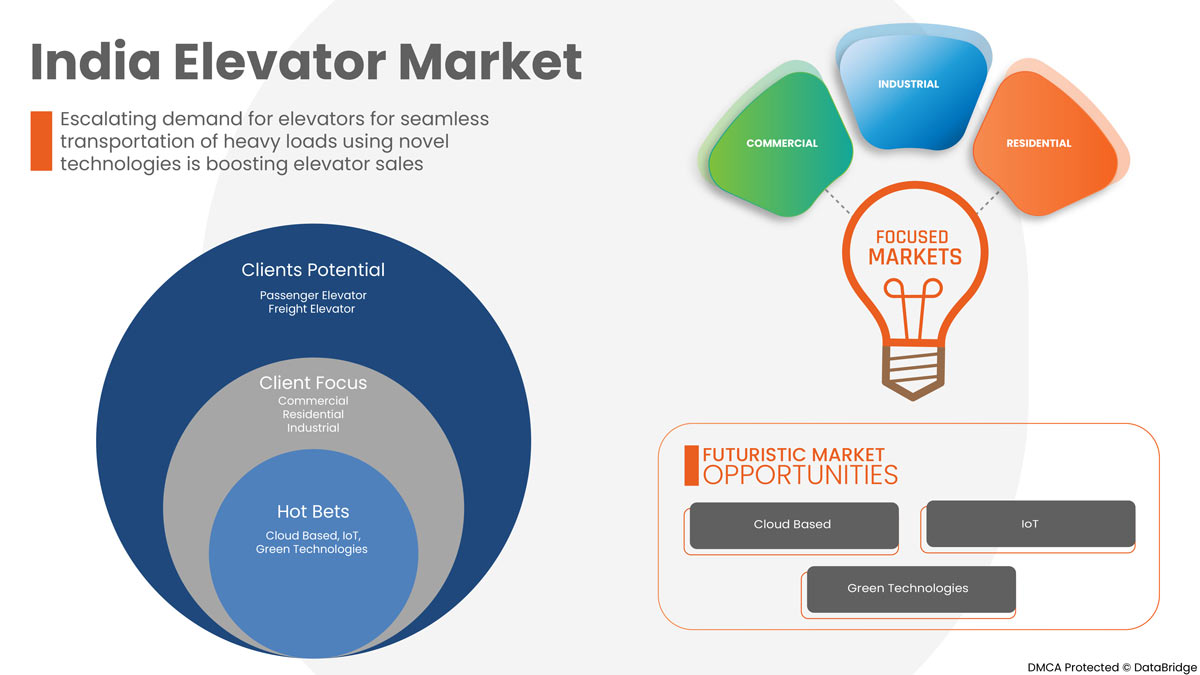

In recent times the popularity of elevators has increased exponentially as it is an important component in infrastructure development. Manufacturers are continuously trying to find ways to increase the production of elevators with innovative technological features. Advancement in technology is one of the major factors hoisting the market growth. Rapid urbanization, commercial construction, and upgrading infrastructure of industrial and residential spaces are other major factors aiding the country's market growth. Along with the adoption of digital transformation, using cloud-based solutions is also fuelling and responsible for the market growth in India. These factors are expected to hoist the market growth for the India elevator market.

Data Bridge Market Research analyses that the India elevator market is expected to reach the value of USD 2,421.03 million by 2029, at a CAGR of 4.5% during the forecast period. The elevator market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product (Passenger Elevator, And Freight Elevator), Technology (Machine Room-Less (MRL)Traction, Hydraulic Elevator, Traction Elevator, And Pneumatic Elevator ), Deck (Single Deck, And Double Deck), Capacity (450KG-1150 KG, 1150-1500 KG, 1500-2000 KG, 2000-3000 KG, And Above 3000 KG), Destination Control (Smart, Conventional), Application (Commercial, Residential, Industrial, Institutional, And Medical) |

|

Countries Covered |

India |

|

Market Players Covered |

FUJITEC CO., LTD., Hyundai Elevator Ltd, Sigma Gearless Pvt. Ltd., TK Elevator, Mitsubishi Elevator India Pvt Ltd, Schindler, KONE Elevator India Private Limited, Hitachi, Ltd., OTIS, TOSHIBA CORPORATION among others. |

Market Definition

An elevator can be defined as an electric lift that is used for vertical transportation of goods as well as people among the floors in buildings. Usually, these are equipment that is activated or operated with the help of electric motors that also drive counterweight system cables for drive transactions for lifting the weight of load and people. There are various types of elevators. For instance,

- Geared and Gearless Traction Elevator

- Hydraulic Elevator

- Machine-Room-Less (MRL) Elevator

- Vacuum (Air Driven) Home Elevator

There are various other types available in the market based on their applications. These elevators find their applications in various sectors, such as the industrial, commercial, and residential sectors.

India Elevator Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

-

Increased Usage of Energy-efficient Elevator

In India, elevators can run solely on solar power. This latest elevator technology innovation boasts up to 50 percent per year of energy savings compared to a conventional model. The new elevator can run on solar energy, power from the grid, or a combination of both. Depending on the configuration and available sunlight, it is possible to run the elevator solely on solar power. Solar panels are placed on the rooftop of the building to create power for the elevator. The energy captured by the solar panels can be used immediately, stored in batteries, or even re-sold to the grid. It offers a unique advantage of storing power during a power outage, thus making it safer to travel in than a conventional one.

• Installation of Advanced IoT Technology-enabled Elevator

Internet of Things (IoT) enabled elevators to use artificial intelligence (AI) to effectively enable vertical transportation of passengers and commodities. It is a process of upgrading the critical parts of the elevator to handle new technology, perform better, improve safety, and ensure the maintenance is up to date.

Advanced technology elevator functionality has two key components: it enables access to all buildings, such as commercial and residential. It is fully customized to deliver the data and services in a meaningful form to various enterprises. The second component of an IoT-enabled elevator is that it can map and orchestrate data to implement business logic.

Opportunity

- Minimization of the Carbon Footprint Using Green-Building Materials

One of the major problems faced is the generation of greenhouse gases in the construction industry, which uses heavy elevators to transport loads and others. This has an indirect relation to energy consumption. According to VIATechnik LLC, Buildings consume about 40 % of the world's energy, and elevators account for up to 10 percent of building energy use. More the consumption of energy, more usage of natural resources such as biomass, coal, and others. Which tends to have a high carbon footprint. To reduce carbon footprint in the construction sector, smart and innovative elevator systems must be used with innovative features such as Regenerative Drive Systems, efficient in-cab sensors & computerized control systems, and others to minimize power consumption and make the construction sector greener.

Restraints/Challenges

- High Maintenance and Installation Costs

One of the major challenges faced in the elevator market is the high maintenance requirement of the elevator. As elevator face multiple issues which arises due to malfunctions and breakdowns. These frequent malfunctions and breakdowns occur due to factors such as,

- Power Failure

- Worn Sheaves

- Contamination

- Bearing Malfunction or Loud Bearings

- Misaligned Motor Drive

This can be avoided by taking proactive, preventative steps to minimize the impact of breakdown. Prevention is better than cure, as proactive & preventative steps are much easier than fixing a broken elevator. Regular inspection is the first step to ensuring smooth and reliable operation of the elevators, upon inspections combined with routine maintenance can significantly increase productivity by eliminating downtime and decreasing energy consumption by up to 15%.

Recent Developments

- In February 2022, Schindler installed Schindler's Robotic Installation System for Elevators. It was the world's first self-climbing, an autonomous robotic system to conduct installation work in an elevator shaft. The first time has been deployed in customer projects in the Asia-Pacific region

- In March 2019, Mitsubishi Elevator India Pvt Ltd. announced that they had launched the NEXIEZ-LITE MRL elevator, an Indian-produced model that does not require a machine room

India Elevator Market Scope

The India elevator market is segmented on the basis of product, technology, deck, application, destination control, and capacity. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Passenger Elevator

- Freight Elevator

On the basis of product, the India elevator market is segmented into passenger elevator, and freight elevator

Technology

- Machine Room-Less (MRL) Traction

- Hydraulic Elevator

- Traction Elevator

- Pneumatic Elevator

On the basis of technology, India elevator market is segmented into machine room-less (MRL) traction, hydraulic elevator, traction elevator, and pneumatic elevator.

Deck

- Single Deck

- Double Deck

On the basis of deck, the India elevator market is segmented into a single deck and double deck

Capacity

- 450KG-1150 KG,

- 1150-1500 KG,

- 1500-2000 KG,

- 2000-3000 KG,

- Above 3000 KG

On the basis of capacity, the India elevator market is segmented into 450kg-1150 kg, 1150-1500 kg, 1500-2000 kg, 2000-3000 kg, and above 3000 kg.

Destination Control

- Smart

- Conventional

On the basis of destination control, the India elevator market is segmented into smart and conventional.

Application

- Commercial

- Residential

- Industrial

- Institutional

- Medical

On the basis of application, India elevator market is segmented into commercial, residential, industrial, institutional, and medical.

Competitive Landscape and India Elevator Market Share Analysis

The India elevator market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, India presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to India elevator market.

Some major players operating in the India elevator market are FUJITEC CO., LTD., Hyundai Elevator Ltd, Sigma Gearless Pvt. Ltd., TK Elevator, Mitsubishi Elevator India Pvt Ltd, Schindler, KONE Elevator India Private Limited, Hitachi, Ltd., and OTIS, TOSHIBA CORPORATION among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE INDIA ELEVATOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENRAIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATIONS

4.2 VENDOR SELECTION CRITERIA

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4 REGULATION COVERAGE

4.5 DBMR ANALYSIS

4.5.1 STRENGTH:

4.5.2 THREAT:

4.5.3 OPPORTUNITY:

4.5.4 WEAKNESS:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INSTALLATION OF ADVANCED IOT TECHNOLOGY-ENABLED ELEVATOR

5.1.2 INCREASED USAGE OF ENERGY-EFFICIENT ELEVATOR

5.1.3 RAPID URBANIZATION & URBAN COMMERCIAL CONSTRUCTION

5.1.4 ESCALATION IN DEMAND FOR ELEVATORS FOR SEAMLESS TRANSPORTATION OF HEAVY LOADS USING NOVEL TECHNOLOGIES

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS ASSOCIATED WITH ELEVATORS

5.3 OPPORTUNITIES

5.3.1 MINIMIZATION OF THE CARBON FOOTPRINT USING GREEN-BUILDING MATERIALS

5.3.2 GROWTH IN THE FOCUS ON UPGRADING INFRASTRUCTURE OF INDUSTRIAL AND RESIDENTIAL SPACES

5.4 CHALLENGES

5.4.1 HIGH MAINTENANCE AND INSTALLATION COSTS

5.4.2 OVER-THE-TOP DEMAND FOR TOP-NOTCH ASSISTANCE/SKILLED WORKFORCE

6 INDIA ELEVATOR MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 PASSENGER ELEVATOR

6.2.1 RESIDENTIAL ELEVATORS

6.2.2 OBSERVATION ELEVATORS

6.2.3 BED ELEVATORS

6.3 FREIGHT ELEVATOR

6.3.1 VEHICLE

6.3.2 DUMBWAITERS

7 INDIA ELEVATOR MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MACHINE ROOM-LESS (MRL) TRACTION

7.3 HYDRAULIC ELEVATOR

7.3.1 DIRECT ACTING HYDRAULIC LIFT

7.3.2 SUSPENDED HYDRAULIC LIFT

7.4 TRACTION ELEVATOR

7.4.1 GEARED

7.4.2 GEARLESS

7.5 PNEUMATIC ELEVATOR

8 INDIA ELEVATOR MARKET, BY DECK

8.1 OVERVIEW

8.2 SINGLE DECK

8.3 DOUBLE DECK

9 INDIA ELEVATOR MARKET, BY CAPACITY

9.1 OVERVIEW

9.2 450KG-1150 KG

9.3 1150-1500 KG

9.4 1500-2000 KG

9.5 2000-3000 KG

9.6 ABOVE 3000 KG

10 INDIA ELEVATOR MARKET, BY DESTINATION CONTROL

10.1 OVERVIEW

10.2 SMART

10.3 CONVENTIONAL

11 INDIA ELEVATOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 COMMERCIAL

11.2.1 MACHINE ROOM-LESS (MRL) TRACTION

11.2.2 HYDRAULIC ELEVATOR

11.2.3 TRACTION ELEVATOR

11.2.4 PNEUMATIC ELEVATOR

11.2.4.1 AIRPORTS

11.2.4.2 PARKING BUILDINGS

11.2.4.3 MALLS

11.2.4.4 HOTELS

11.2.4.5 RETAIL

11.2.4.6 HOSPITALS

11.2.4.7 CORPORATE OFFICES

11.2.4.8 RAILWAY STATIONS

11.2.4.9 RESTAURANTS

11.2.4.10 OTHERS

11.3 RESIDENTIAL

11.3.1 MACHINE ROOM-LESS (MRL) TRACTION

11.3.2 HYDRAULIC ELEVATOR

11.3.3 TRACTION ELEVATOR

11.3.4 PNEUMATIC ELEVATOR

11.4 INDUSTRIAL

11.4.1 MACHINE ROOM-LESS (MRL) TRACTION

11.4.2 HYDRAULIC ELEVATOR

11.4.3 TRACTION ELEVATOR

11.4.4 PNEUMATIC ELEVATOR

11.5 INSTITUTIONAL

11.5.1 SCHOOL

11.5.2 COLLEGES & UNIVERSITIES

11.5.2.1 MACHINE ROOM-LESS (MRL) TRACTION

11.5.2.2 HYDRAULIC ELEVATOR

11.5.2.3 TRACTION ELEVATOR

11.5.2.4 PNEUMATIC ELEVATOR

11.6 MEDICAL

11.6.1 MACHINE ROOM-LESS (MRL) TRACTION

11.6.2 HYDRAULIC ELEVATOR

11.6.3 TRACTION ELEVATOR

11.6.4 PNEUMATIC ELEVATOR

12 SWOT

13 INDIA ELEVATOR MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GERMANY

14 COMPANY PROFILES

14.1 OTIS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 KONE ELEVATOR INDIA PRIVATE LIMITED

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 SCHINDLER

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 HITACHI, LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 FUJITEC CO., LTD.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 MITSUBISHI ELEVATOR INDIA PVT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 HYUNDAI ELEVATOR LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 SIGMA ELEVATOR.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 TK ELEVATOR

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 TOSHIBA CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 INDIA ELEVATOR MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 INDIA ELEVATOR MARKET, BY PRODUCTS, 2020-2029 (UNITS)

TABLE 3 PRICE (USD/UNIT)

TABLE 4 INDIA PASSENGER ELEVATOR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 5 INDIA FREIGHT ELEVATOR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 6 INDIA ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 7 INDIA ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (UNITS)

TABLE 8 PRICE (USD/UNIT)

TABLE 9 INDIA HYDRAULIC ELEVATOR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 10 INDIA TRACTION ELEVATOR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 11 INDIA ELEVATOR MARKET, BY DECK, 2020-2029 (USD MILLION)

TABLE 12 INDIA ELEVATOR MARKET, BY DECK, 2020-2029 (UNITS)

TABLE 13 PRICE (USD/UNIT)

TABLE 14 INDIA ELEVATOR MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 15 INDIA ELEVATOR MARKET, BY CAPACITY, 2020-2029 (UNITS)

TABLE 16 PRICE (USD/UNIT)

TABLE 17 INDIA ELEVATOR MARKET, BY DESTINATION CONTROL, 2020-2029 (USD MILLION)

TABLE 18 INDIA ELEVATOR MARKET, BY DESTINATION CONTROL, 2020-2029 (UNITS)

TABLE 19 PRICE (USD/UNIT)

TABLE 20 INDIA ELEVATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 INDIA ELEVATOR MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 22 PRICE (USD/UNIT)

TABLE 23 INDIA COMMERCIAL ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 24 INDIA COMMERCIAL ELEVATOR MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 25 INDIA RESIDENTIAL ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 26 INDIA INDUSTRIAL ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 27 INDIA INSTITUTIONAL ELEVATOR MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 28 INDIA INSTITUTIONAL ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 29 INDIA MEDICAL ELEVATOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 INDIA ELEVATOR MARKET: SEGMENTATION

FIGURE 2 INDIA ELEVATOR MARKET: DATA TRIANGULATION

FIGURE 3 INDIA ELEVATOR MARKET: DROC ANALYSIS

FIGURE 4 INDIA ELEVATOR MARKET: GLOBAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 INDIA ELEVATOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA ELEVATOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA ELEVATOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA ELEVATOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 INDIA ELEVATOR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 INDIA ELEVATOR MARKET: SEGMENTATION

FIGURE 11 RAPID URBANIZATION & URBAN COMMERCIAL CONSTRUCTION IS EXPECTED TO DRIVE THE INDIA ELEVATOR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PASSENGER ELEVATOR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA ELEVATOR MARKET IN 2022 & 2029

FIGURE 13 TECHNOLOGICAL TRENDS IN AUDIO-CRITICAL COMMUNICATIONS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE INDIA ELEVATOR MARKET

FIGURE 15 GLOBAL CARBON EMISSION BY EACH SECTOR

FIGURE 16 INDIA ELEVATOR MARKET: BY PRODUCT, 2021

FIGURE 17 INDIA ELEVATOR MARKET: BY TECHNOLOGY, 2021

FIGURE 18 INDIA ELEVATOR MARKET: BY DECK, 2021

FIGURE 19 INDIA ELEVATOR MARKET: BY CAPACITY, 2021

FIGURE 20 INDIA ELEVATOR MARKET: BY DESTINATION CONTROL, 2021

FIGURE 21 INDIA ELEVATOR MARKET: BY APPLICATION, 2021

FIGURE 22 INDIA ELEVATOR MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.