North America Molecular Diagnostics Services Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

56,705.30 Thousand

USD

103,058.75 Thousand

2022

2030

USD

56,705.30 Thousand

USD

103,058.75 Thousand

2022

2030

| 2023 –2030 | |

| USD 56,705.30 Thousand | |

| USD 103,058.75 Thousand | |

|

|

|

|

North America Molecular Diagnostics Services Market, By Service Type (Instrument Repair Services, Training Services, Compliance Services, Calibration Services, Maintenance Services, Scalable Automation Services, Turnkey Services, Instrument Relocation Services, Hardware Customization, Performance Assurance Services, Design and Development Services, Supply Chain Solutions, New Product Introduction Services, Manufacturing Services, Environmental & Regulatory Services, Medical Management Systems Certification & Auditing, Clinical Research Services, Consultative Services, and Other Services), Technology (PCR, Real Time PCR, Next Generation Sequencing, and Other Technologies), End User (Hospitals, Diagnostic Centers, Academic & Research Institutions, and Others) Industry Trends and Forecast to 2030.

North America Molecular Diagnostics Services Market Analysis and Insights

The increasing demand for testing, therapies, and faster diagnosis is helping to boost overall market growth. The growing funding in the molecular diagnostics sector is also attributing to the market growth. The major market players are highly focused on various new diagnostics services. In addition, the rising prevalence of chronic and infectious diseases is also contributing to the rising demand for the market.

The North America molecular diagnostics services market is growing in the forecast year due to the rise in market players and the availability of various advanced molecular diagnostics services in the market. Along with this, the number of government and private collaborations has increased in the market which is further boosting the market growth. However, the high cost associated with molecular diagnostics labs setups and other instrumentations might hamper the market growth in the forecast period.

The strategic initiatives by key market players, rising government and private collaborations, and increasing R&D activities are giving opportunities for market growth. However, stringent regulations by the government and lack of skilled professionals are the key challenges to market growth.

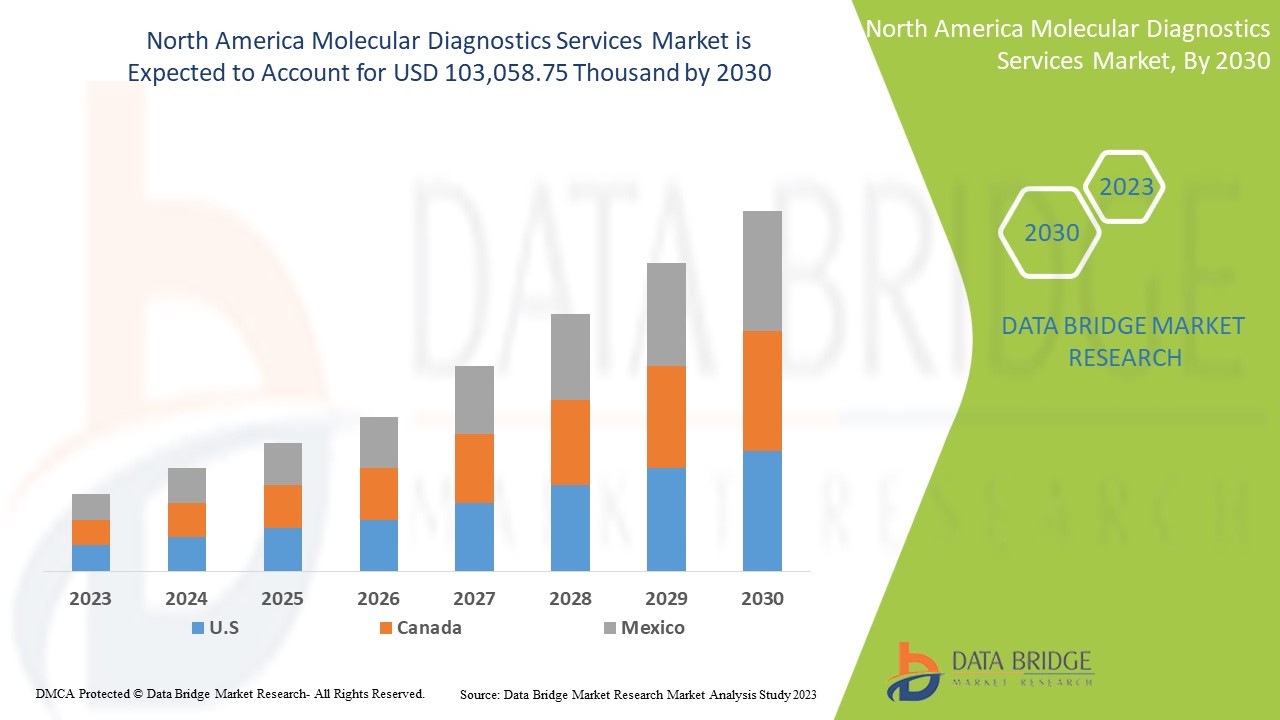

North America molecular diagnostics services market is expected to reach USD 103,058.75 thousand by 2030 from USD 56,705.30 thousand in 2022, growing at a CAGR of 8.0% in the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2020 - 2016) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Service Type (Instrument Repair Services, Training Services, Compliance Services, Calibration Services, Maintenance Services, Scalable Automation Services, Turnkey Services, Instrument Relocation Services, Hardware Customization, Performance Assurance Services, Design and Development Services, Supply Chain Solutions, New Product Introduction Services, Manufacturing Services, Environmental & Regulatory Services, Medical Management Systems Certification & Auditing, Clinical Research Services, Consultative Services, and Other Services), Technology (PCR, Real Time PCR, Next Generation Sequencing, and Other Technologies), End User (Hospitals, Diagnostic Centers, Academic & Research Institutions, and Others. |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

F. Hoffmann-La Roche Ltd, Danaher, BIOMERIEUX, QIAGEN, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc, Abbott, DiaSorin S.p.A., and Hologic, Inc among others |

Market Definition

Molecular diagnostics is known as the process of identifying a disease by studying molecules such as proteins, DNA, and RNA in a tissue or fluid. These molecular diagnostics services are used as a strategy to research, analyze, and diagnose certain molecules with the help of technologies in the laboratory. These are specially used for the measurement of a specific biomarker in the fluids, Polymerase Chain Reaction (PCR)-based detection of bacterial genes, and molecular responses of any certain infection. These services are used to provide more efficient testing and diagnostics.

Molecular diagnostic services enable researchers and technicians to efficiently and effectively produce output in less time, which drives the Asia-Pacific molecular diagnostics services market. Furthermore, with the potential for clinical practice, these services are used to give additional support to boost efficiency in molecular diagnosis and the presence of major market players also contributes to the market growth.

North America Molecular Diagnostics Services Market Dynamics

Drivers

-

Rising prevalence of chronic and infectious diseases

Chronic and infectious diseases are currently the major cause of death among adults in almost all countries. The prevalence of chronic and infectious diseases is increasing, as a result of which people are more dependent on diagnostic labs and centers for disease diagnosis. The rising prevalence has increased the demand for molecular diagnostics services to provide accurate diagnoses, therapies, and test results within less time. Health-damaging behaviors- particularly tobacco use, lack of physical activity, poor eating habits, and excessive alcohol use are major contributors to the rising prevalence of chronic and infectious diseases. These diseases can be diagnosed by several techniques such as immunoassay, molecular techniques, PCR, and gene manipulation techniques among others. Hence, the demand for molecular diagnostic services is increasing to fulfill the patient’s demand for faster diagnosis and treatment.

The occurrence of chronic and infectious diseases is high and the number of molecular tests has also increased for diagnosis and treatment, the demand for products and services will rise eventually. Hence, the rising prevalence of chronic and infectious diseases is driving market growth across the globe.

-

Increasing demand for testing, therapies, faster diagnostics

The demand for high-priced specialist therapies is more in the present scenario. The awareness among consumers about faster diagnostics is rising and the adoption of analyzer software for molecular diagnostics is increasing at a higher rate. Molecular diagnostics render accurate and effective results and have indispensable applications in disease diagnostics. People are preferring personalized medications that rely on identifying the genetic, epigenomic, and clinical information of the individual.

Furthermore, in recent years patients are shifting to personalized care and treatment and the demand for molecular testing, therapies, and faster diagnostics is increasing which may act as a driving factor for market growth across the globe.

-

Growing funding in the molecular diagnostics segment

Government initiatives, schemes, and funding activities to support and promote innovation and development have increased, as a result, the molecular diagnostics segment is growing rapidly. This segment is an integral part of disease control, hence the funding is rising and scientists are more focused on developing new ideas for disease control and healthy survival. Again chronic disease like cancer has become dominant all over the world and the demand for specialized treatment and the fastest diagnosis is rising.

As the government and public funding are rising to support the molecular diagnostic segment for better innovations and alternatives for faster diagnosis, the market is boosting to a higher extent. Considering the above instances, it can be predicted that growing funding in the molecular diagnostics segment is going to drive the market in near future.

Opportunity

-

Increasing research & development activities

The increasing R&D activities offer alternative options for receiving molecular diagnostics services globally, improving access and reducing costs associated with diagnostics services. However, the full potential of molecular diagnostics has not been realized with slow and fragmented uptake.

The increase in the awareness program, rising awareness initiatives, and support through the government have increased the usage of molecular diagnostics in various areas. The increased R&D activities will help to increase the knowledge to develop new or improved products and processes. The design, technical manufacturing, and phase trials are often the most important part of R&D activities that provide improvement in the services.

As the market players are constantly engaged in R&D activities more molecular diagnostic services are likely to be involved in the market. This would increase the demand for molecular diagnostic services by various end users such as hospitals, clinics, and diagnostic centers.

Restraint/Challenge

- High cost associated with molecular diagnostics labs setups and other instrumentations

The molecular diagnostic lab comprises several techniques such as Fluorescence In Situ Hybridization (FISH), Polymerase Chain Reaction (PCR)-based molecular diagnostics, interphase chromosome profiling, DNA fingerprinting, and others. There are several services associated with a molecular diagnostics lab such as installation service, validation service, rectification service, automation services, and others. Hence, the overall lab setup and instrumentation costs are too high which becomes quite difficult to be established without government and private funding and investments and this may restrain the market growth.

Post-COVID-19 Impact on North America Molecular Diagnostics Services Market

The post-COVID-19 has positively affected the market. A large number of the population were affected by this pandemic and the number of diagnostics tests had increased worldwide. Mostly, the PCR-based COVID-19 diagnosis increased. Thus, COVID-19 affected the market positively.

Recent Development

- In August 2022, Abbott shared its new study on a blood test for a concussion that can predict outcomes from brain injury and inform treatment interventions. This has helped the company to increase its North America presence in the market.

North America Molecular Diagnostics Services Market Scope

North America molecular diagnostics services market is segmented into three notable segments based on service type, technology, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

By Service Type

- Instrument Repair Services

- Training Services

- Maintenance Services

- Calibration Services

- Compliance Services

- Turnkey Services

- Scalable Automation Services

- Hardware Customization

- Instrument Relocation Services

- Performance Assurance Services

- Design & Development Services

- Supply Chain Solutions

- New Product Introduction Services

- Manufacturing Services

- Environmental & Regulatory Services

- Medical Management Systems Certification & Auditing

- Clinical Research Services

- Consultative Services

- Other Services

Based on service type, the market is segmented into instrument repair services, training services, maintenance services, calibration services, compliance services, turnkey services, scalable automation services, hardware customization, instrument relocation services, performance assurance services, design & development services, supply chain solutions, new product introduction services, manufacturing services, environmental & regulatory services, medical management systems certification & auditing, clinical research services, consultative services, and other services.

By Technology

- PCR

- Real Time PCR

- Next Generation Sequencing

- Other Technologies

Based on technology, the market is segmented into PCR, real time PCR, next generation sequencing, and other technologies.

By End User

- Hospitals

- Diagnostics Centers

- Academic & Research Institutes

- Others

Based on end user, the market is segmented into hospitals, diagnostic centers, academic & research institutes, and others.

North America Molecular Diagnostics Services Market Regional Analysis/Insights

The North America molecular diagnostics services market is analyzed and market size insights and trends are provided by country, service type, technology, and end user.

The countries covered in this report are U.S., Canada, and Mexico.

The U.S. dominates the North America molecular diagnostics services market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period.

This is due to implementing awareness programs among people and the rise in technological advancement further improves this market growth.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and the challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Molecular Diagnostics Services Market Share Analysis

The North America molecular diagnostics services market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the North America molecular diagnostics services market are F. Hoffmann-La Roche Ltd, Danaher, BIOMERIEUX, QIAGEN, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc, Abbott, DiaSorin S.p.A., and Hologic, Inc among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING PREVALENCE OF CHRONIC AND INFECTIOUS DISEASES

5.1.2 INCREASING DEMAND FOR TESTING, THERAPIES, AND FASTER DIAGNOSTICS

5.1.3 GROWING FUNDINGS IN MOLECULAR DIAGNOSTICS SEGMENT

5.2 RESTRAINTS

5.2.1 HIGH-COST ASSOCIATED WITH MOLECULAR DIAGNOSTICS LABS SET-UPS AND OTHER INSTRUMENTATIONS

5.2.2 NON-AVAILABILITY OF RELEVANT AND APPROPRIATE KITS

5.3 OPPORTUNITIES

5.3.1 STRATEGIC INITIATIVES BY KEY PLAYERS

5.3.2 RISING GOVERNMENT AND PRIVATE COLLABORATIONS

5.3.3 INCREASING RESEARCH AND DEVELOPMENT ACTIVITIES

5.4 CHALLENGES

5.4.1 STRINGENT REGULATIONS

5.4.2 LACK OF SKILLED PROFESSIONALS

6 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE

6.1 OVERVIEW

6.2 INSTRUMENT REPAIR SERVICES

6.2.1 ON-SITE REPAIR SERVICES

6.2.1 OFF-SITE REPAIR SERVICES

6.3 MAINTENANCE SERVICES

6.4 TRAINING SERVICES

6.4.1 PCR BASED MOLECULAR DIAGNOSTICS

6.4.2 IMMUNOHISTOCHEMISTRY (IHC)

6.4.3 VIRAL LOAD TESTING

6.4.4 INTERPHASE CHROMOSOME PROFILING (ICP)

6.4.5 APPLICATION TRAINING SERVICES

6.5 CALIBRATION SERVICES

6.6 COMPLIANCE SERVICES

6.6.1 IQ/OQ & PM/OQ SERVICES

6.6.2 INSTALLATION SERVICES

6.6.3 VALIDATION SERVICES

6.6.4 OTHER SERVICES

6.7 TURNKEY SERVICES

6.8 SCALABLE AUTOMATION SERVICES

6.8.1 AUTOMATION FOR HIGH-CONTENT SCREENING (HCS)

6.8.2 AUTOMATION FOR HIGH-THROUGHPUT PLATE-BASED ASSAYS

6.8.3 AUTOMATION FOR HIGH-THROUGHPUT CLONE SCREENING

6.9 HARDWARE CUSTOMIZATION

6.1 INSTRUMENT RELOCATION SERVICES

6.10.1 PLATE RECERTIFICATION

6.10.2 FACTORY-APPROVED PARTS

6.10.3 INSTRUMENT PERFORMANCE EVALUATION

6.10.4 OTHER SERVICES

6.11 PERFORMANCE ASSURANCE SERVICES

6.12 DESIGN AND DEVELOPMENT SERVICES

6.13 SUPPLY CHAIN SOLUTIONS

6.14 NEW PRODUCT INTRODUCTION SERVICES

6.15 MANUFACTURING SERVICES

6.16 ENVIRONMENTAL AND REGULATORY SERVICES

6.17 MEDICAL MANAGEMENT SYSTEMS CERTIFICATION & AUDITING

6.18 CLINICAL RESEARCH SERVICES

6.19 CONSULTATIVE SERVICES

6.2 OTHER SERVICES

7 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 REAL TIME PCR

7.2.1 INSTRUMENT REPAIR SERVICES

7.2.2 MAINTENANCE SERVICES

7.2.3 TRAINING SERVICES

7.2.4 CALIBRATION SERVICES

7.2.5 COMPLIANCE SERVICES

7.2.6 TURNKEY SERVICES

7.2.7 SCALABLE AUTOMATION SERVICES

7.2.8 HARDWARE CUSTOMIZATION

7.2.9 INSTRUMENT RELOCATION SERVICES

7.2.10 PERFORMANCE ASSURANCE SERVICES

7.2.11 DESIGN AND DEVELOPMENT SERVICES

7.2.12 SUPPLY CHAIN SOLUTIONS

7.2.13 NEW PRODUCT INTRODUCTION SERVICES

7.2.14 MANUFACTURING SERVICES

7.2.15 ENVIRONMENTAL & REGULATION SERVICES

7.2.16 MEDICAL MANAGEMENT SYSTEMS CERTIFICATION & AUDITING

7.2.17 CLINICAL RESEARCH SERVICES

7.2.18 CONSULTATIVE SERVICES

7.2.19 OTHER SERVICES

7.3 PCR

7.3.1 INSTRUMENT REPAIR SERVICES

7.3.2 MAINTENANCE SERVICES

7.3.3 TRAINING SERVICES

7.3.4 CALIBRATION SERVICES

7.3.5 COMPLIANCE SERVICES

7.3.6 TURNKEY SERVICES

7.3.7 SCALABLE AUTOMATION SERVICES

7.3.8 HARDWARE CUSTOMIZATION

7.3.9 INSTRUMENT RELOCATION SERVICES

7.3.10 PERFORMANCE ASSURANCE SERVICES

7.3.11 DESIGN AND DEVELOPMENT SERVICES

7.3.12 SUPPLY CHAIN SOLUTIONS

7.3.13 NEW PRODUCT INTRODUCTION SERVICES

7.3.14 MANUFACTURING SERVICES

7.3.15 ENVIRONMENTAL AND REGULATION SERVICES

7.3.16 MEDICAL MANAGEMENT SYSTEMS CERTIFICATION & AUDITING

7.3.17 CLINICAL RESEARCH SERVICES

7.3.18 CONSULTATIVE SERVICES

7.3.19 OTHER SERVICES

7.4 NEXT GENERATION SEQUENCING

7.4.1 INSTRUMENT REPAIR SERVICES

7.4.2 MAINTENANCE SERVICES

7.4.3 TRAINING SERVICES

7.4.4 CALIBRATION SERVICES

7.4.5 COMPLIANCE SERVICES

7.4.6 TURNKEY SERVICES

7.4.7 SCALABLE AUTOMATION SERVICES

7.4.8 HARDWARE CUSTOMIZATION

7.4.9 INSTRUMENT RELOCATION SERVICES

7.4.10 PERFORMANCE ASSURANCE SERVICES

7.4.11 DESIGN AND DEVELOPMENT SERVICES

7.4.12 SUPPLY CHAIN SOLUTIONS

7.4.13 NEW PRODUCT INTRODUCTION SERVICES

7.4.14 MANUFACTURING SERVICES

7.4.15 ENVIRONMENTAL AND REGULATION SERVICES

7.4.16 MEDICAL MANAGEMENT SYSTEMS CERTIFICATION & AUDITING

7.4.17 CLINICAL RESEARCH SERVICES

7.4.18 CONSULTATIVE SERVICES

7.4.19 OTHER SERVICES

7.5 OTHER TECHNOLOGIES

8 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY END USER

8.1 OVERVIEW

8.2 HOSPITALS

8.2.1 INSTRUMENT REPAIR SERVICES

8.2.2 MAINTENANCE SERVICES

8.2.3 TRAINING SERVICES

8.2.4 CALIBRATION SERVICES

8.2.5 COMPLIANCE SERVICES

8.2.6 TURNKEY SERVICES

8.2.7 SCALABLE AUTOMATION SERVICES

8.2.8 HARDWARE CUSTOMIZATION

8.2.9 INSTRUMENT RELOCATION SERVICES

8.2.10 PERFORMANCE ASSURANCE SERVICES

8.2.11 DESIGN AND DEVELOPMENT SERVICES

8.2.12 SUPPLY CHAIN SOLUTIONS

8.2.13 NEW PRODUCT INTRODUCTION SERVICES

8.2.14 MANUFACTURING SERVICES

8.2.15 ENVIRONMENTAL AND REGULATORY SERVICES

8.2.16 MEDICAL MANAGEMENT SYSTEMS CERTIFICATION AND AUDITING

8.2.17 CLINICAL RESEARCH SERVICES

8.2.18 CONSULTATIVE SERVICES

8.2.19 OTHER SERVICES

8.3 DIAGNOSTIC CENTERS

8.3.1 CLINICAL LABORATORIES

8.3.1.1 INSTRUMENT REPAIR SERVICES

8.3.1.2 Maintenance services

8.3.1.3 Training SERVICES

8.3.1.4 CALIBRATION SERVICES

8.3.1.5 COMPLIANCE SERVICES

8.3.1.6 TURNKEY SERVICES

8.3.1.7 SCALABLE AUTOMATION SERVICES

8.3.1.8 HARDWARE CUSTOMIZATION

8.3.1.9 INSTRUMENT RELOCATION SERVICES

8.3.1.10 PERFORMANCE Assurance SERVICES

8.3.1.11 DESIGN and DEVELOPMENT SERVICES

8.3.1.12 SUPPLY CHAIN SOLUTIONS

8.3.1.13 NEW PRODUCT INTRODUCTION SERVICES

8.3.1.14 MANUFACTURING SERVICES

8.3.1.15 ENVIRONMENTAL and REGULATory SERVICES

8.3.1.16 MEDICAL MANAGEMENT SYSTEMS CERTIFICATION and AUDITING

8.3.1.17 CLINICAL RESEARCH SERVICES

8.3.1.18 CONSULTATIVE SERVICES

8.3.1.19 Other SERVICES

8.3.2 AMBULATORY SURGICAL CENTERS

8.3.2.1 INSTRUMENT REPAIR SERVICES

8.3.2.2 MAINTENANCE SERVICES

8.3.2.3 TRAINING SERVICES

8.3.2.4 CALIBRATION SERVICES

8.3.2.5 COMPLIANCE SERVICES

8.3.2.6 TURNKEY SERVICES

8.3.2.7 SCALABLE AUTOMATION SERVICES

8.3.2.8 HARDWARE CUSTOMIZATION

8.3.2.9 INSTRUMENT RELOCATION SERVICES

8.3.2.10 PERFORMANCE Assurance SERVICES

8.3.2.11 DESIGN and DEVELOPMENT SERVICES

8.3.2.12 SUPPLY CHAIN SOLUTIONS

8.3.2.13 NEW PRODUCT INTRODUCTION SERVICES

8.3.2.14 MANUFACTURING SERVICES

8.3.2.15 ENVIRONMENTAL AND REGULATORY SERVICES

8.3.2.16 MEDICAL MANAGEMENT SYSTEMS CERTIFICATION and AUDITING

8.3.2.17 CLINICAL RESEARCH SERVICES

8.3.2.18 CONSULTATIVE SERVICES

8.3.2.19 OTHER SERVICES

8.4 ACADEMIC AND RESEARCH INSTITUTES

8.4.1 INSTRUMENT REPAIR SERVICES

8.4.2 MAINTENANCE SERVICES

8.4.3 TRAINING SERVICES

8.4.4 CALIBRATION SERVICES

8.4.5 COMPLIANCE SERVICES

8.4.6 TURNKEY SERVICES

8.4.7 SCALABLE AUTOMATION SERVICES

8.4.8 HARDWARE CUSTOMIZATION

8.4.9 INSTRUMENT RELOCATION SERVICES

8.4.10 PERFORMANCE ASSURANCE SERVICES

8.4.11 DESIGN AND DEVELOPMENT SERVICES

8.4.12 SUPPLY CHAIN SOLUTIONS

8.4.13 NEW PRODUCT INTRODUCTION SERVICES

8.4.14 MANUFACTURING SERVICES

8.4.15 ENVIRONMENTAL AND REGULATORY SERVICES

8.4.16 MEDICAL MANAGEMENT SYSTEMS CERTIFICATION & AUDITING

8.4.17 CLINICAL RESEARCH SERVICES

8.4.18 CONSULTATIVE SERVICES

8.4.19 OTHER SERVICES

8.5 OTHERS

9 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 F.HOFFMANN-LA ROCHE LTD

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SERVICE PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 DANAHER

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 BIOMERIEUX

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 SERVICE PORTFOLIO

12.3.5 RECENT DEVELOPMENT

12.4 QIAGEN

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 SERVICE PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 THERMO FISHER SCIENTIFIC

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 SERVICE PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 ABBOTT

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 SERVICE PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 BIO-RAD LABORATORIES, INC

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 SERVICE PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 DIASORIN

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 SERVICE PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 HOLOGIC, INC

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 SERVICE PORTFOLIO

12.9.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 1 NORTH AMERICA INSTRUMENT REPAIR SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA INSTRUMENT REPAIR SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA MAINTENANCE SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA TRAINING SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA TRAINING SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA CALIBRATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA COMPLIANCE SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA COMPLIANCE SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA TURNKEY SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA SCALABLE AUTOMATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA SCALABLE AUTOMATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA HARDWARE CUSTOMIZATION IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA INSTRUMENT RELOCATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA INSTRUMENT RELOCATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA PERFORMANCE ASSURANCE SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA DESIGN AND DEVELOPMENT SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA SUPPLY CHAIN SOLUTIONS SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA NEW PRODUCT INTRODUCTION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA MANUFACTURING SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA ENVIRONMENTAL AND REGULATORY SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA MEDICAL MANAGEMENT SYSTEMS AND AUDITING SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA CLINICAL RESEARCH SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA CONSULTATIVE SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA OTHER SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA REAL TIME PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA REAL TIME PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA NEXT GENERATION SEQUENCING IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA NEXT GENERATION SEQUENCING IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA OTHER TECHNOLOGIES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA HOSPITALS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA HOSPITALS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA DIAGNOSTIC CENTERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA DIAGNOSTIC CENTERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA CLINICAL LABORATORIES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA OTHERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA INSTRUMENT REPAIR SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA TRAINING SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA COMPLIANCE SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA SCALABLE AUTOMATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA INSTRUMENT RELOCATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA REAL TIME PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA NEXT GENERATION SEQUENCING IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA HOSPITALS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA DIAGNOSTIC CENTERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA CLINICAL LABORATORIES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA ACADEMIC & RESEARCH INSTITUTES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 U.S. MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 U.S. INSTRUMENT REPAIR SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 U.S. TRAINING SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 U.S. COMPLIANCE SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 U.S. SCALABLE AUTOMATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 U.S. INSTRUMENT RELOCATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 U.S. MOLECULAR DIAGNOSTICS SERVICES MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 67 U.S. REAL TIME PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 U.S. PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 U.S. NEXT GENERATION SEQUENCING IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 U.S. MOLECULAR DIAGNOSTICS SERVICES MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 71 U.S. HOSPITALS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE 2021-2030 (USD THOUSAND)

TABLE 72 U.S. DIAGNOSTIC CENTERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 73 U.S. CLINICAL LABORATORIES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 U.S. AMBULATORY SURGICAL CENTERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 U.S. ACADEMIC & RESEARCH INSTITUTES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 CANADA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 CANADA INSTRUMENT REPAIR SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 CANADA TRAINING SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 CANADA COMPLIANCE SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 CANADA SCALABLE AUTOMATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 CANADA INSTRUMENT RELOCATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 CANADA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 83 CANADA REAL TIME PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 CANADA PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 CANADA NEXT GENERATION SEQUENCING IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 CANADA MOLECULAR DIAGNOSTICS SERVICES MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 87 CANADA HOSPITALS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE 2021-2030 (USD THOUSAND)

TABLE 88 CANADA DIAGNOSTIC CENTERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 89 CANADA CLINICAL LABORATORIES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 CANADA AMBULATORY SURGICAL CENTERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 CANADA ACADEMIC & RESEARCH INSTITUTES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 MEXICO MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 MEXICO INSTRUMENT REPAIR SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 MEXICO TRAINING SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 MEXICO COMPLIANCE SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 MEXICO SCALABLE AUTOMATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 MEXICO INSTRUMENT RELOCATION SERVICES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 MEXICO MOLECULAR DIAGNOSTICS SERVICES MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 99 MEXICO REAL TIME PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 MEXICO PCR IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 MEXICO NEXT GENERATION SEQUENCING IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 MEXICO MOLECULAR DIAGNOSTICS SERVICES MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 103 MEXICO HOSPITALS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE 2021-2030 (USD THOUSAND)

TABLE 104 MEXICO DIAGNOSTIC CENTERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 105 MEXICO CLINICAL LABORATORIES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 MEXICO AMBULATORY SURGICAL CENTERS IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 MEXICO ACADEMIC & RESEARCH INSTITUTES IN MOLECULAR DIAGNOSTICS SERVICES MARKET, BY SERVICE TYPE, 2021-2030 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: SEGMENTATION

FIGURE 11 THE RISING PREVALENCE OF CHRONIC AND INFECTIOUS DISEASES IS EXPECTED TO DRIVE THE NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SERVICE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET

FIGURE 14 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET : BY SERVICE TYPE, 2022

FIGURE 15 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET : BY SERVICE TYPE, 2023-2030 (USD THOUSAND)

FIGURE 16 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET : BY SERVICE TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET : BY SERVICE TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: BY TECHNOLOGY, 2022

FIGURE 19 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: BY TECHNOLOGY, 2023-2030 (USD THOUSAND)

FIGURE 20 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: BY END USER, 2022

FIGURE 23 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 24 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: BY END USER, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET : BY END USER, LIFELINE CURVE

FIGURE 26 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: BY SERVICE TYPE (2023-2030)

FIGURE 31 NORTH AMERICA MOLECULAR DIAGNOSTICS SERVICES MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.