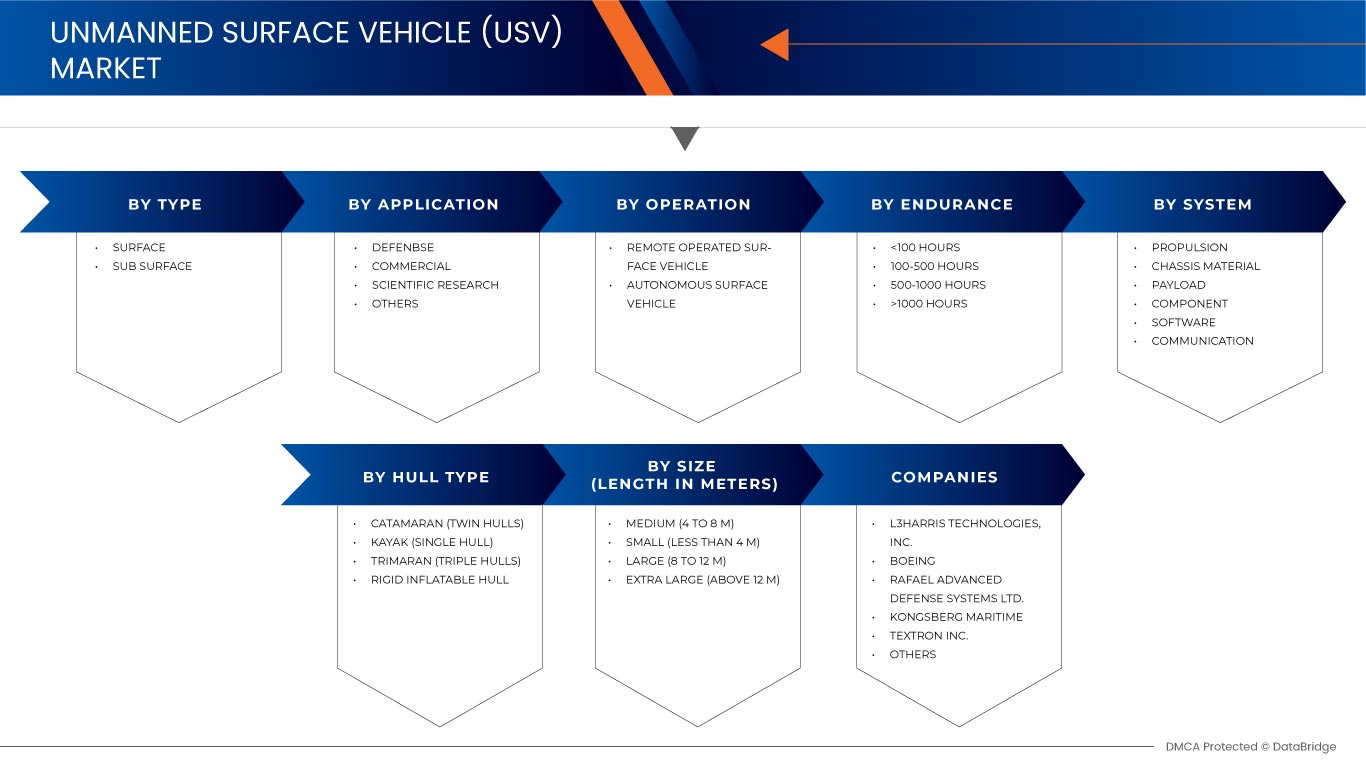

북미 무인 수상 차량(USV) 시장, 유형(수면 및 수중), 응용 분야(방위, 상업, 과학 연구 및 기타), 지속 시간(100~500시간, 1000시간), 운영(원격 작동 수상 차량 및 자율 수상 차량), 시스템(추진력, 섀시 소재, 탑재량, 구성 요소, 소프트웨어 및 통신), 선체 유형(쌍동선(쌍동선), 카약(단일 선체), 삼동선(삼중 선체) 및 단단한 팽창형 선체), 크기(중형(4~8M), 소형(4M 미만), 대형(8~12M) 및 초대형(12M 이상)) - 2030년까지의 산업 동향 및 예측.

북미 무인 수상 차량(USV) 시장 분석 및 규모

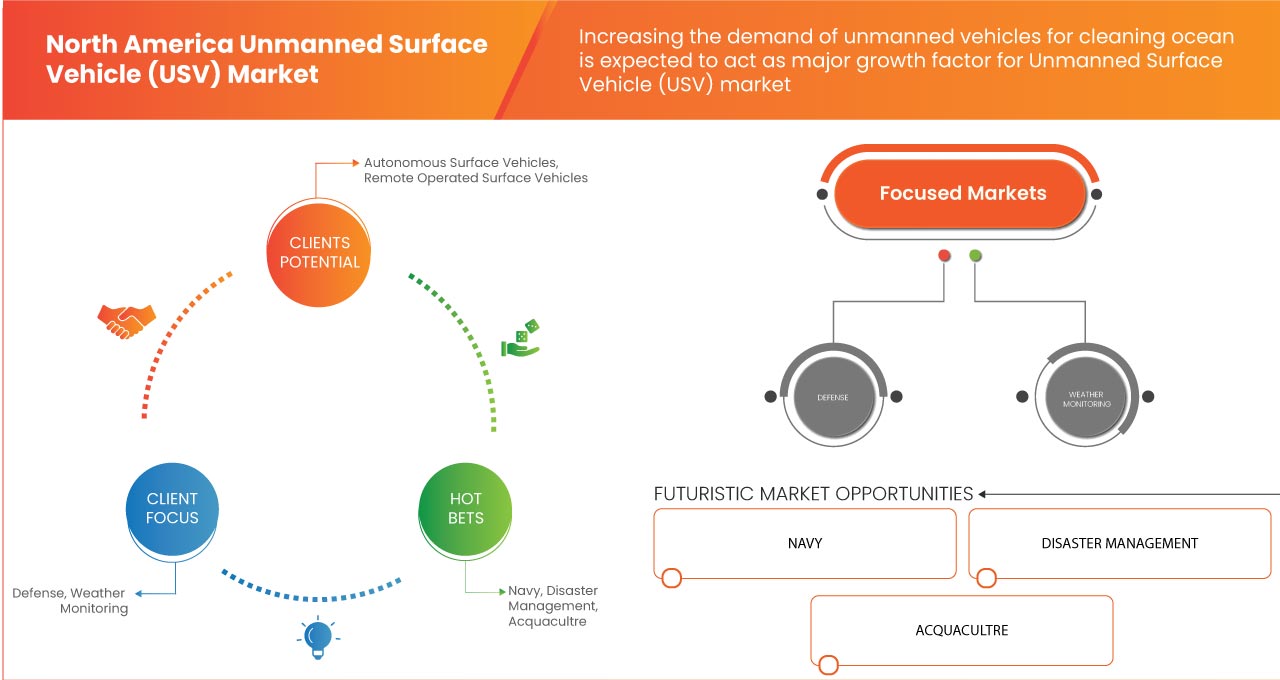

자율 주행 수상 차량(ASV)에 전력을 공급하기 위해 태양 전지를 사용하는 것이 증가함에 따라 무인 수상 차량(USV)의 성장이 가속화되고 있습니다. 오염 수준 증가로 인한 수질 모니터링 수요 증가와 과학자들이 과거 기후 조건을 연구할 수 있는 해양 데이터 매핑으로 인해 무인 수상 차량(USV)의 성장이 촉진되고 있습니다. 또한 해상 안보 위협이 증가함에 따라 북미 해군은 함대에 자율 주행 수상 차량(ASV)을 도입하여 우위를 점하고 북미 무인 수상 차량(USV) 시장 성장을 더욱 가속화하고 있습니다. 특히 수색 및 구조, 예방 유지 관리 분야에서 재난 관리 서비스에서 다양하게 사용되어 영토 및 폐쇄된 수역의 무결성을 보호합니다. 전 세계 수산물에 대한 수요 증가에 부응하기 위해 실시간 모니터링이 가능한 양식 산업에서 빠르게 도입됨에 따라 북미 무인 수상 차량(USV) 시장에 강력한 기회가 생길 것으로 예상됩니다. 그러나 아직 초기 단계인 충돌 감지 기술과 이를 완전 자율 주행으로 만들기 위해 제기되는 기술적 복잡성은 북미 무인 수상 차량(USV) 시장의 성장에 과제를 안겨줍니다.

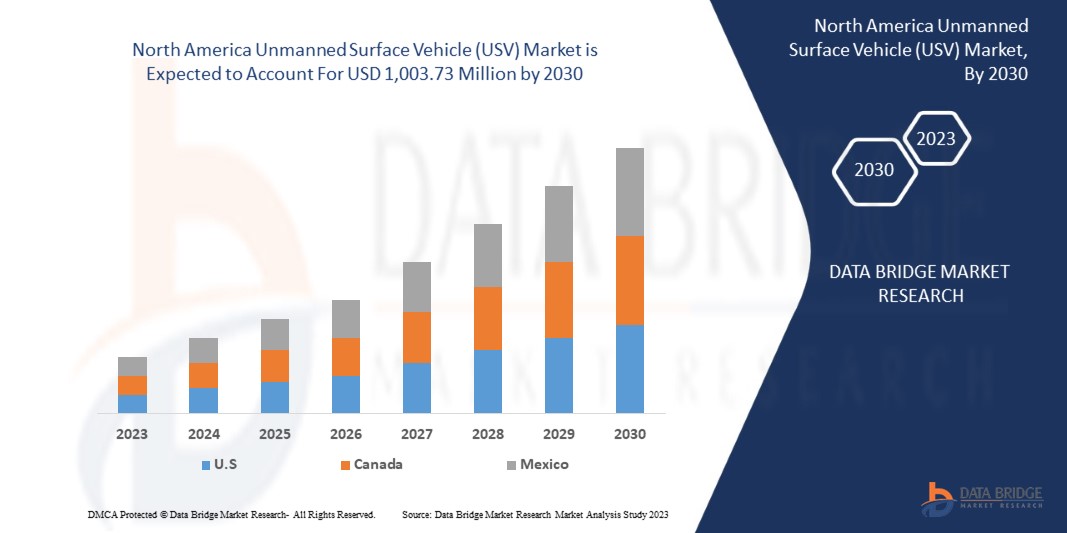

Data Bridge Market Research는 북미 무인 수상 차량(USV) 시장이 2030년까지 1,003.73백만 달러 규모에 도달할 것으로 예상하며, 예측 기간 동안 CAGR은 13.8%가 될 것으로 분석했습니다. 무인 수상 차량(USV) 시장 보고서는 또한 가격 분석, 특허 분석, 기술 발전에 대한 심층적인 내용을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적 연도 |

2021 (2015-2020까지 사용자 정의 가능) |

|

양적 단위 |

수익 (단위: USD 백만) |

|

다루는 세그먼트 |

Type (Surface and Sub-Surface), Application (Defense, Commercial, Scientific Research, and Others), Endurance (100-500 Hours, <100 Hours, 500-1000 Hours, and >1000 Hours), Operation (Remote Operated Surface Vehicle, and Autonomous Surface Vehicle), System (Propulsion, Chassis Material, Payload, Component, Software, and Communication), Hull Type (Catamaran (Twin Hulls), Kayak (Single Hull), Trimaran (Triple Hulls), and Rigid Inflatable Hull), Size (Medium (4 to 8 M), Small (Less than 4 M), Large (8 to 12 M), And Extra-Large (Above 12 M)) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Boeing, Utek, Seafloor Systems, Inc., SeaRobotics Corporation, Saildrone Inc., Deep Ocean Engineering, Inc., Kongsberg Maritime, Tecnologies, Inc., ATLAS ELEKTRONIK GmbH, Clearpath Robotics Inc., Teledyne Technologies Incorporated, Textron Inc., ECA GROUP and 5G Maritime |

Market Definition

The unmanned surface vehicle (USV) is a water-borne vessel that can operate without the requirement of human onboard operators. They can be either remotely operated by an operator or are pre-programmed to be able to run on their own. It is usually powered by rapidly rechargeable lithium-ion batteries or solar energy and is mainly used for ocean exploration and maritime purposes.

The unmanned surface vehicle offers various advantages, which can be used for different kinds of applications such as commercial and research, defense purposes, search and rescue, and many more. Its adoption is steadily growing across various industry verticals, such as aquaculture, and has a huge potential to be an ideal vehicle that can be used for disaster management purposes.

North America Unmanned Surface Vehicle (USV) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Increasing the Demand for Unmanned Vehicles for Clean Ocean

Marine pollution or the contamination of ocean has been growing over the years. Moreover, about 75% of Earth’s surface has been covered by water of which 97.5% is occupied by ocean and 2.5% by fresh water. The rapidly increasing population has led to the growing need of fresh water for drinking and other purposes.

Although, the growth in industrialization and North Americaization has led to a surge in water pollution. A huge amount of plastic waste is being deployed in the ocean which is contaminating the water. In addition, the history of oil and gas exploration and transportation has witnessed several oil spills which have destroyed the aquatic life and quality of water. Along with this, chemical contamination is concerning for health, environmental, and economic reason which has led to the demand for the cleaning of such water resources.

- Increasing Asymmetric Threats and Use of Unmanned Surface Vehicle (USV) in Defense

Unmanned Surface Vehicles are being revolutionised for naval purpose from past few years. These vehicles have been evolving from tools to carry out the number of tasks to systems capable operating with high degree of autonomy. Moreover, most of the countries are facing asymmetry in warfare because of different strategies framed by different defence departments.

However, asymmetric warfare can describe conflicts. Such conflicts often involves strategies and tactics of unconventional warfare. The resources of Asymmetric threats can be referred to as the attack by individuals, organizations or nation to target any government, military or some valuable asset in order to acquire the asset or destroy the state. These attacks need to be continuously monitored by countries in order to protect them from any form of attack or any other type of applications such as illegal drug trafficking, air crash, maritime search investigations, payload delivery and many others

Opportunity

- Growing Demand of USV for Disaster Management

Disasters, whether natural or man-made have ruthless consequences for human lives, environments and also artificial constructions. Man-made disasters can range from oil spills to heavy metals to forest fires namely Deepwater Horizon oil spill (2010), Chernobyl disaster (1986) and California wildfires (2018) among others.

The awareness has been growing regarding disasters over the years and even though ground, aerial and underwater robots have been used for Disaster Management (DM), surface vehicles are only starting to gain popularity. Although they are predominantly used for search and rescue purposes, they can be used for detection of crustal deformation with the help of on-board seismometers and other seaboard pressure sensors.

Restraints/Challenges

- Lack of Collision Detection Capability of Unmanned Surface Vehicle (USV)

The usage of unmanned surface vehicle is increasing with its wide range of application in commercial, military and research. These vehicles can work on their own and be fully autonomous, or they can be controlled by an operator to navigate their course and control their functioning.

The autonomous vehicles are facing the technological complexity of collision detection. As these vehicles can easily collide with any other marine vehicle, the lack of any proper collision system in the vehicle is acting as major restraint for the market.

- Increasing Investments by Governments and Private Players

More than half-a-century ago, wars were fought by show of force as countries focused on full-force attack. However, as times progressed and technologies advanced, various economies developed simultaneously and they relied more on other factors like reconnaissance and surveillance. Thus, North America leaders have shifted their focus to Autonomous Surface Vehicles (ASV), to make them more efficient. They can be generally used to accompany large warships and battleships as well as detect underwater mines and traps.

It is becoming essential to increase investment in unmanned platforms with an impenetrable command network. USVs have the potential to become the centrepiece for various maritime operations. This is further propelled by rising skirmishes between various economies resulting in trade wars, illegal land captures and surveillance. As a result, rising investments by North America naval forces to strengthen their capability as well as investments by private entities, is the factor which will create an opportunity for growth of the market.

Recent Developments

- In October 2022, ECA GROUP designed Critical Design Review to promote autonomous robotic systems in the 3rd generation MCM program. This product has helped the company to expand its product portfolio and enhance the offerings to the customers

- In April 2019, Kongsberg Maritime launched a brand-new unmanned surface vehicle (USV) and sounder USV System. The sounder USV system is a multipurpose platform that was designed to work across different market segments, including surveys. This has helped the company to enhance its product offerings and to grow in the market

North America Unmanned Surface Vehicle (USV) Market Scope

North America unmanned surface vehicle (USV) market is segmented six notable segments, which are based on type, application, endurance, operation, system, hull type, size. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Surface

- Sub-Surface

On the basis of type, the North America unmanned surface vehicle (USV) market is segmented into surface and sub-surface.

Application

- Defense

- Commercial

- Scientific Research

- Others

On the basis of application, the North America unmanned surface vehicle (USV) market has been segmented into defense, commercial, scientific research, and others.

Endurance

- 100-500 Hours

- <100 Hours

- 500-1000 Hours

- >1000 Hours

On the basis of endurance, the North America unmanned surface vehicle (USV) market has been segmented into 100-500 hours, <100 hours, 500-1000 hours, and >1000 hours.

Operation

- Remote Operated Surface Vehicle

- Autonomous Surface Vehicle

On the basis of operation, the North America unmanned surface vehicle (USV) market is segmented into remote operated surface vehicle, and autonomous surface vehicle.

System

- Propulsion

- Chassis Material

- Payload

- Component

- Software

- Communication

On the basis of system, the North America unmanned surface vehicle (USV) market is segmented into propulsion, chassis material, payload, component, software, and communication.

Hull Type

- Catamaran (Twin Hulls)

- Kayak (Single Hull)

- Trimaran (Triple Hulls)

- Rigid Inflatable Hull

On the basis of hull type, the North America unmanned surface vehicle (USV) market is segmented into catamaran (twin hulls), kayak (single hull), trimaran (triple hulls), and rigid inflatable hull.

Size

- Medium (4 to 8 M)

- 소형(4M 이하)

- 대형(8~12M)

- 특대형(12M 이상)

크기에 따라 북미 무인 수상 차량(USV) 시장은 중형(4~8m), 소형(4m 미만), 대형(8~12m), 특대형(12m 초과)으로 구분됩니다.

북미 무인 수상 차량(USV) 시장 지역 분석/통찰력

북미 무인수상정(USV) 시장을 분석하고, 위에 참조된 대로 국가, 유형, 응용 분야, 내구성, 운영, 시스템, 선체 유형, 크기별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

무인 수상 차량(USV) 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

미국은 해저 지도 작성, 수질 검사, 교량과 같은 인프라 도입이 증가하면서 북미 무인 수상 차량(USV) 시장을 장악하고 있습니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 무인 수상 차량(USV) 시장 점유율 분석

북미 무인 수상 차량(USV) 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 무인 수상 차량(USV) 시장과 관련된 회사의 초점에만 관련됩니다.

북미 무인 수상 차량(USV) 시장의 주요 기업으로는 Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Boeing, Utek, Seafloor Systems, Inc., SeaRobotics Corporation, Saildrone Inc., Deep Ocean Engineering, Inc., Kongsberg Maritime, L3Harris Tecnologies, Inc., ATLAS ELEKTRONIK GmbH, Clearpath Robotics Inc., Teledyne Technologies Incorporated, Textron Inc., ECA GROUP, 5G Marine 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MARKET APPLICATION COVERAGE GRID

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR UNMANNED VEHICLES FOR CLEANING OCEAN

5.1.2 INCREASING ASYMMETRIC THREATS AND USE OF UNMANNED SURFACE VEHICLES (USV) IN DEFENSE

5.1.3 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION

5.1.4 INCREASING USE OF UNMANNED SURFACE VEHICLE (USV) FOR OCEANOGRAPHY

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF UNMANNED UNDERWATER VEHICLE (UUV) AS AN ALTERNATIVE

5.2.2 LACK OF COLLISION DETECTION CAPABILITY OF UNMANNED SURFACE VEHICLE (USV)

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR USV FOR DISASTER MANAGEMENT

5.3.2 APPLICATION IN TERRITORIAL AND PROTECTED WATERS

5.3.3 INCREASING INVESTMENTS BY GOVERNMENTS AND PRIVATE PLAYERS

5.3.4 REAL TIME MONITORING OF AQUACULTURE ENVIRONMENTS

5.4 CHALLENGES

5.4.1 DECREASING NAVY BUDGET OF VARIOUS COUNTRIES

6 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE

6.1 OVERVIEW

6.2 SURFACE

6.3 SUB-SURFACE

7 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 DEFENSE

7.2.1 TYPE

7.2.1.1 SURFACE

7.2.1.2 SUB-SURFACE

7.3 COMMERCIAL

7.3.1 BY PURPOSE

7.3.1.1 OCEANOGRAPHY AND ENVIRONMENTAL SCIENCES

7.3.1.2 OIL AND GAS

7.3.1.3 EXPLORATION

7.3.2 BY TYPE

7.3.2.1 SURFACE

7.3.2.2 SUB-SURFACE

7.4 SCIENTIFIC RESEARCH

7.4.1 TYPE

7.4.1.1 SURFACE

7.4.1.2 SUB-SURFACE

7.5 OTHERS

8 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE

8.1 OVERVIEW

8.2 100-500 HOURS

8.3 <100 HOURS

8.4 500-1000 HOURS

8.5 >1000 HOURS

9 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION

9.1 OVERVIEW

9.2 REMOTE OPERATED SURFACE VEHICLE

9.3 AUTONOMOUS SURFACE VEHICLE

10 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM

10.1 OVERVIEW

10.2 PROPULSION

10.3 CHASSIS MATERIAL

10.4 PAYLOAD

10.5 COMPONENT

10.6 SOFTWARE

10.7 COMMUNICATION

11 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE

11.1 OVERVIEW

11.2 CATAMARAN (TWIN HULLS)

11.3 KAYAK (SINGLE HULL)

11.4 TRIMARAN (TRIPLE HULLS)

11.5 RIGID INFLATABLE HULL

12 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE

12.1 OVERVIEW

12.2 MEDIUM (4 TO 8 M)

12.3 SMALL (LESS THAN 4 M)

12.4 LARGE (8 TO 12 M)

12.5 EXTRA LARGE (ABOVE 12 M)

13 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 L3HARRIS TECHNOLOGIES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 BOEING

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENTS

16.4 KONGSBERG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 TEXTRON, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 5G MARINE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ATLAS ELEKTRONIK GMBH

16.7.1 COMPANY SNAPSHOT

16.7.2 SOLUTION PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CLEARPATH ROBOTICS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ECA GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 ELBIT SYSTEMS LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 IXBLUE SAS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 SAILDRONE, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 TECHNOLOGY PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 SEAFLOOR SYSTEMS, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 SEAROBOTICS CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 TELEDYNE TECHNOLOGIES INCORPORATED

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 12 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 14 U.S. DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 U.S. COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 16 U.S. COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 U.S. SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 19 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 20 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 21 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 22 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 23 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 25 CANADA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 CANADA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 27 CANADA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 CANADA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 30 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 31 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 32 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 33 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 34 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 MEXICO DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 MEXICO COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 38 MEXICO COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 MEXICO SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 41 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 42 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 43 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 44 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: TYPE TIMELINE CURVE

FIGURE 12 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 13 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION IS EXPECTED TO DRIVE THE NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET IN THE FORECAST PERIOD

FIGURE 14 SURFACE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET

FIGURE 16 PLASTICS PRODUCTION ACROSS GLOBE

FIGURE 17 CRUDE OIL PRODUCTION DATA, BY REGION

FIGURE 18 DEFENCE EXPENDITURE ACROSS THE GLOBE

FIGURE 19 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE, 2022

FIGURE 20 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY APPLICATION, 2022

FIGURE 21 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY ENDURANCE, 2022

FIGURE 22 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY OPERATION, 2022

FIGURE 23 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY SYSTEM, 2022

FIGURE 24 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY HULL TYPE, 2022

FIGURE 25 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY SIZE, 2022

FIGURE 26 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE (2023-2030)

FIGURE 31 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.