Global Remote Mobile Payment Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

10.30 Billion

USD

114.99 Billion

2024

2032

USD

10.30 Billion

USD

114.99 Billion

2024

2032

| 2025 –2032 | |

| USD 10.30 Billion | |

| USD 114.99 Billion | |

|

|

|

|

Global Remote Mobile Payment Market Segmentation, By Technology (Near Field Communication, QR Code Payments, Mobile Wallets, and Blockchain Technology), Deployment Model (Cloud-Based and On-Premises), Payment Type (Digital Wallets, Bank Transfers, Credit/Debit Card Payments, and Cryptocurrency Transactions), End User (Retail, Hospitality, Transportation, and Healthcare) – Industry Trends and Forecast to 2032

Remote Mobile Payment Market Analysis

The global remote mobile payment market is experiencing rapid growth due to the increasing adoption of smartphones, internet connectivity, and digital payment solutions. Remote mobile payments enable consumers to make transactions without being physically present, offering convenience and flexibility. This market is driven by the rising demand for contactless payment methods, enhanced security features such as biometrics, and the growing shift toward cashless societies. Key players such as PayPal, Apple Pay, and Google Pay are leading the way with innovative solutions that integrate payment systems into everyday applications. Recent developments in blockchain technology, artificial intelligence, and secure payment protocols are expected to further boost market growth by improving transaction security and efficiency. In addition, the ongoing digitalization of banking services and increased internet penetration, especially in emerging markets, are contributing to the widespread adoption of remote mobile payments, positioning the market for continued expansion in the coming years.

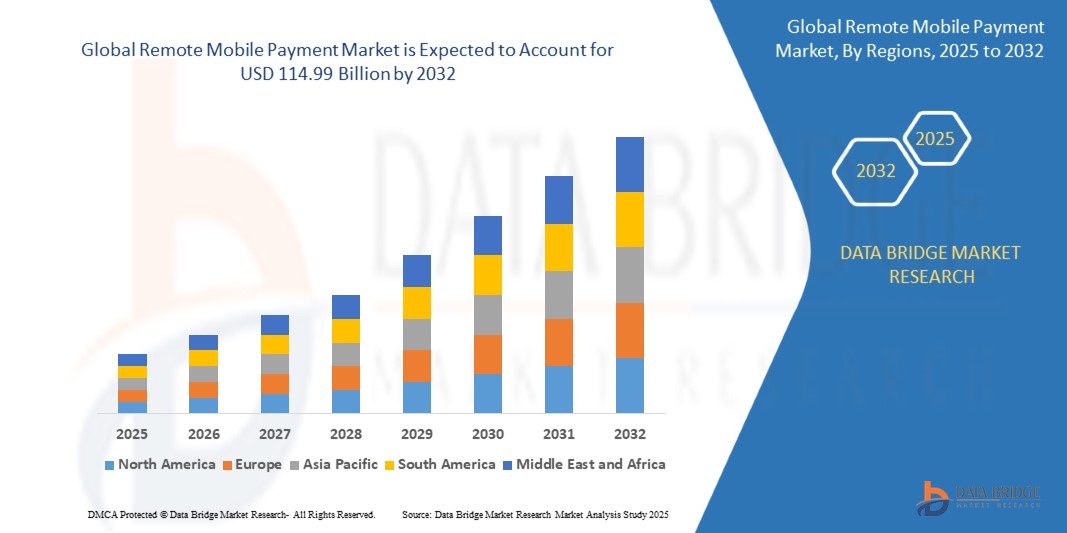

Remote Mobile Payment Market Size

The global remote mobile payment market size was valued at USD 10.30 billion in 2024 and is projected to reach USD 114.99 billion by 2032, with a CAGR of 35.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Remote Mobile Payment Market Trends

“Innovations in Payment Technology”

The global remote mobile payment market is evolving rapidly with increased smartphone usage, digital wallets, and contactless payment systems. Innovations in payment technology, such as biometric authentication, blockchain, and AI-powered security, are reshaping the landscape. One significant trend is the integration of mobile payments into everyday apps and services, allowing consumers to pay seamlessly for a variety of transactions, from shopping to bill payments. This trend is supported by the growing adoption of QR codes and NFC-based payment solutions, enhancing convenience and speed. As more consumers shift toward cashless transactions, and with improvements in security, the remote mobile payment market is set to continue expanding, driven by these innovations and consumer preferences for faster, safer, and more accessible payment methods.

Report Scope and Remote Mobile Payment Market Segmentation

|

Attributes |

Remote Mobile Payment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

MoneyGram (U.S.), PayPal Holdings Inc. (U.S.), SAMSUNG (South Korea), Visa Inc. (U.S.), Alibaba Group Holdings Limited (China), Apple Inc. (U.S.), American Express Company (U.S.), Vodacom Group Limited (South Africa), Alipay (China), Amazon Inc. (U.S.), Mastercard (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Remote Mobile Payment Market Definition

Global remote mobile payment refers to the process of making financial transactions using a mobile device, such as a smartphone or tablet, without being physically present at the point of sale. It allows consumers to make purchases, pay bills, or transfer money remotely through mobile applications, digital wallets, or mobile banking services. These payments are typically facilitated by technologies such as Near Field Communication (NFC), QR codes, or online platforms that support secure payment processing. Remote mobile payments offer convenience, speed, and security, enabling users to conduct transactions from anywhere, at any time, using their mobile devices.

Remote Mobile Payment Market Dynamics

Drivers

- Increasing Smartphone Penetration

The growing adoption of smartphones, particularly in emerging markets, is a significant driver of the remote mobile payment market. As more consumers in these regions gain access to smartphones, mobile payment solutions become more accessible and convenient. With smartphones being used for various daily activities, including shopping, banking, and entertainment, the integration of payment systems into these devices allows users to make secure and efficient transactions. This trend is helping mobile payments gain popularity, as consumers prefer the ease and flexibility of managing their finances through their smartphones, thus fueling market growth.

- Rising Preference for Cashless Transactions

The shift toward cashless societies is a major driver of the remote mobile payment market. As consumers seek more convenient and hygienic payment methods, mobile payments have gained traction as an effective solution. The increasing preference for contactless payments, which offer faster, safer, and more secure transactions compared to traditional cash, is accelerating this trend. In addition, governments worldwide are promoting cashless initiatives to reduce the spread of infections and enhance financial inclusion. These factors collectively contribute to the widespread adoption of mobile payments, further driving the growth of the remote mobile payment market.

Opportunities

- Integration of Blockchain Technology

The integration of blockchain technology into mobile payment systems presents a significant market opportunity by enhancing security, transparency, and transaction efficiency. Blockchain's decentralized nature ensures that payment data is more secure, reducing the risk of fraud and cyberattacks, while its transparency improves trust between consumers and service providers. The technology can also streamline transactions, offering faster and lower-cost processing. As businesses adopt blockchain to strengthen their mobile payment solutions, they can attract a wider customer base by addressing growing concerns about security and reliability, ultimately driving higher adoption rates and market growth.

- Partnerships with E-commerce Platforms

As e-commerce continues to experience rapid growth, partnering with online retailers and service providers offers a valuable opportunity for mobile payment providers. By integrating mobile payment solutions into e-commerce platforms, businesses can facilitate seamless transactions, enhancing customer convenience and streamlining the purchase process. This integration allows consumers to make quick and secure payments using their smartphones, reducing friction and improving the overall shopping experience. As more consumers shift toward online shopping, offering mobile payment options can help businesses capture a larger share of the market, drive higher transaction volumes, and increase customer satisfaction.

Restraints/Challenges

- Security and Fraud Concerns

Despite significant advancements in encryption and authentication technologies, security continues to be a major challenge in the remote mobile payment market. Many consumers remain hesitant to adopt mobile payment systems due to concerns about data breaches, identity theft, and fraud. The rise in cyberattacks and fraudulent activities targeting mobile payment platforms further exacerbates these fears. As a result, potential users may be reluctant to trust mobile payment solutions with sensitive financial information. Addressing these security concerns through stronger safeguards, robust encryption methods, and user education is essential to overcoming this challenge and encouraging wider adoption of mobile payments.

- Consumer Trust and Adoption

Many consumers are still unfamiliar with mobile payment technology, and this lack of understanding, combined with concerns about security, prevents widespread adoption. In regions with low technological literacy, people may view mobile payments as complicated or risky compared to traditional payment methods. This lack of trust in digital payment solutions is a significant barrier, as consumers are hesitant to move away from cash or credit cards. To overcome this restraint, it is essential for companies to invest in consumer education, simplify mobile payment processes, and enhance security features to build trust and encourage wider adoption.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Remote Mobile Payment Market Scope

The market is segmented on the basis of technology, deployment model, payment type, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Near Field Communication

- QR Code Payments

- Mobile Wallets

- Blockchain Technology

Deployment Model

- Cloud-Based

- On-Premises

Payment Type

- Digital Wallets

- Bank Transfers

- Credit/Debit Card Payments

- Cryptocurrency Transactions

End User

- Retail

- Hospitality

- Transportation

- Healthcare

Remote Mobile Payment Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, technology, deployment model, payment type, and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

The Asia Pacific mobile payments market is expected to dominate globally, accounting for a 35.4% revenue share in 2024. The surge in UPI transactions in India, along with its expansion into countries such as U.A.E. Is driving this growth. Factors such as improved high-speed internet connectivity, stronger infrastructure development, and rising adoption are further contributing to the region's dominance in the mobile payments market.

The mobile payment market in Europe is set to experience substantial growth during the forecast period. Key factors driving this growth include the rapid shift towards digital payments, reduced cash usage, an influx of international visitors, and increased participation in global trade. In addition, the region's focus on providing seamless payment experiences, coupled with diverse payment alternatives, is further fueling the expansion of the mobile payment market in Europe.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Remote Mobile Payment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Remote Mobile Payment Market Leaders Operating in the Market Are:

- MoneyGram (U.S.)

- PayPal Holdings Inc. (U.S.)

- SAMSUNG (South Korea)

- Visa Inc. (U.S.)

- Alibaba Group Holdings Limited (China)

- Apple Inc. (U.S.)

- American Express Company (U.S.)

- Vodacom Group Limited (South Africa)

- Alipay (China)

- Amazon Inc. (U.S.)

- Mastercard (U.S.)

Latest Developments in Remote Mobile Payment Market

- In August 2024, Windcave, a leading payment technology provider in New Zealand, teamed up with Alipay+ to offer seamless mobile payment solutions for businesses in Australia and New Zealand. This partnership aims to equip merchants with the ability to accept payments from travelers across Asia and Europe. The new solution is expected to enhance the payment experience for international visitors, driving growth in the mobile payment market in both countries

- In 2023, Visa revealed a collaboration with PayPal and Venmo to launch Visa+, a groundbreaking service designed to enable fast and secure transfers of money between various person-to-person (P2P) digital payment apps. This initiative aims to streamline digital transactions, offering users greater flexibility and convenience. By bridging different payment platforms, Visa+ is expected to enhance the overall digital payment experience for consumers

- In 2021, Alipay (Ant Group) introduced a QR code payment method that allows users to complete transactions without manually entering the transaction amount. This innovation simplifies the payment process by enabling quick and seamless payments using QR codes. The feature enhances user convenience and streamlines the overall payment experience

- In 2021, American Express introduced both a web version and a mobile app for Amex Pay, allowing users to pay various bills, including taxes, insurance, cable, and internet bills. This new feature provides customers with a convenient and secure way to manage and pay their recurring expenses. The launch enhances the flexibility and accessibility of payments through American Express's platform

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.