Us Class B Bench Top Dental Autoclaves Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

29.44 Billion

USD

42.84 Billion

2021

2029

USD

29.44 Billion

USD

42.84 Billion

2021

2029

| 2022 –2029 | |

| USD 29.44 Billion | |

| USD 42.84 Billion | |

|

|

|

미국 B형 벤치탑 치과용 오토클레이브 시장, 제품별(시스템, 부속품), 재료(스테인리스 강철 구리), 부하 유형(다공성 재료, 고체 재료, 기타), 용량(24L), 최종 사용자( 병원 및 치과 진료소, 치과 연구소, 학술 및 연구 기관, 기타) - 2029년까지의 산업 동향 및 예측.

미국 클래스 B 벤치탑 치과용 오토클레이브 시장 분석 및 통찰력

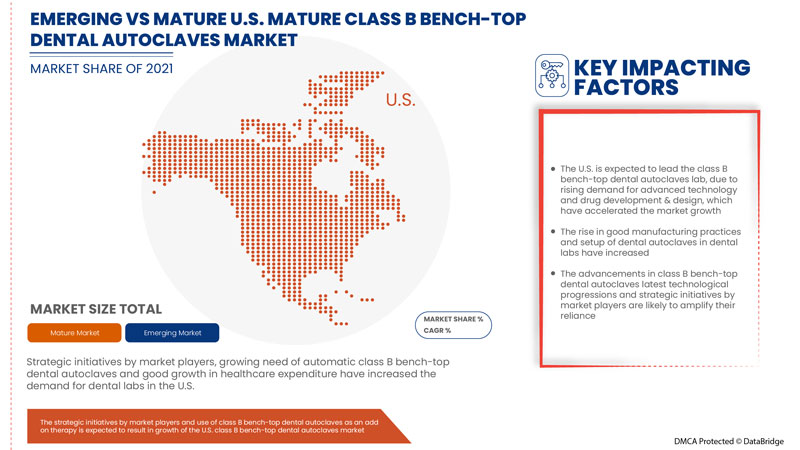

시장 성장을 주도하는 요인은 치과 질환 유병률 증가, 여러 치과 의사와 치과 병원의 증가, 미용 치과 시술 수요 증가, 병원 감염 유병률입니다. 그러나 엄격한 규제와 부적절한 환불 시나리오가 시장 성장을 억제할 것으로 예상됩니다.

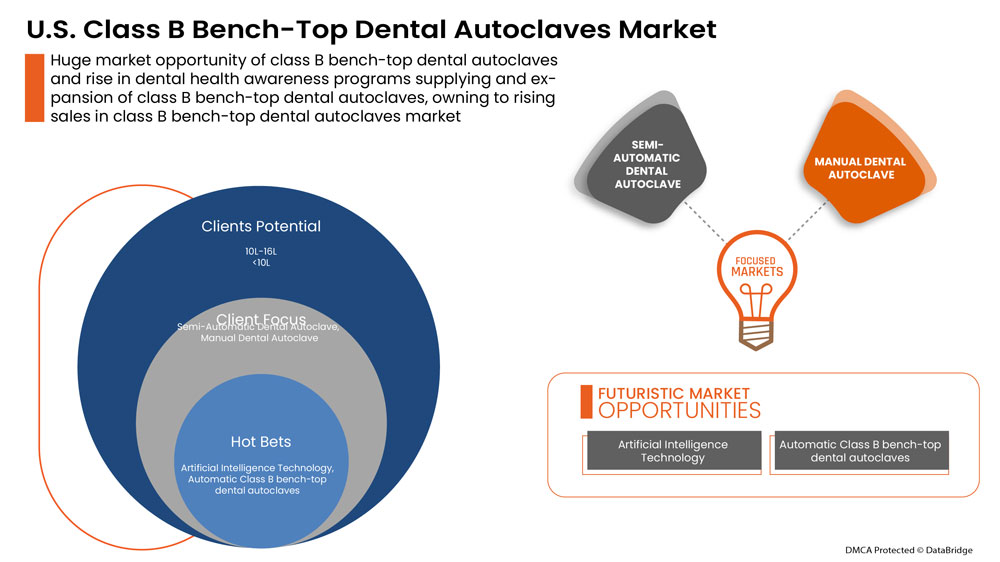

반면, 시장 참여자들의 전략적 이니셔티브, 치과 건강 문제의 유병률 증가, 모든 연령대에 걸친 인식 증가, 의료비 지출 증가는 시장 성장의 기회로 작용할 수 있습니다. 그러나 숙련된 전문성의 필요성, 치과 연구소에서 클래스 B 벤치탑 치과용 오토클레이브를 구현하는 데 따른 과제, 규제 승인은 시장에 과제를 안겨줄 수 있습니다.

미국 클래스 B 벤치탑 치과용 오토클레이브 시장은 2022년부터 2029년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년부터 2029년까지의 예측 기간 동안 4.7%의 CAGR로 성장하고 있으며 2021년 2,944만 달러에서 2029년까지 4,284만 달러에 도달할 것으로 예상된다고 분석합니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014로 사용자 정의 가능) |

|

양적 단위 |

매출(백만 달러), 볼륨(단위) |

|

다루는 세그먼트 |

제품별(시스템, 부속품), 재질별(스테인리스 강 , 구리), 하중 종류별(다공성 재료, 고체 재료, 기타), 용량별(<10L, 10L-16L, 16L-18L, 18L-24L, >24L), 최종 사용자별( 병원 및 치과, 치과 연구소, 학술 및 연구 기관, 기타) |

|

적용 국가 |

우리를 |

|

시장 참여자 포함 |

W&H DENTALWERK INTERNATIONAL, Dentsply Sirona, NSK/Nakanishi Inc., Neu-tec Group Inc., MELAG Medizintechnik GmbH & Co. KG, ZEALWAY Instrument Inc., Flight Dental System, FONA srl, Tuttnauer, Labomiz SCIENTIFIC 등 |

시장 정의

클래스 B 벤치탑 치과용 오토클레이브는 사전 살균 진공 사이클로 정의됩니다. 클래스 B는 가장 높은 오토클레이브 클래스로 간주되며 고체, 유형 A 중공 기구, 유형 B 중공 기구, 다공성 로드 및 포장된 기구를 포함한 모든 로드를 살균하는 데 사용할 수 있습니다. 클래스 B 벤치탑 오토클레이브는 EN 867-5:2001에 명시된 표준 EN 13060에 따라 Helix 테스트를 통과해야 합니다. 이는 사전 살균 분획 진공을 사용하여만 달성할 수 있습니다. 살균 후 진공 건조는 전체 살균 프로세스 후 모든 로드를 완전히 건조합니다. 클래스 B 살균기는 모든 치과에 필수적인 오토클레이브입니다. 기구에 대해 매우 효과적이고 안전한 살균을 제공합니다. STERICOX 클래스 b 오토클레이브는 EN13060 표준을 충족하며 23리터 용량으로 제공되며 이는 경제적인 가격으로 가장 선호되는 브랜드입니다. 클래스 B 치과 살균기는 의사, 직원 및 환자의 보안을 보호하기 위해 의료 및 치과에서 광범위하게 사용됩니다. 다공성 재료, 직물, 파우치 제품, 터빈, 막대 및 팁과 같은 다양한 유형의 하중은 클래스 B 치과 오토클레이브에서 효과적으로 살균할 수 있습니다.

미국 클래스 B 벤치탑 치과용 오토클레이브 시장 동향

운전자

- 치과 장애의 유병률 증가

구강 건강은 말하고, 씹고, 웃을 수 있게 해주는 건강한 잇몸, 치아, 구강 안면 시스템을 말합니다. 가장 흔한 치과 질환으로는 충치, 치주 질환 , 구강암 등이 있습니다. 세계보건기구의 보고서에 따르면, 전 세계적으로 약 23억 명이 영구치 충치로 고통받고 있으며, 그 중 약 5억 3천만 명의 어린이가 유치 충치로 고통받고 있습니다.

충치는 박테리아, 숙주 감수성, 시간, 음식 등을 포함한 변수의 복잡한 상호 작용으로 인해 발생합니다. 구강 건강이 좋지 않은 것과 같은 비위생적인 관행은 영구치의 성장과 성숙에 영향을 미치는 충치를 일으킬 수 있으며, 설탕이 많은 음식을 널리 섭취하면 치아 공동이 발생합니다. 살균은 모든 생물학적 유체로 인해 오염된 재사용 가능한 치과 기구에서 필수적인 단계입니다.

치과 질환의 수가 증가함에 따라 치과 장비를 통한 감염 또는 교차 오염의 가능성도 증가합니다. 따라서 치과 질환의 증가로 인해 클래스 B 벤치탑 치과 오토클레이브의 가용성과 사용이 시장 확장을 촉진할 것으로 예상됩니다.

따라서 충치 , 치아 부식, 구강암과 같은 치과 질환의 증가로 인해 미국 B등급 벤치탑 치과용 오토클레이브 시장 성장이 촉진될 것으로 예상됩니다.

- 치과 의사와 치과 병원 수 증가

치과 문제가 전 세계적으로 증가함에 따라 치과 전문가와 치과 병원에 대한 수요도 증가하고 있습니다. 첨단 기구를 사용하면 숙련된 치과 전문가가 필요하므로 개발도상국과 선진국에서 치과 의사 수가 급증하고 있습니다.

따라서 치과 의사 인구와 치과 연구소 수의 증가가 예상 기간 동안 시장 성장을 견인할 것으로 예상됩니다.

- 미용 치과 시술에 대한 수요 증가

미용 치과는 기분과 외모가 모두 뛰어난 완전한 웰빙 감각을 제공함으로써 구강 건강에 대한 아이디어를 향상시킵니다. 시간이 지남에 따라 미용 치과가 발전함에 따라 새로운 치과 재료가 더 우수한 결과를 낳습니다. 미용 치과의 발전은 단순히 치아를 교정하는 것을 훨씬 넘어서 얼굴에 더 크고 오래 지속되는 변화를 위한 문을 열었습니다. 따라서 미용 치과 시술에 대한 수요는 강력한 진공 펌프를 포함하여 챔버에서 모든 공기를 제거하여 치과 시술에 필요한 모든 기구를 효과적으로 살균할 수 있기 때문에 클래스 B 벤치탑 오토클레이브의 시장 성장을 증가시켰습니다. 속도와 사용자 친화적인 인터페이스는 의료진 사이에서 수요를 높였습니다.

기회

- 모든 연령대에서 치과 건강 문제의 증가와 인식

치과 문제는 때때로 간과되어 심각한 치과 문제로 이어집니다. 다양한 연령대에 따라 구강 또는 치과 감염 사례가 증가하고 있습니다. 따라서 정부 기관은 다양한 치과 건강 관련 지침을 부과했습니다. 게다가 정부 기관과 의료 기관은 다양한 건강 결의안과 프로그램을 통해 감염을 통제하기 위한 인식을 확산하고 있습니다.

치과 건강 프로그램의 성장은 시장에서 더 좋고 진보된 치과 제품의 개발에 상당한 영향을 미칩니다. 따라서 모든 연령대에서 치과 문제와 인식이 급증하면서 미국 B급 벤치탑 치과용 오토클레이브 시장에 더 큰 기회가 생깁니다.

제약/도전

- 치과 위생에 대한 인식 부족

전세계 치과용 오토클레이브 시장 발전은 개발도상국의 치과 위생 인식 부족으로 인해 방해를 받을 것으로 예상됩니다.

예를 들어, 구강 질환은 전 세계적으로 흔한 일이며, 사람들의 건강과 세계 경제에 부정적인 영향을 미칩니다.

대다수 국가에서 구강 질환 유병률은 증가하고 있는데, 이는 주로 사람들이 구강 건강 관리 시설을 이용할 수 없고 치과 위생에 대한 지식이 부족하기 때문에 발생합니다(이로 인해 사람들이 치과 위생의 중요성을 인식하지 못합니다).

- 프로세스에 대한 주의 부족

치과 및 기타 외래 진료 시설에서 살균 과정에 대한 주의가 부족하면 환자가 오염된 기구, 임플란트 또는 기타 중요한 품목에 노출될 수 있습니다. 사용하기 전에 오염된 품목을 일관되고 효과적으로 세척, 소독 또는 살균하지 않으면 환자가 악성 병원균에 노출될 수 있습니다. 환자는 오염된 품목, 특히 살균된 조직이나 혈관계에 들어가려는 품목에 접촉할 수 있습니다.

이는 예측 기간 동안 시장 성장을 제한할 몇 가지 요인입니다.

최근 개발

- 2018년 1월, Flight Dental Systems는 Flight CLAVE B Pre & Post Vacuum Autoclave를 출시했습니다. 새로운 Class B 오토클레이브는 이중 잠금 시스템, LCD 모니터, 스테인리스 스틸 챔버, 자체 조절 증기 발생기를 갖추고 있어 빠른 살균 주기를 보장합니다. 이 신제품을 출시하면서 회사는 제품 라인을 다양화하고 소비자 기반을 확대할 수 있었습니다.

미국 클래스 B 벤치탑 치과용 오토클레이브 시장 범위

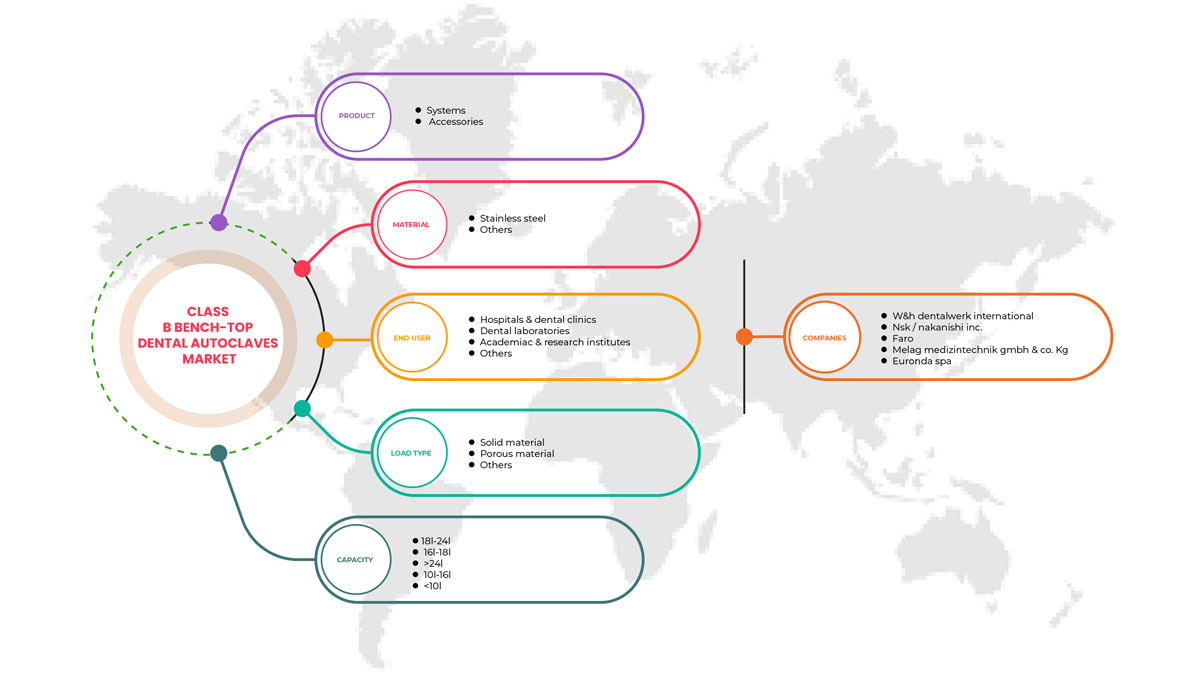

미국 클래스 B 벤치탑 치과용 오토클레이브 시장은 제품, 소재, 부하 유형, 용량 및 최종 사용자로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품

- 시스템

- 부속품

미국 B등급 벤치탑 치과용 오토클레이브 시장은 제품을 기준으로 시스템과 액세서리로 구분됩니다.

재료

- 스테인리스 스틸

- 구리

미국 B등급 벤치탑 치과용 오토클레이브 시장은 재료를 기준으로 스테인리스 스틸과 구리로 구분됩니다.

하중 유형

- 고체 물질

- 다공성 재료

- 기타

미국 B등급 벤치탑 치과용 오토클레이브 시장은 하중 유형을 기준으로 고체 소재, 다공성 소재 및 기타 소재로 구분됩니다.

용량

- <10리터

- 10L-16L

- 16L-18L

- 18L-24L

- >24리터

용량을 기준으로 미국 B등급 벤치탑 치과용 오토클레이브 시장은 <10L, 10L-16L, 16L-18L, 18L-24L, >24L로 구분됩니다.

최종 사용자

- 병원 및 치과 병원

- 치과 연구소

- 학술 및 연구 기관

- 기타

미국 B등급 벤치탑 치과용 오토클레이브 시장은 최종 사용자를 기준으로 병원 및 치과 진료소, 치과 연구소, 학술 및 연구 기관 등으로 구분됩니다.

경쟁 환경 및 미국 Class B 벤치탑 치과용 오토클레이브 시장 점유율 분석

미국 클래스 B 벤치탑 치과용 오토클레이브 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우위가 포함됩니다. 위에 제공된 데이터 포인트는 미국 클래스 B 벤치탑 치과용 오토클레이브 시장에 대한 회사의 초점에만 관련이 있습니다.

미국 B등급 벤치탑 치과용 오토클레이브 시장의 주요 기업으로는 W&H DENTALWERK INTERNATIONAL, Dentsply Sirona, NSK/Nakanishi Inc., Neu-tec Group Inc., MELAG Medizintechnik GmbH & Co. KG, ZEALWAY Instrument Inc., Flight Dental System, FONA srl, Tuttnauer, Labomiz SCIENTIFIC 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 미국 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가에게 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 RESEARCH METHODOLOGY

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 THE CATEGORY VS TIME GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF DENTAL DISORDERS

6.1.2 INCREASED NUMBER OF DENTAL PRACTITIONERS AND DENTAL CLINICS

6.1.3 INCREASED DEMAND FOR COSMETIC DENTAL PROCEDURES

6.1.4 INCREASED PREVALENCE OF HOSPITAL-ACQUIRED INFECTION

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS

6.2.2 INAPPROPRIATE REIMBURSEMENT SCENARIO

6.2.3 INSUFFICIENT ATTENTION TO PROCESS

6.3 OPPORTUNITIES

6.3.1 RISING PREVALENCE OF DENTAL HEALTH ISSUES AND AWARENESS ACROSS ALL AGE GROUPS

6.3.2 STRATEGIC INITIATIVES OF KEY PLAYERS

6.3.3 RISING HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 HIGH COST OF BENCH-TOP DENTAL AUTOCLAVES

6.4.2 LACK OF AWARENESS ABOUT DENTAL HYGIENE

7 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 SYSTEMS

7.2.1 AUTOMATIC

7.2.2 SEMI-AUTOMATIC

7.2.3 MANUAL

7.3 ACCESSORIES

8 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 STAINLESS STEEL

8.3 OTHERS

9 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE

9.1 OVERVIEW

9.2 SOLID MATERIAL

9.2.1 TYPE A SOLID LOADS WITH HOLLOW SECTIONS

9.2.2 TYPE B SOLID LOADS WITH HOLLOW SECTIONS

9.3 POROUS MATERIAL

9.4 OTHERS

10 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 18L-24L

10.3 16L-18L

10.4 >24L

10.5 >10L-16L

10.6 <10L

11 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & DENTAL CLINICS

11.3 DENTAL LABORATORIES

11.4 ACADEMIC & RESEARCH INSTITUTES

11.5 OTHERS

12 U.S. CLASS B BENCH TOP DENTAL AUTOCLAVE MARKET BY COUNTRY

12.1 U.S.

13 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 W&H DENTALWERK INTERNATIONAL

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 NSK/NAKANISHI INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 MELAG MEDIZINTECHNIK GMBH & CO. KG

15.3.1 COMPANY SNAPSHOT

15.3.2 1.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 FARO

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 EURONDA SPA

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 CELITRON MEDICAL TECHNOLOGIES KFT

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DENTSPLY SIRONA

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 FLIGHT DENTAL SYSTEM

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 FONA

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 LTE SCIENTIFIC LTD, 2022

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 LABOMIZ SCIENTIFIC

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 MEDICAL TRADING S.R.L.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MATACHANA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 NEU-TEC GROUP INC.

15.15 COMPANY SNAPSHOT

15.15.1 PRODUCT PORTFOLIO

15.15.2 RECENT DEVELOPMENT

15.16 NEWMED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PRIORCAVE LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 STURDY INDUSTRIAL CO., LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 TUTTNAUER

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TECNO-GAZ S.P.A.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 ZEALWAY INSTRUMENT INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 U.S. SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 4 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 5 U.S. SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 6 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 7 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 8 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 9 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY, BY VOLUME 2020-2029 (UNITS)

TABLE 10 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 U.S. SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 14 U.S. SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 15 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 16 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: SEGMENTATION

FIGURE 2 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: GEOGRAPHIC SCOPE

FIGURE 3 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: DATA TRIANGULATION

FIGURE 4 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: SNAPSHOT

FIGURE 5 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 6 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: INTERVIEWS: BY REGION AND DESIGNATION

FIGURE 8 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S., CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: END USER COVERAGE GRID

FIGURE 10 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: THE CATEGORY VS TIME GRID

FIGURE 11 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET SEGMENTATION

FIGURE 12 GROWING APPLICATIONS OF CLASS B BENCH-TOP DENTAL AUTOCLAVES, RISE IN PREVALENCE OF DENTAL DISORDERS AND RISE IN DENTAL PRACTITIONERS, AND INCREASED SAFETY OF HYGIENE AND MAINTENANCE ARE EXPECTED TO DRIVE THE MARKET FOR U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET IN 2019 AND 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE CLASS B BENCH-TOP DENTAL AUTOCLAVE MARKET

FIGURE 15 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, 2021

FIGURE 16 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 17 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 18 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, 2021

FIGURE 20 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, 2022-2029 (USD MILLION)

FIGURE 21 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, CAGR (2022-2029)

FIGURE 22 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 23 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, 2021

FIGURE 24 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, 2022-2029 (USD MILLION)

FIGURE 25 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, CAGR (2022-2029)

FIGURE 26 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, LIFELINE CURVE

FIGURE 27 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, 2021

FIGURE 28 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, 2022-2029 (USD MILLION)

FIGURE 29 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, CAGR (2022-2029)

FIGURE 30 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, LIFELINE CURVE

FIGURE 31 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, 2021

FIGURE 32 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 U.S. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.