Us Business Travel Accident Insurance Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

3.27 Billion

USD

11.81 Billion

2024

2032

USD

3.27 Billion

USD

11.81 Billion

2024

2032

| 2025 –2032 | |

| USD 3.27 Billion | |

| USD 11.81 Billion | |

|

|

|

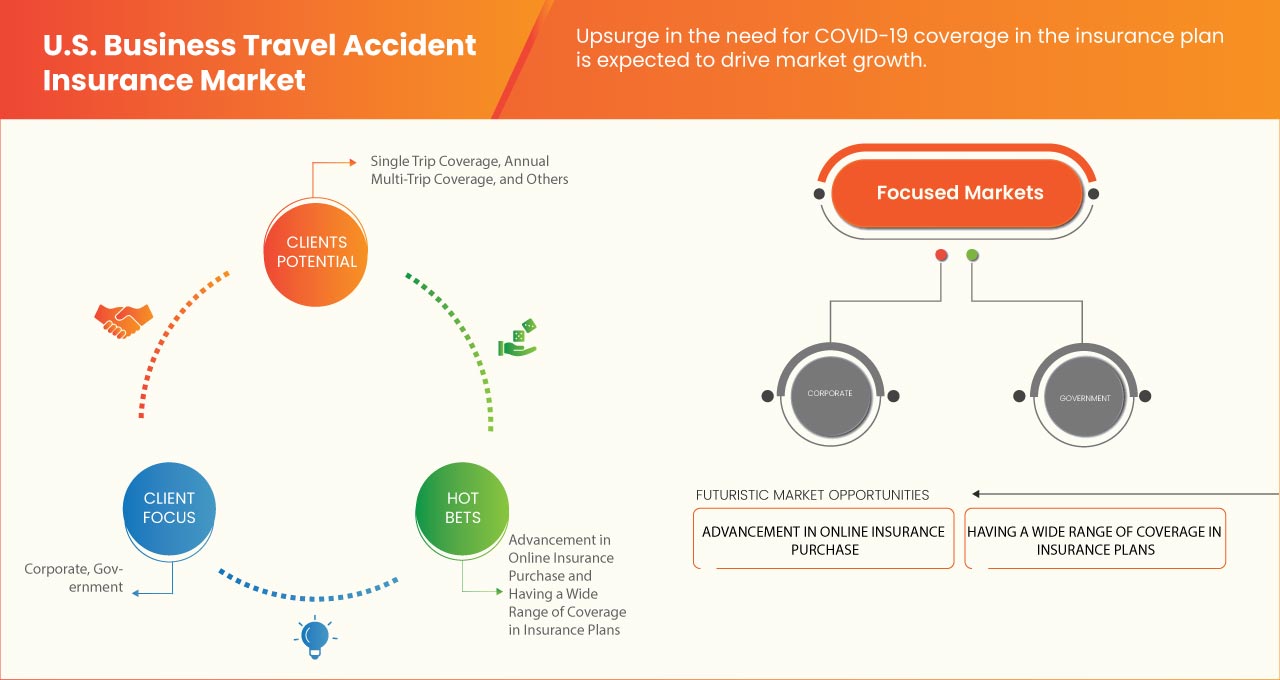

U.S. Business Travel Accident Insurance Market Segmentation, By Type (Single Trip Coverage, Annual Multi-Trip Coverage, and Others), User Type (B2B, B2C, and B2B2C), Distribution Channel (Insurance Brokers, Insurance Aggregators, Insurance Company, Bank, and Others), Coverage (Accidental Medical, Accidental Death, Accidental Dismemberment, Out-of-Country Medical, Emergency Medical Evacuation, Security Evacuation, and Others), Policy Type (Local Policies, Global Policies, and Controlled Master Program), Business Size (Large Businesses (More Than 500 Employees), Mid-Size Businesses (10 - 500 Employees), and Small Businesses (2 - 10 Employees)), End-User (Corporate, Government, International Travelers, and Employees (Expats)) – Industry Trends and Forecast to 2031

U.S. Business Travel Accident Insurance Market Analysis

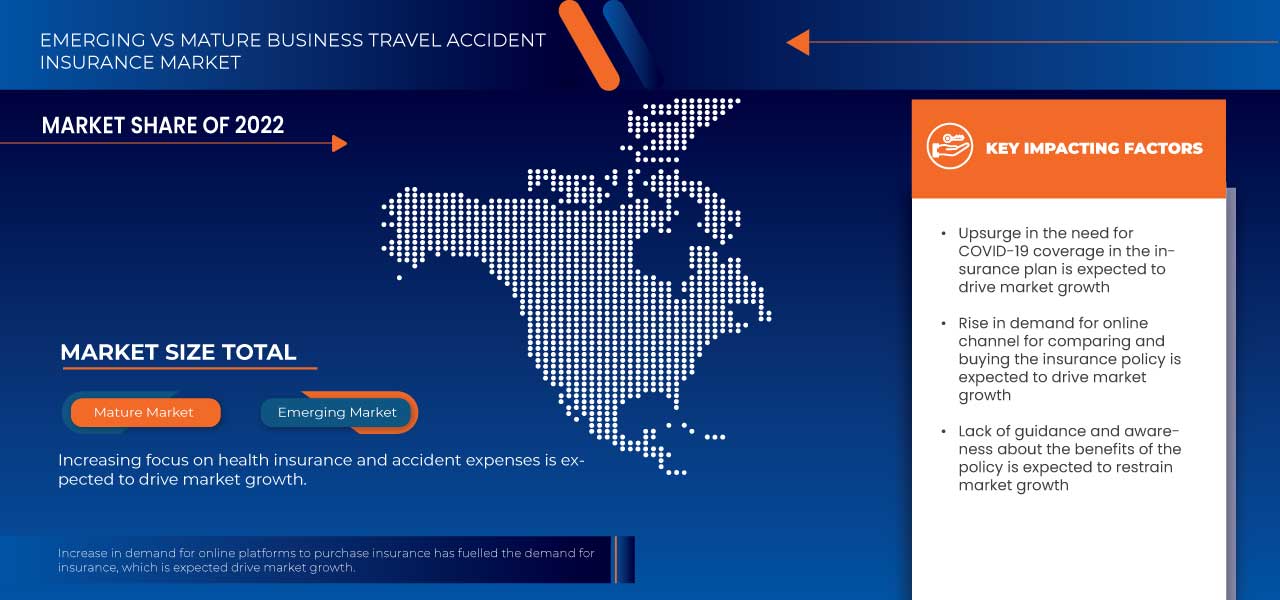

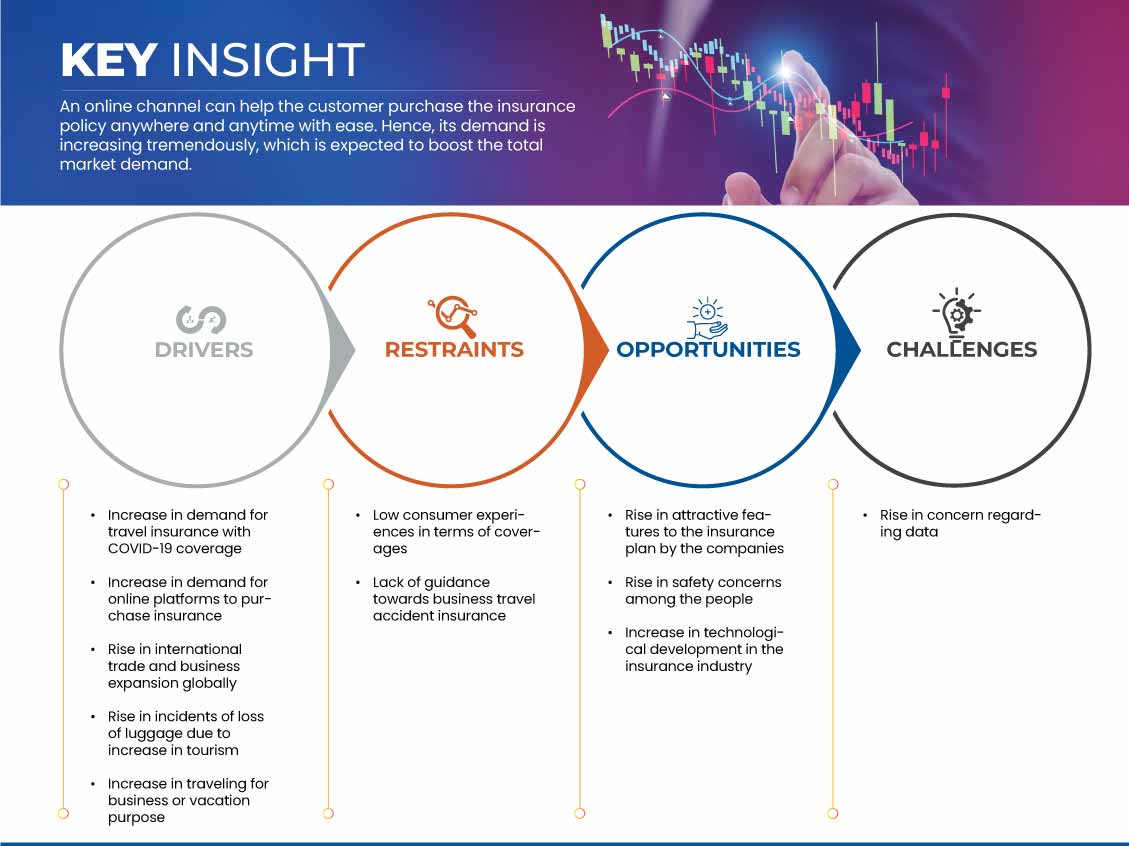

The U.S. business travel accident insurance market is driven by increase in demand for online platforms to purchase insurance also rise in international trade and business expansion globally enhance market growth, while low consumer experiences in terms of and rise in concern regarding data posses emerging challenges for future development.

U.S. Business Travel Accident Insurance Market Size

The U.S. business travel accident insurance market is expected to reach USD 10.07 billion by 2031 from USD 2.84 billion in 2023, growing with a substantial CAGR of 17.4 % in the forecast period of 2024 to 2031.

U.S. Business Travel Accident Insurance Market Trends

“Rise In International Trade and Business Expansion Globally”

Globalization has increased the integration of the world economy through the rise of international trade. Thus, both consumers and companies can now choose from a broader range of products and services. Also, many companies are expanding their geographical reach by investing in foreign companies and are setting up their branches in others countries. They have to travel from one place to another numerous times to expand their business and look into the flow of operations. Many insurance companies are coming up with different plans like multi-trip travel protection plans helping their clients for necessary coverage. Also, the companies are coming with a plan which can provide them complete travel safety.

Report Scope and Market Segmentation

|

Attributes |

U.S. Business Travel Accident Insurance Market Key Market Insights |

|

Segmentation |

|

|

주요 시장 참여자 |

Chubb(미국), AGA Service Company(Allianz Partners)(미국), American International Group, Inc.(AIG)(미국), AXA Partners USA SA(미국), The Hartford(미국), American Express(미국), MetLife Services and Solutions, LLC(미국), Berkshire Hathaway Specialty Insurance(미국), Arch Capital Group Ltd.(버뮤다), Generali Global Assistance(미국), Jokio Marine HCC(미국), Travel Insured International(미국), International Medical Group, Inc.(SiriusPoint Ltd. 자회사)(미국), Berkley Accident and Health(미국), Travelex Insurance Services Inc.(미국), Visitors Coverage Inc(미국), Insubuy, LLC(미국) |

|

시장 기회 |

|

|

부가가치 데이터 정보 세트 |

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위, 주요 업체와 같은 시장 시나리오에 대한 통찰력 외에도 수입 수출 분석, 생산 능력 개요, 생산 소비 분석, 가격 추세 분석, 기후 변화 시나리오, 공급망 분석, 가치 사슬 분석, 원자재/소모품 개요, 공급업체 선택 기준, PESTLE 분석, 포터 분석 및 규제 프레임워크가 포함됩니다. |

미국 비즈니스 여행 사고 보험 시장 정의

출장 사고 보험은 출장 중 사고로 인한 부상, 질병 또는 사망을 경험한 직원에게 재정적 보호를 제공합니다. 일반적으로 의료비, 비상 대피, 사고 사망 또는 신체 절단과 같은 비용을 보장하는 이 보험은 직원과 고용주 모두를 예상치 못한 여행 위험으로부터 보호합니다. 보험에 따라 운송 지연, 송환 및 업무 관련 여행 중 발생한 사고와 관련된 특정 비용까지 보장 범위가 확대될 수 있습니다. 출장 사고 보험은 조직이 직무상 의무를 이행하고 출장 중 직원의 웰빙과 마음의 평화를 보장하는 데 도움이 되며, 고용주에게 여행 관련 사고와 관련된 재정적 책임으로부터 보호합니다.

미국 비즈니스 여행 사고 보험 시장 동향

운전자

- 관광 증가로 인한 짐 분실 사고 증가

미국 관광의 급증으로 여행객 수가 눈에 띄게 증가했고, 이로 인해 짐을 분실하거나 잘못 취급하는 경우가 증가하고 있습니다. 이러한 추세는 점점 더 많은 기업과 개인이 개인 및 업무에 중요한 소지품의 분실로 인한 재정적, 물류적 영향으로부터 보호를 추구함에 따라 비즈니스 여행 사고 보험에 대한 수요를 크게 촉진하고 있습니다. 귀중한 품목을 자주 운반하는 비즈니스 여행객의 경우, 분실된 짐은 일정을 방해하고 생산성을 떨어뜨리며 예상치 못한 교체 비용을 초래할 수 있습니다. 결과적으로 조직은 이러한 잠재적 손실을 완화하기 위해 포괄적인 비즈니스 여행 사고 보험에 점점 더 투자하고 있으며, 직원의 원활한 여행 경험을 보장하고 기업의 책임을 강화하는 것을 목표로 합니다.

더 많은 승객 수와 확장된 국제 노선으로 인해 글로벌 여행 물류가 점점 더 복잡해지면서 분실된 짐 사고의 가능성이 높아졌습니다. 출장 사고 보험 제공자는 신속한 청구 프로세스, 필수 비즈니스 항목에 대한 고가 보장, 신속한 해결을 위한 전담 고객 서비스를 포함하여 기업 부문의 특정 요구 사항을 충족하는 맞춤형 솔루션으로 대응하고 있습니다. 이러한 개선 사항은 출장객에게 마음의 평화를 제공할 뿐만 아니라 회사가 혼란스러운 시기에 직원을 효과적으로 지원하여 분실된 짐과 관련된 재정적 및 운영적 위험으로부터 보호할 수 있습니다.

예를 들어,

- 세계관광기구(UNWTO)는 2019년 전 세계적으로 15억 명의 국제 관광객이 방문했다고 발표했습니다. 또한 UNWTO 세계관광기압계에 따르면 2020년 관광이 4% 증가할 것으로 예측되었습니다. 2019년 아메리카는 2017년 허리케인 이후 카리브해의 많은 섬 목적지가 회복세를 공고히 하면서 엇갈린 성장세를 보였습니다. UNWTO는 또한 세계 경제 침체라는 배경 속에서도 관광 지출이 계속 증가했다고 밝혔습니다. 프랑스는 11%로 가장 큰 증가를 보고했고, 미국 관광은 6% 증가했습니다.

요약하자면, 관광 증가로 인한 분실 수하물 사고의 증가는 미국 출장 사고 보험 시장의 성장을 촉진하고 있습니다. 기업들이 직원을 보호하고 출장 중단과 관련된 재정적 위험을 완화하고자 하면서 포괄적 보험 솔루션에 대한 수요가 급증하고 있습니다. 이러한 추세는 기업 위험 관리의 중요한 구성 요소로서 견고한 여행 보험의 중요성을 강조하며, 출장 사고 보험 시장이 지속적으로 확장될 수 있는 위치를 차지하고 있습니다.

- 비즈니스 또는 휴가 목적으로 여행하는 사람의 증가

사업 확장과 전문가들의 휴가 여행 급증으로 인해 국내 및 해외 여행이 지속적으로 성장하면서 미국 출장 사고 보험 시장이 크게 성장하고 있습니다. 미국 경제가 조직이 고객 관계를 강화하고, 새로운 시장을 개척하고, 현장 관리를 강화함에 따라 출장을 선호함에 따라, 인력 보호를 보장하기 위해 포괄적인 여행 보험에 대한 수요가 높아지고 있습니다. 기업이 글로벌화된 운영 모델을 채택함에 따라 직원들은 더 자주 출장해야 하며, 사고, 의료 비상 사태, 운송 관련 사고 등 다양한 위험에 노출됩니다. 따라서 기업은 이러한 책임을 완화하고 직원 복지를 보호하기 위해 출장 사고 보험을 점점 더 많이 제공하고 있습니다.

마찬가지로, 직원들이 유연한 근무 일정과 원격 근무 제도를 활용하여 핵심 사업 목적을 넘어 여행을 확장함에 따라, 종종 "블레저" 여행이라고 불리는 사업과 여가 여행을 결합하는 경우가 현저히 증가했습니다. 블레저 여행의 증가는 사업과 개인 여행 위험을 모두 보장하는 보험 상품에 대한 필요성이 커지고 있음을 강조하며, 보험사는 유연하고 포괄적인 정책을 개발하게 되었습니다. 더욱이 여행지가 다양화되고 고위험 지역이 포함됨에 따라, 여행 보험 상품은 의료 후송, 사고 사망, 빈번한 여행자의 요구에 맞는 절단 혜택을 포함한 보장 옵션이 확대되고 있습니다. 건강 위험, 안전 문제, 예측할 수 없는 사고에 대한 인식이 높아짐에 따라 기업과 개인 모두 여행 사고 보험을 선택 사항이 아닌 필수 사항으로 여기게 되었습니다.

예를 들어,

- TravelPerk SLU에서 실시한 조사에 따르면 코로나바이러스 팬데믹이 발발하기 전인 2019년 비즈니스 여행의 가치는 1조 2,800억 달러였습니다. 또한 비즈니스 여행이 90% 감소했고 코로나가 정점에 달한 반면, 팬데믹 이전에는 일부 회사에서 비즈니스 여행 활동이 여름에 제한이 완화되었을 때의 약 80% 수준으로 회복된 것으로 나타났습니다. 팬데믹 이전의 여행 보험에는 항공편 취소 또는 변경, 빠른 보안 레인 이용 등의 기능이 포함됩니다.

이에 대응하여 보험사는 점점 더 정교해지는 정책을 제공하고 있으며, 종종 포괄적인 지원 서비스와 함께 패키지로 제공되어 비즈니스 여행객의 변화하는 요구에 부응하고 있습니다. 비즈니스 및 휴가 관련 여행의 증가는 미국 비즈니스 여행 사고 보험 시장을 크게 촉진하는데, 이는 회사가 여행 루틴이 확대되는 가운데 위험 관리와 직원 안전을 우선시하기 때문입니다.

기회

- 회사별 보험 플랜의 매력적인 특징 증가

비즈니스 여행 사고(BTA) 보험 플랜에 향상되고 매력적인 기능을 도입하면 미국 시장에서 성장할 수 있는 상당한 기회가 제공됩니다. 업계 전반의 기업이 직원 안전, 웰빙 및 포괄적인 여행 지원에 집중함에 따라 보험사는 이러한 변화하는 수요에 맞춰 BTA 플랜을 확장하고 맞춤화하여 대응하고 있습니다. 확장된 의료 보장, 비상 대피, 글로벌 의료 서비스 접근, 심지어 여행 중 웰빙 지원과 같은 추가 혜택을 통해 보험사는 BTA 정책의 인식된 가치를 높일 수 있습니다. 이러한 추가 가치는 출장이 많은 직책에서 직원을 유지하고 지원하기 위해 견고하고 경쟁력 있는 패키지를 제공하려는 기업의 기대에 부응합니다.

BTA 플랜의 개선은 미국 시장에서 입지를 확립하거나 강화하려는 보험사의 차별화 요인이 될 수도 있습니다. 보다 유연하고 사용자 정의 가능한 보험 옵션에 대한 수요로 인해 중소기업(SME)이 BTA 정책을 모색하는 경우가 늘어났습니다. 사용자 정의 가능한 옵션을 통합하고 단계별 보장 수준을 제공함으로써 보험사는 다양한 기업 요구 사항을 충족하고 더 광범위한 고객 기반에 어필할 수 있습니다. 예를 들어, 기술, 의료 및 에너지 부문에 대한 산업별 보장은 고유한 여행 위험을 충족시켜 경쟁 우위를 확보하고 고객 충성도를 강화할 수 있습니다.

또한 디지털화와 기술 기반 서비스 제공은 보험사에게 클레임 프로세스를 간소화하고, 고객 경험을 개선하고, 데이터 분석을 활용하여 고객의 요구를 예측할 수 있는 방법을 제공하고 있습니다. 모바일 앱, 24시간 연중무휴 지원, 글로벌 위험에 대한 실시간 알림을 포함하여 BTA 보험 제공자는 이제 출장 직원에게 원활하고 사용자 친화적인 지원을 제공할 수 있습니다. 이는 고객 만족도를 높일 뿐만 아니라 보험사를 현대적 비즈니스 환경에 진보적이고 적응 가능한 사람으로 자리 매김합니다.

예를 들어,

- 2021년 7월, American Express는 US Platinum 및 Business Platinum 카드 회원이 여행 시 더 많은 공항 라운지와 프리미엄 편의 시설을 이용할 수 있다고 발표했습니다. 이 회원은 세계적 수준의 여행 및 라이프스타일 서비스를 제공받고 독점적인 여행 프로그램, 혜택 및 제공 사항에 액세스할 수 있습니다. 이를 통해 회사는 카드 회원이 여행 복귀를 시작할 수 있도록 돕고 있습니다.

기업 여행이 계속 회복됨에 따라 BTA 보험 플랜의 혁신과 향상은 미국 내 시장 확장, 향상된 고객 유지 및 더 높은 수익 잠재력을 위한 명확한 길을 제시합니다.

- 국민들 사이에서 안전에 대한 우려 증가

미국 여행객 사이에서 증가하는 안전 우려는 미국 출장 사고(BTA) 보험 시장에 상당한 기회를 제공합니다. 출장 중 개인의 안전과 건강 보안에 대한 인식이 높아짐에 따라 회사는 직원을 위한 포괄적인 여행 보호를 우선시하게 되었습니다. 이러한 변화는 여러 요인에 의해 주도됩니다. 세계적 정치적 불안정성 증가, 잠재적 건강 위험 노출, 자연 재해 우려. 회사는 직원이 여행 중 예상치 못한 위험으로부터 보호받을 수 있도록 하는 의무 의무에 집중하고 있으며, 이는 맞춤형 고보장 BTA 정책에 대한 수요를 촉진하고 있습니다.

BTA 보험 시장의 경우, 이러한 변화하는 환경은 안전에 대한 강조가 커짐에 따라 혁신하고 제공 범위를 확대할 수 있는 기회를 제공합니다. 보험사는 국제적 의료 비상 사태, 테러 행위, 여행 중단과 같은 특정 위험을 해결하는 정책을 개발하여 이러한 추세를 활용할 수 있습니다. 또한 데이터 분석 및 디지털화의 발전으로 보험사는 실시간 위험 평가 및 지원을 제공할 수 있게 되어 위기 상황에서 신속하고 포괄적인 대응을 우선시하는 기업 고객에게 이러한 정책의 매력을 높일 수 있습니다.

또 다른 중요한 성장 영역은 원격 및 하이브리드 작업 모델의 증가로, 이는 종종 팀 응집력을 유지하고 분산된 인력을 관리하기 위해 더 자주 출장해야 합니다. 기업이 더 넓은 지역으로 사업을 확장함에 따라 직원들의 여행 위험 노출도 증가하여 더 광범위하고 유연한 BTA 보험 정책에 대한 필요성이 촉발되었습니다. 이제 기업은 직원 혜택 패키지의 일부로 이러한 정책을 제공하는 경향이 더 커져 BTA 보험을 기업 여행 프로그램의 필수 구성 요소로 자리 매김하고 있습니다.

예를 들어,

- 2021년 7월, Generali Global Assistance는 Trip Mate 여행 보호 플랜을 강화하기 위해 FootprintID와 협력한다고 발표했습니다. 이 파트너십을 통해 Trip Mate 보호 플랜을 사용하는 여행객은 FootprintID의 휴대용 개인 건강 기록에 액세스할 수 있으며, 이를 통해 의료 정보를 어디든 가지고 다닐 수 있습니다. 이를 통해 회사는 고객에게 제공하는 치료 수준을 높일 수 있습니다.

- Travelex Insurance Services는 Berkshire Hathaway Specialty Insurance Company의 Berkshire Hathaway Travel Protection(BHTP)과 협력하여 혁신적인 여행 보호 계획을 제공합니다. 이 파트너십을 통해 두 회사는 여행 전문가와 고객에게 높은 수준의 서비스, 제품 혁신, 클레임 처리 전문성과 편의성을 제공하고자 합니다. 따라서 이 회사는 고객에게 양질의 여행 보호 계획을 제공할 수 있을 것입니다.

결론적으로, 여행자 안전에 대한 관심 증가와 원격 근무로 인한 여행 증가는 미국 비즈니스 여행 사고 보험 시장이 확장될 수 있는 좋은 환경을 제공합니다. 맞춤형 및 대응형 솔루션으로 이러한 우려 사항을 해결함으로써 보험사는 시장 수요를 충족하고 직원 보호에 집중하는 기업 고객의 증가하는 점유율을 확보할 수 있습니다.

제약/도전

- 데이터에 대한 우려 증가

미국 출장 사고 보험 시장은 데이터 프라이버시와 보안에 대한 우려가 커지면서 상당한 어려움에 직면해 있습니다. 기업이 글로벌 입지를 확장함에 따라 여행 안전을 강화하고 위험 관리 전략을 개선하기 위해 데이터 기반 통찰력에 크게 의존하고 있습니다. 그러나 데이터 침해 빈도가 증가하고 일반 데이터 보호 규정(GDPR) 및 캘리포니아 소비자 프라이버시 법(CCPA)과 같은 데이터 보호 규정을 둘러싼 대중의 인식이 커지면서 보험사에 복잡한 환경이 조성되고 있습니다.

데이터 보안에 대한 우려가 커지면서 출장 사고 보험 부문에 여러 과제가 제기되었습니다. 첫째, 보험사는 이제 포괄적 보장을 제공할 뿐만 아니라 강력한 데이터 보호 조치가 마련되어 있는지 확인해야 합니다. 그렇지 않으면 진화하는 법적 프레임워크를 준수하지 않아 평판이 손상되고 재정적 피해가 발생할 수 있습니다. 게다가 기업은 데이터 처리 관행에 대해 보험 파트너를 점점 더 면밀히 조사하고 있습니다. 강력한 데이터 거버넌스와 보안 프로토콜을 입증할 수 없는 보험사는 이러한 측면을 우선시하는 경쟁사에게 고객을 빼앗길 위험이 있습니다. 결과적으로 보험 제공자는 데이터 보호 기능을 강화하기 위해 첨단 기술과 교육에 투자해야 하며, 이는 리소스를 압박하고 수익성에 영향을 미칠 수 있습니다.

또한 데이터 프라이버시에 대한 우려가 커지면서 보험 인수 기준이 더욱 엄격해져 보험을 신청하는 기업의 비용이 증가할 가능성이 있습니다. 보험사는 고객이 중요한 데이터를 공유하는 것을 주저할 때 위험을 정확하게 평가하는 데 어려움을 겪을 수 있습니다. 이러한 단절은 보험 적용 범위에 격차가 생기고 보험료가 인상되어 기업과 보험사 간의 관계가 더욱 복잡해질 수 있습니다.

예를 들어,

- 2020년 1월에 시행된 캘리포니아 소비자 개인정보 보호법(CCPA)에 따라 CCPA는 기업이 데이터 수집 및 사용 관행에 대한 투명성을 강화하도록 요구합니다. 출장 부문의 기업은 이 규정을 준수해야 하며, 그렇지 않으면 벌금을 내야 하며, 이는 보험사가 위험을 평가하고 보험료를 설정하는 방식에 영향을 미칩니다. 기업은 보험사와 특정 데이터를 공유하지 않기로 선택할 수 있으며, 이는 인수 절차를 복잡하게 만들고 잠재적으로 비용이 증가하거나 보장 범위에 격차가 생길 수 있습니다.

- Vox Media, LLC 웹사이트에 게재된 기사에 따르면 Marriott은 약 5억 명의 투숙객에게 영향을 미치는 데이터 침해를 공개했으며, 이름, 주소, 전화번호, 여권 번호와 같은 개인 정보가 노출되었습니다. Marriott과 같은 여행사가 방대한 양의 데이터를 수집함에 따라 이러한 사고는 보험사에게 여행자 정보의 안전에 대한 우려를 불러일으키며, 여행 사고 보험사가 데이터 보안 프로토콜을 강화하는 것이 매우 중요합니다.

요약하자면, 데이터 개인정보 보호 및 보안에 대한 우려 증가는 미국 비즈니스 여행 사고보험 시장에 다면적인 과제를 안겨주며, 점점 경쟁이 치열해지는 환경에서 지속 가능한 성장을 보장하기 위해 데이터 관리 및 규정 준수에 대한 사전 예방적 접근 방식이 필요해졌습니다.

- 적용 범위 측면에서 낮은 소비자 경험

미국 출장 사고 보험 시장에서 보장 옵션과 관련된 낮은 소비자 경험은 주목할 만한 제약입니다. 많은 출장자, 특히 처음으로 보험을 탐색하는 사람들은 출장의 고유한 위험과 다양한 요구 사항을 해결하는 데 복잡하거나 불충분해 보이는 정책에 직면합니다. 보장 한도는 종종 포괄적인 의료 지원, 개인 소지품 분실, 응급 의료 후송 및 여행 중단 보호와 같은 중요한 측면을 포함하지 못할 수 있습니다. 이용 가능한 정책의 이러한 포괄성 부족은 소비자 불만족과 이러한 보험 상품 구매에 대한 낙담으로 이어질 수 있습니다.

주요 제약 중 하나는 소비자가 기대하는 것과 정책이 제공하는 것 사이의 인식된 격차에 있습니다. 이 격차는 잠재 고객이 가치나 관련성이 부족하다고 생각하는 정책에 투자하기를 주저할 수 있으므로 채택에 대한 장벽을 만듭니다. 종종 정책은 표준화된 조건과 제한된 사용자 정의 옵션으로 제공되어 고유한 여행 요구 사항이 있는 기업에 덜 매력적입니다. 결과적으로 다양한 직원 역할이나 국제 여행 요구 사항에 맞는 맞춤형 보장을 확보하려는 회사는 서비스가 부족하다는 것을 알게 되어 대안 또는 자가 보험 옵션을 모색하게 됩니다.

예를 들어,

- Wonderflow에서 실시한 연구에 따르면 보험 산업은 평판 문제로 어려움을 겪고 있습니다. 고객은 종종 이기적이고 기회주의적이라고 여겨지기 때문에 보험 회사와 거리를 느낍니다. 고객의 의견으로 인해 거의 44%의 고객이 지난 18개월 동안 보험사와 상호 작용하지 않았습니다. 또한 약 40%의 보험 고객이 회사 서비스에 불만족합니다.

- ValuePenguin에서 50가지 여행 보험 정책에 대해 조사한 결과, 미국에서 여행 보험의 평균 비용은 148달러였습니다. 하지만 모든 여행 보험 정책이 같은 것은 아닙니다. 일부는 다른 정책보다 훨씬 포괄적이어서 그 결과 비용 범위가 넓을 수 있습니다. 또한 포괄적 여행 보험 정책의 비용이 기본 여행 보험 정책보다 평균 56% 더 비싼 것으로 나타났습니다. 또한, 정책 보유자의 연령도 정책 비용에 영향을 미칩니다. 연령이 높을수록 정책 비용이 높아집니다. 정책 비용은 82달러에서 415달러까지입니다.

요약하자면, 제한적이고 투명하지 않은 보장 옵션으로 인해 소비자 경험이 부족하여 미국 출장 사고 보험 시장 성장이 상당히 제한되고 있습니다.

원자재 부족 및 운송 지연의 영향 및 현재 시장 시나리오

Data Bridge Market Research는 시장에 대한 고수준 분석을 제공하고 원자재 부족과 운송 지연의 영향과 현재 시장 환경을 고려하여 정보를 제공합니다. 이는 전략적 가능성을 평가하고, 효과적인 행동 계획을 수립하고, 기업이 중요한 결정을 내리는 데 도움을 주는 것으로 해석됩니다.

표준 보고서 외에도 예상 배송 지연 등의 조달 수준에 대한 심층 분석, 지역별 유통업체 매핑, 상품 분석, 생산 분석, 가격 매핑 추세, 소싱, 카테고리 성과 분석, 공급망 위험 관리 솔루션, 고급 벤치마킹 및 조달 및 전략적 지원을 위한 기타 서비스를 제공합니다.

경제 침체가 제품 가격 및 가용성에 미치는 영향 예상

경제 활동이 둔화되면 산업이 어려움을 겪기 시작합니다. 경기 침체가 제품의 가격 책정 및 접근성에 미치는 예상 효과는 DBMR에서 제공하는 시장 통찰력 보고서 및 인텔리전스 서비스에서 고려됩니다. 이를 통해 고객은 일반적으로 경쟁사보다 한 발 앞서 나가고, 매출과 수익을 예측하고, 손익 지출을 추정할 수 있습니다.

미국 비즈니스 여행 사고 보험 시장 범위

시장은 유형, 사용자 유형, 유통 채널, 적용 범위, 정책 유형, 사업 규모 및 최종 사용자를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 단일 여행 보장

- 연간 다중 여행 보장

- 기타

사용자 유형

- B2B

- B2C

- B2B2C

유통 채널

- 보험 브로커

- 보험 통합업체

- 보험 회사

- 은행

- 기타

적용 범위

- 우발적 의료

- 단일 여행 보장

- 연간 다중 여행 보장

- 기타

- 비명

- 단일 여행 보장

- 연간 다중 여행 보장

- 기타

- 우발적 절단

- 단일 여행 보장

- 연간 다중 여행 보장

- 기타

- 해외 의료

- 단일 여행 보장

- 연간 다중 여행 보장

- 기타

- 응급 의료 후송

- 단일 여행 보장

- 연간 다중 여행 보장

- 기타

- 보안 대피

- 단일 여행 보장

- 연간 다중 여행 보장

- 기타

- 기타

- 단일 여행 보장

- 연간 다중 여행 보장

정책 유형

- 지역 정책

- 글로벌 정책

- 제어된 마스터 프로그램

사업 규모

- 대기업(직원 500명 이상)

- 우발적 의료

- 비명

- 우발적 절단

- Out-of-Country Medical

- Emergency Medical Evacuation

- Security Evacuation

- Others

- Mid-Size Businesses (10 - 500 Employees)

- Accidental Medical

- Accidental Death

- Accidental Dismemberment

- Out-of-Country Medical

- Emergency Medical Evacuation

- Security Evacuation

- Others

- Small Businesses (2 - 10 Employees)

- Accidental Medical

- Accidental Death

- Accidental Dismemberment

- Out-of-Country Medical

- Emergency Medical Evacuation

- Security Evacuation

- Others

End-User

- Corporate

- Government

- International Travelers and Employees (Expats)

U.S. Business Travel Accident Insurance Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

U.S. Business Travel Accident Insurance Leaders Operating in the Market Are:

- Chubb (U.S.)

- AGA Service Company (Allianz Partners) (U.S.)

- American International Group, Inc. (AIG) (U.S.)

- AXA Partners USA S.A (U.S.)

- The Hartford (U.S.), American Express (U.S.)

- MetLife Services and Solutions, LLC (U.S.)

- Berkshire Hathaway Specialty Insurance (U.S.)

- Arch Capital Group Ltd. (Bermuda)

- Generali Global Assistance (U.S.)

Latest Developments in U.S. Business Travel Accident Insurance Market

- In July 2022, Chubb completed the acquisition of the life and non-life insurance companies that house the personal accident, supplemental health, and life insurance business of Cigna in several Asian markets. Chubb paid approximately USD 5.4 billion in cash for the operations, which include Cigna's accident and health (A&H) and life business in Korea, Taiwan, New Zealand, Thailand, Hong Kong, and Indonesia, collectively referred to as Cigna's business in Asia. This complementary strategic acquisition expands our presence and advances our long-term growth opportunity in Asia. Effective July 1, 2022, the results of operations of this acquired business are reported primarily in our Life Insurance segment and, to a lesser extent, our Overseas General Insurance segment

- In July 2023, American International Group, Inc. (NYSE: AIG) announced the successful closure of its definitive agreement with funds managed by Stone Point Capital LLC (Stone Point) to form an independent Managing General Agency (MGA) specializing in the High Net Worth and Ultra High Net Worth markets called Private Client Select Insurance Services (PCS)

- 2021년 7월, AXA Partners USA SA는 COVID-19를 포함하여 여행 전, 여행 중 또는 여행 후에 여행객이 겪을 수 있는 예상치 못한 사건을 보장하도록 설계된 보험 정책을 제공하기 위해 Club Med와 계약을 체결했다고 발표했습니다. Serenity Protection Plan 보험 정책에는 COVID로 인한 오염에 대한 보장이 포함되어 있어 보험 정책에서 숙박 및 교통비를 보상할 수 있습니다. 또한 이 정책은 "놓친 항공편", 수하물 보험 및 숙박이 중단된 경우의 보상과 같은 사건에 대한 보장을 제공합니다. 따라서 이 회사는 고객에게 안전하고 편안함을 느끼면서 휴가를 즐길 수 있는 정책을 제공할 것입니다.

- 2021년 5월, The Hartford는 2021 Virtual Wells Fargo Financial Services Investor Conference에 참여한다고 발표했습니다. 회사의 회장 겸 CEO인 Christopher Swift와 최고 재무 책임자인 Beth Costello가 난로 옆 대화에 참여하고 금융 서비스에 대해 연설할 예정입니다. 이를 통해 회사가 글로벌 플랫폼에서 인정받고 브랜드 이미지를 개선하는 데 도움이 될 것입니다.

- 2021년 7월, American Express Company는 US Platinum 및 Business Platinum 카드 회원이 여행 시 더 많은 공항 라운지와 프리미엄 편의 시설을 이용할 수 있다고 발표했습니다. 이 회원에게는 세계적인 수준의 여행 및 라이프스타일 서비스와 독점적인 여행 프로그램, 혜택 및 제공 사항에 대한 액세스가 제공됩니다. 이를 통해 회사는 카드 회원이 여행으로의 복귀를 시작할 수 있도록 돕고 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.