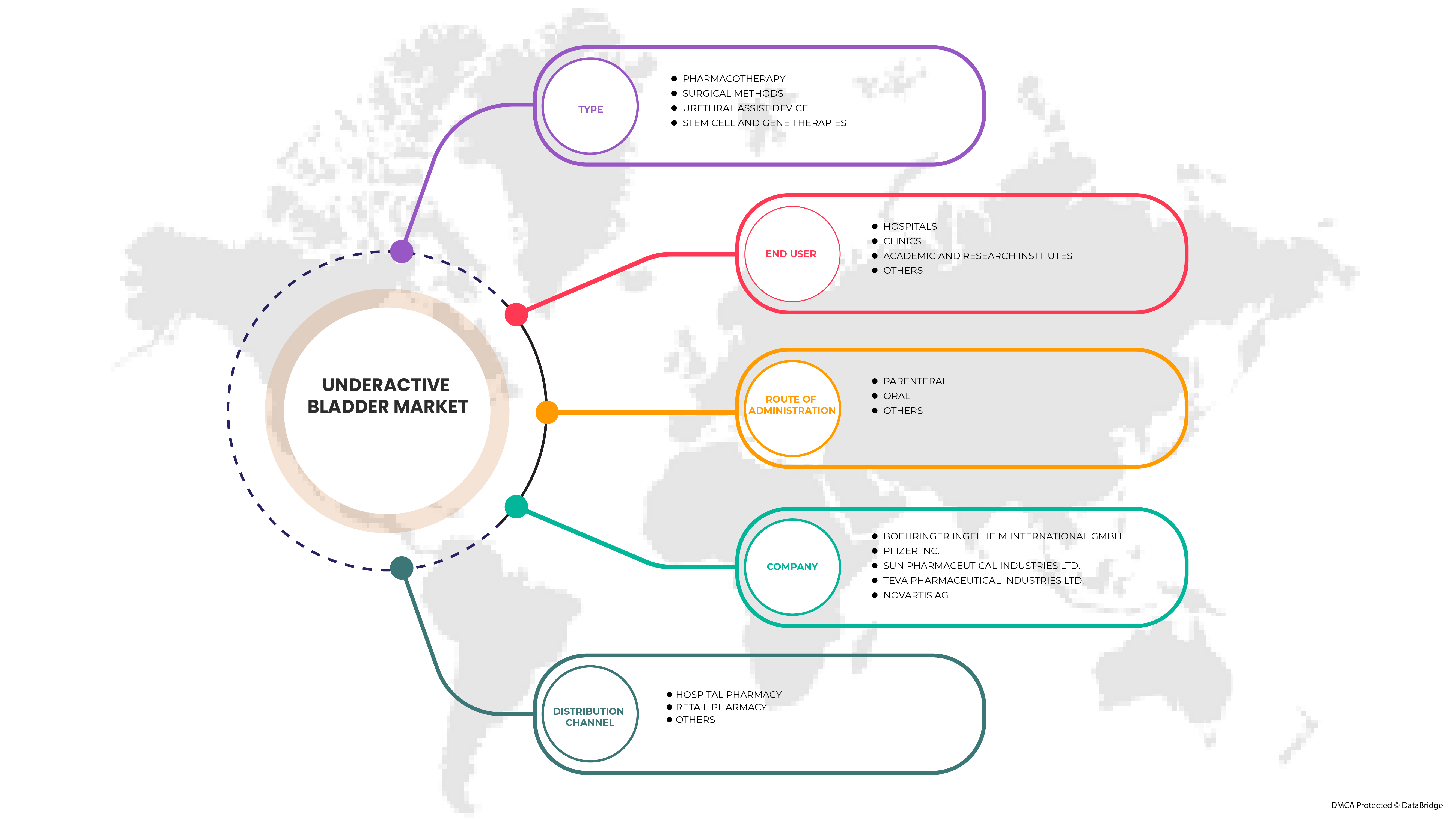

North America Underactive Bladder Market, By Type (Pharmacotherapy, Surgical Methods, Urethral Assist Device, and Stem Cell and Gene Therapies), Route of Administration (Oral, Parenteral, and Others), End User (Hospitals, Clinics, Academic and Research Institutes, and Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Others) Industry Trends and Forecast to 2029

North America Underactive Bladder Market Analysis and Insights

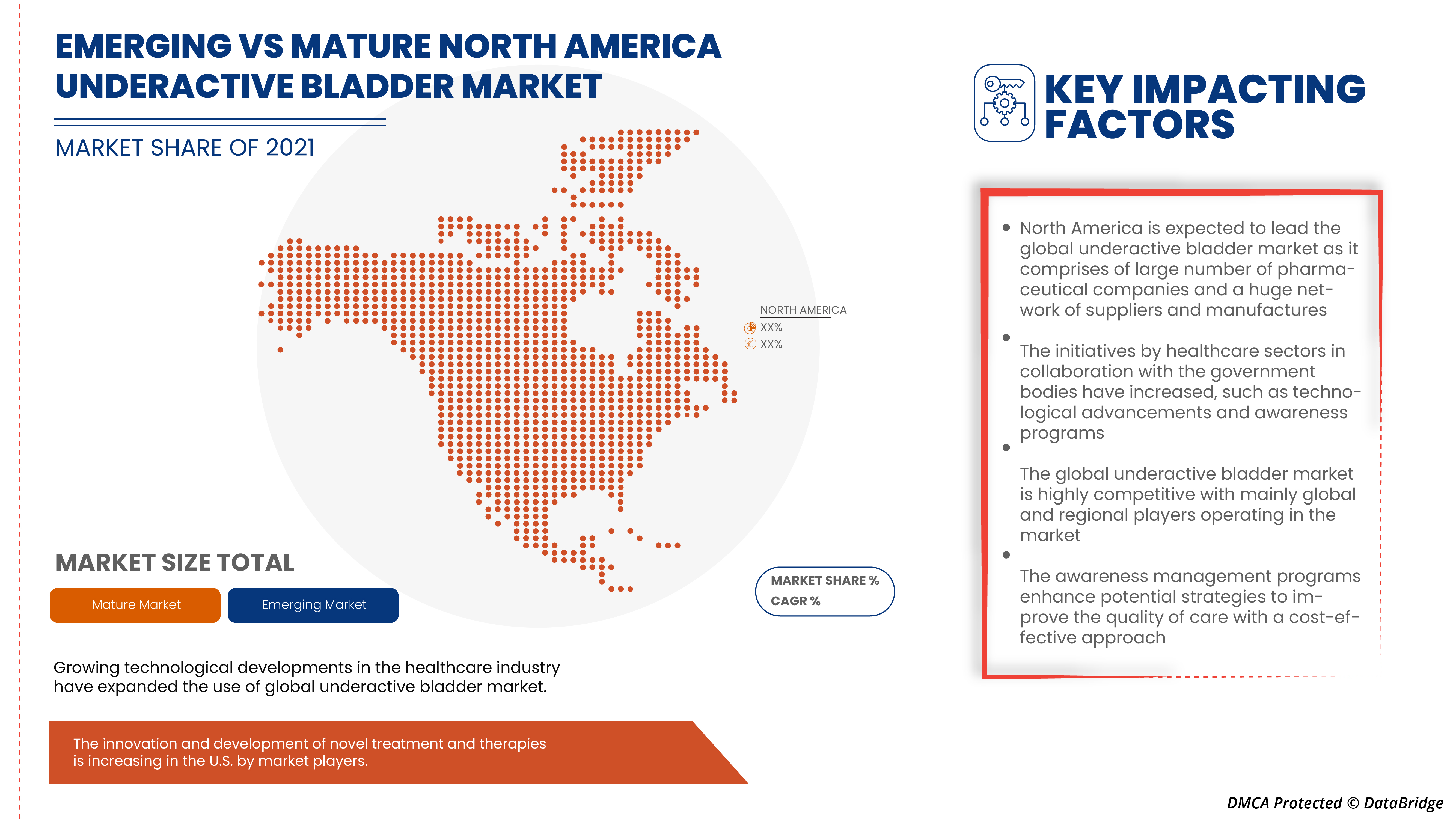

North America underactive bladder market is driven by the factors such as rising incidences of neurogenic bladder infections, increasing research funding, development of novel therapies for Underactive Bladder (UAB), and pipeline products enhancing its demand along with rising investment in R&D leading to market growth. Currently, healthcare expenditure has increased across developed and emerging countries which is expected to create a competitive advantage for manufacturers to develop new and innovative products. Additionally, the surge in healthcare expenditure and increase in the prevalence of bladder disorders positively affect the market.

However, the high cost of treatment restricts patients to accommodate high-quality and effective solutions. Henceforth, the high cost of treatment procedures negatively impact the cost of overall treatment. Moreover, the drugs which are currently used for the treatment of UAB are not proven to satisfy clinically from the viewpoint of effectiveness and safety, which leads to the requirement for new therapeutic agents to develop.

North America underactive bladder market is expected to grow in the forecast period due to the rise in market players and the presence of novel pipeline drugs. Along with this, manufacturers are engaged in R&D activities for launching novel products in the market.

However, the high cost associated with the research and studies is expected to restrain market growth which can further impact the launch of new products in the market.

The increase in the number of R&D programs, and the rise in public-private partnerships for facilitating novel developments for innovative and effective treatment further influence the market.

북미 저활성 방광 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 지역 시장 참여자의 영향에 대한 세부 정보를 제공하고, 새로운 수익 주머니, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서 기회를 분석합니다. 분석 및 시장 시나리오를 이해하려면 분석가 브리핑을 위해 저희에게 연락하세요. 저희 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드릴 것입니다. 다양한 지역의 개발도상국에 있는 소매점의 확장성과 사업 확장, 기계 및 약물 제품의 안전한 유통을 위한 공급업체와의 파트너십은 예측 기간 동안 시장 수요를 촉진한 주요 원동력입니다.

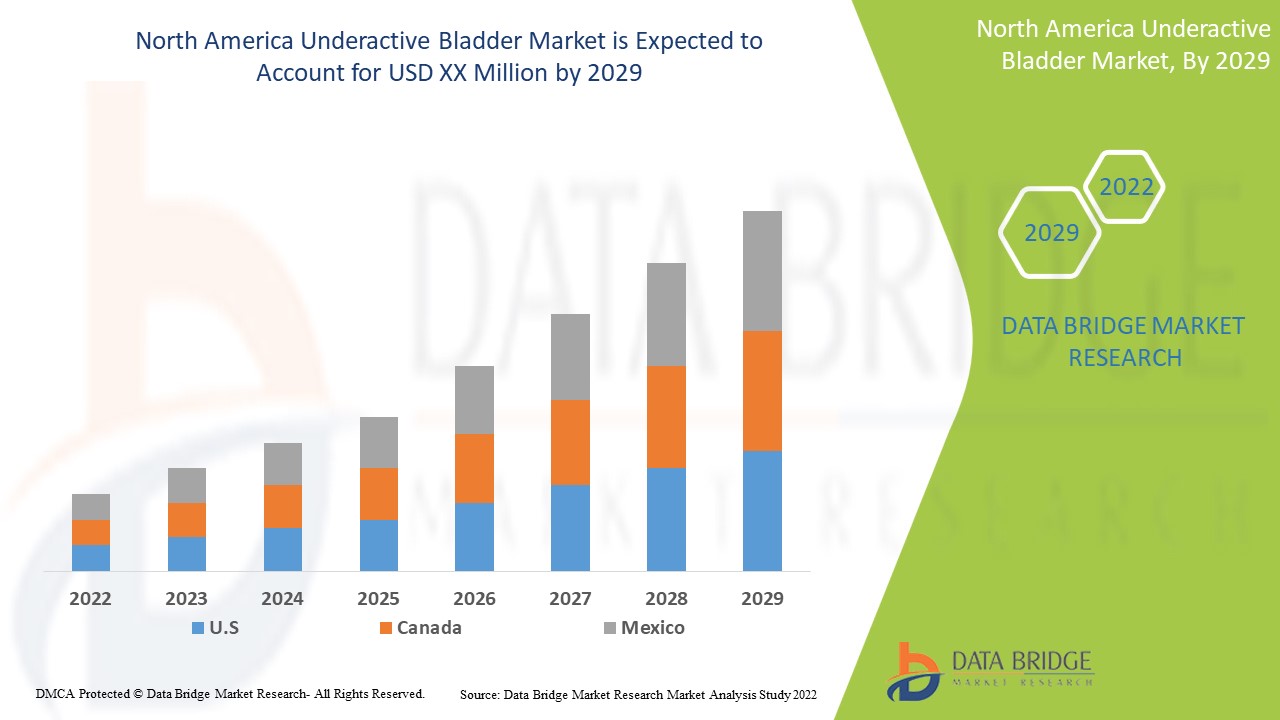

북미 저활성 방광 시장은 지지적이며 질병의 진행을 줄이는 것을 목표로 합니다. Data Bridge Market Research는 북미 저활성 방광 시장이 2022년에서 2029년의 예측 기간 동안 5.3%의 CAGR로 성장할 것이라고 분석합니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

유형별(약물 치료, 수술 방법, 요도 보조 장치, 줄기 세포 및 유전자 치료), 투여 경로별(경구, 비경구 및 기타), 최종 사용자별(병원, 진료소, 학술 및 연구 기관 및 기타), 유통 채널별(병원 약국, 소매 약국 및 기타) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Astellas Pharma Inc., Aurobindo Pharma., Boehringer Ingelheim International GmbH, Macleods Pharmaceuticals Ltd., Orion Corporation, ONO PHARMACEUTICAL CO., LTD., Novartis AG, Pfizer Inc., Cipla Inc., Dr. Reddy's Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Almirall, SA, Vesiflo, Inc., Alkem Labs. 등이 있습니다. |

시장 정의

저활동성 방광(UAB)은 배뇨 시 방광근(방광의 근육)의 수축이 감소하여 배뇨 장애가 발생하는 임상적 상태입니다. 이는 즉시 배뇨해야 한다는 느낌이 특징이므로, 이 상태는 과활동성 방광(OAB)과 다릅니다. 본 발명은 소변 흐름 속도를 개선하는 효과, 방광의 과팽창(방광 용량을 감소시키는 효과)을 개선하는 효과가 있는 UAB의 예방 또는 치료에 유용한 약제학적 조성물을 제공하며, 따라서 UAB의 예방 또는 치료에 유용합니다.

또한, 최근 주목을 받고 있는 요의 급박함을 특징으로 하는 OAB와는 다른 질환 상태입니다. UAB의 원인에는 당뇨병 및 알코올 중독과 같은 자율신경병증, 근치적 자궁적출술 및 근치적 직장암과 같은 골반 수술, 척추이분증과 같은 척수 질환이 있으며, 디스크 탈출증도 알려져 있습니다. 중증 및 경증 방광 장애 관련 문제로 고통받는 환자는 종종 여러 치료법과 순환하는 약물 치료가 필요하고 적절한 완화 없이 지속적인 치료를 받아야 하며, 이는 의료비 지출에도 영향을 미칩니다.

북미 저활동성 방광 시장 동향

이 섹션에서는 시장 동인, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전자

- 신경계 질환의 유병률 증가

UAB는 신경과 근육이 잘 작동하지 않아 배뇨 시간이 길어지고 방광이 완전히 비워지지 않은 느낌이 들거나 들지 않는 일반적인 신경학적 질환입니다. 이 질환에서 방광근은 수축 활동이 제대로 이루어지지 않아 소변이 느리게 나오고 주저하며, 배뇨 시 힘을 주고, 방광이 완전히 비워지지 않은 느낌이 들거나 들지 않고, 때로는 저장 증상이 나타나기도 합니다. 따라서 방광은 비우지 않거나 부분적으로만 비우는데, 이는 방광 근육이 소변을 제대로 배출하지 못하기 때문입니다.

결과적으로 UAB 환자는 다양한 배뇨 증상을 보일 수 있으며 많은 양의 잔뇨를 동반할 수 있습니다. 악화로 인한 요폐 합병증과 만성 잔뇨로 인한 요로감염(UTI)이 자주 나타나 문제가 되었습니다. 게다가 최근 주목을 받고 있는 요의 긴급성을 특징으로 하는 OAB와는 다른 질병 상태입니다. 따라서 신경성 방광 장애의 유병률이 증가함에 따라 시장 성장이 촉진될 것으로 예상됩니다. 이는 환자도 감지할 수 있는 치료에 대한 수요 증가로 이어질 것이며, 이로 인해 시장에서 수익성 있는 성장이 예상됩니다.

- 증가하는 의료비 지출

연구자, 보험, 운송, 윤리위원회 수수료, 데이터 처리 및 기타 소모품에 대한 피해가 발생할 경우 도구, 인력 및 의료 관리가 시장 참여자에게 주요 비용 관련으로 이어집니다. 의료 지출은 모든 의료 서비스, 검사 장치, 가족 계획 활동 및 건강에 지정된 응급 지원을 포함합니다. 국가 건강 계정은 국제적으로 인정된 프레임워크 내에서 수집된 지출을 기반으로 많은 지표를 제공합니다. 모든 국가의 의료 지출을 결정하는 요인은 소득(1인당 GDP), 기술 진보 및 의료 관행의 변화, 의료 시스템 특성입니다.

의료비 지출 증가는 동시에 의료 기관과 정부 기관이 폐경 약물에 대한 연구 활동, 다가올 임상 시험 및 R&D 활동을 늘리는 데 도움이 됩니다. 또한, 신제품의 생산 및 제조에 관련된 비용, 시장 참여자는 적절한 자금 및 자원 할당이 필요하므로, 정부는 이 시나리오에서 도움의 손길을 내밉니다. 증가하는 의료비 지출은 의료 부문의 추가 경제 개발 및 성장에도 이롭습니다. 게다가, 인구의 가처분 소득 증가는 유리한 요인입니다. 따라서 증가하는 의료비 지출은 미래에 시장 성장을 촉진할 것으로 예상됩니다.

기회

- 당뇨병의 비뇨기 합병증 증가

UAB의 알려진 원인 중 하나는 당뇨병과 같은 자율신경병증입니다. 게다가 당뇨병은 비뇨기 질환의 조기 발병 및 심각도 증가와 관련이 있으며, 이는 비용이 많이 들고 쇠약해지는 비뇨기 합병증을 초래합니다. 방광 기능 장애 및 UTI를 포함한 이러한 비뇨기 합병증은 당뇨병이 있는 남성과 여성 모두의 삶의 질에 큰 영향을 미칩니다. 당뇨병과 비뇨기 질환은 매우 흔한 건강 문제로, 나이가 들면서 유병률과 발생률이 현저히 증가합니다. 당뇨병의 비뇨기 합병증은 즉각적인 효과입니다. 당뇨병은 가장 두드러진 질환이며 전 세계적으로 유병률이 높습니다.

당뇨병 관련 방광 합병증은 방광 평활근의 변화, 신경 기능 장애 및 요로 상피 기능 장애로 인해 발생할 수 있습니다. 관련 신경에 따라 당뇨병 신경병의 영향은 다리의 불편함과 무감각에서 소화계, 요로, 혈관 및 핵심의 합병증까지 다양할 수 있습니다. 당뇨병에 대한 증가하는 데이터는 전 세계적으로 당뇨병의 비뇨기 합병증 위험을 크게 증가시킬 것입니다. 따라서 당뇨병의 비뇨기 합병증을 적절히 치료하기 위한 연구 및 임상 치료에 대한 미래 방향을 제안할 필요가 있습니다. 소홀히 다루어진 합병증을 해결하기 위해 미개발 지역에 도달하기 위해 다른 기관의 지원도 필요할 것입니다. 따라서 이는 당뇨병의 비뇨기 합병증 증가가 시장 성장의 기회로 작용할 것으로 예상된다는 것을 의미합니다.

제지/도전

- 높은 연구개발(R&D) 비용

R&D는 다양한 종류의 환자를 치료하기 위한 절차를 수정하는 데 필수적입니다. 신제품에 대한 R&D 비용이 높을수록 심층적인 연구와 임상 연구가 필요합니다. R&D의 다양한 임상 단계에는 시장 성장에 영향을 미칠 수 있는 막대한 투자가 필요합니다. 연구 계획 및 실행과 관련된 연구 비용과 연구에는 자금과 자원의 적절한 할당이 필요하며, 이는 시장의 새로운 개발에 영향을 미칠 수 있습니다. 제품 비용은 시장에서 중요한 요인입니다. 시중에는 많은 진단 옵션이 있지만 비용이 많이 들기 때문에 대부분의 사람들은 진단을 피하는 경향이 있습니다. 진단 접근 방식은 민감도와 특이도가 더 높아졌고 검사 비용도 증가했습니다.

이 시술의 높은 비용은 이러한 시술을 수행하기 위해 하이테크 방식을 사용하는 것과 더불어 다양한 치료 체크포인트 때문입니다. 치료를 위한 R&D 비용이 너무 높기 때문에 고품질의 효과적인 솔루션을 수용하는 데 제한이 있습니다. 따라서 높은 비용은 전반적인 치료 비용에 부정적인 영향을 미칩니다. 결과적으로 저소득 및 중소득 국가에서 치료에 대한 미래 수요를 제한할 것입니다. 이는 연구와 조사와 관련된 높은 비용이 시장 성장을 제한할 것으로 예상되며, 이는 시장에서 신제품 출시에 더욱 영향을 미칠 수 있음을 시사합니다.

COVID-19 이후 북미 저활동성 방광 시장에 미치는 영향

COVID-19는 이 지역에서 제품에 대한 수요가 널리 증가함에 따라 시장 성장에 긍정적인 영향을 미쳤습니다. 이 지역에서 다양한 방광 질환의 유병률이 증가함에 따라 사람들은 건강을 더 의식하게 되었습니다. 악화로 인한 요폐 합병증과 만성 잔뇨로 인한 UTI가 자주 나타나고 문제가 되었습니다. 따라서 COVID-19는 이 시장에 긍정적인 영향을 미쳤습니다.

최근 개발 사항

- 2020년 6월, Vesiflo, Inc.는 성인 여성이 간헐적 카테터 삽입의 대안으로 29일 동안 사용할 수 있는 자기 결합 FDA 승인 요도 밸브 펌프 장치인 inFlow 요도 보철물의 Medicare 적용을 발표했습니다. 이는 시장에서 상용화와 함께 제품 사업을 빠르게 확장하는 데 기여합니다.

- 2020년 4월, Astellas Pharma Europe Ltd.는 저활동성 방광 치료를 위한 피험자를 대상으로 실시한 임상 시험을 완료했습니다. 현재 ASP8302는 저활동성 방광 환자에서 약물의 안전성과 내약성을 조사하기 위한 2상 임상 시험을 진행 중입니다.

북미 저활동성 방광 시장 범위

북미 저활동성 방광 시장은 유형, 투여 경로, 최종 사용자 및 유통 채널을 기준으로 4개의 주요 세그먼트로 분류됩니다. 세그먼트 간의 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

유형

- 약물 치료

- 수술 방법

- 요도 보조 장치

- 줄기세포 및 유전자 치료

시장은 유형에 따라 약물 치료, 수술적 방법, 요도 보조 장치, 줄기세포 및 유전자 치료로 구분됩니다.

투여 경로

- 경구

- 비경구적

- 기타

투여 경로를 기준으로 시장은 경구, 비경구 및 기타로 구분됩니다.

최종 사용자

- 병원

- 클리닉

- 학술 및 연구 기관

- 기타

최종 사용자를 기준으로 시장은 병원, 진료소, 학술 및 연구 기관 및 기타로 세분화됩니다.

유통 채널

- 병원 약국

- 소매 약국

- 기타

유통 채널을 기준으로 시장은 병원 약국, 소매 약국 및 기타로 구분됩니다.

북미 저활동성 방광 시장 지역 분석/통찰력

북미 저활동성 방광 시장을 분석하고, 위에 언급된 대로 유형, 투여 경로, 최종 사용자 및 유통 채널별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 저활동성 방광 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

- 2022년 북미 저활동성 방광 장애 시장은 요실금(UI), UAB 등과 같은 방광 문제 발생률 증가로 인해 성장할 것으로 예상됩니다. 게다가 노인 인구의 증가도 시장 성장을 견인하고 있는데, 나이가 들면서 방광 조절 문제와 같은 방광 문제의 위험이 증가하기 때문입니다. UI와 UAB의 유병률도 나이가 들면서 증가하고 있으며, 노인은 인구에서 가장 빠르게 성장하는 계층입니다.

미국은 주요 기업들의 진출과 제조 시설의 증가로 인해 이 지역을 지배할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세, 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 저활동성 방광 시장 점유율 분석

북미 저활성 방광 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 회사가 북미 저활성 방광 시장에 집중하는 것과만 관련이 있습니다.

시장에서 활동하는 주요 기업은 다음과 같습니다.

- 아스텔라스제약 주식회사

- 오로빈도 파마.

- 베링거인겔하임인터내셔널 GmbH

- 맥리오즈 제약 유한회사

- 오리온 주식회사

- 오노제약 주식회사

- 노바티스 AG

- 화이자 주식회사

- 주식회사 시플라

- 레디스 연구소 유한회사

- 테바제약산업주식회사

- 선제약산업주식회사

- 알미랄, SA

- 주식회사 베시플로

- 알켐랩스.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 북미 대 국가 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA UNDERACTIVE BLADDER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 EPIDEMIOLOGY

4.4 THE IMPORTANCE OF UNDERSTANDING PATENTS-

4.4.1 DOXAZOSIN

4.4.2 BETHANECHOL CHLORIDE

4.4.3 TAMSULOSIN HYDROCHLORIDE

4.5 CLINICAL TRIALS FOR UNDERACTIVE BLADDER

4.5.1 EU CLINICAL TRIALS REGISTER-

4.6 MERGER & ACQUISITION IN HEALTHCARE INDUSTRY

4.7 M&A DEALS IN 2021 BY TARGET COMPANY TERRITORY:

4.8 CROSS-BORDER DEALS:

4.9 OUTLOOK FOR 2022:

4.1 PATIENT ENROLMENT STRATEGIES

4.11 FACTORS AFFECTING PATIENT RECRUITMENT:

4.12 CHALLENGES:

4.13 PATIENT FUNNEL ANALYSIS:

4.14 RECOMMENDATIONS

4.14.1 USE OF TECHNOLOGY:

4.14.2 PARTICIPANT CHARACTERISTICS:

4.14.3 RECRUITER CHARACTERISTICS:

4.14.4 SYSTEMS & PROCEDURES:

4.14.5 LOCATION:

4.14.6 NATURE OF RESEARCH:

4.15 CONCLUSION:

4.16 UNDERACTIVE BLADDER PATIENT FLOW DIAGRAM

4.17 WHAT CAUSES UNDERACTIVE BLADDER?

4.17.1 CAUSES OF UNDERACTIVE BLADDER INCLUDE

4.17.2 TESTS TO EVALUATE UNDERACTIVE BLADDER

4.18 UNDERACTIVE BLADDER INVESTIGATIONAL PRODUCTS-

5 NORTH AMERICA UNDERACTIVE BLADDER MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF NEUROGENIC DISORDER

6.1.2 INCREASE IN RESEARCH AND DEVELOPMENT OF UNDERACTIVE BLADDER TREATMENT

6.1.3 FAVOURABLE REIMBURSEMENT SCENARIO

6.1.4 RISING HEALTHCARE EXPENDITURE

6.2 RESTRAINTS

6.2.1 HIGH COST OF RESEARCH AND DEVELOPMENT

6.2.2 STRINGENT GOVERNMENT REGULATIONS ON NEW PRODUCTS APPROVAL

6.3 OPPORTUNITIES

6.3.1 RISING UROLOGIC COMPLICATIONS OF DIABETES

6.3.2 PRESENCE OF NOVEL PIPELINE DRUGS

6.3.3 IMPROVING A BETTER HEALTHCARE SYSTEM

6.4 CHALLENGES

6.4.1 LACK OF PROPER TREATMENT

6.4.2 RISK INVOLVED DURING TREATMENT OF UNDERACTIVE BLADDER

7 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY TYPE

7.1 OVERVIEW

7.2 PHARMACOTHERAPY

7.2.1 ALPHA-BLOCKERS

7.2.2 MUSCARINIC AGONISTS

7.2.3 CHOLINESTERASE INHIBITOR

7.2.3.1 BY DRUGS

7.2.3.1.1 TAMSULOSIN

7.2.3.1.2 DOXAZOSIN

7.2.3.1.3 DISTIGMINE

7.2.3.1.4 BETHANECHOL

7.2.3.1.5 OTHERS

7.2.4 BY PRODUCT TYPES

7.2.4.1 GENERICS

7.2.4.2 BRANDED

7.2.4.2.1 FLOMAX

7.2.4.2.2 ALFADIL

7.2.4.2.3 GRAVITOR

7.2.4.2.4 URIVOID

7.2.4.2.5 OTHERS

7.3 SURGICAL METHODS

7.3.1 SURGICAL NERVE STIMULATION

7.3.2 REDUCTION CYSTOPLASTY

7.3.3 SURGERIES FOR BLADDER OBSTRUCTION

7.3.4 INJECTION INTO EXTERNAL SPHINCTER

7.3.5 OTHERS

7.4 URETHRAL ASSIS DEVICE

7.4.1 INFLOW INTRAURETHRAL VALVE PUMP

7.5 STEM CELL AND GENE THERAPIES

7.5.1 NERVE GROWTH FACTOR

7.5.2 GLIAL-CELL DERIVE NEUTOPHIC FACTORGLIAL

7.5.3 NEUTOPHIN-3 DERIVES FROM GLIALL CELLS

8 NORTH AMERICA UNDERACTIVE BLADDER MARKET,BY ROUTE OF ADMINISTRATION

8.1 OVERVIEW

8.2 PARENTERAL

8.3 ORAL

8.4 OTHERS

9 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY END USER

9.1 OVERVIEW

9.2 HOSPITALS

9.3 CLINICS

9.4 ACADEMIC AND RESEARCH

9.5 OTHERS

10 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 HOSPITAL PHARMACY

10.3 RETAIL PHARMACY

10.4 OTHERS

11 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA UNDERACTIVE BLADDER MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 PFIZER INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 SUN PHARMACEUTICAL INDUSTRIES LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 TEVA PHARMACEUTICAL INDUSTRIES LTD

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 NOVARTIS AG

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 DR. REDDY’S LABORATORIES LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 ASTELLAS PHARMA INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 ORION CORPORATION.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 ALKEM LABS.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 ALMIRALL, S.A

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 AUROBINDO PHARMA.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 CIPLA INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 GLENWOOD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MACLEODS PHARMACEUTICALS LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 ONO PHARMACEUTICAL CO., LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 VESIFLO, INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 TOTAL 40 DOXAZOSIN DRUGS WERE DISCONTINUED FROM THE MARKET

TABLE 2 TOTAL 38 DOXAZOSIN DRUGS ARE STILL IN THE MARKET

TABLE 3 TOTAL PRESCRIPTION AND DISCONTINUED DRUGS (DOXAZOSIN) BY COMPANY

TABLE 4 TOTAL 58 DRUGS DISCONTINUED

TABLE 5 TOTAL PRESCRIPTION AND DISCONTINUED DRUGS (BETHANECHOL CHLORIDE) BY COMPANY

TABLE 6 OUT OF 3,128 STUDIES ON BLADDER DISORDER, ONLY 22 STUDIES ARE ONGOING FOR THE UAB-

TABLE 7 THESE CLINICAL TRIALS ARE MOSTLY RECRUITING/ONGOING IN DIFFERENT REGIONS OF THE WORLD-

TABLE 8 TOP ACQUISITIONS OF 2021 RANKED BY TOTAL DEAL VALUE:

TABLE 9 FDA REQUIRES THE FOLLOWING SCENARIO BEFORE A DRUG IS APPROVED

TABLE 10 NORTH AMERICA UNDERACTIVE BLADDER MARKET, TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA STEM CELL AND GENE THERAPIES IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PARENTERAL IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ORAL IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY END USER, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA HOSPITALS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA CLINICS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ACADEMIC AND RESEARCH IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY DISTRIBUTION CHANNEL , 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA HOSPITAL PHARMACY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA RETAIL PHARMACY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 39 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 40 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 41 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 42 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 43 NORTH AMERICA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 44 NORTH AMERICA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 45 NORTH AMERICA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 46 NORTH AMERICA BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 47 NORTH AMERICA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 48 NORTH AMERICA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 49 NORTH AMERICA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 50 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 51 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 52 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 53 U.S. UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 55 U.S. PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 56 U.S. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 57 U.S. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 58 U.S. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 59 U.S. BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 60 U.S. BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 61 U.S. BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 62 U.S. BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 63 U.S. SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 64 U.S. URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 65 U.S. STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 66 U.S. UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 67 U.S. UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 68 U.S. UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 69 CANADA UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CANADA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 71 CANADA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 72 CANADA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 73 CANADA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 74 CANADA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 75 CANADA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 76 CANADA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 77 CANADA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 78 CANADA BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 79 CANADA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 80 CANADA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 81 CANADA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 82 CANADA UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 83 CANADA UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 84 CANADA UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 85 MEXICO UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 MEXICO PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 87 MEXICO PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 88 MEXICO BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 89 MEXICO BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 90 MEXICO BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 91 MEXICO BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 92 MEXICO BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 93 MEXICO BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 94 MEXICO BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 95 MEXICO SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 96 MEXICO URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 97 MEXICO STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 98 MEXICO UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 99 MEXICO UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 100 MEXICO UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA UNDERACTIVE BLADDER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA UNDERACTIVE BLADDER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA UNDERACTIVE BLADDER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA UNDERACTIVE BLADDER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA UNDERACTIVE BLADDER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA UNDERACTIVE BLADDER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA UNDERACTIVE BLADDER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA UNDERACTIVE BLADDER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA UNDERACTIVE BLADDER MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA UNDERACTIVE BLADDER MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF NEUROGENIC BLADDER INFECTIONS IS EXPECTED TO DRIVE THE NORTH AMERICA UNDERACTIVE BLADDER MARKET IN THE FORECAST PERIOD

FIGURE 12 TREATMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA UNDERACTIVE BLADDER MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA UNDERACTIVE BLADDER MARKET

FIGURE 14 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, 2021

FIGURE 15 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, 2021

FIGURE 19 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, 2021

FIGURE 23 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, LIFELINE CURVE

FIGURE 26 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 30 NORTH AMERICA UNDERACTIVE BLADDER MARKET: SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY TYPE (2022-2029)

FIGURE 35 NORTH AMERICA UNDERACTIVE BLADDER MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.