북미 건물 및 건설용 테스트, 검사 및 인증(TIC) 시장, 서비스 유형별( 테스트 , 검사 및 인증), 소싱 유형(사내 및 아웃소싱), 테스트 유형(구조 테스트, 엔지니어링 지원, 화재 안전 테스트, 실내 환경 테스트, 히트 펌프 테스트, 음향 테스트 및 풍하중 테스트), 응용 프로그램(인프라, 상업용 건물 및 주거용 건물), 국가(미국, 캐나다, 멕시코) 산업 동향 및 2028년까지의 예측

시장 분석 및 통찰력: 북미 건축 및 건설용 테스트, 검사 및 인증(TIC) 시장

시장 분석 및 통찰력: 북미 건축 및 건설용 테스트, 검사 및 인증(TIC) 시장

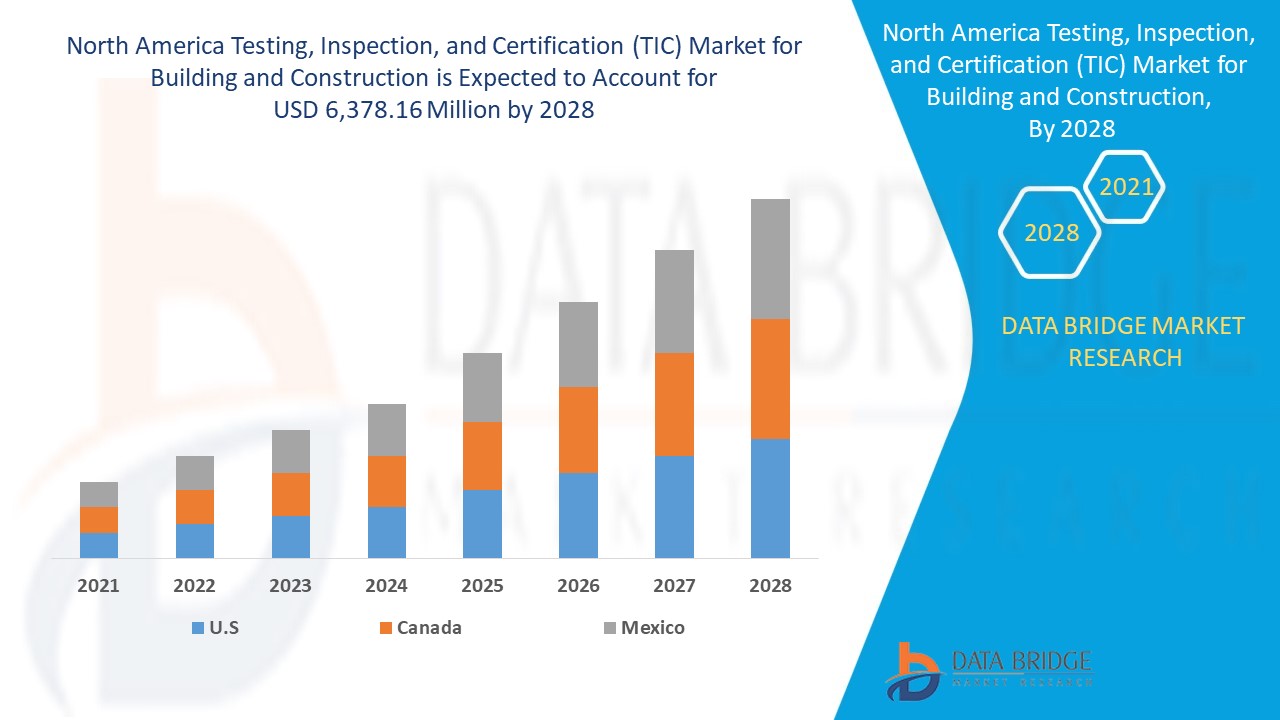

북미 건축 및 건설용 시험, 검사 및 인증(TIC) 시장은 2021년부터 2028년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2021년부터 2028년까지의 예측 기간 동안 5.2%의 CAGR로 성장하고 있으며 2028년까지 6,378.16백만 달러에 도달할 것으로 예상한다고 분석합니다.

시험, 검사 및 인증(TIC)은 감사 및 검사, 시험, 검증, 품질 보증 및 인증과 같은 다양한 서비스를 제공하는 적합성 평가 기관으로 구성됩니다. 건물 및 건설 부문에서는 음향 시험, 엔지니어링 지원, 화재 안전 시험, 히트 펌프 시험, 실내 환경 시험, 구조 시험 및 풍하중 시험을 포함한 다양한 유형의 TIC 서비스가 사용됩니다. 이러한 서비스는 제품의 내구성을 제공하는 데 도움이 됩니다.

건물 및 건설 산업에서 구조적 안전에 대한 수요가 증가함에 따라 건물 및 건설에 대한 테스트, 검사 및 인증(TIC)에 대한 수요가 증가하고 있습니다. 여러 건설업체와 계약자는 건설 프로젝트를 적시에 완료하는 데 도움이 되기 때문에 TIC를 선호합니다. 테스트 방법의 가격 변동이 지속적으로 시장을 제한할 수 있습니다. 녹색 및 지속 가능한 건설의 출현은 시장에서 TIC 서비스 제공업체에게 기회가 될 수 있습니다. 그러나 테스트 시설과 숙련된 리소스가 부족한 것이 시장의 과제가 될 수 있습니다.

이 건물 및 건설을 위한 테스트, 검사 및 인증(TIC) 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서의 기회 분석에 대한 세부 정보를 제공합니다. 분석 및 시장 시나리오를 이해하려면 분석가 브리핑을 위해 저희에게 연락하세요. 저희 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드릴 것입니다.

북미 건축 및 건설을 위한 시험, 검사 및 인증(TIC) 시장 범위 및 시장 규모

북미 건축 및 건설을 위한 시험, 검사 및 인증(TIC) 시장 범위 및 시장 규모

북미 건축 및 건설용 테스트, 검사 및 인증(TIC) 시장은 서비스 유형, 소싱 유형, 테스트 유형 및 애플리케이션으로 세분화됩니다. 세그먼트 간 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 애플리케이션 영역과 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

- 서비스 유형을 기준으로, 북미 건설 및 시공용 테스트, 검사 및 인증(TIC) 시장은 테스트, 검사 및 인증으로 세분화됩니다. 2021년에는 정부가 각 회사가 따라야 하는 다양한 엄격한 규정과 표준을 부과함에 따라 테스트 부문이 시장을 지배할 것으로 예상됩니다.

- 소싱 유형을 기준으로, 북미 건설용 테스트, 검사 및 인증(TIC) 시장은 사내 및 아웃소싱으로 세분화됩니다. 2021년에는 회사가 전 세계적으로 더 광범위한 입지를 확보하고 있기 때문에 사내 부문이 시장을 지배할 것으로 예상됩니다.

- 테스트 유형을 기준으로, 북미 건물 및 건설용 테스트, 검사 및 인증(TIC) 시장은 음향 테스트, 엔지니어링 지원, 방화 테스트, 히트펌프 테스트, 실내 환경 테스트, 구조 테스트, 풍하중 테스트로 세분화됩니다. 2021년에는 주거 및 상업용 건물 건설에 대한 수요가 증가함에 따라 구조 테스트 부문이 시장을 지배할 것으로 예상됩니다.

- 응용 프로그램을 기준으로, 북미 건물 및 건설용 테스트, 검사 및 인증(TIC) 시장은 주거용 건물, 상업용 건물 및 인프라로 세분화됩니다. 2021년에는 전 세계적으로 인프라 프로젝트가 성장함에 따라 인프라 부문이 시장을 지배할 것으로 예상됩니다.

북미 건축 및 건설을 위한 시험, 검사 및 인증(TIC) 시장 국가 수준 분석

북미 건축 및 건설용 테스트, 검사 및 인증(TIC) 시장이 분석되고 시장 규모 정보가 국가, 서비스 유형, 소싱 유형, 테스트 유형 및 애플리케이션별로 제공됩니다. 북미에서는 코드 품질 사용이 증가하고 모든 프로젝트의 비용이 감소함에 따라 미국이 우세할 것입니다.

건물 및 건설을 위한 북미 시험, 검사, 인증(TIC) 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

천연 케어 제품에 대한 수요 증가

건물 및 건설을 위한 테스트, 검사 및 인증(TIC) 시장은 또한 모든 국가에 대한 자세한 시장 분석을 제공합니다. 건물 및 건설을 위한 다양한 종류의 제품 설치 기반 성장, 수명선 곡선을 사용한 기술의 영향, 제품 요구 사항의 변화, 규제 시나리오 및 건물 및 건설을 위한 테스트, 검사 및 인증(TIC) 시장에 미치는 영향. 이 데이터는 2010년부터 2019년까지의 과거 기간에 대해 제공됩니다.

경쟁 환경 및 건물 및 건설을 위한 테스트, 검사 및 인증(TIC) 시장 점유율 분석

북미 건축 및 건설용 시험, 검사 및 인증(TIC) 시장 경쟁 환경은 경쟁자별 세부 정보를 제공합니다. 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 임상 시험 파이프라인, 브랜드 분석, 제품 승인, 특허, 제품 폭 및 호흡, 응용 프로그램 우세, 기술 수명선 곡선이 포함됩니다. 위에 제공된 데이터 포인트는 북미 건축 및 건설용 시험, 검사 및 인증(TIC) 시장과 관련된 회사의 초점에만 관련됩니다.

건물 및 건설을 위한 북미 시험, 검사, 인증(TIC) 시장에 참여하는 주요 시장 주체는 DEKRA eV, BRE, Applus+, MISTRAS Group, Eurofins Scientific, The British Standards Institution, TÜV Rheinland, Lloyd's Register Group Services Limited입니다.

예를 들어,

- 2021년 5월, Applus+ 회사는 유럽의 IMA 드레스덴 시험소를 인수했습니다. 이러한 인수를 통해 회사는 이 지역에서 강력한 잠재력을 갖게 되었습니다. 이러한 시험소는 회사의 수익 부문을 늘리는 데 도움이 됩니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 SOURCING TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND OF STRUCTURAL SAFETY IN BUILDING AND CONSTRUCTION INDUSTRY

5.1.2 GOVERNMENTS REGULATION AND MANDATE ENCOURAGING THE USE OF QUALITY MATERIALS

5.1.3 GROWING NEED OF TIMELY COMPLETION OF CONSTRUCTION PROJECTS

5.1.4 INCREASED UTILITY OF TIC FOR PROVIDING ACCREDITATION OF QUALITY

5.2 RESTRAINTS

5.2.1 LACK OF INTERNATIONALLY ACCEPTED TIC STANDARDS IN DEVELOPING ECONOMIES OF AFRICA AND MIDDLE EAST

5.2.2 CONSTANT VARIATION IN THE PRICES OF TESTING METHODS

5.2.3 HIGH COST OF TIC SERVICES PERTAINING TO WIDE-RANGING RULES AND REGULATIONS

5.3 OPPORTUNITIES

5.3.1 INCORPORATION OF ADVANCED TECHNOLOGIES SUCH AS ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.3.2 EMERGENCE OF GREEN & SUSTAINABLE CONSTRUCTION

5.4 CHALLENGES

5.4.1 LACK OF TESTING FACILITIES AND SKILLED RESOURCES

5.4.2 LIMITED ACCESS OF AFTERSALES

6 IMPACT OF COVID-19 ON THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION

6.3 STRATERGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE

7.1 OVERVIEW

7.2 TESTING

7.3 INSPECTION

7.4 CERTIFICATION

8 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE

8.1 OVERVIEW

8.2 IN-HOUSE

8.3 OUTSOURCED

9 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE

9.1 OVERVIEW

9.2 STRUCTURAL TESTING

9.3 ENGINEERING SUPPORT

9.4 FIRE SAFETY TESTING

9.5 INDOOR ENVIRONMENT TESTING

9.5.1 AIR QUALITY

9.5.2 VENTILATION

9.5.3 LIGHTING

9.5.4 THERMAL COMFORT

9.5.5 OTHERS

9.6 HEAT PUMP TESTING

9.7 ACOUSTICS TESTING

9.8 WIND LOAD TESTING

10 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION

10.1 OVERVIEW

10.2 INFRASTRUCTURAL

10.2.1 BY SERVICE TYPE

10.2.1.1 TESTING

10.2.1.2 INSPECTION

10.2.1.3 CERTIFICATION

10.3 COMMERCIAL BUILDINGS

10.3.1 BY APPLICATION

10.3.1.1 CORPORATE OFFICES

10.3.1.2 INDUSTRIAL BUILDINGS

10.3.1.3 SHOPPING CENTERS

10.3.1.4 MULTIPLEXES

10.3.1.5 SCHOOLS

10.3.1.6 COLLEGES & UNIVERSITIES

10.3.1.7 HOTELS & RESORTS

10.3.1.8 STADIUMS

10.3.1.9 RESTAURANTS & CAFES

10.3.1.10 OTHERS

10.3.2 BY SERVICE TYPE

10.3.2.1 TESTING

10.3.2.2 INSPECTION

10.3.2.3 CERTIFICATION

10.4 RESIDENTIAL BUILDINGS

10.4.1 BY SERVICE TYPE

10.4.1.1 TESTING

10.4.1.2 INSPECTION

10.4.1.3 CERTIFICATION

11 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION MARKET FOR BUILDING & CONSTRUCTION, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 MERGERS & ACQUISITIONS

12.3 EXPANSIONS

12.4 NEW PRODUCT DEVELOPMENTS

12.5 PARTNERSHIPS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 INTERTEK GROUP PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALISIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT UPDATES

14.2 ELEMENT MATERIALS TECHNOLOGY

14.2.1 COMPANY SNAPSHOT

14.2.2 SERVICE PORTFOLIO

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 RECENT UPDATE

14.3 BRE

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 SERVICE PORTFOLIO

14.3.4 RECENT UPDATES

14.4 LLOYD'S REGISTER GROUP SERVICES LIMITED

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 SERVICE PORTFOLIO

14.4.4 RECENT UPDATE

14.5 BUREAU VERITAS

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SERVICE PORTFOLIO

14.5.5 RECENT UPDATES

14.6 SGS SA

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICE PORTFOLIO

14.6.4 RECENT UPDATE

14.7 UL LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICE PORTFOLIO

14.7.3 RECENT UPDATES

14.8 TÜV SÜD

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 SERVICE PORTFOLIO

14.8.4 RECENT UPDATE

14.9 EUROFINS SCIENTIFIC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 SERVICE PORTFOLIO

14.9.4 RECENT UPDATES

14.1 APPLUS+

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 SERVICE PORTFOLIO

14.10.4 RECENT UPDATE

14.11 ICC NTA, LLC.

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICE PORTFOLIO

14.11.3 RECENT UPDATE

14.12 ALS LIMITED

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SERVICE PORTFOLIO

14.12.4 RECENT UPDATES

14.13 ANTYIPOUR2007 LLC

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATE

14.14 DEKRA E.V.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 SERVICE PORTFOLIO

14.14.4 RECENT UPDATES

14.15 DNV AS

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 SERVICE PORTFOLIO

14.15.4 RECENT UPDATE

14.16 MISTRAS GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 SERVICE PORTFOLIO

14.16.4 RECENT UPDATE

14.17 THE BRITISH STANDARDS INSTITUTION

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SERVICE PORTFOLIO

14.17.4 RECENT UPDATE

14.18 TÜRK LOYDU

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT UPDATE

14.19 TÜV NORD GROUP

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 SERVICE PORTFOLIO

14.19.4 RECENT UPDATE

14.2 TÜV RHEINLAND

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 SERVICE PORTFOLIO

14.20.4 RECENT UPDATE

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA INSPECTION IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA CERTIFICATION IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA IN-HOUSE IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA OUTSOURCED IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA STRUCTURAL TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA ENGINEERING SUPPORT IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA FIRE SAFETY TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA HEAT PUMP TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA ACOUSTICS TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA WIND LOAD TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 ( USD MILLION)

TABLE 33 NORTH AMERICA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 35 U.S. TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 36 U.S. TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE, 2019-2028 (USD MILLION)

TABLE 37 U.S. TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 38 U.S. INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 39 U.S. TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 40 U.S. INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 41 U.S. COMMERCIAL BUILDING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 ( USD MILLION)

TABLE 42 U.S. COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 43 U.S. RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 44 CANADA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 45 CANADA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE, 2019-2028 (USD MILLION)

TABLE 46 CANADA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 47 CANADA INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 48 CANADA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 49 CANADA INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 50 CANADA COMMERCIAL BUILDING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 ( USD MILLION)

TABLE 51 CANADA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 52 CANADA RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 53 MEXICO TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 54 MEXICO TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE, 2019-2028 (USD MILLION)

TABLE 55 MEXICO TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 56 MEXICO INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 57 MEXICO TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 58 MEXICO INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 59 MEXICO COMMERCIAL BUILDING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 ( USD MILLION)

TABLE 60 MEXICO COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 61 MEXICO RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : SEGMENTATION

FIGURE 2 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: THE SOURCING TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: SEGMENTATION

FIGURE 13 EUROPE IS EXPECTED TO DOMINATE THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 GROWING NEED FOR TIMELY COMPLETION OF CONSTRUCTION PROJECTS IS DRIVING THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 TESTING IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION MARKET IN 2021 & 2028

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION

FIGURE 17 U.S. TALENT SHORTAGES AT RECORD HIGH

FIGURE 18 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY SERVICE TYPE, 2020

FIGURE 19 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY SOURCING TYPE, 2020

FIGURE 20 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY TESTING TYPE, 2020

FIGURE 21 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY APPLICATION, 2020

FIGURE 22 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: SNAPSHOT (2020)

FIGURE 23 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY COUNTRY (2020)

FIGURE 24 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY COUNTRY (2021 & 2028)

FIGURE 25 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY COUNTRY (2020 & 2028)

FIGURE 26 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY SERVICE TYPE (2021-2028)

FIGURE 27 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION MARKET FOR BUILDING & CONSTRUCTION: COMPANY SHARE 2020 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.