북미 설탕 대체재 시장, 유형별(고과당 시럽, 고강도 감미료 , 저강도 감미료), 형태별(결정형, 액상, 분말형), 범주별(천연, 합성), 응용 분야별(음료, 식품, 구강 관리, 제약, 기타) - 2029년까지 산업 동향 및 전망

시장 분석 및 규모

비만, 당뇨병, 대사 증후군은 모두 칼로리 섭취 불균형과 연관되어 주요 공중 보건 문제로 대두되었습니다. 설탕 대체 식품은 위에서 언급한 질환들을 극복하기 위한 건강한 식단과 신체 활동 요법의 일환으로 칼로리를 줄이는 데 중요한 역할을 합니다.

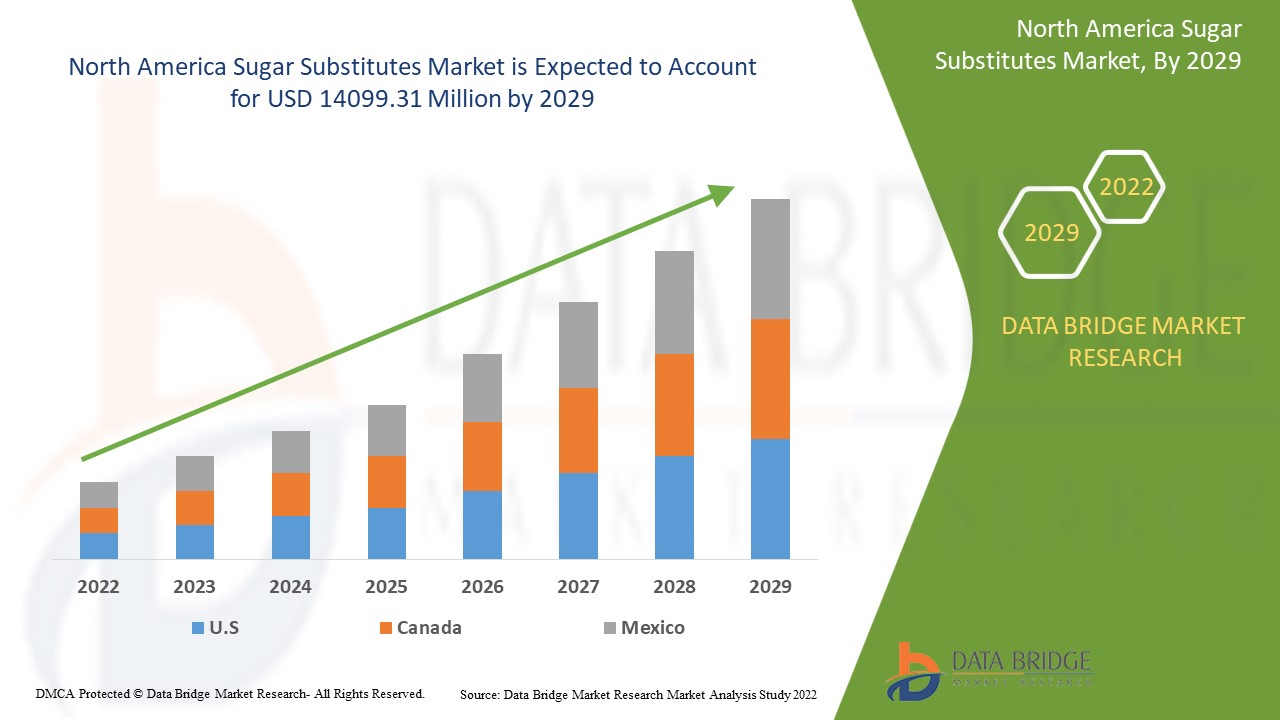

Data Bridge Market Research에 따르면 설탕 대체품 시장은 2021년에 76억 1,742만 달러 규모로 성장했으며, 2029년까지 1억 4,099만 3,100달러 규모로 성장할 것으로 예상됩니다. 2022년부터 2029년까지의 예측 기간 동안 연평균 성장률은 8.0%입니다.

시장 정의

설탕 대체물은 설탕과 비슷한 맛을 내지만 설탕 기반 감미료보다 칼로리가 훨씬 낮아 제로 칼로리 또는 저칼로리 감미료라고 할 수 있는 식품 첨가물입니다. 천연 물질에서 추출하거나 화학 물질과 방부제를 사용하여 인공적으로 제조합니다.

보고서 범위 및 시장 세분화

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적인 해 |

2020 (2019~2014년으로 맞춤 설정 가능) |

|

양적 단위 |

매출(백만 달러), 볼륨(단위), 가격(달러) |

|

다루는 세그먼트 |

유형(고과당 시럽, 고강도 감미료, 저강도 감미료), 형태(결정형, 액상, 분말형), 범주(천연, 합성), 응용 분야(음료, 식품, 구강 관리, 제약, 기타) |

|

포함 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

DuPont(미국), ADM(미국), Tate & Lyle(영국), Ingredion(미국), Cargill Incorporated(미국), Roquette Frères(프랑스), PureCircle Ltd(미국), MacAndrews & Forbes Incorporated(미국), JK Sucralose Inc.(중국), Ajinomoto Co. Inc.(일본), JK Sucralose Inc.(중국), Ajinomoto Co. Inc.(일본), NutraSweetM Co.(미국), Südzucker AG(독일), Layn Corp.(중국), Zhucheng Haotian Pharm Co., Ltd.(중국), HSWT(프랑스) |

|

기회 |

|

설탕 대체품 시장 동향

운전자

- 천연 설탕에 대한 선호도 증가

설탕 대체물은 청량음료나 탄산음료 , 향료 주스, 기타 식품 등 음료의 설탕 대체물로 널리 사용됩니다 . 미국에서는 소비자들의 선호도가 유기농 식품과 음료로 이동함에 따라 천연 설탕 대체물이 인기를 얻고 있습니다. 천연 설탕은 스테비아, 몽크푸르트 등의 식물에서 추출한 저칼로리 감미료로 설탕보다 200배 더 달콤합니다. 이러한 설탕 대체물의 장점과 유기농이라는 장점은 시장 성장에 기여했습니다.

다양한 최종 사용자 산업의 수요 증가

제약, 화장품, 식품, 에탄올 생산, 사료 등 다양한 최종 용도에서 설탕 대체재 사용이 증가함에 따라 시장 성장도 촉진되고 있습니다. 설탕 대체재는 개인 관리 및 화장품 세럼의 수분 유지제뿐만 아니라 시럽이나 주사제와 같은 의약품의 영양 보충제로도 활용될 수 있습니다. 탄탄한 R&D와 기술 전문성을 바탕으로 회사는 업계 선두를 달리고 있으며, 그 결과 결정 설탕 수요는 시간이 지남에 따라 증가했습니다.

기회

식품 가공 분야의 기술 혁신과 영양 스낵바 수요 증가는 시장 성장을 더욱 가속화할 것입니다. 설탕 대체재 제조업체들은 설탕 가격 변동으로 수혜를 볼 것으로 예상됩니다. 이러한 요인들로 인해 당뇨병 환자 수 증가 및 소비자 건강 의식 향상과 함께 시장이 확대되고 있습니다.

제약

그러나 많은 과학자들은 과도한 설탕 대체 식품 섭취가 제2형 당뇨병, 심장병, 비만, 그리고 경우에 따라 암과 같은 심각한 건강 문제를 유발할 수 있다고 생각합니다. 설탕 대체 식품의 공급 감소와 인공 감미료의 개발은 소비자의 인공 감미료 선호도를 변화시켜 시장 성장을 저해했습니다.

이 설탕 대체재 시장 보고서는 최근 동향, 무역 규제, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 현지 시장 참여자의 영향, 신규 매출 창출 기회 분석, 시장 규제 변화, 전략적 시장 성장 분석, 시장 규모, 카테고리별 시장 성장, 적용 분야별 틈새 시장 및 시장 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장 기술 혁신 등에 대한 자세한 정보를 제공합니다. 설탕 대체재 시장에 대한 자세한 정보를 원하시면 Data Bridge Market Research에 문의해 주세요. 분석 브리핑을 통해 시장 성장을 위한 정보에 기반한 결정을 내릴 수 있도록 도와드리겠습니다.

설탕 대체재 시장에 대한 COVID-19의 영향

북미에서 발생한 코로나19 팬데믹은 북미 경제의 주요 장애물이 되고 있으며, 식음료 산업 성장에도 영향을 미치고 있습니다. 식품 제조업체들은 주요 식품 생산을 줄였습니다. 더 나아가, 사람들이 전반적인 건강과 웰빙을 개선하기 위한 해결책을 모색함에 따라, 코로나19 팬데믹으로 인해 설탕 함량이 낮고 면역력을 강화하는 제품에 대한 수요가 급증했습니다. 건강을 중시하는 대부분의 소비자들은 저칼로리 또는 무설탕 식품을 선호하게 되었습니다. 북미 인구의 건강 의식 향상과 저당 솔루션에 대한 수요 증가로 제조업체와 제품 생산자들은 설탕 대체재를 사용해야 했습니다.

최근 개발

- Tate & Lyle은 2020년 7월에 VANTAGE 감미료 솔루션 설계 도구를 출시할 예정입니다. 이는 저칼로리 감미료를 사용하여 설탕을 줄인 음식과 음료를 만들기 위한 새롭고 혁신적인 감미료 솔루션 설계 도구와 교육 프로그램을 모아놓은 것입니다.

북미 설탕 대체재 시장 범위

설탕 대체재 시장은 유형, 형태, 범주 및 용도를 기준으로 세분화됩니다. 이러한 세그먼트의 성장은 업계 내 저조한 성장 세그먼트를 분석하고, 사용자에게 핵심 시장 용도를 파악하기 위한 전략적 의사 결정에 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공합니다.

유형

- 고강도 감미료

- 저강도 감미료

- 고과당 시럽

시장은 유형을 기준으로 고강도 감미료, 저강도 감미료, 고과당 시럽으로 구분됩니다.

형태

- 가루

- 결정화된

- 액체.

시장은 형태에 따라 분말, 결정형, 액상으로 구분됩니다.

범주

- 자연스러운

- 인조

시장은 범주별로 천연과 합성으로 구분됩니다.

애플리케이션

- 식품

- 구강 관리

- 제약품

- 음료수

시장은 응용 분야를 기준으로 음료, 식품, 구강 관리, 의약품 및 기타로 세분화됩니다.

설탕 대체품 시장 지역 분석/통찰력

설탕 대체품 시장을 분석하고, 위에 언급된 대로 국가, 유형, 형태, 범주 및 응용 분야별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

설탕 대체품 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

북미 설탕 대체재 시장에서 북미와 유럽은 주요 시장 참여자들의 존재, 상당한 R&D 투자, 기술적으로 진보된 생산 방식, 그리고 풍부한 원료 공급 덕분에 시장 점유율의 대부분을 차지했습니다. 천연 설탕을 활용한 의약품 개발은 시장 성장에 가장 유망한 것으로 입증되었습니다.

보고서의 국가별 섹션은 현재 및 미래 시장 동향에 영향을 미치는 개별 시장 영향 요인과 시장 규제 변화도 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 동향, 포터의 5대 경쟁 요인 분석, 사례 연구 등의 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 활용됩니다. 또한, 북미 브랜드의 존재 및 가용성, 그리고 국내 및 국내 브랜드와의 경쟁이 심화되거나 부족하여 직면하는 과제, 국내 관세 및 무역 경로의 영향 등을 고려하여 국가별 데이터를 예측 분석합니다.

경쟁 환경 및 설탕 대체재 시장 점유율 분석

설탕 대체재 시장 경쟁 구도는 경쟁사별 세부 정보를 제공합니다. 여기에는 회사 개요, 회사 재무 상태, 매출 창출액, 시장 잠재력, 연구 개발 투자, 신규 시장 진출, 북미 지역 사업 현황, 생산 시설 및 설비, 생산 능력, 회사의 강점과 약점, 제품 출시, 제품 종류 및 범위, 응용 분야별 지배력 등이 포함됩니다. 위에 제시된 데이터는 설탕 대체재 시장과 관련된 해당 회사의 주요 관심 분야와 관련된 정보입니다.

설탕 대체품 시장에서 활동하는 주요 기업은 다음과 같습니다.

- 듀폰(미국)

- ADM(미국)

- 테이트 앤 라일(영국)

- 인그리디언(미국)

- 카길 주식회사(미국)

- 로케트 프레르(프랑스)

- 퓨어서클 주식회사(미국)

- 맥앤드류스 & 포브스 주식회사(미국)

- JK 수크랄로스 주식회사(중국)

- 아지노모토 주식회사(일본)

- JK 수크랄로스 주식회사(중국)

- 아지노모토 주식회사(일본)

- NutraSweetM Co. (미국)

- Südzucker AG(독일)

- Layn Corp. (중국)

- 주청하오톈약품유한공사(중국)

- HSWT(프랑스)

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SUGAR SUBSTITUTES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.1.1 GROWING NUMBER OF OBESITY & DIABETIC POPULATION

3.1.2 RISING TREND OF HEALTHY LIFESTYLE AND HEALTHY PRODUCTS

3.1.3 INCREASED USAGE OF SUGAR SUBSTITUTES IN FOOD & BAKERY PRODUCTS

3.1.4 INCREASING DEMAND FOR NATURAL SWEETENERS/PLANT SOURCED SWEETENERS

3.1.5 FLUCTUATING PRICES OF SUGAR AND INCREASED TAXATION ON SUGAR PRODUCTS

3.2 RESTRAINTS

3.2.1 STRINGENT REGULATIONS AND POLICIES FOR SUGAR SUBSTITUTE

3.2.2 SIDE EFFECTS OF THE SUGAR SUBSTITUTE

3.3 OPPORTUNITIES

3.3.1 GROWING CONSUMPRION OF HEALTHY AND NUTRITIONAL DRINKS HAVING SUGAR SUBSTITUTES

3.3.2 INCREASING AWARENESS OF SUGAR SUBSTITUTE IN DEVELOPING NATIONS

3.3.3 STRONG INITIATIVES AND STUDIES FOR THE PRODUCT DEVELOPMENT

3.3.4 NEW SUGAR LABELING RULES

3.4 CHALLENGES

3.4.1 MORE EFFORTS TOWARDS TASTE IMPROVEMENT

3.4.2 VAGUENESS ABOUT SUGAR SUBSTITUTE BENEFITS

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PARENT MARKET ANALYSIS

5.2 EXPECTED GROWTH OF SWEETENERS USAGE FOR NEXT 3 YEARS

6 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE

6.1 OVERVIEW

6.2 HIGH-FRUCTOSE SYRUPS

6.3 HIGH-INTENSITY SWEETENERS

6.3.1 ASPARTAME

6.3.2 CYCLAMATE

6.3.3 ACE-K

6.3.4 SACCHARINE

6.3.5 STEVIA

6.3.6 SUCROLOSE

6.3.7 HONEY

6.3.8 GLYCYRRHIZIN

6.3.9 ALITAME

6.3.10 NEOTAME

6.3.11 OTHERS

6.4 LOW-INTENSITY SWEETENERS

6.4.1 ERYTHRITOL

6.4.2 MALTITOL

6.4.3 SORBITOL

6.4.4 XYLITOL

6.4.5 ISOMALT

6.4.6 HYDROGENATED STARCH HYDROYSATES

6.4.7 MANNITOL

6.4.8 LACITOL

6.4.9 D-TAGATOSE

6.4.10 TREHALOSE

6.4.11 OTHERS

7 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM

7.1 OVERVIEW

7.2 CRYSTALLIZED

7.3 LIQUID

7.4 POWDER

8 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BEVERAGES

8.2.1 CARBONATED SOFT DRINKS

8.2.2 FLAVORED DRINKS

8.2.3 POWDERED BEVERAGES

8.2.3.1 RTD COFFEE

8.2.3.2 RTD TEA

8.2.3.3 SMOOTHIES

8.2.3.4 OTHERS

8.2.4 JUICES

8.2.5 DAIRY ALTERNATIVE DRINKS

8.2.6 FUNCTIONAL DRINKS

8.2.7 OTHERS

8.3 FOOD PRODUCTS

8.3.1 DAIRY PRODUCTS

8.3.1.1 ICE CREAM

8.3.1.2 TOPPINGS

8.3.1.3 YOGURTS

8.3.1.4 PUDDING

8.3.1.5 OTHERS

8.3.2 BAKERY PRODUCTS

8.3.2.1 COOKIES & BISCUITS

8.3.2.2 CAKE & PASTRIES

8.3.2.3 MUFFINS & DONUTS

8.3.2.4 BREADS & ROLLS

8.3.2.5 OTHERS

8.3.3 CONFECTIONERY

8.3.3.1 CHOCOLATE

8.3.3.2 GUMMIES & MARSHMALLOWS

8.3.3.3 HARD CANDIES

8.3.3.4 OTHERS

8.3.4 TABLE-TOP SWEETENER

8.3.5 NUTRITIONAL BARS

8.3.6 BREAKFAST CEREALS

8.3.7 OTHERS

8.4 ORAL CARE

8.4.1.1 TOOTHPASTE

8.4.1.2 ORAL RINSES

8.4.1.3 OTHERS

8.5 PHARMACEUTICALS

8.5.1.1 SYRUPS

8.5.1.2 GRANULATED POWDERS

8.5.1.3 TABLETS

8.5.1.4 OTHERS

8.6 OTHERS

9 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 NATURAL

9.3 SYNTHETIC

10 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY GEOGRAPHY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA SUGAR SUBSTITUTES MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT & DBMR ANALYSIS

12.1 DATA BRIDGE MARKET RESEARCH ANALYSIS

13 COMPANY PROFILES

13.1 ADM

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 CARGILL, INCORPORATED.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 INGREDION INCORPORATED

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 TATE & LYLE

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 AJINOMOTO HEALTH & NUTRITION NORTH AMERICA, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALSIANO

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BENEO (A SUBSIDIARY OF SÜDZUCKER AG)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 DUPONT.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 FOODCHEM INTERNATIONAL CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 HYET SWEET

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 JK SUCRALOSE INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 MAFCO WORLDWIDE LLC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 MATSUTANI CHEMICAL INDUSTRY CO., LTD.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MITSUI SUGAR CO.,LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 NUTRASWEET CO.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PURECIRCLE

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENEUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 PYURE BRANDS LLC

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 ROQUETTE FRÈRES

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 STARTINGLINE S.P.A.

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 ZUCHEM INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 2 NORTH AMERICA HIGH-FRUCTOSE SYRUPS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 7 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 8 NORTH AMERICA CRYSTALLIZED FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA LIQUID FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA POWDER FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA BEVERAGES APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 15 NORTH AMERICA FOOD PRODUCTS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 18 NORTH AMERICA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA ORAL CARE APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA PHARMACEUTICALS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA NATURAL CATGORY IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICA SYNTHETIC CATEGORY IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 34 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 35 NORTH AMERICA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 36 NORTH AMERICA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 37 NORTH AMERICA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 38 NORTH AMERICA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 41 NORTH AMERICA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 NORTH AMERICA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 43 U.S. SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 44 U.S. HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 45 U.S. LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 46 U.S. SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 47 U.S. SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 48 U.S. SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 49 U.S. BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 50 U.S. POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 51 U.S. FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 52 U.S. BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 53 U.S. CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 54 U.S. DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 55 U.S. ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 56 U.S. PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 57 CANADA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 58 CANADA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 59 CANADA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 60 CANADA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 61 CANADA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 62 CANADA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 63 CANADA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 64 CANADA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 65 CANADA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 66 CANADA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 67 CANADA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 68 CANADA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 69 CANADA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 70 CANADA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 71 MEXICO SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 MEXICO HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 73 MEXICO LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 74 MEXICO SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 75 MEXICO SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 76 MEXICO SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 77 MEXICO BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 78 MEXICO POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 79 MEXICO FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 80 MEXICO BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 81 MEXICO CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 82 MEXICO DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 83 MEXICO ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 84 MEXICO PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SUGAR SUBSTITUTES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SUGAR SUBSTITUTES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SUGAR SUBSTITUTES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SUGAR SUBSTITUTES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SUGAR SUBSTITUTES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA SUGAR SUBSTITUTES MARKET

FIGURE 11 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SEGMENTATION

FIGURE 12 GROWING NUMBER OF OBESITY & DIABETIC POPULATION AND RISING TREND OF HEALTHY LIFESTYLE AND HEALTHY PRODUCTS ARE EXPECTED TO DRIVE THE NORTH AMERICA SUGAR SUBSTITUTES MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 HIGH-FRUCTOSE SYRUPS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA SUGAR SUBSTITUTES MARKET IN 2020 & 2027

FIGURE 14 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY TYPE, 2019

FIGURE 15 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY FORM, 2019

FIGURE 16 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY APPLICATION, 2019

FIGURE 17 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY CATEGORY, 2019

FIGURE 18 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SNAPSHOT (2019)

FIGURE 19 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2019)

FIGURE 20 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2020 & 2027)

FIGURE 21 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2019 & 2027)

FIGURE 22 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY TYPE (2020-2027)

FIGURE 23 NORTH AMERICA SUGAR SUBSTITUTES MARKET: COMPANY SHARE 2019 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.