North America Rigid Thermoform Plastic Packaging Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

207.80 million

USD

290.53 million

2022

2030

USD

207.80 million

USD

290.53 million

2022

2030

| 2023 –2030 | |

| USD 207.80 million | |

| USD 290.53 million | |

|

|

|

북미 강성 열성형 플라스틱 포장 시장, 제품별(폴리메틸 메타크릴레이트(PMMA), 생분해성 폴리머, 폴리에틸렌, 아크릴로니트릴 부타디엔 스티렌(ABS), 폴리염화비닐(PVC), 고충격 폴리스티렌, 폴리스티렌, 폴리프로필렌(PP)), 포장 제품(병 및 항아리, 트레이, 통, 컵, 기타), 공정(플러그 어시스트 성형, 두꺼운 게이지 열성형, 얇은 게이지 열성형, 진공 스냅백), 제조 공정(압출, 사출 성형, 기타), 응용 분야(식품 및 음료, 개인 관리, 의료 및 건강 관리, 전기 및 전자, 자동차, 건설, 소비재 및 가전 제품, 기타), 최종 사용자(식품 및 음료, 개인 관리, 가정, 건강 관리, 기타) - 산업 동향 및 2030년까지의 예측.

북미 강성 열성형 플라스틱 포장 시장 분석 및 규모

경질 플라스틱 포장의 주요 트렌드 중 하나는 포장에 섬유 기반 소재를 사용하는 것입니다. 농업, 의학, 개인 관리 및 제약 외에도 경질 플라스틱 포장 솔루션은 다양한 산업 분야에서 사용됩니다. 압출, 사출 성형, 블로우 성형, 열 성형 및 기타 기술을 사용하여 이러한 포장 구성 요소를 만듭니다. 반면 플라스틱 병은 매력적인 품질, 저렴한 가격, 가벼움, 생산 용이성 및 내충격성으로 인해 유리 병의 매력적인 대체품이 되었습니다.

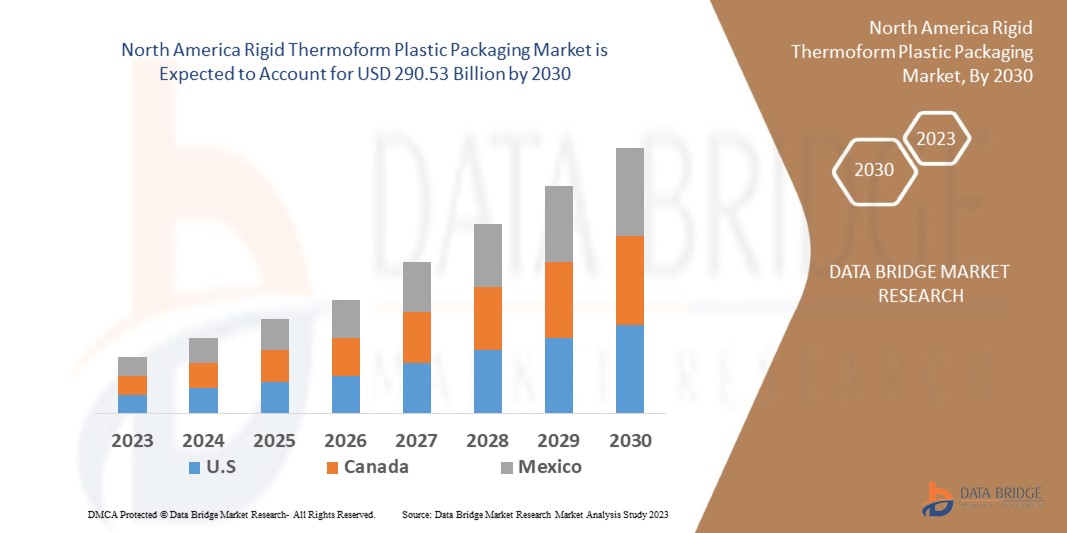

Data Bridge Market Research는 경질 열성형 플라스틱 포장 시장이 2030년까지 2,905억 3,000만 달러에 도달할 것으로 예상하고, 2022년에는 2,078억 달러였으며, 2023년에서 2030년까지의 예측 기간 동안 4.82%의 CAGR을 기록할 것으로 분석했습니다. 시장 가치, 성장률, 세분화, 지리적 범위, 주요 업체와 같은 시장 시나리오에 대한 통찰력 외에도 Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 심층적인 전문가 분석, 지리적으로 표현된 회사별 생산 및 용량, 유통업체 및 파트너의 네트워크 레이아웃, 자세하고 업데이트된 가격 추세 분석, 공급망 및 수요의 적자 분석이 포함됩니다.

북미 강성 열성형 플라스틱 포장 시장 범위 및 세분화

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적 연도 |

2021 (2015-2020까지 사용자 정의 가능) |

|

양적 단위 |

매출은 10억 달러, 볼륨은 단위, 가격은 10억 달러 |

|

다루는 세그먼트 |

제품(폴리메틸 메타크릴레이트(PMMA), 생분해성 폴리머, 폴리에틸렌, 아크릴로니트릴 부타디엔 스티렌(ABS), 폴리염화비닐(PVC), 고충격 폴리스티렌, 폴리스티렌, 폴리프로필렌(PP)), 포장 제품(병 및 항아리, 트레이, 통, 컵, 기타), 공정(플러그 어시스트 성형, 두꺼운 게이지 열성형, 얇은 게이지 열성형, 진공 스냅백), 제조 공정(압출, 사출 성형, 기타), 응용 분야(식품 및 음료, 개인 관리, 의료 및 건강 관리, 전기 및 전자, 자동차, 건설, 소비재 및 가전 제품, 기타), 최종 사용자(식품 및 음료, 개인 관리, 가정, 건강 관리, 기타) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

ALPLA(오스트리아), Amcor plc(호주), DS Smith(영국), Klöckner Pentaplast(독일), Berry Global Inc.(미국), Pactiv Evergreen Inc.(미국), Sonoco Products Company(미국) |

|

시장 기회 |

|

시장 정의

열성형 플라스틱은 플라스틱 시트를 유연해질 때까지 가열하고, 특정 모양으로 성형하고, 포장용 제품을 만들기 위해 다듬는 제조 공정입니다. 플라스틱 클램셸 트레이, 블리스터, 뚜껑 필름을 포함한 많은 유형의 포장은 얇은 게이지 열성형을 사용하여 만들어집니다.

폴리프로필렌(pp), 고밀도 폴리에틸렌(HDPE), 폴리에틸렌(pet)과 같은 플라스틱 소재는 새로운 병과 용기를 포장하기 위한 단단한 플라스틱 포장에 사용됩니다. 이러한 소재는 튼튼하고 가볍습니다. 폴리에틸렌 및 폴리프로필렌 포장 솔루션은 식품 및 음료, 농업, 항공우주, 자동차, 의료를 포함한 다양한 산업에서 사용됩니다.

북미 강성 열성형 플라스틱 포장 시장 동향

운전자

• 재활용은 폐기물과 쓰레기를 줄이는 데 도움이 됩니다.

전 세계적으로 포장재의 재사용 및 재활용에 대한 관심이 많았습니다. 재활용은 쓰레기를 다시 사용할 수 있는 제품으로 전환하는 것입니다. HDPE와 PET로 만든 우유병은 자주 재활용됩니다. 단단한 플라스틱 포장재를 재활용하면 원자재의 필요성이 줄어들어 대기 및 수질 오염이 감소하고 온실 가스 배출이 줄어듭니다. 재활용된 재료를 사용하면 CO2 배출도 제어할 수 있습니다. 단단한 플라스틱 포장재는 상당한 재활용률을 보였습니다. 많은 정부와 기업 이해 관계자가 재활용을 통해 플라스틱 폐기물을 줄이기 위한 계획을 수립했습니다.

• 의료 분야 수요 증가

강도, 청결성, 투명성, 가볍고 단단한 플라스틱 포장은 약물을 오염으로부터 보호합니다. 바늘, 정제, 시럽, 수술 장비 및 기타 품목과 같은 의료 용품을 보관하는 데 이상적입니다. 예측에 따르면, 의료 산업이 확장됨에 따라 단단한 플라스틱 포장에 대한 수요는 전 세계적으로 증가할 것입니다.

기회

- 개인 관리 및 화장품 분야에서 경질 플라스틱 포장에 대한 수요 증가

선케어, 스킨케어, 구강케어, 바디케어, 장식용 및 헤어케어 제품의 제품 포장에는 화장품 및 개인 관리 산업에서 경질 플라스틱 포장을 사용합니다. 이를 통해 제품에 마찰 없는 보관과 더 긴 유통기한이 제공됩니다. 화장품 및 개인 관리 시장이 국가에서 빠르게 부상함에 따라 경질 플라스틱 포장에 대한 수요도 증가하고 있습니다.

- 폴리스티렌 응용 분야 확대로 성장이 촉진될 것으로 예상

단단하고 경질의 폴리스티렌은 텔레비전과 컴퓨터 케이스에 사용됩니다. 폴리스티렌은 적절한 유형의 마감과 모양을 제공하기 때문에 다른 장비에도 사용됩니다. 폴리스티렌은 식품 포장에 널리 사용됩니다. 식품의 청결과 신선도를 증진시킵니다. 폴리스티렌은 사용 비용이 저렴하고 투명하기 때문에 소매업에서 중요한 외관 면에서 우수합니다. 범용 폴리스티렌(GPPS)과 고충격 폴리스티렌(HIPS)은 모두 사출 성형에 적합합니다. 따라서 폴리스티렌의 확장되는 응용 분야가 성장을 촉진하고 있습니다.

- 열성형의 이점으로 인해 경질 플라스틱 포장에 대한 수요가 증가할 것으로 예상됩니다.

열성형은 플라스틱 시트를 금형 위에 부드럽게 한 다음 식혀 다양한 소비재를 만드는 데 사용되는 플라스틱 성형 기술입니다. 적절한 기계를 사용하면 열성형을 통해 시간당 수백 개의 플라스틱 부품을 생산할 수 있으므로 플라스틱 부품을 생산하는 데 이상적인 성형 기술입니다. 얇은 게이지 플라스틱 부품을 만드는 데 사용되는 얇은 플라스틱 시트는 열성형 필름이라고 합니다. 열성형의 장점으로는 비용 절감, 다재다능성 향상, 빠른 처리 속도, 폐기물 감소가 있습니다. 소매, 의료, 식품 및 음료, 기타 산업의 제품용 플라스틱 포장은 얇은 게이지 열성형을 사용하여 만들어집니다. 이러한 열성형의 장점은 예측 기간 동안 시장 성장을 촉진하고 있습니다.

제약/도전

- 포장이 환경에 미치는 영향으로 인해 성장이 저해되고 있습니다.

고밀도 폴리에틸렌(HDPE), 발포 폴리스티렌(EPS), 폴리에틸렌 테레프탈레이트(PET), 폴리염화비닐은 포장 산업(PVC)에서 사용되는 폴리머입니다. 많은 산업에서 산업 장비, 식품, 의료용품과 같은 포장된 상품을 보존하고 보관하기 위해 단단한 플라스틱 포장을 사용합니다. 이러한 폴리머가 제기하는 주요 문제는 플라스틱 폐기물을 재활용, 재사용 및 분류하는 데 어려움이 있다는 것입니다. 플라스틱 포장재는 매립지에서 최대 1,000년 동안 분해되어 공기, 토양, 물을 오염시킬 수 있습니다. 또한 실온에서 열가소성 플라스틱은 직사광선에 노출되면 부드러워지고 기계적 강도를 잃습니다. 결과적으로 단단한 플라스틱 포장의 부정적인 환경적 영향은 시장 성장을 제한할 것입니다.

이 경질 열성형 플라스틱 포장 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 경질 열성형 플라스틱 포장 시장에 대한 자세한 정보를 얻으려면 분석가 브리핑을 위해 데이터 브리지 시장 조사에 문의하십시오. 당사 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드립니다.

원자재 부족 및 운송 지연의 영향 및 현재 시장 시나리오

Data Bridge Market Research는 시장에 대한 고수준 분석을 제공하고 원자재 부족과 운송 지연의 영향과 현재 시장 환경을 고려하여 정보를 제공합니다. 이는 전략적 가능성을 평가하고, 효과적인 행동 계획을 수립하고, 기업이 중요한 결정을 내리는 데 도움을 주는 것으로 해석됩니다.

표준 보고서 외에도 예상 배송 지연 등의 조달 수준에 대한 심층 분석, 지역별 유통업체 매핑, 상품 분석, 생산 분석, 가격 매핑 추세, 소싱, 카테고리 성과 분석, 공급망 위험 관리 솔루션, 고급 벤치마킹 및 조달 및 전략적 지원을 위한 기타 서비스를 제공합니다.

경제 침체가 제품 가격 및 가용성에 미치는 영향 예상

경제 활동이 둔화되면 산업이 어려움을 겪기 시작합니다. 경기 침체가 제품의 가격 책정 및 접근성에 미치는 예상 효과는 DBMR에서 제공하는 시장 통찰력 보고서 및 인텔리전스 서비스에서 고려됩니다. 이를 통해 고객은 일반적으로 경쟁사보다 한 발 앞서 나가고, 매출과 수익을 예측하고, 손익 지출을 추정할 수 있습니다.

최근 개발 사항

- 2021년, Coexpan은 생산된 식품에만 적용되는 단일 소재 coexshield pet 또는 pp 트레이를 활용한 여러 가지 포장 솔루션을 출시하여 유통기한을 7일에서 12일로 연장한다고 주장했습니다. Coexpan의 혁신 및 기술 센터는 복잡한 중간 및 고차단성 라미네이트를 식품 접촉에 적합한 첨가제가 포함된 고차단성 단일 소재로 대체하는 것을 목표로 합니다. 이 책 시리즈의 목표는 지속 가능한 개발 목표를 통해 식품 낭비를 줄이는 것입니다.

북미 강성 열성형 플라스틱 포장 시장 범위

경질 열성형 플라스틱 포장 시장은 제품, 포장, 공정, 제조 공정, 응용 분야 및 최종 사용자를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 분야를 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품

- 폴리메틸메타크릴레이트(PMMA)

- 생분해성 폴리머

- 폴리에틸렌

- 아크릴로니트릴부타디엔스티렌(ABS)

- 폴리염화비닐(PVC)

- 고충격 폴리스티렌

- 폴리스티렌

- 폴리프로필렌(PP)

포장

- 병과 항아리

- 트레이

- 욕조

- 컵

- 기타

프로세스

- 플러그 어시스트 성형

- 두꺼운 게이지 열성형

- 얇은 게이지 열성형

- 진공 스냅백

제조 공정

- 압출

- 사출성형

- 기타

애플리케이션

- 음식과 음료

- 개인 관리

- 의료 및 건강 관리

- 전기 및 전자

- 자동차

- 건설

- 소비재 및 가전제품

- 기타

최종 사용자

- 음식과 음료

- 개인 관리

- 가정

- 헬스케어

- 기타

북미 강성 열성형 플라스틱 포장 시장 지역 분석/통찰력

북미 강성 열성형 플라스틱 포장 시장을 분석하고, 위에 언급된 대로 국가별, 제품별, 포장재, 공정, 제조 공정, 응용 분야 및 최종 사용자별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 강성 열성형 플라스틱 포장 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

미국은 제품 제조에 있어서 높은 혁신과 개발로 인해 북미의 강성 열성형 플라스틱 포장 시장을 장악하고 있으며, 강성 열성형 플라스틱 포장 시장에 대한 광범위한 고객 기반을 구축하고 있습니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 시장 가치, 성장률, 세분화, 지리적 범위 및 주요 업체와 같은 데이터 포인트, 데이터 브리지 시장 조사에서 큐레이팅한 시장 보고서에는 심층적인 전문가 분석, 지리적으로 표현된 회사별 생산 및 용량, 유통업체 및 파트너의 네트워크 레이아웃, 자세하고 업데이트된 가격 추세 분석 및 공급망 및 수요의 적자 분석도 포함됩니다.

경쟁 환경 및 북미 강성 열성형 플라스틱 포장 시장 점유율 분석

The rigid thermoform plastic packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to rigid thermoform plastic packaging market.

Some of the major players operating in the rigid thermoform plastic packaging market are:

- ALPLA (Austria)

- Amcor plc (Australia)

- DS Smith (U.K.)

- Klöckner Pentaplast (Germany)

- Berry Global Inc.(U.S.)

- Pactiv Evergreen Inc.(U.S.)

- Sonoco Products Company (U.S.)

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET

- LIMITATION

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- material type LIFE LINE CURVE

- MULTIVARIATE MODELING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- MARKET APPLICATION COVERAGE GRID

- DBMR MARKET CHALLENGE MATRIX

- vendor share analysis

- IMPORT-EXPORT DATA

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- Increasing use of thermoformed packaging for the transportation for medical supplies in global pandemiC

- increasing consumption rate for thermoform packaging in the growing e-commerce industry

- advanceD property of secure seals in the thermoform packaging

- Increasing demand FOR packaged food among the working population

- Restraints

- Issues in the sorting and recycling of thermoformed plastic waste

- Vulnerable nature of raw material and machinery pricing

- Opportunity

- Advancements in the thermoformed blister packaging in the pharmaceutical sector

- CHALLENGES

- high rates of complexity in shapes and designs of thermoformed packaging in the developing nations

- Stringent Rules and regulations on plastics ban

- IMPACT OF COVID-19 ON THE North America Rigid Thermoform Plastic Packaging Market

- ANALYSIS ON IMPACT OF COVID-19 ON RIGID THERMOFORM PLASTIC PACKAGING market

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE RIGID THERMOFORM PLASTIC PACKAGING

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- North America rigid thermoform plastic packaging market, BY Material TYPE

- overview

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polystyrene (PS)

- OTHERS

- North America rigid thermoform plastic packaging market, BY Distribution Channel

- overview

- online

- offline

- North America rigid thermoform plastic packaging market, BY Application

- overview

- Containers

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- homecare

- Others

- Trays & Lids

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- Blister Pack

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- Clamshells

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- OTHERS

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- North AMERICA rigid thermoform plastic packaging market, BY COUNTRY

- North America

- U.S.

- Canada

- Mexico

- NORTH AMERICA rigid thermoform plastic packaging Market: COMPANY landscape

- company share analysis: NORTH AMERICA

- MergerS & AcquisitionS

- EXPANSIONS

- new product developmentS

- SWOT

- company profiles

- WestRock Company

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Amcor plc

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Sonoco Products Company

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- WINPAK LTD.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- DS Smith

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- COEXPAN

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Huhtamaki

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Fabri-Kal

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- D&W Fine Pack

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- EasyPak

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Constantia Flexibles

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Display Pack

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Genpak, LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Pactiv LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Placon

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Sabert Corporation

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- questionnaire

- related reports

표 목록

TABLE 1 IMPORT DATA of Plates, sheets, film, foil and strip, of non-cellular plastics, not reinforced, laminated, supported or similarly combined with other materials, without backing, unworked or merely surface-worked or merely cut into squares or rectangles (excluding self-adhesive products, and floor, wall and ceiling coverings of heading (HS CODE- 3920) (USD Thousand)

TABLE 2 EXPORT data of Plates, sheets, film, foil and strip, of non-cellular plastics, not reinforced, laminated, supported or similarly combined with other materials, without backing, unworked or merely surface-worked or merely cut into squares or rectangles (excluding self-adhesive products, and floor, wall and ceiling coverings of heading (HS CODE- 3920) (USD Thousand)

TABLE 3 Thermoforming Machine Price (USD Dollar)

TABLE 4 Time taken for material to decompose in the environment (2015)

TABLE 5 demand brought on by Covid-19

TABLE 6 North America rigid thermoform plastic packaging market, BY material type, 2019-2028 (Million units)

TABLE 7 North America rigid thermoform plastic packaging market, BY material type, 2019-2028 (USD Million)

TABLE 8 North America rigid thermoform plastic packaging market, BY distribution Channel, 2019-2028 (USD Million)

TABLE 9 North America rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 10 North America containers in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 11 North America Trays & lids in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 12 North America Blister pack in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 13 North America Clamshells in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 14 North America others in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 15 North America rigid thermoform plastic packaging Market, By Country, 2019-2028 (million Units)

TABLE 16 North America rigid thermoform plastic packaging Market, By Country, 2019-2028 (USD Million)

TABLE 17 North America rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 18 North America rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 19 North America rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 20 North America rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 21 North America containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 22 North America Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 23 North America Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 24 North America Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 25 North America Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 26 U.S. rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 27 U.S. rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 28 U.S. rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 29 U.S. rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 30 U.S. containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 31 U.S. Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 32 U.S. Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 33 U.S. Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 34 U.S. Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 35 CANADA rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 36 CANADA rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 37 CANADA rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 38 CANADA rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 39 CANADA containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 40 CANADA Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 41 CANADA Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 42 CANADA Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 43 CANADA Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 44 MEXICO rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 45 MEXICO rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 46 MEXICO rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 47 MEXICO rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 48 MEXICO containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 49 MEXICO Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 50 MEXICO Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 51 MEXICO Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 52 MEXICO Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: segmentation

FIGURE 2 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: data triangulation

FIGURE 3 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: regionaL VS COUNTRY MARKET analysis

FIGURE 5 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: company research analysis

FIGURE 6 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: THE material type LIFE LINE CURVE

FIGURE 7 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 North America rigid thermoform plastic packaging Market: vendor share analysis

FIGURE 13 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 14 Increasing use of thermoformed packaging for the transportation for medical supplies in global pandemic IS DRIVING THE North America rigid thermoform plastic packaging market in the forecast period of 2021 to 2028

FIGURE 15 Polyethylene Terephthalate (PET) SEGMENT is expected to account for the largest share of the NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET in 2021 & 2028

FIGURE 16 DRIVERS, RESTRAINTs, OPPORTUNITy AND CHALLENGEs OF North America rigid thermoform plastic packaging MARKET

FIGURE 17 the U.S. Retail Sales via E-commerce in 2019 (USD million)

FIGURE 18 Revenue Earned By Couriers and Express delivery service In the U.S. (2012-2018) (USD million)

FIGURE 19 the U.S. internet Users (2011-2016)

FIGURE 20 North America rigid thermoform plastic packaging market: BY Material Type, 2020

FIGURE 21 North America rigid thermoform plastic packaging market: BY distribution Channel, 2020

FIGURE 22 North America rigid thermoform plastic packaging market: BY application, 2020

FIGURE 23 North America rigid thermoform plastic packaging MARKET: SNAPSHOT (2020)

FIGURE 24 North America rigid thermoform plastic packaging MARKET: by COUNTRY (2020)

FIGURE 25 North America rigid thermoform plastic packaging MARKET: by COUNTRY (2021 & 2028)

FIGURE 26 North America rigid thermoform plastic packaging MARKET: by COUNTRY (2020 & 2028)

FIGURE 27 North America rigid thermoform plastic packaging MARKET: by Material TYPE (2021-2028)

FIGURE 28 North America rigid thermoform plastic packaging Market: company share 2020 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.