North America Plastic Compounding Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

58.94 Billion

USD

85.13 Billion

2024

2032

USD

58.94 Billion

USD

85.13 Billion

2024

2032

| 2025 –2032 | |

| USD 58.94 Billion | |

| USD 85.13 Billion | |

|

|

|

|

تقسيم سوق مُركّبات البلاستيك في أمريكا الشمالية، حسب نوع البوليمر (البلاستيك الحراري، البلاستيك الصلب بالحرارة، البلاستيك الهندسي، البلاستيك الحيوي، وغيرها)، نوع الحشو (الحشو المعدني، التعزيزات، الإضافات، وغيرها)، عملية التصنيع (البثق، الضغط/الضغط، العجن/الخلط باستخدام آلة بانبري، التركيب بالقولبة بالحقن، وغيرها)، الخصائص (المقاومة، المتانة، المرونة، مقاومة الصدمات، الصلابة، وغيرها)، التطبيقات (الفضاء والدفاع، التغليف، الكهرباء والإلكترونيات، الطاقة والكهرباء، البناء والتشييد، السيارات، الأجهزة الطبية، الأثاث، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق مُركّبات البلاستيك في أمريكا الشمالية

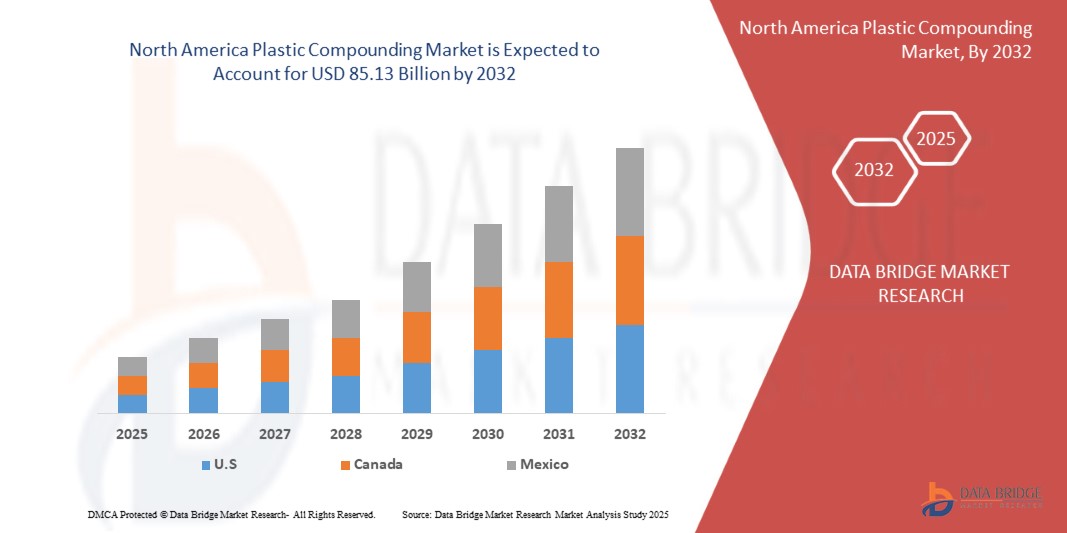

- تم تقييم حجم سوق مركبات البلاستيك في أمريكا الشمالية بـ 58.94 دولارًا أمريكيًا في عام 2024 ومن المتوقع أن يصل إلى 85.13 مليار دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 4.75٪ خلال الفترة المتوقعة من خلال التحول نحو مركبات بلاستيكية قابلة لإعادة التدوير والتحلل البيولوجي بسبب اللوائح البيئية والتقدم في تقنيات التركيب التي تعمل على تحسين أداء المنتج وكفاءة التكلفة والسياسات والمبادرات الحكومية الداعمة التي تروج لاستخدام البلاستيك في مختلف الصناعات.

- علاوة على ذلك، من المتوقع أن يشهد السوق استخدامًا متزايدًا للبلاستيك الحيوي والبدائل المركبة المستدامة، وزيادة في اعتماد المركبات الكهربائية التي تتطلب بوليمرات متقدمة، وزيادة الطلب على حلول البلاستيك القابلة لإعادة التدوير والدائرية.

تحليل سوق مُركّبات البلاستيك في أمريكا الشمالية

- الارتفاع العالمي في التحول نحو المركبات البلاستيكية القابلة لإعادة التدوير والقابلة للتحلل الحيوي بسبب اللوائح البيئية والتقدم في تقنيات التركيب التي تعمل على تحسين أداء المنتج وكفاءة التكلفة

- تشمل العوامل الرئيسية الارتفاع العالمي في التحول نحو المركبات البلاستيكية القابلة لإعادة التدوير والقابلة للتحلل الحيوي بسبب اللوائح البيئية، والتقدم في تقنيات التركيب التي تعمل على تحسين أداء المنتج وفعاليته من حيث التكلفة، والطلب المتزايد من قطاعات نقل الطاقة، وزيادة الاستثمارات في تحديث الشبكة والبنية التحتية عبر الحدود.

- تهيمن الولايات المتحدة على سوق المركبات البلاستيكية في أمريكا الشمالية، حيث تمتلك أكبر حصة من الإيرادات بنسبة 64.03% في عام 2024، مع تزايد الطلب على خصائص المواد المحسنة، وكفاءة التكلفة، وزيادة التبني في التطبيقات الصناعية المختلفة

- من المتوقع أن تكون الولايات المتحدة أسرع دولة نموًا في السوق خلال فترة التوقعات، مدفوعة بالطلب المتزايد على المواد خفيفة الوزن والمتينة عبر الصناعات والتركيز المتزايد على المركبات البلاستيكية القابلة لإعادة التدوير والمستدامة

- من المتوقع أن يهيمن قطاع اللدائن الحرارية على سوق مركبات البلاستيك في أمريكا الشمالية بحصة 61.36٪ في عام 2025، مدفوعًا بالطلب المتزايد على خصائص المواد المحسنة والفعالية من حيث التكلفة والاستخدام الصناعي الأوسع.

نطاق التقرير وتقسيم سوق مُركّبات البلاستيك في أمريكا الشمالية

|

صفات |

رؤى رئيسية حول سوق مُركّبات البلاستيك في أمريكا الشمالية |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أمريكا الشمالية

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم إعدادها بواسطة Data Bridge Market Research تشمل أيضًا تحليل الاستيراد والتصدير، ونظرة عامة على القدرة الإنتاجية، وتحليل استهلاك الإنتاج، وتحليل اتجاه الأسعار، وسيناريو تغير المناخ، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

اتجاهات سوق مُركّبات البلاستيك في أمريكا الشمالية

الطلب المتزايد على البلاستيك عالي الأداء

- يتزايد الطلب على المركبات البلاستيكية عالية الأداء بوتيرة متسارعة، مدفوعًا بتزايد التحضر والنشاط الصناعي والاستخدام المتزايد للسيارات الكهربائية والبنية التحتية الذكية. تُعالج المركبات البلاستيكية المتطورة هذه التحديات من خلال توفير متانة مُحسّنة وكفاءة طاقة مُحسّنة وأداء مُحسّن للمنتج.

- مع تركيز الدول على خفض انبعاثات الكربون وتعزيز استقرار الشبكة، يتزايد التوجه نحو تحديث البنية التحتية للطاقة باستخدام مركبات بلاستيكية مبتكرة. يُعد هذا التحول بالغ الأهمية لتلبية الطلب المتزايد على الكهرباء، مع دعم أنظمة نقل أكثر نظافة وكفاءة.

- تعمل شركات الصناعة الكبرى مثل Covestro و LyondellBasell و BASF على زيادة جهود البحث والتطوير بشكل كبير لتطوير مركبات بلاستيكية من الجيل التالي أكثر استدامة ومرونة وأداءً عاليًا، مما يدفع الابتكار ونمو السوق بشكل أكبر.

- تُسهم التطورات في تكنولوجيا مُركّبات البلاستيك، التي تتميز بتحسين الاستقرار الحراري والعزل الكهربائي والمتانة الميكانيكية، في نمو السوق. وتعمل شركات التصنيع الرائدة بنشاط على تطوير مُركّبات متخصصة لدعم التكامل واسع النطاق في مجال الطاقة المتجددة، وتعزيز البنية التحتية للطاقة عبر المناطق، مما يُعزز التوسع في سوق مُركّبات البلاستيك العالمية في أمريكا الشمالية.

ديناميكيات سوق مُركّبات البلاستيك في أمريكا الشمالية

سائق

التحول نحو المركبات البلاستيكية القابلة لإعادة التدوير والقابلة للتحلل الحيوي بسبب اللوائح البيئية

- إن الطلب العالمي المتزايد على المواد المستدامة - مدفوعًا بلوائح بيئية صارمة، ووعي متزايد لدى المستهلكين، وأهداف الشركات للاستدامة - يُلقي بضغط هائل على أساليب إنتاج البلاستيك التقليدية. ولمواجهة هذا التحدي، يُسرّع العديد من المصنّعين استثماراتهم في مركبات بلاستيكية قابلة لإعادة التدوير والتحلل الحيوي للحد من الأثر البيئي ودعم مبادرات الاقتصاد الدائري. تُسهم هذه التطورات في إيجاد حلول مواد أكثر مراعاةً للبيئة وكفاءةً واستعدادًا للمستقبل، على غرار كيفية تحسين التقنيات الموفرة للطاقة لاستخدام الموارد.

- على سبيل المثال، في عام ٢٠٢٤، أعلنت العديد من شركات الكيماويات الكبرى عن مشاريع واسعة النطاق تُركز على توسيع قدرات تصنيع مُركّبات البلاستيك القابلة للتحلل الحيوي، بهدف تلبية الطلب المتزايد من قطاعات التعبئة والتغليف والسيارات والسلع الاستهلاكية. تُركز هذه المبادرات على الحد من النفايات البلاستيكية، وتعزيز قابلية إعادة التدوير، والامتثال للأطر التنظيمية العالمية، مثل خطة عمل الاتحاد الأوروبي للاقتصاد الدائري.

- لا تُحدث هذه الاستثمارات تحولاً في تركيبات المواد فحسب، بل تُمكّن أيضاً من توسيع نطاق استخدام البلاستيك المستدام في مختلف الصناعات. وتستثمر شركات رائدة، مثل باسف وكوفيسترو وليونديل باسل، بكثافة في البحث والتطوير لتطوير الجيل التالي من المركبات البلاستيكية الحيوية والقابلة لإعادة التدوير، مما يضمن تحسين الأداء والامتثال البيئي.

- علاوةً على ذلك، يلعب الالتزام المستمر من جانب الحكومات والشركات الخاصة والهيئات التنظيمية دورًا محوريًا في تعزيز استخدام البلاستيك القابل لإعادة التدوير والتحلل الحيوي كعنصر أساسي في جهود الاستدامة العالمية. تُرسخ هذه المبادرات مكانة المركّبات البلاستيكية الصديقة للبيئة كعامل تمكين رئيسي للاقتصاد الدائري ومحرك نمو رئيسي في سوق مركّبات البلاستيك العالمية في أمريكا الشمالية.

ضبط النفس/التحدي

التقلبات في أسعار المواد الخام، وخاصة المواد الخام القائمة على البترول مثل البولي بروبيلين والبولي إيثيلين

- لا يزال تقلب أسعار المواد الخام، وخاصةً المواد الخام البترولية مثل البولي بروبيلين والبولي إيثيلين، يُشكّل عائقًا كبيرًا أمام سوق مُركّبات البلاستيك في أمريكا الشمالية. يؤثر تقلب الأسعار على تكاليف الإنتاج والربحية، مما يُولّد حالة من عدم اليقين لدى المُصنّعين والمستخدمين النهائيين على حدٍ سواء.

- علاوة على ذلك، فإن الاعتماد على أسواق النفط الخام يعرض صناعة المركبات للتوترات الجيوسياسية، وانقطاعات سلسلة التوريد، وتغيير السياسات التجارية، مما قد يؤدي إلى ارتفاع مفاجئ في الأسعار أو نقصها.

- على سبيل المثال، في أوائل عام 2025، تسببت تقلبات أسعار النفط الخام العالمية في اختلاف أسعار البولي بروبلين بنسبة تزيد عن 20٪ في غضون أشهر، مما أثر بشكل مباشر على تكاليف مدخلات مصنعي المركبات البلاستيكية وأجبرهم على إجراء تعديلات في استراتيجيات التسعير.

- بالإضافة إلى ذلك، فإن المواد الخام البديلة مثل المواد الخام القائمة على المواد الحيوية، على الرغم من كونها واعدة، إلا أنها محدودة حاليًا بسبب التكاليف المرتفعة وتحديات قابلية التوسع، مما يمنع التخفيف الكامل من تقلب أسعار البترول.

- يُشكّل عدم استقرار الأسعار هذا تحديًا للتخطيط والاستثمار طويل الأجل في قطاع مُركّبات البلاستيك، لا سيما بالنسبة للمُصنّعين الصغار والمناطق ذات المرونة المالية المحدودة. ورغم الجهود المبذولة لتنويع مصادر المواد الخام وتحسين مرونة سلسلة التوريد، لا يزال تقلب أسعار المواد الخام عائقًا رئيسيًا أمام النمو المستقر.

نطاق سوق مُركّبات البلاستيك في أمريكا الشمالية

يتم تقسيم السوق على أساس نوع البوليمر ونوع الحشو وعملية التصنيع وقابلية الاستخدام والخصائص والتطبيق.

- نوع البوليمر

بناءً على نوع البوليمر، يُقسّم السوق إلى بلاستيك حراري، وبلاستيك حراري التصلب، وبلاستيك هندسي، وبلاستيك حيوي، وغيرها. في عام 2025، من المتوقع أن يهيمن قطاع اللدائن الحرارية على السوق بحصة سوقية تبلغ 61.36%، بمعدل نمو سنوي مركب قدره 4.24% خلال الفترة المتوقعة من 2025 إلى 2032، مدفوعًا بالطلب المتزايد على المواد خفيفة الوزن والمتينة في مختلف القطاعات، والتركيز المتزايد على المركبات البلاستيكية القابلة لإعادة التدوير والمستدامة.

- نوع الحشو

بناءً على نوع الحشو، يُقسّم السوق إلى حشوات معدنية، ومعززات، وإضافات، وغيرها. في عام 2025، من المتوقع أن يهيمن قطاع الحشوات المعدنية على السوق بحصة سوقية تبلغ 47.86%، بمعدل نمو سنوي مركب قدره 5.56% خلال الفترة المتوقعة من 2025 إلى 2032، مدفوعًا بالطلب المتزايد على خصائص المواد المُحسّنة، وكفاءة التكلفة، والاعتماد المتزايد في مختلف التطبيقات الصناعية.

- عملية التصنيع

بناءً على عملية التصنيع، يُقسّم السوق إلى عمليات البثق، والضغط/الكبس، والعجن/الخلط، والتركيبات القائمة على حقن البلاستيك، وغيرها. في عام 2025، من المتوقع أن يهيمن قطاع البثق على السوق بحصة سوقية تبلغ 44.05%، بمعدل نمو سنوي مركب قدره 5.12% خلال الفترة المتوقعة من 2025 إلى 2032، مدفوعًا باعتماده الواسع النطاق للتركيب الفعال والمستمر، والطلب المتزايد على مركبات بلاستيكية عالية الجودة في مختلف الصناعات.

- ملكيات

بناءً على خصائصه، يُقسّم السوق إلى مقاومة، ومتانة، ومرونة، ومقاومة للصدمات، وصلابة، وغيرها. في عام 2025، من المتوقع أن يهيمن قطاع المقاومة على السوق بحصة سوقية تبلغ 27.98%، بمعدل نمو سنوي مركب قدره 5.42% خلال الفترة المتوقعة من 2025 إلى 2032، مدفوعًا بتزايد الطلب على المركبات البلاستيكية طويلة الأمد وعالية الأداء في قطاعات السيارات والبناء والسلع الاستهلاكية.

- طلب

بناءً على التطبيق، يُقسّم السوق إلى قطاعات الطيران والدفاع، والتغليف، والكهرباء والإلكترونيات، والطاقة، والبناء والتشييد، والسيارات، والأجهزة الطبية، والأثاث، وغيرها. في عام 2025، من المتوقع أن يهيمن قطاع السيارات على السوق بحصة سوقية تبلغ 26.65%، بمعدل نمو سنوي مركب قدره 3.38% خلال الفترة المتوقعة من 2025 إلى 2032، مدفوعًا بتزايد الطلب على مركبات بلاستيكية خفيفة الوزن ومتينة وقابلة لإعادة التدوير لتحسين كفاءة الوقود والوفاء باللوائح البيئية الصارمة.

تحليل إقليمي لسوق مُركّبات البلاستيك في أمريكا الشمالية

- من المتوقع أن يصل سوق مركبات البلاستيك في أمريكا الشمالية إلى 85.13 مليار دولار أمريكي بحلول عام 2032، من 58.94 مليار دولار أمريكي في عام 2024، بمعدل نمو سنوي مركب قدره 4.75٪ في الفترة المتوقعة من 2025 إلى 2032

- تُخصّص أمريكا الشمالية جزءًا كبيرًا من ناتجها المحلي الإجمالي للتصنيع والتنمية الصناعية، مما يضمن تمويلًا قويًا للمواد المتقدمة وتقنيات مُركّبات البلاستيك المبتكرة. في المقابل، تُزيد الأسواق الناشئة استثماراتها في مُركّبات البلاستيك مدفوعةً بتنامي التصنيع والتحضر، وتزايد الطلب على المواد المستدامة وعالية الأداء. ويلعب توافر التمويل من القطاعين العام والخاص دورًا حاسمًا في توسيع قدرات الإنتاج واعتماد مُركّبات البلاستيك المتقدمة عالميًا.

- في الولايات المتحدة، تُعتمد تقنيات تصنيع البلاستيك المتقدمة على نطاق واسع وتُدمج في مختلف التطبيقات الصناعية، داعمةً قطاعات مثل السيارات والفضاء والإلكترونيات. في المقابل، تشهد الأسواق الناشئة ذات البنية التحتية الصناعية المتطورة نموًا سريعًا في الطلب على المركبات البلاستيكية المتخصصة، مدفوعًا بتوسع القواعد الصناعية وتزايد احتياجات الرعاية الصحية والسيارات والتغليف. ومع تزايد مركزية أو خصخصة أنظمة الرعاية الصحية والصناعية، غالبًا ما يؤدي ذلك إلى زيادة الاستثمار في تقنيات تصنيع البلاستيك المتطورة، مما يعزز نمو السوق وسهولة الوصول إليها.

نظرة عامة على سوق مُركّبات البلاستيك في كندا وأمريكا الشمالية

من المتوقع أن تسجل كندا معدل نمو سنوي مركب بنسبة 4.44% من عام 2025 إلى عام 2032 في منطقة أمريكا الشمالية، مدفوعًا بالطلب المتزايد على خصائص المواد المحسنة، والكفاءة من حيث التكلفة، والتبني المتزايد في مختلف التطبيقات الصناعية.

نظرة عامة على سوق مركبات البلاستيك في المكسيك وأمريكا الشمالية

من المتوقع أن تسجل المكسيك معدل نمو سنوي مركب بنسبة 3.91% من عام 2025 إلى عام 2032، مدفوعًا بالطلب المتزايد على المواد خفيفة الوزن والمتينة في جميع الصناعات والتركيز المتزايد على المركبات البلاستيكية القابلة لإعادة التدوير والمستدامة.

حصة سوق مركبات البلاستيك في أمريكا الشمالية

إن سوق المركبات البلاستيكية في أمريكا الشمالية يقوده في المقام الأول شركات راسخة، بما في ذلك:

- شركة ليونديل باسل للصناعات القابضة بي في (الولايات المتحدة)

- باسف (ألمانيا)

- LG Chem (كوريا الجنوبية)

- داو (الولايات المتحدة)

- سابك (المملكة العربية السعودية)

- شركة كوفسترو (ألمانيا)

- تكنور أبيكس (الولايات المتحدة)

- لانكسيس (ألمانيا)

- شركة سيلانيز (الولايات المتحدة)

- شركة بورياليس المحدودة (النمسا)

- شركة أساهي كاساي (اليابان)

- مجموعة ميتسوبيشي الكيميائية (اليابان)

- دوبونت (الولايات المتحدة)

- شركة أفينت (الولايات المتحدة)

- إنيوس (المملكة المتحدة)

- كينجفا العلوم. والتكنولوجيا. المحدودة (الصين)

- واشنطن بن (الولايات المتحدة)

- شركة RTP (الولايات المتحدة)

- سيينسكو (بلجيكا)

- إنفاليور (ألمانيا)

- أركيما (فرنسا)

- ترينسيو (الولايات المتحدة)

- شركة دايسل (اليابان)

- شركة كانيكا (اليابان)

- شركة توراي للصناعات (اليابان)

- شركة ميتسوي للكيماويات (اليابان)

- إنسينجر (ألمانيا)

- كلاريانت (سويسرا)

أحدث التطورات في سوق مُركّبات البلاستيك في أمريكا الشمالية

- في يونيو 2025، أعلنت شركة Envalior، بالتعاون مع SENTImotion ومجموعة Frencken، عن ابتكار منتج يتضمن مفهومًا جديدًا لعلبة تروس لأذرع الروبوتات باستخدام البلاستيك الهندسي Stanyl PA46. يتيح هذا التطوير علب تروس أخف وزنًا وأكثر فعالية من حيث التكلفة بنسبة 50% مقارنةً بالبدائل المعدنية، مما يدعم الإنتاج واسع النطاق للروبوتات خفيفة الوزن والموفرة للطاقة. يُفيد هذا الابتكار Envalior بشكل كبير من خلال توسيع نطاق حضورها في قطاعي الروبوتات والتنقل، مما يفتح آفاقًا جديدة للنمو في مجال الأتمتة الاستهلاكية والصناعية.

- في مايو 2024، أعلنت شركة إنفاليور عن مشاركتها في مؤتمر "البلاستيك في تطبيقات الهندسة والكهرباء" (SKZ)، حيث عرضت ابتكارات في المنتجات، بما في ذلك مركبات البولي أميد 6 المستدامة ومادة PBT جديدة مقاومة للهب وخالية من الهالوجين (مثل Pocan BFN4221Z). يركز هذا التطوير على توسيع محفظة إنفاليور من البلاستيك الهندسي بزيادة نسبة المواد الخام المستدامة، مما يُمكّن العملاء من تقليل بصمتهم الكربونية وتقليل اعتمادهم على المدخلات القائمة على الوقود الأحفوري. تتميز المواد المميزة بأداء ميكانيكي مُحسّن ومقاومة للهب، مما يُمكّن إنفاليور من تلبية الطلب المتزايد في قطاعات الهندسة والكهرباء بشكل أفضل، مثل التنقل الكهربائي، وشبكات الجيل الخامس، والأنظمة ذاتية القيادة، مع تعزيز ريادتها في مجال اللدائن الحرارية المستدامة.

- في يوليو 2025، أطلقت أركيما منتجها الجديد Zenimid، وهو اسم تجاري جديد لمجموعة البولي إيميد فائقة الأداء، مما يُمثل تطويرًا استراتيجيًا للمنتج. يُعزز هذا الابتكار محفظة أركيما من المواد المتخصصة من خلال تلبية احتياجات القطاعات عالية الطلب مثل الفضاء والطيران والإلكترونيات والسيارات. بفضل مقاومته الحرارية والميكانيكية والكيميائية الاستثنائية، يدعم Zenimid نمو الشركة في التطبيقات المتقدمة. ويعزز هذا الإطلاق مكانة أركيما في سوق البوليمرات عالية الأداء.

- في يونيو 2025، كشفت شركة ترينسيو عن منتجها الجديد LIGOS A9615، وهو لاصق أكريليك جديد مصمم خصيصًا لقطاع ملصقات الأغراض العامة (GPL)، والذي أُطلق في 9 يونيو 2025، ويستهدف ملصقات الأفلام في سوق جنوب شرق آسيا. يمثل هذا التطور إطلاقًا استراتيجيًا للمنتج، مما يعزز مكانة ترينسيو الرائدة في ابتكار المواد اللاصقة. تشمل المزايا الرئيسية للمنتج مقاومة ممتازة للشيخوخة، وسهولة الإزالة مع إمكانية إعادة التموضع، ومقاومة الملدنات، مما يتيح التصاقًا موثوقًا حتى على أسطح PVC المنحنية الشائعة في السلع الاستهلاكية وتطبيقات التغليف.

- في فبراير 2025، أعلنت شركة ترينسيو عن إطلاق أول منتج شفاف من راتنج البوليسترين المعاد تدويره بالذوبان (rPS) في أوروبا معتمد خصيصًا للاتصال المباشر بالأغذية، ومتوافق رسميًا مع اللائحة الأوروبية 2022/1616. وقد جاء هذا الإنجاز التنظيمي بعد اختبارات مكثفة شملت "اختبار التحدي" الذي أُجري مع معهد فراونهوفر للتحقق من صحة فعالية إزالة التلوث والامتثال لسلامة الأغذية للراتنج النهائي. يُنتج راتنج rPS الجديد في منشأة ترينسيو في شكوباو ويحتوي على ما يقرب من 30% من المحتوى المعاد تدويره، ويوفر انخفاضًا في البصمة الكربونية بنحو 18% مقارنةً بالبوليسترين البكر. وبالنسبة لشركة ترينسيو، يمثل هذا التطور تقدمًا استراتيجيًا في مجال الاستدامة، مما يُمكّن الشركة من تلبية الطلب المتزايد على حلول المواد الدائرية ودعم أهداف المحتوى المعاد تدويره لدى عملائها.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INTERNAL COMPETITION

4.2 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.2.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.2.1.1 JOINT VENTURES

4.2.1.2 MERGERS AND ACQUISITIONS

4.2.1.3 LICENSING AND PARTNERSHIP

4.2.1.4 TECHNOLOGY COLLABORATIONS

4.2.1.5 STRATEGIC DIVESTMENTS

4.2.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.2.3 STAGE OF DEVELOPMENT

4.2.4 TIMELINES AND MILESTONES

4.2.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.2.6 RISK ASSESSMENT AND MITIGATION

4.2.7 FUTURE OUTLOOK

4.3 VALUE CHAIN ANALYSIS

4.4 IMPORT EXPORT SCENARIO

4.5 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CONSUMER BUYING BEHAVIOUR

4.8 DATA BASE OF COMPOUNDERS & THE EQUIPMENT THEY HAVE IN USE

4.9 PATENT ANALYSIS

4.9.1 PATENT QUALITY AND STRENGTH

4.9.2 PATENT FAMILIES

4.9.3 LICENSING AND COLLABORATIONS

4.9.4 REGION PATENT LANDSCAPE

4.9.5 IP STRATEGY AND MANAGEMENT

4.1 RAW MATERIAL COVERAGE

4.11 SUPPLY CHAIN ANALYSIS OF THE NORTH AMERICA PLASTIC COMPOUNDING MARKET

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIOS

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS (LSPS)

4.12 TECHNOLOGICAL ADVANCEMENTS IN THE NORTH AMERICA PLASTIC COMPOUNDING MARKET

4.12.1 AI AND DIGITAL PROCESS OPTIMIZATION

4.12.2 ADVANCED EXTRUSION AND MATERIAL HANDLING TECHNOLOGIES

4.12.3 BIO-BASED AND FUNCTIONALIZED POLYMER COMPOUNDS

4.12.4 SMART AND RESPONSIVE COMPOUNDING SOLUTIONS

4.12.5 AUTOMATION AND INDUSTRY 4.0 IN COMPOUNDING OPERATIONS

4.12.6 SUSTAINABILITY AND CIRCULAR ECONOMY INNOVATIONS

4.12.7 DIGITAL CUSTOMER ENGAGEMENT AND FORMULATION PLATFORMS

4.13 VENDOR SELECTION CRITERIA

4.14 COMPANY EVALUATION QUADRANT

4.15 PRICING ANALYSIS

5 ROLE OF TARIFFS IN THE NORTH AMERICA PLASTIC COMPOUNDING MARKET

5.1 TARIFF LANDSCAPE: DUTIES ON POLYMERS, ADDITIVES, AND MACHINERY

5.2 IMPACT OF TARIFFS ON COST STRUCTURES AND SUPPLY CHAIN DYNAMICS

5.3 INFLUENCE OF TRADE AGREEMENTS AND REGULATORY POLICIES

5.4 MARKET TRENDS AMPLIFYING TARIFF IMPACTS

5.5 COMPETITIVE IMPLICATIONS FOR INDUSTRY PARTICIPANTS

5.6 CHALLENGES AND OPPORTUNITIES ARISING FROM TARIFFS

5.7 KEY COMPANIES AND TARIFF STRATEGY SNAPSHOT

6 REGULATION COVERAGE: NORTH AMERICA PLASTIC COMPOUNDING MARKET

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 SHIFT TOWARDS RECYCLABLE AND BIODEGRADABLE PLASTIC COMPOUNDS DUE TO ENVIRONMENTAL REGULATIONS

7.1.2 ADVANCEMENTS IN COMPOUNDING TECHNOLOGIES IMPROVING PRODUCT PERFORMANCE AND COST-EFFICIENCY

7.1.3 DEVELOPMENT OF NANOCOMPOSITE PLASTICS OFFERING SUPERIOR MECHANICAL AND BARRIER PROPERTIES

7.1.4 INCREASED USE OF COMPOUNDED PLASTICS IN MEDICAL DEVICES DUE TO BIOCOMPATIBILITY AND STERILIZATION COMPATIBILITY

7.2 RESTRAINTS

7.2.1 VOLATILITY IN RAW MATERIAL PRICES, ESPECIALLY PETROLEUM-BASED FEEDSTOCKS LIKE POLYPROPYLENE AND POLYETHYLENE

7.2.2 COMPLEX RECYCLING PROCESSES AND LACK OF PROPER INFRASTRUCTURE FOR PLASTIC COMPOUND WASTE MANAGEMENT

7.3 OPPORTUNITIES

7.3.1 GROWING USE OF BIOPLASTICS AND SUSTAINABLE COMPOUND ALTERNATIVES

7.3.2 SURGE IN ELECTRIC VEHICLE ADOPTION REQUIRING ADVANCED POLYMERS

7.3.3 INCREASING DEMAND FOR RECYCLABLE AND CIRCULAR PLASTIC SOLUTIONS

7.4 CHALLENGES

7.4.1 PERFORMANCE LIMITATIONS OF SUSTAINABLE ALTERNATIVES

7.4.2 REGULATORY AND STANDARDS FRAGMENTATION ACROSS REGIONS

8 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE

8.1 OVERVIEW

8.2 THERMOPLASTICS

8.2.1 THERMOPLASTICS, BY TYPE

8.2.2 POLYETHYLENE (PE), BY TYPE

8.3 ENGINEERING PLASTICS

8.3.1 ENGINEERING PLASTICS, BY TYPE

8.4 THERMOSETTING PLASTICS

8.4.1 THERMOSETTING PLASTICS, BY TYPE

8.5 BIOPLASTICS

8.5.1 BIOPLASTICS, BY TYPE

8.6 OTHERS

9 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY FILLER TYPE

9.1 OVERVIEW

9.2 MINERAL FILLERS

9.2.1 MINERAL FILLERS, BY TYPE

9.3 REINFORCEMENTS

9.3.1 REINFORCEMENTS, BY TYPE

9.4 ADDITIVES

9.4.1 ADDITIVES, BY TYPE

9.5 OTHERS

10 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS

10.1 OVERVIEW

10.2 EXTRUSION

10.2.1 EXTRUSION, BY TYPE

10.2.2 EXTRUSION, BY PELLETIZING SYSTEM

10.3 INJECTION MOLDING BASED COMPOUNDING

10.3.1 INJECTION MOLDING BASED COMPOUNDING, BY PELLETIZING SYSTEM

10.4 COMPACTION/PRESSING

10.4.1 COMPACTION/PRESSING, BY PELLETIZING SYSTEM

10.5 KNEADER/BANBURY MIXING

10.5.1 KNEADER/BANBURY MIXING, BY PELLETIZING SYSTEM

10.6 OTHERS

11 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY PROPERTIES

11.1 OVERVIEW

11.2 RESISTANCE

11.3 DURABILITY

11.4 FLEXIBILITY

11.5 IMPACT RESISTANCE

11.6 RIGIDITY

11.7 OTHERS

12 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 AUTOMOTIVE

12.2.1 AUTOMOTIVE, BY CATEGORY

12.2.1.1 INTERIOR COMPONENTS, BY TYPE

12.2.1.2 EXTERIOR BODY PARTS, BY TYPE

12.2.1.3 UNDER-THE-HOOD APPLICATIONS, BY TYPE

12.3 PACKAGING

12.3.1 PACKAGING, BY CATEGORY

12.3.1.1 FOOD & BEVERAGE PACKAGING, BY TYPE

12.3.1.2 INDUSTRIAL PACKAGING, BY TYPE

12.3.1.3 CONSUMER GOODS PACKAGING, BY TYPE

12.4 BUILDING & CONSTRUCTION

12.4.1 BUILDING & CONSTRUCTION, BY CATEGORY

12.5 ELECTRICAL & ELECTRONICS

12.5.1 ELECTRICAL & ELECTRONICS, BY CATEGORY

12.6 MEDICAL DEVICES

12.6.1 MEDICAL DEVICES, BY CATEGORY

12.7 FURNITURE

12.7.1 FURNITURE, BY CATEGORY

12.8 ENERGY AND POWER

12.8.1 ENERGY & POWER, BY CATEGORY

12.9 AEROSPACE AND DEFENSE

12.9.1 AEROSPACE AND DEFENSE, BY CATEGORY

12.1 OTHERS

13 NORTH AMERICA PLASTIC COMPOUNDING MARKET BY COUNTRIES

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA PLASTIC COMPOUNDING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 SABIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS/NEWS

16.3 DOW

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 DUPONT

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 ARKEMA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASAHI KASEI CORP.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AVIENT CORPORATION

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 BOREALIS GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BASF

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 CLEANESE CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 CHIMEI

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 CLARIANT

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 COVESTRO AG

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 DAICEL CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 ENSINGER GMBH

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 ENVALIOR

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 INEOS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 KANEKA CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 KINGFA SCI.&TECH. CO.,LTD.

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 LANXESS

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 BUSINESS PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 LG CHEM

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 MITSUBISHI CHEMICAL GROUP CORPORATION.

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 MITSUI CHEMICALS, INC

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 RTP COMPANY

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 SCG

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENT

16.26 SYENSQO

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 TEKNOR APEX

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 TORAY INDUSTRIES, INC.

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENT

16.29 TRINSEO

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 SOLUTION PORTFOLIO

16.29.4 RECENT DEVELOPMENTS

16.3 WASHINGTON PENN

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 STAGES OF VALUE CHAIN

TABLE 2 BRAND OUTLOOK: NORTH AMERICA PLASTIC COMPOUNDING MARKET

TABLE 3 CONSUMER BUYING BEHAVIOUR

TABLE 4 NORTH AMERICA PLAYERS IN PLASTIC COMPOUNDING

TABLE 5 NUMBER OF PATENTS PER YEAR

TABLE 6 NUMBER OF PATENTS PER REGION/COUNTRY

TABLE 7 TOP PATENT APPLICANTS

TABLE 8 TARIFF EXPOSURE AND STRATEGIC RESPONSE BY COMPANY TYPE

TABLE 9 TARIFF EXPOSURE AND STRATEGIC RESPONSE OF KEY PLAYERS

TABLE 10 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 12 NORTH AMERICA THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 14 NORTH AMERICA THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND )

TABLE 17 NORTH AMERICA ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 18 NORTH AMERICA ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 21 NORTH AMERICA THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 24 NORTH AMERICA BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 27 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY FILTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 37 NORTH AMERICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 39 NORTH AMERICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 43 NORTH AMERICA INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 46 NORTH AMERICA COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 49 NORTH AMERICA KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 52 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA RESISTANCE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA DURABILITY IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA FLEXIBILITY IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA IMPACT RESISTANCE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA RIGIDITY IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 61 NORTH AMERICA AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 63 NORTH AMERICA AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA PACKAGING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA PACKAGING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 69 NORTH AMERICA PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 75 NORTH AMERICA BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 78 NORTH AMERICA ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 81 NORTH AMERICA MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA FURNITURE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA FURNITURE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 84 NORTH AMERICA FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 87 NORTH AMERICA ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 90 NORTH AMERICA AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 93 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 95 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 97 NORTH AMERICA THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 NORTH AMERICA POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 108 NORTH AMERICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 116 NORTH AMERICA AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 117 NORTH AMERICA INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 NORTH AMERICA UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NORTH AMERICA PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 121 NORTH AMERICA FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NORTH AMERICA INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NORTH AMERICA CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 NORTH AMERICA BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 125 NORTH AMERICA ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 126 NORTH AMERICA MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 127 NORTH AMERICA FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 128 NORTH AMERICA ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 129 NORTH AMERICA AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 130 U.S. PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.S. PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 132 U.S. THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.S. POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.S. ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.S. BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.S. MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.S. REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.S. ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.S. PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 142 U.S. PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 143 U.S. EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.S. EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 145 U.S. INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 146 U.S. COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 147 U.S. KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 148 U.S. PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 149 U.S. PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 150 U.S. PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 151 U.S. AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 152 U.S. INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 U.S. EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.S. CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 U.S. BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 160 U.S. ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 161 U.S. MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 163 U.S. ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 164 U.S. AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 165 CANADA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 167 CANADA THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 CANADA ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 CANADA THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 CANADA PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 CANADA MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 CANADA REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 CANADA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 178 CANADA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 180 CANADA INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 181 CANADA COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 182 CANADA KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 183 CANADA PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 184 CANADA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 CANADA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 186 CANADA AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 187 CANADA INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 CANADA EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 CANADA UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 CANADA PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 191 CANADA FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 CANADA INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 CANADA CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 CANADA BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 195 CANADA ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 196 CANADA MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 197 CANADA FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 198 CANADA ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 199 CANADA AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 200 MEXICO PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 MEXICO PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 202 MEXICO THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 MEXICO POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 MEXICO ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 MEXICO THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 MEXICO BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 MEXICO PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 MEXICO MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 MEXICO ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 MEXICO PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 213 MEXICO EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 MEXICO EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 217 MEXICO KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 219 MEXICO PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 220 MEXICO PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 221 MEXICO AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 222 MEXICO INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 MEXICO EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 MEXICO UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 MEXICO CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MEXICO BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 230 MEXICO ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 231 MEXICO MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 232 MEXICO FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 233 MEXICO ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 234 MEXICO AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA PLASTIC COMPOUNDING MARKET

FIGURE 2 NORTH AMERICA PLASTIC COMPOUNDING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PLASTIC COMPOUNDING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PLASTIC COMPOUNDING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PLASTIC COMPOUNDING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PLASTIC COMPOUNDING MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA PLASTIC COMPOUNDING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA PLASTIC COMPOUNDING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA PLASTIC COMPOUNDING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 NORTH AMERICA PLASTIC COMPOUNDING MARKET: SEGMENTATION

FIGURE 12 FIVE SEGMENTS COMPRISE THE NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 SHIFT TOWARDS RECYCLABLE AND BIODEGRADABLE PLASTIC COMPOUNDS DUE TO ENVIRONMENTAL REGULATION IS EXPECTED TO DRIVE THE NORTH AMERICA PLASTIC COMPUNDING MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 THERMOPLASTICS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PLASTIC COMPUNDING MARKET IN 2025 AND 2032

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 NORTH AMERICA PLASTIC COMPOUNDING MARKET: VALUE CHAIN ANALYSIS

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

FIGURE 20 IPC CODE V/S NUMBER OF PATENTS

FIGURE 21 NUMBER OF PATENTS PER YEAR

FIGURE 22 NUMBER OF PATENTS PER REGION/COUNTRY

FIGURE 23 TOP PATENT APPLICANTS

FIGURE 24 NORTH AMERICA PLASTIC COMPOUNDING MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA PLASTIC COMPOUNDING MARKET

FIGURE 26 NORTH AMERICA PLASTIC COMPOUNDING MARKET: BY POLYMER TYPE, 2024

FIGURE 27 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY FILTER TYPE, 2024

FIGURE 28 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2024

FIGURE 29 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2024

FIGURE 30 NORTH AMERICA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2024

FIGURE 31 NORTH AMERICA PLASTIC COMPOUNDING MARKET: SNAPSHOT (2024)

FIGURE 32 NORTH AMERICA PLASTIC COMPOUNDING MARKET: COMPANY SHARE 2024 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.