North America Orthopedic Surgical Robots Market, By Product Type (Robotic System, Robotic Accessories, and Software and Services), End User (Hospital and Ambulatory Surgery Centers (ASCS)), Distribution Channel (Direct Tenders and Third Party Distributors) - Industry Trends and Forecast to 2029.

North America Orthopedic Surgical Robots Market Analysis and Insight

The orthopedic surgical robots market is largely influenced by the surging focus of key players towards technological advances in molecular diagnostics and indulging towards collaboration and partnerships with other organizations. The first documented use of orthopedic surgery had started during the 15th century. Modern orthopedic surgery and musculoskeletal research makes surgery less invasive and to make implanted components better and more durable. The orthopedic surgical robots are used to correct the bone deformities and to restore the function of the human skeletal system. During the last few years, new innovative orthopedic surgical robots products have been developed for increasing the growth of orthopedic surgical robots market, and the market players are enhancing their product portfolio. Many market players are involved in the manufacturing of orthopedic surgical robots with innovations that pave the way for market growth.

North America orthopedic surgical robots market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal.

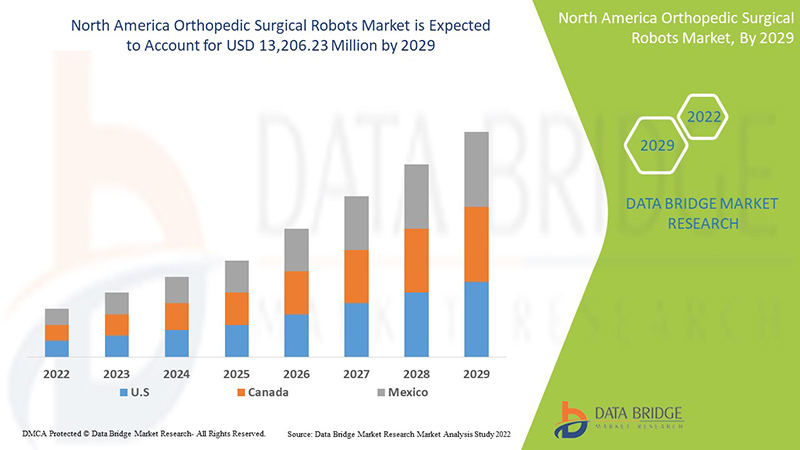

Data Bridge Market Research analyses that the orthopedic surgical robots market is expected to reach the value of USD 13,206.23 million by 2029, at a CAGR of 26.3% during the forecast period 2022-2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Product Type (Robotic System, Robotic Accessories, and Software and Services), End User (Hospital and Ambulatory Surgery Centers (ASCS)), Distribution Channel (Direct Tenders and Third Party Distributors) |

|

Countries Covered |

U.S., Canada, Mexico in North America |

|

Market Players Covered |

Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, Smith & Nephew, Corin Group, NuVasive, Inc., Brainlab AG, Integrity Implants Inc. d/b/a/ Accelus, Beijing Tinavi Medical Technologies Co., Ltd, Medtronic, Globus Medical, Inc., Accuray Incorporated, THINK Surgical, Inc., CUREXO, INC. are among others. |

Market Definition

The orthopedic surgical robots are used to correct the bone deformities and to restore the function of the human skeletal system. It uses energy such as radiation, radio frequency, and ultrasound to seal the skin and bone tissue. The orthopedic surgical robots require an energy source, such as an electro surgery generator (ESU), and an instrument to transfer the energy to the patient. The important types include radio frequency (RF), modified electrical current, and ultrasound, which converts electrical current into mechanical motion. More specialized technologies include those that use argon gas, plasma, or a combination of technologies. The technological advancements used in the orthopedic surgical robots are ultrasound, radiofrequency, and radiation. The diagnostic technology used in the orthopedic surgical robots have permitted orthopedic surgeons to achieve new levels of precision and safety. It provides a surgeon to diagnose, plan, and expedite the orthopedic surgery for outstanding results.

Orthopedic Surgical Robots Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

DRIVERS

-

RISING PREVALENCE OF OSTEOPOROSIS

Osteoporosis is a chronic disease that suppresses the bones. If an individual has osteoporosis, he will be at a greater risk for sudden and unexpected bone fractures. In 2021, the World Health Organization (WHO) data stated that about 200 million people are predicted to have osteoporosis.

Though osteoporosis affects males and females, females are likely to develop more osteoporosis than men. For the treatment of osteoporosis, hip fractures and knee replacements are there, and it is important to understand the previous physical health conditions of elderly patients, such as reduced bone mass and bone fragility. The regularity of osteoporosis is increasing, so the surgical approach for osteoporosis is rising. The reamer-irrigator aspirator is a type of hand piece which are used among orthopedic surgeons. For example, the high torq power tool is a reamer used to treat osteoporosis.

With the rising prevalence of osteoporosis globally, the demand for early diagnosis of the disease is also increasing, with which the demand for care, services, and technologies is rising to treat chronic conditions in old age.

-

INCREASE IN NUMBER OF ORTHOPEDIC SURGERIES

The increase in the geriatric population and orthopedic disorders such as osteoporosis. Due to the increase in orthopedic disorders, the number of orthopedic-related surgeries is also increasing. The increased number of orthopedic surgeries would increase the number of orthopedic surgeons. This would increase the use of orthopedic surgical robots. It would increase the production and supply of orthopedic surgical robots.

Surgical robots are already transforming the healthcare market. As they capture a growing volume of surgical procedures, outpatient centers will force down prices on medtech devices and trigger changes for payers and providers. Hence, an increase in the number of orthopedic surgeries is expected to drive the growth of the orthopedic surgical robots market.

RESTRAINTS

-

LACK OF AWARENESS ABOUT ORTHOPEDIC SURGERIES

Although orthopedic surgical energy devices have positioned themselves as a platform in the market of non-invasive devices, the non-existence of orthopedic surgeries is present in developing countries. This would result in delay and diagnosis of the orthopedic disease and the orthopedic surgical robots having a lower market position. The lack of awareness and self-efficacy also adds to the potential barriers and imperfect implementation.

-

RISKS OBSERVED IN ORTHOPEDIC SURGERIES

Orthopedic surgical are performed by orthopedics to cure orthopedic disorders, blood vessels, cut tissue, and stop bleeding. They are hand-held devices, so they must be operated as part of the doctor's instrument. Although they do not offer a diagnosis, they deliver medications that enable better treatment. However, there are certain risks observed while using orthopedic surgeries.

However, the variety of risks and health complications associated with orthopedic surgery and the need for further surgical intervention to fix some of them are expected to hamper its demand in the market. Thus, the health complications associated with orthopedic surgeries are expected to restrain the orthopedic surgical robots market.

OPPORTUNITIES

-

INCREASE IN GERIATRIC POPULATIONS

Knee disorders are common in the elderly population globally. Adults aged 60 years and above, particularly those living in long-term care facilities, are likely to suffer from chronic knee symptoms. As aging increases, the burden of knee disorders in the geriatric population may increase, which paves the way for the development of medications and implants in diagnostic and prevention strategies critical for improving the knee disorders of older adults.

As age increases, the susceptibility to knee disorders and other risk factors also increases. For some individuals, it may be hereditary, while for others, knee osteoarthritis can result from injury, infection, or even from being overweight. The increase in the geriatric population is expected to propel the market growth as it leads to greater use of robots in numerous surgeries. These robots were introduced to address the needs of geriatric people, including physical and medical care. Additionally, the senior population is greatly affected by chronic diseases can be a factor in the growth of the orthopedic surgical robots market.

-

RISING HEALTHCARE EXPENDITURE

The expense of money used by a country on its healthcare and its growth rate over time is inclined by a wide variety of economic and social factors, including the financing arrangements and structure of the organization for the health system. In particular, there is a strong association between the whole income level of a country and how much the country's population spends on health care.

Healthcare expenditure has increased across developed, and emerging countries as the disposable income of people are growing. The more money is spent on healthcare the healthier a country's population is. Moreover, to accomplish the population requirements, government bodies and healthcare organizations in different regions are taking the initiative to accelerate healthcare expenditure. Therefore, the rise in healthcare expenditure simultaneously helps healthcare organizations and government bodies to increase healthcare management services in various aspects.

CHALLENGES

-

LACK OF SKILLED PROFESSIONALS

The lack or shortage of skilled expertise would challenge the pace of recovery and growth in one place. Often, the unemployed people in one place have skills in short supply elsewhere. Moreover, rapid technological advancement in this field also leads to a lack of expertise. Despite the call to increase, the number of podiatrists and some residency training programs remains unknown.

Even as the revalidation process for orthopedic surgeons began in Switzerland, the United Kingdom, and other countries, some orthopedic and medical professionals elsewhere in Europe have not started to address the issue of CME and related requirements. As skill demands are too high, retaining and managing skill-specified professionals has become a challenge. Moreover, technological advancement is another aspect that leads to the increased demand for skilled professionals. Podiatrists report significant unmet supportive care needs and barriers in their centers, with only a small minority rating themselves as competently providing supportive care. There is an urgent need for the requirement of podiatrists and professionals to treat chronic knee disorders and procure available supportive care resources. Lack of trained and experienced professionals and persistent skill gaps limit the employability prospects and access to quality jobs. Therefore, this signifies that the lack of skilled professionals is a challenge to the growth of the orthopedic surgical robots market.

-

STRICT REGULATORY FRAMEWORKS

Regulation of medical devices plays a significant role in healthcare. Achieving the requisite approval for legal selling medical devices in such jurisdictions can entail significant financial expenditure, which could take months or years to complete. If these constraints are not understood or considered, delays can seriously jeopardize the likelihood of success in a highly competitive market. Medical robots are increasingly used in minimally invasive surgeries; assistive surgeries are important for treating various diseases. But their approval and marketing in various regions across different regions require a meeting of stringent regulatory standards and approvals by various regulatory bodies.

Post COVID-19 Impact on Orthopedic Surgical Robots Market

COVID-19 created a major impact on the orthopedic surgical robots market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the orthopedic surgical robots market is increasing prevalence of osteoporosis this sector has increased the demand because it targets patient who has the bone related disease. Other reasons driving the demand for these procedures are increasing aging people and rising requirement of healthcare facilities which can further result in decrease in burden on healthcare facilities. Hence, rise in demand for surgical robots procedure is estimated over the forecast period. However, factors such as inadequate availability of raw material to meet orthopedic surgical robots product production demand are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Recent Developments

- In February 2022, Stryker completes the acquisition of Vocera Communications. This acquisition provides significant opportunities to advance innovations and accelerate our digital aspirations. Vocera brings a highly complementary and innovative portfolio to Stryker’s Medical division that will enhance the company’s Advanced Digital Healthcare offerings and further advance Stryker’s focus on preventing adverse events throughout the continuum of care.

- In March 2022, Corin Group has announced that the company is partnering with Efferent Health, LLC, a leader in medical operations automation technology, delivering innovative solutions that streamline key processes. This results in strengthening the portfolio of interoperability data services as well as expanding the company’s credibility in the market.

North America Orthopedic Surgical Robots Market Scope

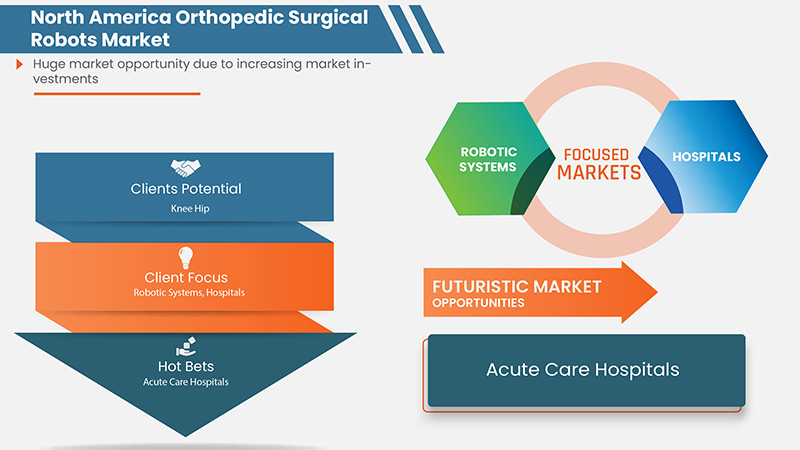

North America orthopedic surgical robots market is segmented on the basis of product type, end user, distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Product Type

- Robotic System

- Robotic Accessories

- Software and Services

On the basis of product type, the North America orthopedic surgical robots market is segmented into robotic system, robotic accessories, and software and services.

By End User

- Hospitals

- Ambulatory Surgical Centers

On the basis of by end user, the North America orthopedic surgical robots market has been segmented into hospitals, and ambulatory surgical centers.

By Distribution Channel

- Direct Tender

- Third Party Distributors

On the basis of by distribution channel, the North America orthopedic surgical robots market has been segmented into direct tender, and third party distributors.

Orthopedic Surgical Robots Market Regional Analysis/Insights

The orthopedic surgical robots market is analysed and market size insights and trends are provided by country, product type, end user, distribution channel as referenced above.

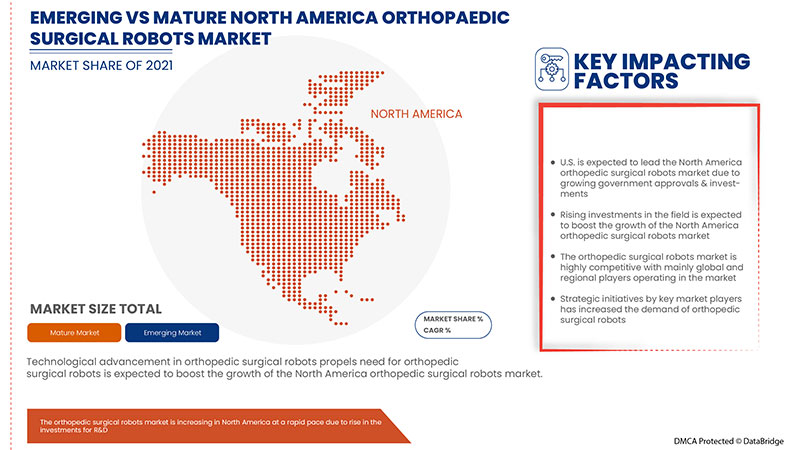

The countries covered in the North America orthopedic surgical robots market report are U.S., Canada and Mexico in North America.

The U.S. dominates the North America region due to exponential use of robotic system in the country.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Orthopedic Surgical Robots Market Share Analysis

The orthopedic surgical robots market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the orthopedic surgical robots market.

Some of the major players operating in the orthopedic surgical robots market are Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, Smith & Nephew, Corin Group, NuVasive, Inc., Brainlab AG, Integrity Implants Inc. d/b/a/ Accelus, Beijing Tinavi Medical Technologies Co., Ltd, Medtronic, Globus Medical, Inc., Accuray Incorporated, THINK Surgical, Inc., CUREXO, INC. are among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES

4.3 CLINICAL TRIALS ON ORTHOPEDIC SURGICAL ROBOTS NORTH AMERICALY

4.4 STRATEGIC INITIATIVES

4.4.1 DEMOGRAPHIC TRENDS

4.4.2 KEY PATENT ENROLLMENT STRATEGIES

4.5 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING PREVALENCE OF OSTEOPOROSIS

5.1.2 GROWING TECHNOLOGICAL ADVANCEMENTS IN ROBOTIC SYSTEMS

5.1.3 INCREASE IN NUMBER OF ORTHOPEDIC SURGERIES

5.1.4 RISE IN INCIDENCE OF SPORTS AND TRAUMA INJURIES

5.2 RESTRAINTS

5.2.1 LACK OF AWARENESS ABOUT ORTHOPEDIC SURGERIES

5.2.2 RISKS OBSERVED IN ORTHOPEDIC SURGERIES

5.2.3 HIGH COST ASSOCIATED WITH THE ORTHOPEDIC SURGERY

5.3 OPPORTUNITIES

5.3.1 INCREASE IN GERIATRIC POPULATIONS

5.3.2 RISING HEALTHCARE EXPENDITURE

5.3.3 RISE IN FRACTURE INCIDENCE

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS

5.4.2 STRICT REGULATORY FRAMEWORKS

6 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 ROBOTIC SYSTEMS

6.2.1 KNEE

6.2.1.1 SURGERY TYPE

6.2.1.1.1 TOTAL KNEE ARTHROPLASTY

6.2.1.1.2 UNICOMPARTMENTAL KNEE ARTHROPLASTY

6.2.1.1.3 ANTERIOR CRUCIATE LIGAMENT RECONSTRUCTION

6.2.1.1.4 OTHERS

6.2.1.1.5 ROBOT TYPE

6.2.1.1.6 MAKO

6.2.1.1.7 CORI

6.2.1.1.8 NAVIO

6.2.1.1.9 TIROBOT

6.2.1.1.10 TSOLUTION ONE

6.2.1.1.11 OTHERS

6.2.2 HIP

6.2.2.1 SURGERY TYPE

6.2.2.1.1 TOTAL HIP ARTHROPLASTY

6.2.2.1.2 OTHERS

6.2.2.1.3 ROBOT TYPE

6.2.2.1.4 MAKO

6.2.2.1.5 TSOLUTION ONE

6.2.2.1.6 OTHERS

6.2.3 SPINE

6.2.3.1 SURGERY TYPE

6.2.3.1.1 PEDICLE SCREW IMPLANTATION

6.2.3.1.2 VERTEBRAL AUGMENTATION

6.2.3.1.3 LAPAROSCOPIC ANTERIOR LUMBAR INTERBODY FUSION

6.2.3.1.4 SPINE TUMOR RESECTION SURGERY

6.2.3.1.5 INTRAOPERATIVE LOCALIZATION

6.2.3.1.6 ANTERIOR LUMBER INTERBODY FUSION

6.2.3.1.7 OTHERS

6.2.3.1.8 ROBOT TYPE

6.2.3.1.9 MAZOR

6.2.3.1.9.1 RENAISSANCE

6.2.3.1.9.2 MAZOR X

6.2.3.1.9.3 SPINE ASSIST

6.2.3.1.10 ROSA

6.2.3.1.11 CIRQ

6.2.3.1.12 EXCELSIUSGPS

6.2.3.1.13 OTHERS

6.2.4 FEMUR

6.2.4.1 SURGERY TYPE

6.2.4.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.4.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.4.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.4.1.4 OTHERS

6.2.4.1.5 ROBOT TYPE

6.2.4.1.6 TIROBOT

6.2.4.1.7 OTHERS

6.2.5 PELVIS

6.2.5.1 SURGERY TYPE

6.2.5.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.5.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.5.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.5.1.4 OTHERS

6.2.5.1.5 ROBOT TYPE

6.2.5.1.6 TIROBOT

6.2.5.1.7 OTHERS

6.2.6 HAND

6.2.6.1 SURGERY TYPE

6.2.6.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.6.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.6.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.6.1.4 OTHERS

6.2.6.1.5 ROBOT TYPE

6.2.6.1.6 TIROBOT

6.2.6.1.7 OTHERS

6.2.7 ELBOW

6.2.7.1 SURGERY TYPE

6.2.7.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.7.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.7.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.7.1.4 OTHERS

6.2.7.1.5 ROBOT TYPE

6.2.7.1.6 TIROBOT

6.2.7.1.7 OTHERS

6.2.8 OTHERS

6.3 ROBOTIC ACCESSORIES

6.4 SOFTWARE AND SERVICES

7 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER

7.1 OVERVIEW

7.2 HOSPITALS

7.2.1 ACTUE CARE HOSPITALS

7.2.2 LONG-TERM CARE HOSPITALS

7.2.3 NURSING FACILITIES

7.2.4 REHABILITATION CENTERS

7.3 AMBULATORY SURGICAL CENTERS

8 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT TENDER

8.3 THIRD PARTY DISTRIBUTORS

9 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 STRYKER

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 SMITH & NEPHEW

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 JOHNSON & JOHNSON SERVICES, INC.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 MEDTRONIC

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 ZIMMER BIOMET

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ACCURAY INCORPORATED

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 BEIJING TINAVI MEDICAL TECHNOLOGIES CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BRAINLAB AG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 CORIN GROUP

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 CUREXO, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 GLOBUS MEDICAL, INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 INTEGRITY IMPLANTS INC. D/B/A/ ACCELUS

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 NUVASIVE, INC.

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 THINK SURGICAL, INC.

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2021-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 4 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 5 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 6 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020- 2029 (UNITS)

TABLE 7 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 8 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 9 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020- 2029 (UNITS)

TABLE 10 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 11 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 12 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 VOLUME, (UNITS)

TABLE 13 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 14 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 15 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 16 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 17 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 18 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 19 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 20 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 21 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 22 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 23 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 24 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 25 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 26 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 27 NORTH AMERICA ROBOTIC ACCESSORIES IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SOFTWARE AND DEVICES IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA DIRECT TENDER IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 42 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 45 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 48 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 50 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 53 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 56 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 59 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 62 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 U.S. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 U.S. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 70 U.S. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 73 U.S. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 76 U.S. MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 78 U.S. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 81 U.S. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.S. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 83 U.S. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 84 U.S. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.S. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 87 U.S. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.S. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.S. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 90 U.S. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 U.S. HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 U.S. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 CANADA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 CANADA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 CANADA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 96 CANADA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 97 CANADA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 98 CANADA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 101 CANADA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 102 CANADA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 104 CANADA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 105 CANADA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 106 CANADA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 109 CANADA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 110 CANADA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 112 CANADA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 115 CANADA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 117 CANADA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 118 CANADA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 CANADA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 120 CANADA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 MEXICO ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 MEXICO KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 126 MEXICO HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 129 MEXICO SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MEXICO SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 132 MEXICO MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 133 MEXICO MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 134 MEXICO FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 137 MEXICO PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 140 MEXICO HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 141 MEXICO HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 143 MEXICO ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 144 MEXICO ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 145 MEXICO ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 146 MEXICO ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 147 MEXICO HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 MEXICO ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: MARKET END USER GRID

FIGURE 9 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVELANCE OF OESTOPOROSIS AND INCREASE INCIDENCE OF SPORTS AND TRAUMA INJURY IS EXPECTED TO DRIVE THE NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 PRODUCT TYPE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET

FIGURE 14 CURRENT HEALTHCARE EXPENDITURE (% OF GDP) 2018-2019-

FIGURE 15 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, 2021

FIGURE 16 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, 2021-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, CAGR (2021-2029)

FIGURE 18 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, 2021

FIGURE 20 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 23 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 27 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 32 NORTH AMERICA ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.