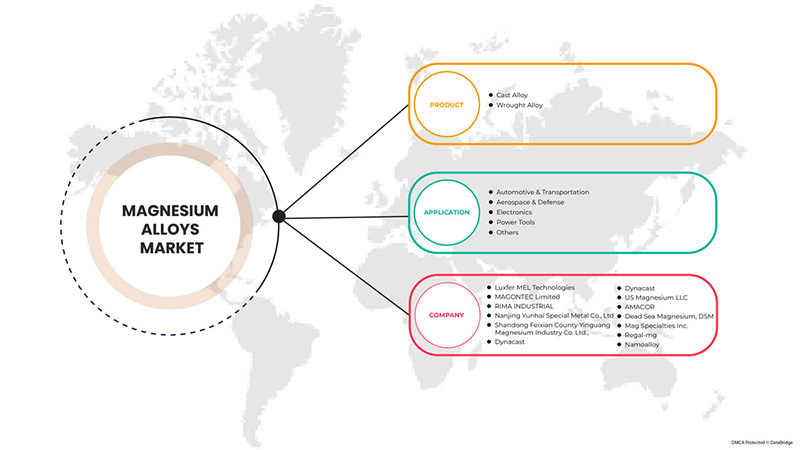

북미 마그네슘 합금 시장, 제품별(주조 합금 및 단조 합금), 응용 분야별(자동차 및 운송, 항공 우주 및 방위, 전자, 전동 공구 및 기타) 산업 동향 및 2029년 예측.

북미 마그네슘 합금 시장 분석 및 규모

자동차 산업에서 마그네슘 합금의 사용이 증가함에 따라 시장 성장과 북미 마그네슘 합금 시장 수요가 증가할 것으로 예상됩니다. 그러나 이 시장 확장의 주요 장애물은 마그네슘의 가격 불확실성과 용접성 및 내식성 문제입니다.

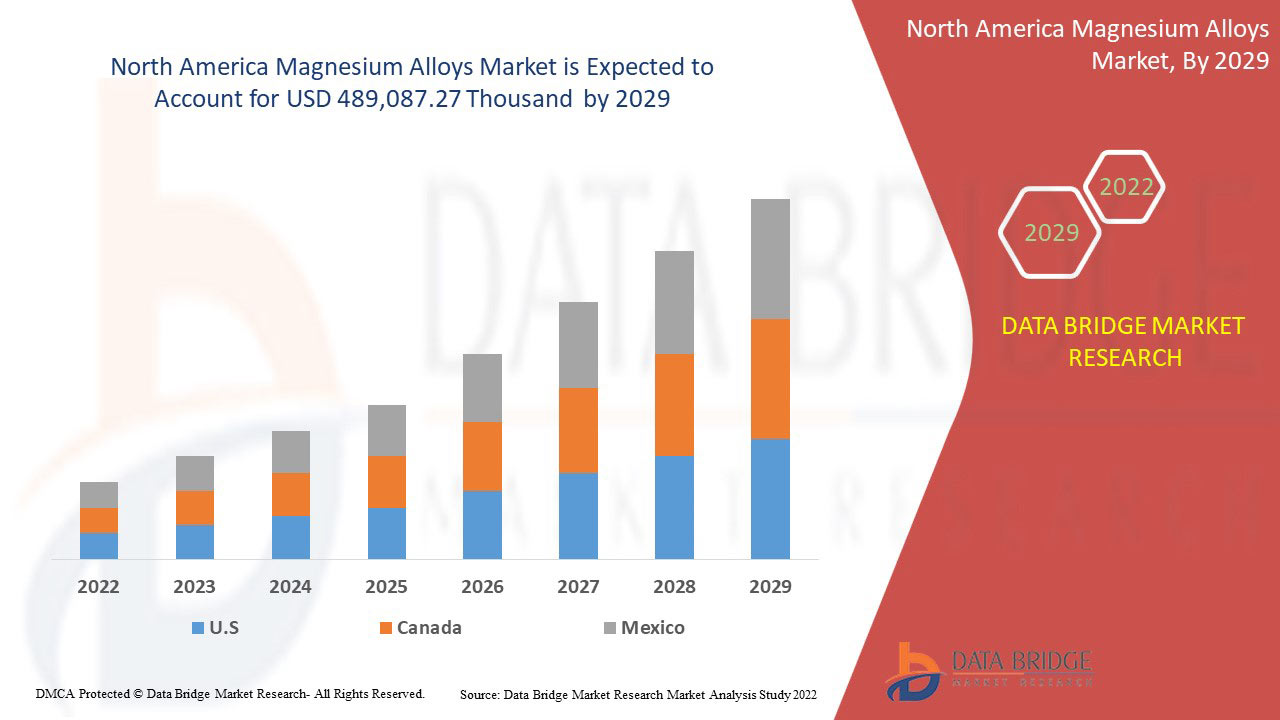

이러한 북미 마그네슘 합금은 주로 자동차 및 운송, 기어박스, 프런트 엔드 및 IP 빔, 스티어링 컬럼 및 운전석 에어백 하우징, 스티어링 휠, 시트 프레임 및 연료 탱크 커버에 사용됩니다. Data Bridge Market Research는 북미 마그네슘 합금 시장이 2029년까지 489,087.27천 달러에 도달할 것으로 예상한다고 분석합니다. Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 심층적인 전문가 분석, 수입/수출 분석, 가격 분석 및 생산 소비 분석과 기후 사슬 시나리오가 포함됩니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

매출은 USD 천, 볼륨은 톤 |

|

다루는 세그먼트 |

제품별(주조 합금 및 단조 합금), 응용 분야별(자동차 및 운송, 항공 우주 및 방위, 전자, 전동 공구 및 기타). |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Luxfer MEL Technologies, Shandong Feixian County Yinguang Magnesium Industry Co., Ltd., regal-mg, US Magnesium LLC, Namoalloy, Dead sea Magnesium, DSM, Amacor, Dynacast, RIMA INDUSTRIAL, Mag Specialties Inc., MAGONTEC Limited, Nanjing Yunhai Special Metal Co., Ltd 등이 있습니다. |

시장 정의

마그네슘은 밀도가 1.74g/cm3인 가장 가벼운 구조 재료이며, 금속과 합금한 마그네슘은 경도, 주조성 및 강도를 증가시키는 반면 점도에는 무시할 만한 영향을 미칩니다. 알루미늄은 주로 마그네슘과 합금 금속으로 사용됩니다. 마그네슘 합금은 경량, 열전도도, 강도, 내구성, 내식성 및 고온 크립과 같은 특성을 가지고 있습니다.

COVID-19는 북미 마그네슘 합금 시장에 최소한의 영향을 미쳤습니다.

COVID-19는 2020-2021년에 다양한 제조 산업에 영향을 미쳐 직장 폐쇄, 공급망 중단 및 운송 제한으로 이어졌습니다. COVID-19 발생 동안 자동차 및 항공우주 산업의 제조가 중단되면서 마그네슘 합금 시장은 상당한 손실을 입었습니다. 의료용품 및 생명 지원 부문만 운영이 허용되었습니다. 물류 제한으로 인해 공급망도 중단되었습니다. 결과적으로 마그네슘 합금 시장 성장도 방해를 받았습니다.

북미 마그네슘 합금 시장의 시장 역학은 다음과 같습니다.

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

북미 마그네슘 합금 시장이 직면한 동인/기회

- 자동차 산업에서 마그네슘 합금 사용 증가

자동차 산업에서 마그네슘 합금의 사용이 증가하는 것은 북미 마그네슘 합금 시장을 더욱 촉진할 것이기 때문에 중요합니다. 이 시장은 차량의 전반적인 강도를 손상시키지 않으면서 중량을 줄이기 위한 엔지니어링 구성품의 제조 증가와 진동 감쇠 용량에 대한 수요 증가에 의해 주도됩니다. 게다가 마그네슘 합금은 차량에 강도, 경량, 내구성, 열 전도성, 고온 크립 및 내식성을 제공합니다. 결과적으로 이러한 특성으로 인해 마그네슘 합금에 대한 수요가 상당히 증가할 것으로 예상됩니다.

- 인공인간 임플란트 및 의료기기에서 마그네슘 합금의 인기 상승

인공 인간 임플란트에서 마그네슘 합금의 인기 상승과 의료 기기에서 이 소재의 적용 증가는 이 산업의 성장을 촉진할 가능성이 높습니다. 의료 기기 및 임플란트 제조업체는 주로 밀도가 낮아 마그네슘 합금을 사용합니다. 마그네슘 합금은 경량 특성으로 인해 휴대용 의료 장비 및 휠체어 제조에 사용됩니다.

이러한 장점에 힘입어 다양한 의료용 임플란트 및 장치 제조업체는 마그네슘 합금을 자사 생산의 중요한 소재로 사용하기 시작했습니다.

- 항공우주 및 방위 산업 분야에서 해당 소재의 적용 증가

항공우주 및 방위 부문에서 경량 구성품에 대한 수요 증가는 북미 마그네슘 합금 시장의 주요 원동력입니다. 마그네슘 합금은 헬리콥터 변속기 케이스, 항공기 엔진, 기어박스 케이스, 터빈 엔진, 제트 엔진 팬 프레임, 우주선 및 미사일 제조에 사용됩니다. 따라서 방위 부문에 대한 지출 증가와 새로운 상업용 항공기에 대한 수요는 북미 마그네슘 합금 시장의 주요 성장 동인으로 남을 것으로 예상됩니다.

예를 들어:

- 2019년 미국 정부는 국방부에 6,860억 달러의 예산을 제안했습니다. 항공기에 대한 예산의 주요 투자에는 F-35 공동 타격 전투기 77대, P-8A 항공기 10대, KC-46 탱커 교체 15대가 포함되었습니다.

- 2019년 보잉이 발표한 연구에 따르면 북미는 2038년까지 9,130대의 신규 항공기 인도를 예상하며, 이는 아시아 태평양에 이어 두 번째로 높은 수치입니다. 또한 연료 효율이 높은 차량에 대한 선호도가 이러한 경량 소재의 사용을 촉진하여 마그네슘 합금 제품 수요를 증가시킬 것으로 예상됩니다.

- 틱소몰딩(Thixomolding) 및 뉴 레오캐스팅(New Rheocasting)과 같은 새로운 공정 도입

저비용으로 고강도, 인장 및 압력 밀폐형 구성 요소를 주조하여 마그네슘 합금을 유압 및 구조용 응용 분야에 도입합니다. 액체보다 낮은 온도에서 주조 구성 요소에서 많은 개발 작업이 수행되었습니다. 즉, 반고체 상태 또는 상당한 양의 고체를 포함하는 형태입니다. 따라서 마그네슘 합금 처리에 이점을 제공하는 이러한 모든 새로 개발된 공정은 북미 마그네슘 합금 시장의 성장과 개발에 수익성 있는 기회를 제공할 것입니다.

북미 마그네슘 합금 시장이 직면한 제약/과제

- 변동 마그네슘 가격

마그네슘과 그 합금 가격의 변동은 북미 마그네슘 합금의 시장 확장을 어느 정도 제한할 것으로 예상됩니다. 과거에는 석탄 공급 감소, 폐쇄 및 기타 정책과 같은 다양한 요인으로 인해 마그네슘 가격이 상승했습니다. 공급 측면에서 전반적인 긴축으로 인해 마그네슘 잉곳 생산이 감소했습니다.

마그네슘 가격이 급등락하는 가운데, 마그네슘 합금 회사들은 생산 확대, 장비 업그레이드, 고부가가치 프로젝트 도입 등을 통해 업계에서 적극적으로 입지를 확보하려 하고 있습니다.

- 마그네슘 합금의 부식 및 용접과 관련된 문제

마그네슘 합금의 사용은 내식성이 낮고 유연성이 낮아 제한적이었습니다. 이러한 합금은 일반 환경에서 연강과 거의 같은 내식성을 가지고 있지만, 일반 부식이나 갈바닉 부식에 관해서는 알루미늄 합금 보다 내식성이 낮습니다.

또한 제조 엔지니어에게 가장 큰 어려움 중 하나는 용접 공정을 통해 가장 낮은 비용으로 마그네슘 합금의 만족스러운 특성을 생성할 공정을 정의하는 것입니다. 일반적으로 마그네슘 합금의 용접은 텅스텐 아크 불활성 가스(TIG)와 같은 고급적이고 신뢰할 수 있는 기술과 공정을 사용해야 하기 때문에 쉬운 작업이 아닙니다.

- 마그네슘 합금을 위한 다양한 대체 재료의 가용성

알루미늄은 다이캐스팅에서 일반적으로 사용되는 모든 합금 중에서 입방인치당 가장 저렴한 합금으로 남아 있습니다. 따라서 다양한 다른 합금 유형의 가용성은 북미 마그네슘 합금 시장의 판매와 성장에 도전할 것입니다.

최근 개발 사항

- 현대자동차는 2019년 11월 인도네시아 신공장에 15억5천만 달러를 투자했다. 신공장 생산은 2021년 말에 시작됐다.

- 2016년, Biotronik이 Magmaris 마그네슘 스캐폴드를 출시했으며, 현재 CE 마크를 획득한 세계 최초의 임상적으로 검증된 마그네슘 기반 흡수성 스캐폴드입니다.

시간이 지남에 따라 재흡수되는 심혈관 스텐트입니다. 이 맞춤형 신기술은 마그네슘 합금 시스템인 SynergMag 410이 Biotronik의 Magmaris 스캐폴드의 중요한 백본으로 만들어진 10년간의 연구 프로그램에 따라 출시되었습니다.

북미 마그네슘 합금 시장 범위

북미 마그네슘 합금 시장은 제품 및 응용 분야를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 귀중한 시장 개요와 시장 통찰력을 제공하여 핵심 시장 응용 분야를 식별하기 위한 전략적 결정을 내리는 데 도움이 됩니다.

제품

- 주조 합금

- 단조 합금

제품 기준으로 시장은 주조 합금과 단조 합금으로 구분됩니다.

애플리케이션

- 자동차 및 운송

- 항공우주 및 방위

- 전자제품

- 전동공구

- 기타

시장은 응용 분야별로 자동차 및 운송, 항공우주 및 방위, 전자 제품, 전동 공구 및 기타 분야로 구분됩니다.

북미 마그네슘 합금 시장 지역 분석/통찰력

위에 언급된 대로, 북미 마그네슘 합금 시장을 분석하고, 국가별, 제품별, 응용 분야별 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 마그네슘 합금 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

미국은 경량 소재 사용 증가, 연비 효율적인 차량 사용 증가, 해당 지역 내 제품 수요 증가로 인해 마그네슘 합금 시장을 장악하고 있습니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 하류 및 상류 가치 사슬 분석, 기술 추세, 포터의 5가지 힘 분석 및 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 마그네슘 합금 점유율 분석

북미 마그네슘 합금 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 유럽의 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우위가 포함됩니다. 위에 제공된 데이터 포인트는 북미 마그네슘 합금 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 마그네슘 합금 시장의 주요 기업으로는 Luxfer MEL Technologies, Shandong Feixian County Yinguang Magnesium Industry Co. Ltd., regal-mg, US Magnesium LLC, Namoalloy, Dead sea Magnesium, DSM, Amacor, Dynacast, RIMA INDUSTRIAL, Mag Specialties Inc., MAGONTEC Limited, Nanjing Yunhai Special Metal Co., Ltd 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA MAGNESIUM ALLOYS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 IMPORT EXPORT SCENARIO

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES:

4.4.1 THE THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 RAW MATERIAL COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 REGULATORY COVERAGE

5 PRODUCTION CAPACITY OUTLOOK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING USE OF MAGNESIUM ALLOYS IN THE AUTOMOTIVE INDUSTRY

6.1.2 RISING POPULARITY OF MAGNESIUM ALLOYS IN ARTIFICIAL HUMAN IMPLANTS AND MEDICAL DEVICES

6.1.3 INCREASING APPLICATIONS OF THE MATERIAL IN AEROSPACE AND DEFENSE INDUSTRIES

6.1.4 RISING USES AS A REPLACEMENT OF PLASTICS IN ELECTRONIC APPLICATIONS

6.2 RESTRAINTS

6.2.1 FLUCTUATING MAGNESIUM PRICES

6.2.2 ISSUES ASSOCIATED WITH CORROSION AND WELDING OF MAGNESIUM ALLOYS

6.2.3 ENGINEERING BARRIERS SUCH AS FORMABILITY AT ROOM TEMPERATURE AND DIFFICULTY FORGING

6.3 OPPORTUNITIES

6.3.1 INTRODUCTION OF NEW PROCESSES SUCH AS THIXOMOLDING AND NEW RHEOCASTING

6.3.2 RECYCLABLE NATURE OF MAGNESIUM ALLOYS

6.3.3 HIGH ABUNDANCE OF MAGNESIUM ELEMENTS ACROSS THE GLOBE

6.4 CHALLENGES

6.4.1 VARIOUS AVAILABILITY OF ALTERNATIVE MATERIALS FOR MAGNESIUM ALLOYS

6.4.2 PROBLEMS RELATED TO PURITY OF MAGNESIUM ALLOYS

7 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CAST ALLOY

7.3 WROUGHT ALLOY

8 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE & TRANSPORTATION

8.2.1 CAST ALLOY

8.2.2 WROUGHT ALLOY

8.3 AEROSPACE & DEFENSE

8.3.1 CAST ALLOY

8.3.2 WROUGHT ALLOY

8.4 ELECTRONICS

8.4.1 CAST ALLOY

8.4.2 WROUGHT ALLOY

8.5 POWER TOOLS

8.5.1 CAST ALLOY

8.5.2 WROUGHT ALLOY

8.6 OTHERS

8.6.1 CAST ALLOY

8.6.2 WROUGHT ALLOY

9 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA MAGNESIUM ALLOYS MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.1.1 EXPANSIONS

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 LUXFER MEL TECHNOLOGIES

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 SWOT

12.1.5 RECENT DEVELOPMENT

12.2 MAGNOTEC LIMITED

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY PROFILE

12.2.4 SWOT

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT UPDATES

12.3 RIMA INDUSTRIAL

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 SWOT

12.3.5 RECENT DEVELOPMENTS

12.4 NANJING YUNHAI SPECIAL METAL CO., LTD

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 SWOT

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATE

12.5 SHANDONG FEIXIAN COUNTY YINGUANG MAGNESIUM INDUSTRY CO. LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT DEVELOPMENT

12.6 AMACOR

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT DEVELOPMENT

12.7 DEAD SEA MAGNESIUM, DSM

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT DEVELOPMENTS

12.8 DYNACAST

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT DEVELOPMENTS

12.9 MAG SPECIALITY INC

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 SWOT

12.9.4 RECENT DEVELOPMENTS

12.1 NAMOALLOY

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT DEVELOPMENT

12.11 REGAL-MG

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT DEVELOPMENTS

12.12 US MAGNESIUM LLC

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF ARTICLES OF MAGNESIUM, N.E.S.; HS CODE – 810490 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF MAGNESIUM, N.E.S.; HS CODE – 810490 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 6 NORTH AMERICA CAST ALLOY IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA CAST ALLOY IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 8 NORTH AMERICA WROUGHT ALLOY IN NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA WROUGHT ALLOY IN NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 10 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 12 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 14 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 16 NORTH AMERICA AEROSPACE & DEFENSE IN NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA AEROSPACE & DEFENSE IN NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 18 NORTH AMERICA AEROSPACE & DEFENSE IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA AEROSPACE & DEFENSE IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 20 NORTH AMERICA ELECTRONICS IN NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA ELECTRONICS IN NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 22 NORTH AMERICA ELECTRONICS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA ELECTRONICS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 24 NORTH AMERICA POWER TOOLS IN NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA POWER TOOLS IN NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 26 NORTH AMERICA POWER TOOLS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA POWER TOOLS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 28 NORTH AMERICA OTHERS IN NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA OTHERS IN NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 30 NORTH AMERICA OTHERS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA OTHERS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 32 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 34 NORTH AMERICA MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 36 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 38 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 40 NORTH AMERICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 42 NORTH AMERICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 44 NORTH AMERICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 46 NORTH AMERICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 48 U.S. MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 50 U.S. MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 52 U.S. AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 54 U.S. AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 U.S. AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 56 U.S. ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 58 U.S. POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 59 U.S. POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 60 U.S. OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 61 U.S. OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 62 CANADA MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 64 CANADA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 66 CANADA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 CANADA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 68 CANADA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 CANADA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 70 CANADA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 CANADA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 72 CANADA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 CANADA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 74 CANADA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 CANADA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 76 MEXICO MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 77 MEXICO MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 78 MEXICO MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 MEXICO MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 80 MEXICO AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 81 MEXICO AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 82 MEXICO AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 83 MEXICO AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 84 MEXICO ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 MEXICO ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 86 MEXICO POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 MEXICO POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 88 MEXICO OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 MEXICO OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

그림 목록

FIGURE 1 NORTH AMERICA MAGNESIUM ALLOYS MARKET

FIGURE 2 NORTH AMERICA MAGNESIUM ALLOYS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MAGNESIUM ALLOYS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MAGNESIUM ALLOYS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MAGNESIUM ALLOYS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MAGNESIUM ALLOYS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA MAGNESIUM ALLOYS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA MAGNESIUM ALLOYS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA MAGNESIUM ALLOYS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA MAGNESIUM ALLOYS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA MAGNESIUM ALLOYS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA MAGNESIUM ALLOYS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA MAGNESIUM ALLOYS MARKET: SEGMENTATION

FIGURE 14 THE GROWING USE OF MAGNESIUM ALLOYS IN THE AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA MAGNESIUM ALLOYS MARKET IN THE FORECAST PERIOD

FIGURE 15 CAST ALLOY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MAGNESIUM ALLOY MARKET IN 2022 & 2029

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA MAGNESIUM ALLOYS MARKET

FIGURE 18 NORTH AMERICA MAGNESIUM ALLOYS MARKET: BY PRODUCT, 2021

FIGURE 19 NORTH AMERICA MAGNESIUM ALLOYS MARKET: BY APPLICATION, 2021

FIGURE 20 NORTH AMERICA MAGNESIUM ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA MAGNESIUM ALLOYS MARKET: BY PRODUCT (2022-2029)

FIGURE 25 NORTH AMERICA MAGNESIUM ALLOYS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.