>북미 리튬 이온 배터리 재활용 시장, 구성 요소(활성 물질, 비활성 물질), 화학(리튬-니켈 망간 코발트(Li-NMC), 리튬 코발트 산화물(LCO), 리튬-망간 산화물(LMO), 리튬-철 인산염 (LFP), 리튬-니켈 코발트 알루미늄 산화물(NCA), 리튬-티타네이트 산화물(LTO)), 재활용 공정(습식 제련 공정, 건식 제련 공정, 물리적/기계적 공정) - 산업 동향 및 2029년까지의 예측.

시장 분석 및 규모

리튬 이온 배터리는 충전 중에 전해질을 통해 음극에서 양극으로 이동 하고 충전 시 뒤로 이동하는 리튬 이온으로 구성됩니다. 이러한 배터리는 충전이 가능하며 가전제품과 자동차에 일반적으로 사용됩니다. 양극, 양극, 분리막 및 전해질의 네 가지 구성 요소로 구성됩니다. 양극 은 양극에서 리튬 이온을 저장하고 방출하여 외부 회로를 통해 전류를 통과시키는 데 도움이 됩니다. 음극은 배터리의 용량과 평균 전압을 결정하는 리튬 이온의 공급원 역할을 합니다. 전해는 기본적으로 이온의 이동을 돕는 매체입니다. 분리막은 기본적으로 음극과 양극 사이의 접촉을 방지하는 데 도움이 됩니다. 알루미늄 호일은 음극의 전류 수집기로 사용되고 구리 호일은 양극의 전류 수집기로 사용됩니다. 네 가지 구성 요소를 모두 조합하면 다양한 응용 분야에 전원을 공급하는 데 사용되는 셀이 됩니다. 셀 클러스터로 모듈이 형성되고 모듈 클러스터로 팩이 형성됩니다. 리튬 이온 배터리는 다른 충전식 배터리보다 높은 에너지 밀도, 전압 용량 및 낮은 자가 방전율을 제공합니다. 이로 인해 광범위한 응용 분야에 매우 적합합니다.

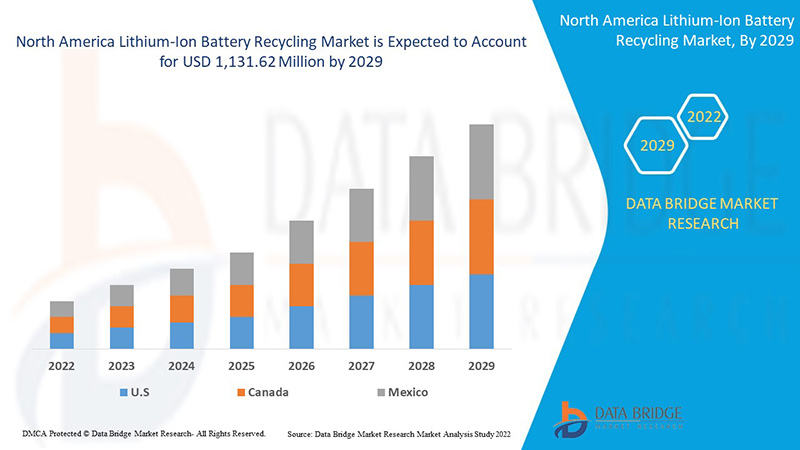

Data Bridge Market Research는 북미 리튬 이온 배터리 재활용 시장이 2029년까지 1,131.62백만 달러에 도달할 것으로 예상하며, 예측 기간 동안 CAGR은 19.7%라고 분석했습니다. 리튬 이온 배터리 재활용 시장 보고서는 또한 가격 분석, 특허 분석 및 기술 발전에 대한 심층적인 내용을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

성분별(활성 물질, 비활성 물질), 화학(리튬-니켈 망간 코발트(Li-NMC), 리튬 코발트 산화물(LCO), 리튬-망간 산화물(LMO), 리튬-철 인산염 (LFP), 리튬-니켈 코발트 알루미늄 산화물(NCA), 리튬-티타네이트 산화물(LTO)), 재활용 공정(수소야금 공정, 건식야금 공정, 물리적/기계적 공정) |

|

적용 국가 |

북미의 미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Glencore, Retriev Technologies, Umicore, American Manganese Inc., Li-Cycle Corp, TES, Contemporary Amperex Technology Co., Limited, Ganfeng Lithium Co.,Ltd., OnTo Technology LLC, Lithion Recycling, ECOBAT, Veolia Environnement SA, Batrec Industrie, Redwood Materials, Inc. |

Lithium-Ion Battery Recycling Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rising demand for smart phones & consumer electronics

The demands and requirements of consumer electronics have continued to increase at an exponential rate. Lithium-ion batteries are common in consumer electronics. They are one of the most popular types of rechargeable battery for portable electronics, with proper energy-to-weight ratios, high open circuit voltage and low self-discharge rate. The advancement in technologies has compacted the size of electronic devices making it slimmer and lightweight which is increasing the requirement of lithium ion battery. The lithium ion battery last longer, charge faster and have a higher power density for more battery life in a lighter package.

- Penetration of low carbon generation transportation fleet

Road transport emissions account for almost 75% of all transport GHG (greenhouse gas) emissions and 11% of global GHG emissions. Electrification is the key decarburization lever for road transport. In contrast, Electric vehicle currently emits 30-60% fewer emissions than combustion engines depending on the power mix. Without action, global road transport emissions would continue to grow as a result of increased transport needs supplied by fossil fuels. However, electrification helps to reduce CO2 emissions and improve air quality by avoiding mixing of toxic gases. To mitigate climate change and create a fossil fuel-free economy, the global community has agreed that GHG emissions must be reduced rapidly and significantly. Li-ion batteries are thus considered as the promising clean technology to replace the conventional fossil-fuel powered device. Compared to the other high-quality rechargeable battery technologies, Li-ion batteries have highest energy densities of any battery technology today (100-265 Wh/kg or 250-670 Wh/L). Li-ion batteries are also used to power electrical systems for some aerospace applications, being environmental friendly & lightweight is the major factor among others.

Opportunities

- Growing number of R&D initiatives and government facilities for recycling

Lithium ion batteries have wide range of application and with more efforts put in through research and development, more advance characteristics are being developed. Companies are building new manufacturing facilities for fulfilling the surging demands of lithium ion batteries in application for electrical vehicles, medical devices and data communication. The new facilities and growing research and development is creating new opportunity for growth of global lithium ion battery market.

Restraints/Challenges

- Safety issues related to the storage and transportation of spent batteries

Lithium ions are widely used in various applications such as consumer electronics, industrial applications, medical devices and in automobiles. Lithium ion batteries are light weight and are now designed to be flexible in nature with variable shapes. However, lithium ion batteries can be extremely dangerous if defective or overcharged, packaged incorrectly, misused or mishandled. Lithium is highly reactive and flammable and can therefore cause severe damage to life and property. These characteristics can cause harm during storage, usage and transportation of lithium ion.

- Issues related to overheating of lithium-ion battery

Despite their technological promise, Li-ion batteries still have a number of shortcomings, particularly with regards to safety. Li-ion batteries have a tendency to overheat, and can be damaged at high voltages. In some cases, this can lead to thermal runaway and combustion. These batteries require safety mechanisms to limit voltage and internal pressures, which can increase weight and limit performance in some cases. Li-ion batteries are also subject to aging, meaning that they can lose capacity and frequently fail after a number of years. Another factor limiting their widespread adoption is their cost, which is around 40% higher than Ni-Cd.

Post COVID-19 Impact on Lithium-Ion Battery Recycling Market

COVID-19 created a major impact on the lithium-ion battery recycling market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods.

Post pandemic, the growth of the lithium-ion battery recycling market is attributed to the increasing adoption of electrification of automotive industry across all regions and countries. Although automotive industry faced major issues during pandemic, the electric vehicle sales jumped to higher levels in post pandemic scenario. Also demand for consumer battery operated electronics has increased over the period of time which is acting as a driver for this market’s growth.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the lithium-ion battery recycling. With this, the companies will bring advanced technologies to the market. In addition, government initiatives for usage of electric vehicle has led to the market's growth

Recent Development

- In March 2022, Li-Cycle Corp had expanded their foot printinto North America region where acenter of excellence to be established in Kingston’s Clogg’s Road business park. This will further help the company to enhance their lithium-ion battery recycling services portfolio across the market.

- In November 2021, ECOBAT had announced the expansion of its new facilities in the North American and European region into a new 5-year upsized global funding facility led by J.P. Morgan. With this, the company had aimed to offer full suite lithium battery recycling services across the region.

North America Lithium-Ion Battery Recycling Market Scope

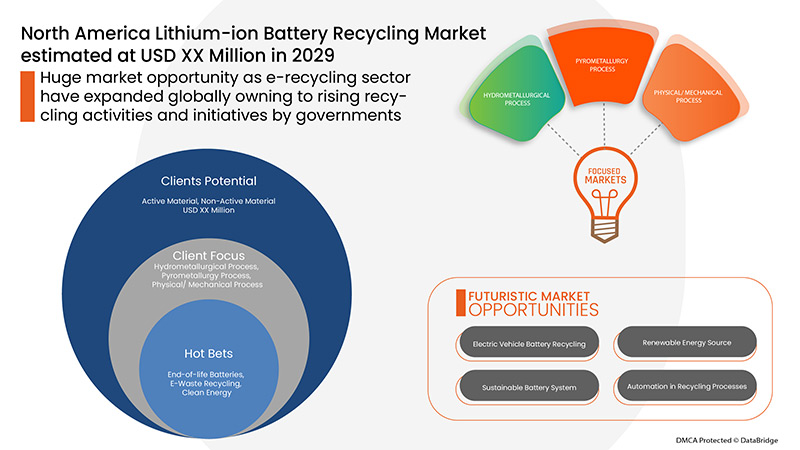

The lithium-ion battery recycling market is segmented on the basis of component, chemistry, and recycling process. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Active Material

- Non-Active Material

On the basis of component, the lithium-ion battery recycling market is segmented into active material and non-active material.

Chemistry

- Lithium-Nickel Manganese Cobalt (Li-NMC)

- Lithium Cobalt Oxide (LCO)

- Lithium-Manganese Oxide (LMO)

- Lithium-Iron Phosphate (LFP)

- Lithium-Nickel Cobalt Aluminium Oxide (NCA)

- Lithium-Titanate Oxide (LTO)

On the basis of chemistry, the lithium-ion battery recycling market has been segmented into below lithium-nickel manganese cobalt (Li-NMC), lithium cobalt oxide (LCO), lithium-manganese oxide (LMO), lithium-iron phosphate (LFP), lithium-nickel cobalt aluminium oxide (NCA), lithium-titanate oxide (LTO).

Recycling process

- Hydrometallurgical Process

- Pyrometallurgy Process

- Physical/ Mechanical Process

On the basis of recycling process, the lithium-ion battery recycling market has been segmented into hydrometallurgical process, pyrometallurgy process, physical/ mechanical process.

Lithium-Ion Battery Recycling Market Regional Analysis/Insights

The lithium-ion battery recycling market is analysed and market size insights and trends are provided by country, component, recycling process and chemistry as referenced above.

The countries covered in the lithium-ion battery recycling market report are U.S., Canada and Mexico in North America.

U.S. dominates in North America region due to increasing demand for lithium-ion batteries in electric vehicles, mobile devices and smart wearables.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 리튬 이온 배터리 재활용 시장 점유율 분석

리튬 이온 배터리 재활용 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 리튬 이온 배터리 재활용 시장과 관련된 회사의 초점에만 관련이 있습니다.

리튬 이온 배터리 재활용 시장의 주요 기업으로는 Glencore, Retriev Technologies, Umicore, American Manganese Inc., Li-Cycle Corp, TES, Contemporary Amperex Technology Co., Limited, Ganfeng Lithium Co.,Ltd., OnTo Technology LLC, Lithion Recycling, ECOBAT, Veolia Environnement SA, Batrec Industrie, Redwood Materials, Inc. 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MANUFACTURING OUTLOOK

4.2 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.3 PORTER’S FIVE FORCES

4.4 VENDOR SELECTION CRITERIA

4.5 PESTEL ANALYSIS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR SMART PHONES & CONSUMER ELECTRONICS

6.1.2 PENETRATION OF LOW CARBON GENERATION TRANSPORTATION FLEET

6.1.3 INCREASE IN DEMAND FOR LITHIUM-ION BATTERIES FOR VARIOUS INDUSTRIAL APPLICATIONS

6.1.4 RISE IN THE NUMBER OF ELECTRIC VEHICLES ACROSS THE REGION

6.1.5 INCREASE IN THE ADOPTION OF LITHIUM-ION BATTERIES IN THE DEFENSE SECTOR

6.2 RESTRAINTS

6.2.1 SAFETY ISSUES RELATED TO THE STORAGE AND TRANSPORTATION OF SPENT BATTERIES

6.2.2 STRINGENT GOVERNMENT REGULATIONS AND POLICIES FOR RECYCLING OF LITHIUM-ION BATTERY

6.3 OPPORTUNITIES

6.3.1 GROWING NUMBER OF R&D INITIATIVES AND GOVERNMENT FACILITIES FOR RECYCLING

6.3.2 RISE IN ACQUISITIONS & PARTNERSHIPS AMONG VARIOUS ORGANIZATIONS

6.3.3 INCREASE IN GROWTH OF RENEWABLE ENERGY ACROSS THE REGION

6.3.4 HIGHER ADOPTION OF CORDLESS POWER TOOLS

6.4 CHALLENGES

6.4.1 ISSUES RELATED TO OVERHEATING OF LITHIUM-ION BATTERY

6.4.2 HIGHER DEGRADATION RATE OF LITHIUM-ION BATTERY

7 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 ACTIVE MATERIAL

7.3 NON-ACTIVE MATERIAL

8 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY

8.1 OVERVIEW

8.2 LITHIUM-NICKEL MANGANESE COBALT (LI-NMC)

8.3 LITHIUM COBALT OXIDE (LCO)

8.4 LITHIUM-MANGANESE OXIDE (LMO)

8.5 LITHIUM-IRON PHOSPHATE (LFP)

8.6 LITHIUM-NICKEL COBALT ALUMINIUM OXIDE (NCA)

8.7 LITHIUM-TITANATE OXIDE (LTO)

9 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS

9.1 OVERVIEW

9.2 HYDROMETALLURGICAL PROCESS

9.3 PYROMETALLURGY PROCESS

9.4 PHYSICAL/ MECHANICAL PROCESS

10 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 GLENCORE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SOLUTION CATEGORIES

13.2.5 ECENT DEVELOPMENT

13.3 UMICORE

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT POTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 GEM CO., LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 VEOLIA

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ACCUREC-RECYCLING GMBH

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AKKUSER OY

13.7.1 COMPANY SNAPSHOT

13.7.2 SERVICE PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 AMERICAN MANGANESE INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 ATTERO RECYCLING PVT. LTD.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 BATREC INDUSTRIE

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 CAWLEYS

13.11.1 COMPANY SNAPSHOT

13.11.2 SERVICE PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 DUESENFELD GMBH

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 ECOBAT

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 ENVIROSTREAM AUSTRALIA PTY LTD

13.14.1 COMPANY SNAPSHOT

13.14.2 SERVICE PORTFOLIO

13.14.3 RECENT DEVELOPMENTS

13.15 FORTUM

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 GANFENG LITHIUM CO., LTD

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 LI-CYCLE CORP

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 SERVICE PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 LITHION RECYCLING

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 NEOMETALS LTD

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 NICKELHÜTTE AUE GMBH

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 ONTO TECHNOLOGY LLC

13.21.1 COMPANY SNAPSHOT

13.21.2 SERVICE PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

13.22 REDWOOD MATERIALS, INC.,

13.22.1 COMPANY SNAPSHOT

13.22.2 SERVICE PORTFOLIO

13.22.3 RECENT DEVELOPMENT

13.23 RETRIEV TECHNOLOGIES

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

13.24 SAUBERMACHER DIENSTLEISTUNGS AG

13.24.1 COMPANY SNAPSHOT

13.24.2 PRODUCT PORTFOLIO

13.24.3 RECENT DEVELOPMENT

13.25 TATA CHEMICALS LTD.

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 PRODUCT PORTFOLIO

13.25.4 RECENT DEVELOPMENT

13.26 TES

13.26.1 COMPANY SNAPSHOT

13.26.2 PRODUCT PORTFOLIO

13.26.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

표 목록

TABLE 1 LIST OF THE COMPANIES WITH THEIR RECYCLING PROCESS AND APPROXIMATE CAPACITY

TABLE 2 STANDARDS RELATED TO LITHIUM-ION BATTERIES

TABLE 3 POLICIES RELEVANT TO LIB RECYCLING PUBLISHED IN CHINA

TABLE 4 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA ACTIVE MATERIAL IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA NON-ACTIVE MATERIAL IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA LITHIUM-NICKEL MANGANESE COBALT (LI-NMC) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA LITHIUM COBALT OXIDE (LCO) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA LITHIUM-MANGANESE OXIDE (LMO) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA LITHIUM-IRON PHOSPHATE (LFP) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA LITHIUM-NICKEL COBALT ALUMINUM OXIDE (NCA) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA LITHIUM-TITANATE OXIDE (LTO) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HYDROMETALLURGICAL PROCESS IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA PYROMETALLURGY PROCESS IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA PHYSICAL/ MECHANICAL PROCESS IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 22 U.S. LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 23 U.S. LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 24 U.S. LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 25 CANADA LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 26 CANADA LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 27 CANADA LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 28 MEXICO LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 29 MEXICO LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 30 MEXICO LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR SMARTPHONES AND CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET IN 2022 & 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET IN THE FORECAST PERIOD OF 2020 TO 2029

FIGURE 13 HISTORICAL DATA FOR ANNUAL NORTH AMERICA LITHIUM-ION BATTERY DEPLOYMENT FOR ALL MARKETS

FIGURE 14 REGION WITH LITHIUM ION BATTERY RECYCLING CAPACITY FOR ALL APPLICATIONS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET

FIGURE 16 PROJECTION OF STEADY GROWTH FOR DEMAND FOR CONSUMER ELECTRONICS (2015-2025)

FIGURE 17 NUMBER OF PLUG-IN ELECTRIC PASSENGER CAR SALES IN 2020 IN UNITS

FIGURE 18 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY COMPONENT, 2021

FIGURE 19 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY CHEMISTRY, 2021

FIGURE 20 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY RECYCLING PROCESS, 2021

FIGURE 21 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: BY COMPONENT (2022-2029)

FIGURE 26 NORTH AMERICA LITHIUM-ION BATTERY RECYCLING MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.