North America Left Ventricular Assist Device (LVAD) Market, By Product Type (Heart Pump, Controller, Batteries, and Wires), Therapy (Bridge-To-Transplant (BTT) Therapy, Destination Therapy, Bridge-To-Candidacy (BTC) Therapy, and Bridge-To-Recovery (BTR) Therapy), Age Group (Adult and Pediatric), Indication (Congestive Heart Failure, Congenital Heart Disease, Myocarditis, Cardiac Arrest, Familial Arrhythmias and Arrhythmic, Cardiomyopathies, Advanced Heart Failure, and Others), Generation (Second Generation Devices, Third Generation Devices, and First Generation Devices), Durability (Long-Term, Intermediate-Term, and Short-Term), Design (Axial and Centrifugal), Pulse Type (Nonpulsatile and Pulsatile), End User (Hospitals, Cardiac Cath Laboratories, Specialty Clinics, and Others), Distribution Channel (Direct Tender, Retail Sales, and Others) - Industry Trends and Forecast to 2029.

North America Left Ventricular Assist Device (LVAD) Market Analysis and Size

A left ventricular assist device (LVAD) is a mechanical pump implanted in patients with heart failure. It helps the left bottom chamber of the heart (left ventricle) pump blood out of the ventricle to the aorta and the rest of the body. It is used for patients who have reached end-stage heart failure. The LVAD is surgically implanted, a battery-operated mechanical pump, which helps the left ventricle (main pumping chamber of the heart) pump blood to the rest of the body.

The occurrence of cardiovascular illnesses is growing at a rapid pace. It is estimated that advanced cardiovascular breakdown affects around 2.3% of North America's total population and is a severe socioeconomic burden. Further strong emphasis on R&D exercises aimed at the development of progressively enticing devices, as well as optimum government efforts, drive the left ventricular assist device (LVAD) market. Furthermore, the Canadian market is likely to benefit from low-intensity competition in the vendor landscape, making the country an attractive investment ground for firms looking to enter the sector of ventricular assist devices. The enormous pool of patients awaiting donor hearts for transplant gives commercial opportunities. However, there are dangers associated with the LVAD implant, and these hazards have an influence on market growth by acting as a restraining factor. Furthermore, the sector is currently confronted with a number of challenges, including barriers to DT adoption and safety concerns.

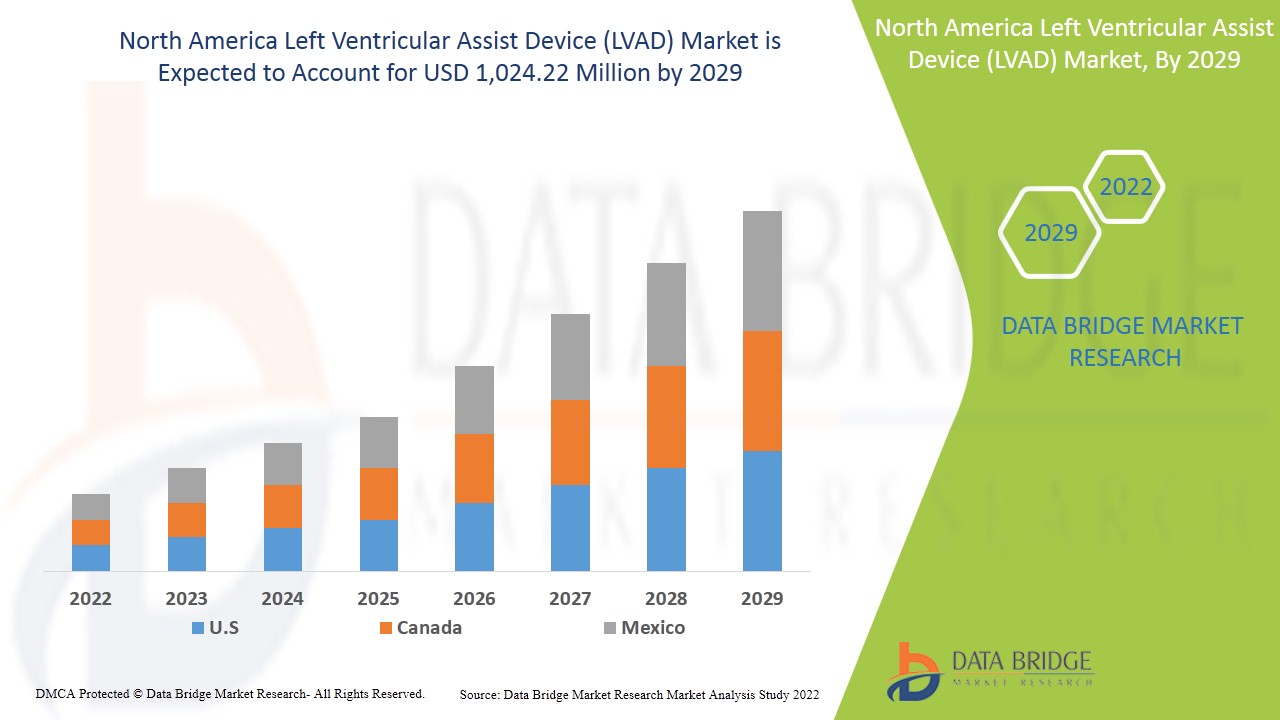

북미 좌심실 보조 장치(LVAD) 시장은 2022년에서 2029년의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년에서 2029년의 예측 기간 동안 9.5%의 CAGR로 성장하고 있으며 2029년까지 1,024.22백만 달러에 도달할 것으로 예상된다고 분석합니다. 좌심실 보조 장치의 기술적 발전이 증가함에 따라 좌심실 보조 장치(LVAD) 시장 성장이 촉진되고 있습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2015-2020으로 사용자 정의 가능) |

|

양적 단위 |

매출은 백만 달러, 볼륨은 단위, 가격은 달러로 표시 |

|

다루는 세그먼트 |

제품 유형별(심장 펌프, 컨트롤러, 배터리 및 전선), 치료(BTT(Bridge-To-Transplant) 치료, 목적지 치료, BTC(Bridge-To-Candidacy) 치료 및 BTR(Bridge-To-Recovery) 치료), 연령대별(성인 및 소아), 적응증(울혈성 심부전, 선천성 심장병, 심근염, 심장마비, 가족성 부정맥 및 부정맥, 심근병증, 진행성 심부전 및 기타), 세대별(2세대 기기, 3세대 기기 및 1세대 기기), 내구성(장기, 중기 및 단기), 설계(축 및 원심), 맥박 유형(비맥박 및 맥박), 최종 사용자(병원, 심장 카테터 실험실, 전문 병원 및 기타), 유통 채널(직접 입찰, 소매 판매 및 기타) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

시장에서 거래하고 있는 주요 회사로는 ABIOMED, Abbott, Berlin Heart, Saft, Jarvik Heart, Inc., CorWave SA, Evaheart, Inc. 등이 있습니다. |

시장 정의

좌심실 보조 장치(LVAD)는 심부전 환자에게 이식하는 기계적 펌프입니다. 심장의 왼쪽 하부 챔버(좌심실)가 심실에서 대동맥과 신체의 나머지 부분으로 혈액을 펌핑하도록 돕습니다.

말기 심부전에 도달한 환자에게 사용됩니다. LVAD는 수술적으로 이식되는 배터리로 작동하는 기계적 펌프로, 좌심실(심장의 주요 펌핑 챔버)이 신체의 나머지 부분으로 혈액을 펌핑하는 데 도움이 됩니다. LVAD는 다음과 같이 사용할 수 있습니다.

심혈관 질환의 높은 유병률, 기술의 진보, 의료비 지출의 증가는 북미 좌심실 보조 장치(LVAD) 시장 성장을 촉진하고 있습니다.

북미 좌심실 보조 장치(LVAD) 시장 동향

이 섹션에서는 시장 동인, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

운전자

- 심장 질환 유병률 증가와 함께 노령 인구 증가

심장 질환의 유병률도 북미 전역의 노령 인구 증가에 따라 증가하고 있습니다. 약 4천만 명의 시각 장애인이 있으며, 대부분이 노령 인구에 속합니다. 그러나 모든 연구에 따르면 노령 인구에서 심장 질환의 유병률이 높습니다. 나이가 들고 노인 인구에서 심부전과 같은 심장 질환의 유병률이 증가함에 따라 적절한 치료와 약물도 증가하고 있습니다. 또한 인구 증가로 인해 의료 시스템에 대한 압박이 커져 치료, 서비스 및 기술에 대한 필요성이 빠르게 증가하고 있습니다. 따라서 노령 인구 증가로 인해 북미 좌심실 보조 장치(LVAD) 시장이 성장할 것으로 예상됩니다.

- 유리한 환불 정책의 존재

의료보험 및 의료급여 서비스 센터(CMS)는 심실 보조 장치(CMS, 2010) 적용 기준을 완화하는 결정 각서를 발표했습니다. CMS 정책은 신체 크기 기준을 제거하고 실패한 의료 치료의 필요 기간과 최대 산소 소비량에 대한 제한을 완화합니다. 따라서 유리한 환불 정책이 예측 연도에 북미 좌심실 보조 장치(LVAD) 시장을 주도할 것으로 예상됩니다.

기회

- 의료비 지출 증가

북미에서는 가처분 소득이 증가함에 따라 의료비가 증가했습니다. 게다가 인구 수요를 충족하기 위해 정부 기관과 의료 기관은 의료비를 가속화하여 주도권을 잡고 있습니다. 의료비 증가는 동시에 의료 기관이 다양한 심혈관 질환에 대한 치료 시설을 개선하고 최근 몇 년 동안 이 질환이 매우 유행했기 때문에 수술적 치료를 제공하는 데 도움이 됩니다.

의료비 지출 증가는 시장에 더 많은 치료 옵션, 무료 진단, 조기 진단을 촉진하기 위한 다양한 프로그램을 제공함으로써 기회를 제공했습니다. 게다가, 정부의 의료비 지출은 증가하는 경제적 부담을 낮추기 위해 관리 및 환자 결과를 개선하는 전략에 자원을 할당하는 데 집중되어 있습니다.

증가하는 의료비 지출은 또한 추가적인 경제 성장과 의료 부문 성장에 유익하며, 이러한 심장 질환에 대한 더 좋고 더 진보된 장치의 개발에 상당한 영향을 미치기 때문에 주로 유익합니다. 따라서 의료비 지출의 급증은 북미 좌심실 보조 장치(LVAD) 시장에 더 큰 기회입니다.

제약/도전

- LVAD 이식 및 치료의 높은 비용

비이노트로프 의존성 심부전 환자의 LVAD는 삶의 질을 개선하지만 빈번한 재입원과 값비싼 후속 치료로 인해 평생 비용이 크게 증가합니다. 좌심실 보조 장치는 또한 고용과 경력을 증가시켜 재정에 영향을 미칩니다.

LVAD 이식 및 치료 비용이 높으면 환자에게 재정적 부담과 어려움이 따릅니다. 게다가 후속 치료 비용이 높으면 환자의 재정적 부담이 더 커져 시장 성장이 제한됩니다.

북미 좌심실 보조 장치(LVAD) 시장 보고서는 최근의 새로운 개발 사항, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 현지 시장 참여자의 영향, 새로운 수익 창출 기회 분석, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주별 시장 성장, 응용 분야 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 세부 정보를 제공합니다.

최근 개발

- 2020년 12월 21일, 미국 식품의약국(FDA)은 12월 17일 진행성 내성 좌심실 심부전 소아 환자에게 사용되는 Abbott의 HeartMate 3 좌심실 보조 장치(LVAD)에 대한 업데이트된 라벨링을 승인했습니다.

북미 좌심실 보조 장치(LVAD) 시장 범위

북미 좌심실 보조 장치(LVAD) 시장은 제품 유형, 치료, 연령대, 적응증, 세대, 내구성, 디자인, 펄스 유형, 최종 사용자 및 유통 채널을 기준으로 10개의 주요 세그먼트로 분류됩니다. 이러한 세그먼트의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 통찰력을 제공하는 데 도움이 됩니다.

제품 유형별

- 심장 펌프

- 제어 장치

- 배터리

- 전선

제품 유형을 기준으로, 북미 좌심실 보조 장치(LVAD) 시장은 심장 펌프, 컨트롤러, 배터리, 전선으로 세분화됩니다. 배터리는 충전식과 비충전식으로 더 세분화됩니다.

치료를 통해

- 브릿지-투-트랜스플랜트(BTT) 치료

- 목적지 테라피

- 후보자 브리지(BTC) 치료

- 회복을 위한 다리(BTR) 치료

치료법을 기준으로 보면, 북미 좌심실 보조 장치(LVAD) 시장은 이식을 위한 브리지(BTT) 치료법, 목적지 치료법, 후보자를 위한 브리지(BTC) 치료법, 회복을 위한 브리지(BTR) 치료법으로 세분화됩니다.

연령대별

- 성인

- 소아과

연령대를 기준으로 북미 좌심실 보조 장치(LVAD) 시장은 성인용과 소아용으로 구분됩니다.

지시에 따라

- 울혈성 심부전

- 선천성 심장병

- 심근염

- 심정지

- 가족성 부정맥 및 부정맥

- 심근병증

- 심부전 진행

- 기타

북미 좌심실 보조 장치(LVAD) 시장은 증상에 따라 심부전, 선천적 심장병, 심근염, 심장마비, 가족성 부정맥 및 부정맥성 심근병, 진행성 심부전 등으로 구분됩니다.

세대별

- 2세대 장치

- 3세대 장치

- 1세대 장치

세대별로 보면 북미 좌심실 보조 장치(LVAD) 시장은 2세대 장치, 3세대 장치, 1세대 장치로 구분됩니다.

내구성에 따라

- 장기적으로

- 중급-기간

- 단기

내구성을 기준으로 북미 좌심실 보조 장치(LVAD) 시장은 장기, 중기, 단기로 구분됩니다.

디자인에 의해

- 축방향

- 원심 분리기

디자인을 기준으로 북미 좌심실 보조 장치(LVAD) 시장은 축형과 원심형으로 구분됩니다.

펄스 유형별

- 비맥동성

- 타악기

맥박 유형을 기준으로 북미 좌심실 보조 장치(LVAD) 시장은 비맥박형과 맥박형으로 구분됩니다.

최종 사용자별

- 병원

- 심장 카테터 실험실

- 전문 클리닉

- 기타

최종 사용자를 기준으로 북미 좌심실 보조 장치(LVAD) 시장은 병원, 전문 클리닉, 심장 카테터 검사실 및 기타로 구분됩니다.

유통 채널별

- 직접 입찰

- 소매 판매

- 기타

유통 채널을 기준으로 북미 좌심실 보조 장치(LVAD) 시장은 직접 입찰, 소매 판매 및 기타로 구분됩니다.

북미 좌심실 보조 장치(LVAD) 시장 지역 분석/통찰력

북미 좌심실 보조 장치(LVAD) 시장을 분석하고, 위에 언급된 대로 국가, 제품 유형, 치료법, 연령대, 적응증, 세대, 내구성, 디자인, 펄스 유형, 최종 사용자 및 유통 채널별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 좌심실 보조 장치(LVAD) 시장은 미국, 캐나다, 멕시코와 같은 국가를 포함하며 심장 질환 사례 증가와 노령 인구 증가로 인해 성장할 것으로 예상됩니다. 심실 질환 위험 증가도 시장 성장을 견인하고 있습니다.

미국은 첨단 기술, 심장 질환의 높은 유병률, 확립된 의료 시스템의 존재로 인해 북미 좌심실 보조 장치(LVAD) 시장을 지배할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변경 사항을 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 다른 브랜드의 존재 및 가용성과 지역 및 국내 브랜드의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 좌심실 보조 장치(LVAD) 시장 점유율 분석

북미 좌심실 보조 장치(LVAD) 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 국가적 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우위가 포함됩니다. 위에 제공된 데이터 포인트는 골다공증 약물 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 좌심실 보조 장치(LVAD) 시장의 주요 기업으로는 ABIOMED, Abbott, Berlin Heart, Saft, Jarvik Heart, Inc., CorWave SA, Evaheart, Inc. 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S

4.3 INDUSTRIAL INSIGHTS:

5 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: REGULATIONS

5.1 REGULATION IN U.S.

5.1.1 GUIDELINES-

5.2 REGULATION IN CANADA

5.2.1 GUIDELINES FOR THE MANUFACTURERS:

5.3 REGULATION IN MEXICO

5.3.1 GUIDELINES FOR THE MANUFACTURERS:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING GERIATRIC POPULATION ALONG WITH RISING PREVALENCE OF CARDIAC DISEASES

6.1.2 PRESENCE OF FAVOURABLE REIMBURSEMENT POLICIES

6.1.3 CHANGING LIFESTYLE TRIGGERS THE DEVELOPMENT OF CARDIOVASCULAR DISEASES

6.2 RESTRAINTS

6.2.1 HIGH COST OF LVAD IMPLANTATION AND TREATMENT

6.2.2 COMPLICATIONS AND RISKS ASSOCIATED WITH LVAD

6.3 OPPORTUNITIES

6.3.1 INCREASE IN HEALTHCARE EXPENDITURE

6.3.2 INCREASE IN MINIMALLY INVASIVE PROCEDURE

6.3.3 INCREASING SHORTAGE OF ORGAN DONORS

6.3.4 TECHNOLOGICAL ADVANCEMENTS IN LEFT VENTRICULAR ASSIST DEVICES

6.4 CHALLENGES

6.4.1 ONGOING COVID-19

6.4.2 INCREASE IN PRODUCT RECALL

7 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 HEART PUMP

7.3 CONTROLLER

7.4 BATTERIES

7.4.1 RECHARGEABLE

7.4.2 NON-RECHARGEABLE

7.5 WIRES

8 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY

8.1 OVERVIEW

8.2 BRIDGE-TO-TRANSPLANT (BTT) THERAPY

8.2.1 HEART PUMP

8.2.2 CONTROLLER

8.2.3 BATTERIES

8.2.4 WIRES

8.3 DESTINATION THERAPY

8.3.1 HEART PUMP

8.3.2 CONTROLLER

8.3.3 BATTERIES

8.3.4 WIRES

8.4 BRIDGE-TO-CANDIDACY (BTC) THERAPY

8.4.1 HEART PUMP

8.4.2 CONTROLLER

8.4.3 BATTERIES

8.4.4 WIRES

8.5 BRIDGE-TO-RECOVERY (BTR) THERAPY

8.5.1 HEART PUMP

8.5.2 CONTROLLER

8.5.3 BATTERIES

8.5.4 WIRES

9 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP

9.1 OVERVIEW

9.2 ADULT

9.2.1 19-39 YEARS

9.2.2 40-59 YEARS

9.2.3 60-79 YEARS

9.2.4 ABOVE 80 YEARS

9.3 PEDIATRIC

10 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION

10.1 OVERVIEW

10.2 SECOND GENERATION DEVICES

10.3 THIRD GENERATION DEVICES

10.4 FIRST GENERATION DEVICES

11 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN

11.1 OVERVIEW

11.2 AXIAL

11.3 CENTRIFUGAL

12 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION

12.1 OVERVIEW

12.2 CONGESTIVE HEART FAILURE

12.2.1 HEART PUMP

12.2.2 CONTROLLER

12.2.3 BATTERIES

12.2.4 WIRES

12.3 CONGENITAL HEART DISEASE

12.3.1 HEART PUMP

12.3.2 CONTROLLER

12.3.3 BATTERIES

12.3.4 WIRES

12.4 MYOCARDITIS

12.4.1 HEART PUMP

12.4.2 CONTROLLER

12.4.3 BATTERIES

12.4.4 WIRES

12.5 CARDIAC ARREST

12.5.1 HEART PUMP

12.5.2 CONTROLLER

12.5.3 BATTERIES

12.5.4 WIRES

12.6 FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES

12.6.1 HEART PUMP

12.6.2 CONTROLLER

12.6.3 BATTERIES

12.6.4 WIRES

12.7 ADVANCED HEART FAILURE

12.7.1 HEART PUMP

12.7.2 CONTROLLER

12.7.3 BATTERIES

12.7.4 WIRES

12.8 OTHERS

13 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY DURABILITY

13.1 OVERVIEW

13.2 LONG-TERM

13.3 INTERMEDIATE-TERM

13.4 SHORT-TERM

14 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY PULSE TYPE

14.1 OVERVIEW

14.2 NONPULSATILE

14.3 PULSATILE

15 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITAL

15.3 CARDIAC CATH LABORATORIES

15.4 SPECIALTY CLINICS

15.5 OTHERS

16 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.4 OTHERS

17 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY NORTH AMERICA

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 ABIOMED

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.1.5.1 FDA APPROVAL

20.1.5.2 FDA APPROVAL

20.2 ABBOTT

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.2.5.1 SUPPLY INCREMENT

20.2.5.2 BREAK THROUGH DEVICE DESIGNATION

20.3 BERLIN HEART

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.3.4.1 PRODUCT APPROVAL

20.4 SAFT (A SUBSIDIARY OF TOTALENERGIES)

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENT

20.4.5.1 PARTNERSHIP

20.5 JARVIK HEART, INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.5.4.1 FDA APPROVAL

20.6 CORWAVE SA

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.6.3.1 EXPANSION

20.7 EVAHEART, INC

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.7.3.1 PRODUCT TRIAL

21 QUESTIONNAIRE

22 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 26 U.S. BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 28 U.S. BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 29 U.S. DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 30 U.S. BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 31 U.S. BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 32 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 33 U.S. ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 34 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 35 U.S. CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 36 U.S. CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 37 U.S. MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 38 U.S. CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 39 U.S. FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 40 U.S. ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 41 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 42 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 43 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 44 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 47 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 49 CANADA BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 51 CANADA BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 52 CANADA DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 53 CANADA BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 54 CANADA BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 55 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 56 CANADA ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 57 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 58 CANADA CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 59 CANADA CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 60 CANADA MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 61 CANADA CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 62 CANADA FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 63 CANADA ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 64 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 65 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 66 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 67 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 68 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 72 MEXICO BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 74 MEXICO BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 75 MEXICO DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 76 MEXICO BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 77 MEXICO BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 78 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 79 MEXICO ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 80 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 82 MEXICO CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 83 MEXICO MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 84 MEXICO CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 85 MEXICO FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 86 MEXICO ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 87 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 88 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 89 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 90 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET:VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF CARDIOVASCULAR DISEASE AND RISING HEALTHCARE EXPENDITURE ARE EXPECTED TO DRIVE THE NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HEART PUMP SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET

FIGURE 14 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, 2021

FIGURE 19 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, 2020-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, 2021

FIGURE 23 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, 2020-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 26 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, 2021

FIGURE 27 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, 2020-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, 2021

FIGURE 31 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, 2020-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, LIFELINE CURVE

FIGURE 34 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, 2021

FIGURE 35 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, 2020-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 38 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, 2021

FIGURE 39 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, 2020-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, CAGR (2022-2029)

FIGURE 41 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, LIFELINE CURVE

FIGURE 42 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, 2021

FIGURE 43 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, 2020-2029 (USD MILLION)

FIGURE 44 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, CAGR (2022-2029)

FIGURE 45 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, LIFELINE CURVE

FIGURE 46 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, 2021

FIGURE 47 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 48 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 49 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 50 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 51 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 52 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 53 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 54 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: SNAPSHOT (2021)

FIGURE 55 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY COUNTRY (2021)

FIGURE 56 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 57 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 58 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 59 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.