북미 IVD 규제 업무 아웃소싱 시장, 서비스별(규제 문서 작성 및 제출, 규제 등록 및 임상 시험 신청, 규제 컨설팅, 법률 대리, 데이터 관리 서비스, 화학 제조 및 제어(CMC) 서비스 및 기타), 지표(종양학, 신경학, 심장학, 임상 화학 및 면역 검정, 정밀 의학, 감염성 질환, 당뇨병, 유전자 검사, HIV/AIDS, 혈액학 , 약물 검사/약리유전체학, 수혈, 진료 시점 및 기타), 배포 모드(클라우드 및 온프레미스), 조직 규모(중소기업(SMES) 및 대기업), 단계(임상, 전임상 및 PMA(시판 후 허가)), 클래스(클래스 I, 클래스 II 및 클래스 III), 최종 사용자(제약 회사, 의료 기기 회사, 생명 공학 회사 및 기타), 국가(미국, 캐나다, 멕시코) 산업 동향 및 예측 2029년.

시장 분석 및 통찰력 : 북미 IVD 규제 업무 아웃소싱 시장

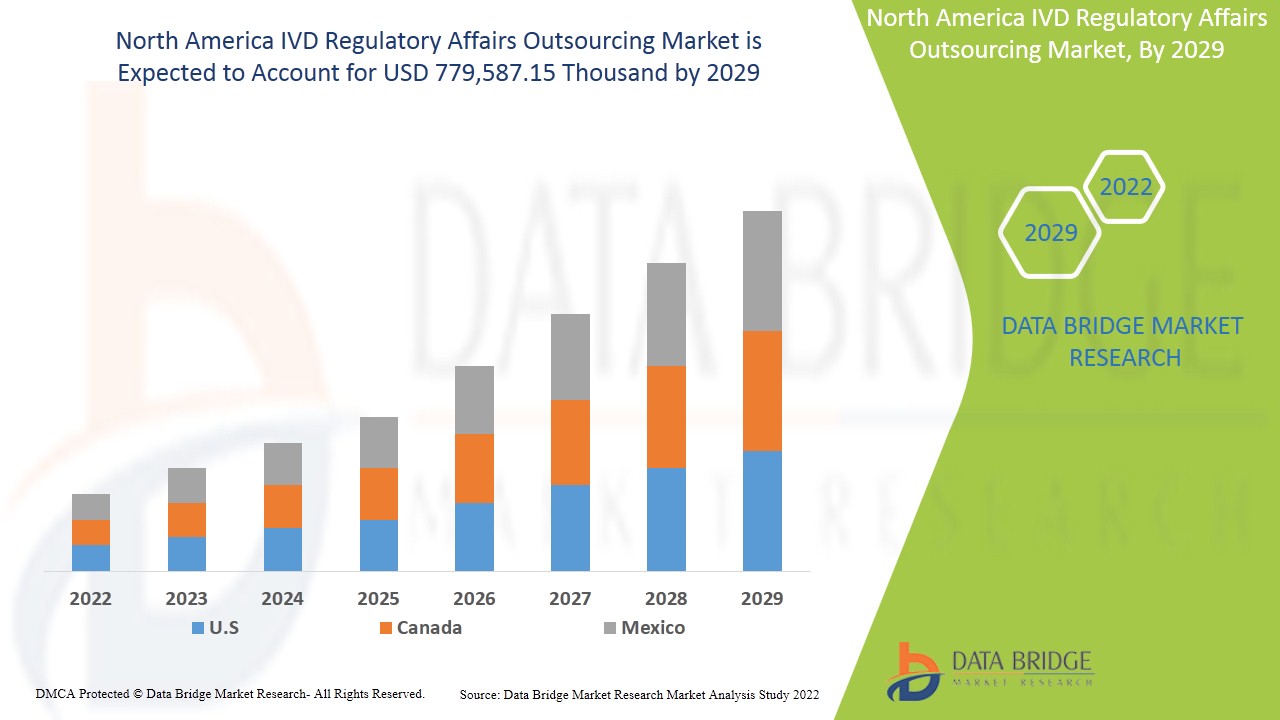

북미 IVD 규제 업무 아웃소싱 시장은 2022년부터 2029년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년부터 2029년까지의 예측 기간 동안 13.4%의 CAGR로 성장하고 있으며 2029년까지 779,587.15천 달러에 도달할 것으로 예상한다고 분석합니다.

- 체외진단 제품은 질병이나 기타 상태를 진단하는 데 사용되는 시약, 장치 및 시스템으로, 질병을 치료, 완화, 치료 또는 예방하기 위해 건강 상태를 판단하는 것을 포함합니다. 이러한 제품은 인체 표본을 수집, 준비 및 검사하는 데 사용하도록 의도되었습니다. 규제 업무는 체외진단 장치(IVD) 및 의료 기기 산업에서 중요한 역할을 합니다. 규제 업무 아웃소싱 서비스에는 임상 연구 프로젝트를 위한 고품질 문서 제작에 기여하는 전문가가 의료 문서를 작성하고 규제 문서를 발행하는 것이 포함됩니다. 신흥 경제권에서 수행되는 임상 연구에서 규제 서비스 아웃소싱에 대한 수요가 크게 증가하고 있어 이 산업의 성장을 위한 건강한 플랫폼을 제공합니다.

IVD 규제 업무 아웃소싱 시장 성장을 주도하는 주요 요인은 프로젝트 기반 지원 개발로 인해 조직 간 장기 아웃소싱 계약이 이루어지고 다양한 체외 진단 기기의 기술이 발전했기 때문입니다. 이 지역 전체의 기업에서 R&D 활동이 증가하면서 시장 성장의 기회가 창출되고 있습니다. IVD의 유지 관리 및 아웃소싱과 관련된 높은 비용이 IVD 규제 업무 아웃소싱 시장의 주요 제약으로 작용하고 있습니다. 체외 진단 기기를 취급할 수 있는 숙련된 인력이 부족한 것이 시장 성장의 주요 과제로 작용하고 있습니다.

이 IVD 규제 업무 아웃소싱 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 지역 시장 참여자의 영향, 새로운 수익 주머니, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서의 기회 분석을 제공합니다. 분석 및 시장 시나리오를 이해하려면 분석가 브리핑을 위해 저희에게 연락하세요 . 저희 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드릴 것입니다.

북미 IVD 규제 업무 아웃소싱 시장 범위 및 시장 규모

북미 IVD 규제 업무 아웃소싱 시장은 서비스, 적응증, 배포 모드, 조직 규모, 단계, 계층 및 최종 사용자를 기준으로 7개의 주요 세그먼트로 구분됩니다.

- 북미 IVD 규제 업무 아웃소싱 시장은 서비스 기준으로 규제 작성 및 제출, 규제 등록 및 임상 시험 신청, 규제 컨설팅, 법률 대리, 데이터 관리 서비스, 화학 제조 및 통제(CMC) 서비스 등으로 세분화됩니다. 2022년에는 규제 작성 및 제출이 시장을 지배할 것으로 예상되는데, 이는 업계가 IVD 기술의 혁신과 확장을 촉발한 여러 가지 광범위한 개발에 대응하고 있기 때문입니다. 이러한 대규모 추세에는 인구 고령화, 감염성 질환 발생 증가, 거대 기술 혁신가의 영향 및 개인화된 치료 수용, 사용 편의성에 대한 욕구가 포함됩니다.

- 북미 IVD 규제 업무 아웃소싱 시장은 지표에 따라 종양학, 신경학, 심장학, 임상 화학 및 면역 검사, 정밀 의학, 감염성 질환, 당뇨병, 유전자 검사, HIV/AIDS, 혈액학, 약물 검사/약리유전체학, 수혈 , 진료 시점 및 기타로 세분화됩니다. 2022년에는 종양학 부문이 종양학 약물 개발 프로세스의 예측 가능성을 개선하고 종양학자가 환자의 치료 계획을 결정할 때 유용한 도구가 되면서 지배적인 위치를 차지할 것으로 예상됩니다.

- 배포 모드를 기준으로 북미 IVD 규제 업무 아웃소싱 시장은 클라우드와 온프레미스로 구분됩니다. 2022년에는 클라우드 세그먼트가 우세할 것으로 예상되는데, IVD 규제 분야의 클라우드 컴퓨팅 기술은 비용 효율적이고 솔루션에 유연한 특성으로 인해 IVD 시스템 거래 회사에 최대 출력을 제공하는 안정적인 인프라를 제공하기 때문입니다.

- 조직 규모에 따라 북미 IVD 규제 업무 아웃소싱 시장은 중소기업(SMES)과 대기업으로 세분화됩니다. 2022년에는 대기업 부문이 IVD 규제와 관련된 동급의 고품질 기술 및 서비스 포트폴리오를 포함하기 때문에 지배적일 것으로 예상됩니다.

- 북미 IVD 규제 업무 아웃소싱 시장은 단계에 따라 임상, 전임상 및 PMA(시판 후 허가)로 세분화됩니다. 2022년에는 임상 부문이 시장을 지배할 것으로 예상되는데, 임상 시험에는 당국의 허가가 필요하고 모든 결과는 제출 전에 제출하고 철저히 기록해야 하며, 이 분야에서 규제 업무 서비스에 대한 수요가 높기 때문입니다.

- 클래스 기준으로 북미 IVD 규제 업무 아웃소싱 시장은 클래스 I, 클래스 II, 클래스 III으로 세분화됩니다. 2022년에는 클래스 I 세그먼트가 시장을 지배할 것으로 예상되며, 이는 공공 보건 위험이 없거나 개인 위험이 낮고 규제가 가장 낮기 때문입니다. 이러한 세그먼트는 수요가 높고 의료 기기의 47%가 이 범주에 속합니다.

- 최종 사용자를 기준으로 북미 IVD 규제 업무 아웃소싱 시장은 제약 회사, 의료 기기 회사, 생명공학 회사 등으로 세분화됩니다. 2022년에는 의료 기기 회사가 다양한 효율적인 기술 서비스와 표준을 선보이며 시장을 지배할 것으로 예상됩니다.

북미 IVD 규제 업무 아웃소싱 시장 국가 수준 분석

북미 IVD 규제 업무 아웃소싱 시장을 분석하고, 국가, 서비스, 적응증, 배포 모드, 조직 규모, 단계, 계층 및 최종 사용자별로 시장 규모 정보를 제공합니다.

북미 IVD 규제 업무 아웃소싱 시장 보고서에서 다루는 국가는 미국, 멕시코, 캐나다입니다.

미국은 의료 분야에서 새로운 기술 개발이 증가하고 조직 간의 전략적 인수 및 파트너십이 확대됨에 따라 북미 지역 시장을 장악하고 있습니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

IVD 규제 업무 아웃소싱에 대한 수요 증가

북미 IVD 규제 업무 아웃소싱 시장은 또한 모든 국가에 대한 자세한 시장 분석을 제공하여 산업의 매출, 구성 요소 매출, IVD 규제 업무 아웃소싱의 기술 개발 영향 및 IVD 규제 업무 아웃소싱 시장에 대한 지원과 함께 규제 시나리오의 변화를 제공합니다. 이 데이터는 2012년부터 2020년까지의 과거 기간에 대해 제공됩니다.

경쟁 환경 및 북미 IVD 규제 업무 아웃소싱 시장 점유율 분석

북미 IVD 규제 업무 아웃소싱 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 폭, 응용 분야 우세, 기술 수명선 곡선이 있습니다. 위에 제공된 데이터 포인트는 북미 IVD 규제 업무 아웃소싱 시장과 관련된 회사의 초점에만 관련이 있습니다.

보고서에서 활동하는 주요 기업 중 일부는 IVD 규제 업무 아웃소싱 시장으로 Freyr Solutions, AXSource, LORENZ Life Sciences Group, PPD Inc.(Thremofisher Scientific Inc.의 자회사), Promedica International(캘리포니아 법인), Assent Compliance Inc., MakroCare, EMERGO, ICON, Parexel International Corporation, CRITERIUM, INC., Groupe ProductLife SA, Propharma Group, VCLS, Labcorp Drug Development, WuXi AppTec, Charles River Laboratories, Genpact, Medpace, Regulatory Compliance Associates Inc., RQM+, Saraca Solutions Private Limited, PBC BioMed, Dor Pharmaceutical Services, Qserve, mdiConsultants, Inc. 등이 있습니다. DBMR 분석가는 경쟁 우위를 이해하고 각 경쟁자에 대한 경쟁 분석을 별도로 제공합니다.

또한 전 세계 여러 회사에서 많은 제품 개발을 시작하면서 북미 IVD 규제 업무 아웃소싱 시장 성장도 가속화되고 있습니다.

예를 들어,

- 2021년 9월, Tánaiste는 ICON plc의 수백만 유로 규모의 R&D 지원을 발표하여 분산형 임상 시험 기술을 가속화합니다. Tánaiste와 기업, 무역 및 고용부 장관인 Leo Varadkar TD는 제약, 생명공학 및 의료 기기 산업에 약물 개발 및 상용화 서비스를 제공하는 더블린에 본사를 둔 글로벌 공급업체인 ICON plc(NASDAQ: ICLR)가 Enterprise Ireland에서 관리하는 400만 달러 규모의 R&D 지원을 받아 데이터 솔루션과 분산형 임상 시험 기술을 더욱 강화했다고 발표했습니다. 이를 통해 회사는 시장에서 입지를 강화할 수 있었습니다.

- 2021년 10월, Propharma 그룹은 Pharmica Consulting을 인수했습니다. Odyssey Investment Partners의 포트폴리오 회사인 ProPharma Group은 제약 및 바이오텍 회사에 임상 시험 실행을 위한 프로젝트 관리(PM) 컨설팅 솔루션과 독점 운영 소프트웨어를 제공하는 생명 과학 컨설팅 회사인 Pharmica Consulting을 인수했습니다. 이를 통해 회사는 시장에서 글로벌 사업을 확장할 수 있었습니다.

파트너십, 합작 투자 및 기타 전략은 적용 범위와 입지를 확대하여 회사 시장 점유율을 높입니다. 또한 조직이 규모 범위를 확대하여 IVD 규제 업무 아웃소싱에 대한 제안을 개선할 수 있는 이점도 제공합니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SERVICE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, REGULATORY SCENARIO

4.1.1 THE U.S.

4.1.2 REGULATIONS IN EUROPE

4.1.3 REGULATIONS IN ASIA

4.1.3.1 CHINA

4.1.3.2 SOUTH KOREA

4.1.3.3 MALAYSIA

4.1.3.4 THAILAND

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN PREVALENCE OF CHRONIC DISEASES ACROSS THE REGION

5.1.2 TECHNOLOGICAL ADVANCEMENT IN DEVELOPING VARIOUS IN VITRO DIAGNOSTIC DEVICES

5.1.3 DEVELOPMENT OF PROJECT-BASED SUPPORT LEADS TO LONG TERM OUTSOURCING AGREEMENT AMONG ORGANIZATION

5.1.4 INCREASE IN PRODUCT REGISTRATION NUMBERS AND CLINICAL TRIAL APPROVALS ACROSS THE REGION

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS REGARDING MEDICAL DEVICES IN DIFFERENT REGIONS

5.2.2 HIGHER COST RELATED TO MAINTENANCE AND OUTSOURCING OF IVD

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC ACQUISITION & PARTNERSHIP AMONG ORGANIZATION

5.3.2 EMERGENCE OF VARIOUS EFFICIENT TECHNOLOGICAL SERVICES AND STANDARDS

5.3.3 INCREASE IN R&D ACTIVITIES BY COMPANIES ACROSS THE REGION

5.4 CHALLENGES

5.4.1 LACK OF INFRASTRUCTURE IN HEALTHCARE SERVICE

5.4.2 SHORTAGE OF SKILLED PERSONNEL FOR HANDLING IN VITRO DIAGNOSTIC DEVICES

6 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE

6.1 OVERVIEW

6.2 REGULATORY WRITING & SUBMISSIONS

6.3 LEGAL REPRESENTATION

6.4 REGULATORY CONSULTING

6.5 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

6.6 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

6.7 DATA MANAGEMENT SERVICES

6.8 OTHERS

7 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION

7.1 OVERVIEW

7.2 CLINICAL CHEMISTRY AND IMMUNOASSAYS

7.3 INFECTIOUS DISEASES

7.3.1 VIROLOGY

7.3.2 MICROBIOLOGY AND MYCOLOGY

7.3.3 BACTERIOLOGY

7.3.4 SEPSIS

7.3.5 HEPATITIS B

7.3.6 HEPATITIS C

7.3.7 MALARIA

7.3.8 TUBERCULOSIS

7.3.9 SYPHILIS

7.3.10 HUMAN PAPILLOMAVIRUS (HPV) INFECTION

7.3.11 OTHERS

7.4 HAEMATOLOGY

7.5 DRUG TESTING/PHARMACOGENOMICS

7.6 PRECISION MEDICINE

7.7 DIABETES

7.8 BLOOD TRANSFUSION

7.9 CARDIOLOGY

7.1 POINT OF CARE

7.10.1 WAIVED TEST

7.10.2 AT HOME TESTS

7.11 ONCOLOGY

7.12 NEUROLOGY

7.13 HIV/AIDS

7.14 GENETIC TESTING

7.15 OTHERS

8 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS

8.1 OVERVIEW

8.2 CLASS I

8.3 CLASS III

8.4 CLASS II

9 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 SMALL & MEDIUM ENTERPRISES (SMES)

11 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE

11.1 OVERVIEW

11.2 CLINICAL

11.3 PRECLINICAL

11.4 PMA (POST MARKET AUTHORIZATION)

12 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER

12.1 OVERVIEW

12.2 MEDICAL DEVICE COMPANIES

12.2.1 BY ORGANIZATION SIZE

12.2.1.1 LARGE ENTERPRISES

12.2.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.2.2 BY SERVICE

12.2.2.1 REGULATORY WRITING & SUBMISSIONS

12.2.2.2 LEGAL REPRESENTATION

12.2.2.3 REGULATORY CONSULTING

12.2.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.2.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.2.2.6 DATA MANAGEMENT SERVICES

12.2.2.7 OTHERS

12.3 PHARMACEUTICAL COMPANIES

12.3.1 BY ORGANIZATION SIZE

12.3.1.1 LARGE ENTERPRISES

12.3.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.3.2 BY SERVICE

12.3.2.1 REGULATORY WRITING & SUBMISSIONS

12.3.2.2 LEGAL REPRESENTATION

12.3.2.3 REGULATORY CONSULTING

12.3.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.3.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.3.2.6 DATA MANAGEMENT SERVICES

12.3.2.7 OTHERS

12.4 BIOTECHNOLOGY COMPANIES

12.4.1 BY ORGANIZATION SIZE

12.4.1.1 LARGE ENTERPRISES

12.4.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.4.2 BY SERVICE

12.4.2.1 REGULATORY WRITING & SUBMISSIONS

12.4.2.2 LEGAL REPRESENTATION

12.4.2.3 REGULATORY CONSULTING

12.4.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.4.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.4.2.6 DATA MANAGEMENT SERVICES

12.4.2.7 OTHERS

12.5 OTHERS

13 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ICON PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MEDPACE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 PAREXEL INTERNATIONAL CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 LABCORP DRUG DEVELOPMENT

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 PPD INC. (A SUBSIDIARY OF THERMOFISHER SCIENTIFIC INC.)

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 CHARLES RIVER LABORATORIES

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 FREYR

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ASSENT COMPLIANCE INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ANDAMAN MEDICAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ASIA ACTUAL

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 AXSOURCE

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 CRITERIUM, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 DOR PHARMACEUTICAL SERVICES

16.13.1 COMPANY SNAPSHOT

16.13.2 SERVICE PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 EMERGO BY UL

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 GENPACT

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 GROUPE PRODUCTLIFE S.A.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 LORENZ LIFE SCIENCES GROUP

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MAKROCARE

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MARACA INTERNATIONAL BVBA

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MDICONSULTANTS, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 PBC BIOMED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 PROMEDICA INTERNATIONAL, A CALIFORNIA CORPORATION

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 PROPHARMA GROUP

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 QSERVE

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 REGULATORY COMPLIANCE ASSOCIATES INC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 RMQ+

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SARACA SOLUTIONS PRIVATE LIMITED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 VCLS

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENTS

16.29 WUXI APPTEC

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PRODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 2 NORTH AMERICA REGULATORY WRITING & SUBMISSIONS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 NORTH AMERICA LEGAL REPRESENTATION IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA REGULATORY CONSULTING IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA DATA MANAGEMENT SERVICES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA CLINICAL CHEMISTRY AND IMMUNOASSAYS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION,2020-2029 (THOUSAND)

TABLE 12 NORTH AMERICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA HAEMATOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA DRUG TESTING/PHARMACOGENOMICS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 15 NORTH AMERICA PRECISION MEDICINE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 16 NORTH AMERICA DIABETES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 17 NORTH AMERICA BLOOD TRANSFUSION IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 18 NORTH AMERICA CARDIOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 19 NORTH AMERICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 20 NORTH AMERICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA ONCOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 22 NORTH AMERICA NEUROLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 23 NORTH AMERICA HIV/AIDS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 24 NORTH AMERICA GENETIC TESTING IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 25 NORTH AMERICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 26 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA CLASS I IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA CLASS III IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 29 NORTH AMERICA CLASS II IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA CLOUD IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA ON-PREMISES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA LARGE ENTERPRISES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA SMALL & MEDIUM ENTERPRISES (SMES) IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA CLINICAL IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA PRECLINICAL IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA PMA (POST MARKET AUTHORIZATION) IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 67 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 68 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 69 U.S. INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 U.S. POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 72 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 73 U.S. REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 74 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 75 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 76 U.S. MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 77 U.S. MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 78 U.S. PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 79 U.S. PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 80 U.S. BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 81 U.S. BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 82 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 83 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 84 CANADA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 CANADA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 87 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 88 CANADA REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 89 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 90 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 91 CANADA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 92 CANADA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 93 CANADA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 94 CANADA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 95 CANADA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 96 CANADA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 97 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 98 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 99 MEXICO INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 MEXICO POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 102 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 103 MEXICO REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 104 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 105 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 106 MEXICO MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 107 MEXICO MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 108 MEXICO PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 109 MEXICO PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 110 MEXICO BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 111 MEXICO BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SEGMENTATION

FIGURE 11 RISE IN THE PREVALENCE OF CHRONIC DISEASES ACROSS IS EXPECTED TO DRIVE NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET

FIGURE 15 MULTIPLE CHRONIC CONDITIONS AMONG PEOPLE AGED 65 AND ABOVE IN EUROPEAN REGION (2017)

FIGURE 16 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY SERVICE, 2021

FIGURE 17 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY INDICATION, 2021

FIGURE 18 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY CLASS, 2021

FIGURE 19 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 20 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 21 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY STAGE, 2021

FIGURE 22 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY END USER, 2021

FIGURE 23 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY SERVICE (2022-2029)

FIGURE 28 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.