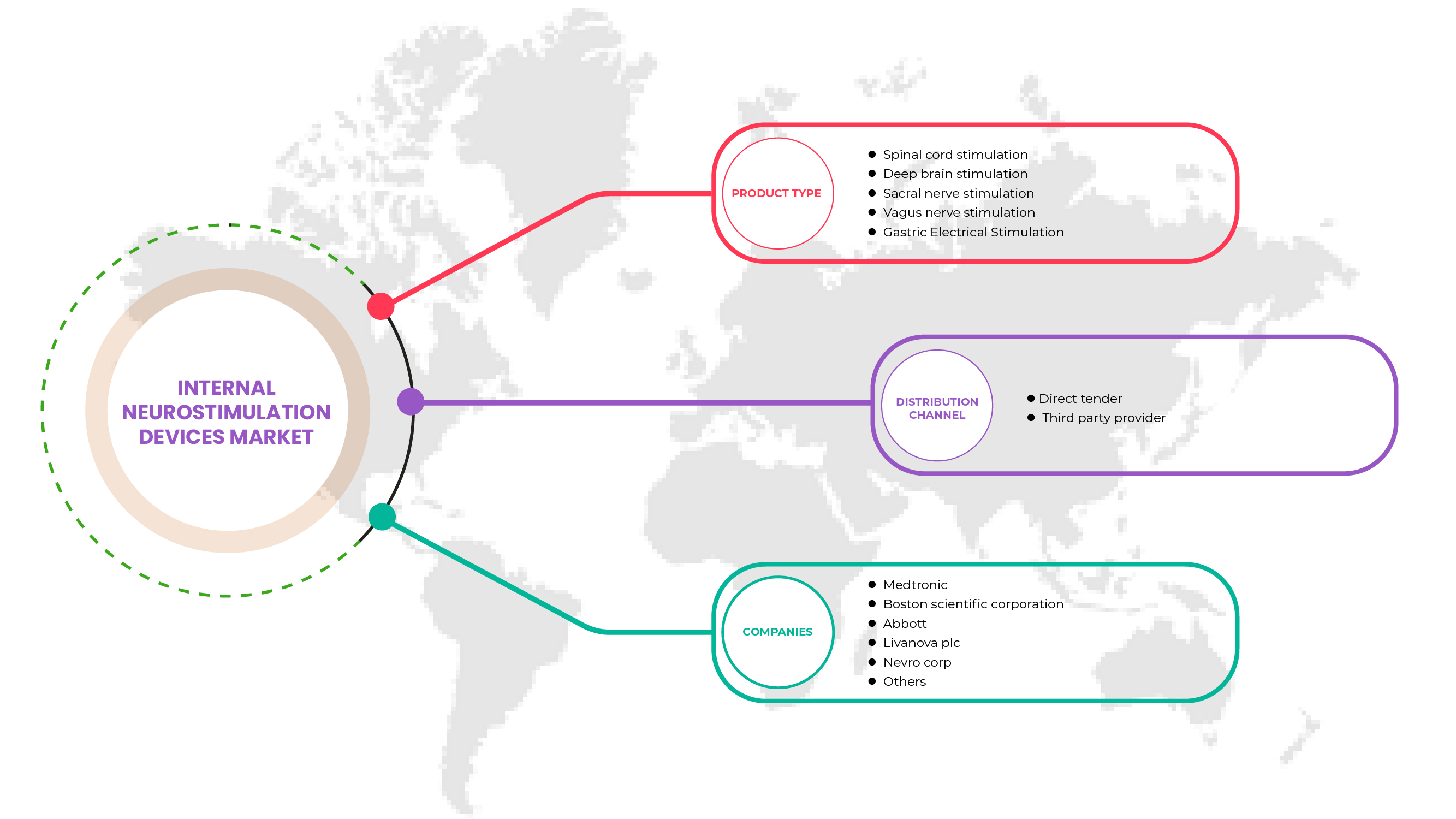

북미 내부 신경 자극 장치 시장, 제품 유형별( 척수 자극(SCS), 뇌 심부 자극, 미주신경 자극, 천골 신경 자극 및 위 전기 자극), 유통 채널(직접 입찰 및 제3자 서비스 제공업체) - 업계 동향 및 2029년까지의 전망.

북미 내부 신경 자극 장치 시장 분석 및 통찰력

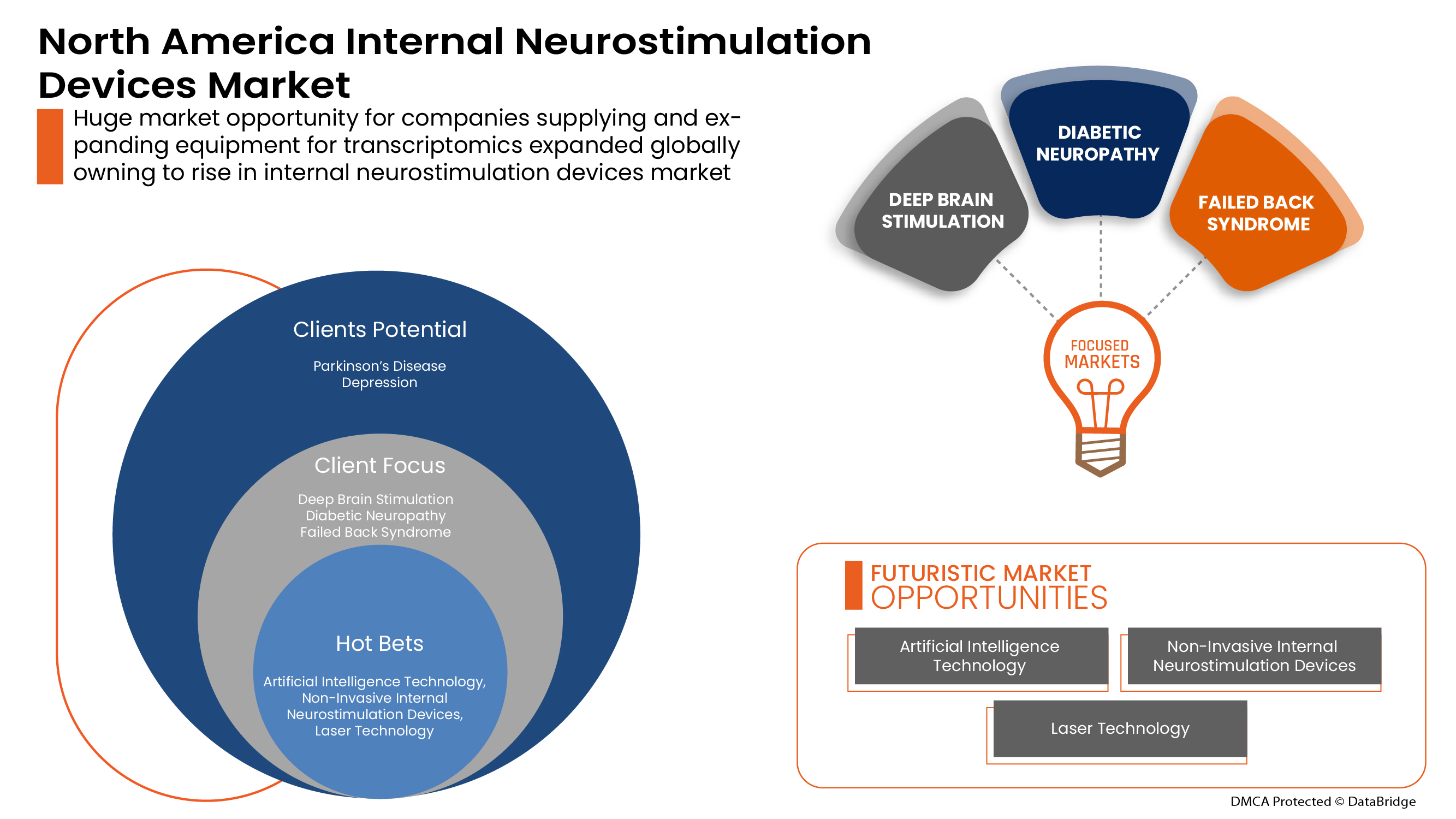

추가 치료법으로서의 내부 신경 자극 장치에 대한 수요 증가, 신경 질환의 유병률과 발생률 증가, 신경 자극 장치에 대한 자금 지원 증가, 내부 신경 자극 장치의 기술적 발전, 제품 승인 증가는 시장 성장을 촉진할 것으로 예상됩니다.

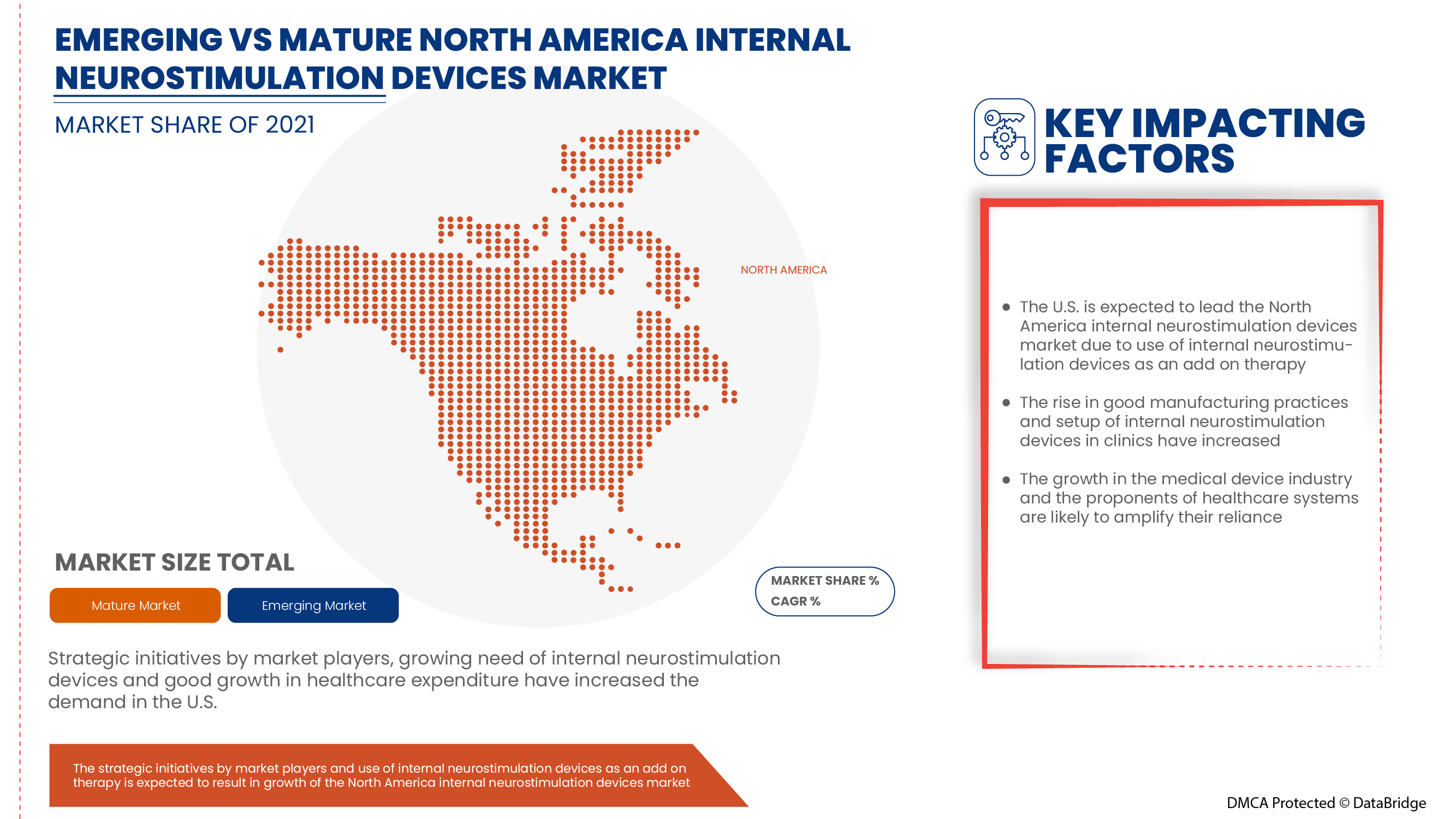

시장 참여자들의 전략적 이니셔티브와 내부 신경 자극 장치에 대한 공공 및 민간 시장 참여자들의 자금 지원 증가는 시장 성장의 기회를 창출할 것으로 예상됩니다. 그러나 내부 신경 자극 장치에 대한 숙련되고 훈련된 전문가의 부족은 이 부문의 성장을 제한할 것으로 예상됩니다. 대체 영상 장치의 가용성은 시장 성장에 도전할 것으로 예상됩니다.

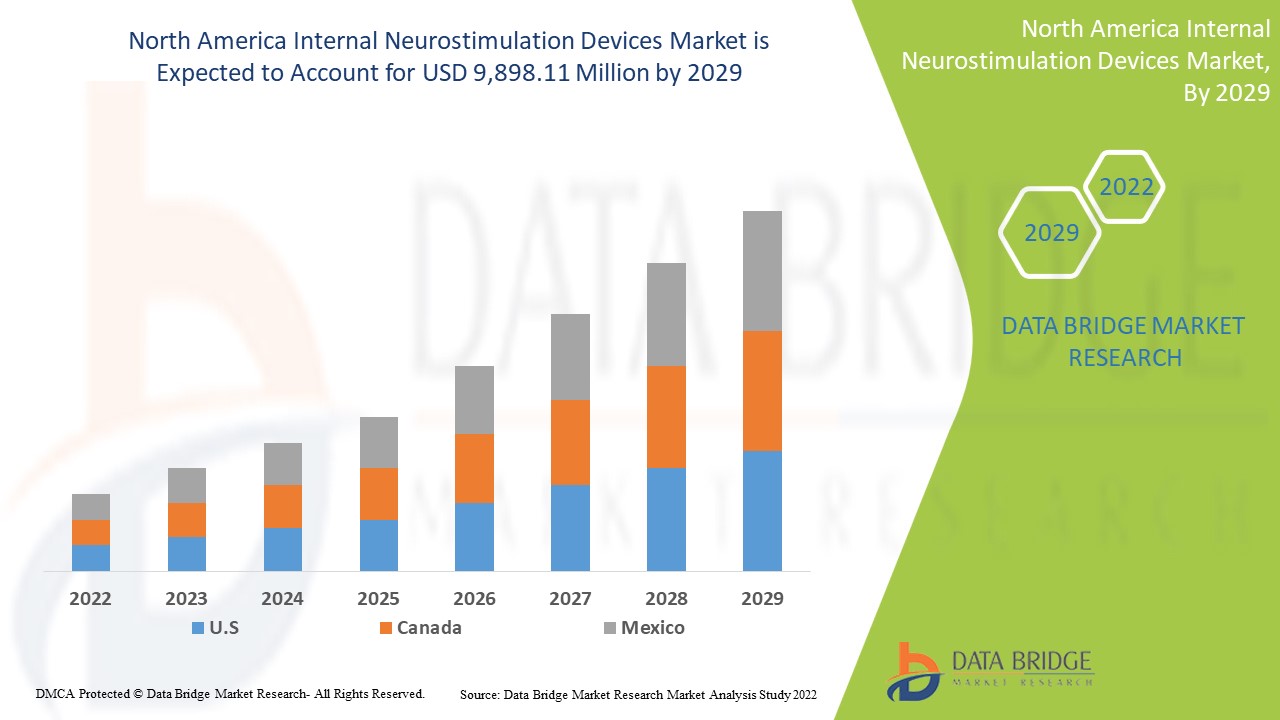

Data Bridge Market Research에 따르면, 북미 내부 신경 자극 장치 시장은 2022년부터 2029년까지의 예측 기간 동안 연평균 성장률 20.5%, 98억 9,811만 달러로 성장할 것으로 분석되었습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2024까지 맞춤 설정 가능) |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

제품 유형별( 척수 자극(SCS), 뇌 심부 자극, 미주신경 자극, 천골 신경 자극 및 위 전기 자극), 유통 채널(직접 입찰 및 제3자 서비스 제공자) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Medtronic, LivaNova PLC, Abbott, ONWARD, Sequana Medical NV, CIRTEC, Valencia Technologies, Nalu Medical, Inc., NEVRO CORP., Stimwave LLC, MicroTransponder Inc., Newronika SpA, Microsemi(Microchip Technology Inc.의 자회사), Boston Scientific Corporation, Inspire Medical Systems, Inc, Integer Holdings Corporation, BlueWind Medical, Micro-Leads, Axonics, Inc. 등 |

시장 정의

내부 신경 자극 장치는 외과적으로 배치된 장치입니다. 척추 근처의 경막외 공간에 가벼운 전기 신호를 리드라고 하는 하나 이상의 얇은 전선을 통해 전달합니다. 신경 자극은 척수와 뇌 사이를 이동하는 통증 신호를 방해하여 통증을 완화합니다.

신경 자극 장치에는 회로 내에서 신경 기능을 구동하기 위한 전기 자극을 포함하는 침습적 및 비침습적 접근 방식이 포함됩니다. 내부 신경 자극 장치에 대한 수요 증가는 신경 자극 장치의 차세대 기술 진보로 인한 것이며, 전 세계적으로 쇠약해지는 신경 및 정신 질환의 영향을 받는 전례 없는 수의 사람들에게 절실히 필요한 치료적 완화를 제공합니다. 현대 신경 조절 요법의 증가는 반세기 이상 증가했으며, 우연한 발견과 다양한 신경 자극 전략으로 이어진 기술적 발전이 풍부했습니다. 지난 20년 동안 의료 기기 기술의 혁신은 이러한 신경 자극 시스템의 진화를 더욱 가속화된 속도로 이끌기 시작했습니다.

환자가 사용하는 편리한 내부 신경 자극 장치는 미주신경 자극입니다. 미주신경 자극 장치는 전기적 자극으로 미주신경을 자극하는 장치를 사용합니다. 이식형 미주신경 자극기는 현재 FDA에서 간질과 우울증을 치료하는 데 승인을 받았습니다. 신체의 양쪽에 미주신경이 하나씩 있으며, 뇌간에서 목을 거쳐 가슴과 복부까지 이어집니다. 미래에는 폐쇄 루프 자극 및 원격 프로그래밍과 같은 소프트웨어 발전으로 내부 신경 자극 장치가 보다 개인화되고 접근 가능한 기술이 될 것입니다. 내부 신경 자극 장치의 미래는 삶의 질을 더욱 향상시킬 것으로 예상됩니다.

북미 내부 신경 자극 장치 시장 역학

이 섹션에서는 시장 동인, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전자

- 만성 요실금 치료에 대한 인식 증가

환자와 의료 서비스 제공자 사이에서 인지도가 높아지고 요실금 서비스에 대한 접근성이 높아지는 것이 치료 제공을 개선하는 데 중요한 요인이었습니다. 요실금(UI)과 하부 요로 증상(LUTS)은 흔하며 모든 연령대의 많은 여성과 남성에게 고통을 줍니다. 신경학에서 임플란트 내부 신경 자극 장치에 대한 인지도가 높아지면서 고급 무통 내부 신경 자극 장치의 발견과 개발을 위한 연구 개발 관련 투자가 늘어나 시장 성장이 촉진될 것으로 예상됩니다.

- 내부 신경 자극 장치의 기술적 발전

내부 신경 자극 장치의 기술적 발전은 전기 또는 약제를 목표 영역에 직접 전달하는 신경 조절 기술을 활용합니다. 신경 조절 및 내부 신경 자극 장치와 치료는 삶을 변화시킵니다. 기술적 발전은 프로그래밍 가능한 방식으로 신경 기능을 조절하고 무질서한 신경 활동을 조절합니다. 결과는 최소한의 오류로 전달될 수 있습니다.

예를 들어,

- ONWARD는 2022년 5월 SCI 및 이동성에 영향을 미치는 기타 질환이 있는 사람들의 운동 및 자율신경 기능을 회복하기 위해 척수를 자극하는 ARC 이식형 펄스 생성기(IPG)를 출시했습니다.

내부 신경 자극 장치에 대한 승인은 장치가 사용하기에 안전하다고 선언되고 시판 후 승인을 받을 준비가 됨을 의미합니다. 이는 미국 인구 통계의 개발 시장에 MRI 기계를 공급하고 유통하는 결과를 가져올 것입니다. 따라서 제품 승인의 증가는 북미 내부 신경 자극 장치 시장 성장을 촉진할 것으로 예상됩니다.

기회

- 내부 신경 자극 장치의 최근 제품 개발

북미 내부 신경 자극 장치 시장의 성장 곡선은 신경 혈관 질환(예: 간질, 뇌졸중, 뇌동맥류)의 유병률 증가와 대상 환자의 질병(예: 분비물 및 주변 장애)의 심각성으로 인해 효과적인 신경 혈관 치료에 대한 수요가 꾸준히 증가함에 따라 상승 추세를 따르고 있습니다. 유병률이 증가하고 이러한 질병의 심각성에 대한 인식이 높아짐에 따라 다양한 장비 또는 장치가 제조되거나 임상 시험 중입니다.

따라서 최근 몇 년간의 제품 개발은 이러한 기술의 잠재력을 보여주었고, 이 시장에서 활동하는 회사들은 시장 성장의 기회가 될 더욱 진보된 제품을 개발하고자 노력하고 있습니다.

- 주요 시장 참여자의 전략적 이니셔티브

내부 신경 자극 장치에 대한 수요는 혁신적 약물에 대한 욕구에 힘입어 북미 내부 신경 자극 장치 시장의 성장과 더불어 연구 개발 수준이 높아짐에 따라 시장에서 증가하고 있습니다. 따라서 주요 시장 참여자들은 새로운 장치와 장비를 개발하고, 시장의 다른 참여자들과 협력하며, 사업 운영과 수익성을 개선함으로써 새로운 전략을 실행했습니다.

- 2021년 1월, Boston Scientific은 Wave Writer Alpha 척추선 트리거 프레임워크를 미국으로 운송하기 시작했습니다.

따라서 신경 자극 장치 시장에서 전 세계적으로 운영되는 회사들은 협업을 채택하여 첨단 기술이 풍부한 제품으로 제품 포트폴리오를 늘려 다양한 차원에서 사업을 확대하고 있습니다. 따라서 주요 시장 참여자의 전략적 이니셔티브는 북미 내부 신경 자극 장치 시장에서 운영되는 시장 참여자에게 상당한 기회를 제공할 것으로 예상됩니다.

제약/도전

- 이러한 장치의 이식과 관련된 위험

의료용 임플란트는 설치 또는 제거 시 수술, 감염 및 임플란트 실패와 관련된 위험을 포함하여 여러 가지 위험을 안고 있습니다. 임플란트에 사용되는 재료는 잠재적으로 일부 사람에게 반응을 일으킬 수 있습니다. 모든 수술 절차에는 어느 정도의 위험이 있습니다. 여기에는 수술 부위의 멍, 불편함, 붓기 및 발적이 포함됩니다. 따라서 임플란트 장치의 성장을 비례적으로 방해할 것입니다. 따라서 신경 자극 임플란트와 관련된 위험 증가에 대한 인식이 증가함에 따라 시장 성장이 방해받을 수 있습니다.

예를 들어,

- 임플란트 실패

- 삽입 또는 제거 중 수술 위험

- 이식형 장치 해킹 위험

- 감염 증가

- 임플란트에 사용되는 재료는 환자에게 부작용을 나타낼 수 있습니다.

위에서 언급한 위험은 환자와 관련된 위험이 매우 중요하기 때문에 내부 신경 자극 장치 시장의 성장을 방해할 수 있습니다. 따라서 이식형 장치의 잠재적 위험에 대한 인식은 북미 내부 신경 자극 장치 시장에 대한 과제입니다.

- 숙련된 의료 전문가 부족

신경 자극 장치는 환자의 뇌, 척수 또는 말초 신경계의 특정 부위에 전기 자극을 전달하여 만성 통증, 운동 장애, 간질 및 파킨슨병을 포함한 다양한 질환을 치료하는 데 도움이 되는 이식 가능하고 프로그래밍 가능한 의료 장치입니다. 이러한 강력한 기술은 고비용 개발 절차와 민감한 장치를 다루는 숙련된 전문가가 필요합니다. 이식 후 3~6년마다 교체해야 하며, 이는 비용 부담이며 일반적으로 대부분 환자가 직접 부담해야 합니다.

가난한 나라의 환자 중 비교적 소수만이 높은 가격, 취약한 환불 환경, 숙련된 의료 자원 부족으로 인해 신경학적 치료를 감당할 수 있습니다. 그 결과, 의료 시설은 새로운 기술이나 최첨단 기술에 돈을 쓰는 것을 주저하여 시장 확장을 제한합니다. 따라서 이러한 과제는 시장 성장을 방해할 수 있습니다.

COVID-19가 북미 내부 신경 자극 장치 시장에 미치는 영향

팬데믹 동안 북미 내부 신경 자극 장치 부문은 생물학과 정보 기술을 결합하는 데 중점을 둡니다. COVID-19 팬데믹 동안 내부 신경 자극 장치의 일반적인 것에 새로운 치료적 과제가 추가되었습니다. 척추강 주입을 위한 이식형 장치를 사용하는 환자는 금욕 증후군을 피하기 위해 펌프를 다시 채워야 합니다. 신경 자극 임플란트를 사용하는 환자는 감염, 상처 열개 또는 리드 이동의 경우 검진이 필요할 수 있습니다.

최근 개발 사항

- 2022년 1월, Medtronic은 당뇨병성 말초신경병증으로 인한 만성 통증을 치료하는 척수 자극 요법인 Intellis 충전식 신경 자극기에 대한 식품의약국(FDA)의 제품 승인을 받았습니다. 받은 제품 승인으로 척수 자극 제품 범주에 새로운 제품이 추가되었습니다. 이 승인은 미국 시장에서 시판 후 승인을 받을 것으로 예상됩니다.

- 2022년 7월, 애보트는 식품의약국(FDA)으로부터 우울증 치료를 위한 인피니티 심부 뇌 자극 시스템에 대한 승인을 받았습니다. 승인으로 인해 시판 전 및 시판 후 승인이 증가하고 제품 포트폴리오에 새로운 제품이 추가되었습니다.

북미 내부 신경 자극 장치 시장 범위

북미 내부 신경 자극 장치 시장은 제품 유형과 유통 채널로 분류됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품 유형

- 척수 자극 (SCS)

- 심부 뇌 자극

- 미주신경 자극

- 천골신경 자극

- 위 전기 자극

제품 유형을 기준으로 북미 내부 신경 자극 장치 시장은 척수 자극(SCS), 뇌 심부 자극, 미주 신경 자극, 천골 신경 자극, 위 전기 자극으로 구분됩니다.

유통 채널

- 직접 입찰

- 제3자 서비스 제공자

유통 채널을 기준으로 볼 때, 북미 내부 신경 자극 장치 시장은 직접 입찰과 제3자 서비스 제공업체로 구분됩니다.

북미 내부 신경 자극 장치 시장 지역 분석/통찰력

북미 내부 신경 자극 장치 시장을 분석하고, 위에 참조된 대로 국가, 제품 유형 및 유통 채널별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 내부 신경 자극 장치 시장에서 다루는 국가로는 미국, 캐나다, 멕시코가 있습니다. 미국은 연구 개발 활동의 증가, 신경과 및 요실금 치료에서 통합된 내부 신경 자극 장치 요구 사항, 신경 자극 장치에 대한 공공-민간 부문 자금 지원의 증가로 인해 시장을 지배할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변경 사항을 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드의 대규모 또는 희소한 경쟁으로 인해 직면한 과제는 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 내부 신경 자극 장치 시장 점유율 분석

북미 내부 신경 자극 장치 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우위가 포함됩니다. 위에 제공된 데이터 포인트는 북미 내부 신경 자극 장치 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 내부 신경 자극 장치 시장의 주요 기업으로는 Medtronic, LivaNova PLC, Abbott, ONWARD, Sequana Medical NV, CIRTEC, Valencia Technologies, Nalu Medical, Inc., NEVRO CORP., Stimwave LLC, MicroTransponder Inc., Newronika SpA, Microsemi(Microchip Technology Inc.의 자회사), Boston Scientific Corporation, Inspire Medical Systems, Inc, Integer Holdings Corporation, BlueWind Medical, Micro-Leads, Axonics, Inc. 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 THE CATEGORY VS TIME GRID

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 PIPELINE ANALYSIS FOR INTERNAL NEUROSTIMULATION DEVICES MARKET

5 REGULATIONS OF NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET

6 EPIDEMIOLOGY OF DISEASES

6.1 INCIDENCE OF ISCHEMIA

6.2 INCIDENCE OF PARKINSON'S DISEASE

6.3 INCIDENCE OF FAILED BACK SYNDROME

6.4 INCIDENCE OF TREMOR

6.5 INCIDENCE OF DEPRESSION

6.6 INCIDENCE OF URINE INCONTINENCE

6.7 INCIDENCE OF FECAL INCONTINENCE

6.8 INCIDENCE RATE OF EPILEPSY

6.9 INCIDENCE OF GASTROPARESIS

6.1 PREVALENCE OF OBESITY

7 EPIDEMIOLOGY OF NEUROSTIMULATION PROCEDURES

7.1 NUMBER OF SPINAL CORD STIMULATION (SCS) PROCEDURES

7.1.1 NUMBER OF TEST PROCEDURES

7.1.2 NUMBER OF IMPLANTATION PROCEDURES

7.2 NUMBER OF DEEP BRAIN STIMULATION PROCEDURES

7.3 NUMBER OF VAGUS NERVE STIMULATION PROCEDURES

7.4 NUMBER OF SACRAL NEVER STIMULATION PROCEDURES

7.5 NUMBER OF TRANSCRANIAL MAGNETIC STIMULATION (TMS) PROCEDURES

7.6 NUMBER OF INTERMITTENT THETA BURST STIMULATION (ITBS) PROCEDURES

7.7 NUMBER OF TRANSCRANIAL DIRECT ELECTRICAL STIMULATION (TDCS) PROCEDURES

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISE IN PREVALENCE AND INCIDENCE OF NEUROLOGICAL DISORDERS

8.1.2 DEMAND FOR INTERNAL NEUROSTIMULATION DEVICES AS A ADD ON THERAPY

8.1.3 INCREASED FUNDING FOR THE NEUROSTIMULATION DEVICES

8.1.4 TECHNOLOGICAL ADVANCEMENTS IN THE INTERNAL NEUROSTIMULATION DEVICES

8.1.5 RISE IN PRODUCT APPROVALS

8.2 RESTRAINTS

8.2.1 RISE IN COST OF THE DEEP BRAIN STIMULATION DEVICES

8.2.2 RISKS NOTICED WHILE USING THE INTERNAL NEUROSTIMULATION DEVICES

8.2.3 RISE IN PRODUCT RECALL

8.2.4 AVAILABILITY OF ALTERNATE IMAGING DIAGNOSTIC DEVICES

8.3 OPPORTUNITIES

8.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

8.3.2 RECENT PRODUCT DEVELOPMENTS IN THE INTERNAL NEUROSTIMULATION DEVICES

8.3.3 DEMAND FOR MINIMALLY INVASIVE SURGERY

8.4 CHALLENGES

8.4.1 RISKS ASSOCIATED WITH THE IMPLANTATION OF THESE DEVICES

8.4.2 LACK OF SKILLED HEALTHCARE PROFESSIONALS

9 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 SPINAL CORD STIMULATION

9.2.1 SPINAL CORD STIMULATION, BY TYPE

9.2.1.1 BATTERY

9.2.1.1.1 RECHARGEABLE

9.2.1.1.2 NON-RECHARGEABLE

9.2.1.2 LEAD

9.2.1.2.1 PERCUTANEOUS

9.2.1.2.2 PADDLE

9.2.2 SPINAL CORD STIMULATION, BY APPLICATION

9.2.2.1 ISCHEMIA

9.2.2.2 CHRONIC LOW BACK PAIN (CLBP)

9.2.2.3 DIABETIC NEUROPATHY

9.2.2.4 FAILED BACK SYNDROME

9.3 DEEP BRAIN STIMULATION

9.3.1 DEEP BRAIN STIMULATION, BY TYPE

9.3.1.1 SINGLE CHANNEL DEEP BRAIN STIMULATOR

9.3.1.2 DOUBLE CHANNEL DEEP BRAIN STIMULATOR

9.3.1.3 BATTERY

9.3.1.3.1 RECHARGEABLE

9.3.1.3.2 NON-RECHARGEABLE

9.3.1.4 LEAD

9.3.2 DEEP BRAIN STIMULATION, BY APPLICATION

9.3.2.1 PARKINSON’S DISEASE

9.3.2.2 TREMOR

9.3.2.3 DEPRESSION

9.4 SACRAL NERVE STIMULATION

9.4.1 SACRAL NERVE STIMULATION, BY TYPE

9.4.1.1 BATTERY

9.4.1.2 LEAD

9.5 SACRAL NERVE STIMULATION, BY APPLICATION

9.5.1 URINE INCONTINENCE

9.5.2 FECAL INCONTINENCE

9.6 VAGUS NERVE STIMULATION

9.6.1 VAGUS NERVE STIMULATION, BY TYPE

9.6.1.1 BATTERY

9.6.1.2 LEAD

9.6.2 VAGUS NERVE STIMULATION, BY APPLICATION

9.6.2.1 EPILEPSY

9.6.2.2 OTHERS

9.7 GASTRIC ELECTRICAL STIMULATION

9.7.1 GASTRIC ELECTRICAL STIMULATION, BY TYPE

9.7.1.1 BATTERY

9.7.1.2 LEAD

9.7.2 GASTRIC ELECTRICAL STIMULATION, BY APPLICATION

9.7.2.1 GASTROPARESIS

9.7.2.2 OTHERS

10 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT TENDER

10.3 THIRD PARTY PROVIDER

11 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 MEDTRONIC (2021)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 BOSTON SCIENTIFIC CORPORATION (2021)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 ABBOTT (2021)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 LIVANOVA PLC (2021)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 NEVRO CORP. (2021)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 AXONICS, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 ALEVA NEUROTHERAPEUTICS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 BIONIC VISION TECHNOLOGIES.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 BLUEWIND MEDICAL

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 BIOINDUCTION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 CIRTEC

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 FINETECH MEDICAL

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 GIMER MEDICAL

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 INSPIRE MEDICAL SYSTEMS, INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 INTEGER HOLDINGS CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 INBRAIN NEUROELECTRONICS

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 MAINSTAY MEDICAL

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 MICROSEMI (A WHOLLY OWNDED SUBSIDIARY OF MICROCHIP TECHNOLOGY INC.)

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 MICROTRANSPONDER INC

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 MICRO-LEADS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 NALU MEDICAL, INC

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 NEURONANO AB

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 NEURIMPULSE S.R.L.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 NEWRONIKA S.P.A.

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

14.25 OPTOGENTECH GMBH.

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCT PORTFOLIO

14.25.3 RECENT DEVELOPMENTS

14.26 ONWARD

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENT

14.27 STIMWAVE LLC (2021)

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT PORTFOLIO

14.27.3 RECENT DEVELOPMENTS

14.28 SEQUANA MEDICAL NV (2021)

14.28.1 COMPANY SNAPSHOT

14.28.2 REVENUE ANALYSIS

14.28.3 PRODUCT PORTFOLIO

14.28.4 RECENT DEVELOPMENTS

14.29 VALENCIA TECHNOLOGIES

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA PREVALENCE OF OBESITY

TABLE 2 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SPINAL CORD STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SPINAL CORD STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 7 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 8 NORTH AMERICA LEAD IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA LEAD IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 10 NORTH AMERICA LEAD IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 11 NORTH AMERICA SPINAL CORD STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 15 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 16 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 18 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 19 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 23 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 24 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 28 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 29 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 33 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 34 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA DIRECT TENDER IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA THIRD PARTY PROVIDER IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 43 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 44 NORTH AMERICA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 46 NORTH AMERICA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 47 NORTH AMERICA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 50 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 51 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 53 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 54 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 57 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 58 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 61 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 62 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 65 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 66 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 U.S. NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 72 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 73 U.S. LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. LEAD IN N NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 75 U.S. LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 76 U.S. SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 79 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 80 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 82 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 83 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 86 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 87 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 90 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 91 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 94 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 95 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 U.S. NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 97 CANADA NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 101 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 102 CANADA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 104 CANADA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 105 CANADA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 108 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 109 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 111 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 112 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 115 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 116 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 119 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 120 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 123 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 124 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 CANADA NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 MEXICO NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 130 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 131 MEXICO LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 133 MEXICO LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 134 MEXICO SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 137 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 138 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 140 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 141 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 144 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 145 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 148 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 149 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 152 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 153 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 MEXICO NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: GEOGRAPHIC SCOPE

FIGURE 3 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: DATA TRIANGULATION

FIGURE 4 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: SNAPSHOT

FIGURE 5 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BOTTOM UP APPROACH

FIGURE 6 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: TOP DOWN APPROACH

FIGURE 7 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: THE CATEGORY VS TIME GRID

FIGURE 10 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET SEGMENTATION

FIGURE 11 INCREASE IN PREVALENCE AND INCIDENCE OF NEUROLOGICAL DISEASES AND DEMAND FOR INTERNAL NEUROSTIMULATION DEVICES AS A ADD ON THERAPY ARE EXPECTED TO DRIVE THE NORTH AMERICA INTERNAL NEUROSTIMULATIOJ DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SPINAL CORD STIMULATION IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET IN 2022 TO 2029

FIGURE 13 NORTH AMERICA INCIDENCE OF ISCHEMIA

FIGURE 14 NORTH AMERICA INCIDENCE OF PARKINSON'S DISEASES

FIGURE 15 NORTH AMERICA INCIDENCE OF TREMOR

FIGURE 16 NORTH AMERICA INCIDENCE RATE OF EPILEPSY

FIGURE 17 NORTH AMERICA INCIDENCE RATE OF GASTROPARESIS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET

FIGURE 19 INCIDENCE OF ADULT ONSET BRAIN DISORDERS IN THE U.S. IN 2021

FIGURE 20 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 25 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 33 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.