North America High Barrier Packaging Films Market, By Type (Non-Woven Metalized Films, Clear Films, Organic Coating Films, Inorganic Oxide Coating Films, Others), Material (Plastic, Aluminum, Oxides, Others), Packaging Type (Pouches, Bags, Lids, Shrink Films, Laminated Tubes, Others), End-User (Food, Beverages, Pharmaceuticals, Electronic Devices, Medical Devices, Agriculture, Chemicals, Others, Market Trends and forecast to 2029.

Market Analysis and Insights

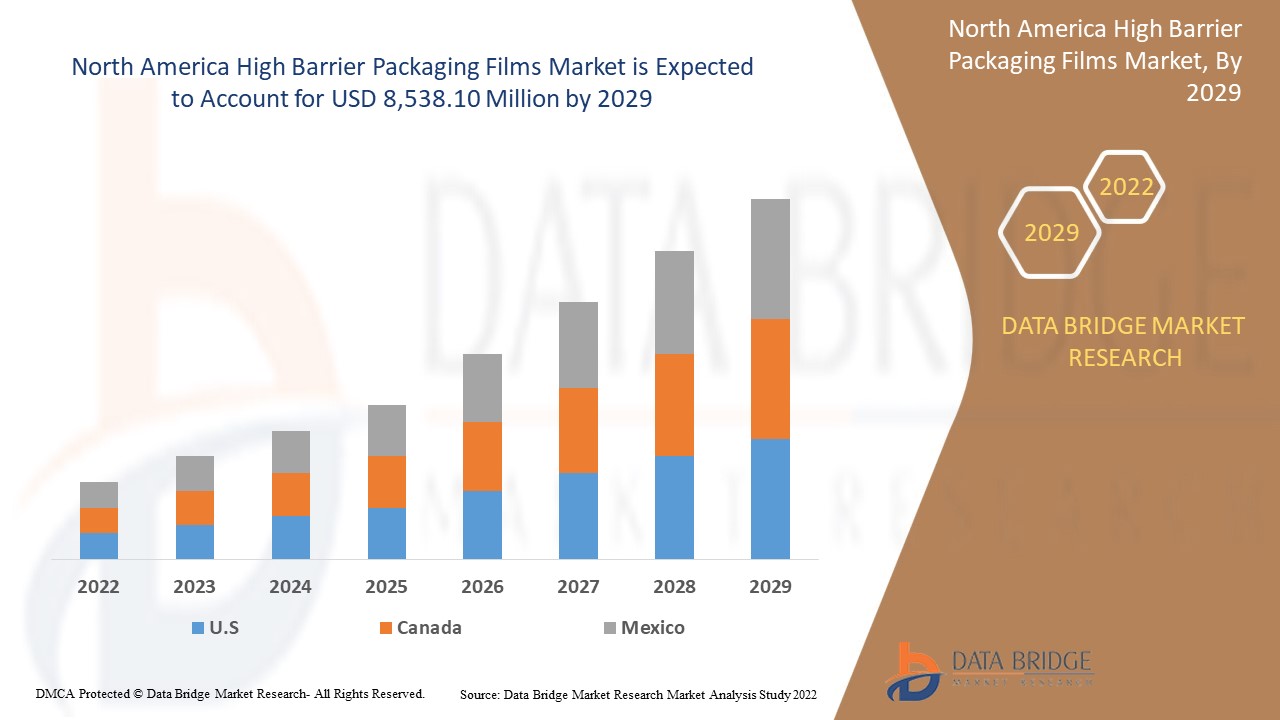

North America high barrier packaging films market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.3% in the forecast period of 2022 to 2029 and is expected to reach USD 8,538.10 million by 2029. The primary factor driving the growth of the high barrier packaging films market is the increasing demand for a multi-layer packaging for preventing oxygen and water permeation, the growing demand for high barrier packaging films for longer shelf-life, shifting consumer preference toward the packaged food, and the rising adoption of high barrier packaging films in pharmaceutical and agriculture industry.

The high barrier packaging films help prevent contact with oxygen, carbon dioxide, or moisture while restricting the effect of mineral oil and UV light. The powerful barrier created using functional materials used in the packaging film also holds the qualities of food such as color, taste, texture, aroma, and flavor. High barrier films play a major role in providing products with required properties and help extend the product's shelf life. It also helps make the structure recyclable with all layers relating to the same family of polymers. Moreover, high barrier films have an impermeable co-extruded & resilient structure. It is solvent-free and usually does not react with packaged food.

Moreover, the increasing popularity of ready-to-eat food influences the consumer shift toward packaged products. Hectic work-life balance and increasing workload also contribute to the rising demand for packaged foods by working professionals. Thus, with the growing demand for packaged food, the North America high barrier packaging films market is expected to propel the market's growth.

북미 고차단 포장 필름 시장 보고서는 시장 점유율, 새로운 개발 및 국내 및 지역 시장 참여자의 영향에 대한 세부 정보를 제공하고, 새로운 수익 창출, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서 기회를 분석합니다. 분석 및 시장 시나리오를 이해하려면 분석가 브리핑을 위해 당사에 문의하세요. 당사 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드립니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 해 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익 (단위: USD 백만) |

|

다루는 세그먼트 |

유형별(부직포 금속화 필름, 투명 필름, 유기 코팅 필름, 무기 산화물 코팅 필름, 기타), 재료별(플라스틱, 알루미늄, 산화물, 기타), 포장 유형별(파우치, 봉지, 뚜껑, 수축 필름, 적층 튜브, 기타), 최종 사용자별(식품, 음료, 제약, 전자 기기, 의료 기기, 농업, 화학 물질). |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Advanced Converting Works, Constantia Flexibles, HPM NORTH AMERICA INC, FLAIR Flexible Packaging Corporation, ClearBags, Perlen Packaging, OLIVER, Celplast Metallized Products, Toray Plastics (America), Inc. (Toray Industries Inc의 자회사), ISOFlex Packaging, KREHALON, MULTIVAC, BERNHARDT Packaging & Process, Sonoco Products Company, Sealed Air, WINPAL LTD., Schur Flexibles Holding GesmbH, Amcor Ltd. |

시장 정의

높은 차단성 포장 필름을 위한 유연한 포장 솔루션에는 파우치, 백, 뚜껑, 수축 필름, 라미네이트 튜브 등이 있습니다. 파우치는 지퍼로 다시 밀봉할 수 있으며, 고객의 제품 안전 및 편의성에 대한 요구가 증가함에 따라 유리 병 및 금속 통과 같은 단단한 포장 디자인을 대체하여 높은 차단성 포장 유형의 파우치를 장려합니다. 파우치는 또한 습기, 빛, 생물학적 오염, 가스 및 기계적 손상과 같은 외부 영향으로부터 제품을 보호하여 품질이나 효과에 영향을 미칩니다.

북미 고차단성 포장 필름 시장 동향

운전자

- 산소와 수분 차단을 위한 다층 포장 수요 증가

고차단 포장 필름에 존재하는 다층 구조는 산소, 습기 및 이산화탄소와 같은 다른 가스와의 접촉을 방지하고 미네랄 오일과 자외선의 영향을 제한하는 데 도움이 됩니다. 기능성 소재를 사용하여 만든 이 강력한 장벽은 색상, 맛, 질감, 향 및 풍미와 같은 식품 품질과 같이 저장된 재료의 무결성을 유지하는 데 도움이 됩니다. 제품이 무결성을 그대로 유지하려면 습기, 가스 및 향과 같은 모든 중요한 장벽 특성을 제공하는 것이 매우 중요합니다. 고차단 필름은 이러한 필수 특성을 가진 제품을 제공하는 데 중요한 역할을 합니다. 또한 고차단 필름은 불투과성 공압출 및 탄력성 구조를 가지고 있어 용매가 없고 의약품, 식품 및 기타와 같은 포장 품목과 반응하지 않습니다.

- 더 긴 보관 수명을 위한 고차단성 포장 필름에 대한 수요 증가

가공 및 냉동 식품 판매도 증가하고 있는데, 많은 소비자가 신선한 식품에서 벗어나 유통기한이 긴 식품을 비축하는 것을 선호하기 때문입니다. 소비자의 점점 더 바쁜 라이프스타일과 그에 따른 편리한 식품 포장에 대한 수요는 시장에서 고차단 필름에 대한 필요성을 촉진하고 있습니다. 소비자가 자신의 행동이 환경에 미치는 영향을 더 잘 알게 되면서, 자신의 발자국을 줄이는 구체적인 방법에 점점 더 관심을 갖고 있습니다. 이제 그 어느 때보다 소비자는 자신의 가치를 반영하고 가능한 한 지속 가능하게 조달, 생산 및 포장된 제품을 구매하려고 합니다. 유통기한은 요즘 소비자가 고려하는 핵심 요소입니다.

- 포장식품에 대한 소비자 선호도 변화

고차단성 포장 필름은 가공식품 및 즉석식품 포장 식품에 대한 소비와 수요가 증가함에 따라 식품 및 음료 산업에서 높은 수요를 보이고 있습니다. 게다가 가처분 소득이 증가함에 따라 직장인과 학생들은 포장 식품과 즉석식품에 더 많은 돈을 쓸 의향이 있어 고차단성 포장 필름 시장이 가까운 미래에 성장할 것입니다. 휴대하기 쉽고, 개봉하기 쉬우며, 준비 시간이 덜 걸리는 즉석식품, 냉동식품에서 전자렌지로, 즉석식품 포장, 가공식품에 대한 수요가 높습니다.

- 제약 및 농업 산업에서 고차단성 포장 필름 채택 증가

제약 분야는 외부 환경으로부터의 단열, 높은 수준의 보호, 비용 효율성, 취급 용이성과 같은 포장 솔루션에 대한 다양한 요구 사항을 제시합니다. 따라서 고차단 포장 필름은 이러한 필름이 포장 전체에서 가스 교환을 허용하지 않고 포장 내부의 온도를 제어하기 때문에 널리 사용되며, 주요 포장 재료가 플라스틱이기 때문에 제약 제품을 산소 및 냄새, 수증기 전달, 습기, 오염 및 박테리아로부터 보호하기 때문에 시장 성장을 증가시킵니다. 이러한 특성으로 인해 폴리프로필렌 소재는 고차단 포장에 적합한 선택입니다. 폴리프로필렌 고차단 필름은 높은 녹는점을 가지고 있어 끓일 수 있는 포장 및 직렬화 가능한 제품에 적합합니다.

기회

- 생분해성 고차단성 포장 필름 채택 증가

재활용 문제와 생분해성 혁신적 포장 솔루션으로 인해, 고차단 포장 필름 시장은 재료 생산자가 포장 생산을 위한 새롭고 개선된 플라스틱 필름과 첨가제를 계속 개발함에 따라 가까운 미래에 성장할 것으로 예상됩니다. 여기에는 고차단 및 호일 대체 필름, 실란트 필름 및 더 쉽게 재활용되고 자연적으로 분해되는 필름이 포함됩니다. 재료 사용량을 줄이는 것은 더 얇은 필름이나 더 적은 필름 층을 통해 포장 및 파우치 제조 산업 전반에 걸친 또 다른 주요 추세입니다.

- 고객 친화적 포장에 대한 수요 급증

소비자들이 포장 필름을 선택하기 전에 살펴보는 핵심 사항이 몇 가지 있습니다. 그 중 일부는 위생 및 식품 안전, 유통기한, 사용 편의성, 내구성, 라벨 정보, 외관 및 환경 영향입니다. 소비자들은 재활용 및 재활용 가능한 플라스틱에서 발견되는 섬유 기반 포장에 더 관심이 많습니다. 따라서 고객 친화적인 포장에 대한 추세와 수요가 증가함에 따라 고차단 포장 필름 시장이 미래에 상당한 성장을 기록할 수 있는 엄청난 기회가 있습니다. 이는 사용하기 편리하고 지속 가능하며 친환경적인 고객이 요구하는 제품을 더 많이 출시하여 수행할 수 있습니다.

제약/도전

- 저하에 대한 민감성

열에 노출되면 플라스틱 필름의 산화 메커니즘을 변경할 수 있습니다. 그러나 생분해성 폴리머의 완전한 분해는 수생 및 해양 서식지와 같은 자연 환경에서는 발견되지 않는 온도 및 압력 증가와 같은 제어된 조건에서만 달성할 수 있습니다. 따라서 최적의 조건이 아닐 때 이러한 고차단 포장 필름은 이러한 필름의 특성을 저하시키고 파괴할 것으로 예상됩니다. 이는 북미 고차단 포장 필름 시장의 성장을 제한할 수 있습니다.

- 원자재 가격 변동

다양한 고차단성 포장 필름은 다양한 원료를 사용하여 제조됩니다. 이러한 원료 중 일부는 폴리에틸렌 및 폴리프로필렌과 같은 플라스틱 재료와 알루미늄과 같은 금속 등입니다. 이러한 재료는 생분해성이 없고 재활용하기 어렵고 물과 땅을 포함한 환경에 해롭습니다. 원료 선택은 주로 차단 필름의 최종 용도에 따라 이루어집니다. 포장 필름에 사용되는 주요 원료로는 LDPE, LLDPE, HDPE, BOPP, CPP, BOPET, PVC, EVOH, PLA, PVDC, PVOH 등이 있습니다.

- 다층필름 재활용 관련 이슈

환경적 영향을 고려하면 이러한 포장 솔루션은 매우 효율적이지만 문제는 기존 폐기물 관리 인프라에서 거의 재활용되지 않는다는 것입니다. 유럽과 같이 재활용 단위는 재료를 결합해서 처리하는 탈과립화 공정에서 기계적 재활용의 기존 접근 방식에 널리 의존합니다. 다양한 결합 재료의 열적 비호환성은 재처리의 주요 장애물 중 하나입니다. 그러나 화학적 재활용과 같은 새로운 기술이 유망한 결과를 보이지만 추가적이고 심층적인 조사와 확장이 필요하여 시간과 막대한 자본 투자가 필요합니다. 이는 차례로 북미 고차단 포장 필름 시장의 개발 및 성장 경로에 큰 과제를 제기하고 있습니다.

- 엄격한 정부 규제와 환경 문제

고차단성 포장 필름은 주로 폴리에틸렌, 폴리프로필렌 등의 플라스틱 소재로 만들어집니다. 이러한 소재는 생분해성이 없고 재활용하기 어려우며 물과 땅을 포함한 환경에 해롭습니다. 따라서 정부, 규제 기관 및 환경 보호론자들은 이러한 필름 사용의 위험에 대한 인식을 확산해 왔습니다. 포장 부문에서는 플라스틱 사용량이 40%가 넘습니다. 플라스틱은 분해되는 데 수년이 걸리므로 많은 국가에서 어떤 산업에서도 플라스틱의 소비와 사용을 선호하지 않습니다.

COVID-19는 북미 고차단성 포장 필름 시장에 최소한의 영향을 미쳤습니다.

COVID-19는 2020-2021년에 다양한 제조 산업에 영향을 미쳐 작업장 폐쇄, 공급망 중단, 운송 제한으로 이어졌습니다. 그러나 고차단성 포장 필름 시장에 상당한 영향이 나타났습니다. 여러 제조 시설을 갖춘 고차단성 포장 필름의 운영 및 공급망은 여전히 이 지역에서 운영되고 있었습니다. 서비스 제공업체는 COVID 이후 시나리오에서 위생 및 안전 조치에 따라 고차단성 포장 필름을 계속 제공했습니다.

최근 개발

2021년 5월, DuPont의 모빌리티 및 소재 사업부는 독일과 스위스의 생산 시설에 자본과 운영 리소스에 500만 달러를 투자하여 생산 용량을 늘렸습니다.

북미 고차단성 포장 필름 시장 범위

북미 고차단 포장 필름 시장은 유형, 소재, 포장 유형 및 최종 사용자를 기준으로 분류됩니다. 이러한 세그먼트 간의 성장은 주요 산업 성장 세그먼트를 분석하고 사용자에게 귀중한 시장 개요와 시장 통찰력을 제공하여 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 됩니다.

유형

- 부직포 금속화 필름

- 투명 필름

- 유기코팅필름

- 무기산화물 코팅 필름

- 기타

북미 고차단성 포장 필름 시장은 유형을 기준으로 부직포 금속화 필름, 투명 필름, 유기 코팅 필름, 무기 산화물 코팅 필름 등 5개 부문으로 분류됩니다.

재료

- 플라스틱

- 알류미늄

- 산화물

- 기타

북미 고차단성 포장 필름 시장은 소재를 기준으로 플라스틱, 알루미늄, 산화물 및 기타의 4개 부문으로 분류됩니다.

포장 유형

- 파우치

- 바지

- 뚜껑

- 수축 필름

- 적층 튜브

- 기타

포장 유형을 기준으로 북미 고차단성 포장 필름 시장은 파우치, 백, 뚜껑, 수축 필름, 라미네이트 튜브 및 기타의 6개 부문으로 분류됩니다.

최종 사용자

- 음식

- 음료수

- 제약품

- 전자 장치

- 의료기기

- 농업

- 약

- 기타

북미 고차단성 포장 필름 시장은 최종 사용자를 기준으로 식품, 음료, 제약, 전자 기기, 의료 기기, 농업, 화학 및 기타 분야로 구분됩니다.

북미 고차단 포장 필름 시장 지역 분석/통찰력

포장 산업에서 북미 고차단성 포장 필름 시장은 유형, 소재, 포장 유형 및 최종 사용자에 따라 세분화됩니다.

북미 고차단 포장 필름 시장 국가는 미국, 캐나다, 멕시코입니다. 미국은 시장 점유율과 시장 수익 측면에서 북미 고차단 포장 필름 시장을 지배하고 있으며 예측 기간 동안 지배력을 계속 강화할 것입니다. 이는 병원과 진단 센터의 방문객 증가 때문입니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 하류 및 상류 가치 사슬 분석, 기술 테스트 및 포터의 5가지 힘 분석, 사례 연구의 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세의 영향 및 무역 경로가 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 고차단 포장 필름 시장 점유율 분석

North America high barrier packaging films market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies' focus on the North America high barrier packaging films market.

Some of the prominent participants operating in the North America High barrier packaging films market are Advanced Converting Works, Constantia Flexibles, HPM NORTH AMERICA INC, FLAIR Flexible Packaging Corporation, ClearBags, Perlen Packaging, OLIVER, Celplast Metallized Products, Toray Plastics (America), Inc. (a subsidiary of Toray Industries Inc), ISOFlex Packaging, KREHALON, MULTIVAC, BERNHARDT Packaging & Process, Sonoco Products Company, Sealed Air, WINPAL LTD., Schur Flexibles Holding GesmbH, Amcor Ltd.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 KEY PATENT LAUNCHED

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES:

4.4.1 THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 MANUFACTURING AND PACKING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 TECHNOLOGY ADVANCEMENTS

4.7 VENDOR SELECTION CRITERIA

4.8 REGULATORY COVERAGE

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 MIDDLE EAST AND AFRICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN DEMAND FOR MULTI-LAYER PACKAGING FOR PREVENTING OXYGEN AND WATER

6.1.2 GROW IN DEMAND FOR HIGH BARRIER PACKAGING FILMS FOR LONGER SHELF-LIFE

6.1.3 SHIFTING CONSUMER PREFERENCE TOWARD THE PACKAGED FOOD

6.1.4 RISE IN ADOPTION OF HIGH BARRIER PACKAGING FILMS IN PHARMACEUTICAL AND AGRICULTURE INDUSTRY

6.2 RESTRAINTS

6.2.1 SUSCEPTIBILITY TO DEGRADATION

6.2.2 FLUCTUATION IN PRICES OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 GROW IN ADOPTION OF BIODEGRADABLE HIGH BARRIER PACKAGING FILMS

6.3.2 UPSURGE IN THE DEMAND FOR CUSTOMER-FRIENDLY PACKAGING

6.4 CHALLENGES

6.4.1 ISSUE RELATED TO RECYCLING OF MULTI-LAYER FILMS

6.4.2 STRICT GOVERNMENT REGULATION AND ENVIRONMENTAL CONCERNS

7 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-WOVEN METALIZED FILMS

7.3 CLEAR FILMS

7.4 ORGANIC COATING FILMS

7.5 INORGANIC OXIDE COATING FILMS

7.6 OTHERS

7.6.1 ALUMINIUM FOIL

7.6.2 REST OF OTHERS

8 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 POLYETHYLENE (PE)

8.2.2 POLYPROPYLENE (PP)

8.2.3 POLYETHYLENE TEREPHTHALATE (PET)

8.2.4 ETHYLENE VINYL ALCOHOL (EVOH)

8.2.5 POLYETHYLENE NAPHTHALATE (PEN)

8.2.6 POLYVINYLIDENE CHLORIDE (PVDC)

8.2.7 POLYAMIDE (NYLON)

8.2.8 OTHERS (LCD, PS, PVC, PLA, PA)

8.3 ALUMINIUM

8.4 OXIDES

8.4.1 SILICON OXIDE

8.4.2 ALUMINUM OXIDE

8.5 OTHERS

9 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 POUCHES

9.3 BAGS

9.4 LIDS

9.5 SHRINK FILMS

9.6 LAMINATED TUBES

9.7 OTHERS

10 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER

10.1 OVERVIEW

10.2 FOOD

10.2.1 MEAT, SEA FOOD & POULTRY

10.2.2 READY TO EAT MEALS

10.2.3 SNACKS

10.2.4 DAIRY FOODS

10.2.5 BAKERY & CONFECTIONARY

10.2.6 BABY FOOD

10.2.7 PET FOOD

10.2.8 OTHER FOOD

10.3 BEVERAGES

10.3.1 NON-ALCOHOLIC BEVERAGES

10.3.2 ALCOHOLIC BEVERAGES

10.4 PHARMACEUTICALS

10.5 ELECTRONIC DEVICES

10.6 MEDICAL DEVICES

10.7 AGRICULTURE

10.8 CHEMICALS

10.9 OTHERS

11 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 ACQUISITION

12.3 PRODUCT LAUNCH

12.4 AWARD

12.5 CONFERENCE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 AMCOR PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 DUPONT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATES

14.3 SONOCO PRODUCTS COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATES

14.4 BERRY NORTH AMERICA INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 SEALED AIR

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADVANCED CONVERTING WORKS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BERNHARDT PACKAGING & PROCESS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELPLAST METALLIZED PRODUCTS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CLEARBAGS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 CONSTANTIA FLEXIBLES

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 FLAIR FLEXIBLE PACKAGING CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 HPM NORTH AMERICA INC

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 ISOFLEX PACKAGING

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 KREHALON

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT UPDATES

14.15 MULTIVAC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 OLIVER

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATE

14.17 PERLEN PACKAGING

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATE

14.18 SCHUR FLEXIBLES HOLDING GESMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 TORAY PLASTICS (AMERICA), INC. (SUBSIDIARY OF TORAY INDUSTRIES INC)

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT UPDATES

14.2 WINPAK LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING 3901 TO 3914, N.E.S; HS CODE – 392690 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING 3901 TO 3914, N.E.S; HS CODE – 392690 (USD THOUSAND)

TABLE 3 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 5 NORTH AMERICA NON-WOVEN METALIZED FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA NON-WOVEN METALIZED FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 NORTH AMERICA CLEAR FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CLEAR FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 NORTH AMERICA ORGANIC COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ORGANIC COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 NORTH AMERICA INORGANIC OXIDE COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INORGANIC OXIDE COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 17 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 19 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 21 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 23 NORTH AMERICA ALUMINIUM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA ALUMINIUM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 27 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 29 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 31 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 33 NORTH AMERICA POUCHES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA POUCHES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS )

TABLE 35 NORTH AMERICA BAGS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA BAGS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 37 NORTH AMERICA LIDS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA LIDS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 39 NORTH AMERICA SHRINK FILM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA SHRINK FILM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 41 NORTH AMERICA LAMINATED TUBES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA LAMINATED TUBES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 43 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 45 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 47 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 49 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 51 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 53 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 55 NORTH AMERICA PHARMACEUTICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA PHARMACEUTICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 57 NORTH AMERICA ELECTRONIC DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA ELECTRONIC DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 59 NORTH AMERICA MEDICAL DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA MEDICAL DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 61 NORTH AMERICA AGRICULTURE IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA AGRICULTURE IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 63 NORTH AMERICA CHEMICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA CHEMICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 65 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 67 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 69 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 71 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 75 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 77 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 79 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 81 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 83 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 85 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 87 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 89 U.S. OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.S. OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 91 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 92 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 93 U.S. PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 95 U.S. OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.S. OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 97 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 99 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 101 U.S. FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 U.S. FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 103 U.S. BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 U.S. BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 105 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 107 CANADA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 109 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 110 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 111 CANADA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 CANADA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 113 CANADA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 115 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 117 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 119 CANADA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 120 CANADA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 121 CANADA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 122 CANADA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 123 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 125 MEXICO OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 127 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 128 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 129 MEXICO PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MEXICO PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 131 MEXICO OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 133 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 134 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 135 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 137 MEXICO FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 MEXICO FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 139 MEXICO BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 MEXICO BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

그림 목록

FIGURE 1 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 2 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SHIFTING CONSUMER PREFERENCE TOWARDS THE PACKAGED FOOD IS EXPECTED TO DRIVE NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET FROM 2022 TO 2029

FIGURE 16 NON-WOVEN METALIZED FILMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET IN 2022 & 2029

FIGURE 17 SUPPLY CHAIN ANALYSIS- NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 20 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY TYPE, 2021

FIGURE 21 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY MATERIAL, 2021

FIGURE 22 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY PACKAGING TYPE, 2021

FIGURE 23 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY END USER, 2021

FIGURE 24 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY TYPE (2022-2029)

FIGURE 29 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.