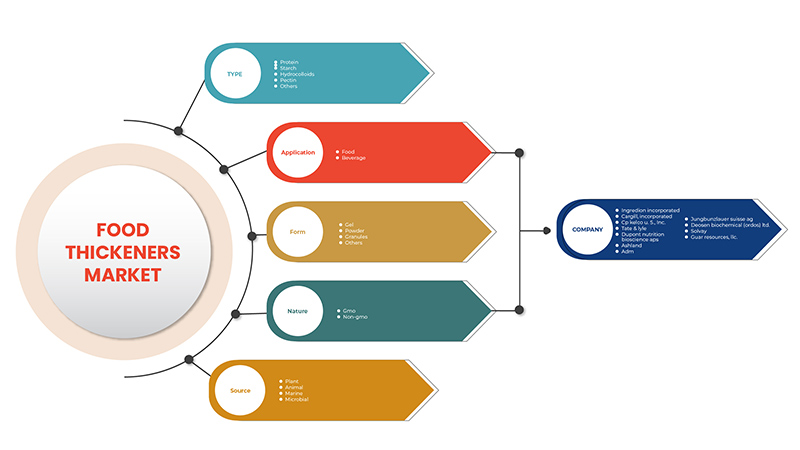

북미 식품 증점제 시장, 유형별(단백질, 전분, 하이드로콜로이드, 펙틴 및 기타), 형태별(젤, 분말, 과립 및 기타), 특성별(GMO 및 비GMO), 출처별(식물, 동물, 해양 및 미생물), 응용 분야별(식품 및 음료) 산업 동향 및 2029년까지의 예측

시장 분석 및 통찰력

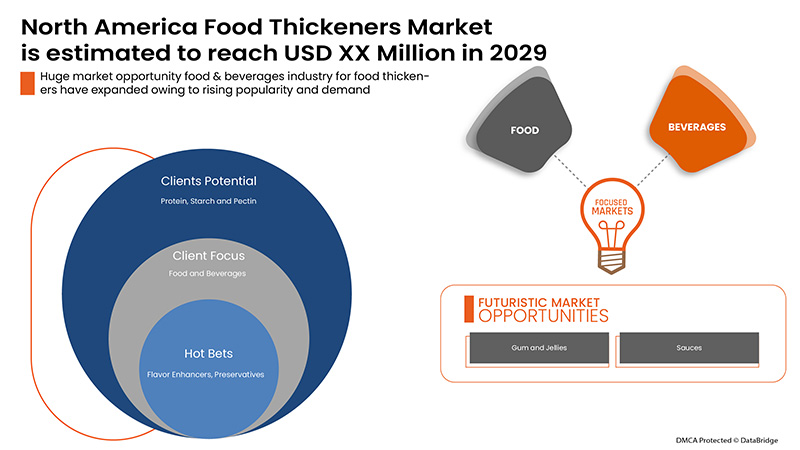

소비자의 라이프스타일 변화 증가로 인해 식단에 대한 집중도가 높아진 것은 시장 성장을 가속화하는 중요한 요인입니다. 게다가, 신제품 혁신의 증가와 시장에서의 연구 개발 활동의 증가는 북미 식품 증점제 시장에 새로운 기회를 더욱 창출할 것입니다. 그러나 식품 증점제 개발 및 제조와 관련된 연구 및 비용 증가와 하이드로콜로이드의 원자재 가격의 지속적인 변동은 예측 기간 동안 북미 식품 시장 증점제 시장을 제한하고 더욱 도전할 것으로 예상되는 주요 요인입니다.

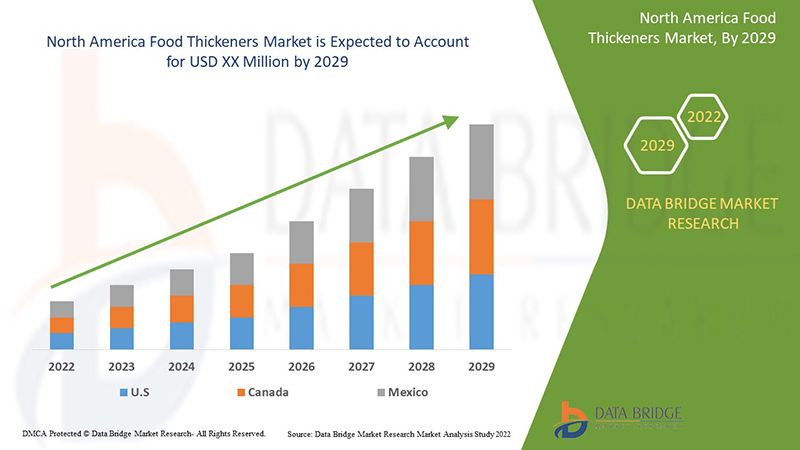

Data Bridge Market Research에 따르면, 북미 식품 증점제 시장은 2022년부터 2029년까지의 예측 기간 동안 연평균 성장률 5.6%로 성장할 것으로 예상됩니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 해 |

2020 (2019-2015까지 사용자 정의 가능) |

|

양적 단위 |

수익 (단위: USD 백만) |

|

다루는 세그먼트 |

유형별(단백질, 전분, 하이드로콜로이드, 펙틴 및 기타), 형태별(젤, 분말, 과립 및 기타), 특성별(GMO 및 비GMO), 출처별(식물, 동물, 해양 및 미생물), 응용 분야별(식품 및 음료) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Ingredion Incorporated, Cargill, Incorporated, CP Kelco US, Inc., Tate & Lyle, DuPont Nutrition Bioscience ApS, Ashland, DSM, ADM, Jungbunzlauer Suisse AG, Deosen Biochemical (Ordos) Ltd., Solvay, Emsland Group, Guar Resources, LLC., Medline Industries, LP., GELITA AG, HL Agro Products Pvt. Ltd., Kent Precision Foods Group, Inc., VIKAS WSP LTD. 등 |

시장 정의

식품 증점제는 식품 및 음료의 질감과 구조를 수정하는 데 사용되는 식품 개질제로 정의됩니다. 식품 및 음료의 두께를 늘리는 데 사용되어 식품에 통합된 후 식품의 수분 함량을 흡수하는 데 도움이 됩니다. 이러한 제품은 주로 점도를 수정하여 일관된 전체 구조를 제공하는 데 사용됩니다. 시장에서 가장 널리 사용되는 식품 증점제는 전분이며 그 다음으로 하이드로콜로이드와 단백질입니다. 식품 증점제는 제빵, 제과, 소스 , 드레싱, 매리네이드, 그레이비, 음료, 유제품, 냉동 디저트, 편의 식품, 가공 식품 등과 같은 식품 응용 분야에서 사용됩니다.

북미 식품 증점제 시장 동향

운전자

- 과일 주스와 에너지 드링크를 포함한 비알코올 음료에 대한 수요 증가

식품 증점제는 과일 주스에 첨가되어 제품의 점도를 높입니다. 과일 주스는 과일을 기계적으로 짜거나 절여서 얻은 발효되지 않은 음료입니다. 오렌지, 사과, 망고, 혼합 과일 등과 같은 과일 주스는 다양한 건강상의 이점으로 인해 성장하고 있습니다. 다양한 유형의 과일 주스는 다양한 건강상의 이점을 제공합니다.

예를 들어,

아보카도 주스는 신체의 자연 에너지를 증진합니다. 수박 주스는 신체를 수분 공급하고 신진대사를 개선합니다. 파파야 주스는 건강한 소화를 담당합니다. 레몬 주스는 바이러스 감염과 싸웁니다. 파인애플 주스는 콜레스테롤 수치를 낮춥니다. 오렌지 주스는 노화 징후를 줄입니다.

라이프스타일의 변화와 소비자의 식습관의 변화로 인해 포장 과일 주스와 같은 저렴하고 건강하며 빠른 영양 공급원의 섭취가 증가했습니다. 또한 제조업체는 다양한 맛을 선보이고 방부제와 설탕이 없는 과일 주스를 생산하여 소비자 기반을 확대하고 전 세계적으로 과일 주스에 대한 전반적인 수요를 증가시키고 있습니다.

또한, 현재 진행 중인 COVID-19 팬데믹 동안 건강상의 이점으로 인해 과일과 야채 주스 소비가 전 세계적으로 증가했습니다. 지역 및 국제 시장의 다양한 업체가 사람들의 면역력을 높이기 위해 강화된 비타민과 미네랄이 함유된 제품을 출시했습니다.

- 식품 증점제 사용과 관련된 장점 및 다양한 기능

식품 증점제는 주로 액체의 특성을 변화시키지 않고 점도를 높이는 데 사용됩니다. 식품 증점제는 제품의 현탁 및 유화를 증가시켜 안정화시키는 식품 첨가물로 사용됩니다. 식품 증점제는 주로 푸딩, 소스, 수프 등과 같은 식품 및 음료 제조에 사용됩니다.

완전히 고형인 음식은 삼키는 동안 질식을 일으킬 수도 있습니다. 그러나 걸쭉해진 액체는 너무 쉽게 통과하고 프레임에서 영양분을 얻을 수 없습니다. 따라서 균형을 유지하기 위해 걸쭉하게 하는 물질을 사용합니다. 이것이 음식을 삼킬 수 없는 암, 외상 및 신경 장애 환자에게 식품 걸쭉함이 도움이 되는 주된 이유입니다.

또한, 식품 증점제는 삼키기 문제가 있는 노인에게 매우 유용합니다. 삼키기 문제는 노인 인구에서 만연하며 예방하기 어렵습니다. 이 문제는 여러 요인으로 인해 발생할 수 있습니다. 건강상의 이유, 신경계 질환, 뇌졸중 및 암과 같은 요인입니다. 성인의 시그마 식품 티커에 대한 또 다른 우려 사항은 치아 상실입니다. 그러나 식품 증점제가 노인의 흡인 문제를 줄인다는 증거가 있습니다. 언어 병리학자는 식품 증점제의 영향을 평가했습니다. 이를 통해 삼키기 문제에 대처하기 위해 식품 증점제 사용 범위를 확장하는 새로운 전략을 도입하는 데 도움이 되었습니다. 앞서 언급한 이러한 장점은 북미 식품 증점제 시장의 원동력이 될 것으로 예상됩니다.

기회

-

주요 참여자들의 전략적 결정

선도적인 시장 참여자들은 개선된 기능을 보여주는 신제품을 출시했습니다. 제조업체들은 신제품의 정확성과 전반적인 기능을 개선하기 위해 필요한 조치를 취했습니다.

예를 들어,

- 2021년 1월, Tate & Lyle은 타피오카 기반 전분 라인을 확장했습니다. 이 확장에는 새로운 REZISTA MAX 증점 전분과 BRIOGEL 겔화 전분의 출시가 포함됩니다. 이를 통해 회사는 제품 포트폴리오를 확대할 수 있었습니다.

따라서, 중요한 혁신과 신제품 출시가 증가함에 따라 북미 식품 증점제 시장에 기회가 제공될 가능성이 높습니다.

제약/도전

- 잔탄검과 카라기난에 대한 건강 문제 가능성

잔탄검은 인체 건강에 부작용이 있는 것으로 나타났습니다. 잔탄검 가루에 노출된 사람들은 독감과 유사한 증상, 코와 목의 자극, 장내 가스(배탈), 팽창, 폐 문제를 경험할 수 있습니다.

많은 의사들이 임신과 모유 수유 중에 잔탄검을 복용하지 말라고 처방했습니다. 지금까지 임신과 모유 수유 중에 잔탄검을 사용하는 것에 대한 정보가 충분하지 않습니다. 하지만 안전을 위해 의사들은 일반적으로 음식에서 발견되는 양보다 많은 양의 잔탄검을 사용하지 말라고 처방했습니다. 또한 잔탄검은 메스꺼움, 구토, 맹장염, 배출하기 어려운 딱딱한 대변(대변 막힘), 장의 협착이나 막힘, 진단되지 않은 복통이 있는 사람에게는 처방되지 않습니다. 잔탄검은 이런 상황에서 해로울 수 있는 덩어리 형성 완하제이기 때문입니다.

또한, 잔탄검은 수술 중 혈당 수치를 낮출 수 있습니다. 수술 중 및 수술 후 혈당 조절을 방해할 수 있다는 우려가 있습니다. 따라서 예정된 수술 최소 2주 전에 잔탄검 사용을 중단하는 것이 처방됩니다. 또한, 잔탄검이 음식에서 당을 흡수하는 것을 감소시켜 혈당을 낮출 수 있습니다. 당뇨병 약물도 혈당을 낮추는 데 사용되므로 당뇨병 환자에게 해롭습니다.

COVID-19 이후 북미 식품 증점제 시장에 미치는 영향

주요 시장 제조업체는 경쟁 시장을 유지하고 변화하는 소비자 트렌드에 부응하기 위해 제품 혁신, 지역 확장, 신제품 개발과 같은 다양한 마케팅 전략을 채택하고 있습니다. 다양한 경쟁업체가 이러한 전략적 마케팅 정책을 채택하면 COVID-19 이후 시대에 경쟁력 있는 시장 점유율을 확보하는 데 도움이 될 것입니다.

최근 개발

- 2021년 2월, Ingredion Incorporated는 Grupo Arcor와 합작 투자를 하여 포도당 시럽, 맥아당, 과당, 전분과 같은 부가가치 성분을 생산하기로 계약을 체결했습니다. 이는 회사가 지역적 속죄에 도움이 되었습니다.

북미 식품 증점제 시장 범위

북미 식품 증점제 시장은 유형, 형태, 특성, 출처 및 응용 프로그램을 기준으로 5개의 주요 세그먼트로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 주요 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 단백질

- 녹말

- 하이드로콜로이드

- 펙틴

- 기타

북미 식품 증점제 시장은 유형을 기준으로 단백질, 전분, 하이드로콜로이드, 펙틴 및 기타로 구분됩니다.

형태

- 젤라틴

- 가루

- 과립

- 기타

북미 식품 증점제 시장은 형태에 따라 젤, 분말, 과립 및 기타로 구분됩니다.

자연

- 유전자 변형

- 비GMO

북미 식품 증점제 시장은 자연적으로 GMO와 비GMO로 구분됩니다.

원천

- 식물

- 동물

- 선박

- 미생물

북미 식품 증점제 시장은 원산지를 기준으로 식물, 동물, 해양, 미생물로 구분됩니다.

애플리케이션

- 음식

- 음료수

북미 식품 증점제 시장은 응용 분야를 기준으로 식품과 음료로 구분됩니다.

북미 식품 증점제 시장 지역 분석/통찰력

북미 식품 증점제 시장을 분석하고, 위에 언급된 대로 국가, 유형, 형태, 특성, 출처 및 응용 분야를 기반으로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 식품 증점제 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

미국은 성장하는 식품 및 음료 산업으로 인해 북미 식품 증점제 시장을 지배할 것으로 예상됩니다. 캐나다는 주요 제조업체 간의 전략적 제휴로 인해 이 지역을 지배할 것으로 예상되고, 멕시코는 식품 증점제의 높은 생산으로 인해 이 지역을 지배할 수 있습니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규정의 변화를 제공합니다. 신규 및 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성, 현지 및 국내 브랜드와의 치열한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 식품 증점제 시장 점유율 분석

경쟁적인 북미 식품 증점제 시장은 경쟁사를 자세히 설명합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위의 데이터 포인트는 북미 식품 증점제 시장에 대한 회사의 초점에만 관련이 있습니다.

북미 식품 증점제 시장의 주요 기업으로는 Ingredion Incorporated, Cargill, Incorporated, CP Kelco US, Inc., Tate & Lyle, DuPont Nutrition Bioscience ApS, Ashland, DSM, ADM, Jungbunzlauer Suisse AG, Deosen Biochemical (Ordos) Ltd., Solvay, Emsland Group, Guar Resources, LLC., Medline Industries, LP., GELITA AG, HL Agro Products Pvt. Ltd., Kent Precision Foods Group, Inc., VIKAS WSP LTD. 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 북미 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가에게 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FOOD THICKENERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIENTS CUSTOMIZATION:

4.1.1 WHAT IS THE MAJOR FOOD THICKENER, AND WHAT IS EACH FOOD THICKENER'S ISSUE (OR REQUIREMENT) TO SOLVE?

4.1.2 STARCH

4.1.3 HYDROCOLLOIDS

4.1.4 PECTIN

4.1.5 PROTEIN:

4.2 ANALYSIS OF MAJOR FOOD THICKENERS:

4.3 PRICING ANALYSIS OF FOOD THICKENERS

4.4 NORTH AMERICA FOOD THICKENERS MARKET: NEW PRODUCT LAUNCH STRATEGIES

4.4.1 GROWING DEMAND FOR PLANT-BASED SOURCED FOOD THICKENERS

4.4.2 LAUNCHING ORGANIC, CLEAN, AND SUSTAINABLE FOOD THICKENERS

4.4.3 PROMOTING BY HIGHLIGHTING GLUTEN-FREE THICKENERS

4.4.4 LAUNCHES-

4.5 FACTORS INFLUENCING PURCHASING DECISION OF END USERS

4.5.1 VARIETY OF APPLICATIONS CATERED BY FOOD THICKENERS PRODUCTS:

4.5.2 AVAILABILITY OF A VARIETY OF PRODUCT TYPES:

4.5.3 QUALITY OF THE PRODUCTS:

4.6 NORTH AMERICA FOOD THICKENERS MARKET: REGULATORY FRAMEWORK

4.7 SUPPLY CHAIN ANALYSIS

4.8 VALUE CHAIN ANALYSIS OF NORTH AMERICA FOOD THICKENERS MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR FRUIT JUICES

5.1.2 RISING DISPOSABLE INCOME COUPLED WITH CHANGING LIFESTYLES DUE TO RAPID URBANIZATION

5.1.3 ADVANTAGES AND SEVERAL FUNCTIONS ASSOCIATED WITH THE USE OF FOOD THICKENERS

5.1.4 RISING DEMAND FOR THICKENING AGENTS IN BAKERY AND CONFECTIONERY PRODUCTS

5.2 RESTRAINTS

5.2.1 POSSIBLE HEALTH CONCERNS REGARDING XANTHAN GUM AND CARRAGEENAN

5.2.2 HIGH R&D COSTS ASSOCIATED WITH THE DEVELOPMENT AND MANUFACTURING OF FOOD THICKENERS

5.2.3 FLUCTUATIONS IN RAW MATERIAL PRICES OF HYDROCOLLOIDS

5.3 OPPORTUNITIES

5.3.1 STRATEGIC DECISIONS BY KEY PLAYERS

5.3.2 ADVANCEMENTS IN THE EXTRACTION AND PROCESSING OF FOOD THICKENERS

5.4 CHALLENGES

5.4.1 STRINGENT GOVERNMENT REGULATIONS

5.4.2 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

6 COVID-19 IMPACT ON THE NORTH AMERICA FOOD THICKENERS MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE NORTH AMERICA FOOD THICKENERS MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE

7.1 OVERVIEW

7.2 HYDROCOLLOIDS

7.2.1 HYDROCOLLOIDS, BY TYPE

7.2.1.1 XANTHAN GUM

7.2.1.2 SODIUM ALGINATE

7.2.1.3 LOCUST BEAN GUM

7.2.1.4 GUM ARABIC

7.2.1.5 GAUR GUM

7.2.1.6 GUM KARAYA

7.2.1.7 GUM TRAGACANTH

7.2.1.8 OTHERS

7.2.2 HYDROCOLLOIDS, BY FORM

7.2.2.1 POWDER

7.2.2.2 GRANULES

7.2.2.3 GEL

7.2.2.4 OTHERS

7.3 PROTEIN

7.3.1 PROTEIN, BY TYPE

7.3.1.1 GELATIN

7.3.1.2 COLLAGEN

7.3.1.3 EGG PROTEIN

7.3.2 PROTEIN, BY FORM

7.3.2.1 POWDER

7.3.2.2 GRANULES

7.3.2.3 GEL

7.3.2.4 OTHERS

7.4 STARCH

7.4.1 STARCH, BY TYPE

7.4.1.1 CORN STARCH

7.4.1.2 WHEAT STARCH

7.4.1.3 ARROWROOT STARCH

7.4.1.4 POTATO STARCH

7.4.1.5 RICE STARCH

7.4.1.6 PEA STARCH

7.4.1.7 OTHERS

7.4.2 STARCH, BY FORM

7.4.2.1 POWDER

7.4.2.2 GRANULES

7.4.2.3 GEL

7.4.2.4 OTHERS

7.5 PECTIN

7.5.1 PECTIN, BY FORM

7.5.1.1 POWDER

7.5.1.2 GRANULES

7.5.1.3 GEL

7.5.1.4 OTHERS

7.6 OTHERS

8 NORTH AMERICA FOOD THICKENERS MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 GRANULES

8.4 GEL

8.5 OTHERS

9 NORTH AMERICA FOOD THICKENERS MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE

10.1 OVERVIEW

10.2 PLANT

10.3 ANIMAL

10.4 MARINE

10.5 MICROBIAL

10.5.1 BACTERIA

10.5.2 YEAST

10.5.3 FUNGI

11 NORTH AMERICA FOOD THICKENERS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD

11.2.1 FROZEN DESSERTS

11.2.2 DAIRY PRODUCTS

11.2.3 FRUIT PREPARATIONS

11.2.4 BAKERY

11.2.5 CONFECTIONERY

11.2.6 MEAT PRODUCTS

11.2.7 CONVENIENCE FOOD

11.2.8 PROCESSED FOOD

11.2.9 DAIRY ALTERNATIVE PRODUCTS

11.2.10 FUNCTIONAL FOOD

11.2.11 SEAFOOD PRODUCTS

11.2.12 SPORTS NUTRITION

11.2.13 MEAT ALTERNATIVE PRODUCTS

11.3 BEVERAGES

11.3.1 JUICES

11.3.2 DAIRY BASED DRINKS

11.3.3 CARBONATED SOFT DRINKS

11.3.4 SMOOTHIES

11.3.5 RTD TEA & COFFEE

11.3.6 SPORTS DRINKS

11.3.7 ENERGY DRINKS

11.3.8 OTHERS

12 NORTH AMERICA FOOD THICKENERS MARKET, BY REGION

12.1 OVERVIEW

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

13 NORTH AMERICA FOOD THICKENERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 INGREDION INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 CARGILL, INCORPORATED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 TATE & LYLE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 ADM

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ASHLAND

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 CP KELCO

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 DSM

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 SOLVAY

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DUPONT NUTRITION BIOSCIENCE APS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 MEDLINE INDUSTRIES, LP.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DEOSEN BIOCHEMICAL (ORDOS) LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 EMSLAND GROUP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 GELITA AG

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 GUAR RESOURCES, LLC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HL AGRO PRODUCTS PVT. LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 JUNGBUNZLAUER SUISSE AG

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 KENT PRECISION FOODS GROUP, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 VIKAS WSP LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 REGULATIONS BY HEALTH CANADA-

TABLE 2 HEALTH CANADA REGULATIONS-

TABLE 3 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 5 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 7 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 9 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 11 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 13 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 15 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 17 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 19 NORTH AMERICA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA FOOD THICKENERS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA FOOD THICKENERS MARKET, BY COUNTRY, 2020-2029 (THOUSAND TONS)

TABLE 28 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 30 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 32 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 34 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 36 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 38 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 40 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 42 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 44 NORTH AMERICA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 U.S. FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 53 U.S. STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 55 U.S. STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 56 U.S. STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 57 U.S. PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 58 U.S. PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 59 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 61 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 62 U.S. HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 63 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 65 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 66 U.S. PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 67 U.S. FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 68 U.S. FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 69 U.S. FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 70 U.S. MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 71 U.S. FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 U.S. FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 U.S. BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 CANADA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 CANADA FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 76 CANADA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 78 CANADA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 CANADA STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 80 CANADA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 81 CANADA PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 82 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 84 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 85 CANADA HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 86 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 88 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 89 CANADA PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 90 CANADA FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 91 CANADA FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 92 CANADA FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 93 CANADA MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 94 CANADA FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 CANADA FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 CANADA BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 MEXICO FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 99 MEXICO STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO STARCH IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 101 MEXICO STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 MEXICO STARCH IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 103 MEXICO PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 104 MEXICO PECTIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 105 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 107 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 108 MEXICO HYDROCOLLOIDS IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 109 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY TYPE, 2020-2029 (THOUSAND TONS)

TABLE 111 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 112 MEXICO PROTEIN IN FOOD THICKENERS MARKET, BY FORM, 2020-2029 (THOUSAND TONS)

TABLE 113 MEXICO FOOD THICKENERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 114 MEXICO FOOD THICKENERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 115 MEXICO FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO MICROBIAL IN FOOD THICKENERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 117 MEXICO FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 MEXICO FOOD IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 MEXICO BEVERAGES IN FOOD THICKENERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA FOOD THICKENERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FOOD THICKENERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD THICKENERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD THICKENERS MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA FOOD THICKENERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD THICKENERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FOOD THICKENERS MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA FOOD THICKENERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FOOD THICKENERS MARKET: SEGMENTATION

FIGURE 10 RISING CONSUMPTION OF PROCESSED FOOD AMONG PEOPLE IS THE KEY DRIVER FOR GLOBAL FOOD THICKENERS MARKET

FIGURE 11 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD THICKENERS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA FOOD THICKENERS MARKET

FIGURE 13 NORTH AMERICA FOOD THICKENERS MARKET: BY TYPE, 2021

FIGURE 14 NORTH AMERICA FOOD THICKENERS MARKET: BY FORM, 2021

FIGURE 15 NORTH AMERICA FOOD THICKENERS MARKET: BY NATURE, 2021

FIGURE 16 NORTH AMERICA FOOD THICKENERS MARKET, BY SOURCE, 2021

FIGURE 17 NORTH AMERICA FAT REPLACERS MARKET: BY APPLICATION, 2021

FIGURE 18 NORTH AMERICA FOOD THICKENERS MARKET: SNAPSHOT (2021)

FIGURE 19 NORTH AMERICA FOOD THICKENERS MARKET: BY COUNTRY (2021)

FIGURE 20 NORTH AMERICA FOOD THICKENERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 NORTH AMERICA FOOD THICKENERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 NORTH AMERICA FOOD THICKENERS MARKET: BY TYPE (2022 & 2029)

FIGURE 23 NORTH AMERICA FOOD THICKENERS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.