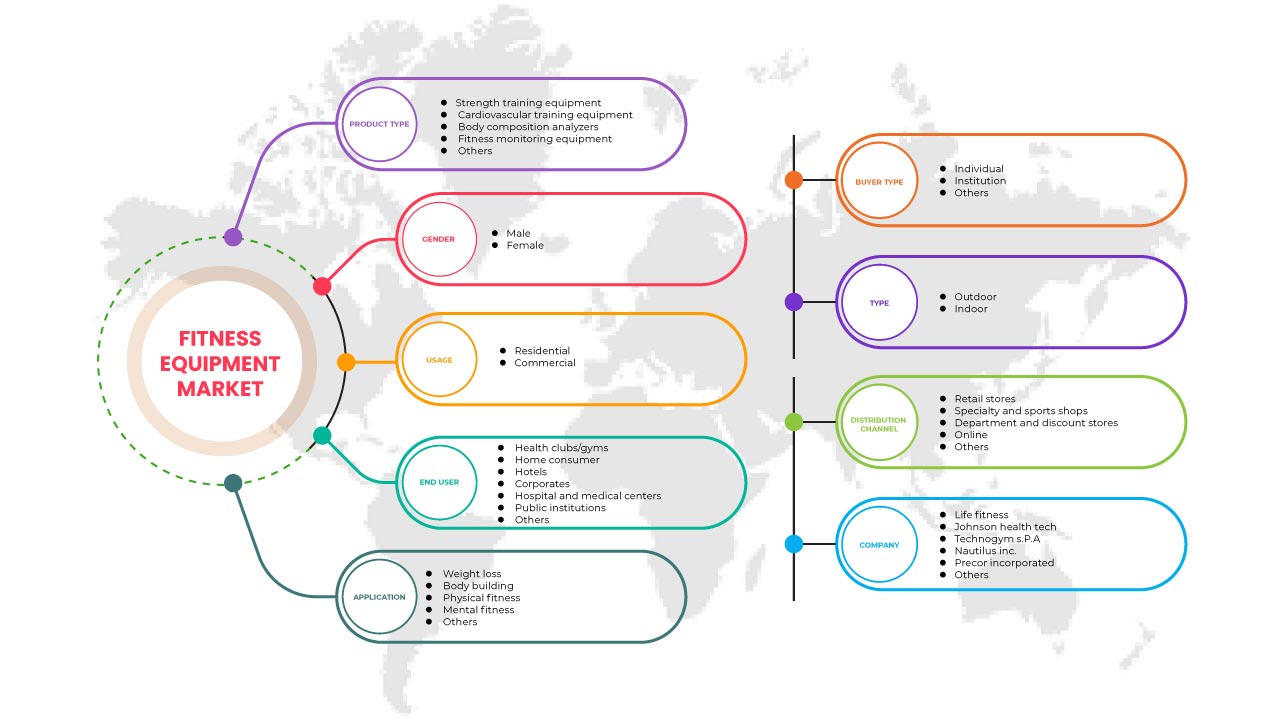

북미 피트니스 장비 시장, 제품 유형별(근력 운동 장비, 심혈관 운동 장비, 체성분 분석기 , 피트니스 모니터링 장비 및 기타), 응용 분야별(체중 감량, 보디빌딩, 신체적 건강, 정신적 건강 및 기타), 성별(남성 및 여성), 구매자 유형(개인, 기관 및 기타), 용도(주거 및 상업), 유형(실외 및 실내), 최종 사용자(헬스클럽/헬스장, 가정 소비자, 호텔, 기업, 병원 및 의료 센터, 공공 기관 및 기타), 유통 채널(소매점, 전문점 및 스포츠 매장, 백화점 및 할인점, 온라인 및 기타) - 업계 동향 및 2030년까지의 예측.

북미 피트니스 장비 시장 분석 및 통찰력

건강과 피트니스에 대한 욕구가 커지면서 이제 운동 장비 산업이 주도권을 잡고 있습니다. 피트니스 장비 시장의 성장은 도시화 증가, 건강에 해로운 생활 방식으로 인한 비만과 만성 질환의 유병률, 기업 웰빙 프로그램 증가 및 다양한 산업의 수요 증가와 같은 주요 요인에 의해 주도됩니다. 게다가 비만 증가의 결과에 대한 인식 증가, 노령 인구 증가, 최소 침습 및 비침습 수술에 대한 수요 증가가 시장의 전반적인 성장을 촉진합니다. 반면, 장비나 장치의 설치 또는 설정 비용이 높고 비용 절감형 운동 장비의 재판매 수요가 증가하면서 예측 기간 동안 시장 성장이 제한될 것으로 추산됩니다.

하지만 다른 트레이닝 시스템을 도입하고 고객 선호도를 변화시키면서 피트니스 장비 시장 성장은 제약을 받고 있습니다.

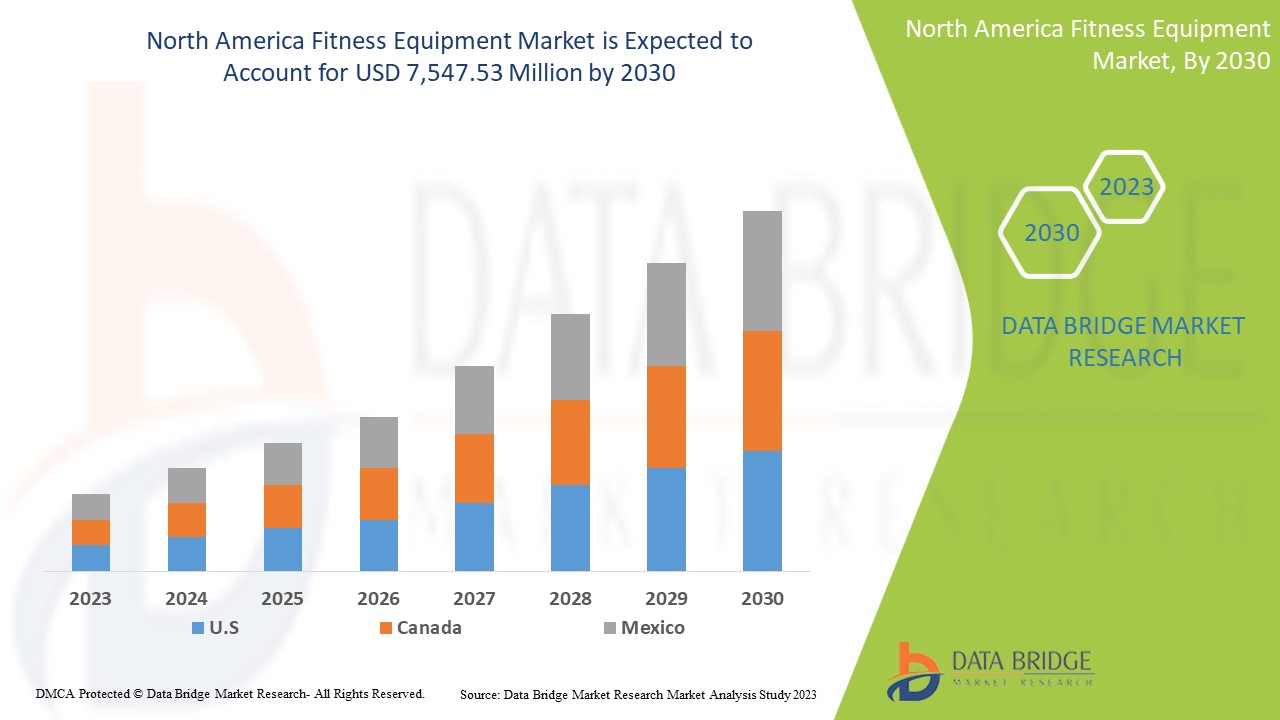

Data Bridge Market Research는 북미 피트니스 장비 시장이 2030년까지 7,547.53백만 달러에 도달할 것으로 예상되며, 예측 기간 동안 CAGR은 7.3%라고 분석했습니다. 이 시장 보고서는 또한 가격 분석, 특허 분석 및 기술 발전에 대한 심층적인 내용을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적 연도 |

2021 (2020-2015까지 사용자 정의 가능) |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

제품 유형별(근력 운동 장비, 심혈관 운동 장비, 체성분 분석기, 피트니스 모니터링 장비 등), 용도별(체중 감량, 보디빌딩, 체력, 정신 건강 등), 성별별(남성 및 여성), 구매자 유형별(개인, 기관 및 기타), 용도별(주거 및 상업), 유형별(실외 및 실내), 최종 사용자별(헬스 클럽/헬스장, 가정 소비자, 호텔, 기업, 병원 및 의료 센터, 공공 기관 및 기타), 유통 채널별(소매점, 전문점 및 스포츠 매장, 백화점 및 할인점, 온라인 및 기타) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Nautilus, Inc., Life Fitness, Johnson Health Tech, TECHNOGYM SpA, TRUE, Impulse (QingDao) Health Tech CO., LTD, iFIT, Torque Fitness, Body-Solid Inc., Core Health & Fitness, LLC., Precor Incorporated, Afton, Fitness World, Shanghai Define Health Tech CO LTD, REALLEADER FITNESS CO., LTD, Shandong Aoxinde Fitness Equipment Co., Ltd., BFT Fitness, Yanre Fitness, FITKING FITNESS, Fitline India. |

북미 피트니스 장비 시장 정의

피트니스 장비는 기본적으로 신체적 또는 피트니스 관련 활동 중에 일반적으로 사용되는 장비를 말합니다. 근력을 강화하거나 신체적 건강을 개선하는 데 도움이 됩니다. 일반적으로 피트니스 장비에는 자유 중량, 조정기, 러닝머신, 웨이트 머신, 고정 자전거, 타원형 크로스 태너 및 계단 스테퍼와 같은 다양한 장비가 포함됩니다. 운동 장비는 근력과 지구력을 높이고 체중을 관리하고 유연성을 개선하기 위해 신체 운동을 수행하는 동안 사람을 저항하는 기계입니다. 성격과 외모를 향상시키는 데 도움이 됩니다. 러닝머신, 타원형 머신, 웨이트 머신, 자유 중량 및 기타 운동 장비를 사용할 수 있습니다. 이러한 장치는 피트니스 센터, 체육관, 가정 사용자 및 기업 사무실에서 사용되었습니다. (VA.gov)에 따르면 사전 설정된 프로그램이 있는 유산소 장비는 상업용으로 간주됩니다. 광범위한 유산소 능력을 가진 사람들을 위한 프로그램을 사용하십시오.

북미 피트니스 장비 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전자

- 신체 활동 대회에 참여하는 사람들의 수가 증가하고 있습니다

신체 활동은 심장, 신체, 정신에 상당한 건강상의 이점이 있으며, 운동은 심혈관 질환, 암, 당뇨병과 같은 비전염성 질환을 예방하고 관리하는 데 도움이 됩니다. 오늘날 전 세계 사람들은 힘든 피트니스 훈련 결과를 경쟁 토너먼트에 가져가 다양한 기능적 피트니스 이벤트에서 기술을 시험할 수 있습니다. 파워리프팅, 보디빌딩, 장거리 달리기 이벤트, 펀런, 크로스핏 대회와 같은 많은 피트니스 활동 대회가 있습니다. 많은 회사와 피트니스 조직이 주도권을 잡고 다양한 피트니스 대회와 야외 활동을 마련했습니다. 남성의 참여율(20.7%)이 여성(18%)보다 높았습니다. 여기에는 스포츠, 운동 및 기타 활동적인 여가 활동이 포함되었습니다.

따라서 신체 활동에 참여하는 사람의 수가 증가함에 따라 시장이 성장하고 있습니다.

- 코로나19 팬데믹으로 인해 홈 피트니스 장비 수요 증가

COVID-19 팬데믹은 피트니스 장비 분야에 상당한 긍정적 영향을 미쳤습니다. 이 팬데믹은 바이러스 확산을 막기 위해 사회적 거리두기 및 봉쇄와 같은 새로운 규범과 규정을 부과했습니다. 그 결과 전 세계 사람들이 집에 머물러야 했고, 이로 인해 재택근무와 같은 새로운 트렌드가 생겨났습니다. 홈 워크아웃의 인기가 높아지면서 팬데믹 동안 운동 장비에 대한 수요가 증가했습니다. 셀프 케어, 운동, 건강에 대한 관심이 높아짐에 따라 피트니스 앱과 플랫폼은 팬데믹 이후 상당한 인기를 얻었습니다. 또한, 팬데믹으로 인해 피트니스에 관심이 없는 사람들도 건강과 피트니스를 유지하는 데 더 많은 중요성을 두게 되었고, 이는 인기를 얻는 데 도움이 되었습니다.

게다가, 코로나19 팬데믹으로 인해 가정용 피트니스 장비와 피트니스 앱에 대한 수요가 크게 늘어나, 2020년에는 온라인에서 매진된 피트니스 장비 수와 피트니스 앱 다운로드 수가 약 30% 증가했습니다.

제지

- 피트니스 장비와 관련된 높은 비용

일부 피트니스 장비는 매우 높은 가격에 판매되고 있으며, 특히 개발도상국과 저개발국의 중저소득층을 대상으로 판매되고 있어 성장에 제약 요인으로 작용합니다. 기술의 발전으로 하이테크 피트니스 장비와 피트니스 웨어러블 기기의 경우 가격 인상이 두드러집니다. 고품질 디스플레이, 전력 효율 향상, 추가 생체 신호 추적, 무선 연결, 업그레이드된 소프트웨어 등 여러 기능을 통합하면 피트니스 장비와 피트니스 기기의 초기 비용이 직접 증가합니다. 다양한 소비자가 웨어러블 기기를 사용하면서 피트니스 건강 관리에 대한 지출이 증가하고 있습니다. 웨어러블 기기의 적용 범위가 확대되면서 수요가 증가하여 비용이 직접 증가합니다.

따라서 피트니스 장비와 관련된 높은 비용이 시장 성장을 방해하고 있다.

기회

- 전자상거래 플랫폼, 인터넷, 스마트폰 의 침투 확대

오늘날의 사람들은 의사와 상담하고, 진찰을 받고, 의사와 소통하고, 자기 건강을 알아차리기 위해 스마트폰이 필요합니다. 많은 사람들이 스마트폰 없이는 자신의 삶을 생각하거나 상상할 수 없습니다. 사람들은 헬스장과 피트니스 클럽에서 후속 조치를 취하는 것보다 집에서 편안하게 운동하는 방법으로 건강을 관리하고 싶어합니다. 따라서 피트니스 앱은 피트니스 앱을 사용하여 피트니스 일정, 다이어트 계획, 운동 등을 받는 사람들 사이의 다리 역할을 합니다. 국가의 기술 발전과 개발로 더 많은 사람들이 일상 생활에서 스마트폰을 사용하고 있습니다.

도전

- 고객 선호도의 변화

디지털 피트니스는 점점 더 많은 사람들이 익숙해지면서 빠르게 업계의 구세주가 되었습니다. 현실적으로 현재의 디지털 피트니스 붐은 봉쇄 제한이 완화됨에 따라 사라질 것입니다. 봉쇄 기간 동안 온라인 트레이닝은 사람들에게 구조, 피트니스, 커뮤니티 감각 및 소통을 제공했습니다. 그들은 사람들을 건강하게 유지했습니다. 온라인 트레이닝은 소비자들이 미래에 하이브리드 제공을 기대함에 따라 계속될 것입니다. 많은 사람들이 결국 정기적인 스튜디오 루틴으로 돌아가지만 온라인 트레이닝을 제공하는 헬스장은 회원들에게 더 쉽게 접근할 수 있습니다. 헬스장 회원들은 오늘날 온라인에서 제공되는 다양한 피트니스 옵션과 경쟁력 있는 가격으로 인해 가격에 더 민감해지고 있습니다. 그리고 헬스장과 스튜디오가 미래에 온라인과 스튜디오로 다각화할 준비를 하면서 경쟁이 치열해지고 있습니다. 초기 구매 후 사람들은 자신의 요구를 충족하고 부가가치를 제공하는 서비스에 대해 더 많은 비용을 지불할 의향이 있습니다. 그들은 반드시 가장 저렴하거나 가장 높은 품질의 옵션을 찾는 것이 아니라 가치를 찾습니다.

COVID-19 이후 북미 피트니스 장비 시장에 미치는 영향

COVID-19 팬데믹은 피트니스 장비 시장에 다소 긍정적인 영향을 미쳤습니다. 팬데믹은 바이러스 확산을 막기 위해 사회적 거리두기 및 봉쇄와 같은 새로운 규범과 규정을 부과했습니다. 그 결과 전 세계 사람들이 집에 머물러야 했고, 이로 인해 재택근무와 같은 새로운 트렌드가 생겨났습니다. 홈 워크아웃의 인기가 높아짐에 따라 팬데믹 동안 운동 장비에 대한 수요가 증가했습니다. 셀프 케어, 운동 및 건강에 대한 집중도가 높아짐에 따라 피트니스 앱과 플랫폼은 팬데믹 이후에도 상당한 인기를 얻었습니다.

제조업체들은 COVID-19 이후 회복하기 위해 다양한 전략적 결정을 내리고 있습니다. 업체들은 여러 R&D 활동과 제품 출시 및 전략적 파트너십을 통해 시장에서 관련된 기술과 테스트 결과를 개선하고 있습니다.

최근 개발 사항

- 2022년 9월, 홈 피트니스 분야의 혁신 리더인 Nautilus, Inc.는 일부 온라인 및 매장 소매 파트너에서 JRNY 적응형 피트니스 앱과 호환되는 Bowflex BXT8J 러닝머신을 출시하여 고객에게 저렴한 가격으로 완벽한 피트니스 솔루션을 제공한다고 발표했습니다. Bowflex BXT8J 러닝머신은 고성능 유산소 운동과 사용자 기기를 JRNY 적응형 피트니스 앱과 페어링하는 기능을 제공합니다. 이를 통해 회사는 제품 포트폴리오를 확장할 수 있었습니다.

- 2022년 6월, Johnson Health Tech는 Johnson Health Tech의 이전 유통업체인 Cravatex Brands Limited의 피트니스 사업부를 인수한다고 발표했으며, 인도에서 전액 출자 자회사를 둔 최초의 피트니스 장비 회사가 되었습니다. Johnson Health Tech는 제품 개발, 제조 전문성에 대한 지속적인 투자를 통해 피트니스 산업을 업그레이드했습니다. 이를 통해 회사는 사업을 확장할 수 있었습니다.

북미 피트니스 장비 시장 범위

북미 피트니스 장비 시장은 제품 유형, 응용 분야, 성별, 구매자 유형, 사용, 유형, 최종 사용자 및 유통 채널로 세분화됩니다. 세그먼트 간 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

제품 유형별 북미 피트니스 장비 시장

- 근력 운동 장비

- 심혈관 훈련 장비

- 체성분 분석기

- 피트니스 모니터링 장비

- 기타

제품 유형을 기준으로 북미 피트니스 장비 시장은 근력 운동 장비, 심혈관 운동 장비, 체성분 분석기, 피트니스 모니터링 장비 등으로 구분됩니다.

북미 피트니스 장비 시장, 응용 분야별

- 체중 감량

- 보디빌딩

- 신체적 건강

- 멘탈 피트니스

- 기타

북미 피트니스 장비 시장은 응용 분야를 기준으로 체중 감량, 보디빌딩, 신체 건강, 정신 건강 등으로 구분됩니다.

성별별 북미 피트니스 장비 시장

- 남성

- 여성

성별을 기준으로 북미 피트니스 장비 시장은 남성용과 여성용으로 구분됩니다.

구매자 유형별 북미 피트니스 장비 시장

- 개인

- 기관

- 기타

구매자 유형을 기준으로 북미 피트니스 장비 시장은 개인, 기관, 기타로 구분됩니다.

북미 피트니스 장비 시장, 사용별

- 주거용

- 광고

사용 방식을 기준으로 북미 피트니스 장비 시장은 주거용과 상업용으로 구분됩니다.

북미 피트니스 장비 시장, 유형별

- 집 밖의

- 실내

북미 피트니스 장비 시장은 유형을 기준으로 실내용과 실외용으로 구분됩니다.

북미 피트니스 장비 시장, 최종 사용자별

- 헬스클럽/헬스장

- 홈 소비자

- 호텔

- 기업

- 병원 및 의료 센터

- 공공기관

- 기타

북미 피트니스 장비 시장은 최종 사용자를 기준으로 헬스클럽/헬스장, 가정 소비자, 호텔, 기업, 병원 및 의료 센터, 공공기관 등으로 구분됩니다.

북미 피트니스 장비 시장, 유통 채널별

- 소매점

- 특산품 및 스포츠 매장

- 백화점 및 할인점

- 온라인

- 기타

북미 피트니스 장비 시장은 유통 채널을 기준으로 소매점, 전문점 및 스포츠 매장, 백화점 및 할인점, 온라인 및 기타로 구분됩니다.

북미 피트니스 장비 시장 지역 분석/통찰력

북미 피트니스 장비 시장을 분석하고, 국가, 제품 유형, 응용 분야, 성별, 구매자 유형, 사용법, 유형, 최종 사용자 및 유통 채널에 따라 시장 규모 정보를 제공합니다.

북미 피트니스 장비 시장은 미국, 캐나다, 멕시코로 구성되어 있습니다. 미국은 R&D 투자 증가와 피트니스 장비의 최신 첨단 기술 및 발명으로 인해 성장할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 피트니스 장비 시장 점유율 분석

북미 피트니스 장비 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, R&D 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭 및 호흡, 응용 프로그램 우세, 기술 수명선 곡선이 있습니다. 위에 제공된 데이터 포인트는 회사의 북미 피트니스 장비 시장에 대한 집중과만 관련이 있습니다.

북미 피트니스 장비 시장의 주요 기업으로는 Nautilus, Inc., Life Fitness, Johnson Health Tech, TECHNOGYM SpA, TRUE, Impulse (QingDao) Health Tech CO., LTD, iFIT, Torque Fitness., Body-Solid Inc., Core Health & Fitness, LLC., Precor Incorporated, Afton, Fitness World, Shanghai Define Health Tech CO LTD, REALLEADER FITNESS CO., LTD, Shandong Aoxinde Fitness Equipment Co., Ltd., BFT Fitness, Yanre Fitness, FITKING FITNESS, Fitline India 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FITNESS EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTE’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING NUMBER OF PEOPLE INVOLVED IN PHYSICAL ACTIVITIES COMPETITIONS

5.1.2 COVID-19 PANDEMIC RESULTED IN A RISING DEMAND FOR HOME FITNESS EQUIPMENT

5.1.3 INCREASING POPULARITY OF FITNESS GEAR AROUND THE GLOBE

5.1.4 INCREASED TECHNOLOGICAL ADVANCEMENT IN THE FITNESS SECTOR

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH FITNESS EQUIPMENT

5.2.2 LACK OF SKILLED FITNESS PROFESSIONALS

5.3 OPPORTUNITIES

5.3.1 GROWING PENETRATION OF E-COMMERCE PLATFORMS, THE INTERNET, AND SMARTPHONES

5.3.2 MULTIPLE APPLICATION COVERAGE

5.3.3 INCREASING NUMBER OF GYMS & FITNESS CLUBS

5.4 CHALLENGES

5.4.1 PATIENT INFORMATION PRIVACY POLICIES

5.4.2 SHIFTING OF CUSTOMER PREFERENCES

6 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 STRENGTH TRAINING EQUIPMENTS

6.2.1 DUMBBELLS

6.2.1.1 FIXED

6.2.1.2 ADJUSTABLE

6.2.2 BARBELLS

6.2.2.1 STRAIGHT BARBELLS

6.2.2.2 SAFETY SQUAT BARS

6.2.2.3 EZ CURL BARS

6.2.2.4 TRICEPS BARS

6.2.2.5 TRAP BARS

6.2.2.6 AXEL BARS

6.2.2.7 SWISS BARS

6.2.2.8 FARMERS WALK HANDLES

6.2.2.9 THICK GRIP BARS

6.2.2.10 OTHERS

6.2.3 BACHES AND RACKS

6.2.4 FREE WEIGHTS

6.2.5 PLATE LOADED

6.2.6 CABLE MACHINES

6.2.7 MULTISTATIONS

6.2.8 SINGLE STATIONS

6.2.9 RESISTANCE BANDS

6.2.9.1 POWER RESISTANCE BANDS

6.2.9.2 TUBE RESISTANCE BANDS WITH HANDLES

6.2.9.3 MINI-BANDS

6.2.9.4 LIGHT THERAPY RESISTANCE BANDS

6.2.9.5 BANDS

6.2.9.6 OTHERS

6.2.10 TRX SUSPENSION TRAINER

6.2.11 KETTLEBELLS

6.2.12 ACCESSORIES

6.2.13 OTHERS

6.3 CARDIOVASCULAR TRAINING EQUIPMENTS

6.3.1 TREADMILLS

6.3.2 ELLIPTICAL CROSS TRAINER

6.3.3 STATIONARY BIKES

6.3.4 ROWING MACHINES

6.3.5 STAIR STEPPER

6.3.6 OTHERS

6.4 FITNESS MONITORING EQUIPMENTS

6.4.1 SMART WATCH

6.4.2 FITNESS BANDS

6.4.3 PATCHES

6.4.4 OTHERS

6.5 BODY COMPOSITION ANALYZERS

6.5.1 BIO-IMPEDANCE ANALYSERS

6.5.2 DUAL ENERGY X-RAY ABSORPTIOMETRY EQUIPMENT

6.5.3 SKINFOLD CALLIPERS

6.5.4 AIR DISPLACEMENT PLETHYSMOGRAPHY EQUIPMENT

6.5.5 HYDROSTATIC WEIGHING EQUIPMENT

6.5.6 OTHERS

6.6 OTHERS

7 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 BODY BUILDING

7.3 WEIGHT LOSS

7.4 PHYSICAL FITNESS

7.5 MENTAL FITNESS

7.6 OTHERS

8 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER

8.1 OVERVIEW

8.2 MALE

8.3 FEMALE

9 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE

9.1 OVERVIEW

9.2 INDIVIDUALS

9.3 INSTITUTION

9.4 OTHERS

10 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 RESIDENTIAL

11 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE

11.1 OVERVIEW

11.2 OUTDOOR

11.3 INDOOR

12 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 HEALTH CLUBS/GYMS

12.3 PUBLIC INSTITUTIONS

12.4 HOTELS

12.5 HOME CONSUMERS

12.6 CORPORATES

12.7 HOSPITAL & MEDICAL CENTERS

12.8 OTHERS

13 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 RETAIL STORES

13.3 ONLINE

13.4 SPECIALTY & SPORTS SHOPS

13.5 DEPARTMENTAL & DISCOUNT STORES

13.6 OTHERS

14 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 LIFE FITNESS

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 IFIT

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 JOHNSON HEALTH TECH

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 TECHNOGYM S.P.A

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 NAUTILUS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 AFTON

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BFT FITNESS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BODY-SOLID INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CORE HEALTH & FITNESS, LLC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 FITKING FITNESS

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 FITLINE INDIA

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 FITNESS WORLD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 IMPULSE (QINGDAO) HEALTH TECH CO., LTD

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 PRECOR INCORPORATED.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 REALLEADER FITNESS CO., LTD

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 SHANDONG AOXINDE FITNESS EQUIPMENT CO., LTD.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 SHANDONG LIZHIXING FITNESS TECHNOLOGY CO., LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 SHANGHAI DEFINE HEALTH TECH CO LTD,

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 TORQUE FITNESS.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 True

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 YANRE FITNESS

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA STRENGTH TRAINING EQUIPMENT IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA STRENGTH TRAINING EQUIPMENT IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA BODY COMPOSITION ANALYZER IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA BODY COMPOSITION ANALYZER IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA BODY BUILDING IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA WEIGHT LOSS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA PHYSICAL FITNESS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA MENTAL FITNESS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA MALE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA FEMALE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA INDIVIDUALS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA INSTITUTION IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA COMMERCIAL IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA RESIDENTIAL IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OUTDOOR IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA INDOOR IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA HEALTH CLUBS/GYMS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PUBLIC INSTITUTION IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA HOTELS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA HOME CONSUMERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CORPORATES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA HOSPITAL AND MEDICAL CENTERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA RETAIL STORES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA ONLINE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA SPECIALTY AND SPORTS SHOP IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA DEPARTMENTAL & DISCOUNT STORES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 63 U.S. FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.S. STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.S. DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 U.S. RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 U.S. CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 69 U.S. FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 71 U.S. FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 U.S. FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 73 U.S. FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 74 U.S. FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 75 U.S. FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 U.S. FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 U.S. FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 78 CANADA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 CANADA STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 CANADA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 84 CANADA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 85 CANADA BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 CANADA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 CANADA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 88 CANADA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 89 CANADA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 90 CANADA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 CANADA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 92 CANADA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 93 MEXICO FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 95 MEXICO DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 96 MEXICO BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 MEXICO BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 101 MEXICO FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 102 MEXICO FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 103 MEXICO FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 104 MEXICO FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 105 MEXICO FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 MEXICO FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 107 MEXICO FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA FITNESS EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FITNESS EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FITNESS EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FITNESS EQUIPMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FITNESS EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FITNESS EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FITNESS EQUIPMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA FITNESS EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FITNESS EQUIPMENT MARKET: SEGMENTATION

FIGURE 11 THE GROWING PRVALENCE OF CARDIOVASCULAR DISEASES AND RISING DEMAND FOR FITNESS EQUIPMENT IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE NORTH AMERICA FITNESS EQUIPMENT MARKET FROM 2023 TO 2030

FIGURE 12 STRENGTH TRAINING EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FITNESS EQUIPMENT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FITNESS EQUIPMENT MARKET

FIGURE 14 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, 2022

FIGURE 23 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, LIFELINE CURVE

FIGURE 26 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, 2022

FIGURE 27 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, LIFELINE CURVE

FIGURE 30 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, 2022

FIGURE 31 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, 2022

FIGURE 35 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, 2023-2030 (USD MILLION)

FIGURE 36 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, LIFELINE CURVE

FIGURE 38 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, 2022

FIGURE 39 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, 2023-2030 (USD MILLION)

FIGURE 40 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, CAGR (2023-2030)

FIGURE 41 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 43 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 44 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 45 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 46 NORTH AMERICA FITNESS EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 47 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 48 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 49 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 50 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 51 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.