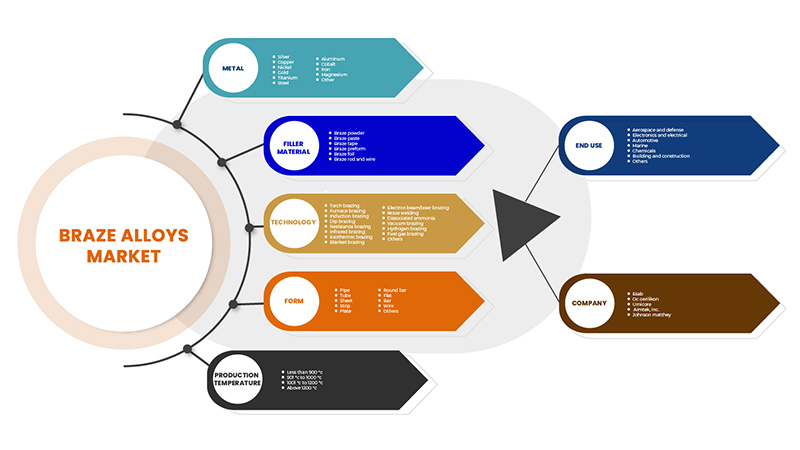

North America Braze Alloys Market, By Metal (Nickel, Cobalt, Silver, Gold, Aluminum, Copper, Steel, Iron, Magnesium, Titanium and Others), Filler Material (Braze Powder, Braze Paste, Braze Tape, Braze Preform, Braze Foil and Braze Rod and Wire), Technology (Torch Brazing, Furnace Brazing, Induction Brazing, Dip Brazing, Resistance Brazing, Infrared Brazing, Exothermic Brazing, Blanket Brazing, Electron Beam/Laser Brazing, Braze Welding, Dissociated Ammonia, Vacuum Brazing, Hydrogen Brazing, Fuel Gas Brazing and Others), Form (Pipe, Tube, Sheet, Strip, Plate, Round Bar, Flat, Bar, Wire and Others), Production Temperature (Less than 900 °C, 901 °C to 1000 °C, 1001 °C to 1200 °C and Above 1200 °C), End Use (Aerospace and Defense, Electronics and Electrical, Automotive, Marine, Chemicals, Building and Construction and Others), Industry Trends and Forecast to 2029.

Market Analysis and Insights

Brazing fillers for joining applications are essential for manufacturing and designing advanced materials. Several types of brazing fillers have been developed in recent decades to join similar or different engineering materials. Important parts of automotive and aircraft components, including steel, are often joined by brazing. In addition, ceramic components in microwave devices and circuits have been joined with a high level of integration in microelectronic devices.

Similarly, in the medical field, metallic implants have been brazed to ceramic dental crowns. These advances have made human life more convenient. However, in brazing, there are certain issues with intermetallic compound (IMC) formation and residual stresses in joints at high temperatures.

Increasing use of braze alloys coupled with growing application of braze alloys in different end industry like aerospace, buildings and electronics has surged its demand. Data Bridge Market Research analyses that the North America braze alloys market will grow at a CAGR of 4.6% during the forecast period of 2022 to 2029

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2020 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Tons, Pricing in USD |

|

Segments Covered |

금속별( 니켈 , 코발트, 은, 금, 알루미늄 , 구리, 강철 , 철, 마그네슘, 티타늄 및 기타), 충전재(브레이징 파우더, 브레이징 페이스트, 브레이징 테이프, 브레이징 프리폼, 브레이징 호일 및 브레이징 막대 및 와이어), 기술별(토치 브레이징, 퍼니스 브레이징, 유도 브레이징, 딥 브레이징, 저항 브레이징, 적외선 브레이징, 발열 브레이징, 블랭킷 브레이징, 전자빔/레이저 브레이징, 브레이징 용접 , 해리 암모니아, 진공 브레이징, 수소 브레이징, 연료 가스 브레이징 및 기타), 형태별(파이프, 튜브, 시트, 스트립, 판, 원형 막대, 플랫, 막대, 와이어 및 기타), 생산 온도(900°C 미만, 901°C~1000°C, 1001°C~1200°C 및 1200°C 초과), 최종 용도별(항공우주 및 방위, 전자 및 전기, 자동차, 해양, 화학, 건축 및 건설 및 기타) |

|

적용 국가 |

미국 캐나다 멕시코 |

|

시장 참여자 포함 |

Johnson Matthey, OC Oerlikon Management AG, Sulzer Ltd, Belmont Metals, Harris Products Group, Morgan Advanced Materials 및 계열사, Aimtek, Inc., Lucas-Milhaupt, Inc., Esprix Technologies, Indium Corporation, AMETEK. Inc., TSI Technologies, ESAB(Colfax Corporation의 자회사), Umicore |

브레이즈 합금 시장 동향

운전자

- 자동차 및 항공 산업에서 브레이즈 합금 사용 증가

브레이즈 합금은 자동차 산업에서 상당한 수요를 보이고 있으며, 에어컨 시스템, 연료 분사 파이프, 브레이크 라이닝의 응축기 및 증발기 연결에 사용됩니다. 자동차 및 항공 산업은 경량 자동차 구성품을 개발하기 위해 노력해 왔습니다.

- 납땜 및 용접 등보다 브레이징 공정에 대한 선호도가 높아지고 있습니다.

브레이징은 두 개 이상의 금속 품목을 녹여서 접합부에 필러 메탈을 흘려 넣어 접합하는 금속 접합 공정입니다. 고압에서 저압 전기 접지 시스템에 이르기까지 금속 도체를 접합하는 데 널리 사용됩니다. 이 공정은 현재 영국, 아일랜드 및 전 세계 여러 국가에서 두 개의 전도성 금속(보통 구리 또는 강철)의 영구 접합을 만드는 데 사용됩니다.

기회

- 다양한 산업에서의 브레이징 합금의 광범위한 응용

브레이징은 알루미늄과 마그네슘을 제외한 거의 모든 금속을 접합할 수 있기 때문에 널리 사용되는 접합 공정입니다. 전기 부품, 파이프 피팅 등에 사용됩니다. 두께가 고르지 않은 금속은 브레이징으로 접합할 수 있습니다. 브레이징은 다양한 금속, 이종 금속, 심지어 비금속을 접합하는 데 사용됩니다.

제약/도전

- 브레이즈 금속의 가격 변동

원자재 가격은 현재 미국과 세계 다른 지역에서 전례 없는 수준으로 변동하고 있습니다. 가격은 공급 시장의 긴축에 영향을 받기 때문입니다. 수요와 공급을 넘어 다른 요인은 원자재 가격의 단기 변동에 영향을 미쳤습니다. 투자자들은 주식과 상품을 포함하여 위험한 것으로 인식되는 것에서 갑자기 벗어날 수 있습니다.

- 브레이징의 환경에 대한 부정적인 영향

브레이징은 제조업의 기본 기술 중 하나이며 항공우주, 철도 운송, 반도체, 냉장 기기 및 기타 분야에서 널리 사용됩니다.

전통적인 브레이징 공정은 유해한 환경 영향을 수반합니다. 오염의 주요 원인은 과도한 플럭스 잔류물입니다. 브레이징 공정에는 플럭스를 정밀하게 제어할 수 없는 것이 포함됩니다. 과도한 잔류 플럭스와 브레이징 후 세척은 플럭스의 심각한 낭비와 환경 오염으로 이어집니다. 또한 용접의 수명에 영향을 미칩니다.

이 브레이즈 합금 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 브레이즈 합금 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드립니다.

COVID-19 이후 브레이즈 합금 시장에 미치는 영향

COVID-19 팬데믹은 브레이즈 합금을 제조하는 데 사용되는 원자재의 공급망과 최종 사용자 산업의 공급망을 크게 교란시켰습니다. 이는 자원과 운송 수단의 부족으로 인해 원자재 제품의 접근성이 낮아지고 재고가 지연되고 공급이 중단되었기 때문입니다. 또한 많은 정부가 국가 간 상품 이동을 제한했고 전체 공급망이 왜곡되었습니다. 공급망이 교란되어 원자재 운송이 중단되어 생산이 중단되었습니다. 마찬가지로 가격 상승과 브레이즈 합금 생산 중단으로 인해 건설, 전자, 항공우주 및 방위와 같은 다양한 최종 사용자의 브레이즈 합금에 대한 수요가 충족되지 않았습니다.

COVID-19 팬데믹은 또한 브레이징 합금의 최종 사용자 산업에 부정적인 영향을 미쳤습니다. 건설 산업에 부정적인 영향을 미쳤습니다.

예를 들어,

글로벌 데이터에 따르면, COVID-19의 경제적 충격으로 인해 북미의 건설 생산량이 2020년에 최대 1,220억 달러까지 감소할 수 있습니다. 팬데믹 이전에 북미 전역에서 건설 생산량이 0.6% 증가할 것으로 예상되었지만, 현재 미국에서는 약 6.5%, 캐나다에서는 7% 감소할 것으로 예상됩니다.

그 결과, 건물과 건설에 납땜 기술이 사용되면서 납땜 합금 시장 도 영향을 받을 것입니다.

따라서 COVID-19 팬데믹으로 인한 공급망의 혼란은 납땜 합금 시장에 어려움을 겪을 것으로 예상됩니다.

최근 개발

- 2022년 2월, OC Oerlikon Management AG는 북미 고객에게 온라인 주문 플랫폼을 확장했습니다. 이 확장을 통해 회사는 더 많은 고객 기반을 유치하는 데 도움이 되었습니다.

북미 브레이즈 합금 시장 범위

북미 브레이즈 합금 시장은 금속, 충전재, 기술, 형태, 생산 온도 및 최종 용도로 구분됩니다.

이들 세그먼트의 성장은 업계 내의 미미한 성장 세그먼트를 분석하고 사용자에게 귀중한 시장 개요와 시장 통찰력을 제공하여 핵심 시장 애플리케이션을 식별하기 위한 전략적 의사 결정을 내리는 데 도움이 됩니다.

궤조

- 은

- 구리

- 니켈

- 금

- 티탄

- 강철

- 알류미늄

- 코발트

- 철

- 마그네슘

- 다른

금속을 기준으로 시장은 은, 구리, 니켈, 금, 티타늄, 강철, 알루미늄, 코발트, 철, 마그네슘 및 기타로 구분됩니다.

필러 재료

- 브레이즈 페이스트

- 브레이즈 막대 및 와이어

- 브레이즈 파우더

- 브레이즈 프리폼

- 브레이즈 포일

- 브레이즈 테이프

충전재에 따라 시장은 브레이징 페이스트, 브레이징 막대 및 와이어, 브레이징 파우더, 브레이징 프리폼, 브레이징 호일 및 브레이징 테이프로 구분됩니다.

기술

- 토치 브레이징

- 로 브레이징

- 저항 브레이징

- 유도 브레이징

- 딥 브레이징

- 적외선 브레이징

- 진공 브레이징

- 전자빔/레이저 브레이징

- 발열 브레이징

- 브레이즈 용접

- 수소 브레이징

- 블랭킷 브레이징

- 해리된 암모니아

- 연료가스 브레이징

- 기타

기술에 따라 시장은 토치 브레이징, 퍼니스 브레이징, 저항 브레이징, 유도 브레이징, 딥 브레이징, 적외선 브레이징, 진공 브레이징, 전자빔/레이저 브레이징, 발열 브레이징, 브레이즈 용접, 수소 브레이징, 블랭킷 브레이징, 해리성 암모니아, 연료가스 브레이징 및 기타로 구분됩니다.

형태

- 철사

- 조각

- 술집

- 파이프

- 튜브

- 평평한

- 시트

- 그릇

- 라운드 바

- 기타

시장은 형태에 따라 와이어, 스트립, 막대, 파이프, 튜브, 플랫, 시트, 판, 둥근 막대 및 기타로 구분됩니다.

생산 온도

- 1001 °C ~ 1200 °C

- 900 °C 미만

- 901 °C ~ 1000 °C

- 1200 °C 이상

생산 온도에 따라 시장은 1001°C~1200°C, 900°C 미만, 901°C~1000°C, 1200°C 이상으로 구분됩니다.

최종 사용

- 자동차

- 항공우주 및 방위

- 전자 및 전기

- 건축 및 건설

- 약

- 선박

- 기타

최종 용도를 기준으로 시장은 자동차, 항공우주 및 방위, 전자 및 전기, 건축 및 건설, 화학, 해양 및 기타로 구분됩니다.

브레이즈 합금 시장 지역 분석/통찰력

납땜 합금 시장을 분석하고, 국가, 금속, 충전재, 기술, 형태, 생산 온도 및 최종 용도별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

브레이즈 합금 시장 보고서에서 다루는 지역은 미국, 캐나다, 멕시코입니다.

The U.S. dominates the North America region due to growing applications of braze alloys in the region. Canada dominates the region due to the growing electronics industry in the region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Braze Alloys Market Share Analysis

The braze alloys market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, GCC presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on braze alloys market.

Some of the major players operating in the braze alloys market are Johnson Matthey, OC Oerlikon Management AG, Sulzer Ltd, Belmont Metals, Harris Products Group, Morgan Advanced Materials and its affiliates, Aimtek, Inc., Lucas-Milhaupt, Inc. , Esprix Technologies, Indium Corporation, AMETEK. Inc., TSI Technologies, ESAB (Subsidary of Colfax Corporation), Umicore among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

- INTRODUCTION

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF NORTH AMERICA BRAZE ALLOYS MARKET

- LIMITATIONS

- MARKET SEGMENTATION

- MARKET SEGMENTATION

- MARKETS COVERED

- GEOGRAPHICAL SCOPE

- YEARS CONSIDERED FOR THE STUDY

- CURRENCY AND PRICING

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- METAL LIFELINE CURVE

- PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

- DBMR MARKET POSITION GRID

- DBMR END-USER POSITION GRID

- VENDOR SHARE ANALYSIS

- SECONDARY SOURCES

- ASSUMPTIONS

- EXECUTIVE SUMMARY

- PREMIUM INSIGHTS

- MARKET OVERVIEW

- DRIVERS

- INCREASE IN USAGE OF BRAZE ALLOYS IN THE AUTOMOTIVE AND AVIATION INDUSTRY

- INCREASING PREFERENCE TOWARD BRAZING PROCESS OVER SOLDERING, AND WELDING, AMONG OTHERS

- INCREASING DEMAND FOR COPPER & ALUMINUM BRAZE ALLOYS

- RISING ELECTRICAL & ELECTRONICS MARKET IN NORTH AMERICA

- RESTRAINTS

- FLUCTUATING PRICES OF BRAZE METALS

- COMPLEXITIES IN THE MANUFACTURING PROCESS OF BRAZE ALLOYS

- AVAILABILITY OF SUBSTITUTES OF BRAZE ALLOYS

- OPPORTUNITIES

- WIDE APPLICATIONS OF BRAZING ALLOYS IN VARIOUS INDUSTRIES

- COST-EFFECTIVENESS OF BRAZE ALLOYS

- RISING NUMBER OF INNOVATIONS IN THE BRAZING INDUSTRY

- CHALLENGES

- SUPPLY CHAIN DISRUPTION DUE TO COVID -19

- IMPACT OF COVID-19 ON THE NORTH AMERICA BRAZE ALLOYS MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON SUPPLY CHAIN

- IMPACT ON PRICE

- IMPACT ON DEMAND

- CONCLUSION

- NORTH AMERICA BRAZE ALLOYS MARKET, BY METAL

- OVERVIEW

- SILVER

- COPPER

- NICKEL

- GOLD

- TITANIUM

- STEEL

- STAINLESS STEEL

- CARBON STEEL

- LOW ALLOY STEEL

- OTHERS

- ALUMINUM

- COBALT

- IRON

- MAGNESIUM

- OTHERS

- NORTH AMERICA BRAZE ALLOYS MARKET, BY FILLER MATERIAL

- OVERVIEW

- BRAZE PASTE

- BRAZE ROD AND WIRE

- BRAZE POWDER

- BRAZE PREFORM

- BRAZE FOIL

- BRAZE TAPE

- NORTH AMERICA BRAZE ALLOYS MARKET, BY TECHNOLOGY

- OVERVIEW

- TORCH BRAZING

- FURNACE BRAZING

- RESISTANCE BRAZING

- INDUCTION BRAZING

- DIP BRAZING

- INFRARED BRAZING

- VACUUM BRAZING

- ELECTRON BEAM/LASER BRAZING

- EXOTHERMIC BRAZING

- BRAZE WELDING

- HYDROGEN BRAZING

- BLANKET BRAZING

- DISSOCIATED AMMONIA

- FUEL GAS BRAZING

- OTHERS

- NORTH AMERICA BRAZE ALLOYS MARKET, BY PRODUCT FORMS

- OVERVIEW

- WIRE

- STRIP

- BAR

- PIPE

- TUBE

- FLAT

- SHEET

- PLATE

- ROUND BAR

- OTHERS

- NORTH AMERICA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE

- OVERVIEW

- 1001 °C TO 1200 °C

- LESS THAN 900 °C

- 901 °C TO 1000 °C

- ABOVE 1200 °C

- NORTH AMERICA BRAZE ALLOYS MARKET, BY END USER

- OVERVIEW

- AUTOMOTIVE

- AUTOMOTIVE, BY METAL

- SILVER

- COPPER

- NICKEL

- GOLD

- TITANIUM

- STEEL

- ALUMINUM

- COBALT

- IRON

- MAGNESIUM

- OTHERS

- AEROSPACE AND DEFENSE

- AEROSPACE AND DEFENSE, BY METAL

- SILVER

- COPPER

- NICKEL

- GOLD

- TITANIUM

- STEEL

- ALUMINUM

- COBALT

- IRON

- MAGNESIUM

- OTHERS

- ELECTRONICS AND ELECTRICAL

- ELECTRONICS AND ELECTRICAL, BY METAL

- SILVER

- COPPER

- NICKEL

- GOLD

- TITANIUM

- STEEL

- ALUMINUM

- COBALT

- IRON

- MAGNESIUM

- OTHERS

- BUILDING AND CONSTRUCTION

- BUILDING AND CONSTRUCTION, BY METAL

- SILVER

- COPPER

- NICKEL

- GOLD

- TITANIUM

- STEEL

- ALUMINUM

- COBALT

- IRON

- MAGNESIUM

- OTHERS

- CHEMICALS

- CHEMICALS, BY METAL

- SILVER

- COPPER

- NICKEL

- GOLD

- TITANIUM

- STEEL

- ALUMINUM

- COBALT

- IRON

- MAGNESIUM

- OTHERS

- MARINE

- MARINE, BY METAL

- SILVER

- COPPER

- NICKEL

- GOLD

- TITANIUM

- STEEL

- ALUMINUM

- COBALT

- IRON

- MAGNESIUM

- OTHERS

- OTHERS

- OTHERS, BY METAL

- SILVER

- COPPER

- NICKEL

- GOLD

- TITANIUM

- STEEL

- ALUMINUM

- COBALT

- IRON

- MAGNESIUM

- OTHERS

- NORTH AMERICA BRAZE ALLOYS MARKET, BY COUNTRY

- U.S.

- CANADA

- MEXICO

- NORTH AMERICA BRAZE ALLOYS MARKET: COMPANY LANDSCAPE

- COMPANY SHARE ANALYSIS: NORTH AMERICA

- NEW PRODUCT DEVELOPMENTS

- MERGERS, PARTNERSHIPS & ACQUISITIONS

- AWARD AND CERTIFICATION

- SWOT ANALYSIS

- COMPANY PROFILE

- LUCAS-MILHAUPT, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- AMETEK.INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ESAB

- COMPANY SANPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- OC OERLIKON MANAGEMENT AG

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- UMICORE

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- AIMTEK

- COMPANY SANPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- BELMONT METALS

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ESPRIX TECHNOLOGIES

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- HARRIS PRODUCTS GROUP.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- INDIUM CORPORATION

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- JOHNSON MATTHEY

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- MORGAN ADVANCED MATERIALS

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- PRINCE IZANT COMPANY.

- COMPANY SANPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- SULZER LTD

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- TSI TECHNOLOGIES

- COMPANY SANPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- QUESTIONNAIRE

- RELATED REPORTS

표 목록

TABLE 1 North America Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 2 North America Steel In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 3 North America Braze alloys market, By Filler Material, 2019-2028 (USD Million)

TABLE 4 North America Braze alloys market, By Technology, 2019-2028 (USD Million)

TABLE 5 North America Braze alloys market, By Product Forms, 2019-2028 (USD Million)

TABLE 6 North America Braze alloys market, By Production Temperature, 2019-2028 (USD Million)

TABLE 7 North America Braze alloys market, By End-User, 2019-2028 (USD Million)

TABLE 8 North America Automotive In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 9 North America aerospace and defense In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 10 North America Electronics and electrical In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 11 North America Building and construction In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 12 North America chemicals In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 13 North America Marine In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 14 North America Others In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 15 North America braze alloys market, By COUNTRY, 2019-2028 (USD million)

TABLE 16 U.S. Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 17 U.S. Steel In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 18 U.S. Braze alloys market, By Filler Material, 2019-2028 (USD Million)

TABLE 19 U.S. Braze alloys market, By Technology, 2019-2028 (USD Million)

TABLE 20 U.S. Braze alloys market, By Product Forms, 2019-2028 (USD Million)

TABLE 21 U.S. Braze alloys market, By Production Temperature, 2019-2028 (USD Million)

TABLE 22 U.S. Braze alloys market, By End-User, 2019-2028 (USD Million)

TABLE 23 U.S. Automotive In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 24 U.S. Aerospace and Defense In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 25 U.S. Electronics and Electrical In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 26 U.S. Building and Construction In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 27 U.S. Chemicals In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 28 U.S. Marine In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 29 U.S. Others In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 30 CANADA Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 31 CANADA Steel In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 32 CANADA Braze alloys market, By Filler Material, 2019-2028 (USD Million)

TABLE 33 CANADA Braze alloys market, By Technology, 2019-2028 (USD Million)

TABLE 34 CANADA Braze alloys market, By Product Forms, 2019-2028 (USD Million)

TABLE 35 CANADA Braze alloys market, By Production Temperature, 2019-2028 (USD Million)

TABLE 36 CANADA Braze alloys market, By End-User, 2019-2028 (USD Million)

TABLE 37 CANADA Automotive In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 38 CANADA Aerospace and Defense In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 39 CANADA Electronics and Electrical In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 40 CANADA Building and Construction In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 41 CANADA Chemicals In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 42 CANADA Marine In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 43 CANADA Others In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 44 MEXICO Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 45 MEXICO Steel In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 46 MEXICO Braze alloys market, By Filler Material, 2019-2028 (USD Million)

TABLE 47 MEXICO Braze alloys market, By Technology, 2019-2028 (USD Million)

TABLE 48 MEXICO Braze alloys market, By Product Forms, 2019-2028 (USD Million)

TABLE 49 MEXICO Braze alloys market, By Production Temperature, 2019-2028 (USD Million)

TABLE 50 MEXICO Braze alloys market, By End-User, 2019-2028 (USD Million)

TABLE 51 MEXICO Automotive In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 52 MEXICO Aerospace and Defense In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 53 MEXICO Electronics and Electrical In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 54 MEXICO Building and Construction In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 55 MEXICO Chemicals In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 56 MEXICO Marine In Braze alloys market, By Metal, 2019-2028 (USD Million)

TABLE 57 MEXICO Others In Braze alloys market, By Metal, 2019-2028 (USD Million)

그림 목록

FIGURE 1 North America Braze alloys MARKET: segmentation

FIGURE 2 North America Braze alloys MARKET: data triangulation

FIGURE 3 North America Braze alloys MARKET: DROC ANALYSIS

FIGURE 4 North America Braze alloys market: Regional VS COuntry MARKET ANALYSIS

FIGURE 5 North America Braze alloys market: COMPANY RESEARCH ANALYSIS

FIGURE 6 North America Braze alloys MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 North America Braze alloys MARKET: DBMR MARKET POSITION GRID

FIGURE 8 North America Braze alloys MARKET: DBMR END-USER POSITION GRID

FIGURE 9 NORTH AMERICA BRAZE ALLOYS MARKET: vendor share analysis

FIGURE 10 North America Braze alloys MARKET: SEGMENTATION

FIGURE 11 AN Increase in usage of braze alloys in the automotive and aviation is a major driver for the growth of North America braze alloys market in the forecast period of 2021-2028

FIGURE 12 SILVER IS expected to account for the largest share of the North America Braze alloys market in 2021 and 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA BRAZE ALLOYS MARKET

FIGURE 14 PRICE GRAPH OF SOME OF THE METALS USED IN BRAZE ALLOYS

FIGURE 15 EXPORT OF FLUXES AND OTHER AUXILIARY PREPARATIONS FOR SOLDERING, BRAZING, OR WELDING; SOLDERING, BRAZING, OR WELDING PASTES AND POWDERS CONSISTING OF METAL AND OTHER MATERIALS

FIGURE 16 North America braze alloys Market: BY metal, 2020

FIGURE 17 North America braze alloys Market: BY filler material, 2020

FIGURE 18 North America braze alloys Market: BY Technology, 2020

FIGURE 19 North America braze alloys Market: BY product forms, 2020

FIGURE 20 North America braze alloys Market: BY Production Temperature, 2020

FIGURE 21 North America braze alloys Market: BY end user, 2020

FIGURE 22 North America braze alloys market: SNAPSHOT (2020)

FIGURE 23 North America braze alloys market: BY COUNTRY (2020)

FIGURE 24 North America braze alloys market: BY COUNTRY (2021 & 2028)

FIGURE 25 North America braze alloys market: BY COUNTRY (2020 & 2028)

FIGURE 26 North America braze alloys market: BY METAL (2021 & 2028)

FIGURE 27 North America braze alloys market: company share 2020 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.