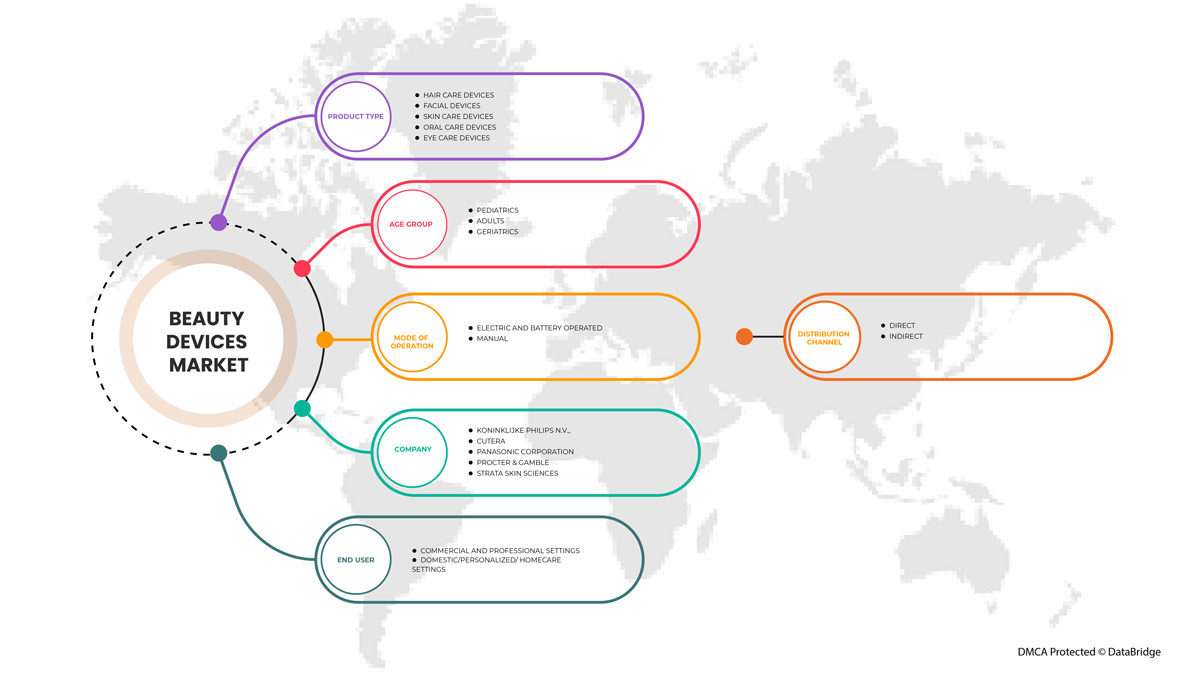

North America Beauty Devices Market By Product Type (Hair Care Devices, Facial Devices, Skin Care Devices, Oral Care Devices, and Eye Care Devices), Age Group (Pediatrics, Adult And Geriatrics), Mode of Operation (Electric and Battery Operated and Manual), End User (Commercial and Professional Settings and Domestic/ Personalized/ Homecare Settings), Distribution Channel (Direct and Indirect), Industry Trends and Forecast to 2029.

North America Beauty Devices Market Analysis and Insights

The increasing awareness of the skin among both the men as well as women has accelerated the demand of the beauty devices. The skin related issues such as creases, acne, pigmentation, wrinkles as well as burn scars due to accidents are extremely common among the people which require appropriate treatment to enhance the appearance of the skin.

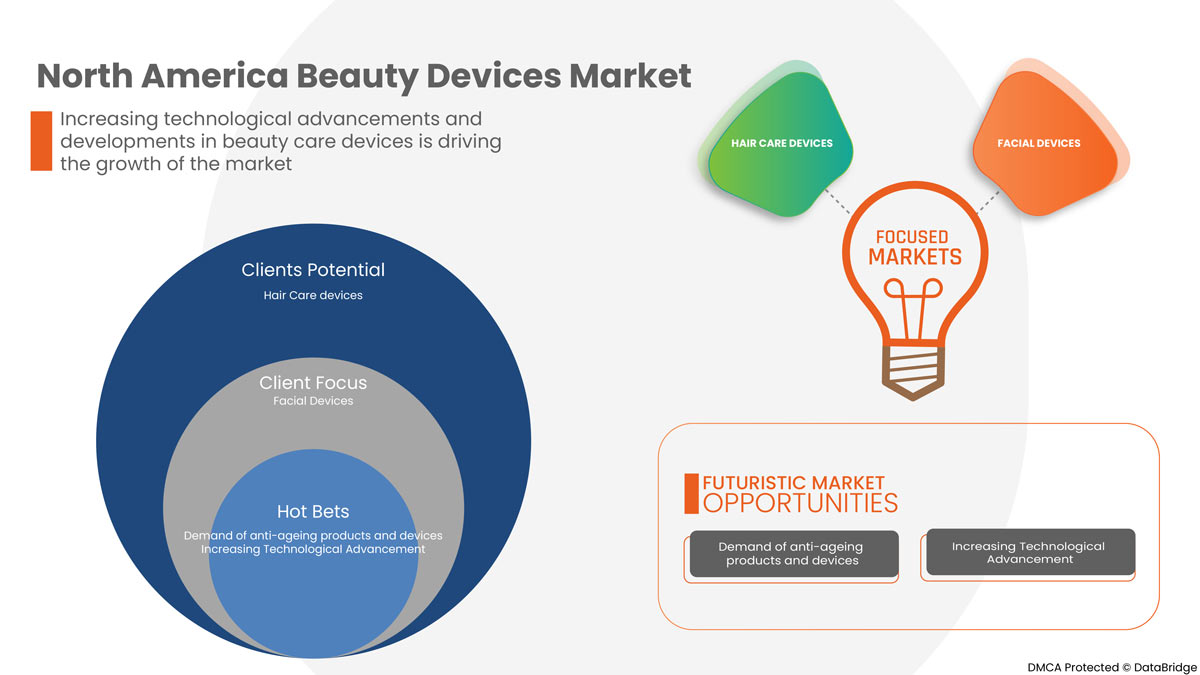

The market of beauty devices is growing in the forecast year due to several reasons such as the increasing consumer awareness towards their beauty appearance and improving lifestyle of the consumers. Along with this, manufacturers are engaged in R&D activity for launching novel technology based advanced products in the beauty devices market.

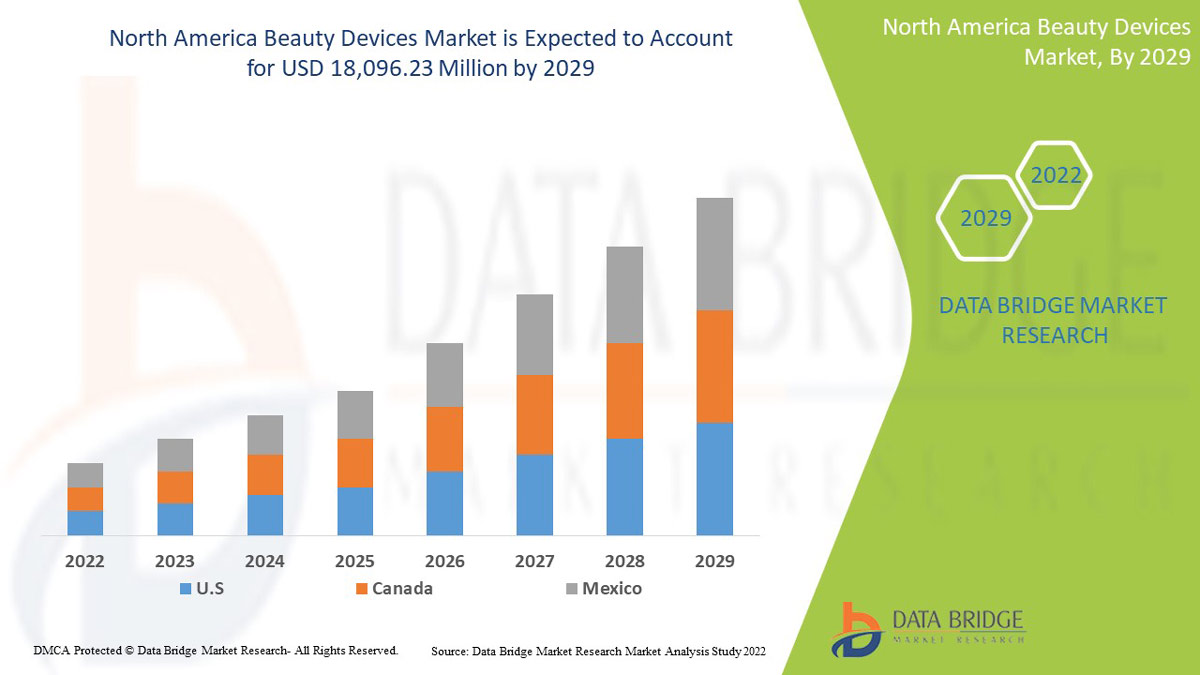

North America beauty devices market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 13.5% in the forecast period of 2022 to 2029 and is expected to reach USD 18,096.23 million by 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Hair Care Devices, Facial Devices, Skin Care Devices, Oral Care Devices, and Eye Care Devices), Age Group (Pediatrics, Adult And Geriatrics), Mode of Operation (Electric and Battery Operated and Manual), End User (Commercial and Professional Settings and Domestic/ Personalized/ Homecare Settings), Distribution Channel (Direct and Indirect). |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Nu Skin, CANDELA CORPORATION, Curallux LLC, FOREO, Koninklijke Philips N.V., Conair Corporation, Lumenis Be Ltd, Cynosure, Sciton, Inc., Fotona, Procter & Gamble, LUTRONIC, STRATA Skin Sciences, NuFACE, Spectrum Brands, Inc., Cutera, Merz North America, Inc., Panasonic Corporation, Procter & Gamble among others. |

North America Beauty Devices Market Definition

Beauty is the essential characteristic of women as well as men. Beauty devices are used in various types of beauty appearance related issues including hair, facial, skin, oral and eye. Beauty devices are extremely beneficial for the treatment of beauty related problems. Various types of beauty devices such as hair care devices, facial devices, skin care devices, oral care devices and eye care devices are commercialized in the market which is used to improve the beauty appearance.

Light / LED & photo rejuvenation therapy devices is a form of beauty system that uses narrow band and non-thermal LED light energy to activate the natural cell processes in the body to promote skin rejuvenation and repair. Anti-aging is one of the greatest challenges for beauty related issue, the cases of anti-aging is increasing very rapidly along with that the beauty devices target the multiple signs of anti-aging and reduce the appearance of wide range of aging signs including wrinkles or fine lines. The beauty industry is fragmented by the introduction of advanced technology based products in the market which is highly adopted among the end users.

North America Beauty Devices Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

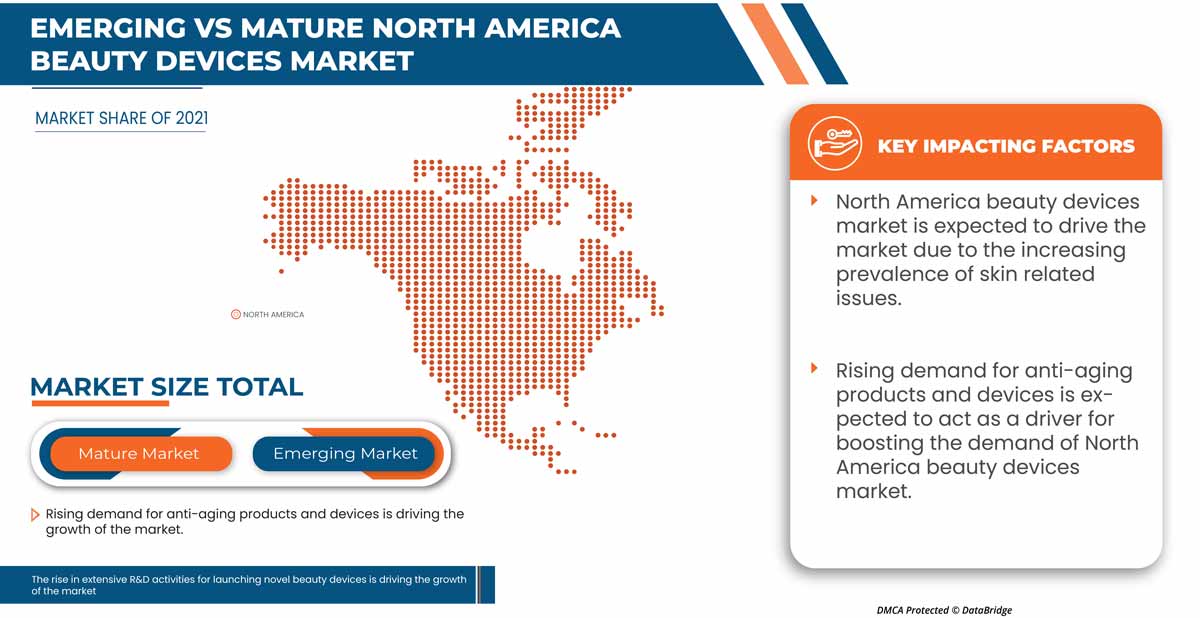

Rising demand for anti-aging products and devices

Anti-aging is a type of complex biological process which is influenced by the combination of exogenous or extrinsic factors and endogenous or intrinsic. The Anti-aging populations is one of the greatest challenges facing beauty related issue such skin firmness, loss of hairs, anti-aging wrinkle and oral care issue, among others. There are wide ranges of beauty devices are commercialized in the market which are used to minimize the effect of anti-aging on the beauty of aging population.

The elderly populations are increasing very rapidly along with that the beauty devices are targets the multiple signs of anti-aging and reduce the appearance of wide range of aging sings including wrinkles or fine lines, due to which rising demand for anti-aging products and devices is propelling the demand of the market.

Increasing prevalence of skin related IssueS

Skin related issues are generally among the most common issue seen in the primary care settings. According to the study of National Center for Biotechnology Information, under the age of 18 to 44 years the prevalence of skin related issue was 34% and prevalence increased to 49.4% among the people who are age 65 years and older. Acne is a type of universal skin disease which afflicting 79% to 95% of the adolescent population.

According to the American Medical Association, In the U.S. between 40 million and 50 million individuals are suffering from acne. According to the report, women and men in the U.S. who are over 25 have some degree of facial acne by 40 percent to 54 percent, and clinical facial acne in 12 percent of women and 3 percent of men continues in middle age.

The usages of beauty skin care devices provide additional benefit for skin appearance. Beauty devices are used to improve the health and appearance of the skin, due to which, the increasing prevalence of skin related issues is propelling the demand of the market.

Skin related problems such as creases, acne, pigmentation, wrinkles as well as accident-based burn scars are extremely common among humans. According to the Association of American Academy of Dermatology, acne is the most common skin disease in the USA. Annually, acne affects some 50 million people in the U.S. About 5.1 million people seek acne treatment each year. Approximately between the ages of 12 and 24 years 85% of people experience the onset of minor acne.

Facial wrinkling is one of the most notable signs of skin related issues. Men and women show the different wrinkling patterns of lifestyle and physiological factors. Wide range skin care beauty devices such as light/LED & photo rejuvenation therapy devices, cellulite reduction devices, acne removal devices, oxygen & steamer devices, dermal rollers, cleansing devices and smart devices are used to enhance the appearance of skin, for this reason increasing prevalence of skin related issues is acting as a driver for boosting the demand of North America beauty devices market.

OPPORTUNITIES

Increasing beauty expenditure

According to data from Aesthetic Society members, Americans spent over USD 6 billion on aesthetic surgical procedures and over USD 3 billion on non-surgical aesthetic procedures in 2020. Increase in the beauty expenditure due to several reasons such as improving lifestyle of people and increasing demand of beauty devices to enhance their appearance.

The increasing beauty expenditure will increase the process of adoption of advance beauty devices which will enhance the product profile in the market-leading, for this reason increasing beauty expenditure is acting as an opportunity for boosting the demand of North America beauty devices market.

RESTRAINTS/ CHALLENGES

High cost of beauty devices

The modern technology based beauty devices helps in tone and tightens the face muscles also the devices are used to reducing the appearance of fine lines and wrinkles. Consumers can use beauty device in their home itself.

The beauty devices have been exploding variety of options to treat multiple type of beauty related issue such skin care, hair care and oral care among others. But along with this beauty devices are very expensive to purchase, due to which high cost of beauty devices is hampering the demand of the North America beauty devices market.

Recent Developments

- In January 2021, Candela Corporation, a leading global medical aesthetic device company, announced the availability of the Frax Pro system, an FDA-cleared, non-ablative fractional device for skin resurfacing with both Frax 1550 and the novel Frax 1940 applicators. This helped the company to expand its product portfolio of aesthetics in the North America market.

- In June 2021, Cutera announced the launch of the Secret radiofrequency (RF) microneedling device, Secret PRO. The device would provide practitioners with a multi-layered approach to skin rejuvenation, using CO2 skin resurfacing application 'UltraLight' to target the epidermis. This has helped the company to increase its product portfolio.

North America Beauty Devices Market Scope

North America beauty devices market is segmented into product type, age group, mode of operation, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

NORTH AMERICA BEAUTY DEVICES MARKET, BY PRODUCT TYPE

- HAIR CARE DEVICES

- FACIAL DEVICES

- SKIN CARE DEVICES

- ORAL CARE DEVICES

- EYE CARE DEVICES

On the basis of product type, North America beauty devices market is segmented into hair care devices, facial devices, skin care devices, oral care devices, and eye care devices.

NORTH AMERICA BEAUTY DEVICES MARKET, BY AGE GROUP

- Pediatrics

- Adult

- Geriatrics

On the basis of age group, North America beauty devices market is segmented into pediatrics, adult and geriatrics.

NORTH AMERICA BEAUTY DEVICES MARKET, BY MODE OF OPERATION

- Electric And Battery Operated

- Manual

On the basis of mode of operation, North America beauty devices market is segmented into electric and battery operated and manual.

NORTH AMERICA BEAUTY DEVICES MARKET, BY END USER

- Commercial And Professional Settings

- Domestic/Personalized/ Homecare Settings

North America beauty devices market is segmented into commercial and professional settings and domestic/ personalized/ homecare settings.

NORTH AMERICA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL

- Direct

- Indirect

On the basis of distribution channel, the North America beauty devices market is segmented into direct and indirect.

Competitive Landscape and North America Beauty Devices Market Share Analysis

North America beauty devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America beauty devices market.

The major companies which are dealing in the North America beauty devices market are Nu Skin, CANDELA CORPORATION, Curallux LLC, FOREO, Koninklijke Philips N.V., Conair Corporation, Lumenis Be Ltd, Cynosure, Sciton, Inc., Fotona, Procter & Gamble, LUTRONIC, STRATA Skin Sciences, NuFACE, Spectrum Brands, Inc., Cutera, Merz North America, Inc., Panasonic Corporation, Procter & Gamble among others.

Research Methodology: North America Beauty Devices Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include vendor positioning grid, market time line analysis, market overview and guide, company positioning grid, company market share analysis, standards of measurement, North America vs Regional, and vendor share analysis. Please request analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BEAUTY DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 LIFELINE CURVE, BY PRODUCT TYPE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 NORTH AMERICA BEAUTY DEVICES MARKET: PRICING ANALYSIS

4.4 INDUSTRIAL INSIGHTS:

5 NORTH AMERICA BEAUTY DEVICE MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR ANTI-AGING PRODUCTS AND DEVICES

6.1.2 INCREASING PREVALENCE OF SKIN RELATED ISSUES

6.1.3 GROWING TECHNOLOGICAL ADVANCEMENTS AND DEVELOPMENTS

6.1.4 EXTENSIVE R&D ACTIVITIES FOR LAUNCHING NOVEL BEAUTY DEVICES

6.2 RESTRAINTS

6.2.1 HIGH COST OF BEAUTY DEVICES

6.2.2 SIDE EFFECTS AND ALLERGIES ASSOCIATED WITH THE USAGE OF BEAUTY DEVICES

6.3 OPPORTUNITIES

6.3.1 INCREASING APPEARANCE CONSCIOUSNESS AND AWARENESS

6.3.2 INCREASING BEAUTY EXPENDITURE

6.4 CHALLENGES

6.4.1 STRICT REGULATIONS AND STANDARDS FOR THE APPROVAL AND COMMERCIALIZATION OF BEAUTY DEVICES

6.4.2 PRODUCT RECALL

7 NORTH AMERICA BEAUTY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 HAIR CARE DEVICES

7.2.1 HAIR REMOVAL DEVICES

7.2.1.1 LASER DEVICES

7.2.1.2 TRIMERS

7.2.1.3 SHAVERS

7.2.1.4 EPILATORS

7.2.1.5 OTHERS

7.2.2 HAIR GROWTH DEVICES

7.2.3 OTHERS

7.3 FACIAL DEVICES

7.3.1 CLEANING DEVICES

7.3.1.1 FACIAL CLEANING BRUSH

7.3.1.2 CLEANING MASSAGER

7.3.1.3 OTHERS

7.3.2 WHITENING DEVICES

7.3.3 MASSAGE DEVICES

7.3.4 OTHER FACIAL DEVICES

7.4 SKIN CARE DEVICES

7.4.1 CLEANSING DEVICES

7.4.2 ACNE TREATMENT DEVICES

7.4.3 ANTI AGING DEVICES

7.4.4 DERMAL ROLLERS

7.4.5 REJUVENATION DEVICES

7.4.6 LIGHT/LED & PHOTO REJUVENATION THERAPY DEVICES

7.4.7 CELLULITE REDUCTION DEVICES

7.4.8 SKIN TEXTURE TONE ENHANCEMENT

7.4.9 OXYGEN & STEAMER DEVICES

7.4.10 OTHERS

7.5 ORAL CARE DEVICES

7.5.1 TOOTHBRUSHES & ACCESSORIES

7.5.1.1 MANUAL TOOTHBRUSHES

7.5.1.2 ELECTRIC TOOTHBRUSHES

7.5.1.3 BATTERY POWERED TOOTHBRUSHES

7.5.1.4 REPLACEMENT TOOTHBRUSH HEAD

7.5.2 OTHERS

7.6 EYE CARE DEVICES

8 NORTH AMERICA BEAUTY DEVICES MARKET, BY AGE GROUP

8.1 OVERVIEW

8.2 ADULT

8.2.1 FEMALE

8.2.2 MALE

8.3 GERIATRICS

8.3.1 FEMALE

8.3.2 MALE

8.4 PEDIATRICS

8.4.1 FEMALE

8.4.2 MALE

9 NORTH AMERICA BEAUTY DEVICES MARKET, BY MODE OF OPERATION

9.1 OVERVIEW

9.2 ELECTRIC AND BATTERY OPERATED

9.2.1 POCKET-SIZED/HANDHELD DEVICE

9.2.2 FIXED

9.3 MANUAL

9.3.1 POCKET-SIZED/HANDHELD DEVICE

9.3.2 FIXED

10 NORTH AMERICA BEAUTY DEVICES MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL AND PROFESSIONAL SETTINGS

10.2.1 MEDICAL SPA

10.2.2 BEAUTY SPA

10.2.3 CLINICAL

10.3 DOMESTIC/PERSONALIZED/HOMECARE SETTINGS

11 NORTH AMERICA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

11.3.1 STORE BASED RETAILING

11.3.1.1 MODERN TRADE

11.3.1.2 DEPARTMENTAL STORES

11.3.1.3 SPECIALTY STORE

11.3.1.4 OTHERS

11.3.2 NON-STORE BASED RETAILING

11.3.2.1 MULTIBRAND ONLINE SHOP

11.3.2.2 COMPANY WEBSITE

12 NORTH AMERICA BEAUTY DEVICES MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 PROCTER & GAMBLE

15.1.1 COMPANY SNAPSHOT

15.1.2 RECENT FINANCIALS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 KONINKLIJKE PHILIPS N.V.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 PANASONIC CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 RECENT FINANCIALS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 CONAIR CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 FOREO

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 BAUSCH HEALTH COMPANIES INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 RECENT FINANCIALS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 CANDELA CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CURALLUX LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CUTERA

15.9.1 COMPANY SNAPSHOT

15.9.2 RECENT FINANCIALS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 CYNOSURE. INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DD KARMA LLC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 FOTONA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 HITACHI POWER SEMICONDUCTOR DEVICE, LTD (2021)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 LUTRONIC

15.14.1 COMPANY SNAPSHOT

15.14.2 RECENT FINANCIALS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 LIGHTSTIM

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 LUMENIS BE LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 MERZ NORTH AMERICA, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 NU SKIN

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 PHOTOMEDEX

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 PURE DAILY CARE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 SCITON, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SPECTRUM BRANDS, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 STRATA SKIN SCIENCE

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENTS

15.24 SILKN

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 SINCLAIR

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 UNILEVER

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

15.27 VENUS CONCEPT

15.27.1 COMPANY SNAPSHOT

15.27.2 RECENT FINANCIALS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 THE FOLLOWING ARE THE PRICES OF PRODUCTS OFFERED BY THE COMPANIES:

TABLE 2 DEVICES WITH BEAUTY PURPOSE LISTED IN FDA MEDICAL DEVICE CLASSIFICATION DATABASE

TABLE 3 SIDE EFFECTS ASSOCIATED WITH THE USAGE OF BEAUTY DEVICES

TABLE 4 NORTH AMERICA BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BEAUTY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 26 U.S. BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.S. HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.S. HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 U.S. FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.S. SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 35 U.S. ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 36 U.S. GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 37 U.S. PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 38 U.S. BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 39 U.S. ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 40 U.S. MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 41 U.S. BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 U.S. COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 43 U.S. BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 U.S. INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 U.S. STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 U.S. NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 47 CANADA BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 CANADA HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CANADA CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 56 CANADA ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 57 CANADA GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 58 CANADA PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 59 CANADA BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 60 CANADA ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 61 CANADA MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 62 CANADA BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 CANADA COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 CANADA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 CANADA INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 CANADA STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 CANADA NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 MEXICO BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 77 MEXICO ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 78 MEXICO GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 79 MEXICO PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 80 MEXICO BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 82 MEXICO MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 83 MEXICO BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 MEXICO COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 MEXICO BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 MEXICO INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 MEXICO STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 MEXICO NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA BEAUTY DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BEAUTY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BEAUTY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BEAUTY DEVICES MARKET: REGIONAL VS COUNRTY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BEAUTY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BEAUTY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BEAUTY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA BEAUTY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BEAUTY DEVICES MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR ANTI-AGING PRODUCTS AND DEVICES AND GROWING TECHNOLOGICAL ADVANCEMENTS AND DEVELOPMENTS ARE EXPECTED TO DRIVE THE NORTH AMERICA BEAUTY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HAIR CARE DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BEAUTY DEVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BEAUTY DEVICES MARKET

FIGURE 14 NUMBER OF AESTHETIC PROCEDURES PERFORMED, U.S., 2020

FIGURE 15 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, 2021

FIGURE 16 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, 2021

FIGURE 20 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 23 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, 2021

FIGURE 24 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, LIFELINE CURVE

FIGURE 27 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, 2021

FIGURE 28 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 NORTH AMERICA BEAUTY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 NORTH AMERICA BEAUTY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.