북미 자율 지게차 시장, 판매 채널(리스, 자체 구매), 응용 분야(자재 취급, 창고, 물류 및 운송, 제조 및 기타), 산업(3PL, 전자 상거래, 자동차, 금속 및 중장비, 식품 및 음료, 반도체 및 전자, 제지 및 펄프 산업 , 항공, 의료 및 기타), 내비게이션 기술(레이저 유도, 자기 유도, 유도 유도, 비전 유도, 광학 테이프 유도 및 기타) - 산업 동향 및 2030년까지의 예측.

북미 자율 지게차 시장 분석 및 규모

자율 지게차는 인간의 도움 없이 상품을 들어올리는 자체 추진식 지게차라고도 합니다. 모든 보관 서비스는 개별적으로 처리할 수 있습니다. 이를 통해 창고 운영에 대한 인간 노동의 필요성이 없어집니다. 창고 운영에서 인간의 개입으로 인해 발생한 결함은 자동 지게차의 출현으로 편리하게 관리할 수 있습니다. 물류 및 건설 산업의 급속한 성장으로 자율 장치에 대한 수요가 증가했습니다. 자재 취급 및 공급망에서 무거운 하중을 처리해야 하는 필요성으로 인해 자동 지게차에 대한 수요가 증가하고 있습니다. 기술의 발전으로 산업용 트럭의 효율성도 높아졌습니다. 자동 지게차는 물류 프로세스를 최적화하는 데 크게 기여합니다. 이를 통해 적절한 부품이 항상 적절한 시기에 적절한 위치에 있도록 합니다. 이 기술은 운전자가 어려운 상황에서 가장 안전한 기동을 계산하여 잠재적 위험을 피하는 데 도움이 되므로 사고가 크게 줄어듭니다.

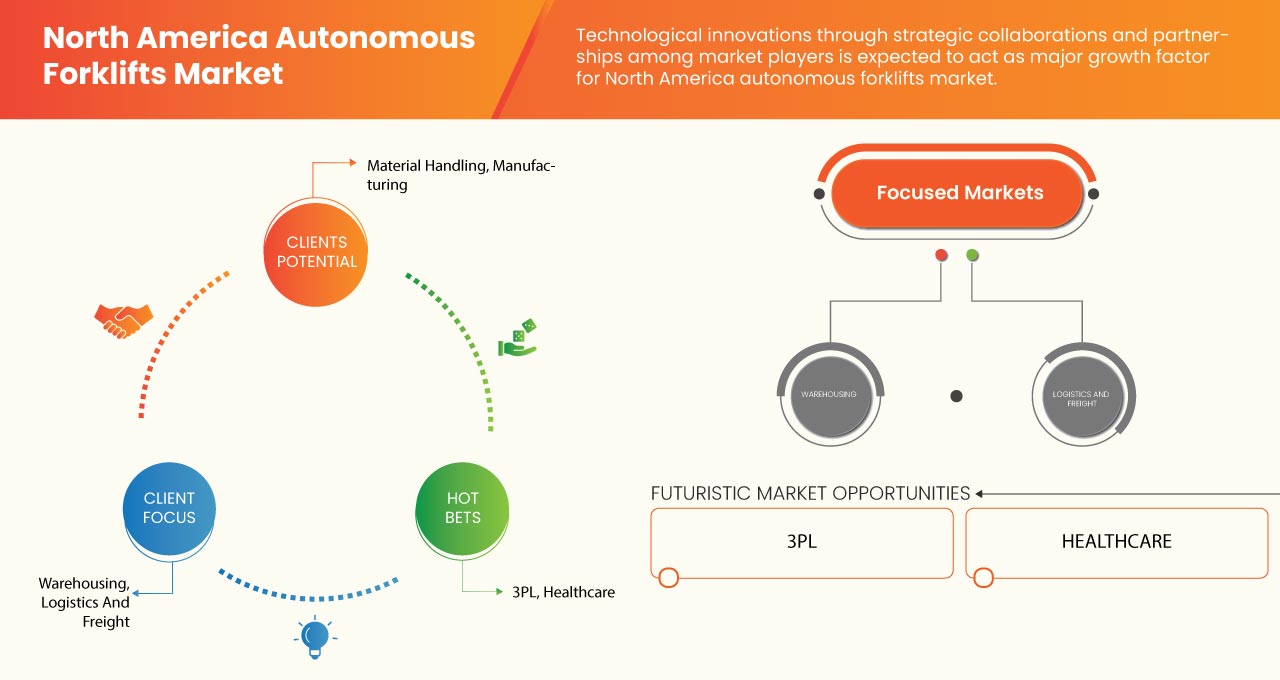

이를 위해 다양한 시장 참여자들이 새로운 제품을 출시하고 파트너십을 형성하여 자율 주행 지게차 시장에서 사업을 확장하고 있습니다.

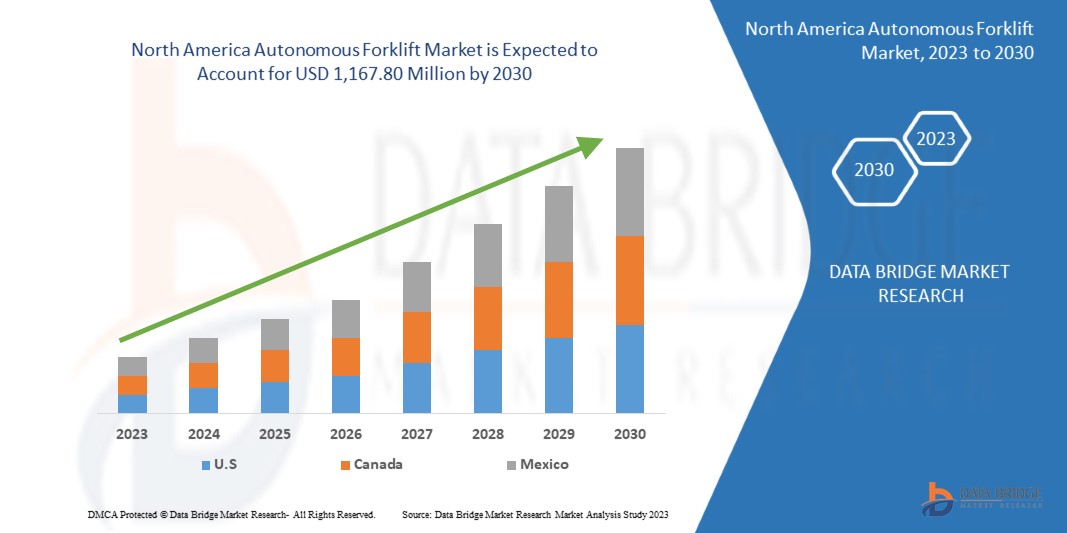

Data Bridge Market Research에 따르면, 북미 자율 주행 지게차 시장은 2030년까지 1,167.80백만 달러 규모에 도달할 것으로 예상되며, 이는 예측 기간 동안 연평균 성장률 7.2%를 기록할 것으로 예상됩니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적 연도 |

2021 (2015-2020으로 사용자 정의 가능) |

|

양적 단위 |

매출은 백만 달러, 볼륨은 단위, 가격은 달러로 표시됨 |

|

다루는 세그먼트 |

판매 채널별(리스, 사내 구매), 응용 분야별(자재 취급, 창고, 물류 및 운송, 제조 및 기타), 산업별(3PL, 전자 상거래 , 자동차, 금속 및 중장비, 식품 및 음료, 반도체 및 전자, 제지 및 펄프 산업, 항공, 의료 및 기타), 내비게이션 기술별(레이저 유도, 자기 유도, 유도 유도, 비전 유도, 광학 테이프 유도 및 기타) |

|

국가 커버 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Oceaneering International, Inc 및 Seegrid Corporation |

시장 정의

Autonomous forklifts are the powered machines that are capable of transporting heavy loads from one place to another. These are designed to be capable of carrying maximum loads of weight in the warehouses. These are capable of load and unloading with requiring any human intervention. Therefore, autonomous forklifts help to minimize human errors and reduce the probability of industrial accidents.

Rapid industrialization and growth and expansion of construction industry are the two major factors fostering growth in the demand for autonomous forklifts. Rising demand for machines that can load and unload heavy weights in the warehouses is further inducing growth of autonomous forklifts. Increasing cases of warehouse accidents and human errors is also bolstering the growth of market.

North America Autonomous Forklift Market Dynamics

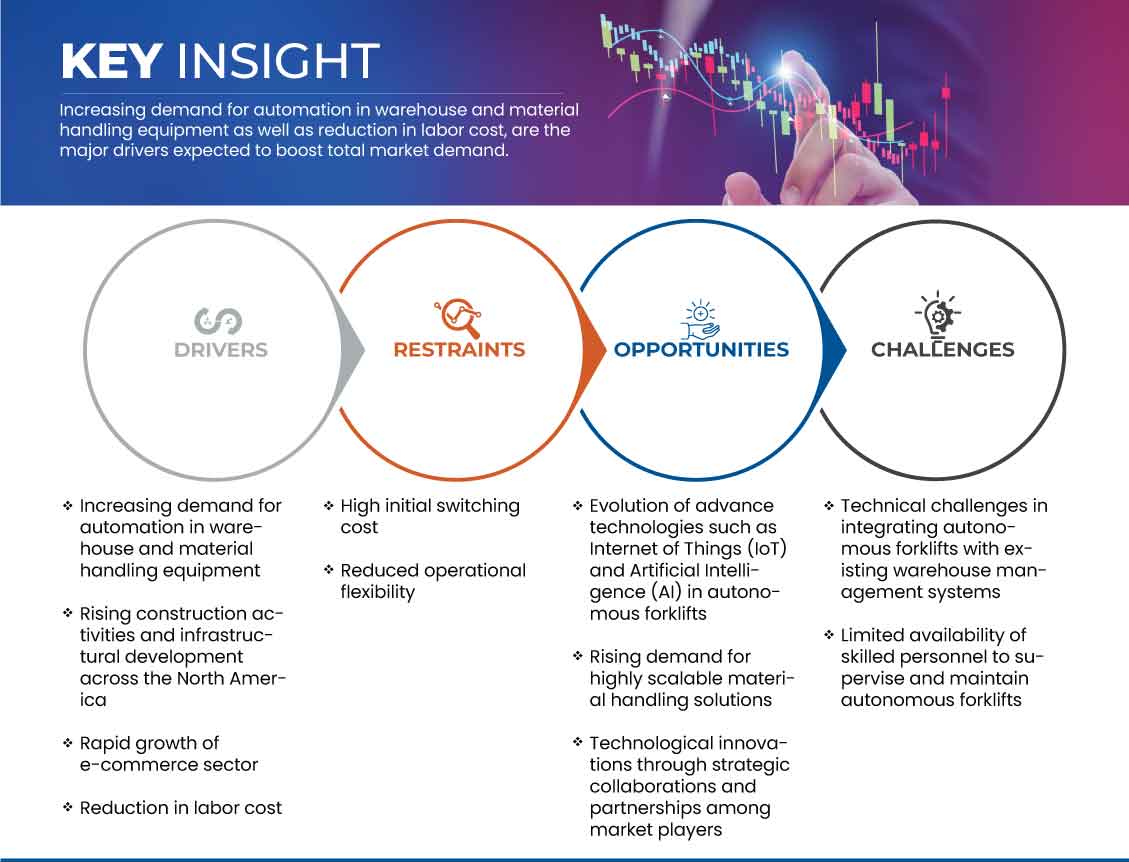

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Increasing demand for automation in warehouse and material handling equipment

Automation forklifts in warehouse and material handling equipment have revolutionized the way these operations are carried due to a growing demand over time. Automation forklifts have become an essential component of modern material handling and logistics operations as a result of technological advancements. This enables businesses to:-

- Increased efficiency and productivity: Automation forklifts can move and store materials faster and with greater precision than human operators, which can save time and labor. The operations of the warehouse and material handling become more productive and efficient as a result of this

- Improved safety: Forklift mishaps are a significant reason for workplace injuries and fatalities, and computerization forklifts can assist with decreasing the risk of accidents by eliminating the need for human operators. They can also be programmed to operate safely at all times by adhering to stringent safety procedures

- Increased flexibility: Programmable automation forklifts can be set up to transport materials, stack and organize inventory, pick and place products, and transport goods. They are ideal for use in a variety of warehouses due to their adaptability

- Improved accuracy: Automation forklifts can be programmed to operate with extreme precision, ensuring that materials are moved and stored appropriately. This can help reduce errors and improve the accuracy of inventory management

Rising construction activities and infrastructural development across north america

The use of autonomous forklifts is one of the main factors behind the significant expansion of the construction and logistics sectors in North America. Advanced sensors and cameras in autonomous forklifts enable them to operate without human intervention, resulting in increased productivity, increased safety, and decreased labour costs. How autonomous forklifts are changing construction and logistics in North America:-

- Improved Productivity: The ability of autonomous forklifts to operate 24/7 without breaks without taking breaks is one of their primary advantages. This prompts expanded efficiency and quicker finish of development projects. Autonomous forklifts are versatile tools for construction and logistics operations because they can load and unload materials, transport materials to various locations, and stack materials. With independent forklifts, development organizations can finish projects quicker and more effectively than any other time

- Increased Safety: Advanced cameras and sensors are included in autonomous forklifts so that they can avoid collisions and detect obstacles. Because of this, they are safer to operate than conventional forklifts, which require a human operator to manoeuvre around obstacles. The sensors and cameras on autonomous forklifts allow them to detect obstacles in real-time and adjust their path to avoid collisions. This reduces the risk of accidents and injuries on construction sites, making them safer for workers

Opportunity

- Rising demand for highly scalable material handling solutions

The need for greater goods movement efficiency, speed, and accuracy has led to a significant shift in the logistics and material handling industries in recent years. The rising demand for highly scalable material handling solutions that are able to adapt to shifting business requirements and keep up with the growing demands of e-commerce is one of the most important trends in this industry.

The number of packages and parcels being shipped around the world has increased as a result of the rise of e-commerce. As a result, warehouse operators and logistics companies are under a lot of pressure to make their operations more efficient and deliver goods faster than ever before. Material handling solutions that are highly scalable, adaptable, and flexible have become increasingly in demand as a result. Scalability is a critical factor in material handling systems because it enables businesses to adjust their operations quickly and efficiently in response to changes in demand. For example, during top peak seasons or sales events, organizations might have to handle altogether higher volumes of packages than expected. These surges in demand can be accommodated by highly scalable material handling solutions without requiring significant alterations to the underlying infrastructure.

Restraint/Challenge

- High initial switching cost

The logistics industry has the potential to be transformed by autonomous forklifts, but widespread adoption may be hindered by the high initial switching costs. Because autonomous navigation requires specialized sensors, cameras, and other equipment, the technology itself can be expensive. Costs may also rise further due to the technology's proprietary nature.

Additionally, significant integration with existing warehouse management systems (WMS), ERP systems, and other logistics software is required for the implementation of autonomous forklifts. This integration can be difficult, expensive, and requires specialized resources and expertise. A significant expense can also be incurred when specialized training and support are required. The autonomous forklifts' continued operation necessitates ongoing support and maintenance, which can drive up costs even further.

Post-COVID-19 Impact on North America Autonomous Forklift Market

The autonomous forklift market noted a gradual decrease in demand due to lockdown and COVID-19 governmental laws, as manufacturing facilities and services were closed. Even private and public development was called off. Moreover, the industry was also affected by halt of supply chain especially of raw materials used in the manufacturing process of autonomous forklift. Stringent government regulations for different industries, restrictions on trade & transportation were some of the top factors that had cause dent towards the growth of the market for autonomous forklift around the world in 2020 and in first two quarters of 2021. As the autonomous forklift production slowed down owing to the restrictions by the governments across the globe, the production was not meeting the demand in the first three quarters of 2020. Thus, this had not only led to the hike in the demand but also increased the cost of the product.

Recent Developments

- In April 2023, Oceaneering International, Inc announces the availability of new supervisory software for its fleet of autonomous mobile robots by its Mobile Robotics division. The software platform can be used for a wide range of things, from assembly lines to intricate logistical flows that span multiple floors in different buildings

- In October 2022, Seegrid Corporation announces strategic partnership with Koops Automation Systems a main frameworks integrator gaining practical experience in modern mechanization for assembling conditions. Koops is able to expand their product offering by introducing their clients to the entire line of autonomous mobile robots known as Seegrid Palion and Fleet Central enterprise software solutions because of the collaboration agreement. Such partnership helps the company to develop according to customer requirements

North America Autonomous Forklift Market Scope

North America autonomous forklift market is analysed, and market size insights and trends are provided by industry, navigation technology, application, and sales channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

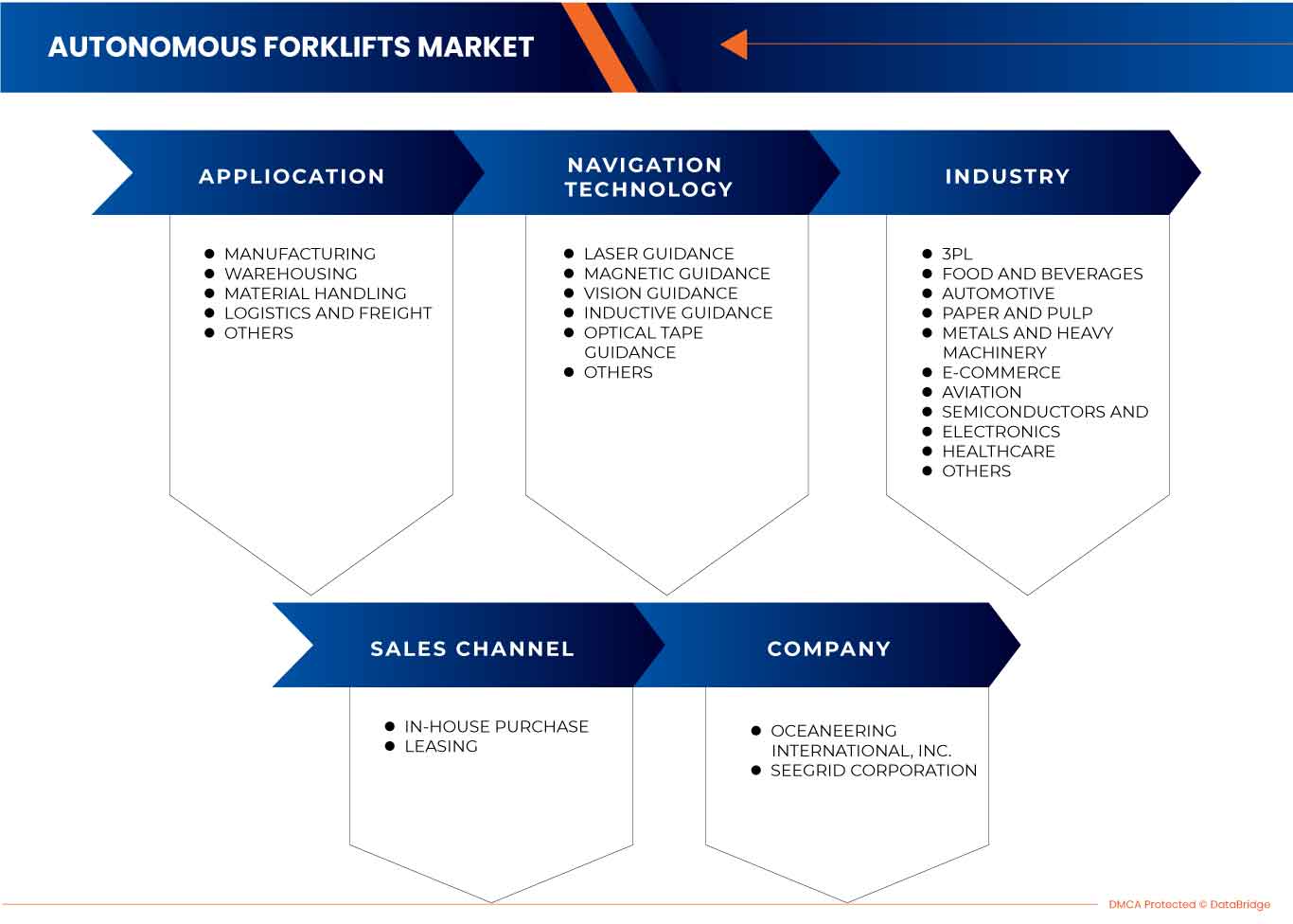

North America Autonomous Forklift Market, By Sales Channel

- Leasing

- In-House Purchase

On the basis of sales channel, the North America autonomous forklift market is segmented into leasing & in-house purchase.

North America Autonomous Forklift Market, By Application

- Material Handling

- Warehousing

- Logistics & Freight

- Manufacturing

- Others

On the basis of application, the North America autonomous forklift market is segmented into material handling, warehousing, logistics & freight, manufacturing, and others.

North America Autonomous Forklift Market, By Industry

- 3PL

- E-Commerce

- Automotive

- Metal & Heavy Machinery

- Food and Beverages

- Semiconductor & Electronics

- Paper & Pulp Industry

- Aviation

- Healthcare

- Others

On the basis of industry, the North America autonomous forklift market is segmented into 3PL, e-commerce, automotive, metal & heavy machinery, food and beverages, semiconductor & electronics, paper & pulp industry, aviation, healthcare, and others.

North America Autonomous Forklift Market, By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Inductive Guidance

- Vision Guidance

- Optical Tape Guidance

- Others

On the basis of navigation technology, the North America autonomous forklift market is segmented into laser guidance, magnetic guidance, inductive guidance, vision guidance, optical tape guidance, and others.

North America Autonomous Forklift Market Regional Analysis/Insights

North America autonomous forklift market is analysed, and market size insights and trends are provided by region, industry, navigation technology, application, and sales channel, as referenced above.

The country covered in the North America autonomous forklift market report are U.S., Canada, & Mexico. U.S. dominates in the region due to high demand of forklifts across the logistic industries.

The region section of the report also provides individual market-impacting factors and changes in market regulation that affect the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and Porter’s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and North America Autonomous Forklift Market Share Analysis

북미 자율 지게차 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 유럽의 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 제공된 위의 데이터 포인트는 자율 지게차 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 자율 지게차 시장의 주요 업체로는 Oceaneering International, Inc와 Seegrid Corporation이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 PREMIUM INSIGHTS

1.1 MARKET DEFINATION

1.2 VALUE CHAIN ANALYSIS

1.3 CASE STUDY

1.3.1 AUTONOMOUS FORKLIFTS STACK CHEESE BOXES USING 3D TIME-OF-FLIGHT

1.3.2 HOBURNE HOLIDAYS CASE STUDY

1.3.3 MILTON CAT ACHIEVES UP TO 50% IMPROVED ORDER FULFILLMENT

1.4 REGULATORY FRAMEWORK

1.4.1 ANSI/ITSDF

1.4.2 ISO STANDARDS

1.5 TECHNOLOGICAL TRENDS

1.6 PRICING ANALYSIS

1.7 SUPPLY CHAIN ANALYSIS

2 MARKET OVERVIEW

2.1 DRIVERS

2.1.1 INCREASING DEMAND FOR AUTONOMOUS IN WAREHOUSE AND MATERIAL HANDLING EQUIPMENT

2.1.2 RISING CONSTRUCTION ACTIVITIES AND INFRASTRUCTURAL DEVELOPMENT ACROSS NORTH AMERICA

2.1.3 RAPID GROWTH OF THE E-COMMERCE SECTOR

2.1.4 REDUCTION IN LABOR COST

2.2 RESTRAINTS

2.2.1 HIGH INITIAL SWITCHING COST

2.2.2 REDUCED OPERATIONAL FLEXIBILITY

2.3 OPPORTUNITIES

2.3.1 EVOLUTION OF ADVANCED TECHNOLOGIES SUCH AS THE INTERNET OF THINGS (IOT) AND ARTIFICIAL INTELLIGENCE (AI) IN AUTONOMOUS FORKLIFTS

2.3.2 RISING DEMAND FOR HIGHLY SCALABLE MATERIAL HANDLING SOLUTIONS

2.3.3 TECHNOLOGICAL INNOVATIONS THROUGH STRATEGIC COLLABORATIONS AND PARTNERSHIPS AMONG MARKET PLAYERS

2.4 CHALLENGES

2.4.1 TECHNICAL CHALLENGES IN INTEGRATING AUTONOMOUS FORKLIFTS WITH EXISTING WAREHOUSE MANAGEMENT SYSTEMS

2.4.2 LIMITED AVAILABILITY OF SKILLED PERSONNEL TO SUPERVISE AND MAINTAIN AUTONOMOUS FORKLIFTS

3 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL

3.1 OVERVIEW

3.2 LEASING

3.3 IN-HOUSE PURCHASE

4 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION

4.1 OVERVIEW

4.2 MATERIAL HANDLING

4.3 WAREHOUSING

4.4 LOGISTICS & FREIGHT

4.5 MANUFACTURING

4.6 OTHERS

5 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY

5.1 OVERVIEW

5.2 3PL

5.3 E-COMMERCE

5.4 AUTOMOTIVE

5.5 METAL & HEAVY MACHINERY

5.6 FOOD AND BEVERAGES

5.7 SEMICONDUCTOR & ELECTRONICS

5.8 PAPER & PULP INDUSTRY

5.9 AVIATION

5.1 HEALTHCARE

5.11 OTHERS

6 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY

6.1 OVERVIEW

6.2 LASER GUIDANCE

6.3 MAGNETIC GUIDANCE

6.4 INDUCTIVE GUIDANCE

6.5 VISION GUIDANCE

6.6 OPTICAL TAPE GUIDANCE

6.7 OTHERS

7 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET:BY COUNTRIES

7.1 U.S.

7.2 CANADA

7.3 MEXICO

8 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

9 COMPANY PROFILE

9.1 OCEANEERING INTERNATIONAL, INC

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 SEEGRID CORPORATION

9.2.1 COMPANY SNAPSHOT

9.2.2 PRODUCT PORTFOLIO

9.2.3 RECENT DEVELOPMENTS

표 목록

TABLE 1 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 6 U.S. AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 7 U.S. AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 U.S. AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 9 U.S. AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 10 CANADA AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 11 CANADA AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 12 CANADA AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 13 CANADA AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 14 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 15 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 17 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

그림 목록

FIGURE 1 TOTAL CONSTRUCTION IN THE UNITED STATES

FIGURE 2 E-COMMERCE RETAIL SALES IN UNITED STATES

FIGURE 3 EMPLOYMENT COST INDEX IN UNITED STATES

FIGURE 4 NEW ORDERS OF MATERIAL HANDLING EQUIPMENT IN THE UNITED STATES

FIGURE 5 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: SNAPSHOT (2022)

FIGURE 6 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY COUNTRY (2022)

FIGURE 7 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 8 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 9 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY SALES CHANNEL (2023-2030)

FIGURE 10 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.