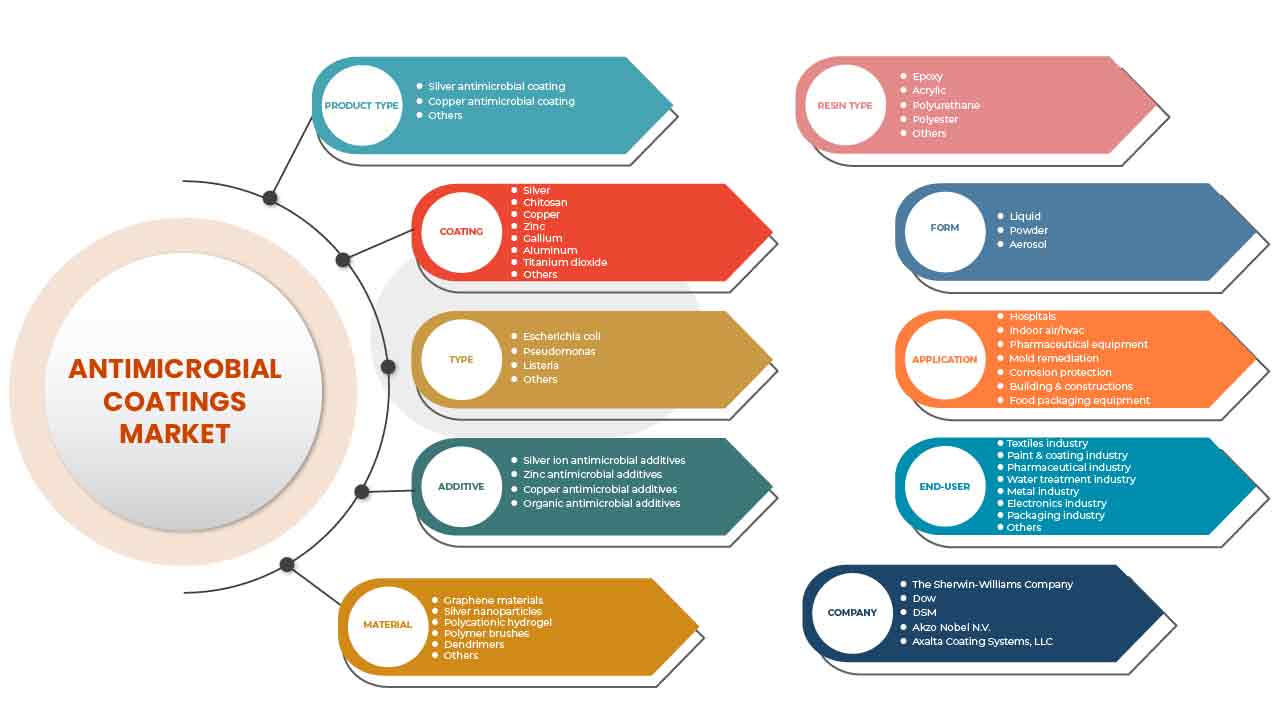

North America Antimicrobial Coatings Market, By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), Coating (Silver, Chitosan, Titanium Dioxide, Aluminum, Copper, Zinc, Gallium, Others), Type (Escherichia Coli, Pseudomonas, Listeria, Others), Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), Form (Liquid, Powder, Aerosol), Application (Hospitals, Indoor Air/HVAC, Pharmaceutical Equipment, Mold Remediation, Corrosion Protection, Building & Construction and Food Packaging Equipment), End-Users (Pharmaceutical Industry, Paint and Coating Industry, Packaging Industry, Textiles Industry, Electronics Industry, Metal Industry, Water Treatment Industry, and Others) - Industry Trends and Forecast to 2029.

Market Analysis and Insights

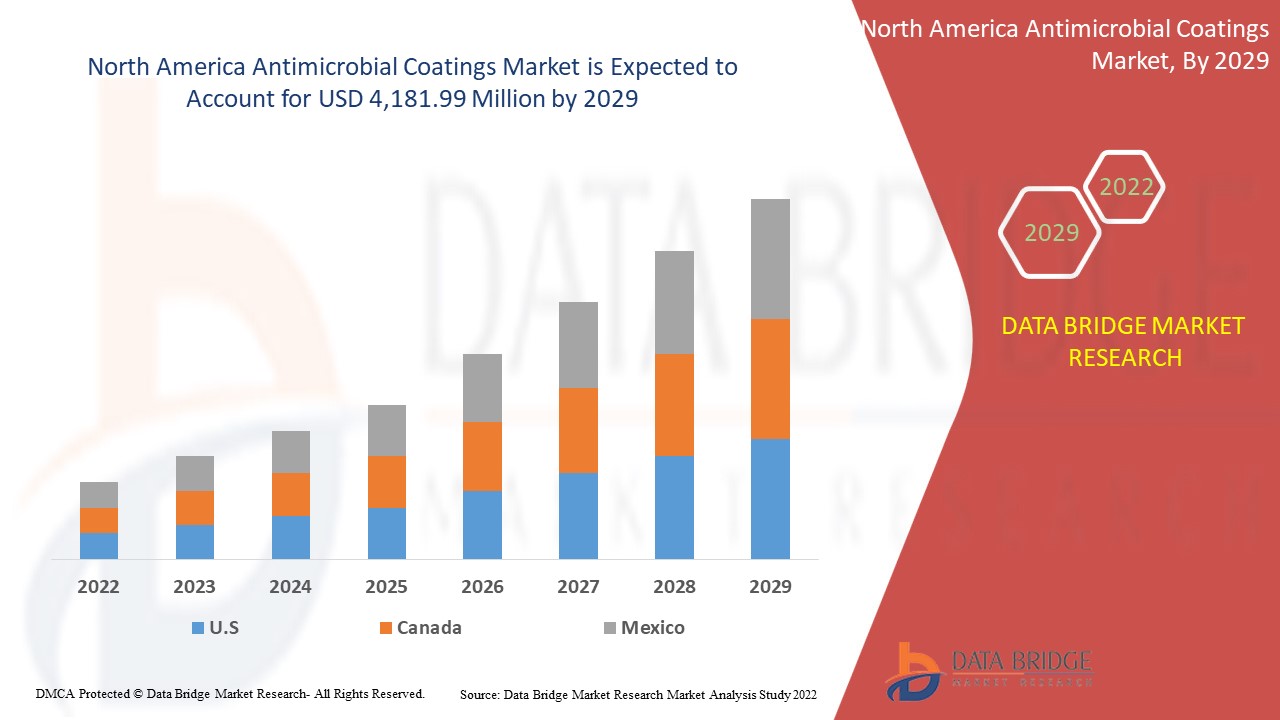

The North America antimicrobial coatings market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 11.5% in the forecast period of 2022 to 2029 and is expected to reach USD 4,181.99 million by 2029. The major factor driving the growth of the North America antimicrobial coatings market is the growing demand for heating, ventilation, and air conditioning to improve indoor air quality

Antimicrobial coatings assist in maintaining the quality of applied surfaces by preventing the growth of microorganisms such as fungi, parasites, and bacteria. The usage of these antimicrobial coatings provides improved cleanliness and hygiene as they end the requirement of frequent cleaning. As a result, antimicrobial coatings are more cost-effective and offer lasting protection against pathogens. These coatings are generally applied on walls, vents, counters, and door handles. Moreover, as these coatings help sterilize medical tools, surgical masks, gloves, and clothing, they find vast applications in clinics, hospitals, and healthcare centers.

The application of antimicrobial coatings improves the durability and appearance of the applied surface and aids in shielding the surface from the attack of microbes. As a result, these coatings are widely used to eliminate the germination of pathogens that can cause infectious diseases such as Ebola, influenza, mumps, measles, chickenpox, and rubella.

Growing demand for heating, ventilation, and air conditioning to improve indoor air quality and rising awareness regarding healthcare-associated infections (HCAI) are expected to boost market antimicrobial coatings demand. With the increasing consumption of antimicrobial coatings globally, major companies are expanding their production capacities in different countries to strengthen their presence of these products in the market.

The major restraint which may impact the market is stringent regulations associated with antimicrobial coatings. Also, the emission of active ingredients into the environment is a restraining factor for the North America antimicrobial coatings market.

North America antimicrobial coatings market report provides details of market share, new developments, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in Million, Pricing in USD |

|

Segments Covered |

By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), By Coating (Silver, Chitosan, Titanium Dioxide, Aluminum, Copper, Zinc, Gallium, Others), By Type (Escherichia Coli, Pseudomonas, Listeria, Others), By Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), By Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), By Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), By Form (Liquid, Powder, Aerosol), By Application (Hospitals, Indoor Air/HVAC, Pharmaceutical Equipment, Mold Remediation, Corrosion Protection, Building & Construction and Food Packaging Equipment), By End-Users (Pharmaceutical Industry, Paint and Coating Industry, Packaging Industry, Textiles Industry, Electronics Industry, Metal Industry, Water Treatment Industry, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Axalta Coating Systems, LLC, Akzo Nobel N.V., SANITIZED AG, PPG Industries Inc., The Sherwin-Williams Company, Microban International, Fiberlock, Burke Industrial Coatings, Aereus Technologies, Linetec, Katilac Coatings, Dow, Kastus Technologies Company Limited, Specialty Coating Systems Inc., DuPont, Flowcrete, Nano Care Deutschland AG, among others |

Market Definition

항균 코팅은 미생물 불순물을 방지하는 항균제를 포함하는 미생물 저항성 코팅입니다. 건설, 식품 및 의료 산업에서 광범위하게 사용됩니다. 문, 유리 패널, 벽, 문, HVAC 텐트, 카운터 등에 적용됩니다. 항균 코팅은 질병을 일으키는 미생물의 성장을 막을 수 있는 표면에 화학제를 도포하는 것입니다. 이 외에도 항균 코팅은 표면 내구성, 외관, 내식성 등을 높이는 데 도움이 됩니다. 이러한 코팅은 미생물의 성장을 파괴하거나 억제하고 인간이 전염병에 감염되지 않도록 보호하기 위해 의료 기기에 사용됩니다. 항균 코팅은 의료 관련 감염에 대한 강력한 무기로 알려져 있습니다. 항균 코팅은 매우 효과적인 실행 가능한 항균 코팅과 의료 기기 표면에서 바로 정확하게 투여되고 전달되는 수정이 특징입니다. 항균 코팅은 계면 특성을 변경하여 생물 의학 기기의 축적을 줄이는 데 중점을 둡니다.

북미 항균 코팅 시장 동향

운전자

- 실내 공기 질 개선을 위한 난방, 환기 및 에어컨에 대한 수요 증가

북미 지역은 거대한 사무실과 주거 공간이 있는 많은 대형 빌딩이 있는 곳입니다. 이 지역의 인프라 개발이 증가함에 따라 질병 확산이 증가함에 따라 양호한 실내 공기 질에 대한 인식이 커지고 있습니다. 따라서 실내 공기 질을 개선하기 위한 효과적인 난방, 환기 및 공조에 대한 수요가 증가하여 북미 항균 코팅 시장이 성장할 것으로 예상됩니다.

- 의료 기기 산업의 상당한 수요

특히 의료 분야에서 모든 표면에서 병원균의 성장을 예방하고 통제할 수 있는 항균 코팅의 능력과 잠재력은 의료 기기 산업에서 그 수요를 급증시키고 있습니다. 따라서 의료 기기 산업에 대한 의료 분야와 병원 및 진료소와 같은 시설의 상당한 수요가 북미 항균 코팅 시장의 원동력이 될 것으로 예상됩니다.

기회

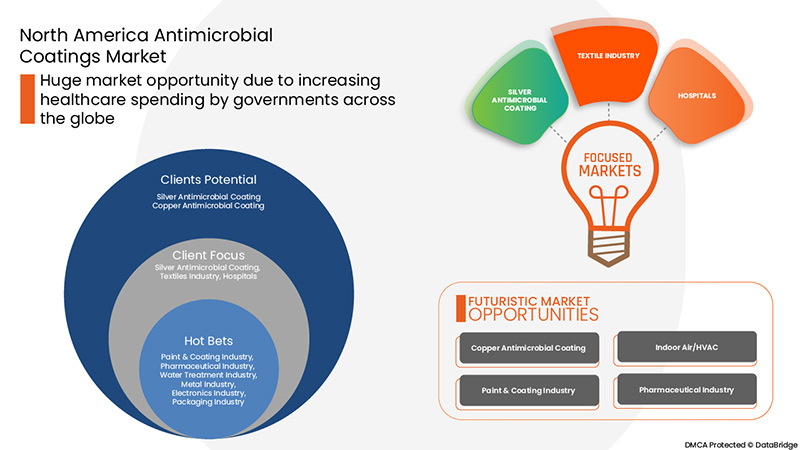

- 주요 신규 응용 분야에서 사용량 증가

미국과 캐나다와 같은 선진국에서 안전과 위생에 대한 우려가 커지고 인식이 높아지면서 다양한 회사가 고객의 안전을 보장하기 위해 항균 및 항균 제품 개발에 주력하고 있습니다. 또한 이는 변화하는 소비자 선호도를 준수하는 데 도움이 되고 항균 코팅 제품에 대한 시장 수요를 증가시키는 데 도움이 되므로 북미 항균 코팅 시장 성장에 수익성 있는 기회를 제공합니다.

- 항균 코팅의 기술적 발전

다양한 산업에서 사용되는 고급 항균 코팅 제품에 대한 수요 증가와 더불어 항균 코팅 기술의 급속한 발전은 예측 기간 동안 항균 코팅 시장에 기회를 창출할 것으로 예상됩니다.

제약/도전

- 환경으로의 활성 성분 배출

항균 코팅은 인간과 다른 유기체에 대한 감염 확산을 방지하기 위해 모든 제품이나 표면에 적용됩니다. 그러나 항균 코팅을 매우 장기간 사용하면 건강에 위험을 초래할 수도 있습니다. 대부분의 항균 코팅은 아연, 은, 구리와 같은 성분으로 구성되어 있으며 이러한 성분을 환경으로 적극적으로 방출합니다. 이러한 활성 성분은 주변 공기와 다른 수역으로 천천히 유입되어 생태계에 해를 끼칩니다.

따라서 항균 코팅이 환경에 미치는 부정적 영향과, 환경에 미치는 부정적 영향을 최소화하는 방법에 대한 인식과 정보 부족이 북미 항균 코팅 시장 성장을 저해할 수 있습니다.

- 항균 코팅과 관련된 엄격한 규정

환경보호청(EPA), FDA, REACH 등을 비롯한 다양한 기관에서 항균 코팅 사용에 대한 엄격한 규정을 시행함에 따라 북미 항균 코팅 시장 성장이 방해받을 가능성이 높습니다.

- 나노입자의 독성에 대한 우려 증가

항균 코팅에서 방출되는 나노입자의 독성에 장기간 노출되면 심각한 건강 문제가 발생할 수 있으며, 이는 우려를 불러일으키고 북미 항균 코팅 시장 성장에 어려움을 줄 수 있습니다.

- COVID-19 팬데믹으로 인한 높은 제품 비용 및 공급망 중단

COVID-19의 발발은 전국적인 봉쇄로 인해 예측 기간 동안 북미 항균 코팅 시장 성장에 도전이 될 것으로 예상되며, 이는 항균 코팅의 수요와 판매에 부정적인 영향을 미쳤습니다. 그러나 봉쇄가 완화되면서 워크플로가 증가하기 시작하여 제조업체가 시장에 복귀하는 데 도움이 되었습니다. 또한 경제 성장과 신생 기업의 증가에 대한 지원적인 정부 규제로 인해 예측 기간 동안 항균 코팅 시장 수요가 급증할 수 있습니다.

최근 개발 사항

- 2021년 3월, Parylene 컨포멀 코팅 서비스 및 기술 분야의 글로벌 리더인 Specialty Coating Systems, Inc.는 Parylene 및 액상 컨포멀 코팅 서비스 공급업체인 Diamond-MT, Inc.를 인수한다고 발표했습니다. 이 개발은 회사에 새로운 성장 기회를 제공할 것입니다.

- 2021년 11월, DuPont는 Rogers Corporation("Rogers")을 52억 달러에 인수하기로 확정 계약을 체결했습니다. DuPont는 보완적인 기술과 재무적 특성을 갖춘 시장을 선도하는 고성장, 고마진 사업에 집중하는 최고의 다산업 기업으로서의 전략을 발전시키는 일련의 조치를 발표했습니다. 이러한 발전은 DuPont가 Rogers Corporation의 도움으로 사업을 확장하는 데 도움이 될 것입니다.

북미 항균 코팅 시장 범위

북미 항균 코팅 시장은 제품 유형, 코팅, 유형, 재료, 첨가제, 수지 유형, 형태, 응용 분야 및 최종 사용자를 기준으로 분류됩니다.

제품 유형

- 실버 항균 코팅

- 구리 항균 코팅

- 기타

제품 유형을 기준으로 북미 항균 코팅 시장은 은 항균 코팅, 구리 항균 코팅 및 기타로 구분됩니다.

코팅

- 은

- 키토산

- 구리

- 아연

- 갈륨

- 알류미늄

- 이산화티타늄

- 기타

코팅을 기준으로 북미 항균 코팅 시장은 은, 키토산, 구리, 아연, 갈륨, 알루미늄, 이산화티타늄 등으로 구분됩니다.

유형

- 대장균

- 슈도모나스

- 리스테리아

- 기타

북미 항균 코팅 시장은 유형을 기준으로 대장균, 슈도모나스, 리스테리아 등으로 구분됩니다.

첨가물

- 은이온 항균첨가제

- 아연 항균 첨가제

- 구리 항균 첨가제

- 유기 항균 첨가제

첨가제를 기준으로 북미 항균 코팅 시장은 은 이온 항균 첨가제, 아연 항균 첨가제, 구리 항균 첨가제, 유기 항균 첨가제로 구분됩니다.

재료

- 그래핀 소재

- 폴리양이온 하이드로젤

- 은나노입자

- 폴리머 브러쉬

- 덴드리머

- 기타

재료를 기준으로 보면 북미 항균 코팅 시장은 그래핀 소재, 은 나노입자, 폴리양이온 하이드로젤, 폴리머 브러시, 덴드리머 등으로 구분됩니다.

수지 유형

- 아크릴

- 폴리에스터

- 폴리우레탄

- 에폭시

- 기타

수지 유형을 기준으로 북미 항균 코팅 시장은 에폭시, 아크릴, 폴리우레탄, 폴리에스터 등으로 구분됩니다.

형태

- 액체

- 에어로졸

- 가루

북미 항균 코팅 시장은 형태에 따라 액체, 에어로졸, 분말로 구분됩니다.

애플리케이션

- 병원

- 실내 공기/HVAC

- 제약 장비

- 곰팡이 제거

- 부식 방지

- 건물 및 건설

- 식품 포장 장비

- 기타

북미 항균 코팅 시장은 적용 분야를 기준으로 병원, 실내 공기/HVAC, 제약 장비, 곰팡이 제거, 부식 방지, 건축 및 건설, 식품 포장 장비 등으로 구분됩니다.

최종 사용자

- 제약 산업

- 페인트 및 코팅 산업

- 포장 산업

- 섬유 산업

- 전자 산업

- 금속 산업

- 물 처리 산업

- 기타

On the basis of end-users, North America antimicrobial coatings market is segmented into the pharmaceutical industry, paint and coating industry, packaging industry, textiles industry, electronics industry, metal industry, water treatment industry, and others.

North America Antimicrobial Coatings Regional Analysis/Insights

The North America antimicrobial coatings market is categorized based on country, product type, coating, type, material, additive, resin type, form, application, and end-users.

North America antimicrobial coatings market is further segmented into the U.S., Canada, and Mexico.

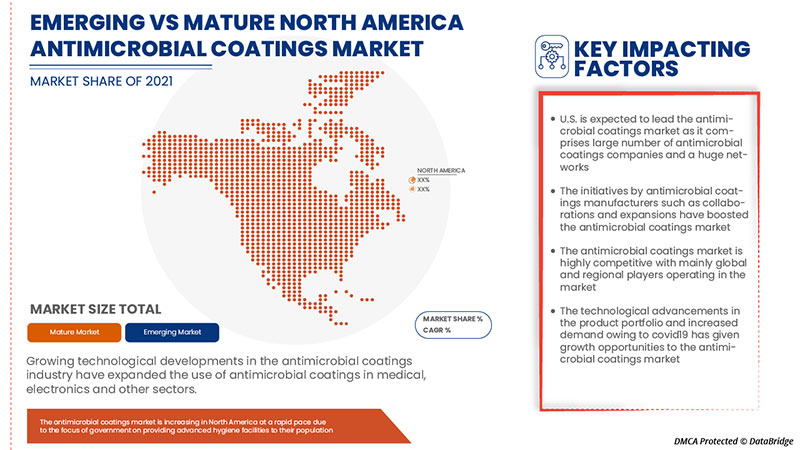

U.S. is expected to dominate the North America antimicrobial coatings market in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the increasing need for safe environments in the country.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North American brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Antimicrobial Coatings Market Share Analysis

North America antimicrobial coatings market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the North America antimicrobial coatings market.

Some of the prominent participants operating in the North America antimicrobial coatings market are Axalta Coating Systems, LLC, Akzo Nobel N.V., SANITIZED AG, PPG Industries Inc., The Sherwin-Williams Company, Microban International, Fiberlock, Burke Industrial Coatings, Aereus Technologies, Linetec, Katilac Coatings, Dow, Kastus Technologies Company Limited, Specialty Coating Systems Inc., DuPont, Flowcrete, Nano Care Deutschland AG, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR HEATING, VENTILATION, AND AIR CONDITIONING TO IMPROVE INDOOR AIR QUALITY

5.1.2 RISING AWARENESS REGARDING HEALTHCARE ASSOCIATED INFECTIONS (HCAI)

5.1.3 SIGNIFICANT DEMAND FROM THE MEDICAL DEVICE INDUSTRY

5.1.4 INCREASING ADOPTION ACROSS VARIOUS INDUSTRIAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 EMISSION OF ACTIVE INGREDIENTS INTO THE ENVIRONMENT

5.2.2 STRINGENT REGULATIONS ASSOCIATED WITH ANTIMICROBIAL COATINGS

5.3 OPPORTUNITIES

5.3.1 RISING USAGE ACROSS KEY NOVEL APPLICATIONS

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN ANTIMICROBIAL COATINGS

5.3.3 INCREASING HEALTHCARE SPENDING BY GOVERNMENTS ACROSS THE GLOBE

5.4 CHALLENGES

5.4.1 INCREASING CONCERNS REGARDING THE TOXICITY OF NANOPARTICLES

5.4.2 HIGH COST OF PRODUCTS AND SUPPLY CHAIN DISRUPTIONS DUE TO COVID-19 PANDEMIC

6 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SILVER ANTIMICROBIAL COATINGS

6.3 COPPER ANTIMICROBIAL COATINGS

6.4 OTHERS

7 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS

7.1 OVERVIEW

7.2 SILVER

7.3 CHITOSAN

7.4 TITANIUM DIOXIDE

7.5 ALUMINUM

7.6 COPPER

7.7 ZINC

7.8 GALLIUM

7.9 OTHERS

8 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE

8.1 OVERVIEW

8.2 ESCHERICHIA COLI

8.3 PSEUDOMONAS

8.4 LISTERIA

8.5 OTHERS

9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE

9.1 OVERVIEW

9.2 SILVER ION ANTIMICROBIAL ADDITIVES

9.3 ORGANIC ANTIMICROBIAL ADDITIVES

9.4 COPPER ANTIMICROBIAL ADDITIVES

9.5 ZINC ANTIMICROBIAL ADDITIVES

10 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 GRAPHENE MATERIALS

10.3 SILVER NANOPARTICLES

10.4 POLYCATIONIC HYDROGEL

10.5 POLYMER BRUSHES

10.5.1 FUNCTIONALIZED POLYMER BRUSHES

10.5.2 NON-FOULING POLYMER BRUSHES

10.5.3 BRUSHES COMPRISING BACTERIAL POLYMERS

10.6 DENDRIMERS

10.7 OTHERS

11 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE

11.1 OVERVIEW

11.2 EPOXY

11.3 ACRYLIC

11.4 POLYURETHANE

11.5 POLYESTER

11.6 OTHERS

12 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM

12.1 OVERVIEW

12.2 LIQUID

12.3 POWDER

12.4 AEROSOL

13 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 HOSPITALS

13.3 INDOOR AIR/HVAC

13.4 PHARMACEUTICAL EQUIPMENT

13.5 MOLD REMEDIATION

13.6 CORROSION PROTECTION

13.7 BUILDING & CONSTRUCTIONS

13.8 FOOD PACKAGING EQUIPMENT

13.9 OTHERS

14 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER

14.1 OVERVIEW

14.2 TEXTILES INDUSTRY

14.2.1 SILVER ANTIMICROBIAL COATING

14.2.2 COPPER ANTIMICROBIAL COATING

14.2.3 OTHERS

14.3 PAINT & COATING INDUSTRY

14.3.1 SILVER ANTIMICROBIAL COATING

14.3.2 COPPER ANTIMICROBIAL COATING

14.3.3 OTHERS

14.4 PHARMACEUTICAL INDUSTRY

14.4.1 SILVER ANTIMICROBIAL COATING

14.4.2 COPPER ANTIMICROBIAL COATING

14.4.3 OTHERS

14.5 WATER TREATMENT INDUSTRY

14.5.1 SILVER ANTIMICROBIAL COATING

14.5.2 COPPER ANTIMICROBIAL COATING

14.5.3 OTHERS

14.6 METAL INDUSTRY

14.6.1 SILVER ANTIMICROBIAL COATING

14.6.2 COPPER ANTIMICROBIAL COATING

14.6.3 OTHERS

14.7 ELECTRONICS INDUSTRY

14.7.1 SILVER ANTIMICROBIAL COATING

14.7.2 COPPER ANTIMICROBIAL COATING

14.7.3 OTHERS

14.8 PACKAGING INDUSTRY

14.8.1 SILVER ANTIMICROBIAL COATING

14.8.2 COPPER ANTIMICROBIAL COATING

14.8.3 OTHERS

14.9 OTHERS

14.9.1 SILVER ANTIMICROBIAL COATING

14.9.2 COPPER ANTIMICROBIAL COATING

14.9.3 OTHERS

15 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.2 MERGERS & ACQUISITIONS

16.3 EXPANSIONS

16.4 NEW PRODUCT DEVELOPMENTS

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 THE SHERWIN-WILLIAMS COMPANY

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT UPDATES

18.2 DOW

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT UPDATES

18.3 DSM

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT UPDATE

18.4 AKZO NOBEL N.V.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT UPDATES

18.5 AXALTA COATING SYSTEMS, LLC

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT UPDATES

18.6 AEREUS TECHNOLOGIES

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT UPDATES

18.7 ARXADA AG

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT UPDATES

18.8 BURKE INDUSTRIAL COATINGS

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT UPDATE

18.9 DUPONT

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT UPDATE

18.1 FIBERLOCK

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT UPDATES

18.11 FLOWCRETE

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT UPDATE

18.12 GBNEUHAUS GMBH

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT UPDATE

18.13 LINETEC

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT UPDATE

18.14 KASTUS TECHNOLOGIES COMPANY LIMITED

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT UPDATE

18.15 KATILAC COATINGS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT UPDATE

18.16 MICROBAN INTERNATIONAL

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT UPDATE

18.17 NANO CARE DEUTSCHLAND AG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT UPDATE

18.18 SANITIZED AG

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT UPDATES

18.19 SPECIALTY COATING SYSTEMS INC.

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT UPDATES

18.2 PPG INDUSTRIES, INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT UPDATES

19 QUESTIONNAIRE

20 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 3 NORTH AMERICA SILVER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SILVER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 5 NORTH AMERICA COPPER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA COPPER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 7 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SILVER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CHITOSAN IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA TITANIUM DIOXIDE IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ALUMINUM IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA COPPER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ZINC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA GALLIUM IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ESCHERICHIA COLI IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA PSEUDOMONAS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA LISTERIA IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SILVER ION ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ORGANIC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA COPPER ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ZINC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA GRAPHENE MATERIALS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA SILVER NANOPARTICLES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA POLYCATIONIC HYDROGEL IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA DENDRIMERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA EPOXY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ACRYLIC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA POLYURETHANE IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA POLYESTER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA LIQUID IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA POWDER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA AEROSOL IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA INDOOR AIR/HVAC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PHARMACEUTICAL EQUIPMENT IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA MOLD REMEDIATION IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CORROSION PROTECTION IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BUILDING & CONSTRUCTIONS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD PACKAGING EQUIPMENT IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA PAINT & COATING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA PAINT & COATING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2029 (KILO TONNES)

TABLE 74 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 76 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 95 U.S. ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 96 U.S. ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 98 U.S. ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 U.S. POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 100 U.S. ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 101 U.S. ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 U.S. ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 U.S. ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 U.S. TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 105 U.S. PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.S. PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.S. WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.S. METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.S. ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.S. PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.S. OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 CANADA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 114 CANADA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 115 CANADA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 117 CANADA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 118 CANADA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 119 CANADA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 121 CANADA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 CANADA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 CANADA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 CANADA PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 CANADA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 CANADA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 CANADA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 CANADA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 133 MEXICO ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 134 MEXICO ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 137 MEXICO POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 138 MEXICO ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 140 MEXICO ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 MEXICO ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 142 MEXICO TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 MEXICO PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 MEXICO WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 MEXICO METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 MEXICO ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 MEXICO PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 149 MEXICO OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: PRODUCT TYPE LIFELINE CURVE

FIGURE 7 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GROWING DEMAND FOR HEATING, VENTILATION, AND AIR CONDITIONING TO IMPROVE INDOOR AIR QUALITY IS EXPECTED TO DRIVE THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SILVER ANTIMICROBIAL COATINGS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET

FIGURE 18 RELATIVE CONTRIBUTIONS TO U.S. HEALTH EXPENDITURES, 2020

FIGURE 19 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY PRODUCT TYPE, 2021

FIGURE 20 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COATINGS, 2021

FIGURE 21 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY TYPE, 2021

FIGURE 22 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY ADDITIVE, 2021

FIGURE 23 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY MATERIAL, 2021

FIGURE 24 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY RESIN TYPE, 2021

FIGURE 25 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY FORM, 2021

FIGURE 26 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY END USER, 2021

FIGURE 28 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 33 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.