North America Agricultural Lubricants Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

505.56 Million

USD

640.43 Million

2021

2029

USD

505.56 Million

USD

640.43 Million

2021

2029

| 2022 –2029 | |

| USD 505.56 Million | |

| USD 640.43 Million | |

|

|

|

North America Agricultural Lubricants Market By Category (Mineral Oil, Synthetic, Bio-based), Type (Engine Oil, Grease, Hydraulic Oils, Transformer Oil, Crankcase Oils, Bar and Chain Oil, Others), Raw Material (Petroleum Based Lubricants, Bio-Based Lubricants), Application (Engines, Gear and Transmission, Hydraulics, Greasing, Chain, Implements, Others), Agricultural Equipment (Tractors, Harvesters, Corn-Pickers, Balers, Verge Cutters, Circular Spike Harrows, Stone Grinders, Fertilizer Spreaders, Slurry Tankers, Sprayers, Fodder Mixers, Silage Spreaders, Straw Blowers, Mowers and Mower-Conditioners, Hay Tedders, Hay Rakes, Bale Wrappers, Grape Harvesting Machines, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

The use of modern agricultural equipment is increasing, which is driving demand for agricultural lubricants and even allowing companies to expand globally. Furthermore, the agricultural lubricants industry is expanding as a result of increased farm mechanisation around the world.

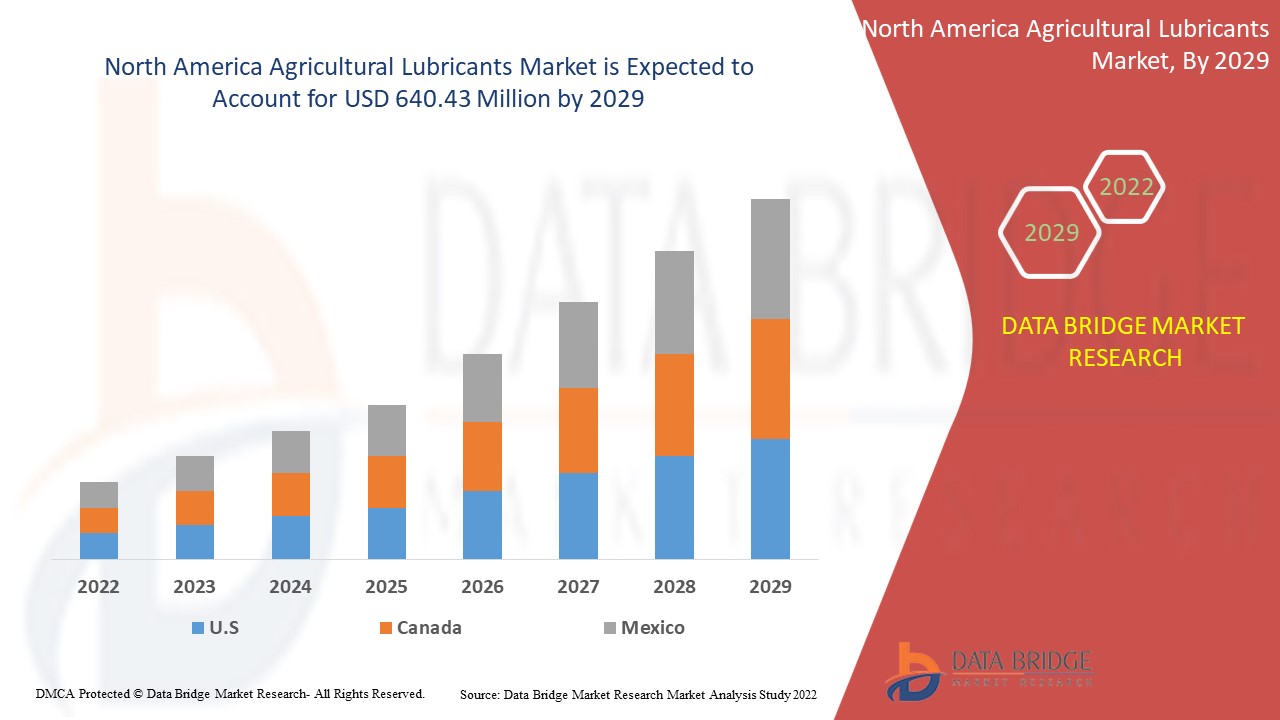

Data Bridge Market Research analyses that the agricultural lubricants market was valued at USD 505.56 million in 2021 and is expected to reach the value of USD 640.43 million by 2029, at a CAGR of 3.0% during the forecast period of 2022 to 2029.

Market Definition

Agricultural lubricants are lubricants used in agricultural equipment to extend the life of machines and equipment. They are used in a variety of machines, including harvesters, tractors, and verge cutters. They are also cost-effective and help to reduce gasoline consumption. They ensure the proper operation of these machines and equipment because it is critical to productivity.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Category (Mineral Oil, Synthetic, Bio-based), Type (Engine Oil, Grease, Hydraulic Oils, Transformer Oil, Crankcase Oils, Bar and Chain Oil, Others), Raw Material (Petroleum Based Lubricants, Bio-Based Lubricants), Application (Engines, Gear and Transmission, Hydraulics, Greasing, Chain, Implements, Others), Agricultural Equipment (Tractors, Harvesters, Corn-Pickers, Balers, Verge Cutters, Circular Spike Harrows, Stone Grinders, Fertilizer Spreaders, Slurry Tankers, Sprayers, Fodder Mixers, Silage Spreaders, Straw Blowers, Mowers and Mower-Conditioners, Hay Tedders, Hay Rakes, Bale Wrappers, Grape Harvesting Machines, Others) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Exxon Mobil Corporation(미국), Shell(네덜란드), Chevron Corporation(미국), Total Energies(프랑스), BP plc(영국), FUCHS(독일), Phillips 66 Company(미국), Exol Lubricants Limited(영국), Witham Group(영국), Rymax Lubricants(네덜란드), Repsol(스페인), Cougar Lubricants International Ltd(영국), Schaeffer Manufacturing Co.(미국), Pennine Lubricants(영국), Frontier Performance Lubricants, Inc.(미국) 및 UNIL(벨기에) |

|

기회 |

|

농업 윤활유 시장 동향

운전자

- 보조금 지급의 실행

농부 보조금은 여러 국가의 정부 기관에서 시행되고 있습니다. 이러한 보조금은 농부가 수확기, 동력 분무기, 논 재배기, 탈곡기, 트랙터 및 기타 유사한 품목과 같은 농업 장비를 구매하는 데 도움이 되도록 설계되었습니다. 결과적으로 보다 정교한 농업 장비가 도입되어 농업 윤활제에 대한 수요가 증가하고 있습니다. 농장 노동 비용의 상승은 농업 윤활제 시장의 성장을 가속화할 것입니다. 또한 고성능 합성 윤활제의 인기 증가와 농장 기계화 비율의 상승은 시장 성장을 촉진할 것으로 예상됩니다.

기회

또한, 특히 선진국에서 바이오 기반 제품의 증가 추세는 2022년부터 2029년까지 시장 참여자에게 수익성 있는 기회를 확대합니다. 또한, 사업 확장, 합작 투자, 인수와 같은 제조업체가 채택하는 다양한 시장 전략의 증가는 농업 윤활유 시장의 미래 성장에 기여할 것입니다.

제약

합성 및 바이오 기반 윤활제 의 높은 비용은 예상 기간 동안 농업 윤활제 시장의 성장을 저해할 것으로 예상됩니다. 또한 농업 마케팅 지출이 감소함에 따라 바이오 기반 농업 윤활제와 같은 농산물에 대한 인지도가 낮아져 예상 기간 동안 농업 윤활제 시장에 부정적인 영향을 미칠 것입니다. 결과적으로 농업 윤활제 시장의 성장률이 도전을 받을 것입니다.

이 농업 윤활유 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 농업 윤활유 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드립니다.

COVID-19가 농업 윤활유 시장에 미치는 영향

최근 코로나바이러스 발생은 농업용 윤활유 시장에 부정적인 영향을 미쳤는데, 중국과 같은 원자재 공급국에서 봉쇄가 시행됨에 따라 COVID-19 팬데믹이 2020년 상반기에 공급망에 영향을 미쳤기 때문입니다. COVID-19는 대부분 국가에서 농업과 농업 관련 활동이 필수 서비스로 간주되었기 때문에 농업용 윤활유 수요에 거의 영향을 미치지 않았습니다. 2020년 상반기에 원자재 조달은 시장 경쟁자들의 과제 중 하나였습니다. 앞서 언급한 결정 요인은 예측 기간 동안 시장의 수익 궤적에 영향을 미칠 것입니다. 긍정적인 측면에서는 개별 규제 기관이 이러한 부과된 제한을 완화하기 시작함에 따라 시장이 회복될 것으로 예상됩니다.

최근 개발

2020년 2월, 루코일 대통령과 아스트라한 지역 주지사는 회사와 아스트라한 지역 간의 협정에 서명했습니다. 이 협정에서 그는 기념물 복원에 자금을 지원하고 연구 목적으로 가스 및 석유 연구소의 실험실을 구매하겠다고 밝혔습니다. 이 투자는 회사가 가까운 미래에 사업을 확장하는 데 도움이 될 것입니다.

북미 농업 윤활유 시장 범위

농업용 윤활제 시장은 범주, 유형, 원자재, 응용 분야 및 농업 장비를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 분야를 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

범주

- 미네랄 오일

- 인조

- 생물 기반

유형

- 엔진 오일

- 유지

- 유압 오일

- 변압기 오일

- 크랭크 케이스 오일

- 바 및 체인 오일

- 기타

원료

- 석유 기반 윤활제

- 생물 기반 윤활제

애플리케이션

- 엔진

- 기어 및 변속기

- 유압 장치

- 그리스칠하기

- 체인

- 구현하다

- 기타

농업 장비

- 트랙터

- 수확기

- 옥수수 따는 사람들

- 베일러

- 버지 커터

- 원형 스파이크 해로우

- 돌 분쇄기

- 비료 살포기

- 슬러리 탱커

- 분무기

- 사료 믹서

- 사일리지 스프레더

- 빨대 송풍기

- 잔디 깎는 기계 및 잔디 깎는 기계 컨디셔너

- 건초 묶는 사람

- 건초 갈퀴

- 베일 포장기

- 포도 수확 기계

- 기타

농업 윤활유 시장 지역 분석/통찰력

농업용 윤활제 시장을 분석하고, 위에 언급된 대로 국가, 범주, 유형, 원재료, 응용 분야 및 농업 장비별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

농업용 윤활제 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

2022년부터 2029년까지의 예측 기간 동안 북미는 농업 부문의 기계화 증가와 지역별 적용을 위한 새롭고 혁신적인 제품 개발로 인해 수익성 있는 성장을 보일 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 농업 윤활유 시장 점유율 분석

농업 윤활제 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 농업 윤활제 시장과 관련된 회사의 초점에만 관련이 있습니다.

농업용 윤활유 시장에서 활동하는 주요 기업은 다음과 같습니다.

- 엑손모빌 코퍼레이션(미국)

- 쉘(네덜란드)

- 쉐브론 코퍼레이션(미국)

- 토탈 에너제(프랑스)

- BP plc (영국)

- FUCHS(독일)

- 필립스 66 회사(미국)

- Exol Lubricants Limited(영국)

- 위텀 그룹(영국)

- 라이맥스 윤활유(네덜란드)

- 레프솔(스페인)

- 쿠거 윤활유 인터내셔널 유한회사(영국)

- 셰퍼 제조 회사(미국)

- 페나인 윤활제(영국)

- Frontier Performance Lubricants, Inc. (미국)

- UNIL(벨기에)

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING MECHANIZATION AND USE OF MACHINERY IN THE AGRICULTURAL INDUSTRY

5.1.2 RISING GOVERNMENT SUBSIDIES FOR AGRICULTURAL EQUIPMENTS

5.1.3 UNIVERSAL LUBE FOR MULTI-BRAND FLEET

5.1.4 GROWING NEED TO INCREASE FOOD PRODUCTIVITY OWING TO INCREASING POPULATION

5.1.5 INCREASING LABOR COST AND LOW AVAILABILITY OF LABOR

5.2 RESTRAINTS

5.2.1 HIGH COST OF SYNTHETIC AND BIO-BASED LUBRICANTS

5.2.2 LOW INCOME OF FARMERS IN DEVELOPING COUNTRIES

5.3 OPPORTUNITIES

5.3.1 INCREASING USE OF BIODEGRADABLE LUBRICANTS IN EQUIPMENT

5.3.2 LEVERAGING E-COMMERCE INDUSTRY TO INCREASE CUSTOMER REACH

5.3.3 INADEQUATE INFRASTRUCTURE IN DEVELOPING COUNTRIES

5.3.4 SKEPTICISM AMONG FARMERS FOR USING ADVANCED AGRICULTURAL EQUIPMENT

5.4 CHALLENGE

5.4.1 VOLATILE CRUDE OIL PRICES ACTS AS A CHALLENGE FOR AGRICULTURAL LUBRICANTS INDUSTRY

6 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE

6.1 OVERVIEW

6.2 ENGINE OIL

6.3 HYDRAULIC OILS

6.4 GREASE

6.5 TRANSFORMER OIL

6.6 CRANKCASE OILS

6.7 BAR AND CHAIN OIL

6.8 OTHERS

7 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 PETROLEUM BASED LUBRICANTS

7.3 MINERAL OIL LUBRICANTS

7.4 SYNTHETIC LUBRICANTS

7.5 BIO-BASED LUBRICANTS

7.6 PLANT OIL

7.7 VEGETABLE OIL

7.8 SOYABEAN OIL

7.9 OTHERS

7.1 ANIMAL OIL

8 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ENGINES

8.3 HYDRAULICS

8.4 GREASING

8.5 GEAR & TRANSMISSION

8.6 IMPLEMENTS

8.7 TILLAGE IMPLEMENTS

8.8 SEED BED PREPARATION IMPLEMENTS

8.9 SEEDING IMPLEMENTS

8.1 WEEDING AND INTERCULTURAL

8.11 OTHERS

8.12 CHAIN

8.13 OTHERS

9 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT

9.1 OVERVIEW

9.2 TRACTORS

9.3 HARVESTERS

9.3.1 SILAGE HARVESTERS

9.3.2 POTATO HARVESTERS

9.3.3 BEET HARVESTERS

9.3.4 OTHERS

9.4 VERGE CUTTERS

9.4.1 CIRCULAR SPIKE HARROWS CUTTERS

9.4.2 STONE GRINDERS

9.5 BALERS

9.5.1 ROUND BALERS

9.5.2 BIG BALERS

9.5.3 OTHERS

9.6 HAY TEDDERS

9.7 HAY RAKES

9.8 SPRAYERS

9.9 FERTILISER SPREADERS

9.1 SILAGE SPREADERS

9.11 FODDER MIXERS

9.12 SLURRY TANKERS

9.13 STRAW BLOWERS

9.14 MOWERS AND MOWER CONDITIONERS

9.15 CORN PICKERS

9.16 BALE WRAPPERS

9.17 GRAPE HARVESTING MACHINES

9.18 OTHERS

10 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY GEOGRAPHY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 COMNPANY PROFILES

12.1 ROYAL DUTCH SHELL PLC,

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 BP P.L.C.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT UPDATES

12.3 EXXON MOBIL CORPORATION.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT UPDATES

12.4 TOTAL

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATE

12.5 CHEVRON CORPORATION.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYISIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT UPDATE

12.6 PHILLIPS 66

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATE

12.7 REPSOL

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATE

12.8 LUKOIL

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT UPDATE

12.9 ENI S.P.A.

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT UPDATE

12.1 VALVOLINE LLC

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT UPDATE

12.11 FUCHS

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT UPDATE

12.12 GULF OIL INTERNATIONAL

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATE

12.13 MORRIS LUBRICANTS

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT UPDATE

12.14 LUBRITA EUROPE B.V.

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATE

12.15 CONDAT

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT UPDATE

12.16 COUGAR LUBRICANTS INTERNATIONAL LTD

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT UPDATE

12.17 DYADE LUBRICANTS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT UPDATE

12.18 UNIL

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT UPDATE

12.19 THE BAHRAIN PETROLEUM COMPANY B.S.C.

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT UPDATE

12.2 KLONDIKE LUBRICANTS CORPORATION

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT UPDATE

13 SWOT AND DATABRIDGE MARKET RESEARCH ANALYSIS

13.1 STRENGTH: - STRONG GEOGRAPHICAL PRESENCE

13.2 WEAKNESS: - LACK OF INNOVATION DUE TO LESS INVESTMENT IN R&D EXPENDITURE

13.3 OPPORTUNITY: - STRATEGIC EXPANSION, COLLABORATIONS, PARTNERSHIP AND ACQUISITIONS

13.4 THREAT: - FLUCTUATION IN RAW MATERIAL PRICE

13.5 DATA BRIDGE MARKET RESEARCH ANALYSIS

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

LIST OF TABLES

TABLE 1 IMPORT DATA OF LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST OR ANTI-CORROSION PREPARATIONS AND MOULD-RELEASE PREPARATIONS BASED ON LUBRICANTS; TEXTILE LUBRICANT PREPARATIONS AND PREPARATIONS OF A KIND USED FOR THE OIL OR GREASE TREATMENT OF TEXTILE MATERIALS, LEATHER, FURSKINS OR OTHER MATERIALS (EXCLUDING PREPARATIONS CONTAINING, AS BASIC CONSTITUENTS, >= 70% PETROLEUM OIL OR BITUMINOUS MINERAL OIL BY WEIGHT), N.E.S.; HS CODE: 3403 (USD THOUSAND)

TABLE 2 EXPORT DATA OF LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST OR ANTI-CORROSION PREPARATIONS AND MOULD-RELEASE PREPARATIONS BASED ON LUBRICANTS; TEXTILE LUBRICANT PREPARATIONS AND PREPARATIONS OF A KIND USED FOR THE OIL OR GREASE TREATMENT OF TEXTILE MATERIALS, LEATHER, FURSKINS OR OTHER MATERIALS (EXCLUDING PREPARATIONS CONTAINING, AS BASIC CONSTITUENTS, >= 70% PETROLEUM OIL OR BITUMINOUS MINERAL OIL BY WEIGHT), N.E.S.; HS CODE: 4802 (USD THOUSAND)

TABLE 3 PRODUCTION AND TRADE IN AGRICULTURAL MACHINERY IN EUROPEAN COUNTRY (USD MILLION)

TABLE 4 EUROPEAN PRODUCTION PER TYPE OF AGRICULTURAL MACHINERY, IN 2017 (USD MILLION)

TABLE 5 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 6 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 7 NORTH AMERICA ENGINE OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 8 NORTH AMERICA ENGINE OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 9 NORTH AMERICA HYDRAULIC OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 10 NORTH AMERICA HYDRAULIC OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 11 NORTH AMERICA GREASE IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 12 NORTH AMERICA GREASE IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 13 NORTH AMERICA TRANSFORMER OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 14 NORTH AMERICA TRANSFORMER OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 15 NORTH AMERICA CRANKCASE OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 16 NORTH AMERICA CRANKCASE OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 17 NORTH AMERICA BAR AND CHAIN OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 18 NORTH AMERICA BAR AND CHAIN OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 20 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 21 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 22 NORTH AMERICA PETROLEUM BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 23 NORTH AMERICA PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 24 NORTH AMERICA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 25 NORTH AMERICA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 26 NORTH AMERICA PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 27 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 28 NORTH AMERICA ENGINES IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 29 NORTH AMERICA HYDRAULICS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 30 NORTH AMERICA GREASING IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 31 NORTH AMERICA GEAR AND TRANSMISSION IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 32 NORTH AMERICA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 33 NORTH AMERICA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 34 NORTH AMERICA CHAIN IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 35 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 36 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 37 NORTH AMERICA TRACTORS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 38 NORTH AMERICA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 39 NORTH AMERICA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 40 NORTH AMERICA VERGE CUTTERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 41 NORTH AMERICA CIRCULAR SPIKE HARROWS CUTTERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 42 NORTH AMERICA STONE GRINDERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 43 NORTH AMERICA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 44 NORTH AMERICA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 45 NORTH AMERICA HAY TEDDERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 46 NORTH AMERICA HAY RAKES IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 47 EUROPE SPRAYERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 48 NORTH AMERICA FERTILISER SPREADERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 49 NORTH AMERICA SILAGE SPREADERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 50 NORTH AMERICA FODDER MIXERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 51 NORTH AMERICA SLURRY TANKERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 52 NORTH AMERICA STRAW BLOWERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 53 NORTH AMERICA MOWERS AND MOWER CONDITIONERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 54 NORTH AMERICA CORN PICKERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 55 NORTH AMERICA BALE WRAPPERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 56 NORTH AMERICA GRAPE HARVESTING MACHINES IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 57 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 58 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY COUNTRY, 2018-2027 (TONS)

TABLE 59 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY COUNTRY, 2018-2027 (USD THOUSAND)

TABLE 60 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 61 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 62 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 63 NORTH AMERICA PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 64 NORTH AMERICA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 65 NORTH AMERICA PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 66 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 67 NORTH AMERICA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 68 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 69 NORTH AMERICA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 70 NORTH AMERICA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 71 U.S. AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 72 U.S. AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 73 U.S. AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 74 U.S. PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 75 U.S. BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 76 U.S. PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 77 U.S. AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 78 U.S. IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 79 U.S. AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 80 U.S. HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 81 U.S. BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 82 CANADA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 83 CANADA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 84 CANADA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 85 CANADA PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 86 CANADA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 87 CANADA PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 88 CANADA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 89 CANADA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 90 CANADA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 91 CANADA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 92 CANADA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 93 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 94 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 95 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 96 MEXICO PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 97 MEXICO BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 98 MEXICO PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 99 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 100 MEXICO IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 101 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 102 MEXICO HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 103 MEXICO BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

그림 목록

LIST OF FIGURES

FIGURE 1 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET : NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: THE TECHNOLOGY LIFE LINE CURVE

FIGURE 7 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: SEGMENTATION

FIGURE 14 INCREASING MECHANIZATION AND USE OF MACHINERY IN THE AGRICULTURAL INDUSTRY IS DRIVING THE NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 15 ENGINE OIL IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET IN 2020 & 2027

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET

FIGURE 17 TRACTOR REGISTRATION, BY COUNTRY (2018)

FIGURE 18 NORTH AMERICA POPULATION, IN BILLION (2019 – 2100)

FIGURE 19 AVERAGE INCOME OF FARMERS IN CHINA AND INDIA

FIGURE 20 EUROPEN INTERNET USERS ON MOBILE PHONE, FROM 2011 TO 2016 (IN %)

FIGURE 21 AVERAGE LANDHOLDING SIZE OF A HOUSEHOLD, 2016

FIGURE 22 CRUDE OIL PRICE FLUCTUATION (USD MILLION)

FIGURE 23 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY TYPE, 2019

FIGURE 24 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY RAW MATERIAL, 2019

FIGURE 25 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY APPLICATION, 2019

FIGURE 26 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY AGRICULTURAL EQUIPMENT, 2019

FIGURE 27 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: SNAPSHOT (2019)

FIGURE 28 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY COUNTRY (2019)

FIGURE 29 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY COUNTRY (2020 & 2027)

FIGURE 30 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY COUNTRY (2019 & 2027)

FIGURE 31 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY TYPE (2020-2027)

FIGURE 32 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: COMPANY SHARE 2019 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.