Middle East And Africa Track And Trace Solutions Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

279.04 Million

USD

1,035.81 Million

2024

2032

USD

279.04 Million

USD

1,035.81 Million

2024

2032

| 2025 –2032 | |

| USD 279.04 Million | |

| USD 1,035.81 Million | |

|

|

|

Middle East and Africa Track And Trace Solutions Market, By Product (Software Components, Hardware Components, and Standalone Platform), Solution (Line and Site-Level Serialization, Cloud Enterprise-Level Traceability, Distribution and Warehouse Solution, Supply Chain Data-Sharing Network, and Others), Application (Serialization, Printing, Labeling and Packaging Inspection, Aggregation, Tracking, Tracing, and Reporting), Technology (2D Barcodes, Radiofrequency Identification (RFID), and Linear/1D Barcodes), End User (Pharmaceutical and Biopharmaceutical Companies, Consumer Packaged Goods, Luxury Goods, Food and Beverage, Medical Device Companies, Contract Manufacturing Organizations, Repackagers, Cosmetics Companies, and Others), Distribution Channel (Direct Sales and Third Party Distributors) - Industry Trends and Forecast to 2032

Middle East and Africa Track and Trace Solutions Market Analysis

Tracking and tracing medications to enhance the accessibility of products in the prescription supply chain is not a novel phenomenon. In reality, the concept of serialization has been debated for more than 15 years. In 1999, after a study by the U.S. College of Medicine, President Bill Clinton put patient protection (including avoiding mistakes at the point of dispensing medicines) on the agenda of the federal government and proceeded to advocate for reform after his presidency. In 2003, the U.S. Food and Drug Administration (FDA) required barcoding at unit levels, and in the same year, the World Health Organization (WHO) released a study highlighting the scope of the counterfeit medication problem, claiming that 10% of medicines worldwide were counterfeit. A major shift in serialization took place around 2005 and the variety of countries started to set targets for adoption. However, after making several measures in protecting the supply chain, the challenge was less of a concern after the 2008 financial crisis.

As the world economy has changed, the focus has gradually moved. Turkey adopted serialization standards in 2010 and rules are in effect for other markets such as China, South Korea and India. With the EU Falsified Medicines Directive (FMD) coming into force in February 2019 and the U.S. adopting legislation as part of the Drug Supply Chain Security Act (DSCSA) in November 2017, more than 75% of Middle East and Africa medicines are required to be protected by some form of monitor and trace regulations by 2019. The track and trace solutions market is of keen importance in various industries starting from pharmaceutical to medical devices and food and beverages among more.

The progress in demand of track and trace solutions in healthcare facilities is due to stringent laws formulated for serialization and labeling which leads to the lucrative growth of track and trace solutions in the market. The vast product portfolio with enormous options for almost all major industries such as food and beverage, cosmetic and medical devices among more further impels the growth of track and trace solutions in the Middle East and Africa track and trace solutions market.

Middle East and Africa Track and Trace Solutions Market Size

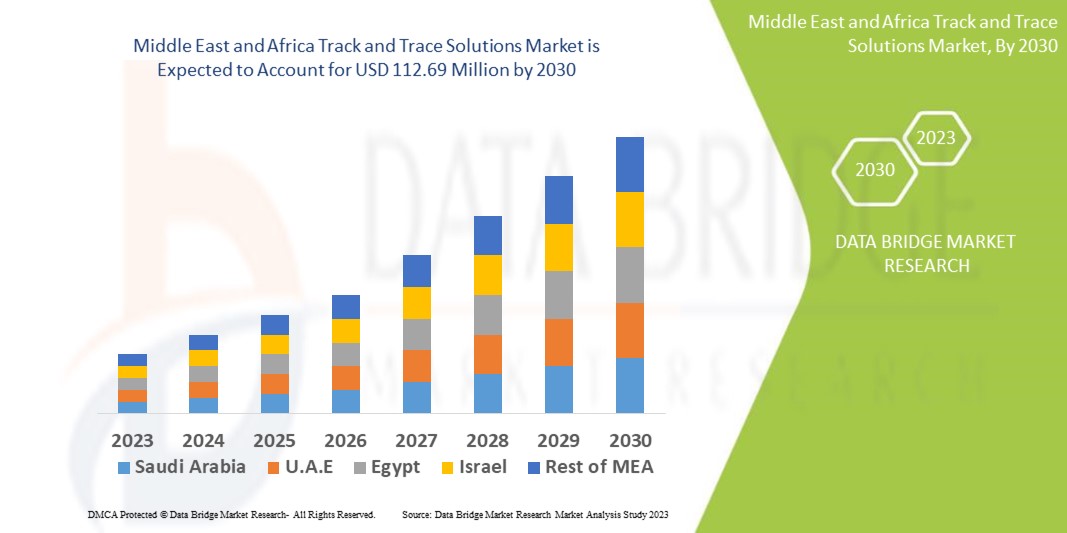

Middle East and Africa track and trace solutions market size was valued at USD 279.04 million in 2024 and is projected to reach USD 1,035.81 million by 2032, with a CAGR of 19.5% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Middle East and Africa Track and Trace Solutions Market Trends

“Increased Demand For Supply Chain Transparency”

The demand for track and trace solutions is particularly strong due to the need for ensuring patient safety, product integrity, and regulatory compliance. Track and trace technologies help monitor the movement of pharmaceutical products, medical devices, and vaccines throughout the supply chain, minimizing the risk of counterfeit drugs and ensuring that products are stored and transported under proper conditions. Additionally, with the rising need for personalized medicine and greater healthcare accountability, these solutions enable healthcare providers to track products from production to end-use, ensuring they reach the right patients safely and efficiently. Regulatory bodies, such as the FDA, require stringent traceability measures, making track and trace systems an essential part of healthcare operations.

Report Scope and Middle East and Africa Track and Trace Solutions Market Segmentation

|

Attributes |

Middle East and Africa Track and Trace Solutions Market Market Insights |

|

Segments Covered |

|

|

적용 지역 |

남아프리카, 사우디아라비아, UAE, 카타르, 이집트, 쿠웨이트, 바레인, 오만 및 기타 중동 및 아프리카 |

|

주요 시장 참여자 |

SAP SE(독일), Zebra Technologies Corp.(미국), Videojet Technologies, Inc.(미국), METTLER TOLEDO(미국), Tracelink Inc.(미국), Siemens, Domino Printing Sciences plc(영국), Laetus GmbH(독일), Xyntek Incorporated(미국), IBM Corporation(미국), WIPOTEC-OCS GmbH(독일), 3Keys(독일), ACG(인도), NJM Packaging Inc.(미국), OPTEL GROUP(캐나다), Systech(미국), Robert Bosch Manufacturing Solutions GmbH(독일), ANTARES VISION SpA(이탈리아), Uhlmann(독일), SEA VISION Srl(이탈리아), Jekson Vision(인도), Kevision Systems(인도), Arvato Systems, Grant-Soft Ltd.(터키), PharmaSecure Inc.(미국), Axyway(프랑스), SL Controls Ltd.(미국) |

|

시장 기회 |

중동 및 아프리카 무역 확대 |

|

부가가치 데이터 정보 세트 |

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위, 주요 업체와 같은 시장 시나리오에 대한 통찰력 외에도 수입 수출 분석, 생산 능력 개요, 생산 소비 분석, 가격 추세 분석, 기후 변화 시나리오, 공급망 분석, 가치 사슬 분석, 원자재/소모품 개요, 공급업체 선택 기준, PESTLE 분석, 포터 분석 및 규제 프레임워크가 포함됩니다. |

중동 및 아프리카 추적 및 추적 솔루션 시장 정의

특정 대상이나 재산의 현재 및 과거 위치(및 기타 정보)를 식별하는 방법에는 여러 종류의 품목을 보관하고 운송하고 모니터링하고 추적하는 것이 포함됩니다. 이 정의에 따라 예를 들어 실시간 데이터베이스에 기록된 자동차 및 컨테이너의 위치를 추정하고 기록할 수 있습니다. 이 방법은 해당 진행 노트에 대한 일관된 설명을 작성하는 과제를 남깁니다. 추적 및 추적은 모든 속도에서 기계를 IT에 연결하고 데이터를 공유하는 것을 의미합니다. 여기에는 강력한 하드웨어 제품군 장치 모듈 또는 독립형 시스템이 포함됩니다. 추적 및 추적 솔루션의 주요 목표는 전 세계적으로 위조 약물 및 가짜 제품의 사슬을 줄이고 각 지점에서 상품의 원활한 흐름과 추적성을 제공하는 것입니다.

중동 및 아프리카 추적 및 추적 솔루션 시장 역학

운전자

- 직렬화 구현을 위한 엄격한 규정 및 표준

의무적 일련번호 부여의 도입으로 제약 시장이 완전히 변모했습니다. 미국 의약품 공급망 보안법(DSCSA)과 아시아 태평양 연합 위조 의약품 지침(FMD)이 모두 "적용"됨에 따라 제약품 공급망은 일련번호가 부여된 제품 및 데이터와 영원히 연결됩니다. 더 깊이 살펴보면, 성공적인 일련번호 부여 프로그램은 포장에 일련번호를 붙이는 것 이상을 포함합니다. 규정은 시장마다 다르며 종종 변경될 수 있으므로 규제 전문가는 이에 맞춰 절차, 프로세스 및 제출을 조정할 준비가 되어 있어야 합니다. 의약품의 라벨링 및 일련번호 부여에 대한 법률은 비교적 최근이기 때문에 아시아 태평양 지역의 복잡성이 더 크고 다른 규정보다 더 자주 변경됩니다. 게다가 정품 의약품의 공급망이 길어짐에 따라 공급망의 모든 단계에서 위조자에게 기회가 생깁니다. 따라서 상품을 보호하기 위해 엄격한 규정과 표준화가 이루어집니다.

- 2024년 7월, 식품의약국이 발표한 기사에 따르면, 약물 공급망 보안법(DSCSA)은 유해한 약물이 미국 공급망에 유입되는 것을 방지하기 위해 패키지 수준에서 처방약의 전자 식별 및 추적을 의무화했습니다. 이 엄격한 규정은 규정 준수를 보장하고, 환자를 보호하고, 위협에 대한 신속한 대응을 가능하게 하는 고급 추적 및 추적 솔루션에 대한 필요성을 촉진하여 아시아 태평양 시장의 주요 원동력 역할을 합니다.

- 2022년 2월, USAID 아시아 태평양 건강 공급망 프로그램에서 발표한 기사에 따르면, 중국 국가식품의약품안전청은 필수 의약품 목록에 있는 502개 의약품에 대한 일련번호 부여를 의무화하여 추적 가능성과 진위성을 보장했습니다. 이 엄격한 규정은 일련번호 부여 요구 사항을 준수하기 위한 추적 및 추적 솔루션에 대한 수요를 증가시킵니다. 결과적으로 아시아 태평양 시장의 핵심 동인으로 작용하여 고급 추적 기술의 광범위한 채택을 촉진합니다.

의약품 및 약물 변조 문제는 수십 년 동안 아시아 태평양 지역의 우려 사항이었습니다. 보안되지 않은 물리적 및 사이버 아시아 태평양 공급망, 인터넷 판매 및 최소한의 처벌로 인해 정부와 전 세계의 다양한 제약 회사는 일련번호를 구현하면 위조와 관련된 문제가 감소하고 중단될 수 있다고 믿습니다. 이로 인해 일련번호 구현에 대한 엄격한 규정 및 표준이 아시아 태평양 추적 및 추적 솔루션 시장의 원동력으로 작용합니다.

- 증가하는 위조 우려

위조 제품에 대한 우려가 높아지는 것은 특히 제약 및 의료 분야에서 심각한 문제가 되었는데, 위조 약물의 존재는 환자의 건강과 안전에 심각한 결과를 초래할 수 있기 때문입니다. 위조 약물은 의료 시스템의 무결성을 손상시킬 뿐만 아니라 부작용, 약물 내성 및 치료 실패의 위험도 증가시킵니다. 이러한 증가하는 위협에 대응하여 규제 기관과 산업 이해 관계자는 보다 엄격한 추적 및 일련 번호 지정 조치를 추진하고 있습니다. 이러한 조치는 제조업체, 유통업체 및 소매업체가 전체 공급망에서 상품의 이동을 추적할 수 있도록 하여 제품의 진위성을 보장하는 데 도움이 됩니다. RFID, 바코드 및 블록체인과 같은 기술은 위조를 방지하기 위해 점점 더 많이 사용되고 있으며, 제조에서 최종 소비자에 이르기까지 공급망의 각 단계에서 제품을 모니터링하고 검증할 수 있습니다. 글로벌 무역의 확대와 보다 복잡한 공급망으로 인해 위조 제품이 시장에 진입할 위험이 더욱 두드러져 향상된 추적 시스템에 대한 필요성이 더욱 커졌습니다. 위조 위험에 대한 인식이 높아짐에 따라 기업과 정부는 제품 진위 확인, 규정 준수, 잠재적으로 유해한 위조 상품으로부터 소비자를 보호하기 위한 견고한 시스템을 모색하고 있으며, 이는 글로벌 추적 및 추적 솔루션 시장을 견인하는 주요 요인으로 작용합니다.

예를 들어,

- 2024년 5월, 식품의약국에서 발표한 기사에 따르면, 잘못된 성분, 불충분한 성분 또는 유해한 성분이 들어 있을 수 있는 위조 의약품은 진짜로 거짓으로 판매되는 동안 심각한 건강 위험을 초래합니다. 의약품의 안전성과 효능에 대한 우려가 커지면서 제품 진위성을 보장하기 위한 추적 및 추적 솔루션 채택이 촉진되고 있습니다. 그 결과, 위조 제품에 대한 우려가 커지면서 글로벌 추적 및 추적 솔루션 시장이 크게 성장하고 있습니다.

- 2024년 10월, Science Direct에서 발표한 기사에 따르면, 위조 및 위조 의약품, 특히 국제 여행은 심각한 공중 보건 위험을 초래합니다. 전 세계적으로 보고된 사례가 증가함에 따라 위조 의약품의 확산에 대한 우려가 크게 커졌습니다. 이로 인해 제품 진위성을 보장하기 위한 추적 시스템에 대한 필요성이 커졌습니다. 결과적으로 위조 의약품에 대한 우려가 커지면서 글로벌 추적 및 추적 솔루션 시장의 주요 원동력이 되었습니다.

위조 제품에 대한 우려는 특히 제약 및 의료 산업에서 위조 약물이 환자에게 미칠 수 있는 잠재적 피해로 인해 주요 문제가 되었습니다. 위조 약물은 비효과적인 치료와 건강 위험으로 이어질 수 있으며, 추적 솔루션에 대한 수요가 증가합니다. RFID, 바코드, 블록체인과 같은 기술을 사용하면 회사는 공급망 전체에서 제품을 추적하여 진위성을 보장할 수 있습니다. 글로벌 공급망이 더욱 복잡해짐에 따라 위조 상품이 시장에 진입할 위험이 증가하여 더 강력한 추적 시스템에 대한 필요성이 커지고 있습니다. 안전하고 신뢰할 수 있는 추적 솔루션에 대한 이러한 수요는 글로벌 추적 및 추적 솔루션 시장의 주요 원동력으로 작용합니다.

기회

- 전자상거래 부문의 성장

전자상거래 부문의 급속한 성장은 온라인 소매 운영의 복잡성과 규모가 증가함에 따라 아시아 태평양 추적 및 추적 솔루션 시장에 상당한 기회를 제공합니다. 더 많은 소비자가 온라인 쇼핑으로 전환함에 따라 기업은 물류 및 공급망 프로세스가 효율적이고 투명하도록 해야 합니다. 추적 및 추적 솔루션은 재고 수준, 배송 상태 및 배달 프로세스를 실시간으로 모니터링하여 회사가 고객에게 주문에 대한 정확한 정보를 제공할 수 있도록 합니다. 이러한 높은 수준의 투명성은 고객의 신뢰를 높이고 전반적인 쇼핑 경험을 개선하여 경쟁이 치열한 시장에서 전자상거래 회사의 경쟁력을 높여줍니다.

예를 들어,

- 2024년 7월, 마켓플레이스 다이제스트에 게재된 '물류에 대한 전자상거래의 영향: 수요에 적응하기'라는 기사에 따르면, 고급 추적 및 가시성 솔루션을 구현하면 추적 및 가시성 솔루션이 전자상거래 수요를 충족하는 데 필수적입니다. 실시간 추적 기술을 통해 운송업체는 정확한 배송 추정치와 업데이트를 제공하여 투명성과 고객 신뢰를 개선할 수 있습니다.

- 2023년 4월, ScienceDirect에 게재된 '전자상거래 산업의 이점, 과제 및 경로 식별: 통합된 2단계 의사 결정 모델'이라는 기사에 따르면 전자상거래 산업은 편의성과 접근성에 중점을 두면서 지난 10년 동안 상당한 성장을 보였으며, 이를 통해 더 많은 소비자가 온라인 쇼핑을 선택하면서 온라인 쇼핑이 급증했습니다.

게다가 전자상거래의 증가로 도난, 사기, 위조 상품과 같은 문제의 위험이 커지고 있으며, 이러한 과제를 완화할 수 있는 강력한 추적 및 추적 시스템이 필요합니다. RFID, 블록체인, 자동 추적 시스템과 같은 첨단 기술을 구현하면 전자상거래 사업체는 창고에서 배송까지 제품의 무결성을 유지할 수 있습니다. 이러한 솔루션을 통해 기업은 제품 책임 및 안전과 관련된 규제 요구 사항과 산업 표준을 준수할 수 있습니다. 전자상거래가 계속 확장됨에 따라 신뢰할 수 있는 추적 및 추적 솔루션에 대한 수요가 증가하여 이러한 기술 공급업체에게 상당한 시장 기회가 창출될 것입니다.

- 세계 무역의 확장

글로벌 무역의 확대는 국경을 넘나드는 공급망의 복잡성 증가로 인해 글로벌 추적 및 추적 솔루션 시장에 상당한 기회를 제공합니다. 기업이 재료를 조달하고 제품을 유통하기 위해 글로벌 네트워크에 점점 더 의존함에 따라 효과적인 추적 시스템에 대한 필요성이 가장 중요해졌습니다. 추적 및 추적 솔루션을 통해 기업은 실시간으로 선적을 모니터링하여 물류 프로세스 전반에 걸쳐 투명성과 효율성을 보장할 수 있습니다. 이 기능은 운영 효율성을 높이고 조직이 국제 규정 및 표준을 준수하도록 지원하여 파트너와 고객 간의 신뢰가 높아집니다. 글로벌 무역이 계속 확대됨에 따라 다양한 규제 요구 사항을 처리하고 여러 관할권에 대한 가시성을 제공할 수 있는 정교한 추적 기술에 대한 수요가 급증할 가능성이 높습니다.

예를 들어,

- 세계경제포럼에 따르면 2024년 5월, 올해 상품 및 서비스의 글로벌 무역은 2.3% 성장할 것으로 예상되며 2025년에는 3.3% 성장할 것으로 예상된다. 이는 2023년 1% 성장률의 두 배 이상이다.

또한 전자상거래와 온라인 소매의 부상으로 소비자들이 주문에 대한 적시 배송과 투명성을 기대함에 따라 추적 및 추적 솔루션에 대한 수요가 더욱 가속화되었습니다. 전 세계적으로 엄청난 양의 상품이 운송되면서 기업은 재고와 선적을 정확하게 추적할 수 있는 강력한 시스템이 필요합니다. 이러한 수요는 추적 및 추적 시장의 혁신을 촉진하여 블록체인, IoT, 인공 지능과 같은 첨단 기술의 개발을 촉진했습니다. 이러한 혁신은 추적 및 추적 솔루션의 기능을 향상시키고 경쟁이 치열한 시장에서 차별화할 수 있는 기회를 제공합니다. 글로벌 무역이 계속 성장하고 진화함에 따라 추적 및 추적 솔루션 시장은 이러한 추세를 활용하여 기업이 현대 공급망 관리의 복잡성을 탐색하는 데 필요한 필수 도구를 제공하면서 투명성과 책임에 대한 소비자의 요구를 충족할 준비가 되었습니다.

제약/도전

- 샘플 오염과 관련된 위험

데이터 보안 및 개인 정보 보호 문제는 아시아 태평양 추적 및 추적 솔루션 시장에 상당한 과제를 안겨줍니다. 이러한 시스템은 종종 민감한 정보의 수집, 저장 및 전송을 포함하기 때문입니다. 여기에는 개인 데이터, 제품 세부 정보 및 공급망 정보가 포함될 수 있으며, 적절하게 보호되지 않으면 소비자와 기업 모두에게 위험을 초래합니다. 데이터 보안 위반은 재정적 손실, 평판 손상 및 법적 결과로 이어질 수 있으며, 특히 아시아 태평양의 GDPR 및 다양한 아시아 태평양 데이터 보호법과 같은 점점 더 엄격해지는 규정에 비추어 볼 때 더욱 그렇습니다. 조직이 추적 및 추적 기술을 구현함에 따라 강력한 보안 조치를 보장해야 하며, 이는 비용을 증가시키고 배포 프로세스를 복잡하게 만들어 회사가 이러한 솔루션을 채택하지 못하게 할 수 있습니다.

예를 들어,

- 2024년 8월, Shriram Veritech Solutions Pvt. Ltd.에서 발행한 '공급망 관리에서 추적 및 추적 솔루션 구현의 주요 과제'라는 기사에 따르면, 추적 및 추적 솔루션을 구현하면 기업은 독점 정보, 고객 세부 정보, 실시간 위치 추적을 포함한 방대한 양의 민감한 데이터를 처리합니다. 추적 및 추적 시스템은 사이버 공격에 취약합니다.

또한 데이터 프라이버시에 대한 소비자의 인식이 높아지면서 개인 정보를 처리하는 기업에 대한 감시가 강화되고 있습니다. 기업은 데이터 보호 규정을 준수하고 고객과 신뢰를 구축해야 하는 압박을 받고 있습니다. 기업이 이해 관계자에게 데이터를 보호할 수 있는 능력을 확신할 수 없다면 시장 점유율을 잃고 소비자의 반발에 직면할 위험이 있습니다. 이러한 우려의 분위기는 기업이 광범위한 데이터 처리 및 처리가 필요할 수 있는 고급 추적 및 추적 솔루션에 대한 완전한 투자와 채택 의지를 제한할 수 있습니다. 결과적으로 기업은 이러한 복잡성을 탐색하고 향상된 추적 기능의 이점과 데이터 프라이버시 및 보안을 유지해야 하는 필수성 간의 균형을 찾으려고 하면서 시장 성장이 더딜 수 있습니다.

- 배송 중 추적 태그 손상

배송 중 추적 태그가 손상되면 글로벌 시장에서 추적 및 추적 솔루션의 효과성에 상당한 영향을 미칩니다. RFID 라벨이나 바코드와 같은 추적 태그가 운송 중에 손상되면 데이터 부정확성, 제품 가시성 손실, 추적 지연으로 이어집니다. 이는 특히 정확한 제품 이동과 규정 준수에 의존하는 산업에서 공급망 운영의 신뢰성을 손상시킵니다. 예를 들어 제약 분야에서 손상된 태그는 중요한 추적 프로세스를 방해하여 위조 제품과 규정 미준수의 위험을 증가시킵니다. 이러한 문제는 비효율성, 더 높은 운영 비용, 고객 신뢰 감소로 이어져 글로벌 추적 및 추적 솔루션 시장에 상당한 제약으로 작용합니다.

예를 들어,

- 2024년 8월, encstorge.com에서 발행한 기사에 따르면 RFID 태그는 물, 과도한 열, 화학 물질 또는 칩이나 안테나 라인의 물리적 파손과 같은 요인으로 인해 배송 중에 손상될 수 있습니다. 이러한 위험을 이해하는 것은 다양한 환경에서 RFID 성능을 최적화하는 데 중요합니다. 이러한 손상은 추적 및 추적 시스템을 방해하여 부정확성과 비효율성을 초래하며, 이는 글로벌 시장 성장에 상당한 제약으로 작용합니다.

- 2023년 8월 Lexicon Tech Solutions에서 발행한 기사에 따르면, 바코드는 습기, 오일 또는 거친 표면에 노출되어 배송 중에 손상될 수 있으며, 얼룩이나 찢어짐과 같은 문제가 발생할 수 있습니다. 이러한 손상으로 인해 바코드를 읽을 수 없게 되어 추적 프로세스가 중단됩니다. 바코드 무결성과 관련된 이러한 문제는 공급망에서 지연, 부정확성 및 비효율성을 초래할 수 있으며, 글로벌 추적 및 추적 솔루션 시장에 상당한 제약으로 작용합니다.

배송 중 추적 태그가 손상되면 글로벌 시장에서 추적 및 추적 시스템의 효과가 저하됩니다. 손상된 RFID 라벨이나 바코드는 추적 오류, 가시성 손실 및 지연을 초래하여 공급망 정확도에 영향을 미칩니다. 제약과 같은 분야에서는 규정 준수 및 추적성이 중단되어 비효율성, 비용 증가 및 신뢰 감소로 이어져 시장 성장을 제한합니다.

중동 및 아프리카 추적 및 추적 솔루션 시장 범위

시장은 제품, 솔루션, 애플리케이션, 기술, 최종 사용자 및 유통 채널을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품

- 소프트웨어 구성 요소

- 플랜트 매니저

- 라인 컨트롤러

- 엔터프라이즈 및 네트워크 관리자

- 번들 추적

- 사례 추적

- 창고 및 배송 관리자

- 팔레트 추적

- 기타

- 하드웨어 구성 요소

- 인쇄 및 마킹

- 바코드 스캐너

- 모니터링 및 검증

- 라벨러

- 체중계

- RFID 리더

- 기타

- 독립형 플랫폼

해결책

- 라인 및 사이트 수준 직렬화

- 클라우드 엔터프라이즈 수준 추적성

- 유통 및 창고 솔루션

- 공급망 데이터 공유 네트워크

- 기타

애플리케이션

- 직렬화

- 카톤 일련번호

- 병 직렬화

- 의료 기기 일련 번호

- 바이알 및 앰플 직렬화

- 물집 직렬화

- 인쇄

- 라벨링 및 포장 검사

- 집합

- 번들 집계

- 사례 집계

- 팔레트 집계

- 추적

- 트레이싱

- 보고하기

기술

- 2d 바코드

- 무선 주파수 식별(RFID)

- 선형/1차원 바코드

최종 사용자

- 제약 및 바이오제약 회사

- 소비자용 포장재

- 고급품

- 음식과 음료

- 의료 기기 회사

- 계약 제조 조직

- 재포장업체

- 화장품 회사

- 기타

유통 채널

- 직접 판매

- 제3자 유통업체

중동 및 아프리카 추적 및 추적 솔루션 시장 지역 분석

The market is analyzed and market size insights and trends are provided country, product, solution, application, technology, end user, and distribution channel as referenced above.

The country covered in the market are South Africa, Saudi Arabia, U.A.E., Qatar, Egypt, Kuwait, Bahrain, Oman, and rest of Middle East and Africa.

South Africa is expected to dominate the market due to technological advancement in the region along with the presence of major players of track and trace solutions in the region.

South Africa is expected to witness the fastest in the Middle East and Africa track and trace market due to rapid industrialization, growing e-commerce, stringent regulatory requirements, and increasing concerns over counterfeit products. Additionally, expanding pharmaceutical and healthcare sectors, along with technological advancements, are driving demand for efficient supply chain visibility solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Track and Trace Solutions Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Middle East and Africa Track and Trace Solutions Market Leaders Operating in the Market Are:

- SAP SE (Germany)

- Zebra Technologies Corp. (U.S.)

- Videojet Technologies, Inc. (U.S.)

- METTLER TOLEDO (U.S.)

- Tracelink Inc. (U.S.)

- Siemens (Germany)

- Domino Printing Sciences plc (U.K.)

- Laetus GmbH (Germany)

- Xyntek Incorporated (U.S.)

- IBM Corporation (U.S.)

- WIPOTEC-OCS GmbH (Germany)

- 3Keys (Germany)

- ACG (India)

- NJM Packaging Inc. (U.S.)

- OPTEL GROUP (Canada)

- Systech (India)

- Robert Bosch Manufacturing Solutions GmbH (Germany)

- ANTARES VISION S.p.A. (Italy)

- Uhlmann (India)

- SEA VISION S.r.l. (Italy)

- Jekson Vision (India)

- Kevision Systems (India)

- Arvato Systems (Germany)

- Grant-Soft Ltd. (Turkey)

- PharmaSecure Inc. (U.S.)

- Axyway (France)

- SL Controls Ltd. (U.S.)

Latest Developments in Middle East and Africa Track and Trace Solution Market

- In May 2024, Videojet has launched the 3350 30-Watt CO2 Laser, designed to provide high-quality, permanent marking for a variety of materials. This advanced laser solution improves operational efficiency and reduces downtime with its reliable, high-speed performance. It is particularly suited for industries requiring precision marking, like food, beverage, and pharmaceuticals

- In May 2019, METTLER TOLEDO opened its new product inspection test centre for Middle East and Africaan food and pharmaceutical processors at Barcelona. This new test center opened by the company increase its credibility in the market leading to increased demand and sales of its product in future

- In February 2020, ACG introduced an innovative blockchain-based brand platform. This new platform introduced by the company will increase its demand in the market

- In November 2019, ACG introduced the NXT Series are future ready machines which will provide smart USER experience to our customers. Under the NXT series, the machines included are Protab 300 NXT, Protab 700 NXT, BMax NXT, KartonX NXT, Verishield CS18 NXT at PMEC 2019. These new product launched by ACG will increased the demand for its product in the market

- In July 2020, Axyway had received both the AWS Healthcare Competency designation and AWS Life Sciences Competency designation from Amazon Web Services (AWS) for its solutions used in multiple industries. This recognition received by the company will increase its credibility in the market

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCTS LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 MIDDLE EAST AND AFRICA TRACK & TRACE SOLUTIONS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION

6.1.2 RISING COUNTERFEIT CONCERNS

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN TRACK AND TRACE SOLUTIONS

6.1.4 COMPLEXITY IN MIDDLE EAST AND AFRICA SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 RESISTANCE FROM SMALL BUSINESSES

6.2.2 DAMAGE TO TRACKING TAGS DURING DELIVERY

6.3 OPPORTUNITIES

6.3.1 GROWTH IN THE E-COMMERCE SECTOR

6.3.2 INCREASING FOCUS ON DATA ANALYTICS

6.3.3 EXPANSION IN MIDDLE EAST AND AFRICA TRADE

6.4 CHALLENGES

6.4.1 HIGH IMPLEMENTATION COSTS

6.4.2 DATA SECURITY AND PRIVACY CONCERNS

7 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 SOFTWARE COMPONENTS

7.2.1.1 PLANT MANAGER

7.2.1.2 ENTERPRISE & NETWORK MANAGER

7.2.1.3 BUNDLE TRACKING

7.2.1.4 PALLET TRACKING

7.2.1.5 CASE TRACKING

7.2.1.6 WAREHOUSE & SHIPMENT MANAGER

7.2.1.7 LINE CONTROLLER

7.2.1.8 OTHERS

7.3 HARDWARE COMPONENTS

7.3.1.1 PRINTING & MARKING

7.3.1.2 LABELER

7.3.1.3 BARCODE SCANNER

7.3.1.4 RFID READER

7.3.1.5 CHECKWEIGHER

7.3.1.6 MONITORING & VERIFICATION

7.3.1.7 OTHERS

7.4 STANDALONE PLATFORMS

8 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION

8.1 OVERVIEW

8.2 LINE & SITE LEVEL SERIALIZATION

8.3 CLOUD ENTERPRISE-LEVEL TRACEABILITY

8.4 DISTRIBUTION & WAREHOUSE SOLUTION

8.5 SUPPLY CHAIN DATA-SHARING NETWORK

8.6 OTHERS

9 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 2D BARCODES

9.3 RADIOFREQUENCY IDENTIFICATION (RFID)

9.4 LINEAR/1D BARCODESS

10 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SERIALIZATION

10.3 PRINTING

10.4 LABELING & PACKAGING INSPECTION

10.5 AGGREGATION

10.6 TRACKING

10.7 TRACING

10.8 REPORTING

11 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE

11.3 CONSUMER PACKAGED GOODS

11.4 LUXURY GOODS

11.5 FOOD & BEVERAGE

11.6 MEDICAL DEVICE COMPANIES

11.7 CONTRACT MANUFACTURING ORGANIZATIONS

11.8 REPACKAGERS

11.9 COSMETICS COMPANIES

11.1 OTHERS

12 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 THIRD PARTY DISTRIBUTORS

13 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E.

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SAP SE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ZEBRA TECHNOLOGIES CORP.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 TRACELINK INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 VIDEOJET TECHNOLOGIES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 METTLER TOLEDO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACG

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AXYWAY

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ANTARES VISION S.P.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 ARVATO SYSTEMS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DOMINO PRINTING SCIENCES PLC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GRANT-SOFT LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 IBM CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 JEKSON VISION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 3KEYS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KEVISION SYSTEMS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LAETUS GMBH

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 NJM PACKAGING INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 OPTEL GROUP

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 PHARMADECURE INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 ROBERT BOSCH MANUFACTURING SOLUTIONS GMBH

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SEA VISION S.R.L.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 SIEMENS

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 SL CONTROLS LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SYSTECH

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 UHLMANN

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 WIPOTEC-OCS GMBH

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 XYNTEK INCORPORATED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA STANDALONE PLATFORMS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA LINE & SITE LEVEL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA CLOUD ENTERPRISE-LEVEL TRACEABILITY IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA DISTRIBUTION & WAREHOUSE SOLUTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA SUPPLY CHAIN DATA-SHARING NETWORK IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA 2D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA RADIOFREQUENCY IDENTIFICATION (RFID) IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA LINEAR/1D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA PRINTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA LABELING & PACKAGING INSPECTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA TRACKING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA TRACING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA REPORTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA CONSUMER PACKAGED GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA LUXURY GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA FOOD & BEVERAGE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA MEDICAL DEVICE COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING ORGANIZATIONS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA REPACKAGERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA COSMETICS COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA DIRECT SALES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA THIRD-PARTY DISTRIBUTORS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 52 SOUTH AFRICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 53 SOUTH AFRICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 54 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 55 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 SOUTH AFRICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH AFRICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 60 SOUTH AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 61 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 62 SAUDI ARABIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 63 SAUDI ARABIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 64 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 65 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 SAUDI ARABIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 SAUDI ARABIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 69 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 70 SAUDI ARABIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 72 U.A.E. SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 73 U.A.E. HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 74 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 75 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 U.A.E. SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 U.A.E. AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 79 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 80 U.A.E. TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 81 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 82 ISRAEL SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 83 ISRAEL HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 84 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 85 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 86 ISRAEL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 87 ISRAEL AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 89 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 90 ISRAEL TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 91 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 92 EGYPT SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 93 EGYPT HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 94 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 95 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 EGYPT SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 EGYPT AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 99 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 100 EGYPT TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 101 REST OF MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

그림 목록

FIGURE 1 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: SEGMENTATION

FIGURE 11 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 12 SOFTWARE COMPONENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET IN 2025 & 2032

FIGURE 13 DROC ANALYSIS

FIGURE 14 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, 2024

FIGURE 15 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, 2025-2032 (USD THOUSAND)

FIGURE 16 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, CAGR (2025-2032)

FIGURE 17 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 18 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, 2024

FIGURE 19 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, 2025-2032 (USD THOUSAND)

FIGURE 20 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, CAGR (2025-2032)

FIGURE 21 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, LIFELINE CURVE

FIGURE 22 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, 2024

FIGURE 23 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

FIGURE 24 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 25 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 26 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, 2024

FIGURE 27 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 28 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 29 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, 2024

FIGURE 31 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 32 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, CAGR (2025-2032)

FIGURE 33 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 35 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 36 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 37 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET SNAPSHOT

FIGURE 39 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY SHARE 2024 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.