Middle East And Africa Plasma Fractionation Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

929.37 Billion

USD

1,362.67 Billion

2025

2033

USD

929.37 Billion

USD

1,362.67 Billion

2025

2033

| 2026 –2033 | |

| USD 929.37 Billion | |

| USD 1,362.67 Billion | |

|

|

|

|

중동 및 아프리카 혈장 분획 시장, 제품 유형(면역글로불린, 응고 인자 농축액, 알부민, 프로테아제 억제제 및 기타 제품), 응용 분야(신경학, 면역학, 혈액학, 중환자 치료, 폐의학, 혈액 종양학, 류마티스학 및 기타), 처리 기술(이온 교환 크로마토그래피, 친화성 크로마토그래피, 냉동 보존, 한외 여과 및 정밀 여과), 모드(현대 혈장 분획 및 전통적 혈장 분획), 최종 사용자(병원 및 진료소, 임상 연구 실험실 학술 기관 및 기타), 유통 채널(직접 입찰, 제3자 유통 및 기타), 국가(남아프리카, 사우디 아라비아, UAE, 이스라엘, 이집트 및 중동 및 아프리카의 나머지 지역) 산업 동향 및 2028년까지의 예측.

시장 분석 및 통찰력: 중동 및 아프리카 플라스마 분획 시장

시장 분석 및 통찰력: 중동 및 아프리카 플라스마 분획 시장

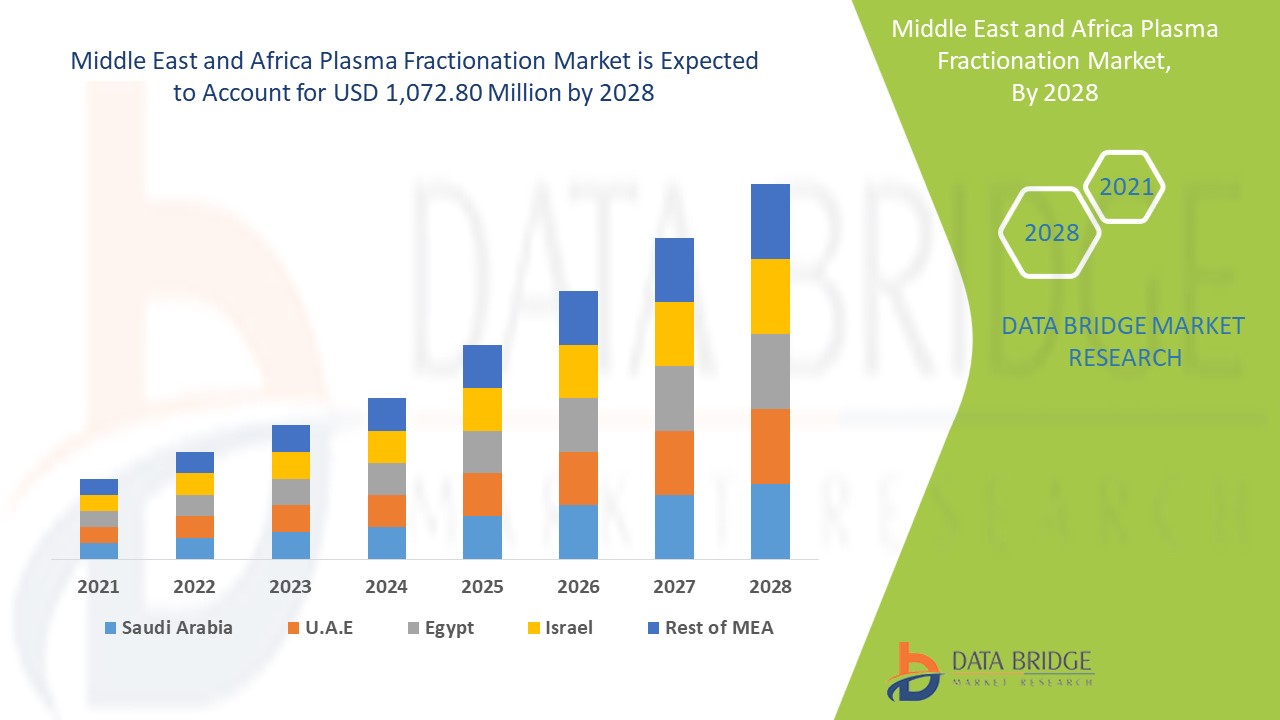

중동 및 아프리카 플라스마 분획 시장은 2021년부터 2028년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2021년부터 2028년까지의 예측 기간 동안 4.9%의 CAGR로 성장하고 있으며 2028년까지 1,072.80백만 달러에 도달할 것으로 예상된다고 분석합니다.

혈장은 혈액 성분으로, 혈장교환술을 통해 전혈에서 추출되며 다양한 치료 및 의료 용도로 사용됩니다. 인간 혈장은 수많은 다른 단백질의 공급원이지만, 이러한 단백질 중 치료용 혈장 제품을 생산하는 데 유용한 것은 일부에 불과합니다. 혈장에서 이러한 단백질을 분리, 추출 및 정제하는 과정을 분획 공정이라고 합니다. 혈장에서 추출한 단백질은 주로 면역글로불린, 응고 인자 농축물, 알부민, 프로테아제 억제제 등과 같은 종류로 분류됩니다.

중동 및 아프리카 혈장 분획 시장은 전 세계 호흡기 질환 증가, 혈액 관련 질환을 앓는 고령 인구 증가, 면역글로불린 사용 증가와 같은 요인으로 성장하고 있습니다. 혈장 요법이나 혈장 파생물을 사용해야 하는 희귀 질환의 증가도 시장 성장의 주요 요인으로 작용합니다. 연구 개발에 대한 투자 증가도 중동 및 아프리카 혈장 분획 시장에 붐을 일으켰습니다.

이 플라스마 분획 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서의 기회 분석을 제공합니다. 분석 및 시장 시나리오를 이해하려면 분석가 브리핑을 위해 저희에게 연락하세요. 저희 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드릴 것입니다.

중동 및 아프리카플라스마 분획 시장 범위 및 시장 규모

중동 및 아프리카플라스마 분획 시장 범위 및 시장 규모

중동 및 아프리카 혈장 분획 시장, 제품 유형(면역글로불린, 응고인자 농축액, 알부민, 프로테아제 억제제 및 기타 제품), 응용 분야(신경학, 면역학, 혈액학, 중환자 치료, 폐의학, 혈액종양학, 류마티스학 및 기타), 처리 기술(이온교환 크로마토그래피, 친화성 크로마토그래피, 냉동보관, 초여과 및 미세여과), 모드(현대 혈장 분획 및 전통적 혈장 분획), 최종 사용자(병원 및 진료소, 임상 연구 실험실 학술 기관 및 기타), 유통 채널(직접 입찰, 제3자 유통 및 기타). 세그먼트 간 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다. 제품 유형을 기준으로 혈장 분획 시장은 면역글로불린, 응고인자 농축액, 알부민, 프로테아제 억제제 및 기타 제품으로 세분화됩니다. 또한, 면역글로불린은 정맥 면역글로불린, 피하 면역글로불린 및 기타로 세분화되었습니다. 응고 인자 농축물은 팩터 VIII, 팩터 CI, 폰 빌레브란트 인자, 프로트롬빈 복합 농축물, 피브리노겐 농축물 및 팩터 XII로 더 세분화됩니다. 2021년에 면역글로불린은 면역 조절 작용과 관련된 많은 건강상의 이점과 같은 요인으로 인해 가장 큰 시장 점유율을 차지했습니다.

- 응용 프로그램을 기준으로, 혈장 분획 시장은 신경학, 면역학, 혈액학, 중환자 치료, 폐의학, 혈액 종양학, 류마티스학 및 기타로 세분화됩니다. 2021년에 면역학은 면역 결핍 치료에 혈장 단백질 사용이 증가하는 것과 같은 요인으로 인해 가장 큰 시장 점유율을 차지했습니다.

- 처리 기술을 기준으로, 플라스마 분획 시장은 이온 교환 크로마토그래피, 친화성 크로마토그래피, 냉동보존, 초여과 및 미세여과로 세분화됩니다. 2021년에 이온 교환 크로마토그래피는 무기 물질을 제거하여 이온을 이용한 높은 정제 능력과 같은 요인으로 인해 가장 큰 시장 점유율을 차지했습니다.

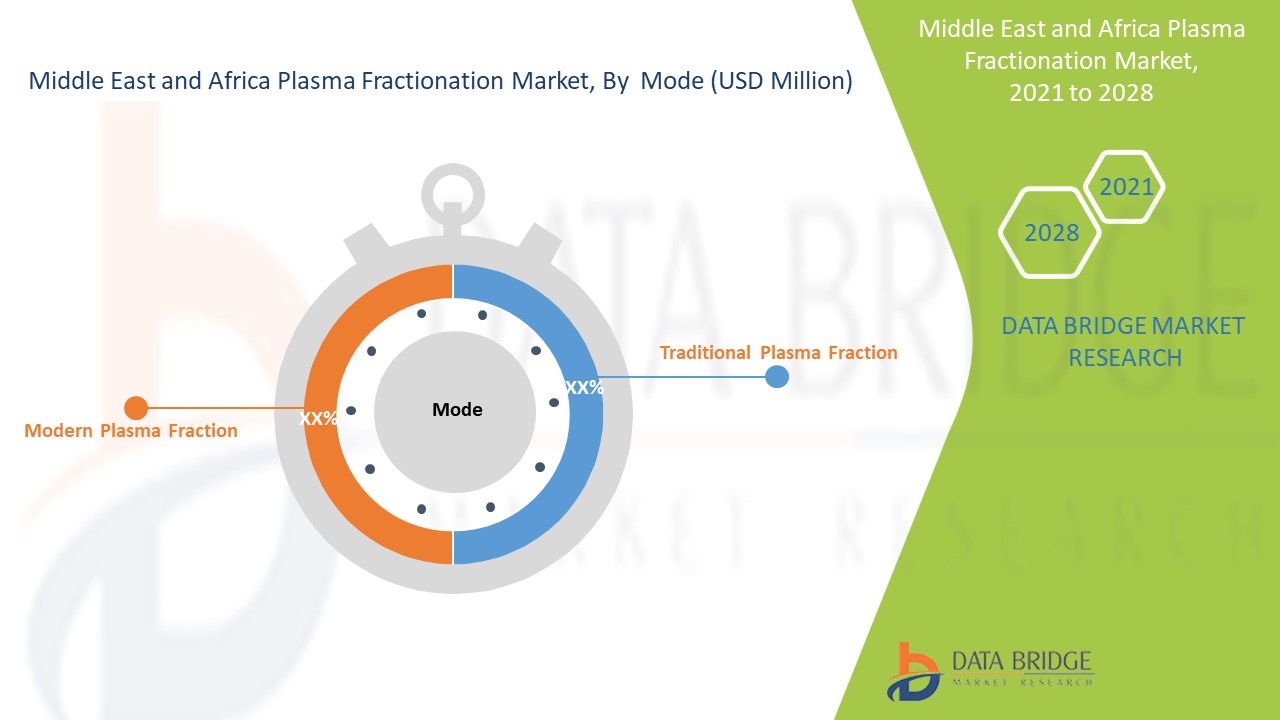

- 모드에 따라 플라스마 분획 시장은 현대 플라스마 분획과 전통적 플라스마 분획으로 세분화됩니다. 2021년에는 현대 플라스마 분획이 플라스마 분획 공정을 위한 최첨단 장비와 생산 시설을 사용하는 것과 같은 요인으로 인해 가장 큰 시장 점유율을 차지했습니다.

- 최종 사용자를 기준으로, 혈장 분획 시장은 병원 및 진료소, 임상 연구 실험실 학술 기관 및 기타로 세분화됩니다. 2021년에는 병원 및 진료소가 병원에서 제공하는 인프라와 의료 시설을 개선하고, 다양한 질병을 치료하기 위해 병원에서 혈장 분획 제품의 오프라벨 사용이 증가함에 따라 시장 점유율이 가장 높습니다.

- 유통 채널을 기준으로, 혈장 분획 시장은 직접 입찰, 제3자 유통 및 기타로 세분화됩니다. 2021년에는 직접 입찰이 가장 큰 시장 점유율을 차지했는데, 그 이유는 제조업체에서 의료 종사자에게 직접 입찰을 통한 유통이 증가하고 있기 때문입니다.

중동 및 아프리카플라스마 분획 시장: 국가 수준 분석

중동 및 아프리카 플라스마 분획 시장을 분석하고, 시장 규모 정보를 국가, 유형(생물 살충제, 생물 살균제, 생물 살충제, 생물 제초제 및 기타), 출처(미생물, 생화학 및 곤충), 형태(건조 및 액상), 적용 분야(엽면 적용, 시비, 토양 처리, 종자 처리 및 기타), 범주(농업 및 원예) 및 위에 참조된 작물별로 제공합니다.

중동 및 아프리카 플라스마 분획 시장 보고서에서 다루는 국가는 남아프리카, 사우디 아라비아, UAE, 이스라엘, 이집트 및 기타 중동 및 아프리카입니다.

남아프리카공화국은 중동 및 아프리카 혈장 분할 시장을 주도하고 있으며, 혈장의 광범위한 이점에 대한 인지도가 높아 가장 높은 CAGR을 기록하고 있습니다.

사우디아라비아는 혈장 분획 수요 증가와 인간 건강에 대한 우려 증가로 중동 및 아프리카의 혈장 분획 시장을 주도하고 있습니다.

UAE는 노령 인구와 면역 결핍 질환으로 인해 가장 높은 시장 점유율을 차지하며 시장을 장악하고 있습니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 중동 및 아프리카 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

농업 분야에서 플라스마 분획 에 대한 수요 증가

중동 및 아프리카 플라즈마 분획 시장은 또한 플라즈마 분획 제품 시장에 대한 지원과 함께 산업의 모든 국가 성장에 대한 자세한 시장 분석을 제공합니다. 판매, 구성 요소 판매, 플라즈마 분획 기술 개발의 영향 및 규제 시나리오의 변화와 함께 플라즈마 분획 제품 시장에 대한 지원이 있습니다. 이 데이터는 2012-2018년의 과거 기간에 대해 제공됩니다.

경쟁 환경 및 중동 및 아프리카 플라즈마 분획 시장 점유율 분석

중동 및 아프리카 플라스마 분획 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 인도의 입지, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 폭, 응용 분야 우세, 기술 수명선 곡선이 포함됩니다. 위에 제공된 데이터 포인트는 중동 및 아프리카 플라스마 분획 시장과 관련된 회사의 초점에만 관련됩니다.

혈장 분획 시장의 주요 기업으로는 SL 혈장, Grifols SA, Octapharma, Kendrion SPA, BPL Inc, Sanquin, Biotest AG, LFB SA, Japan Blood products organization, china biologics product Holdings Inc.,, Green Cross corp, Shanghai Raas, Takeda pharmaceutical company limited, Bioproducts laboratory Ltd, Novasep Inc, Pall corporation, Kabafusion, Sichuan Yuanda shuyang pharmaceutical Co., ltd, Bharat Serums and Vaccines Limited, SK 혈장, Centurion pharma, Ntas biopharmaceuticals, Merck KgAa, Boccard 및 ADMA biologics 등이 있습니다.

전 세계 여러 회사에서 다양한 제품 출시를 시작하면서 중동과 아프리카의 플라스마 분획 시장 성장도 가속화되고 있습니다.

예를 들어,

- 그리폴스는 2020년 4월, 전 세계 광견병 환자 치료에 도움이 되는 혈장 분획 시장에서 광견병 면역글로불린인 Hyper RAB 3ml 바이알을 출시했습니다.

시장 참여자들의 협력, 합작투자 및 기타 전략은 플라스마 분획 시장에서 회사의 입지를 강화하고 있으며, 이는 조직의 성장 속도에 도움이 됩니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.