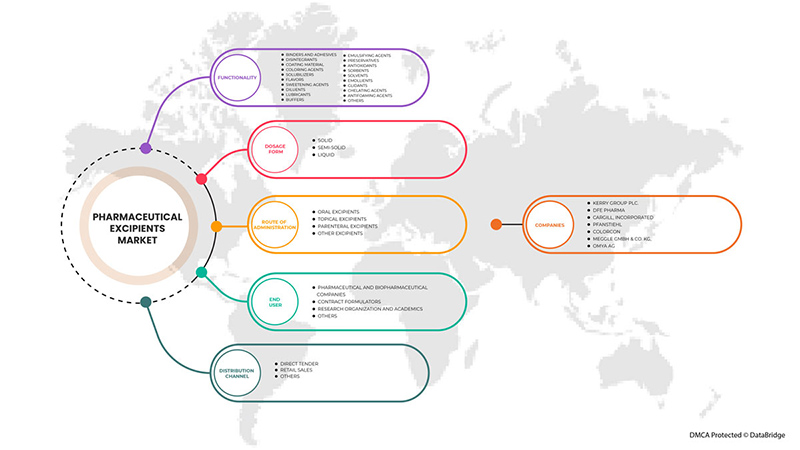

Middle East & Africa Pharmaceutical Excipients Market, By Functionality (Binders And Adhesives, Disintegrants, Coating Material, Coloring Agents, Solubilizers, Flavors, Sweetening Agents, Diluents, Lubricants, Buffers, Emulsifying Agents, Preservatives, Antioxidants, Sorbents, Solvents, Emollients, Glidents, Chelating Agents, Antifoaming Agents, and Others), Dosage Form (Solid, Semi-Solid, Liquid), Route of Administration (Oral Excipients, Topical Excipients, Parenteral Excipients, Other Excipients), End User (Pharmaceutical and Biopharmaceutical Companies, Contract Formulators, Research Organization and Academics, Others), Distribution Channel (Direct Tender, Retail Sales, Others), Industry Trends and Forecast to 2029.

Middle East and Africa Pharmaceutical Excipients Market Analysis and Insights

Pharmaceutical excipients play a major role in drug formulation and its development. These substances involve substances other than the pharmacologically active drug or prodrug. Pharmaceutical excipients provide the drug with efficient drug delivery to the target site. These molecules prevent the drug from being released too early while assimilation and enhancing the drug efficacy. Some pharmaceutical excipients promote drug integration which boosts drug absorption in the bloodstream.

Moreover, pharmaceutical excipients are also used for drug identification. Pharmaceutical excipients are also used to enhance the drug flavor, which increases patients' compliance, especially children's compliance. Based on the chemical nature of pharmaceutical excipients, these can be obtained from organic and inorganic sources. Organic chemicals include carbohydrates, petrochemicals, oleochemicals, and proteins, among others. Pharmaceutical excipients can act as binders, fillers, diluents, suspension or coating agents, flavoring agents, disintegrants, colorants, lubricants and glidants, sweeteners, and preservatives, among others. Pharmaceutical excipients possess several functionalities used for different purposes, including binders and adhesives, disintegrants, solubilizers, flavors, emulsifying agents, preservatives, antioxidants, glidients, and chelating agents, among others.

However, the increasing regulatory stringency regarding the approval of drugs and excipients, along with the cost and time-intensive drug development process, are expected to restrain the growth of this market.

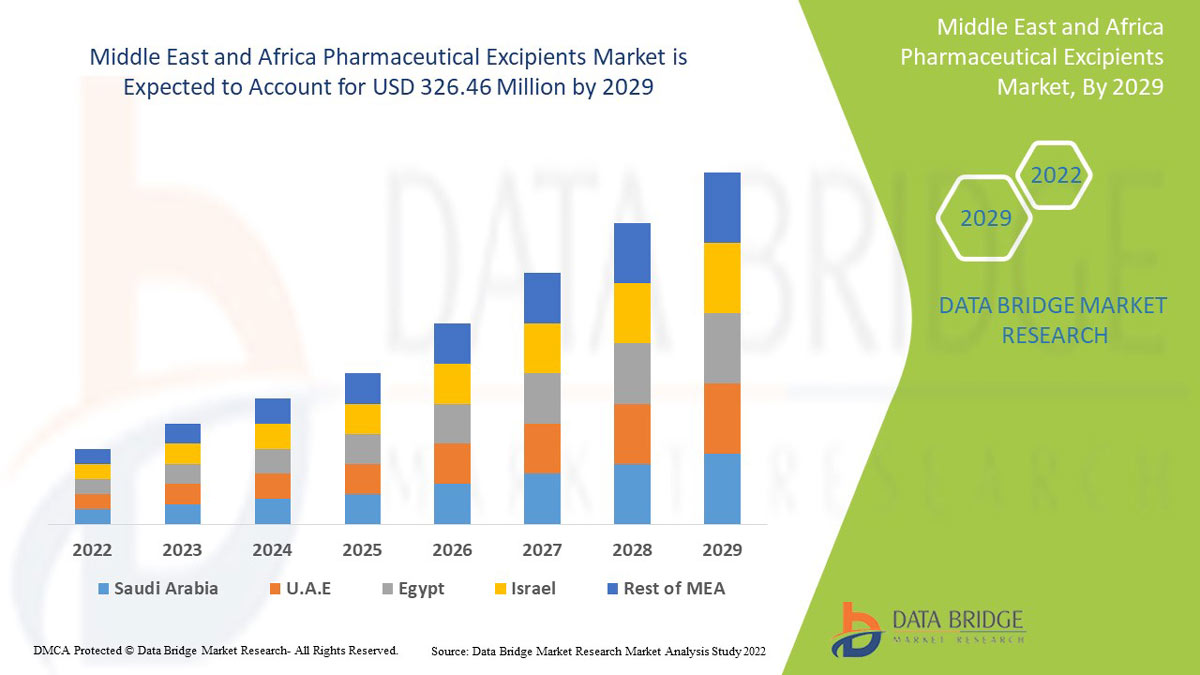

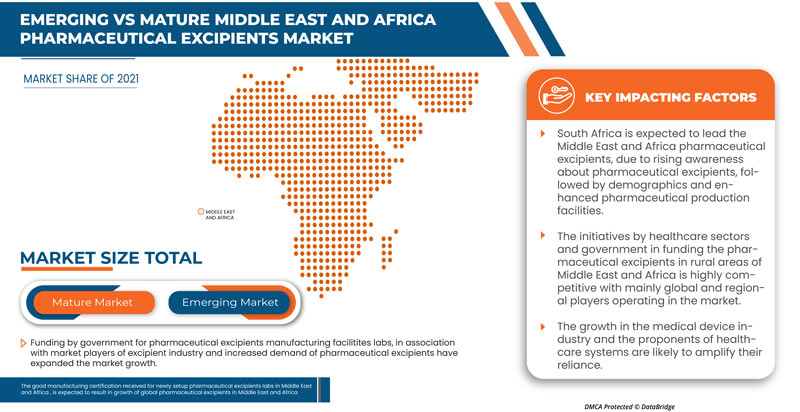

Data Bridge Market Research analyzes that the Middle East & Africa pharmaceutical excipients market is expected to reach the value of USD 326.46 million by 2029, at a CAGR of 5.5% during the forecast period. Functionality accounts for the largest type segment in the market due to the rapid demand for IT solutions and services in the Middle East & Africa. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Functionality (Binders And Adhesives, Disintegrants, Coating Material, Coloring Agents, Solubilizers, Flavors, Sweetening Agents, Diluents, Lubricants, Buffers, Emulsifying Agents, Preservatives, Antioxidants, Sorbents, Solvents, Emollients, Glidents, Chelating Agents, Antifoaming Agents, and Others), Dosage Form (Solid, Semi-Solid, Liquid), Route of Administration (Oral Excipients, Topical Excipients, Parenteral Excipients, Other Excipients), End User (Pharmaceutical and Biopharmaceutical Companies, Contract Formulators, Research Organization and Academics, Others), Distribution Channel (Direct Tender, Retail Sales, Others). |

|

Countries Covered |

South Africa, Saudi Arabia, UAE, Israel, Kuwait, Egypt, the Rest of the Middle East & Africa. |

|

Market Players Covered |

Kerry Group plc., DFE Pharma, Cargill, Incorporated, Pfanstiehl, Colorcon, MEGGLE GmbH & Co. KG, Omya AG, Peter Greven GmbH & Co. KG, Ashland., Evonik, Dow, Croda International Plc, Roquette Frères., The Lubrizol Corporation, BASF SE, Avantor, Inc., BENEO, Chemie Trade, among others. |

Middle East & Africa Pharmaceutical Excipients Market Definition

Pharmaceutical excipients involve everything in a drug except the active pharmaceutical ingredients. These molecules don’t possess medicinal properties and are ultimately used to enhance the drug's physiological absorption. Pharmaceutical excipients are inert in nature, allowing the drug molecule to apply to patients in the right form. Traditionally the pharmaceutical excipients were simple molecules, but technological innovation and increasing demand for novel drug delivery systems enhanced the pharmaceutical excipient's complexity. Pharmaceutical excipients promote the patient’s drug acceptability and boost the drug's stability and bioavailability.

Moreover, pharmaceutical excipients help maintain drug integrity, which helps in drug storage. Different pharmaceutical excipients are based on their chemical nature, including inorganic and organic chemicals. Organic chemicals include carbohydrates, petrochemicals, oleochemicals, and proteins, among others. Pharmaceutical excipients can act as binders, fillers, diluents, suspension or coating agents, flavoring agents, disintegrants, colorants, lubricants and glidants, sweeteners, and preservatives, among others.

The future of excipients science and technology has changed and continues to change. Better progress has been made in such areas as harmonizing excipient pharmacopeial monographs and applying new analytical methods to characterize excipients better.

Middle East & Africa Pharmaceutical Excipients Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise in Generic Drug Production and Uses

According to the U.S. Food and Drug Administration (U.S. Food and Drug Administration). FDA) and the National Center for Biotechnology Information (NCBI), a generic drug is a drug that has been created to look like an approved brand-name drug that is available in dosage form, with safety, strength, route of administration, quality, and performance. After the drug's patent expires, the cost savings associated with conventional drug use are not immediately apparent. Generic drugs, like brand-name drugs, require competition in the generic drug market before reducing costs; two to three years after the loss of exclusivity, the price of a generic drug is usually 60-70% lower than that of a brand-name drug. Since India has the highest per capita spending, these generic drugs will save a lot of money that can be used for other health problems. Nationally, the use of generic drugs has increased significantly in recent years. The fact that cheap substitutes for branded drugs are a major reason likely to spur the growth of the pharmaceutical industry. The generic drug industry in the near future.

Thus, increasing demand for generic drugs and rising production are expected to drive the Middle East & Africa pharmaceutical excipients market growth. Also, the cost of generic drugs is less, which increases the use of generic drugs.

- The Surge in Demand for Excipients

Pharmaceutical excipients are substances in pharmaceutical dosage forms not for direct therapeutic use but to facilitate the manufacture, protection, support, or improvement of stability and availability. With the increased development of the Middle East & Africa pharmaceutical industry, excipients also have a light part. Recently, there has been an increasing demand for generic drugs, which has led to an increase in the excipients demand. In addition, there has been a sharp increase in cases of chronic diseases.

Excipients are inert substances, other than pharmaceutically active drugs, introduced into the manufacturing process or included in the dosage form of pharmaceutical products. Excipients are widely used in drug formulations to add bulk to solid formulations, provide long-term stability, and facilitate drug absorption. Furthermore, it also improves the product's overall safety or functional properties during use or storage.

Thus, wide uses of excipients in drug formulation and applications of excipients are expected to drive the market of the Middle East & Africa pharmaceutical excipients.

Restraint

- Increasing Regulatory Stringency Regarding The Approval of Drugs and Excipients

Generic drug approval rules are largely the same worldwide, with little difference in developing countries. This is because he is not required to undergo bioequivalence (BE) study in this part of the world to obtain generic drug approval. Governments must ensure consistent quality of all generic drugs, medical experts say. Only then will doctors be happy and confident in prescribing generic drugs. A major reason for physicians' (and even patients') lack of confidence in generic drugs has been the lack of strict regulatory requirements regarding the number of generic drugs and the number of impurities allowed.

Controlling the manufacture and distribution of excipients is now considered a top priority by regulators and drug manufacturers, as mixing excipients has resulted in adverse patient events. Furthermore, with the emergence of new excipients and delivery systems, better control of the quality and supply of pharmaceutical excipients has become increasingly important in the context of in vivo activity. Recognizing the important role of excipients in pharmaceutical dosage forms requires excipient suppliers to meet the quality requirements of the pharmaceutical industry, and the pharmaceutical industry, in general, must work to ensure the product's safety. The integrity of use or storage in the supply chain. Hence, the increasing regulatory stringency regarding the approval of drugs and excipients is expected to restrain the Middle East & Africa pharmaceutical excipients market growth.

Opportunity

-

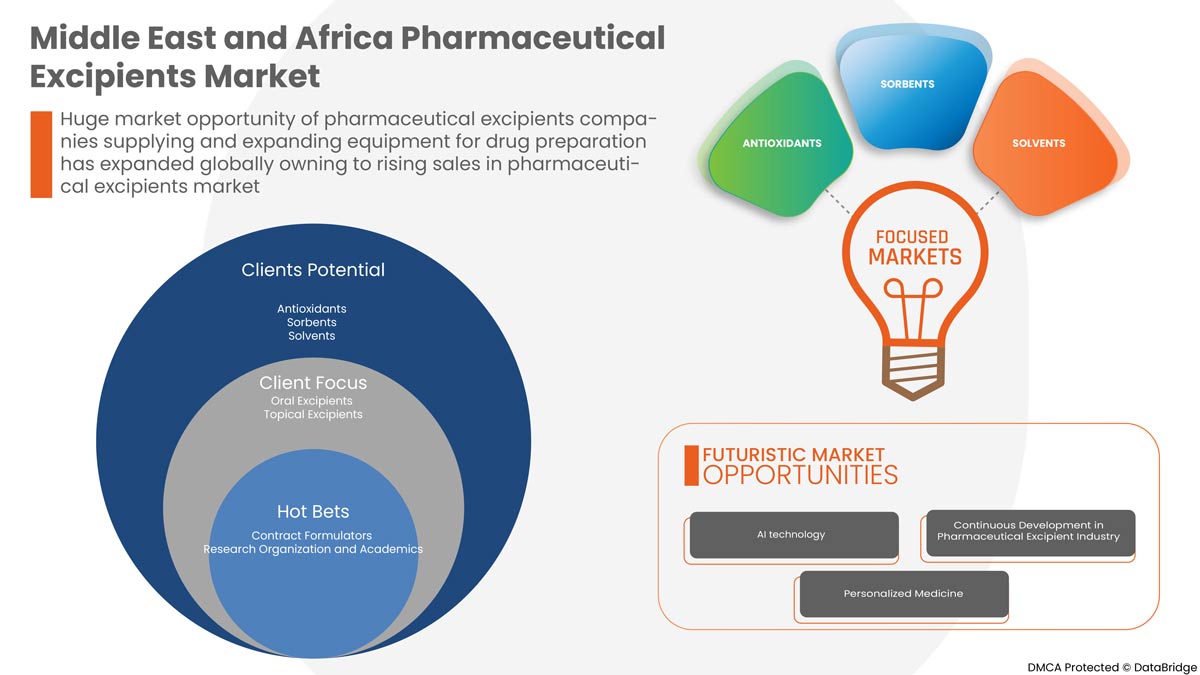

Strategic Initiatives by Market Players

The rise in the pharmaceutical excipients market increases the need for strategic business ideas. It includes a partnership, business expansion, and other development. The rising demand for pharmaceuticals is significantly increasing the demand for pharmaceutical excipients, and to cope with this demand, companies are building new manufacturing sites, among other strategic initiatives.

These strategic initiatives, such as product launches, acquisitions, agreements, and business expansion by the major market player, will boost the pharmaceutical excipients market growth and is expected to act as an opportunity for the Middle East & Africa pharmaceutical excipients market.

Challenge

- Associated Side Effects

Adverse effects due to pharmaceutical excipients in drug formulations are generally uncommon, but the potential for toxicity is increased at high mg per kg doses, especially in neonates and infants. Methyl and Propyl para-hydroxybenzoate (Parabens), Benzyl Alcohol, Sodium Benzoate, Benzoic Acid, and Propylene Glycol, among others, are some of the common pharmaceutical excipients that have reported side effects.

Pharmaceutical excipients are not always the inert substances that we presume. They are intolerant to an individual or, if not properly screened, can cause chemical changes in the drug, causing the side-effect. This can affect the demand for the excipient and is expected to act as a challenge for the Middle East & Africa pharmaceutical excipients market.

Post-COVID-19 Impact on Middle East & Africa Pharmaceutical Excipients Market

The pharmaceutical industry has been severely affected by the COVID-19 pandemic. Lockdowns imposed due to the epidemic have disrupted the supply of raw materials from manufacturing centers such as India and China. This slowed drug development and production, severely affecting companies that relied heavily on outsourcing. Initially, the entire pharmaceutical ecosystem was disrupted. In addition, regulatory agencies had to draft and draft new laws to ensure maximum patient safety after using drugs. After the shutdowns ended, the pharmaceutical industry gained steam, especially due to the demand for drugs such as hydroxychloroquine and Remdesivir, which showed positive results against COVID-19. The growing demand for these drugs boosted the turnover of some companies.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technology and test results involved in the pharmaceutical excipients market.

Recent Developments

- In February 2022, Kerry Group Plc., the world’s leading taste and Nutrition Company, announced that it had made two significant biotechnology acquisitions that have expanded its expertise, technology portfolio, and manufacturing capabilities. The company has announced that it has acquired the leading biotechnology Innovation Company, c-LEcta, and Mexican-based enzyme manufacturer, Enmex. c-LEcta is a leading biotechnology innovation company specializing in precision fermentation, optimized bio-processing, and bio-transformation. Also, Enmex is a well-established enzyme manufacturer based in Mexico, supplying multiple bio-process solutions for food, beverage, and animal nutrition markets. This has helped company to increase its revenue.

- In September 2022, DFE Pharma, the Middle East & Africa leader in pharma- and nutraceutical excipient solutions, opened its new “Closer to the Formulator” (C2F), a Center of Excellence, in Hyderabad, India. C2F helped pharmaceutical companies to shorten the time from concept to finished commercial product through its expertise in all phases of pharmaceutical development. This has helped company to showcase its progress.

Middle East & Africa Pharmaceutical Excipients Market Scope

Middle East & Africa pharmaceutical excipients market is segmented into functionality, dosage forms, route of administration, end-user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY

- BINDERS AND ADHESIVES

- DISINTEGRANTS

- COATING MATERIAL

- COLORING AGENTS

- SOLUBILIZERS

- FLAVORS

- SWEETENING AGENTS

- DILUENTS

- LUBRICANTS

- BUFFERS

- EMULSIFYING AGENTS

- PRESERVATIVES

- ANTIOXIDANTS

- SORBENTS

- SOLVENTS

- EMOLLIENTS

- GLIDENTS

- CHELATING AGENTS

- ANTIFOAMING AGENTS

- OTHERS

On the basis of functionality, the Middle East & Africa pharmaceutical excipients market is segmented into binders and adhesives, disintegrants, coating material, coloring agents, solubilizers, flavors, sweetening agents, diluents, lubricants, buffers, emulsifying agents, preservatives, antioxidants, sorbents, solvents, emollients, glidents, chelating agents, antifoaming agents, and others.

MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM

- SOLID

- SEMI-SOLID

- LIQUID

On the basis of dosage forms, the Middle East & Africa pharmaceutical excipients market is segmented into solid, semi-solid, and liquid.

MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION

- ORAL EXCIPIENTS

- TOPICAL EXCIPIENTS

- PARENTERAL EXCIPIENTS

- OTHER EXCIPIENTS

On the basis of route of administration, the Middle East & Africa pharmaceutical excipients market is segmented into oral pharmaceutical excipients, topical pharmaceutical excipients, parenteral pharmaceutical excipients, and other excipients.

MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY END-USER

- PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

- CONTRACT FORMULATORS

- RESEARCH ORGANIZATION AND ACADEMICS

- OTHERS

On the basis of end user, the Middle East & Africa pharmaceutical excipients market is segmented into pharmaceutical and biopharmaceutical companies, contract formulators, research organizations, and academics, among others.

MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

- OTHERS

On the basis of distribution channel, the Middle East & Africa pharmaceutical excipients market is segmented into direct tender, retail sales, and others.

Middle East & Africa Pharmaceutical Excipients Market Regional Analysis/Insights

The Middle East & Africa pharmaceutical excipients market is analyzed, and market size information is provided functionality, dosage forms, route of administration, end-user, and distribution channel.

The countries covered in this market report are South Africa, Saudi Arabia, UAE, Israel, Kuwait, Egypt, and Rest of the Middle East & Africa

- In 2022, Middle East & Africa is dominating due to the presence of key market players in the largest consumer market with high GDP. South Africa is expected to grow due to the rise in technological advancement in Healthcare IT.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East & Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East & Africa Pharmaceutical Excipients Market Share Analysis

Middle East & Africa pharmaceutical excipients market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the Middle East & Africa pharmaceutical excipients market.

Some of the major players operating in the Middle East & Africa pharmaceutical excipients market are Kerry Group plc., DFE Pharma, Cargill, Incorporated, Pfanstiehl, Colorcon, MEGGLE GmbH & Co. KG, Omya AG, Peter Greven GmbH & Co. KG, Ashland. , Evonik, and Dow.

Research Methodology: Middle East & Africa Pharmaceutical Excipients Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East & Africa vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 FUNCTIONALITY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 INDUSTRIAL INSIGHTS:

4 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENT MARKET: REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN GENERIC DRUG PRODUCTION AND USES

5.1.2 THE SURGE IN DEMAND FOR EXCIPIENTS

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN MULTIFUNCTIONAL EXCIPIENTS

5.1.4 RISING FOCUS ON ORPHAN DRUGS

5.2 RESTRAINTS

5.2.1 INCREASING REGULATORY STRINGENCY REGARDING THE APPROVAL OF DRUGS AND EXCIPIENTS

5.2.2 HIGH PRODUCTION COST

5.3 OPPORTUNITIES

5.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.2 RISING DEMAND FOR EASE OF USE

5.3.3 RISING DISPOSABLE INCOME

5.3.4 INCREASING DEMAND FOR ALTERNATIVE ROUTES OF DELIVERY/DOSAGE FORMS

5.4 CHALLENGES

5.4.1 ASSOCIATED SIDE EFFECTS

5.4.2 SAFETY CONSIDERATION OF PHARMACEUTICAL EXCIPIENTS IN STORAGE & TRANSPORTATION

5.4.3 LACK OF NOVEL PHARMACEUTICAL PHARMACEUTICAL EXCIPIENTS

6 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY

6.1 OVERVIEW

6.2 BINDERS AND ADHESIVES

6.2.1 ORGANIC

6.2.2 INORGANIC

6.3 DISINTEGRANTS

6.3.1 ORGANIC

6.3.2 INORGANIC

6.4 COATING MATERIAL

6.4.1 ORGANIC

6.4.2 INORGANIC

6.5 COLORING AGENTS

6.5.1 ORGANIC

6.5.2 INORGANIC

6.6 SOLUBILIZERS

6.6.1 ORGANIC

6.6.2 INORGANIC

6.7 FLAVORS

6.7.1 ORGANIC

6.7.2 INORGANIC

6.8 SWEETENING AGENTS

6.8.1 ORGANIC

6.8.2 INORGANIC

6.9 DILUENTS

6.9.1 ORGANIC

6.9.2 INORGANIC

6.1 LUBRICANTS

6.10.1 ORGANIC

6.10.2 INORGANIC

6.11 BUFFERS

6.11.1 ORGANIC

6.11.2 INORGANIC

6.12 EMULSIFYING AGENTS

6.12.1 ORGANIC

6.12.2 INORGANIC

6.13 PRESERVATIVES

6.13.1 ORGANIC

6.13.2 INORGANIC

6.14 ANTIOXIDANTS

6.14.1 ORGANIC

6.14.2 INORGANIC

6.15 SORBENTS

6.15.1 ORGANIC

6.15.2 INORGANIC

6.16 SOLVENTS

6.16.1 ORGANIC

6.16.2 INORGANIC

6.17 EMOLLIENTS

6.17.1 ORGANIC

6.17.2 INORGANIC

6.18 GLIDENTS

6.18.1 ORGANIC

6.18.2 INORGANIC

6.19 CHELATING AGENTS

6.19.1 ORGANIC

6.19.2 INORGANIC

6.2 ANTIFOAMING AGENTS

6.20.1 ORGANIC

6.20.2 INORGANIC

6.21 OTHERS

7 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM

7.1 OVERVIEW

7.2 SOLID

7.2.1 PLANT

7.2.2 ANIMALS

7.2.3 SYNTHETIC

7.2.4 MINERALS

7.3 SEMI-SOLID

7.3.1 PLANT

7.3.2 ANIMALS

7.3.3 SYNTHETIC

7.3.4 MINERALS

7.4 LIQUID

7.4.1 PLANT

7.4.2 ANIMALS

7.4.3 SYNTHETIC

7.4.4 MINERALS

8 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION

8.1 OVERVIEW

8.2 ORAL EXCIPIENTS

8.3 TOPICAL EXCIPIENTS

8.4 PARENTERAL EXCIPIENTS

8.5 OTHER EXCIPIENTS

9 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.2.1 COMPANY TENDER

9.2.2 TENDER THROUGH MARCH MERCHANDISER

9.3 RETAIL SALES

9.4 OTHERS

10 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

10.3 CONTRACT FORMULATORS

10.4 RESEARCH ORGANIZATION

10.5 OTHERS

11 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 U.A.E

11.1.3 SAUDI ARABIA

11.1.4 KUWAIT

11.1.5 EGYPT

11.1.6 ISRAEL

11.1.7 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 DOW

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 ROQUETTE FRÈRES.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 EVONIK

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 THE LUBRIZOL CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 BASF SE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ASHLAND (2021)

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AVANTOR, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BENEO

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 CARGILL, INCORPORATED.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 CHEMIE TRADE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 COLORCON

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 CRODA INTERNATIONAL PLC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 DFE PHARMA (SUBSIDIARY OF ROYAL FRIESLANDCAMPINA N.V)

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 KERRY GROUP PLC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 MEGGLE GMBH & CO. KG

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 OMYA AG

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 PETER GREVEN GMBH & CO. KG

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 PFANSTIEHL

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA BINDERS AND ADHESIVES IN PHARMACEUTICAL EXCIPIENTS MARKETS, BY REGION, 2015-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA BINDERS AND ADHESIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA DISINTEGRANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DISINTEGRANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA COATING MATERIAL IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA COATING MATERIAL IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA COLORING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA COLORING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SOLUBILIZERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SOLUBILIZERS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA FLAVORS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA FLAVORS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SWEETENING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SWEETENING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA DILUENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DILUENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA LUBRICANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA LUBRICANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA BUFFERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BUFFERS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA EMULSIFYING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA EMULSIFYING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA PRESERVATIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA PRESERVATIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA ANTIOXIDANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ANTIOXIDANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA SORBENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA SORBENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA SOLVENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA SOLVENTS PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA EMOLLIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA EMOLLIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA GLIDENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA GLIDENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA CHELATING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA CHELATING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ANTIFOAMING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA ANTIFOAMING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA SEMI-SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA SEMI-SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA LIQUID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA LIQUID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION, 2015-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA ORAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA TOPICAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA PARENTERAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA OTHER EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA DIRECT TENDER IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA DIRECT TENDER IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA RETAIL SALES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET, BY END USER, 2015-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA CONTRACT FORMULATORS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA RESEARCH ORGANIZATION AND ACADEMICS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

그림 목록

FIGURE 1 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: SEGMENTATION

FIGURE 12 THE RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS ON PHARMACEUTICAL EXCIPIENTS IS DRIVING THE MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE BINDERS AND ADHESIVES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET

FIGURE 15 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, 2021

FIGURE 16 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, 2021

FIGURE 20 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 24 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, 2021

FIGURE 32 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, LIFELINE CURVE

FIGURE 35 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: SNAPSHOT (2021)

FIGURE 36 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2021)

FIGURE 37 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 MIDDLE EAST AND AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: BY FUNCTIONALITY (2022-2029)

FIGURE 40 MIDDLE EAST & AFRICA PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.