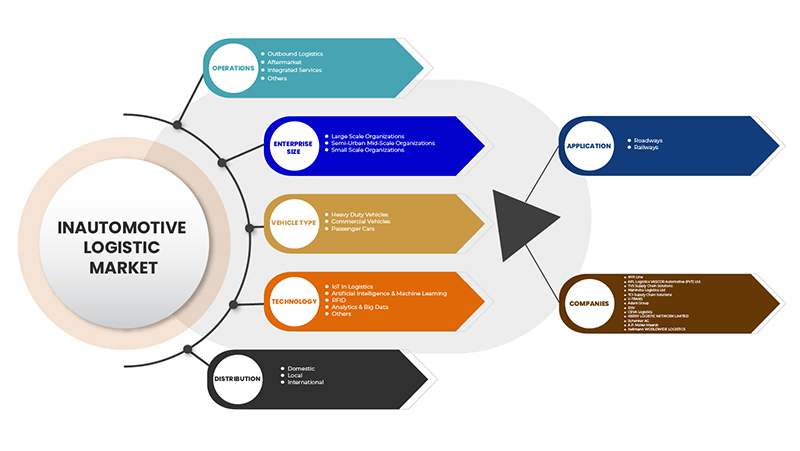

인도 자동차 물류 시장, 운영(아웃바운드 물류, 애프터마켓, 통합 서비스 및 기타), 기업 규모(대규모 조직, 준도시 중규모 조직 및 소규모 조직), 차량 유형(대형 차량, 상용차 및 승용차), 기술(물류 IoT, 인공 지능 및 머신 러닝, RFID분석 및 빅 데이터 및 기타), 유통(국내, 지역 및 국제), 응용 분야(도로 및 철도) 산업 동향 및 2029년까지의 예측.

인도 자동차 물류 시장 분석 및 규모

서비스 제공업체들은 끊임없이 기술 발전에 발맞춰 작업의 정확성, 서비스, 안전성, 그리고 업무 효율성을 높일 방법을 모색해 왔습니다. 이러한 요구는 산업 현장에서 향상되고 중단 없는 무료 서비스를 적시에 제공하는 자동차 물류 도입을 통해 충족되고 있습니다. 고객 경험에 대한 수요 증가로 인해 다양한 산업에서 자동차 물류가 널리 활용되고 있습니다. 자동차 물류는 산업의 운영 및 생산성 향상을 지원합니다. 자동차 물류는 인간의 개입 없이 더욱 자동화된 솔루션을 제공하고 더 나은 운전 경험을 제공함으로써 최종 사용자에게 도움을 줍니다. 인도 자동차 물류 시장은 차량 전기화 수요 증가로 인해 빠르게 성장하고 있으며, 이는 자동차 물류 수요를 견인하고 있습니다. 기업들은 시장 점유율 확대를 위해 신제품을 출시하고 있습니다.

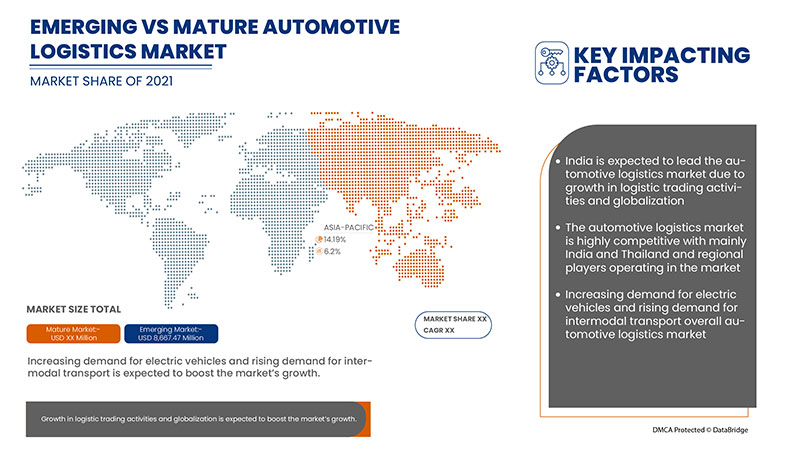

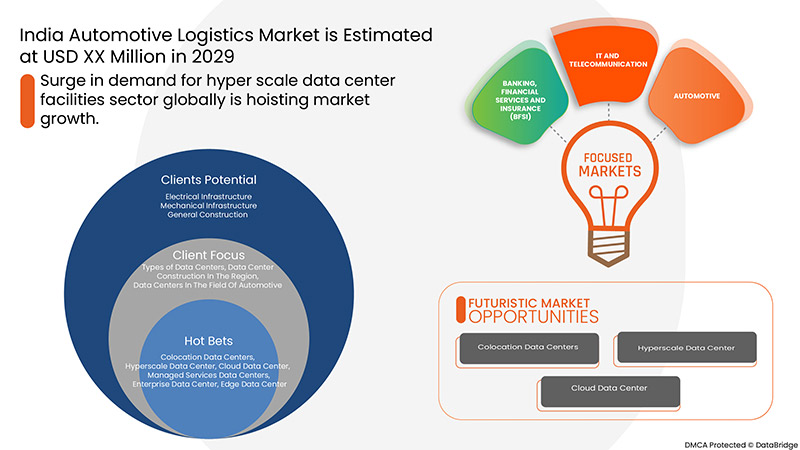

데이터 브릿지 마켓 리서치(Data Bridge Market Research)에 따르면 자동차 물류 시장은 2029년까지 86억 6,747만 달러 규모에 이를 것으로 예상되며, 이는 예측 기간 동안 연평균 6.2% 성장할 것으로 예상됩니다. 아웃바운드 물류는 자동차 물류 시장에서 가장 큰 비중을 차지합니다. 인도 서비스는 고정밀 IoT 네트워크 구축에 활용되는 정확한 정보를 제공합니다. 자동차 물류 시장 보고서는 가격 분석, 특허 분석, 그리고 기술 발전에 대한 심층적인 내용도 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적인 해 |

2020 |

|

양적 단위 |

매출(백만 달러), 가격(미국 달러) |

|

다루는 세그먼트 |

운영(아웃바운드 물류, 애프터마켓, 통합 서비스 및 기타), 기업 규모(대규모 조직, 준도시 중규모 조직 및 소규모 조직), 차량 유형(대형 차량, 상용차 및 승용차), 기술(물류 IoT, 인공 지능 및 머신 러닝, RFID, 분석 및 빅 데이터 및 기타), 유통(국내, 지역 및 국제), 응용 분야(도로 및 철도) |

|

포함 국가 |

인도 |

|

시장 참여자 포함 |

NYK Line, APL Logistics VASCOR Automotive (PVT) Ltd., TVS Supply Chain Solutions, Mahindra Logistics Ltd, TCI Supply Chain Solutions, V-TRANS, Adani Group, DSV, CEVA Logistics, KERRY LOGISTIC NETWORK LIMITED, Schenker AG, AP Moller-Maersk, hellmann WORLDWIDE LOGISTICS 등이 있습니다. |

시장 정의

자동차 물류는 모든 단계가 원활하게 연결된 복잡하고 고도화된 유통 네트워크입니다. 전 세계 모든 운송 업체는 이를 가장 어렵고 숙련된 분야로 간주합니다. 자동차 공급망의 기계화와 정교화는 현대 물류 기술을 도입하여 더욱 강화되어야 하며, 이를 통해 비용 관리 및 품질 향상이라는 목표를 달성하고 전체적인 이점을 창출하며 전반적인 효율성을 향상시켜야 합니다. 자동차 공급망의 물류 계획 및 관리 활동은 부품 공급원부터 최종 사용자까지 통합됩니다. 자동차 공급망은 자동차 부품 공급업체, 완성차 제조업체, 모든 단계의 자동차 딜러, 그리고 최종 소비자가 피드포워드 및 피드백 정보 흐름, 자본 흐름, 그리고 물류 데이터를 통해 하나의 시스템으로 통합되는 조직 구조를 사용합니다. 이러한 활동은 자동차 제조 회사에 원자재, 부품 및 기타 자재를 공급하는 운영과 관련이 있습니다. 생산업체로부터 자동차 제조 공정이 시작될 때까지 원자재와 부품을 공급하는 것을 자동차 공급 물류라고 합니다. 자동차 공급 물류는 자동차의 제조, 운송 및 구매 과정을 원활하게 유지하는 데 도움이 될 수 있습니다. 공급망에서 비용을 절감하고 수익을 늘리고, 자재 가용성을 보장하는 동시에 물류 운영을 효과적으로 관리하는 것이 필요합니다.

자동차 물류 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 데 중점을 둡니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

- 물류 거래 활동과 세계화의 성장

세계화는 기술, 상품 등의 국경 간 무역을 통해 전 세계 경제, 인구, 문화가 상호 의존적으로 연결되는 현상이라고 할 수 있습니다. 오늘날 국가 경제의 대부분은 여러 국가에서의 상품 매매에 크게 의존하고 있습니다. 아시아 태평양 및 북미 지역은 세계 무역의 주요 지역으로, 무역량이 많아 물류 서비스 제공업체의 무역 흐름이 더욱 편리하고 빨라져야 한다는 요구가 증가했습니다. 이는 아시아 태평양 지역 물류 시장의 성장을 촉진했으며, 이는 다른 지역으로 이어졌습니다.

- 전기 자동차 수요 증가

전기 자동차(EV)는 탄소 배출 제로, 저소음, 고효율을 갖춘 지속 가능한 교통 수단을 실현하는 유망한 기술로 설계되었습니다. 더욱이, 전기 자동차는 19세기에 개발되었지만, 기술 발전이 부족했기 때문에 내연 기관 차량에 대한 수요가 전기 자동차에 비해 매우 높았습니다. 20세기에는 기술 발전이 해마다 가속화되었고, 이는 전기 자동차의 모습을 변화시킨 다양한 개발과 혁신의 결과였습니다.

- 물류 및 재고 비용 상승

물류는 매출이 빠르게 성장하고, 물류 처리 업무가 제3자 물류(3PL)에 아웃소싱됨에 따라 복잡한 운영 절차를 필요로 합니다. 물류 비용을 결정하는 두 가지 중요한 변수는 시간과 물량입니다. 운송 중인 물류에 대한 정보는 모든 조직이나 국가에서 효율성을 높이고 규모의 경제를 달성하는 데 중요합니다.

- 아웃바운드 물류에 대한 기업의 선호도 변화

아웃바운드 물류는 기업과 고객을 연결하는 과정입니다. 생산자는 이 과정을 통해 제품을 전략적 위치로 이동할 수 있습니다. 그림은 아웃바운드 물류 과정을 설명합니다. 기업은 시장의 공급업체로부터 제품을 구매한 후 고객에게 아웃바운드로 배송합니다.

기업들은 소비자에게 제품을 직접 배송하는 과정이 간단하고 복잡하지 않기 때문에 아웃바운드 물류를 선호하고 있습니다. 아웃바운드 물류는 대부분의 기업에서 선호되는데, 아웃바운드 물류의 경우 창고 관리 및 보관이 요구사항에 따라 체계적으로 계획되기 때문입니다. 공급업체의 재고 관리, 운송, 그리고 마감 임박 배송이 체계적으로 계획되고 관리됩니다.

- 자동차 물류 차량에 클라우드, 빅데이터, 사물인터넷(IoT)이 확대 적용

클라우드 컴퓨팅은 물류 산업 전반에 걸쳐 디지털 혁신을 이끄는 주요 원동력으로 자리 잡았습니다. 탁월한 민첩성을 제공할 뿐만 아니라 운영 및 관리 비용을 절감합니다. 이를 바탕으로 여러 정부와 기업이 이 기술을 활용하기 시작했으며, 다양한 분야에서 점차 인기를 얻고 있습니다. 클라우드 컴퓨팅의 잠재력이 매우 커지면서 클라우드가 IT 기능에만 국한되었던 개념이 완전히 바뀌었습니다. 이는 인공지능(AI), IoT, 엣지 컴퓨팅 등 다른 기술과 더욱 긴밀하게 통합되고 있습니다.

- 국제 무역의 높은 운송 비용

물류는 모든 경제의 근간이며, 인도의 물류 산업은 빠르게 성장하고 있습니다. 물류는 운영 비용 절감, 배송 성능 향상, 그리고 고객 만족도 향상으로 이어질 수 있기 때문에 그 중요성이 더욱 커지고 있습니다. 국제적으로 거래되는 물류는 제품의 흐름을 관리하는 데 매우 중요합니다.

코로나19 이후 자동차 물류 시장에 미치는 영향

COVID-19는 거의 모든 국가가 필수품 생산 시설을 제외한 모든 생산 시설을 폐쇄하면서 자동차 물류 시장에 큰 영향을 미쳤습니다. 정부는 COVID-19 확산을 막기 위해 비필수품 생산 및 판매 중단, 국제 무역 차단 등 여러 가지 엄격한 조치를 취했습니다. 이러한 팬데믹 상황에서 유일하게 운영이 허용되는 사업체는 필수 서비스업입니다.

자동차 물류 시장의 성장은 최근 여러 정부 기관에서 배출가스 감축을 위해 전기차 사용을 장려하면서 전기차가 등장한 데 기인합니다. 그러나 코로나19는 자동차 물류 시장에 부정적인 영향을 미쳤습니다. 여러 국가에서 차량 판매 및 물류 운영이 중단되었고, 대부분의 기업들이 약 몇 달 동안 일시적으로 운영을 중단했습니다.

게다가, 팬데믹 상황 이후 많은 국가에서 경제가 침체되면서 소비자들은 신차를 구매하려 하지 않았고, 이는 자동차 판매와 물류 성장에 직접적인 영향을 미쳐 자동차 물류 시장 성장에 악영향을 미쳤습니다.

최근 개발

- 2022년 3월, CEVA Logistics는 Kodiak Robotics, Inc.와의 파트너십을 발표했습니다. 이 파트너십은 회사가 자율 화물 배송과 같은 더 나은 물류 솔루션을 개발하고, 회사의 솔루션 포트폴리오를 다각화하며, 새로운 고객을 유치하는 데 도움이 될 것입니다.

2022년 2월, AP 몰러-머스크는 파일럿 화물 서비스 인수를 발표했습니다. 이번 인수를 통해 회사는 통합 물류 서비스를 확장하고 새로운 서비스를 발전시켜 교차 판매 기회를 확대할 수 있을 것입니다.

인도 자동차 물류 시장 범위

자동차 물류 시장은 운영, 기업 규모, 차량 종류, 기술, 유통, 그리고 적용 분야를 기준으로 세분화됩니다. 이러한 세그먼트의 성장은 산업 내 저조한 성장 세그먼트를 분석하고, 사용자에게 핵심 시장 적용 분야를 파악하기 위한 전략적 의사 결정에 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공합니다.

운영

- 아웃바운드 물류

- 애프터마켓

- 통합 서비스

- 기타

인도 자동차 물류 시장은 제공 항목을 기준으로 아웃바운드 물류, 애프터마켓, 통합 서비스 및 기타로 세분화됩니다.

기업 규모

- 대규모 조직

- 준도시 중규모 조직

- 소규모 조직

기업 규모에 따라 인도 자동차 물류 시장은 대규모 기업, 준도시 중규모 기업, 소규모 기업으로 세분화됩니다.

차량 유형

- 중장비 차량

- 상용차

- 승용차

차량 유형을 기준으로 인도 자동차 물류 시장은 대형 차량, 상용차, 승용차로 구분됩니다.

기술

- 물류 분야의 IoT

- 인공지능 및 머신러닝

- RFID

- 분석 및 빅데이터

- 기타

기술을 기반으로 인도 자동차 물류 시장은 물류의 IoT, 인공지능 및 머신러닝, RFID, 분석 및 빅데이터 등으로 세분화되었습니다.

분포

- 국내의

- 현지의

- 국제적인

인도 자동차 물류 시장은 유통을 기준으로 국내, 국내 및 국제로 세분화되었습니다.

애플리케이션

- 도로

- 철도

인도 자동차 물류 시장은 적용 방식에 따라 도로와 철도로 구분됩니다.

경쟁 환경 및 자동차 물류 시장 점유율 분석

자동차 물류 시장 경쟁 구도는 경쟁사별 세부 정보를 제공합니다. 여기에는 회사 개요, 회사 재무 상태, 매출 창출, 시장 잠재력, 연구 개발 투자, 신규 시장 진출, 인도 시장 진출, 생산 시설 및 설비, 생산 능력, 회사의 강점과 약점, 제품 출시, 제품 종류 및 범위, 응용 분야별 우위 등이 포함됩니다. 위에 제시된 데이터는 자동차 물류 시장과 관련된 해당 회사의 주요 관심사와 관련된 정보입니다.

자동차 물류 시장에서 활동하는 주요 기업으로는 NYK Line, APL Logistics VASCOR Automotive (PVT) Ltd., TVS Supply Chain Solutions, Mahindra Logistics Ltd, TCI Supply Chain Solutions, V-TRANS, Adani Group, DSV, CEVA Logistics, KERRY LOGISTIC NETWORK LIMITED, Schenker AG, AP Moller-Maersk, Hellmann WORLDWIDE LOGISTICS 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA AUTOMOTIVE LOGISTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OPEARTIONS TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TRENDS FOR FUTURE DOMESTIC SALES AND EXPORT NUMBER

4.1.1 RANKING, SHARE OF LOGISTICS COMPANIES (INDIA)

4.2 MARKET FREIGHT RATE LEVEL TRANSITION FOR ROAD AND RAIL

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWTH IN LOGISTIC TRADING ACTIVITIES AND GLOBALIZATION

5.1.2 INCREASING DEMAND FOR ELECTRIC VEHICLES

5.1.3 RISING DEMAND FOR INTERMODAL TRANSPORT

5.2 RESTRAINTS

5.2.1 RISING LOGISTICS AND INVENTORY COST

5.2.2 POOR TRANSPORTATION INFRASTRUCTURE

5.3 OPPORTUNITIES

5.3.1 SHIFTING COMPANIES PREFERENCE TOWARD OUTBOUND LOGISTICS

5.3.2 INCREASING PENETRATION OF CLOUD, BIG DATA, AND INTERNET OF THING (IOT) IN THE AUTOMOTIVE LOGISTIC VEHICLES

5.3.3 INCREASING DEMAND FOR BLOCKCHAIN TECHNOLOGY IN LOGISTIC OPERATIONS

5.4 CHALLENGES

5.4.1 HIGH TRANSPORTATION COSTS FOR INTERNATIONAL TRADE

5.4.2 STRINGENT GOVERNMENT REGULATIONS FOR LOGISTICS

6 INDIA AUTOMOTIVE LOGISTICS MARKET, BY OPERATIONS

6.1 OVERVIEW

6.2 OUTBOUND LOGISTICS

6.3 ORDER PROCESSING

6.4 PRODUCT PICKING & PACKING

6.5 SHIPMENT DISPATCH

6.6 AFTERMARKET

6.7 INTEGRATED SERVICES

6.8 OTHERS

7 INDIA AUTOMOTIVE LOGISTICS MARKET, BY ENTERPRISE SIZE

7.1 OVERVIEW

7.2 LARGE SCALE ORGANIZATIONS

7.3 SEMI-URBAN MID SCALE ORGANIZATIONS

7.4 SMALL SCALE ORGANIZATIONS

8 INDIA AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE

8.1 OVERVIEW

8.2 HEAVY DUTY VEHICLES

8.3 PASSENGER CARS

9 INDIA AUTOMOTIVE LOGISTICS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ARTIFICIAL INTELLIGENCE & MACHINE LEARNING

9.3 IOT IN LOGISTICS

9.4 ANALYTICS & BIG DATA

9.5 RFID

9.6 OTHERS

10 INDIA AUTOMOTIVE LOGISTICS MARKET, BY DISTRIBUTION

10.1 OVERVIEW

10.2 DOMESTIC

10.3 LOCAL

10.4 INTERNATIONAL

11 INDIA AUTOMOTIVE LOGISTICS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ROADWAYS

11.3 RAILWAYS

12 INDIA

12.1 INDIA

13 INDIA AUTOMOTIVE LOGISTICS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: INDIA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 DSV

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 ADANI GROUP

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 MAHINDRA LOGISTICS LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 NYK LINE

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 CEVA LOGISTICS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 A.P. MOLLER - MAERSK

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 APL LOGISTICS VASCOR AUTOMOTIVE (PVT) LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 HELLMANN WORLDWIDE LOGISTICS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 KERRY LOGISTIC NETWORK LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 SCHENKER AG

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 TCI SUPPLY CHAIN SOLUTIONS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 TVS SUPPLY CHAIN SOLUTIONS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 V-TRANS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 INDIA AUTOMOTIVE LOGISTICS MARKET, BY OPERATIONS, 2020-2029 (USD MILLION)

TABLE 2 INDIA OUTBOUND LOGISTICS IN AUTOMOTIVE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 INDIA AUTOMOTIVE LOGISTICS MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 4 INDIA AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 5 INDIA AUTOMOTIVE LOGISTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 INDIA AUTOMOTIVE LOGISTICS MARKET, BY DISTRIBUTION, 2020-2029 (USD MILLION)

TABLE 7 INDIA AUTOMOTIVE LOGISTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 INDIA AUTOMOTIVE LOGISTICS MARKET, BY OPERATIONS, 2020-2029 (USD MILLION)

TABLE 9 INDIA OUTBOUND LOGISTICS IN AUTOMOTIVE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 INDIA AUTOMOTIVE LOGISTICS MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 11 INDIA AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 12 INDIA AUTOMOTIVE LOGISTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 INDIA AUTOMOTIVE LOGISTICS MARKET, BY DISTRIBUTION, 2020-2029 (USD MILLION)

TABLE 14 INDIA AUTOMOTIVE LOGISTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 INDIA AUTOMOTIVE LOGISTICS MARKET: SEGMENTATION

FIGURE 2 INDIA AUTOMOTIVE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 INDIA AUTOMOTIVE LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 INDIA AUTOMOTIVE LOGISTICS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 INDIA AUTOMOTIVE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA AUTOMOTIVE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA AUTOMOTIVE LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA AUTOMOTIVE LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 INDIA AUTOMOTIVE LOGISTICS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 INDIA AUTOMOTIVE LOGISTICS MARKET: SEGMENTATION

FIGURE 11 GROWTH IN LOGISTIC TRADING ACTIVITIES AND GLOBALIZATION IS EXPECTED TO DRIVE INDIA AUTOMOTIVE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 OPERATIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF INDIA AUTOMOTIVE LOGISTICS MARKET IN 2022 & 2029

FIGURE 13 AUTOMOTIVE SALES TREND IN INDIA

FIGURE 14 CAR SALES TREND OF THAILAND IN JANUARY MONTH

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF INDIA AUTOMOTIVE LOGISTICS MARKE

FIGURE 16 INDIA AUTOMOTIVE LOGISTICS MARKET: BY OPERATIONS, 2021

FIGURE 17 INDIA AUTOMOTIVE LOGISTICS MARKET: BY ENTERPRISE SIZE, 2021

FIGURE 18 INDIA AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE

FIGURE 19 INDIA AUTOMOTIVE LOGISTICS MARKET: BY TECHNOLOGY, 2021

FIGURE 20 INDIA AUTOMOTIVE LOGISTICS MARKET: BY DISTRIBUTION, 2021

FIGURE 21 INDIA AUTOMOTIVE LOGISTICS MARKET: BY APPLICATION, 2021

FIGURE 22 INDIA AUTOMOTIVE LOGISTICS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.