글로벌 타겟 드론 시장, 유형(회전형 및 고정형), 용도(공중 타겟, 지상 타겟 및 해상 타겟), 타겟 유형(자유 비행 타겟, 실물 크기 타겟, 소형 타겟, 스포츠 타겟 및 견인 타겟), 엔진 유형(제트 엔진 및 내연 기관), 속도(100M/S 미만 및 100M/S 초과), 작동 모드(원격 조종, 자율 및 선택적 조종), 탑재량(20kg 미만, 20~50kg 및 50kg 초과), 응용 분야(전투 훈련, 타겟 및 미끼, 타겟 식별, 정찰 및 타겟 획득), 최종 사용자(방위, 국토 안보 및 상업) - 업계 동향 및 2030년까지의 예측.

타겟 드론 시장 분석 및 규모

증가하는 국방 예산은 시장 성장의 주요 원동력으로 작용하고 있습니다. 또한 드론 기술의 발전과 제품 혁신에 대한 지출 증가가 시장 성장을 촉진할 것으로 예상됩니다. 시장에 부정적인 영향을 미칠 수 있는 주요 제약은 예산 제약과 규정 준수입니다. 연구 개발에 대한 막대한 투자는 시장 성장의 기회를 제공할 것으로 예상됩니다. 그러나 사이버 공격에 대한 타겟 드론 시스템의 취약성은 시장 성장에 도전할 것으로 예상됩니다.

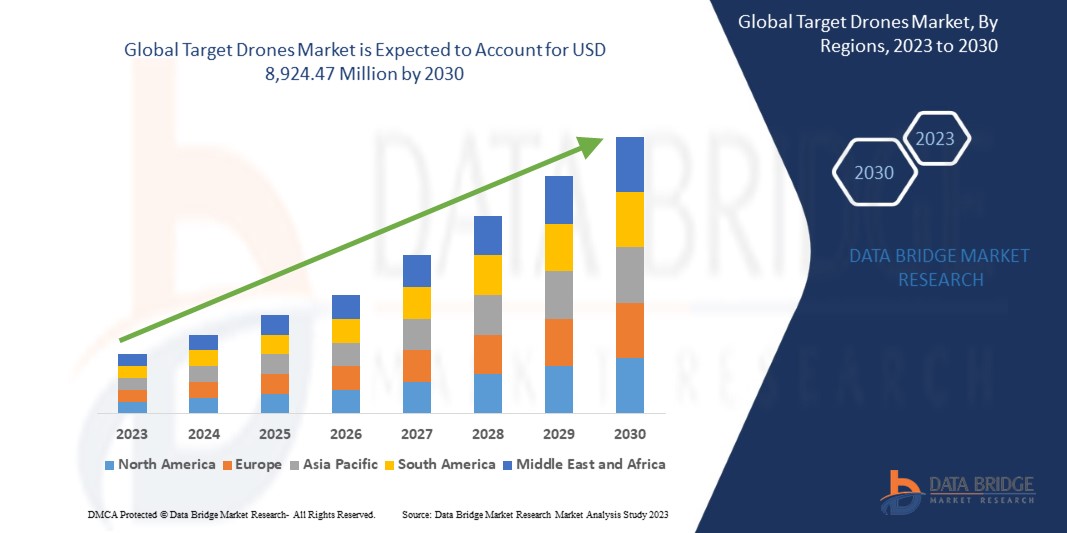

Data Bridge Market Research에 따르면 글로벌 타겟 드론 시장은 2030년까지 89억 2,447만 달러 규모에 도달할 것으로 예상되며, 이는 예측 기간 동안 연평균 성장률 5.3%를 기록할 것으로 예상됩니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적 해 |

2021 (2015-2020까지 사용자 정의 가능) |

|

양적 단위 |

수익 (단위: USD 백만) |

|

다루는 세그먼트 |

유형(회전 및 고정), 용도(항공 타겟, 지상 타겟 및 해상 타겟), 타겟 유형(자유 비행 타겟, 실물 타겟, 소형 타겟, 스포츠 타겟 및 견인 타겟), 엔진 유형(제트 엔진 및 IC 엔진), 속도(100M/S 미만 및 100M/S 초과), 작동 모드(원격 조종, 자율 및 선택적 조종), 탑재량(20kg 미만, 20~50kg 및 50kg 초과), 응용 분야(전투 훈련, 타겟 및 미끼, 타겟 식별, 정찰 및 타겟 획득), 최종 사용자(방위, 국토 안보 및 상업) |

|

적용 국가 |

독일, 영국, 이탈리아, 프랑스, 러시아, 스페인, 스위스, 터키, 벨기에, 네덜란드, 스웨덴, 덴마크, 폴란드 및 유럽의 나머지 지역, 중국, 일본, 한국, 인도, 싱가포르, 태국, 인도네시아, 말레이시아, 필리핀, 호주 및 뉴질랜드, 대만, 베트남 및 아시아 태평양의 나머지 지역, 미국, 캐나다 및 멕시코, 사우디 아라비아, 남아프리카, UAE, 이집트, 이스라엘, 오만, 카타르, 바레인 및 중동 및 아프리카의 나머지 지역, 브라질, 아르헨티나 및 남미의 나머지 지역 |

|

시장 참여자 포함 |

SCR, 원격 제어 시스템, MSP, ANADRONE, AeroTargets International LLC., Denel Dynamics, Thales, SAAB, SAFRAN, Lockheed Martin Corporation, AIRBUS, Griffon Aerospace, Northrop Grumman, Boeing, Leonardo SpA, Kratos Defense & Security Solutions, Inc. 등 |

시장 정의

타겟 드론은 다양한 군사적 목적으로 설계되고 사용되는 무인 항공기 (UAV)로, 주로 대공 시스템, 유도 미사일 또는 기타 무기 시스템의 훈련에서 타겟으로 사용됩니다. 이러한 드론은 실제 적 항공기, 미사일 또는 기타 위협의 동작과 특성을 시뮬레이션하여 군인에게 현실적인 훈련 시나리오를 제공하도록 설계되었습니다.

타겟 드론은 실제 위협의 레이더 단면적, 적외선 시그니처, 비행 패턴을 모방하기 위한 다양한 센서, 시스템, 기술을 갖추고 있습니다. 훈련의 특정 요구 사항에 따라 원격으로 제어하거나 자율적으로 작동할 수 있습니다. 군대는 타겟 드론을 사용하여 인간 조종사나 실제 항공기를 위험에 빠뜨릴 필요 없이 무기 시스템을 테스트하고 개선하고, 운영자를 훈련하고, 잠재적인 전투 상황에 대한 준비 상태를 강화할 수 있습니다.

글로벌 타겟 드론 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

운전자

- 다양한 국가의 국방비 지출 증가

인도, 미국, 중국 등 여러 국가와 유럽 국가도 전략적으로 국방 예산에 대한 투자를 늘리고 있습니다. 이러한 국가는 국방 역량을 강화하고 국가 안보 이익을 보호하기 위해 상당한 재정 자원을 할당하고 있습니다. 인도는 군대를 현대화하고 국방 인프라를 강화하기 위해 국방 지출을 점진적으로 늘리고 있습니다. 세계 군사 강국인 미국은 기술적 우위를 유지하고, 첨단 연구 개발을 지원하고, 군대 전반에 걸쳐 준비 상태를 보장하기 위해 상당한 자금을 계속 할당하고 있습니다. 게다가 중국은 군사 역량을 향상시키고, 최첨단 기술에 투자하고, 지역적 이익을 확보하기 위해 국방 예산을 적극적으로 확대하고 있습니다. 전 세계적으로 국방 예산 지출이 급증하고 있습니다.

- 드론 기술의 발전

드론 기술의 발전은 빠르게 변화하고 있으며, 역량과 가능성의 혁신적인 시대로 나아가고 있습니다. 다양한 도메인에 걸친 과학 및 기술의 발전이 수렴되어 타겟 드론의 잠재력과 그 응용 분야를 재정의하고 있습니다. 중요한 분야 중 하나는 감지 기술로, RADAR(Radio Detection and Ranging)와 LiDaR(Light Detection and Ranging) 시스템을 통합하여 성능 면에서 향상된 용량을 갖춘 드론을 제공합니다. 이를 통해 드론은 복잡한 지역을 탐색하고 정찰을 유지하고, 정밀하게 장애물을 피하고, 매우 정확한 지도를 생성할 수 있습니다. 동시에 무선 및 셀룰러 통신이 드론의 도달 범위를 확장하여 광대한 거리에서 실시간 데이터 전송과 원격 조종이 가능해졌습니다. 이러한 발전은 농업, 인프라 검사, 비상 대응과 같은 산업의 지평을 넓혀 전례 없는 효율성과 대응성으로 운영할 수 있게 했습니다.

제약/도전

- 숙련된 인력에 대한 의존성

타겟 드론의 효과적인 운영 및 활용은 숙련된 인력의 전문성에 달려 있습니다. 유능한 운영자는 훈련 중에 타겟 드론을 정확하게 조종하여 다양한 위협 시나리오의 현실적인 시뮬레이션을 보장하는 데 필수적입니다. 또한 숙련된 기술자는 이러한 고급 시스템을 유지 관리, 수리 및 문제 해결하여 일관된 성능에 기여하고 운영 수명을 연장하는 데 중요한 역할을 합니다. 숙련된 인력에 대한 의존성은 방위 및 훈련 맥락에서 타겟 드론 기술의 역량과 이점을 극대화하기 위한 훈련 프로그램과 전문성 개발의 중요성을 강조합니다.

- 전력 문제와 관련된 우려로 드론 성능이 저하됩니다.

타겟 드론은 작동에 연료를 공급하기 위해 다양한 전원에 의존하며, 각각 고유한 한계가 있습니다. 배터리 구동 드론은 단순성과 사용 편의성을 제공하지만, 제한된 에너지 용량으로 인해 비행 시간이 제한되어 짧은 임무에 적합합니다. 가스 구동 드론에 일반적으로 사용되는 내연 기관은 더 큰 지구력과 빠른 연료 보급 옵션을 제공합니다. 그러나 일반적으로 소음 수준과 배출이 더 높습니다. 수소 연료 전지는 수소 인프라와 저장에 의존하여 물류적 어려움을 일으킵니다.

기회

- AI(인공지능) 및 데이터 중심 기술의 상승 추세

AI 와 데이터 중심 기술 의 새로운 추세는 시장에 기회를 창출하고 있습니다. AI를 통합하면 타겟 드론이 보다 정교하고 적응력 있는 위협 행동을 시뮬레이션하여 훈련 시나리오의 현실성을 높일 수 있습니다. 또한 데이터 중심 기술을 통해 방대한 양의 훈련 데이터를 수집하고 분석하여 훈련생 성과와 시스템 동작에 대한 귀중한 통찰력을 제공할 수 있습니다. 이를 통해 훈련 프로그램을 지속적으로 개선하고 맞춤화할 수 있는 길이 열립니다.

- 내부 협업 및 파트너십

시장과 관련된 주요 시장 참여자들은 타겟 드론 제조업체의 성장하는 시장 전략에 대처하기 위해 시장에서 성장하기 위해 다양한 개발과 전략적 결정을 내리고 있습니다. 새로운 투자에서 협업에 이르기까지 시장의 주요 참여자들은 사업 관행을 발전시키고 전 세계적으로 파트너십과 홍보 전략을 통해 사업을 더욱 확장하고 있습니다.

최근 개발 사항

- 2023년 8월, 호주 국방부는 AIR6500 1단계(AIR6500-1)를 감독할 전략적 파트너로 록히드 마틴 코퍼레이션을 선택했습니다. 호주 방위군(ADF)은 AIR6500-1에서 공동 공중 전투 관리 시스템(JABMS)을 받게 되며, 이는 ADF의 다가올 통합 방공 및 미사일 방어(IAMD) 역량의 핵심이 되는 혁신적인 아키텍처 역할을 할 것입니다. 이를 통해 회사는 고객으로부터 더 많은 주문 제안을 받을 수 있습니다.

- 2023년 7월, 에어버스 재단은 커넥티드 보존 재단(CCF)과 힘을 합쳐 에어버스 방위 및 우주 위성 이미지의 도움을 받아 야생 동물을 보호하고 생태계를 보존했습니다.

- 2023년 7월, 캐나다 정부는 캐나다 대륙 방위 역량을 강화하고자 에어버스 방위 및 우주항공사와 새로 제작한 에어버스 A330 다목적 탱커 수송기(MRTT) 4대와 중고 A330-200 5대 개조 계약을 체결했습니다.

- 2023년 5월, 새로운 Boeing [NYSE: BA] Distribution Services 사이트가 Panattoni Park Rzeszów Airport III에 문을 열었습니다. 이 시설은 이전 위치에 비해 항공기 부품을 보관할 수 있는 공간을 두 배 이상 늘리고, 독특한 산업 허브인 폴란드의 Aviation Valley에서 Boeing의 입지를 확대합니다.

- 2023년 2월, 미국 해병대는 Northrop Grumman Corporation(NYSE: NOC)에 차세대 핸드헬드 타겟팅 시스템(NGHTS)의 초기 생산 및 운영 계약을 수주했습니다. NGHTS는 고급 정밀 타겟팅을 제공하고 GPS가 없는 환경에서도 작동할 수 있는 소형 타겟팅 시스템입니다.

글로벌 타겟 드론 시장 범위

글로벌 타겟 드론 시장은 유형, 용도, 타겟 유형, 엔진 유형, 속도, 작동 모드, 탑재량, 애플리케이션 및 최종 사용자를 기준으로 9개의 주요 세그먼트로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 주요 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 회전식

- 결정된

글로벌 타겟 드론 시장은 유형을 기준으로 회전형과 고정형으로 구분됩니다.

사용

- 공중 표적

- 지상 타겟

- 해양 타겟

글로벌 타겟 드론 시장은 용도를 기준으로 공중 타겟, 지상 타겟, 해상 타겟으로 구분됩니다.

대상 유형

- 자유 비행 표적

- 풀 스케일 타겟

- 하위 규모 대상

- 스포팅 타겟

- 견인 대상

글로벌 타겟 드론 시장은 타겟 유형을 기준으로 자유 비행 타겟, 실물 크기 타겟, 소형 타겟, 스포츠 타겟, 견인 타겟으로 구분됩니다.

엔진 유형

- 제트 엔진

- IC 엔진

엔진 유형을 기준으로 글로벌 타겟 드론 시장은 제트 엔진과 내연 기관 엔진으로 구분됩니다.

속도

- 100M/S 미만

- 100M/S 이상

글로벌 타겟 드론 시장은 속도를 기준으로 100m/s 미만과 100m/s 이상으로 구분됩니다.

작동 모드

- 원격 조종

- 자발적인

- 선택적으로 조종 가능

글로벌 타겟 드론 시장은 작동 방식을 기준으로 원격 조종, 자율 조종, 선택적 조종으로 구분됩니다.

탑재량 용량

- 20kg 이하

- 20 - 50kg

- 50kg 이상

글로벌 타겟 드론 시장은 탑재량을 기준으로 20kg 미만, 20~50kg, 50kg 이상으로 구분됩니다.

애플리케이션

- 전투 훈련

- 타겟과 미끼

- 타겟 식별

- 정찰

- 타겟 획득

글로벌 타겟 드론 시장은 응용 분야를 기준으로 전투 훈련, 타겟 및 미끼, 타겟 식별, 정찰, 타겟 획득으로 구분됩니다.

최종 사용자

- 방어

- 국토안보

- 광고

최종 사용자를 기준으로 글로벌 타겟 드론 시장은 방위, 국토 안보 및 상업으로 구분됩니다.

글로벌 타겟 드론 시장 지역 분석/통찰력

글로벌 타겟 드론 시장을 분석하고, 위에 언급된 대로 국가별 유형, 용도, 타겟 유형, 엔진 유형, 속도, 작동 모드, 탑재량, 응용 분야 및 최종 사용자에 대한 시장 규모 통찰력과 추세를 제공합니다.

글로벌 타겟 드론 시장 보고서에서 다루는 국가는 독일, 영국, 이탈리아, 프랑스, 러시아, 스페인, 스위스, 터키, 벨기에, 네덜란드, 스웨덴, 덴마크, 폴란드 및 기타 유럽 국가, 중국, 일본, 한국, 인도, 싱가포르, 태국, 인도네시아, 말레이시아, 필리핀, 호주 및 뉴질랜드, 대만, 베트남 및 기타 아시아 태평양 국가, 미국, 캐나다 및 멕시코, 사우디 아라비아, 남아프리카 공화국, UAE, 이집트, 이스라엘, 오만, 카타르, 바레인 및 기타 중동 및 아프리카 국가, 브라질, 아르헨티나 및 기타 남미 국가입니다.

북미는 글로벌 타겟 드론 시장을 지배할 것으로 예상되는데, 특히 미국을 비롯한 북미 국가에서는 군사 훈련, 준비 및 방위 연구에 많은 투자가 이루어지기 때문입니다. 타겟 드론은 이러한 군대의 준비 상태를 유지하는 데 필수적입니다. 영국은 강화된 군사 훈련에 대한 강조가 커지면서 유럽 지역에서 우위를 점할 것으로 예상됩니다. 중국은 드론 분야에서 R&D 및 벤처 캐피털 활동이 증가하면서 아시아 태평양 지역에서 우위를 점할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 글로벌 타겟 드론 시장 점유율 분석

글로벌 타겟 드론 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우위가 있습니다. 제공된 위의 데이터 포인트는 글로벌 타겟 드론 시장에 대한 회사의 초점과만 관련이 있습니다.

글로벌 타겟 드론 시장의 주요 기업으로는 SCR, Sistemas de Control Remoto, MSP, ANADRONE, AeroTargets International LLC., Denel Dynamics, Thales, SAAB, SAFRAN, Lockheed Martin Corporation, AIRBUS, Griffon Aerospace, Northrop Grumman, Boeing, Leonardo SpA, Kratos Defense & Security Solutions, Inc. 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MANUFACTURING FACILITIES & CAPACITIES

4.2 PRICING ANALYSIS

4.3 PRODUCTION VOLUME OVERVIEW

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING EXPENDITURES ON DEFENSE BY DIFFERENT COUNTRIES

5.1.2 ADVANCEMENTS IN DRONE TECHNOLOGY

5.1.3 RISING THREATS AND SECURITY CONCERNS

5.2 RESTRAINT

5.2.1 DEPENDENCY ON SKILLED PERSONNEL TO OPERATE

5.3 OPPORTUNITIES

5.3.1 RISING TREND OF AI (ARTIFICIAL INTELLIGENCE) AND DATA-DRIVEN TECHNOLOGY

5.3.2 INTERNAL COLLABORATION AND PARTNERSHIPS

5.4 CHALLENGE

5.4.1 CONCERNS RELATED TO POWER ISSUES HINDER THE PERFORMANCE OF DRONES

6 GLOBAL TARGET DRONES MARKET BY GEOGRAPHY

6.1 OVERVIEW

6.2 NORTH AMERICA

6.3 EUROPE

6.4 ASIA-PACIFIC

6.5 SOUTH AMERICA

6.6 MIDDLE EAST & AFRICA

7 GLOBAL TARGET DRONES MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: GLOBAL

7.2 COMPANY SHARE ANALYSIS: EUROPE

7.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

7.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.5 PARTNERSHIPS & CONTRACTS

7.6 EVENTS

7.7 AWARD

8 SWOT ANALYSIS

9 COMPANY PROFILE

9.1 LOCKHEED MARTIN CORPORATION

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 RECENT DEVELOPMENT

9.2 AIRBUS

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENTS

9.3 BOEING

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 COMPANY SHARE ANALYSIS

9.3.4 PRODUCT PORTFOLIO

9.3.5 RECENT DEVELOPMENTS

9.4 GRIFFON AEROSPACE

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENT

9.5 NORTHROP GRUMMAN

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 COMPANY SHARE ANALYSIS

9.5.4 PRODUCT PORTFOLIO

9.5.5 RECENT DEVELOPMENT

9.6 AEROTARGETS INTERNATIONAL LLC

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENTS

9.7 ANADRONE

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENT

9.8 DENEL DYNAMICS

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENT

9.9 KRATOS DEFENSE & SECURITY SOLUTIONS, INC

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENTS

9.1 LEONARDO S.P.A.

9.10.1 COMPANY SNAPSHOT

9.10.2 REVENUE ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENTS

9.11 MSP

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENT

9.12 SAAB AB

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

9.13 SAFRAN

9.13.1 COMPANY SNAPSHOT

9.13.2 REVENUE ANALYSIS

9.13.3 PRODUCT PORTFOLIO

9.13.4 RECENT DEVELOPMENT

9.14 SCR, SISTEMAS DE CONTROL REMOTO

9.14.1 COMPANY SNAPSHOT

9.14.2 PRODUCT PORTFOLIO

9.14.3 RECENT DEVELOPMENTS

9.15 THALES

9.15.1 COMPANY SNAPSHOT

9.15.2 REVENUE ANALYSIS

9.15.3 PRODUCT PORTFOLIO

9.15.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

그림 목록

FIGURE 1 GLOBAL TARGET DRONES MARKET: SEGMENTATION

FIGURE 2 GLOBAL TARGET DRONES MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL TARGET DRONES MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL TARGET DRONES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL TARGET DRONES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL TARGET DRONES MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL TARGET DRONES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 GLOBAL TARGET DRONES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL TARGET DRONES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL TARGET DRONES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL TARGET DRONES MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL TARGET DRONES MARKET, WHILE ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 13 A RISE IN EXPENDITUTE ON DEFENSE IS EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL TARGET DRONES MARKET IN THE FORECAST PERIOD

FIGURE 14 THE ROTARY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE GLOBAL TARGET DRONES MARKET IN 2023 AND 2030

FIGURE 15 NORTH AMERICA IS THE FASTEST-GROWING MARKET FOR THE TARGET DRONES MARKET IN THE FORECAST PERIOD

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL TARGET DRONES MARKET

FIGURE 17 GLOBAL TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 18 NORTH AMERICA TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 19 EUROPE TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 20 ASIA-PACIFIC TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 21 SOUTH AMERICA TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 22 MIDDLE EAST AND AFRICA TARGET DRONES MARKET: SNAPSHOT (2022)

FIGURE 23 GLOBAL TARGET DRONES MARKET: COMPANY SHARE 2022 (%)

FIGURE 24 EUROPE TARGET DRONES MARKET: COMPANY SHARE 2022 (%)

FIGURE 25 ASIA-PACIFC TARGET DRONES MARKET: COMPANY SHARE 2022 (%)

FIGURE 26 NORTH AMERICA TARGET DRONES MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.