Global Milk-Based Drinks Market, By Product (Animal-Based Milk and Plant-Based Milk), Flavor (Flavored and Unflavored/Plain), Nature (Organic and Conventional), Distribution Channel (Store Based Retailer and Non-Store Retailer) - Industry Trends and Forecast to 2030.

Milk-Based Drinks Market Analysis and Size

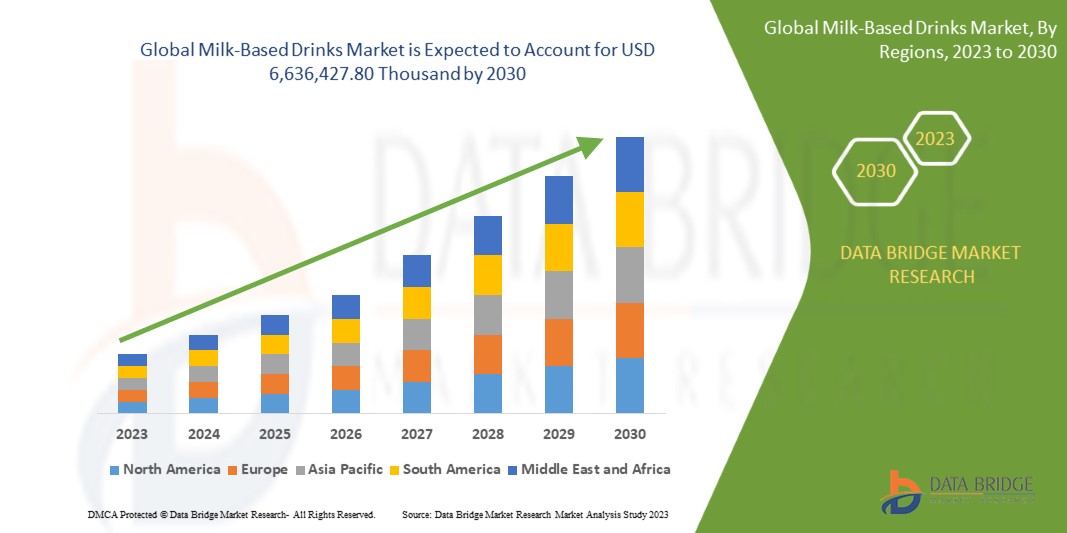

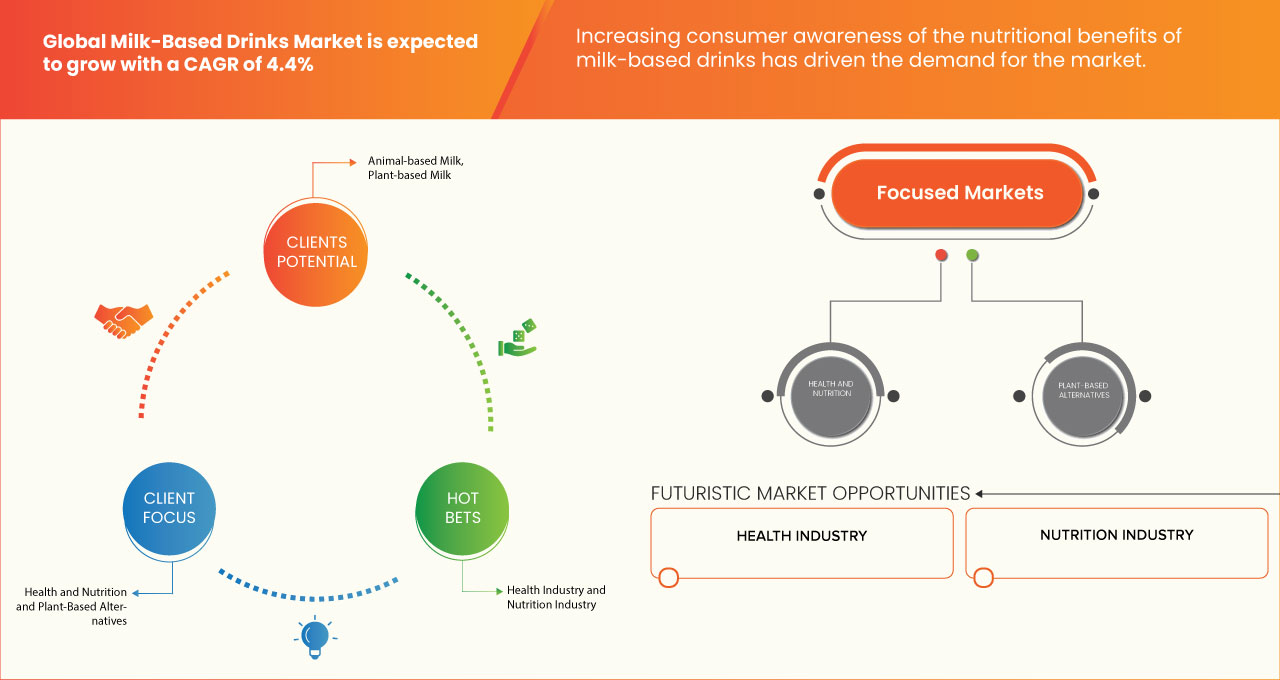

The global milk-based drinks market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyzes that the market is growing with a CAGR of 4.4% in the forecast period of 2023 to 2030 and is expected to reach USD 6,636,427.80 thousand by 2030. The major factor driving the market growth is the increasing consumer consciousness regarding health and well-being and the growing popularity of convenience and fast-paced lifestyles.

The global milk-based drinks market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Product (Animal-Based Milk and Plant-Based Milk), Flavor (Flavored and Unflavored/Plain), Nature (Organic and Conventional), Distribution Channel (Store Based Retailer and Non-Store Retailer) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Italy, U.K., Spain, France, Belgium, Netherlands, Switzerland, Russia, Turkey, and Rest of Europe, India, China, Japan, Australia & New Zealand, South Korea, Singapore, Thailand, Indonesia, Malaysia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, United Arab Emirates, Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East and Africa |

|

Market Players Covered |

Califia Farms, LLC, MOOALA BRANDS, LLC., Chobani, LLC., Simple FOODS Co., Ltd., TURM-Sahne GmbH, Sanitarium, Arla Foods amba, RUDE HEALTH, Danone S.A., Nestlé, THE HERSHEY COMPANY, Oatly Inc, YEO HIAP SENG LTD, Valsoia S.p.A., and GCMMF, among others |

Market Definition

The milk-based drinks market refers to the industry segment focused on the production, distribution, and consumption of beverages primarily derived from milk. This market encompasses a broad range of products, including dairy milk, plant-based milk alternatives, flavored milkshakes, and specialty coffee and tea beverages. It is influenced by consumer preferences for taste, health consciousness, and dietary choices, with companies competing to innovate and meet evolving consumer demands.

Global Milk-Based Drinks Market Dynamics

Drivers

- The Growing Popularity of Convenience and Fast-Paced Lifestyles

In recent years, a notable shift in consumer preferences towards convenience and on-the-go consumption has spurred the growth of various industries, including the global milk-based drinks market. This trend is a response to the fast-paced modern lifestyle, where consumers seek nutritious and protein-rich options that can be conveniently consumed anytime. Milk based drinks offer a solution by combining the nutritional benefits of protein, calcium and vitamins with the convenience of portable, pre-packaged drinks. Urbanization, busier schedules, longer commutes, and increased work demands have led to a significant shift in consumer behavior. As a result, consumers are increasingly seeking products that align with their fast-paced lives, making convenience a top priority. Moreover, the scarcity of time has prompted consumers to look for quick and easy solutions for their nutritional needs. Traditional meal patterns have evolved, with snacking and on-the-go consumption becoming more common.

In today's fast-paced world, traditional sit-down breakfasts are often replaced by on-the-go options. Milk-based drinks, especially those fortified with nutrients, are marketed as a quick and nutritious breakfast substitute. They provide a balanced meal option for people rushing to work or school.

The rise of e-commerce has enabled consumers to order milk-based drinks online, further enhancing convenience. Subscription services deliver these products to consumers' doorsteps at regular intervals, saving them time and effort in grocery shopping

Milk-based beverages are often enriched with other essential nutrients, vitamins, and minerals, making them a well-rounded, on-the-go meal replacement or snack option.

The global milk-based drinks market is experiencing robust growth due to the increasing prevalence of convenience-oriented and on-the-go lifestyles. Milk-based drinks have emerged as a convenient and nutritious solution as consumers prioritize nutrient-rich, portable options that align with their busy schedules. The rising consumption of milk-based drinks is expected to drive market growth globally.

- Increasing Consumer Consciousness Regarding Health and Well-Being

In recent years, there has been a significant shift in consumer preferences toward healthier lifestyles and nutritional awareness. This shift has spurred a rising trend in the consumption of protein-rich diets, which has subsequently driven market growth. Protein is a key component of milk-based drinks, and it aligns with the protein-focused diets favored by many health-conscious consumers.

High-protein milk-based drinks, often marketed as muscle-recovery or meal-replacement options, cater to individuals seeking to increase their protein intake for various health and fitness reasons. The increasing focus on health and wellness has led consumers to seek out dietary options that support their fitness goals and overall well-being. Protein is a critical macronutrient that plays a crucial role in muscle repair, maintenance, and overall bodily functions. Individuals are incorporating protein-rich diets into their daily routines as they become more proactive in managing their health. Milk-based drinks are adapting to various lifestyle diets such as vegetarianism, flexitarianism, and keto diets. Brands are offering alternatives such as almond milk, soy milk, and lactose-free options to cater to these dietary preferences.

There is a growing awareness among consumers about the nutritional value of beverages they consume, including milk-based drinks. Many consumers perceive milk as a source of essential nutrients such as calcium, vitamin D, protein, and various vitamins and minerals. This awareness drives the demand for milk-based drinks as a convenient and nutritious option.

There is a greater emphasis on maintaining health and wellness throughout life as the global population ages. Milk-based drinks fortified with nutrients important for aging, such as vitamin B12 and calcium, can appeal to this demographic.

Consumers' increasing focus on health and wellness, coupled with the convenience and diversity offered by these beverages, has led to their widespread adoption. To capitalize on these health and wellness trends, milk-based drink manufacturers and marketers need to align their product offerings, marketing strategies, and messaging with consumers' evolving health-conscious preferences. Hence, the rising trend of healthy and protein-rich diets is expected to drive market growth.

Opportunity

- The Increasing Favorability of Vegan and Plant-Based Dietary Choices

There has been a notable shift in dietary preferences towards plant-based alternatives, as consumers become increasingly health-conscious and environmentally aware. This shift is creating a favorable environment for market growth, as these products cater to the needs and preferences of this evolving consumer base.

The rising demand for vegan and plant-based diets is spurring innovation in the milk-based drinks segment. Manufacturers are developing a wide range of plant-based protein sources, such as pea protein, soy protein, and rice protein, to cater to different consumer preferences. The market is witnessing the emergence of specialized milk-based drinks targeting specific consumer segments, such as athletes, fitness enthusiasts, and individuals with dietary restrictions. Plant-based options are gaining popularity among these segments due to their nutritional benefits.

Manufacturers are responding to changing consumer preferences by innovating and diversifying their product offerings, expanding their retail presence, and educating consumers about the benefits of plant-based nutrition. The global milk-based drinks market is well-positioned to thrive and contribute to the evolving landscape of the food and beverage industry as the trend toward plant-based diets continues to grow. The rising demand for vegan and plant-based diets is expected to provide significant opportunities for market growth.

Restraints/Challenges

- Stringent Rules and Regulations Regarding Milk-Based Drinks

Stringent rules and regulations regarding milk-based drinks can present significant challenges to market growth, impacting various aspects of production, labeling, marketing, and distribution.

Many countries have strict regulations governing the composition and labeling of milk-based drinks. These rules often require accurate and comprehensive ingredient listings, nutritional information, and allergen declarations. Ensuring compliance can be complicated, particularly when formulating milk-based drinks with added flavors, fortifications, or alternative ingredients such as lactose-free components.

Stringent quality standards must be met to ensure the safety of milk-based drinks. This includes microbiological and chemical criteria, limits on contaminants, and specific requirements for pasteurization or heat treatment. Complying with these standards can be costly, as it may necessitate investments in quality control measures and testing facilities.

Regulations often mandate strict safety and hygiene practices in milk processing facilities. Maintaining these standards requires ongoing investments in infrastructure, equipment, employee training, and sanitation protocols. Failure to meet these requirements can result in costly fines or product recalls.

Increasingly, environmental regulations are impacting the milk-based drinks industry. Regulations related to packaging materials, waste disposal, and carbon emissions can necessitate changes in production processes and sourcing strategies.

In conclusion, stringent rules and regulations in the global milk-based drinks market create complex compliance challenges that can affect product formulation, quality control, and labelling, marketing, and international trade. Companies operating in this industry must invest in legal and regulatory expertise. These compliance efforts can add to operational costs and affect market strategies, making regulatory compliance a significant challenge in this sector.

- Rising Lactose Intolerance and Dairy Allergies

Rising lactose intolerance and dairy allergies pose significant restraint to market growth. These conditions are becoming increasingly prevalent and can act as restraints in several ways.

Consumers are becoming more cautious about their dairy consumption as awareness about lactose intolerance and dairy allergies grows. Many individuals with these conditions experience digestive discomfort, allergic reactions, or other health issues when consuming dairy-based products. This has led to a decline in the demand for traditional milk-based drinks.

Lactose-intolerant and dairy-allergic individuals seek dairy alternatives such as almond milk, soy milk, and oat milk, which do not trigger adverse reactions. This shift in consumer preferences has fueled the growth of the plant-based milk industry, diverting market share away from traditional milk-based drinks.

Milk-based drink manufacturers must invest in developing lactose-free or dairy-free alternatives to cater to lactose-intolerant and dairy-allergic consumers. Creating products that mimic the taste and texture of dairy while maintaining a clean label can be challenging and costly, hindering market expansion.

Strict labeling regulations are in place to protect consumers with allergies. Manufacturers must accurately label their products, and cross-contamination risks are a concern. Meeting these regulatory requirements can add complexity and cost to production, potentially affecting pricing and competitiveness.

Raising awareness about lactose intolerance and dairy allergies is a continuous process. Manufacturers may need to invest in educational campaigns to inform consumers about their lactose-free or dairy-free options, which can be costly and time-consuming.

In conclusion, the rising incidence of lactose intolerance and dairy allergies is a significant restraint in the global milk-based drinks market. Companies must adapt by developing suitable alternatives, complying with labeling regulations, and educating consumers to thrive in this changing landscape.

Recent Developments

- In August 2023, Chobani, LLC a next-generation food and beverage company known for Greek Yogurt, introduced Chobani Oatmilk Pumpkin Spice, a rich, creamy, pumpkin spice-flavored oat drink made from the goodness of whole grain oats. The latest addition to the brand’s pumpkin patch is vegan-friendly, a good source of calcium, and perfect for pumpkin spice enthusiasts looking for fall beverages that do not compromise on quality or flavor.

- In January 2023, Oatly Inc, the world’s original and largest oat drink company, and Ya YA Foods Corporation, a leading contract manufacturer of a broad range of aseptic food and beverage products, announced a long-term strategic hybrid partnership in North America. In this hybrid partnership, Oatly will continue to produce its proprietary oat base at both the Ogden, UT, and Fort Worth, TX facilities, which will then be transferred to Ya YA Foods to be co-packed into Oatly products on-site at each location.

- In November 2021, Arla Foods amba unveiled its new five-year strategy emphasizing its strong commitment to sustainable dairy production and responsible business expansion. Over the next five years, the company is poised to increase its investments by more than 40%, exceeding 4 billion EUR. These investments will be directed toward sustainability initiatives, digitalization, the adoption of innovative production technologies, and product development. In addition, the company plans to raise its dividend to 1+ billion EUR, demonstrating its dedication to supporting its farmer owners as they embark on their sustainability journey.

- In September 2021, Valsoia S.p.A. signed an agreement with Green Pro International B.V., who has 100% stake of Swedish Green Food Company AB, for the acquisition of 100% share capital of the Swedish Company, specialized in importing and distributing 100% vegetable products in the European territory.

- In March 2021, Hershey India Pvt Ltd, a part of THE HERSHEY COMPANY, developed Sofit Plus, a plant protein-fortified drink exclusively for its ‘Nourishing Minds’ social initiative. It is designed to meet the nutritional needs of underprivileged kids, the drink was developed by Hershey India in collaboration with IIT-Bombay, Sion Hospital and the NGO Annamrita.

Global Milk-Based Drinks Market Scope

The global milk-based drinks market is segmented into four notable segments based on product, flavour, nature, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Animal-Based Milk

- Plant-Based Milk

On the basis of product, the market is segmented into animal-based milk and plant-based milk.

Flavor

- Flavored

- Unflavored/Plain

On the basis of flavor, the market is segmented into flavored and unflavored/plain.

Nature

- Organic

- Conventional

On the basis of nature, the market is segmented into organic and conventional.

Distribution Channel

- Store Based Retailer

- Non-Store Retailer

On the basis of distribution channel, the market is segmented into store based retailer and non-store retailer.

Global Milk-Based Drinks Market Regional Analysis/Insights

The global milk-based drinks market is segmented into four notable segments based on product, flavor, nature, and distribution channel.

The countries covered in the global milk-based drinks market report are U.S., Canada, Mexico, Germany, Italy, U.K., Spain, France, Belgium, Netherlands, Switzerland, Russia, Turkey, and Rest of Europe, India, China, Japan, Australia & New Zealand, South Korea, Singapore, Thailand, Indonesia, Malaysia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, United Arab Emirates, Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East and Africa.

Asia-Pacific is expected to dominate the global milk-based drinks market due to the presence of a large production and consumption base in the region. India is expected to dominate the Asia-Pacific region in terms of market share and market revenue due to the ongoing product innovation and the emergence of distinctive and exotic flavors. The U.S. is expected to dominate the North America region due to the growing popularity of convenience and fast-paced lifestyles. Germany is expected to dominate the Europe region due to the increasing consumer consciousness regarding health and well-being.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Milk-Based Drinks Market Share Analysis

The global milk-based drinks market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the prominent participants operating in the global milk-based drinks market are Califia Farms, LLC, MOOALA BRANDS, LLC., Chobani, LLC., Simple FOODS Co., Ltd., TURM-Sahne GmbH, Sanitarium, Arla Foods amba, RUDE HEALTH, Danone S.A., Nestlé, THE HERSHEY COMPANY, Oatly Inc, YEO HIAP SENG LTD, Valsoia S.p.A., and GCMMF, among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING POPULARITY OF CONVENIENCE AND FAST-PACED LIFESTYLES

5.1.2 INCREASING CONSUMER CONSCIOUSNESS REGARDING HEALTH AND WELL-BEING

5.1.3 ONGOING PRODUCT INNOVATION AND THE EMERGENCE OF DISTINCTIVE AND EXOTIC FLAVORS

5.2 RESTRAINTS

5.2.1 RISING LACTOSE INTOLERANCE AND DAIRY ALLERGIES

5.2.2 SUPPLY CHAIN DISRUPTIONS DUE TO VARIOUS FACTORS

5.3 OPPORTUNITIES

5.3.1 INCREASING FAVORABILITY OF VEGAN AND PLANT-BASED DIETARY CHOICES

5.4 CHALLENGE

5.4.1 STRINGENT RULES AND REGULATIONS

6 GLOBAL MILK-BASED DRINKS MARKET BY GEOGRAPHY

6.1 OVERVIEW

6.2 ASIA PACIFIC

6.3 NORTH AMERICA

6.4 EUROPE

6.5 SOUTH AMERICA

6.6 MIDDLE EAST & AFRICA

7 GLOBAL MILK-BASED DRINKS MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: GLOBAL

7.2 COMPANY SHARE ANALYSIS: EUROPE

7.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

7.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.5 PARTNERSHIPS AND ACQUISITION

7.6 BUSINESS EXPANSION

7.7 NEW PRODUCT LAUNCH

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 OATLY INC

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 RECENT DEVELOPMENT

9.2 DANONE S.A.

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENTS

9.3 ARLA FOODS AMBA

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 NESTLÉ

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 COMPANY SHARE ANALYSIS

9.4.4 PRODUCT PORTFOLIO

9.4.5 RECENT DEVELOPMENTS

9.5 GCMMF

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENTS

9.6 CALIFIA FARMS, LLC

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENTS

9.7 CHOBANI, LLC

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENTS

9.8 MOOALA BRANDS, LLC.

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENTS

9.9 RUDE HEALTH

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENTS

9.1 SANITARIUM

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENTS

9.11 SIMPLE FOODS CO., LTD.

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENTS

9.12 THE HERSHEY COMPANY

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

9.13 TURM-SAHNE GMBH

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENTS

9.14 VALSOIA S.P.A.

9.14.1 COMPANY SNAPSHOT

9.14.2 REVENUE ANALYSIS

9.14.3 PRODUCT PORTFOLIO

9.14.4 RECENT DEVELOPMENT

9.15 YEO HIAP SENG LTD

9.15.1 COMPANY SNAPSHOT

9.15.2 REVENUE ANALYSIS

9.15.3 PRODUCT PORTFOLIO

9.15.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

표 목록

TABLE 1 GLOBAL MILK-BASED DRINKS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 2 GLOBAL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 INDIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 22 INDIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 INDIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 24 INDIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 INDIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 26 INDIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 27 INDIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 INDIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 INDIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 CHINA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 CHINA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 CHINA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 33 CHINA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 CHINA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 35 CHINA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 36 CHINA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 CHINA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 CHINA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 JAPAN MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 40 JAPAN PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 JAPAN MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 42 JAPAN FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 JAPAN MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 44 JAPAN MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 45 JAPAN STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 JAPAN NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 JAPAN ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 AUSTRALIA & NEW ZEALAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 51 AUSTRALIA & NEW ZEALAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 53 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 54 AUSTRALIA & NEW ZEALAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 AUSTRALIA & NEW ZEALAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 AUSTRALIA & NEW ZEALAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 SOUTH KOREA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 58 SOUTH KOREA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 SOUTH KOREA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 60 SOUTH KOREA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH KOREA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 62 SOUTH KOREA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 63 SOUTH KOREA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 SOUTH KOREA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH KOREA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 SINGAPORE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 67 SINGAPORE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 SINGAPORE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 69 SINGAPORE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 SINGAPORE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 71 SINGAPORE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 72 SINGAPORE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 SINGAPORE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 SINGAPORE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 THAILAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 76 THAILAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 THAILAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 78 THAILAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 THAILAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 80 THAILAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 81 THAILAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 THAILAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 THAILAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 INDONESIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 85 INDONESIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 INDONESIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 87 INDONESIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 INDONESIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 89 INDONESIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 90 INDONESIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 INDONESIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 INDONESIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 MALAYSIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 94 MALAYSIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 MALAYSIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 96 MALAYSIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 MALAYSIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 98 MALAYSIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 99 MALAYSIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 MALAYSIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 MALAYSIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 PHILIPPINES MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 103 PHILIPPINES PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 PHILIPPINES MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 105 PHILIPPINES FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 PHILIPPINES MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 107 PHILIPPINES MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 108 PHILIPPINES STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 PHILIPPINES NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 PHILIPPINES ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 REST OF ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 112 NORTH AMERICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 113 NORTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 114 NORTH AMERICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 NORTH AMERICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 116 NORTH AMERICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 NORTH AMERICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 118 NORTH AMERICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 119 NORTH AMERICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 NORTH AMERICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 NORTH AMERICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 125 U.S. FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 U.S. MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 127 U.S. MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 128 U.S. STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 U.S. NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 U.S. ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 131 CANADA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 132 CANADA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 134 CANADA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 136 CANADA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 CANADA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 MEXICO MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 141 MEXICO PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 MEXICO MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 143 MEXICO FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 MEXICO MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 145 MEXICO MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 146 MEXICO STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 MEXICO NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 MEXICO ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 EUROPE MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 150 EUROPE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 151 EUROPE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 152 EUROPE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 153 EUROPE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 EUROPE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 155 EUROPE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 156 EUROPE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 EUROPE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 EUROPE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 GERMANY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 160 GERMANY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 GERMANY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 162 GERMANY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 GERMANY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 164 GERMANY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 165 GERMANY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 GERMANY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 167 GERMANY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 ITALY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 169 ITALY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 170 ITALY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 171 ITALY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 ITALY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 173 ITALY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 174 ITALY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 175 ITALY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 ITALY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 U.K. MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 178 U.K. PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 179 U.K. MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 180 U.K. FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 U.K. MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 182 U.K. MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 183 U.K. STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 U.K. NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 185 U.K. ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 SPAIN MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 187 SPAIN PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 SPAIN MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 189 SPAIN FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 SPAIN MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 191 SPAIN MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 192 SPAIN STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 SPAIN NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 194 SPAIN ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 FRANCE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 196 FRANCE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 FRANCE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 198 FRANCE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 199 FRANCE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 200 FRANCE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 201 FRANCE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 202 FRANCE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 203 FRANCE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 204 BELGIUM MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 205 BELGIUM PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 BELGIUM MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 207 BELGIUM FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 BELGIUM MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 209 BELGIUM MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 210 BELGIUM STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 211 BELGIUM NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 BELGIUM ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 213 NETHERLANDS MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 214 NETHERLANDS PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 215 NETHERLANDS MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 216 NETHERLANDS FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 217 NETHERLANDS MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 218 NETHERLANDS MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 219 NETHERLANDS STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 220 NETHERLANDS NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 221 NETHERLANDS ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 222 SWITZERLAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 223 SWITZERLAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 224 SWITZERLAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 225 SWITZERLAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 226 SWITZERLAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 227 SWITZERLAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 228 SWITZERLAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 229 SWITZERLAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 230 SWITZERLAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 231 RUSSIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 232 RUSSIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 233 RUSSIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 234 RUSSIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 235 RUSSIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 236 RUSSIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 237 RUSSIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 238 RUSSIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 239 RUSSIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 TURKEY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 241 TURKEY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 242 TURKEY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 243 TURKEY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 244 TURKEY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 245 TURKEY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 246 TURKEY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 247 TURKEY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 248 TURKEY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 249 REST OF EUROPE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 250 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 251 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 252 SOUTH AMERICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 253 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 254 SOUTH AMERICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 255 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 256 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 257 SOUTH AMERICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 258 SOUTH AMERICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 259 SOUTH AMERICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 260 BRAZIL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 261 BRAZIL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 262 BRAZIL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 263 BRAZIL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 264 BRAZIL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 265 BRAZIL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 266 BRAZIL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 BRAZIL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 268 BRAZIL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 ARGENTINA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 270 ARGENTINA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 271 ARGENTINA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 272 ARGENTINA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 273 ARGENTINA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 274 ARGENTINA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 275 ARGENTINA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 276 ARGENTINA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 277 ARGENTINA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 278 REST OF SOUTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 279 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 280 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 281 MIDDLE EAST AND AFRICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 282 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 283 MIDDLE EAST AND AFRICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 284 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 285 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 286 MIDDLE EAST AND AFRICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 287 MIDDLE EAST AND AFRICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 288 MIDDLE EAST AND AFRICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 289 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 290 UNITED ARAB EMIRATES PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 291 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 292 UNITED ARAB EMIRATES FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 293 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 294 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 295 UNITED ARAB EMIRATES STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 296 UNITED ARAB EMIRATES NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 297 UNITED ARAB EMIRATES ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 299 SAUDI ARABIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 300 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 301 SAUDI ARABIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 302 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 303 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 304 SAUDI ARABIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 305 SAUDI ARABIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 306 SAUDI ARABIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 307 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 308 SOUTH AFRICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 309 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 310 SOUTH AFRICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 311 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 312 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 313 SOUTH AFRICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 314 SOUTH AFRICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 315 SOUTH AFRICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 316 EGYPT MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 317 EGYPT PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 318 EGYPT MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 319 EGYPT FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 320 EGYPT MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 321 EGYPT MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 322 EGYPT STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 323 EGYPT NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 324 EGYPT ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 325 ISRAEL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 326 ISRAEL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 327 ISRAEL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 328 ISRAEL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 329 ISRAEL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 330 ISRAEL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 331 ISRAEL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 332 ISRAEL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 333 ISRAEL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 334 REST OF MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

그림 목록

FIGURE 1 GLOBAL MILK-BASED DRINKS MARKET: SEGMENTATION

FIGURE 2 GLOBAL MILK-BASED DRINKS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL MILK-BASED DRINKS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL MILK-BASED DRINKS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL MILK-BASED DRINKS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL MILK-BASED DRINKS MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL MILK-BASED DRINKS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL MILK-BASED DRINKS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL MILK-BASED DRINKS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL MILK-BASED DRINKS MARKET: SEGMENTATION

FIGURE 11 GROWING CONSUMER AWARENESS AND FOCUS ON HEALTH AND WELLNESS IS EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL MILK-BASED DRINKS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE ANIMAL-BASED MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE GLOBAL MILK-BASED DRINKS MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MILK-BASED DRINKS MARKET

FIGURE 14 GLOBAL MILK-BASED DRINKS MARKET: SNAPSHOT ( 2022)

FIGURE 15 ASIA-PACIFIC MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 16 NORTH AMERICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 17 EUROPE MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 18 SOUTH AMERICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 19 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 20 GLOBAL MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 21 EUROPE MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 22 ASIA-PACIFC MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 23 NORTH AMERICA MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.