Global Bot Service Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

2.60 Billion

USD

5.60 Billion

2024

2032

USD

2.60 Billion

USD

5.60 Billion

2024

2032

| 2025 –2032 | |

| USD 2.60 Billion | |

| USD 5.60 Billion | |

|

|

|

|

Global BOT Services Market Segmentation, By Service (Framework and Platform), Type (Personal and Professional), Deployment Channel (Websites, Contact Centre and Customer Service, and Social Media), Mode (Text and Rich Media, Audio, and Video), End User (Banking, Financial Services, and Insurance (BFSI), Retail and e-commerce, Healthcare, Media and Entertainment, Telecom, Government, Education, Travel and Hospitality, Real Estate and Others) - Industry Trends and Forecast to 2032

BOT Services Market Size

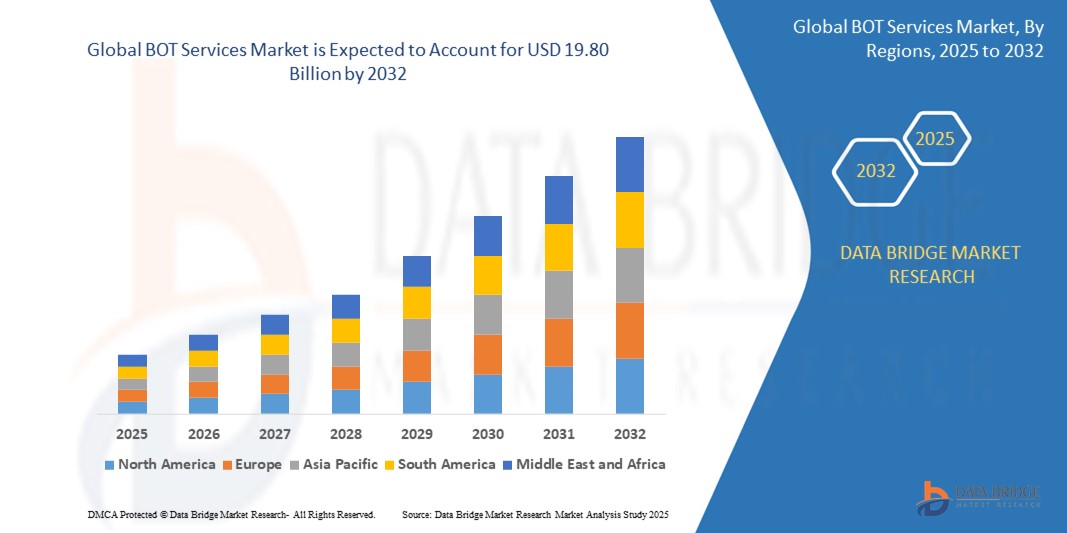

- The global BOT Services market size was valued atUSD 2.60 billion in 2024and is expected to reachUSD 19.80 billion by 2032, at aCAGR of 28.8%during the forecast period

- This growth is driven by factors such as the increasing adoption of AI and NLP technologies, the rising demand for automation in customer service, and the proliferation of internet-based and online services across industries

BOT Services Market Analysis

- BOT Services, encompassing chatbots and virtual assistants, are AI-powered software programs that simulate human conversations using natural language processing (NLP) and machine learning (ML) to automate tasks, enhance customer engagement, and streamline operations.

- The demand for BOT services is significantly driven by the global surge in digital transformation, with 70% of businesses adopting AI-driven solutions by 2025, and the growing number of social media users, projected to reach 5.85 billion by 2027.

- North America is expected to dominate the BOT Services market due to its advanced technological infrastructure and the presence of key players like Microsoft and Amazon Web Services.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid digitalization and increasing investments in AI in countries like China and India.

- The Customer Service segment is expected to dominate the market with a market share of 34.7% in 2025 due to its widespread use in automating support operations and improving customer satisfaction.

Report Scope and BOT Services Market Segmentation

|

Attributes |

BOT Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

BOT Services Market Trends

“Advancements in AI and NLP for Enhanced BOT Interactions”

- One prominent trend in the BOT Services market is the increasing integration of advanced AI and NLP technologies, enabling bots to handle complex queries and deliver personalized interactions with up to 40% improved accuracy.

- These advancements allow businesses to automate customer service and marketing tasks, reducing response times by 30% and enhancing user satisfaction.

- For instance, in January 2025, LG Electronics and Microsoft partnered to develop AI-driven bots for smart ecosystems, improving interactivity in homes and vehicles.

- These innovations are transforming BOT services, driving demand for scalable and intelligent platforms across industries

BOT Services Market Dynamics

Driver

“Increasing Demand for Automation and Cost Efficiency”

- The rising need for automation in customer service, sales, and operational processes, coupled with the potential to reduce support costs by up to 30%, is significantly contributing to the demand for BOT services.

- Businesses across sectors like retail and BFSI are adopting bots to handle high volumes of inquiries, with 80% of routine questions answered automatically.

- For instance, in 2024, HDFC Bank in India deployed AI-based bots to enhance customer experience, handling banking inquiries efficiently.

- As automation becomes critical for operational efficiency, the demand for BOT services rises, ensuring cost-effective and scalable solutions

Opportunity

“Growing Adoption of Cloud-Based BOT Platforms”

- Cloud-based BOT platforms offer scalability, ease of deployment, and cost efficiency, enabling businesses to integrate bots rapidly and support digital transformation.

- These platforms can reduce implementation costs by 25% compared to on-premise solutions, appealing to SMEs and large enterprises alike.

- For instance, in 2023, Amazon Web Services expanded its bot service offerings, enabling seamless integration with cloud-based applications.

- This opportunity drives market growth by addressing the need for flexible and accessible BOT solutions in a digital-first world.

Restraint/Challenge

“Data Privacy and Security Concerns”

- Data privacy and security concerns, with 60% of consumers expressing worries about bot-handled data in 2024, pose a significant challenge to the BOT Services market.

- Strict regulatory compliance requirements, such as GDPR in Europe and CCPA in the U.S., along with the persistent risk of data breaches, limit bot service adoption, particularly in sensitive sectors like BFSI (Banking, Financial Services, and Insurance), healthcare, and government.

- For instance, in 2024, 45% of enterprises reported facing significant challenges in ensuring their BOT services complied fully with updated data protection regulations, impacting bot deployment strategies.

- These challenges can hinder the market's growth trajectory, requiring service providers to invest heavily in advanced security frameworks, encryption, ethical AI practices, and transparent data handling policies to build user trust and ensure regulatory compliance

BOT Services Market Scope

The market is segmented on the basis technology, deployment channel, mode type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Deployment Channel |

|

|

By Mode |

|

|

By End User

|

|

In 2025, the Framework is projected to dominate the market with the largest share in Technology segment

The Framework segment is expected to dominate the BOT Services market with the largest share of 56.22% in 2025 due to its widespread adoption in streamlining development processes and enabling scalable solutions. Frameworks offer a structured and reusable code base, accelerating time-to-market and ensuring consistency across BOT projects. As companies increasingly prioritize automation and integration, the demand for robust development frameworks continues to drive growth and solidify this segment’s market leadership.

The Website is expected to account for the largest share during the forecast period in Deployment Mode market

In 2025, the Website segment is expected to dominate the BOT Services market with the largest market share of 51.31% due to its ease of access, lower operational costs, and growing preference for web-based interfaces. As businesses seek to deliver seamless user experiences and maintain centralized control over services, websites emerge as the preferred deployment channel. The proliferation of cloud computing and cross-platform accessibility further amplifies this segment’s dominance during the forecast period.

BOT Services Market Regional Analysis

“North America Holds the Largest Share in the BOT Services Market”[AN2]

- North America dominates the BOT Services market, driven by advanced technological infrastructure, high AI adoption, and the presence of key players like Microsoft and Google.

- The U.S. holds a significant share, capturing 33.46% of the global market in 2023, due to early adoption of bots in retail, BFSI, and healthcare sectors.

- The availability of robust cloud infrastructure and growing investments in AI research further strengthen the market.

- In addition, the high penetration of social media and e-commerce platforms fuels market expansion across the region.

“Asia-Pacific is Projected to Register the Highest CAGR in the BOT Services Market[AN3] ”

- The Asia-Pacific region is expected to witness the highest growth rate, driven by rapid digitalization, increasing social media users, and government-led AI initiatives.

- Countries such as China and India are emerging as key markets, with India projected to grow at a CAGR of 35.2% due to its expanding IT sector and automation demand.

- China, with a projected market value of USD 1.3 billion by 2032, remains a crucial market for BOT services due to its e-commerce growth.

- The expanding presence of global BOT vendors and improving technological infrastructure further contribute to market growth.

BOT Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Microsoft Corporation (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Google LLC (U.S.)

- IBM Corporation (U.S.)

- Nuance Communications, Inc. (U.S.)

- Meta Platforms, Inc. (U.S.)

- [24]7.ai, Inc. (U.S.)

- Inbenta Holdings Inc. (U.S.)

- Creative Virtual Ltd. (U.K.)

- Kore.ai, Inc. (U.S.)

Latest Developments in Global BOT Services Market

- January 2025: UiPath, a global leader in robotic process automation (RPA), launched its AI-powered automation platform in the European Union to further enhance its capabilities in automating complex business workflows. The platform integrates advanced machine learning and natural language processing to allow businesses to automate tasks that require higher cognitive abilities, such as customer service and document processing. This move aims to expand the use of BOTs beyond simple tasks, positioning UiPath at the forefront of automation in industries like finance and healthcare.

- October 2024: Automation Anywhere unveiled its new Bot Insight 4.0 at the Automation Anywhere World 2024 conference, which includes powerful AI and machine learning capabilities for advanced analytics and decision-making in RPA processes. Bot Insight 4.0 allows organizations to track the real-time performance of BOTs and optimize workflows through in-depth analytics, providing greater transparency and control over automation deployments. The platform is expected to enhance BOT adoption, particularly in industries such as banking, insurance, and telecommunications, where data analysis is crucial.

- September 2024: At the Digital Transformation Expo 2024, Blue Prism announced the launch of Intelligent Automation Hub, a platform designed to help enterprises accelerate their digital transformation initiatives. This platform offers an integrated suite of tools for automating business processes, enabling companies to deploy and manage intelligent BOTs with greater ease. The new system also incorporates enhanced AI capabilities to provide real-time insights into operational performance, making it particularly useful for industries such as retail, healthcare, and logistics.

- September 2024: AutomationEdge, a leading provider of IT process automation, introduced EdgeBot, an advanced BOT service aimed at automating IT operations and support. EdgeBot uses a combination of RPA and artificial intelligence to handle incident management, problem resolution, and system monitoring, helping businesses reduce the workload on IT teams and improve operational efficiency. With the launch of EdgeBot, AutomationEdge continues to strengthen its position in the market by expanding its BOT offerings into the IT management space.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.