Global Bioinformatics Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

14.27 Billion

USD

57.03 Billion

2024

2032

USD

14.27 Billion

USD

57.03 Billion

2024

2032

| 2025 –2032 | |

| USD 14.27 Billion | |

| USD 57.03 Billion | |

|

|

|

|

Global Bioinformatics Market Segmentation, By Type (Knowledge Management Tools and Bioinformatics Software and Services), Sector (Medical Biotechnology, Academics, Animal Biotechnology, AgriculturalBiotechnology, Environmental Biotechnology, Forensic Biotechnology, and Others), Application (Genomics& Drug Development, Proteomics, Evolutionary Studies, Agricultural Studies, Veterinary Science, Metabolomics, Transcriptomics, and Others), Purchase Mode (Group Purchase and Individual Purchase), Method (Genomics and Proteomics) End-User, (Research and Academic Institutes, Clinical Research Organization, Biotech and Pharmaceutical Companies, Research Laboratories, Hospital, and Others) - Industry Trends and Forecast to 2032

Bioinformatics Market Size

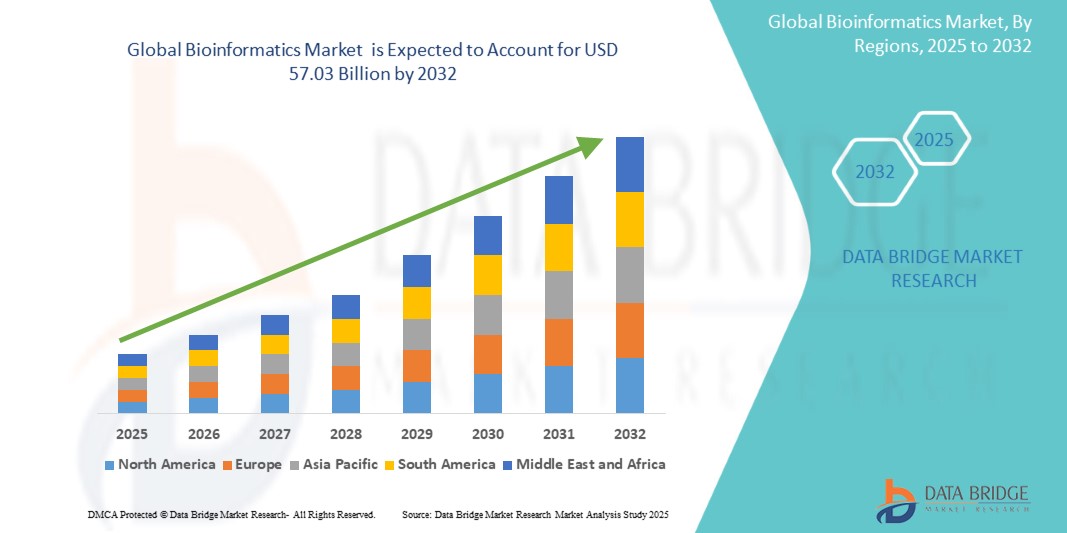

- The global bioinformatics market was valued atUSD 14.27 billion in 2024and is expected to reachUSD 57.03 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 18.90%,primarily driven by growing demand for genomic research

- This growth is driven by increasing applications in drug discovery and advancements in artificial intelligence (AI)-powered analytics

Bioinformatics Market Analysis

- Bioinformatics has gained widespread acceptance due to its role in genomic research, drug discovery, and personalized medicine, driving advancements in healthcare, agriculture, and biotechnology. Its ability to analyze complex biological data, accelerate precision medicine, and support genome sequencing technologies has solidified its position in modern life sciences

- The market is primarily driven by rising demand fornext-generation sequencing(NGS), increasing applications inbiomarkerdiscovery, and the integration ofartificial intelligence(AI) and machine learning (ML) for enhanced biological data interpretation. In addition, growing investments in bioinformatics infrastructure,cloud computingsolutions, and biopharmaceutical collaborations are accelerating market expansion

- For instance, in the U.S. and Europe, the demand for bioinformatics tools has surged due to the increasing adoption ofprecision medicineand AI-driven genomic research, contributing to sustained market growth

- Globally, bioinformatics continues to be a cornerstone in genomic data analysis and biopharmaceutical research, with innovations such as cloud-based bioinformatics platforms, advanced computational biology techniques, and AI-powered genetic diagnostics driving industry transformation and ensuring long-term market sustainability

Report Scope and Bioinformatics Market Segmentation

|

Attributes |

Bioinformatics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Bioinformatics Market Trends

“Growing Adoption of Bioinformatics in Precision Medicine and Drug Discovery”

- The increasing demand for personalized medicine is driving the integration of bioinformatics in genomic research, drug discovery, and biomarker identification to develop targeted therapies

- Pharmaceutical and biotech companies are leveraging bioinformatics-driven AI and machine learning tools to accelerate drug development, improve disease diagnosis, and enhance treatment efficacy

- The rising focus on next-generation sequencing (NGS) technologies and genomic data analysis is fueling investments in cloud-based bioinformatics platforms for scalable and efficient data processing

For instance,

- In March 2024, Illumina, Inc. partnered with AstraZeneca to enhance AI-based genomic interpretation tools for accelerating therapeutic target discovery

- In January 2024, Thermo Fisher Scientific launched a new bioinformatics-powered drug discovery platform, enabling faster and more precise pharmaceutical research

- In September 2023, BGI announced advancements in AI-driven genomic sequencing, improving the accuracy and speed of bioinformatics analysis for personalized medicine

- As the healthcare and pharmaceutical industries continue to embrace data-driven research, bioinformatics will remain pivotal in genomic medicine, drug innovation, and precision healthcare solutions, ensuring long-term industry growth

Bioinformatics Market Dynamics

Driver

“Rising Adoption of Bioinformatics in Precision Oncology”

- The increasing prevalence of cancer is driving demand for bioinformatics, which plays a crucial role in genomic analysis, biomarker discovery, and personalized cancer treatment strategies

- Pharmaceutical companies and research institutions are leveraging bioinformatics-driven AI and machine learning tools to develop targeted therapies, improve early cancer detection, and enhance treatme nt outcomes

- Government-funded cancer genomics projects and advancements in next-generation sequencing (NGS) technologies are further accelerating the integration of bioinformatics in oncology research

For instance,

- In November 2024, QIAGEN launched an AI-powered bioinformatics platform to enhance genomic data interpretation for precision oncology

- In August 2024, Thermo Fisher Scientific partnered with leading cancer research centers to develop bioinformatics-driven tools for personalized treatment plans

- In March 2024, the National Cancer Institute expanded its bioinformatics research funding, supporting AI-based genomic analysis for early cancer detection

- As the demand for precision medicine grows, bioinformatics will continue to transform oncology research, drug development, and patient care, ensuring more effective and personalized cancer treatments

Opportunity

“Increasing Adoption of Bioinformatics in Agriculture and Crop Genomics”

- The rising demand for sustainable agriculture and genetically optimized crops is driving the adoption of bioinformatics in plant breeding, pest resistance research, and yield improvement strategies

- Advancements in genome sequencing and computational biology are enabling researchers to develop climate-resilient crops, reducing the impact of environmental stressors on food production

- Governments and agritech companies are investing in bioinformatics-based research to enhance crop productivity, ensure food security, and optimize agricultural resource management

For instance,

- In March 2025, Syngenta collaborated with a leading bioinformatics firm to develop AI-powered crop genome analysis for precision breeding

- In December 2024, Bayer AG launched a bioinformatics-driven platform to improve pest-resistant crop varieties and reduce chemical pesticide dependency

- In September 2024, the Indian Council of Agricultural Research (ICAR) introduced a national initiative integrating bioinformatics into genetic mapping for drought-resistant crops

- As the agricultural sector embraces data-driven decision-making, bioinformatics will continue to revolutionize crop genomics, sustainable farming, and food security, making it a key driver of agricultural innovation

Restraint/Challenge

“Data Privacy and Security Concerns in Bioinformatics Applications”

- The growing use of bioinformatics in genomics, healthcare, and pharmaceuticals raises concerns over data privacy, cybersecurity threats, and unauthorized access to sensitive genetic information

- Strict regulatory frameworks such as GDPR and HIPAA impose compliance challenges on companies handling large-scale biomedical and genomic data, impacting research and commercial applications

- Increasing incidents of cyberattacks and data breaches in healthcare and biotechnology sectors have led to heightened security requirements and the need for advanced encryption technologies

For instance,

- In January 2025, the U.S. Department of Health and Human Services (HHS) introduced stricter compliance measures for bioinformatics firms handling patient genetic data under HIPAA regulations

- As data security concerns continue to challenge bioinformatics adoption, industry players must invest in robust encryption, block chain-based data management, and AI-driven cybersecurity solutions to maintain regulatory compliance and protect user trust

Bioinformatics Market Scope

The market is segmented on the basis of type, sector, application, purchase mode, genomics, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Sector |

|

|

By Application |

|

|

By Purchase Mode |

|

|

By Method |

|

|

By End User |

|

Bioinformatics Market Regional Analysis

“North America is the Dominant Region in the Bioinformatics Market”

- North America dominates the global bioinformatics market due to advanced research capabilities, strong biotech industry presence, and significant government funding for genomic and computational biology projects

- The region is at the forefront of AI-driven bioinformatics, precision medicine, and next-generation sequencing (NGS), accelerating drug discovery and personalized healthcare

- Major universities, research institutions, and pharmaceutical companies in the U.S. and Canada are actively engaged in genome sequencing, proteomics, and computational drug design

- The widespread integration of cloud computing, machine learning, and data analytics into life sciences is further propelling market growth

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the bioinformatics market, driven by rising investments in genomic research, increasing demand for precision medicine, and expanding biotech and pharmaceutical sectors

- China and India are emerging as key markets due to growing government support for biotechnology, advancements in next-generation sequencing (NGS), and rising adoption of AI-driven bioinformatics solutions

- China leads the region in bioinformatics innovations, with state-backed initiatives to enhance genomic data analysis and increasing collaborations between biotech firms and research institutions

- India is experiencing rapid market expansion, supported by a growing pharmaceutical industry, increasing clinical research activities, and rising demand for computational drug discovery solutions

- The presence of top bioinformatics companies, rapid digital transformation in healthcare, and growing cross-border research collaborations are further fueling Asia-Pacific’s bioinformatics market growth

Bioinformatics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- QIAGEN (Germany)

- SOPHiA GENETICS (Switzerland)

- BGI (China)

- Eurofins Scientific (Luxembourg)

- Water Corporation (Australia)

- DNASTAR (U.S.)

- Dassault Systèmes (France)

- Bayer AG (Germany)

- DNAnexus, Inc. (U.S.)

- PerkinElmer (U.S.)

- Seven Bridges Genomics (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- AstridBio Technologies Inc. (U.S.)

- BioBam Bioinformatics (Spain)

- Strand (India)

- GenoFAB (U.S.)

Latest Developments in Global Bioinformatics Market

- In October 2022, Illumina, Inc. and AstraZeneca established a strategic research collaboration to accelerate therapeutic target discovery by integrating AI-based genome interpretation with genomic analysis tools, enhancing confidence in drug target identification through human omics insights

- In September 2022, Thermo Fisher Scientific became a founding sponsor of the Pennsylvania Biotechnology Center (PABC), supporting both the Philadelphia-based B+Labs incubator and the PABC site in Doylestown, Pennsylvania, to help life science startups accelerate commercialization

- In June 2022, LatchBio introduced an end-to-end bioinformatics platform for managing large-scale biotech data, aiming to streamline scientific discovery and enhance research efficiency

- In March 2022, ARUP unveiled Rio, a bioinformatics pipeline and analytics platform, designed to improve the speed and accuracy of next-generation sequencing (NGS) test results

- In January 2021, BGI expanded its collaboration with the Ministry of Health of Brunei to enhance public health initiatives, including emergency response, diagnostic screening, personalized medicine, and early cancer detection through advanced sequencing technology

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.