Europe Yogurt Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

28.78 Billion

USD

43.35 Billion

2024

2032

USD

28.78 Billion

USD

43.35 Billion

2024

2032

| 2025 –2032 | |

| USD 28.78 Billion | |

| USD 43.35 Billion | |

|

|

|

|

سوق الزبادي في أوروبا، نوع الزبادي (زبادي سكاير/ زبادي على الطريقة الأيسلندية، زبادي مركز، زبادي بروبيوتيك، زبادي متماسك، زبادي حيوي، زبادي مخفوق، وغيرها)، نوع المنتج (زبادي صالح للشرب، زبادي للملعقة، زبادي مجمد، وغيرها)، محتوى الدهون (كامل الدسم، قليل الدسم، وخالي من الدهون)، النكهة (عادي ومُنكّه)، نوع المصدر (حيواني، نباتي، وصناعي)، التركيبة (مُحلى وغير مُحلى)، العلامة التجارية (يوبليه، تشوباني، ستونيفيلد جريك، كورنر، أكتيفيا، يو، أويكوس، أرلا سكاير، أيسلندا بروفيشنز سكاير، إيزي سكاير، وغيرها)، فئة التضمين (عادي ومع إضافات)، المُدعّم (عادي ومُدعّم)، الادعاء (خالي من الغلوتين، خالي من اللاكتوز). خالٍ من المواد الحافظة الصناعية، خالٍ من منتجات الألبان، خالٍ من الصويا، غير معدل وراثيًا، خالٍ من السكر، خالٍ من السعرات الحرارية، مع جميع الادعاءات المذكورة أعلاه، عادي بدون أي ادعاءات، وغيرها)، فئة المنتجات العضوية (التقليدية والعضوية)، العلامة التجارية (العلامة التجارية والعلامة التجارية الخاصة)، التغليف (الأكياس داخل الصندوق، الأكياس، البرطمانات، الأكواب، الزجاجات، عبوات التترا، وغيرها)، حجم التغليف (أقل من 100 جرام، 100-200 جرام، 201-300 جرام، وأكثر من 300 جرام)، وقناة التوزيع (التجزئة القائمة على المتاجر والتجزئة غير القائمة على المتاجر) - اتجاهات الصناعة والتوقعات حتى عام 2032.

تحليل سوق الزبادي في أوروبا

الزبادي طعامٌ قديم، استخدمته شعوب آسيا وأوروبا والشرق الأوسط عبر آلاف السنين. ظهر الزبادي لأول مرة خلال العصر الحجري الحديث، منذ حوالي 5000-10000 عام، وربما كان ذلك نتيجةً لتخمّر الحليب طبيعيًا في درجات الحرارة الدافئة. تُظهر الأدلة المستمدة من الفخار القديم أن سكان العصر الحجري الحديث كانوا يستخدمون الأواني لتخزين الحليب. كان الزبادي، باعتباره طعامًا مُخمّرًا، وسيلةً رائعةً لحفظ الحليب، إذ تُبطئ حموضته نمو البكتيريا الضارة. كان الزبادي طعامًا معروفًا في الإمبراطورية اليونانية والرومانية، ولعب دورًا رئيسيًا في مطبخ البحر الأبيض المتوسط منذ عام 800 قبل الميلاد.

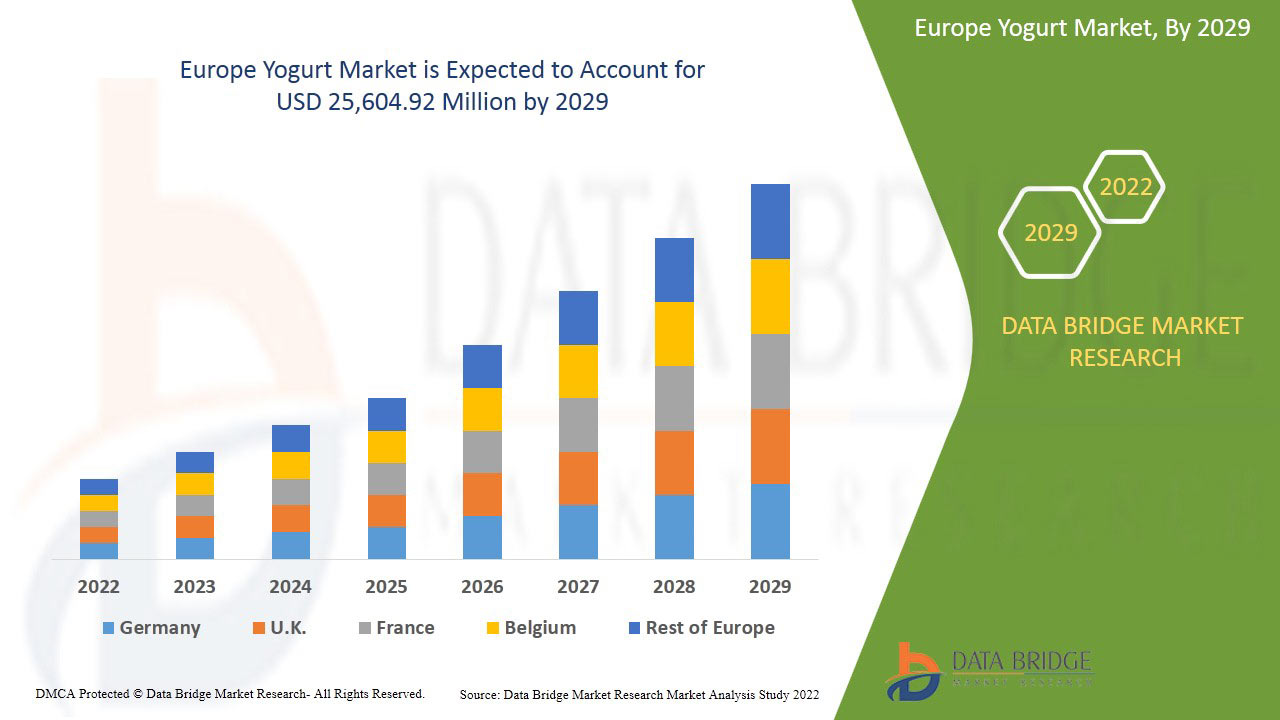

حجم سوق الزبادي في أوروبا

قُدِّر حجم سوق الزبادي في أوروبا بـ 28.78 مليار دولار أمريكي في عام 2024، ومن المتوقع أن يصل إلى 43.35 مليار دولار أمريكي بحلول عام 2032، بمعدل نمو سنوي مركب قدره 5.4% خلال الفترة المتوقعة من 2025 إلى 2032. بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية والجهات الفاعلة الرئيسية، تتضمن تقارير السوق التي أعدتها شركة Data Bridge Market Research أيضًا تحليل الاستيراد والتصدير، ونظرة عامة على القدرة الإنتاجية، وتحليل استهلاك الإنتاج، وتحليل اتجاه الأسعار، وسيناريو تغير المناخ، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام/المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي.

اتجاهات سوق الزبادي في أوروبا

"الاهتمام المتزايد بالأغذية الوظيفية"

يُحدث الاهتمام المتزايد بالأغذية الوظيفية تحولاً سريعاً في سوق الزبادي الأوروبي، حيث يبحث المستهلكون بشكل متزايد عن منتجات تُقدم أكثر من مجرد تغذية أساسية. ويكتسب الزبادي المُضاف إليه الفيتامينات والمعادن والبروبيوتيك زخماً متزايداً مع بحث الناس عن خيارات غذائية تُسهم في فوائد صحية مُحددة، مثل تحسين صحة الأمعاء، وتعزيز المناعة، وتحسين وظيفة الجهاز الهضمي. ويعكس هذا التحول نحو الأغذية الوظيفية توجهاً استهلاكياً أوسع يُعطي الأولوية للأطعمة التي تُلبي غرضاً مزدوجاً - إشباع الجوع مع توفير فوائد صحية ملموسة في الوقت نفسه. ونتيجةً لذلك، يُعزز مُصنّعو الزبادي منتجاتهم بشكل متزايد بمكونات مفيدة مثل فيتامين د والكالسيوم والبكتيريا الحية، مُستفيدين من الطلب المتزايد على الأغذية المُركزة على العافية. ويُسهم التنوع المُتزايد في منتجات الزبادي الوظيفية، بما في ذلك تلك المُصممة خصيصاً لاحتياجات صحية مُحددة مثل صحة العظام أو دعم المناعة، في نمو السوق. ويُسهم هذا الاهتمام المُتزايد من المستهلكين بالأغذية الوظيفية في وضع الزبادي كلاعب رئيسي في قطاع الأغذية الصحية المُتنامي، مما يُسرّع من توسع سوقه في جميع أنحاء أوروبا.

نطاق التقرير وتقسيم سوق الزبادي في أوروبا

|

صفات |

رؤى حول سوق الاختبارات التشخيصية في ألمانيا وسويسرا والنمسا |

|

القطاعات المغطاة |

نوع الزبادي (الزبادي، زبادي سكاير/الزبادي على الطريقة الأيسلندية، الزبادي المركز، زبادي البروبيوتيك، الزبادي المتماسك، الزبادي الحيوي الحي، الزبادي المخفوق، وغيرها)، نوع المنتج (زبادي صالح للشرب، زبادي بالملعقة، زبادي مجمد ، وغيرها)، محتوى الدهون (كامل الدسم، قليل الدسم، وخالي من الدهون)، النكهة (عادي ومُنكّه)، نوع المصدر (حيواني، نباتي، وصناعي)، التركيبة (مُحلى وغير مُحلى)، العلامة التجارية (يوبليه، تشوباني، ستونيفيلد جريك، كورنر، أكتيفيا، يو، أويكوس، أرلا سكاير، آيسلندا بروفيشنز سكاير، إيزي سكاير، وغيرها)، فئة التضمين (عادي ومع شوائب وإضافات)، المُدعّم (عادي ومُدعّم)، الادعاء (خالي من الغلوتين، خالٍ من اللاكتوز، مواد حافظة صناعية) خالي من منتجات الألبان، خالي من الصويا، غير معدل وراثيًا، خالي من السكر، خالي من السعرات الحرارية، مع جميع الادعاءات المذكورة أعلاه، عادي بدون أي ادعاءات، وغيرها)، فئة المنتجات العضوية (التقليدية والعضوية)، العلامة التجارية (العلامة التجارية والخاصة)، التغليف (كيس في صندوق، أكياس، برطمانات، أكواب، زجاجات، عبوات رباعية، وغيرها)، حجم التغليف (أقل من 100 غرام، 100-200 غرام، 201-300 غرام، وأكثر من 300 غرام)، وقناة التوزيع (التجزئة في المتاجر والتجزئة خارج المتاجر) |

|

الدول المغطاة |

ألمانيا، فرنسا، المملكة المتحدة، إيطاليا، إسبانيا، روسيا، هولندا، بلجيكا، سويسرا، تركيا، وبقية أوروبا |

|

اللاعبون الرئيسيون في السوق |

دانون (فرنسا)، نستله (سويسرا)، إيمي المحدودة (لندن)، مولر المملكة المتحدة وأيرلندا (إنجلترا)، فريزلاند كامبينا (هولندا)، شركة كامبل (الولايات المتحدة)، أرلا فودز أمبا (الدنمارك)، شريبر للأغذية (الولايات المتحدة)، سوديال (فرنسا)، كريمو إس إيه (سويسرا)، فين فارم ديري (المملكة المتحدة)، لاكتياس فلور دي بورغوس إس إل (إسبانيا)، لاتيه ماريما (إيطاليا)، نيولات فود إس بي إيه (إيطاليا)، مجموعة هاين سيليستيال (نيويورك)، ويو فالي أورجانيك المحدودة (المملكة المتحدة). |

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم إعدادها بواسطة Data Bridge Market Research تشمل أيضًا تحليل الاستيراد والتصدير، ونظرة عامة على القدرة الإنتاجية، وتحليل استهلاك الإنتاج، وتحليل اتجاه الأسعار، وسيناريو تغير المناخ، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

تعريف سوق الزبادي في أوروبا

الزبادي منتج ألبان غني بالدهون، يحتوي عادةً على ما بين 30% و40% من دهن الحليب، وهو مصمم خصيصًا للخفق للحصول على قوام خفيف وهش. يمكن صنعه من حليب الأبقار أو غيرها من الحيوانات المنتجة للألبان، ويتميز بقوام غني وكريمي، مما يجعله مثاليًا للاستخدامات الطهوية، مثل تزيين الحلويات، وتحضير الحشوات، وإثراء الصلصات. يسمح محتواه العالي من الدهون بامتصاص الهواء عند خفقه، مما ينتج عنه رغوة ثابتة تحافظ على شكلها، مما يجعله مكونًا شائعًا في المطابخ المنزلية والمحترفة، لتحضير مجموعة متنوعة من الأطباق اللذيذة والجذابة.

ديناميكيات سوق الزبادي في أوروبا

السائقين

- الفوائد الصحية للزبادي

تُعدّ الفوائد الصحية للزبادي دافعًا رئيسيًا لسوق الزبادي الأوروبي، إذ يُدرك المزيد من المستهلكين آثاره الإيجابية على الصحة العامة. يُعرف الزبادي بغناه بالبروبيوتيك، الذي يدعم صحة الجهاز الهضمي ويُوازن ميكروبات الأمعاء. كما أن إضافة العناصر الغذائية الأساسية كالكالسيوم والبروتين وفيتامين د إليه تُعزز جاذبيته، لا سيما لدى المهتمين بالصحة. فبالإضافة إلى تعزيز صحة الأمعاء، يرتبط الزبادي بتحسين المناعة وتقوية العظام، بل وحتى الصحة النفسية بفضل قيمته الغذائية العالية. ومع تزايد الطلب على الأغذية الوظيفية، يُصبح الزبادي خيارًا متعدد الاستخدامات وغنيًا بالعناصر الغذائية، مما يضعه في صدارة الأنظمة الغذائية الصحية. وقد أدى هذا الوعي المتزايد بفوائد الزبادي الصحية إلى تحول تفضيلات المستهلكين نحو منتجات تُقدم أكثر من مجرد مذاق، مما أدى إلى زيادة كبيرة في الاستهلاك في جميع أنحاء أوروبا. ويواصل التركيز المتزايد على الصحة والعافية دعم نمو السوق، حيث يُدرج المزيد من الناس الزبادي في روتينهم اليومي لما له من فوائد صحية عديدة.

على سبيل المثال.

- في أبريل 2022، ووفقًا لمقال نُشر على موقع Healthline، يُوفر الزبادي جميع العناصر الغذائية الأساسية التي يحتاجها الجسم تقريبًا، بما في ذلك مستويات عالية من الكالسيوم وفيتامينات ب والمعادن النزرة. تدعم هذه العناصر الغذائية صحة العظام، واستقلاب الطاقة، والصحة العامة. ومع تزايد اهتمام المستهلكين بالخيارات الصحية، فإنّ المحتوى الغذائي الشامل للزبادي يُعزز شعبيته. هذا التركيز على فوائد الزبادي الصحية يُعزز النمو والطلب في سوق الزبادي الأوروبي.

- في ديسمبر 2024، ووفقًا لمقال نشره المركز الوطني لمعلومات التكنولوجيا الحيوية، رُبط استهلاك الزبادي بانخفاض خطر الشيخوخة المتسارعة، وقد يُساعد أيضًا في الحد من خطر زيادة الوزن. هذه الفوائد الصحية المحتملة تجعل الزبادي خيارًا جذابًا للمستهلكين الذين يُركزون على طول العمر والتحكم في الوزن. ومع استمرار تزايد عادات الأكل الصحية، فإن دور الزبادي في دعم نمط حياة صحي يُعزز الطلب المتزايد عليه في السوق الأوروبية.

تُعدّ الفوائد الصحية للزبادي عاملاً رئيسياً في تزايد شعبيته في أوروبا، إذ يُدرك المزيد من المستهلكين تأثيره الإيجابي على الصحة العامة. غنيٌّ بالبروبيوتيك والكالسيوم والبروتين وفيتامين د، يُعزز الزبادي صحة الجهاز الهضمي، والمناعة، وتقوية العظام، والصحة النفسية. ومع تزايد الطلب على الأغذية الوظيفية، تجعله قيمته الغذائية خياراً مثالياً للأفراد المهتمين بصحتهم، مما يُسهم في زيادة استهلاكه في جميع أنحاء أوروبا.

- إضافات وظيفية مبتكرة في الزبادي

تلعب الإضافات الوظيفية المبتكرة دورًا هامًا في دفع عجلة نمو سوق الزبادي الأوروبي. فمع تحول أذواق المستهلكين نحو المنتجات الصحية، يزداد دمج المكونات الوظيفية مثل البروبيوتيك والبريبيوتيك والفيتامينات والمعادن، وحتى الأطعمة الخارقة مثل بذور الشيا والكركم. لا تعزز هذه الإضافات القيمة الغذائية للزبادي فحسب، بل تستهدف أيضًا فوائد صحية محددة، بما في ذلك تحسين الهضم، وتعزيز المناعة، وزيادة الطاقة. واستجابةً للطلب المتزايد على المنتجات التي توفر أكثر من مجرد التغذية الأساسية، يواصل مصنعو الزبادي الابتكار لتقديم نكهات جديدة ومكونات تعزز الصحة. ويلبي هذا التوجه نحو الزبادي المدعم والوظيفي مجموعة واسعة من الاحتياجات الغذائية والأهداف الصحية، مما يجذب المستهلكين المهتمين بالصحة في جميع أنحاء أوروبا. وقد أدى التركيز على الابتكار وإضافة الإضافات الوظيفية إلى خلق ميزة تنافسية للعلامات التجارية، مما زاد من توسع سوق الزبادي.

على سبيل المثال،

- في أكتوبر 2023، ووفقًا لمقال نشره المركز الوطني لمعلومات التكنولوجيا الحيوية، يُقدم الزبادي المُصنّع بإضافات طبيعية ومُعدّلة العديد من الفوائد الغذائية، بما في ذلك مُركّبات حيوية مُعزّزة، وخصائص مُضادة للأكسدة، وتأثيرات مُخفّضة لارتفاع سكر الدم وضغط الدم. تتماشى هذه الفوائد الصحية الإضافية مع الطلب المُتزايد من قِبَل المستهلكين على الأغذية الوظيفية. يُساهم دمج هذه الإضافات المُبتكرة في توسّع سوق الزبادي الأوروبي، حيث يسعى المُستهلكون بشكل مُتزايد إلى منتجات تُعزّز صحتهم ورفاهيتهم بشكل عام.

- في يوليو 2024، ووفقًا لمقال نشرته MDPI، فإن إضافة مكونات البريبايوتيك والبروبيوتيك إلى الزبادي يُحسّن جودة المنتج وصحة المستهلك. تدعم البروبيوتيك، مثل بكتيريا حمض اللاكتيك، صحة الأمعاء ووظائف الجهاز المناعي، بينما تُغذي البريبايوتيك بكتيريا الأمعاء النافعة. يُنتج هذا التآزر زبادي بخصائص وظيفية فائقة، مما يزيد من جاذبيته. ومع تزايد الطلب على الأطعمة المُعززة للصحة، يُعزز هذا الابتكار نمو سوق الزبادي الأوروبي.

تُسهم الإضافات الوظيفية في نمو سوق الزبادي الأوروبي، مع تزايد طلب المستهلكين على المنتجات الصحية. وتُدمج مكونات مثل البروبيوتيك والبريبايوتيك والفيتامينات والمعادن، بالإضافة إلى أطعمة فائقة الجودة مثل بذور الشيا والكركم، لتعزيز القيمة الغذائية وتحقيق فوائد صحية محددة، مثل تحسين الهضم وتحسين المناعة. ويجذب هذا التوجه نحو تدعيم الزبادي بمكونات وظيفية المستهلكين المهتمين بالصحة، مما يُعزز الابتكار والمنافسة في السوق.

فرص

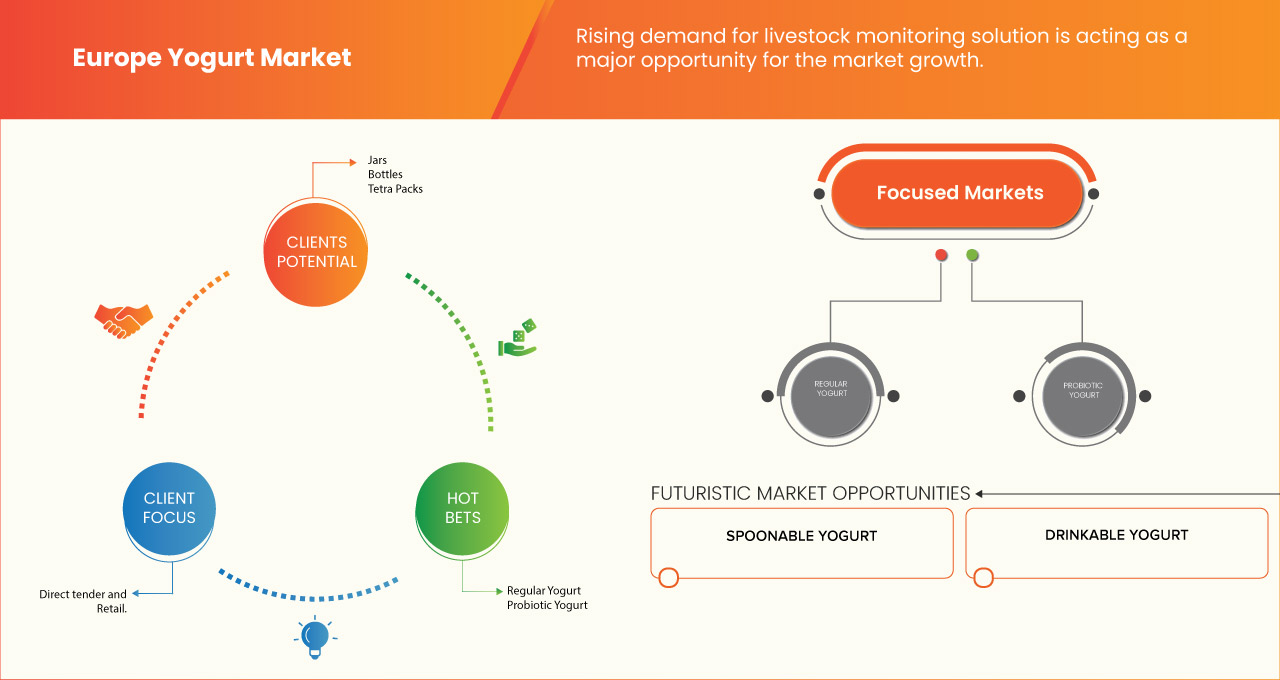

- مقدمة لنموذج الخدمة الذاتية

يحظى الزبادي بإقبال كبير في أوروبا نظرًا لفوائده الصحية التي تتفوق على الحلويات الأخرى كالآيس كريم والكاسترد وغيرها. وتعمل بعض متاجر الزبادي لتلبية هذا الطلب المتزايد من المستهلكين، حيث تقدم هذه المتاجر نماذج الخدمة الذاتية التي تجذب المستهلكين في السوق.

تمنح نماذج الخدمة الذاتية المستهلكين حرية كاملة في اختيار نكهات الزبادي المجمد وإضافاته وكميته، مما يسمح لهم باختيار الكمية التي يتناولونها والتحكم بها وفقًا لاحتياجاتهم الغذائية. مع متاجر الزبادي المجمد ذاتية الخدمة التي تقدم مجموعة واسعة من الإضافات، بالإضافة إلى بديل صحي للآيس كريم، ازداد عدد متاجر الخدمة الذاتية بشكل ملحوظ مقارنةً بمتاجر الخدمة الكاملة.

على سبيل المثال،

يقدم يوغرتيني فروزن يوغرت نكهات مميزة من الزبادي المجمد، بالإضافة إلى أكثر من 65 إضافة. يحرصون على أخذ آراء واقتراحات العملاء بعين الاعتبار، ويضيفون المزيد من الخيارات إلى قائمتهم.

متجر زبادي مجمد ذاتي الخدمة في المملكة المتحدة، يقدم نكهات وإضافات متنوعة للزبادي ليتمكن العملاء من ابتكار حلوياتهم المثالية. يعود نجاح فرويو إلى الطلب المتزايد على خيارات حلويات صحية وقابلة للتخصيص.

ومن ثم، فإن نموذج الخدمة الذاتية في سوق الزبادي المجمد يعد أحد الفرص العظيمة للمصنعين لخدمة مستهلكيهم حسب طلبهم.

- زيادة في اعتماد الأنشطة الترويجية والمنصات عبر الإنترنت

يتزايد الطلب على الزبادي بسرعة كبيرة نتيجةً لعوامل متعددة، منها فوائده الصحية، ونكهاته الجديدة والمثيرة، وغيرها. وتعمل شركاتٌ مختلفة في مجال الزبادي، وتعتمد أنشطةً ترويجيةً جديدةً للترويج لمنتجاتها في السوق، مما يوفر فرصًا جديدةً لمصنعي الزبادي.

تقدم الشركات مكافآت مميزة للمستهلكين، مما يجذب عملاء جدد. على سبيل المثال، أطلقت يوغرتلاند برنامج "مكافآت حقيقية" القائم على مبدأ "كلما استمتعت بالمزيد من الحلويات، زادت نقاطك"، أي نقطتان مقابل كل دولار ينفقه. يكسب المستهلك نقاطًا مع كل عملية شراء، وبعد كل 100 نقطة، يحصل تلقائيًا على مكافأة قدرها 5 دولارات أمريكية. بهذه الطريقة، تسعى الشركات لجذب عملاء جدد من خلال الأنشطة الترويجية.

وبالإضافة إلى ذلك، تقوم الشركات بتقديم تطبيقات الطلب عبر الإنترنت للوصول إلى مجموعة واسعة من العملاء.

على سبيل المثال،

- في سبتمبر 2019، أبرمت يوغرتلاند شراكة مع دور داش لتوصيل زبادي مجمد مُخصص، وآيس كريم، وحلويات قابلة للشرب إلى منازل العملاء أو مكاتبهم. يتيح هذا التعاون لعشاق الزبادي المجمد الاستمتاع بنكهاتهم وإضافاتهم المفضلة، بما في ذلك الخيارات الحلوة والفاكهية والجيلاتينية، من المواقع المشاركة دون الحاجة لمغادرة أماكنهم. وبالتالي، تُتيح الأنشطة الترويجية الجديدة والتحول الرقمي في سوق الزبادي فرصًا جديدة في السوق.

- في عام ٢٠٢٤، أطلقت مينشي شراكة جديدة مع دور داش لتوصيل الزبادي المجمد والإضافات وأصناف أخرى من قائمة الطعام إلى العملاء في مواقع متعددة. تتيح هذه الخدمة لعشاق مينشي الاستمتاع بمنتجات الزبادي المجمد المفضلة لديهم دون مغادرة المنزل، مما يدعم تركيز مينشي على الراحة والتخصيص.

القيود/التحديات

- توفر البدائل

تتوفر في السوق بدائل للزبادي، مثل الآيس كريم، والزبادي، والجيلاتو، والشربات، والآيس كريم غير الألباني، والعصائر، والميلك شيك، وغيرها من الحلويات. ويتزايد الطلب على الزبادي نتيجةً لتغير نمط الحياة، حيث يتجه الناس نحو منتجات غذائية صحية. إلا أن ارتفاع سعر الزبادي دفع المستهلكين إلى العودة إلى الآيس كريم، والميلك شيك، وغيرها من الحلويات الأقل تكلفة، مما أدى إلى تباطؤ مبيعات الزبادي. علاوة على ذلك، يُعتبر بديل الزبادي أكبر تهديد لسوق الزبادي، إذ لا يزال يستهلكه على نطاق واسع المستهلكون الذين يعانون من حساسية الحليب وعدم تحمل اللاكتوز، بالإضافة إلى النباتيين.

بالإضافة إلى ذلك، فإن خيارات الحلوى الأخرى مثل محلات الشوكولاتة ومحلات الحلوى، وأماكن التجمع المحلية مثل المقاهي، وحتى سلاسل العصائر أو المشروبات المخفوقة المتاحة تشكل تحديًا كبيرًا لمنتجات الزبادي.

في الأول من ديسمبر 2024، طرحت بن آند جيري مجموعة متنوعة من خيارات الآيس كريم الجديدة والمميزة الخالية من منتجات الألبان. تلبي هذه النكهات، مثل "كراميل اللوز الهش" و"كوب زبدة الفول السوداني"، الطلب المتزايد على الحلويات النباتية الخالية من منتجات الألبان. ومع تزايد إقبال المستهلكين على البدائل النباتية والخالية من اللاكتوز، تُنافس هذه الخيارات المبتكرة من الآيس كريم منتجات الزبادي التقليدية في سوق الحلويات.

في ١٨ يناير ٢٠٢٤، سلّط موقع "وايركتر" التابع لصحيفة نيويورك تايمز الضوء على الطلب المتزايد على الآيس كريم النباتي. وتحظى هذه البدائل النباتية، المصنوعة من مكونات مثل حليب اللوز وحليب جوز الهند وحليب الشوفان، بشعبية كبيرة بين المستهلكين النباتيين الذين يعانون من عدم تحمل اللاكتوز. ونتيجةً لذلك، تُنافس منتجات الزبادي التقليدية في سوق الحلويات.

وفي الختام، فإن توافر بديل للزبادي قد يشكل تحديًا كبيرًا لنمو السوق خلال فترة التوقعات.

- حساسية الأسعار وارتفاع التكاليف في سوق الزبادي الأوروبي

مع تزايد الطلب على الزبادي الفاخر والمتخصص، ارتفعت أسعار هذه المنتجات أيضًا، مما جعلها أقل توفرًا لبعض المستهلكين. وقد دفع ارتفاع تكلفة الزبادي، وخاصةً الأنواع العضوية أو الغنية بالبروبيوتيك أو الخالية من منتجات الألبان، العديد من المستهلكين إلى اللجوء إلى بدائل أقل تكلفة، مثل الآيس كريم، والميلك شيك، والعصائر، وغيرها من الحلويات. ويتفاقم هذا التحول بفعل الضغوط التضخمية والعوامل الاقتصادية الأوسع نطاقًا، مما يجعل المستهلكين أكثر وعيًا بإنفاقهم.

تواجه علامات الزبادي تحديًا يتمثل في الموازنة بين جودة المنتج وفعالية التكلفة، سعيًا للحفاظ على أسعار تنافسية مع تلبية طلب المستهلكين على خيارات زبادي صحية وعالية الجودة وعملية. واستجابةً لحساسية الأسعار، يستكشف العديد من منتجي الزبادي أساليب تصنيع فعالة من حيث التكلفة، فيطرحون أنواعًا أقل تكلفة، أو يقدمون كميات أصغر لجعل منتجاتهم في متناول شريحة أوسع من الجمهور.

إضافةً إلى ذلك، يُفاقم صعودُ ماركات الزبادي ذات العلامات التجارية الخاصة، والتي غالبًا ما تُقدّم أسعارًا أقلّ مقارنةً بالعلامات التجارية المعروفة، المنافسة. غالبًا ما تأتي هذه الخيارات ذات العلامات التجارية الخاصة بميزاتٍ أقلّ جودةً، لكنها تجذب المستهلكين الذين يُعنون بالتكلفة ويبحثون عن بدائل بأسعارٍ معقولة. نتيجةً لذلك، تُضطرّ ماركات الزبادي العريقة إلى إيجاد طرقٍ للابتكار دون إغضاب المشترين ذوي الميزانية المحدودة، بما في ذلك تقديم عبواتٍ مُخفّضة أو عروضٍ ترويجيةٍ للحفاظ على ولاء العملاء.

على سبيل المثال،

- في أغسطس 2024، ووفقًا لمقال نشرته شركة "دايري فودز"، سلّط تقرير "حالة صناعة الألبان لعام 2024" الضوء على التحديات الكبيرة التي يواجهها منتجو الزبادي في أوروبا نتيجة ارتفاع التكاليف والتضخم وانقطاعات سلسلة التوريد. وعلى غرار التحديات التي تواجه سوق خدمات التجميل في جنوب شرق آسيا (كما أفادت جمعية صناعة الألبان الماليزية)، تواجه صناعة الزبادي عوائق مالية قد تحد من نموها. وتؤدي تكاليف الإنتاج المتزايدة إلى ارتفاع أسعار منتجات الزبادي الفاخرة، مما قد يحدّ من إمكانية وصول شريحة أوسع من المستهلكين إليها. وقد يثني هذا التحدي المالي بعض المستهلكين عن شراء منتجات الزبادي الأعلى سعرًا، مما يعيق توسع السوق في المنطقة.

- في أغسطس 2024، ووفقًا لمقال نشرته مجموعة كيري بعنوان "اتجاهات نمو العلامات التجارية الخاصة"، يُمثل تزايد شعبية منتجات العلامات التجارية الخاصة تحديات كبيرة لمصنعي الزبادي ذي العلامات التجارية في أوروبا، لا سيما في سوق يشهد منافسة متزايدة وحساسية للأسعار. وعلى غرار التحديات في سوق خدمات التجميل في جنوب شرق آسيا (وفقًا لتقرير AIA ماليزيا)، تواجه علامات الزبادي التجارية عوائق مالية، حيث يدفع ارتفاع تكلفة الإنتاج والمنتجات الفاخرة المستهلكين نحو خيارات العلامات التجارية الخاصة الأقل تكلفة. قد يحد هذا التحول من إمكانية الوصول إلى منتجات الزبادي ذات العلامات التجارية وبأسعار معقولة، مما يحد في النهاية من نمو السوق ويزيد من صعوبة جذب الشركات ذات العلامات التجارية للمستهلكين المهتمين بالأسعار.

يتطلب تحدي حساسية الأسعار وارتفاع التكاليف من منتجي الزبادي الابتكار مع الحفاظ على القدرة على تحمل التكاليف. وللحفاظ على القدرة التنافسية، يجب على العلامات التجارية إيجاد طرق للموازنة بين عروض المنتجات الفاخرة والاستراتيجيات الفعالة من حيث التكلفة، واستكشاف بدائل مثل التغليف الأصغر حجمًا، والعروض الترويجية، وتطوير منتجات ذات قيمة عالية تلبي احتياجات المستهلكين المهتمين بالصحة والميزانية على حد سواء.

نطاق سوق الزبادي في أوروبا

يُقسّم سوق الزبادي الأوروبي إلى خمسة عشر قطاعًا رئيسيًا، بناءً على نوع الزبادي، ونوع المنتج، ومحتوى الدهون، والنكهة، ونوع المصدر، والتركيبة، وفئة التضمين، والتدعيم، والادعاء، والنطاق السعري، والفئة العضوية، والعلامة التجارية، والتغليف، وحجم التغليف، وقنوات التوزيع. سيساعدك نمو هذه القطاعات على تحليل القطاعات ذات النمو المحدود في هذه الصناعات، ويوفر للمستخدمين نظرة عامة قيّمة على السوق ورؤى ثاقبة لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الرئيسية.

نوع الزبادي

- زبادي عادي

- زبادي بروبيوتيك

- زبادي بيو لايف

- مجموعة الزبادي

- زبادي سكاير/على الطريقة الأيسلندية

- زبادي مركز

- الزبادي المخفوق

- آحرون

نوع المنتج

- زبادي قابل للملعقة

- زبادي صالح للشرب

- زبادي مجمد

- آحرون

محتوى الدهون

- قليل الدهن

- خالي من الدهون

- كامل الدسم

نكهة

- سهل

- منكه

- الفراولة

- الفانيليا

- توت أزرق

- موز

- خَوخ

- التوت البري

- بلاك بيري

- الفواكه والمكسرات

- الليمون

- جوزة الهند

- المكسرات

- الكرز

- بستان الكرز

- عسل

- اليقطين

- الشوكولاتة

- الكراميل

- كراميل

- موكا/قهوة

- بوموجرانيت

- النعناع

- أماريتو

- آحرون

مصدر

- قائم على الحيوانات

- قائم على الحيوانات، حسب النوع

- حليب البقر

- حليب الجاموس

- حليب الماعز

- آحرون

- نباتي

- نباتي، حسب النوع

- حليب اللوز

- حليب الصويا

- حليب الشوفان

- حليب جوز الهند

- حليب الكاجو

- آحرون

صياغة

- محلى

- غير محلى

نطاق السعر

- كتلة

- غالي

- رفاهية

فئة الإدراج

- سهل

- مع الإضافات والإضافات

- رشات

- الشوكولاتة

- قطع

- رقائق

- شراب

- آحرون

- لا مثيل لها

- حلويات

- قطع مخبوزة

- اللؤلؤ

- حلوى

- برالين البقان

- كراميل كرانشيز

- المكسرات

- اللوز

- الكاجو

- فستق

- البندق

- الزبيب

- مكسرات ماداميا

- الكستناء

- آحرون

التحصين

- عادي

- محصن

مطالبة

- عادي

- خالي من الغلوتين

- خالي من اللاكتوز

- خالي من المواد الحافظة الاصطناعية

- خالي من منتجات الألبان

- خالي من الصويا

- غير معدل وراثيًا

- خالي من السكر

- خالي من السعرات الحرارية

- مع كل ما سبق المطالبة

- عادي بدون مطالبات

- آحرون

الفئة العضوية

- عادي

- عضوي

ماركة

- ماركة تجارية

- علامة تجارية خاصة

التعبئة والتغليف

- حقيبة في صندوق

- الأكياس

- الجرار

- زجاج

- بلاستيك

- الكؤوس

- زجاجات

- زجاج

- بلاستيك

- عبوات تترا

- آحرون

حجم العبوة

- أقل من 100 جرام

- 100-200 جرام

- 201-300 جرام

- أكثر من 300 جرام

قناة التوزيع

- البيع بالتجزئة عبر المتاجر

- متاجر التجزئة

- محلات/صالونات الزبادي

- محلات السوبر ماركت/الهايبر ماركت

- المتاجر المتخصصة

- محلات البقالة

- تجار الجملة

- آحرون

- البيع بالتجزئة خارج المتاجر

- البيع الآلي

- متصل

تحليل إقليمي لسوق الزبادي في أوروبا

يتم تحليل السوق وتوفير رؤى حجم السوق واتجاهاتها حسب البلد ونوع الزبادي ونوع المنتج ومحتوى الدهون والنكهة ونوع المصدر والتركيبة وفئة التضمين والتحصين والمطالبة ونطاق السعر والفئة العضوية والعلامة التجارية والتعبئة والتغليف وحجم التعبئة والتغليف وقناة التوزيع كما هو مذكور أعلاه.

الدول التي يغطيها السوق هي ألمانيا وفرنسا والمملكة المتحدة وإيطاليا وإسبانيا وروسيا وهولندا وبلجيكا وسويسرا وتركيا وبقية أوروبا.

ومن المتوقع أن تهيمن ألمانيا على السوق بفضل صناعة الألبان القوية لديها، والطلب المرتفع على منتجات الكريمة التقليدية والنباتية، وقطاع معالجة الأغذية القوي.

ومن المتوقع أن تكون ألمانيا الأسرع نمواً بسبب صناعة الألبان القوية، والطلب المرتفع على منتجات الكريمة التقليدية والنباتية، وقطاع معالجة الأغذية القوي، وتفضيل المستهلكين لمكونات الألبان عالية الجودة، إلى جانب دورها المركزي في أسواق خدمات الأغذية والتجزئة الأوروبية.

يقدم قسم البلدان في التقرير أيضًا العوامل المؤثرة على السوق الفردية والتغيرات في اللوائح التنظيمية في السوق المحلية، والتي تؤثر على اتجاهات السوق الحالية والمستقبلية. وتُستخدم بيانات مثل تحليل سلسلة القيمة النهائية والنهائية، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة، كمؤشرات للتنبؤ بسيناريو السوق لكل دولة على حدة. كما يُؤخذ في الاعتبار وجود العلامات التجارية العالمية وتوافرها والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة، عند تقديم تحليل تنبؤي لبيانات الدولة.

حصة سوق الزبادي في أوروبا

يُقدم المشهد التنافسي في السوق تفاصيل لكل منافس. تشمل هذه التفاصيل لمحة عامة عن الشركة، وبياناتها المالية، وإيراداتها المحققة، وإمكانياتها السوقية، والاستثمار في البحث والتطوير، ومبادراتها التسويقية الجديدة، وحضورها العالمي، ومواقع ومرافق الإنتاج، وقدراتها الإنتاجية، ونقاط قوتها وضعفها، وإطلاق المنتجات، ونطاقها، وهيمنة تطبيقاتها. تتعلق البيانات المذكورة أعلاه فقط بتركيز الشركات على السوق.

الشركات الرائدة في سوق الزبادي في أوروبا العاملة في السوق هي:

- دانون (فرنسا)

- نستله (سويسرا)

- شركة إيمي المحدودة في المملكة المتحدة (لندن)

- مولر المملكة المتحدة وأيرلندا (إنجلترا)

- فريزلاند كامبينا (هولندا)

- شركة كامبل (الولايات المتحدة)

- أرلا فودز أمبا (الدنمارك)

- شركة شريبر للأغذية (الولايات المتحدة)

- سوديال (فرنسا)

- شركة كريمو ش.م. (سويسرا)

- مزرعة فين للألبان (المملكة المتحدة)

- لاكتياس فلور دي بورغوس إس إل (إسبانيا)

- لاتيه ماريما (إيطاليا)

- نيولات فود سبا (إيطاليا)

- مجموعة هاين سيليستيال المحدودة (نيويورك)

- شركة يو فالي العضوية المحدودة (المملكة المتحدة)

أحدث التطورات في سوق الزبادي في أوروبا

- في مايو 2021، أطلقت شركة Onken، بالتعاون مع مارفن هيومز، حملة "وصفات عائلية أسطورية من منتجات الألبان". تسعى هذه المبادرة الشيقة إلى اكتشاف أشهر وصفات العائلة في المملكة المتحدة من خلال دعوة الناس لمشاركة كنوزهم الطهوية أو ابتكار وصفات جديدة. يقود مارفن هيومز، مقدم البرامج التلفزيونية والإذاعية الشهير، هذه الحملة للترويج ليوم وصفات العائلة.

- في نوفمبر 2024، حصلت شركة آرلا فودز إنجريدينترز على موافقة هيئة المنافسة والأسواق البريطانية لاستحواذها على أعمال فولاك في مجال تغذية مصل اللبن. تشمل الصفقة منشأة معالجة في فيلينفاتش، ويلز، وستعزز مكانة آرلا في سوق بروتين مصل اللبن المتنامي.

- في سبتمبر 2023، توصلت نستله إلى اتفاق مع شركة أدفنت إنترناشونال للاستحواذ على حصة أغلبية في مجموعة CRM، وهي شركة برازيلية متخصصة في الشوكولاتة الفاخرة. ومن المتوقع إتمام هذه الصفقة في عام 2024، مما يعزز حضور نستله في سوق الحلويات الفاخرة في البرازيل.

- في نوفمبر 2022، أعلنت نستله وإل كاتيرتون عن شراكة لدمج فرشلي وكيتل كوزين، الشركة الرائدة في تصنيع الأطعمة الطازجة والحرفية. ستقدم الشركة الجديدة مجموعة متنوعة من منتجات الأطعمة الطازجة عبر قنوات ومناطق جغرافية متنوعة، وستكون إل كاتيرتون المالك الأكبر.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE YOGURT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 GEOGRAPHICAL SCOPE

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 TREATMENT LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.2 ENVIRONMENTAL CONCERNS

4.2.1 INDUSTRY RESPONSE TO CLIMATE CHANGE

4.2.2 GOVERNMENT’S ROLE IN ADDRESSING CLIMATE CHANGE

4.2.3 ANALYST RECOMMENDATIONS

4.3 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYER IN EUROPE YOGURT MARKET

4.3.1 FEN FARM DAIRY

4.3.2 LATTE MAREMMA

4.3.3 NESTLÉ SA

4.3.4 ARLA FOODS AMBA

4.3.5 CAMPBELL SOUP COMPANY

4.3.6 HAIN CELESTIAL GROUP

4.3.7 DIETARY PREFERENCES AND RESTRICTIONS

4.3.8 MARKETING AND ADVERTISING

4.3.9 CONCLUSION

4.4 MARKETING STRATEGIES ADOPTED BY KEY MARKET IN EUROPE YOGURT MARKET

4.4.1 IMPACT ON PRICE

4.4.2 IMPACT ON SUPPLY CHAIN

4.4.3 IMPACT ON SHIPMENT

4.4.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.4.5 CONCLUSION

4.5 IMPORT EXPORT SCENARIO

4.6 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYER IN EUROPE YOGURT MARKET

4.6.1 FEN FARM DAIRY

4.6.2 LATTE MAREMMA

4.6.3 NESTLÉ SA

4.6.4 ARLA FOODS AMBA

4.6.5 CAMPBELL SOUP COMPANY

4.6.6 HAIN CELESTIAL GROUP

4.6.7 EMMI UK LTD (ONKEN)

4.6.8 SCHREIBER FOODS

4.6.9 SCHREIBER FOODS

4.6.10 FLOR DE BURGOS

4.6.11 NEWLAT FOOD S.P.A

4.6.12 CONCLUSION

4.7 NEW PRODUCT LAUNCH STRATEGY FOR THE EUROPE YOGURT MARKET

4.7.1 NUMBER OF NEW PRODUCT LAUNCH

4.7.2 DIFFERENTIAL PRODUCT OFFERING

4.7.3 MEETING CONSUMER REQUIREMENTS

4.7.4 PACKAGE DESIGNING

4.7.5 PRICING ANALYSIS

4.7.6 PRODUCT POSITIONING

4.7.7 CONCLUSION

4.8 PRICING ANALYSIS

4.9 PRIVATE LABEL VS BRAND ANAYSIS

4.1 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.11 PROMOTIONAL ACTIVITIES IN THE EUROPEAN YOGURT MARKET

4.11.1 DIGITAL MARKETING AND SOCIAL MEDIA CAMPAIGNS

4.11.2 CONTENT MARKETING AND EDUCATIONAL INITIATIVES

4.11.3 PRODUCT SAMPLING AND FREE TRIALS

4.11.4 DISCOUNTS, PROMOTIONS, AND LOYALTY PROGRAMS

4.11.5 STRATEGIC PARTNERSHIPS AND SPONSORSHIPS

4.11.6 CELEBRITY ENDORSEMENTS AND MEDIA EXPOSURE

4.11.7 RETAIL AND IN-STORE PROMOTIONS

4.11.8 CONCLUSION

4.12 REGULATION COVERAGE

4.13 SHOPPING BEHAVIOUR AND DYNAMICS

4.13.1 RECOMMENDATION FROM FAMILY & FRIENDS

4.13.2 RESEARCH

4.13.3 IMPULSIVE

4.13.4 ADVERTISEMENT

4.13.4.1 TELEVISION ADVERTISEMENT

4.13.4.2 ONLINE ADVERTISEMENT

4.13.4.3 IN-STORE ADVERTISEMENT

4.13.4.4 OUTDOOR ADVERTISEMENT

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 OVERVIEW

4.14.2 LOGISTIC COST SCENARIO

4.14.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 EUROPE YOGURT MARKET: REGULATIONS

5.1 REGULATORY BODIES

5.2 REGULATIONS

5.3 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED FOCUS ON FUNCTIONAL FOODS

6.1.2 HEALTH BENEFITS OF YOGURT

6.1.3 INNOVATIVE FUNCTIONAL ADDITIVES IN YOGURT

6.1.4 TECHNICAL ADVANCEMENT IN PROCESSING OF YOGURT

6.2 RESTRAINTS

6.2.1 HEALTH CONCERNS OVER LACTOSE INTOLERANCE AND MILK ALLERGIES

6.2.2 HEALTH CONCERNS OVER SUGAR CONTENT

6.3 OPPORTUNITIES

6.3.1 INTRODUCTION OF SELF-SERVE MODEL

6.3.2 INCREASE IN ADOPTION OF PROMOTIONAL ACTIVITIES AND ONLINE PLATFORMS

6.3.3 INNOVATIVE RETAIL EXPERIENCES

6.4 CHALLENGES

6.4.1 AVAILABILITY OF SUBSTITUTES

6.4.2 PRICE SENSITIVITY AND RISING COSTS IN THE EUROPEAN YOGURT MARKET

7 EUROPE YOGURT MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPOONABLE YOGURT

7.3 DRINKABLE YOGURT

7.4 FROZEN YOGURT

7.5 OTHERS

8 EUROPE YOGURT MARKET, BY FORMULATION

8.1 OVERVIEW

8.2 UNSWEETENED

8.3 SWEETENED

9 EUROPE YOGURT MARKET, BY INCLUSION CATEGORY

9.1 OVERVIEW

9.2 PLAIN

9.3 WITH INCLUSIONS & TOPPINGS

9.3.1 NUTS

9.3.1.1 ALMONDS

9.3.1.2 CASHEWS

9.3.1.3 PISTACHIO

9.3.1.4 HAZELNUTS

9.3.1.5 RAISINS

9.3.1.6 MADAMIA NUTS

9.3.1.7 CHESTNUTS

9.3.1.8 OTHERS

9.3.2 SPRINKLES

9.3.3 CHOCOLATES

9.3.3.1 CHUNKS

9.3.3.2 SYRUP

9.3.3.3 FLAKES

9.3.3.4 OTHERS

9.3.4 CONFETTI

9.3.5 NONPAREILS

9.3.6 BAKED PIECES

9.3.7 PEARLS

9.3.8 DRAGEES

9.3.9 PECAN PRALINES

9.3.10 CARAMEL CRUNCHIES

9.3.11 OTHERS

10 EUROPE YOGURT MARKET, BY SOURCE

10.1 OVERVIEW

10.2 ANIMAL-BASED

10.2.1 COW MILK

10.2.2 BUFFALO MILK

10.2.3 GOAT MILK

10.2.4 OTHERS

10.3 PLANT-BASED

10.3.1 ALMOND MILK

10.3.2 SOY MILK

10.3.3 OAT MILK

10.3.4 COCONUT MILK

10.3.5 CASHEW MILK

10.3.6 OTHERS

10.4 ARTIFICIAL

11 EUROPE YOGURT MARKET, BY FLAVOR

11.1 OVERVIEW

11.2 PLAIN

11.3 FLAVORED

11.3.1 STRAWBERRY

11.3.2 VANILLA

11.3.3 BLUBERRY

11.3.4 BANANA

11.3.5 PEACH

11.3.6 BILBERRY

11.3.7 BLACKBERRY

11.3.8 FRUIT & NUT

11.3.9 LIME

11.3.10 COCONUT

11.3.11 NUTS

11.3.12 CHERRY

11.3.13 ORCHARD CHERRY

11.3.14 HONEY

11.3.15 PUMPKIN

11.3.16 CHOCOLATES

11.3.17 BUTTERSCOTCH

11.3.18 CARAMEL

11.3.19 MOCHA/COFFEE

11.3.20 POMOGRANETT

11.3.21 PEPPERMINT

11.3.22 AMARETTO

11.3.23 OTHERS

12 EUROPE YOGURT MARKET, BY FAT CONTENT

12.1 OVERVIEW

12.2 LOW FAT

12.3 FAT FREE

12.4 FULL FAT

13 EUROPE YOGURT MARKET, BY FORTIFICATION

13.1 OVERVIEW

13.2 REGULAR

13.3 FORTIFIED

14 EUROPE YOGURT MARKET, BY ORGANIC CATEGORY

14.1 OVERVIEW

14.2 CONVENTIONAL

14.3 ORGANIC

15 EUROPE YOGURT MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 STORE-BASED RETAILING

15.2.1 SUPERMARKETS/HYPERMARKETS

15.2.2 YOGURT SHOPS/PARLORS

15.2.3 CONVENIENCE STORES

15.2.4 GROCERY STORES

15.2.5 SPECIALTY STORES

15.2.6 WHOLESALERS

15.2.7 OTHERS

15.3 NON-STORE RETAILING

15.3.1 ONLINE

15.3.2 VENDING

16 EUROPE YOGURT MARKET, BY PACKAGING SIZE

16.1 OVERVIEW

16.2 201-300 GRAMS

16.3 MORE THAN 300 GRAMS

16.4 100-200 GRAMS

16.5 LESS THAN 100 GRAMS

17 EUROPE YOGURT MARKET, BY CLAIM

17.1 OVERVIEW

17.2 SUGAR FREE

17.3 DAIRY FREE

17.4 LACTOSE FREE

17.5 SOY FREE

17.6 GLUTEN FREE

17.7 NON GMO

17.8 CALORIE FREE

17.9 ARTIFICIAL PRESERVATIVES FREE

17.1 WITH ALL OF THE ABOVE CLAIM

17.11 REGULAR WITH NO CLAIMS

17.12 OTHERS

18 EUROPE YOGURT MARKET, BY BRAND

18.1 OVERVIEW

18.2 BRANDED

18.3 PRIVATE LABEL

19 EUROPE YOGURT MARKET, BY PRICE RANGE

19.1 OVERVIEW

19.2 MASS

19.3 PREMIUM

19.4 LUXURY

20 EUROPE YOGURT MARKET, BY PACKAGING TYPE

20.1 OVERVIEW

20.2 JARS

20.2.1 PLASTIC

20.2.2 GLASS

20.3 BOTTLES

20.3.1 PLASTIC

20.3.2 GLASS

20.4 TETRA PACK

20.5 CUPS

20.6 BAG-IN-BOX

20.7 POUCHES

20.8 OTHERS

21 EUROPE YOGURT MARKET, BY COUNTRY

21.1 EUROPE

21.1.1 GERMANY

21.1.2 FRANCE

21.1.3 SPAIN

21.1.4 POLAND

21.1.5 BELGIUM

21.1.6 NETHERLANDS

21.1.7 ITALY

21.1.8 AUSTRIA

21.1.9 SWEDEN

21.1.10 DENMARK

21.1.11 UNITED KINGDOM

21.1.12 PORTUGAL

21.1.13 SWITZERLAND

21.1.14 IRELAND

21.1.15 FINLAND

21.1.16 LUXEMBOURG

21.1.17 REST OF EUROPE

22 EUROPE YOGURT MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: EUROPE

23 SWOT ANALYSIS

24 COMPANY PROFILES

24.1 DANONE

24.1.1 COMPANY SNAPSHOT

24.1.2 REVENUE ANALYSIS:

24.1.3 PRODUCT PORTFOLIO

24.1.4 RECENT DEVELOPMENT

24.2 NESTLÉ

24.2.1 COMPANY SNAPSHOT

24.2.2 REVENUE ANALYSIS

24.2.3 PRODUCT PORTFOLIO

24.2.4 RECENT DEVELOPMENT

24.3 EMMY UK LTD

24.3.1 COMPANY SNAPSHOT

24.3.2 PRODUCT PORTFOLIO

24.3.3 RECENT DEVELOPMENT

24.4 MÜLLER UK & IRELAND (SUBSIDIARY OF UNTERNEHMENSGRUPPE THEO MÜLLER)

24.4.1 COMPANY SNAPSHOT

24.4.2 PRODUCT PORTFOLIO

24.4.3 RECENT DEVELOPMENT

24.5 FRIESLAND CAMPINA

24.5.1 COMPANY SNAPSHOT

24.5.2 PRODUCT PORTFOLIO

24.5.3 RECENT DEVELOPMENT

24.6 THE CAMPBELL’S COMPANY

24.6.1 COMPANY SNAPSHOT

24.6.2 PRODUCT PORTFOLIO

24.6.3 RECENT DEVELOPMENT

24.7 ARLA FOODS AMBA

24.7.1 COMPANY SNAPSHOT

24.7.2 REVENUE ANALYSIS

24.7.3 PRODUCT PORTFOLIO

24.7.4 RECENT DEVELOPMENT

24.8 SCHREIBER FOOD INC

24.8.1 COMPANY SNAPSHOT

24.8.2 PRODUCT PORTFOLIO

24.8.3 RECENT DEVELOPMENT

24.9 SODIAAL

24.9.1 COMPANY SNAPSHOT

24.9.2 PRODUCT PORTFOLIO

24.9.3 RECENT DEVELOPMENT

24.1 CREMO SA

24.10.1 COMPANY SNAPSHOT

24.10.2 PRODUCT PORTFOLIO

24.11 FEN FARM DAIRY

24.11.1 COMPANY SNAPSHOT

24.11.2 PRODUCT PORTFOLIO

24.11.3 RECENT DEVELOPMENT

24.12 LACTEAS FLOR DE BURGOS

24.12.1 COMPANY SNAPSHOT

24.12.2 PRODUCT PORTFOLIO

24.12.3 RECENT DEVELOPMENT

24.13 LATTE MAREMMA

24.13.1 COMPANY SNAPSHOT

24.13.2 PRODUCT PORTFOLIO

24.13.3 RECENT DEVELOPMENT

24.14 NEWLAT FOOD S.P.A

24.14.1 COMPANY SNAPSHOT

24.14.2 REVENUE ANALYSIS

24.14.3 SEGMENTED REVENUE ANALYSIS

24.14.4 PRODUCT PORTFOLIO

24.15 THE HAIN CELESTIAL GROUP, INC.

24.15.1 COMPANY SNAPSHOT

24.15.2 REVENUE ANALYSIS

24.15.3 SEGMENTED REVENUE ANALYSIS

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENT

24.16 YEO VALLEY ORGANIC LIMITED

24.16.1 COMPANY SNAPSHOT

24.16.2 PRODUCT PORTFOLIO

24.16.3 RECENT DEVELOPMENT

25 QUESTIONNAIRE

26 RELATED REPORTS

표 목록

TABLE 1 PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 REGULATIONS ACROSS VARIOUS REGIONS AND COUNTRIES

TABLE 3 EUROPE YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 4 EUROPE YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 5 EUROPE YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 6 EUROPE WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 7 EUROPE NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 8 EUROPE CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 9 EUROPE YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 10 EUROPE ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 11 EUROPE PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 12 EUROPE YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 13 EUROPE FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 14 EUROPE YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 15 EUROPE YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 16 EUROPE YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 17 EUROPE YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 18 EUROPE STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 19 EUROPE NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 20 EUROPE YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 21 EUROPE YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 22 EUROPE YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 23 EUROPE YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 24 EUROPE YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 25 EUROPE JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 26 EUROPE BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 27 EUROPE YOGURT MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 28 EUROPE YOGURT MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 29 GERMANY YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 30 GERMANY YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 31 GERMANY YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 32 GERMANY YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 33 GERMANY YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 34 GERMANY FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 35 GERMANY YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 36 GERMANY ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 37 GERMANY PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 38 GERMANY YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 39 GERMANY YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 40 GERMANY WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 41 GERMANY NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 42 GERMANY CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 43 GERMANY YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 44 GERMANY YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 45 GERMANY YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 46 GERMANY YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 47 GERMANY YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 48 GERMANY JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 49 GERMANY BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 50 GERMANY YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 51 GERMANY YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 52 GERMANY YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 53 GERMANY STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 54 GERMANY NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 55 FRANCE YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 56 FRANCE YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 57 FRANCE YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 58 FRANCE YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 59 FRANCE YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 60 FRANCE FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 61 FRANCE YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 62 FRANCE ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 63 FRANCE PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 64 FRANCE YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 65 FRANCE YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 66 FRANCE WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 67 FRANCE NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 68 FRANCE CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 69 FRANCE YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 70 FRANCE YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 71 FRANCE YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 72 FRANCE YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 73 FRANCE YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 74 FRANCE JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 75 FRANCE BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 76 FRANCE YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 77 FRANCE YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 78 FRANCE YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 79 FRANCE STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 80 FRANCE NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 81 SPAIN YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 82 SPAIN YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 83 SPAIN YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 84 SPAIN YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 85 SPAIN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 86 SPAIN FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 87 SPAIN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 88 SPAIN ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 89 SPAIN PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 90 SPAIN YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 91 SPAIN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 92 SPAIN WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 93 SPAIN NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 94 SPAIN CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 95 SPAIN YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 96 SPAIN YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 97 SPAIN YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 98 SPAIN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 99 SPAIN JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 100 SPAIN BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 101 SPAIN YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 102 SPAIN YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 103 SPAIN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 104 SPAIN STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 105 SPAIN NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 106 POLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 107 POLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 108 POLAND YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 109 POLAND YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 110 POLAND YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 111 POLAND FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 112 POLAND YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 113 POLAND ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 114 POLAND PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 115 POLAND YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 116 POLAND YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 117 POLAND WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 118 POLAND NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 119 POLAND CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 120 POLAND YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 121 POLAND YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 122 POLAND YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 123 POLAND YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 124 POLAND YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 125 POLAND JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 126 POLAND BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 127 POLAND YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 128 POLAND YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 129 POLAND YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 130 POLAND STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 131 POLAND NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 132 BELGIUM YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 133 BELGIUM YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 134 BELGIUM YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 135 BELGIUM YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 136 BELGIUM YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 137 BELGIUM FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 138 BELGIUM YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 139 BELGIUM ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 140 BELGIUM PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 141 BELGIUM YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 142 BELGIUM YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 143 BELGIUM WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 144 BELGIUM NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 145 BELGIUM CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 146 BELGIUM YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 147 BELGIUM YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 148 BELGIUM YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 149 BELGIUM YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 150 BELGIUM YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 151 BELGIUM JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 152 BELGIUM BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 153 BELGIUM YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 154 BELGIUM YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 155 BELGIUM YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 156 BELGIUM STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 157 BELGIUM NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 158 NETHERLANDS YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 159 NETHERLANDS YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 160 NETHERLANDS YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 161 NETHERLANDS YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 162 NETHERLANDS YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 163 NETHERLANDS FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 164 NETHERLANDS YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 165 NETHERLANDS ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 166 NETHERLANDS PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 167 NETHERLANDS YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 168 NETHERLANDS YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 169 NETHERLANDS WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 170 NETHERLANDS NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 171 NETHERLANDS CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 172 NETHERLANDS YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 173 NETHERLANDS YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 174 NETHERLANDS YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 175 NETHERLANDS YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 176 NETHERLANDS YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 177 NETHERLANDS JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 178 NETHERLANDS BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 179 NETHERLANDS YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 180 NETHERLANDS YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 181 NETHERLANDS YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 182 NETHERLANDS STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 183 NETHERLANDS NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 184 ITALY YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 185 ITALY YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 186 ITALY YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 187 ITALY YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 188 ITALY YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 189 ITALY FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 190 ITALY YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 191 ITALY ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 192 ITALY PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 193 ITALY YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 194 ITALY YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 195 ITALY WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 196 ITALY NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 197 ITALY CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 198 ITALY YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 199 ITALY YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 200 ITALY YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 201 ITALY YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 202 ITALY YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 203 ITALY JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 204 ITALY BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 205 ITALY YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 206 ITALY YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 207 ITALY YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 208 ITALY STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 209 ITALY NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 210 AUSTRIA YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 211 AUSTRIA YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 212 AUSTRIA YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 213 AUSTRIA YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 214 AUSTRIA YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 215 AUSTRIA FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 216 AUSTRIA YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 217 AUSTRIA ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 218 AUSTRIA PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 219 AUSTRIA YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 220 AUSTRIA YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 221 AUSTRIA WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 222 AUSTRIA NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 223 AUSTRIA CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 224 AUSTRIA YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 225 AUSTRIA YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 226 AUSTRIA YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 227 AUSTRIA YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 228 AUSTRIA YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 229 AUSTRIA JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 230 AUSTRIA BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 231 AUSTRIA YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 232 AUSTRIA YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 233 AUSTRIA YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 234 AUSTRIA STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 235 AUSTRIA NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 236 SWEDEN YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 237 SWEDEN YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 238 SWEDEN YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 239 SWEDEN YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 240 SWEDEN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 241 SWEDEN FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 242 SWEDEN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 243 SWEDEN ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 244 SWEDEN PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 245 SWEDEN YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 246 SWEDEN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 247 SWEDEN WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 248 SWEDEN NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 249 SWEDEN CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 250 SWEDEN YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 251 SWEDEN YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 252 SWEDEN YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 253 SWEDEN YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 254 SWEDEN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 255 SWEDEN JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 256 SWEDEN BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 257 SWEDEN YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 258 SWEDEN YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 259 SWEDEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 260 SWEDEN STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 261 SWEDEN NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 262 DENMARK YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 263 DENMARK YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 264 DENMARK YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 265 DENMARK YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 266 DENMARK YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 267 DENMARK FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 268 DENMARK YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 269 DENMARK ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 270 DENMARK PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 271 DENMARK YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 272 DENMARK YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 273 DENMARK WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 274 DENMARK NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 275 DENMARK CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 276 DENMARK YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 277 DENMARK YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 278 DENMARK YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 279 DENMARK YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 280 DENMARK YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 281 DENMARK JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 282 DENMARK BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 283 DENMARK YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 284 DENMARK YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 285 DENMARK YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 286 DENMARK STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 287 DENMARK NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 288 UNITED KINGDOM YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 289 UNITED KINGDOM YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 290 UNITED KINGDOM YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 291 UNITED KINGDOM YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 292 UNITED KINGDOM YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 293 UNITED KINGDOM FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 294 UNITED KINGDOM YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 295 UNITED KINGDOM ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 296 UNITED KINGDOM PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 297 UNITED KINGDOM YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 298 UNITED KINGDOM YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 299 UNITED KINGDOM WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 300 UNITED KINGDOM NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 301 UNITED KINGDOM CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 302 UNITED KINGDOM YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 303 UNITED KINGDOM YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 304 UNITED KINGDOM YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 305 UNITED KINGDOM YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 306 UNITED KINGDOM YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 307 UNITED KINGDOM JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 308 UNITED KINGDOM BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 309 UNITED KINGDOM YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 310 UNITED KINGDOM YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 311 UNITED KINGDOM YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 312 UNITED KINGDOM STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 313 UNITED KINGDOM NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 314 PORTUGAL YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 315 PORTUGAL YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 316 PORTUGAL YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 317 PORTUGAL YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 318 PORTUGAL YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 319 PORTUGAL FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 320 PORTUGAL YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 321 PORTUGAL ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 322 PORTUGAL PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 323 PORTUGAL YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 324 PORTUGAL YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 325 PORTUGAL WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 326 PORTUGAL NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 327 PORTUGAL CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 328 PORTUGAL YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 329 PORTUGAL YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 330 PORTUGAL YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 331 PORTUGAL YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 332 PORTUGAL YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 333 PORTUGAL JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 334 PORTUGAL BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 335 PORTUGAL YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 336 PORTUGAL YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 337 PORTUGAL YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 338 PORTUGAL STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 339 PORTUGAL NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 340 SWITZERLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 341 SWITZERLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 342 SWITZERLAND YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 343 SWITZERLAND YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 344 SWITZERLAND YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 345 SWITZERLAND FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 346 SWITZERLAND YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 347 SWITZERLAND ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 348 SWITZERLAND PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 349 SWITZERLAND YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 350 SWITZERLAND YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 351 SWITZERLAND WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 352 SWITZERLAND NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 353 SWITZERLAND CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 354 SWITZERLAND YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 355 SWITZERLAND YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 356 SWITZERLAND YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 357 SWITZERLAND YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 358 SWITZERLAND YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 359 SWITZERLAND JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 360 SWITZERLAND BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 361 SWITZERLAND YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 362 SWITZERLAND YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 363 SWITZERLAND YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 364 SWITZERLAND STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 365 SWITZERLAND NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 366 IRELAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 367 IRELAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 368 IRELAND YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 369 IRELAND YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 370 IRELAND YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 371 IRELAND FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 372 IRELAND YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 373 IRELAND ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 374 IRELAND PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 375 IRELAND YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 376 IRELAND YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 377 IRELAND WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 378 IRELAND NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 379 IRELAND CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 380 IRELAND YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 381 IRELAND YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 382 IRELAND YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 383 IRELAND YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 384 IRELAND YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 385 IRELAND JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 386 IRELAND BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 387 IRELAND YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 388 IRELAND YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 389 IRELAND YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 390 IRELAND STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 391 IRELAND NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 392 FINLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 393 FINLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 394 FINLAND YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 395 FINLAND YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 396 FINLAND YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 397 FINLAND FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 398 FINLAND YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 399 FINLAND ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 400 FINLAND PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 401 FINLAND YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 402 FINLAND YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 403 FINLAND WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 404 FINLAND NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 405 FINLAND CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 406 FINLAND YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 407 FINLAND YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 408 FINLAND YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 409 FINLAND YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 410 FINLAND YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 411 FINLAND JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 412 FINLAND BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 413 FINLAND YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 414 FINLAND YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 415 FINLAND YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 416 FINLAND STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 417 FINLAND NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 418 LUXEMBOURG YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 419 LUXEMBOURG YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 420 LUXEMBOURG YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 421 LUXEMBOURG YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 422 LUXEMBOURG YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 423 LUXEMBOURG FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 424 LUXEMBOURG YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 425 LUXEMBOURG ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 426 LUXEMBOURG PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 427 LUXEMBOURG YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 428 LUXEMBOURG YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 429 LUXEMBOURG WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 430 LUXEMBOURG NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 431 LUXEMBOURG CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 432 LUXEMBOURG YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 433 LUXEMBOURG YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 434 LUXEMBOURG YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 435 LUXEMBOURG YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 436 LUXEMBOURG YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 437 LUXEMBOURG JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 438 LUXEMBOURG BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 439 LUXEMBOURG YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 440 LUXEMBOURG YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 441 LUXEMBOURG YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 442 LUXEMBOURG STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 443 LUXEMBOURG NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 444 REST OF EUROPE YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 445 REST OF EUROPE YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

그림 목록

FIGURE 1 EUROPE YOGURT MARKET: SEGMENTATION

FIGURE 2 EUROPE YOGURT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE YOGURT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE YOGURT MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE YOGURT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE YOGURT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE YOGURT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE YOGURT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE YOGURT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE YOGURT MARKET: SEGMENTATION

FIGURE 11 EIGHT SEGMENTS COMPRISE THE EUROPE YOGURT MARKET, BY YOGURT TYPE

FIGURE 12 CHANGING LIFESTYLES OF PEOPLE TO OPT FOR HEALTHIER PRODUCTS IS EXPECTED TO DRIVE THE EUROPE YOGURT MARKET IN THE FORECAST PERIOD 2025 TO 2032

FIGURE 13 REGULAR YOGURT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE YOGURT MARKET IN 2025 AND 2032

FIGURE 14 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 15 PRICING ANALYSIS

FIGURE 16 DROC ANALYSIS

FIGURE 17 EUROPE YOGURT MARKET: BY PRODUCT TYPE, 2024

FIGURE 18 EUROPE YOGURT MARKET: BY PRODUCT TYPE, 2025-2032 (USD MILLION)

FIGURE 19 EUROPE YOGURT MARKET: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 20 EUROPE YOGURT MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 21 EUROPE YOGURT MARKET: BY FORMULATION, 2024

FIGURE 22 EUROPE YOGURT MARKET: BY FORMULATION, 2025-2032 (USD MILLION)

FIGURE 23 EUROPE YOGURT MARKET: BY FORMULATION, CAGR (2025-2032)

FIGURE 24 EUROPE YOGURT MARKET: BY FORMULATION, LIFELINE CURVE

FIGURE 25 EUROPE YOGURT MARKET: BY INCLUSION CATEGORY, 2024

FIGURE 26 EUROPE YOGURT MARKET: BY INCLUSION CATEGORY, 2025-2032 (USD MILLION)

FIGURE 27 EUROPE YOGURT MARKET: BY INCLUSION CATEGORY, CAGR (2025-2032)

FIGURE 28 EUROPE YOGURT MARKET: BY INCLUSION CATEGORY, LIFELINE CURVE

FIGURE 29 EUROPE YOGURT MARKET: BY SOURCE, 2024

FIGURE 30 EUROPE YOGURT MARKET: BY SOURCE, 2025-2032 (USD MILLION)

FIGURE 31 EUROPE YOGURT MARKET: BY SOURCE, CAGR (2025-2032)

FIGURE 32 EUROPE YOGURT MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 33 EUROPE YOGURT MARKET: BY FLAVOR, 2024

FIGURE 34 EUROPE YOGURT MARKET: BY FLAVOR, 2025-2032 (USD MILLION)

FIGURE 35 EUROPE YOGURT MARKET: BY FLAVOR, CAGR (2025-2032)

FIGURE 36 EUROPE YOGURT MARKET: BY FLAVOR, LIFELINE CURVE

FIGURE 37 EUROPE YOGURT MARKET: BY FAT CONTENT, 2024

FIGURE 38 EUROPE YOGURT MARKET: BY FAT CONTENT, 2025-2032 (USD MILLION)

FIGURE 39 EUROPE YOGURT MARKET: BY FAT CONTENT, CAGR (2025-2032)

FIGURE 40 EUROPE YOGURT MARKET: BY FAT CONTENT, LIFELINE CURVE

FIGURE 41 EUROPE YOGURT MARKET: BY FORTIFICATION, 2024

FIGURE 42 EUROPE YOGURT MARKET: BY FORTIFICATION, 2025-2032 (USD MILLION)

FIGURE 43 EUROPE YOGURT MARKET: BY FORTIFICATION, CAGR (2025-2032)

FIGURE 44 EUROPE YOGURT MARKET: BY FORTIFICATION, LIFELINE CURVE

FIGURE 45 EUROPE YOGURT MARKET: BY ORGANIC CATEGORY, 2024

FIGURE 46 EUROPE YOGURT MARKET: BY ORGANIC CATEGORY, 2025-2032 (USD MILLION)

FIGURE 47 EUROPE YOGURT MARKET: BY ORGANIC CATEGORY, CAGR (2025-2032)

FIGURE 48 EUROPE YOGURT MARKET: BY ORGANIC CATEGORY, LIFELINE CURVE

FIGURE 49 EUROPE YOGURT MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 50 EUROPE YOGURT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 51 EUROPE YOGURT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 52 EUROPE YOGURT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 53 EUROPE YOGURT MARKET: BY PACKAGING SIZE, 2024

FIGURE 54 EUROPE YOGURT MARKET: BY PACKAGING SIZE, 2025-2032 (USD MILLION)

FIGURE 55 EUROPE YOGURT MARKET: BY PACKAGING SIZE, CAGR (2025-2032)

FIGURE 56 EUROPE YOGURT MARKET: BY PACKAGING SIZE, LIFELINE CURVE

FIGURE 57 EUROPE YOGURT MARKET: BY CLAIM, 2024

FIGURE 58 EUROPE YOGURT MARKET: BY CLAIM, 2025-2032 (USD MILLION)

FIGURE 59 EUROPE YOGURT MARKET: BY CLAIM, CAGR (2025-2032)

FIGURE 60 EUROPE YOGURT MARKET: BY CLAIM, LIFELINE CURVE

FIGURE 61 EUROPE YOGURT MARKET: BY BRAND, 2024