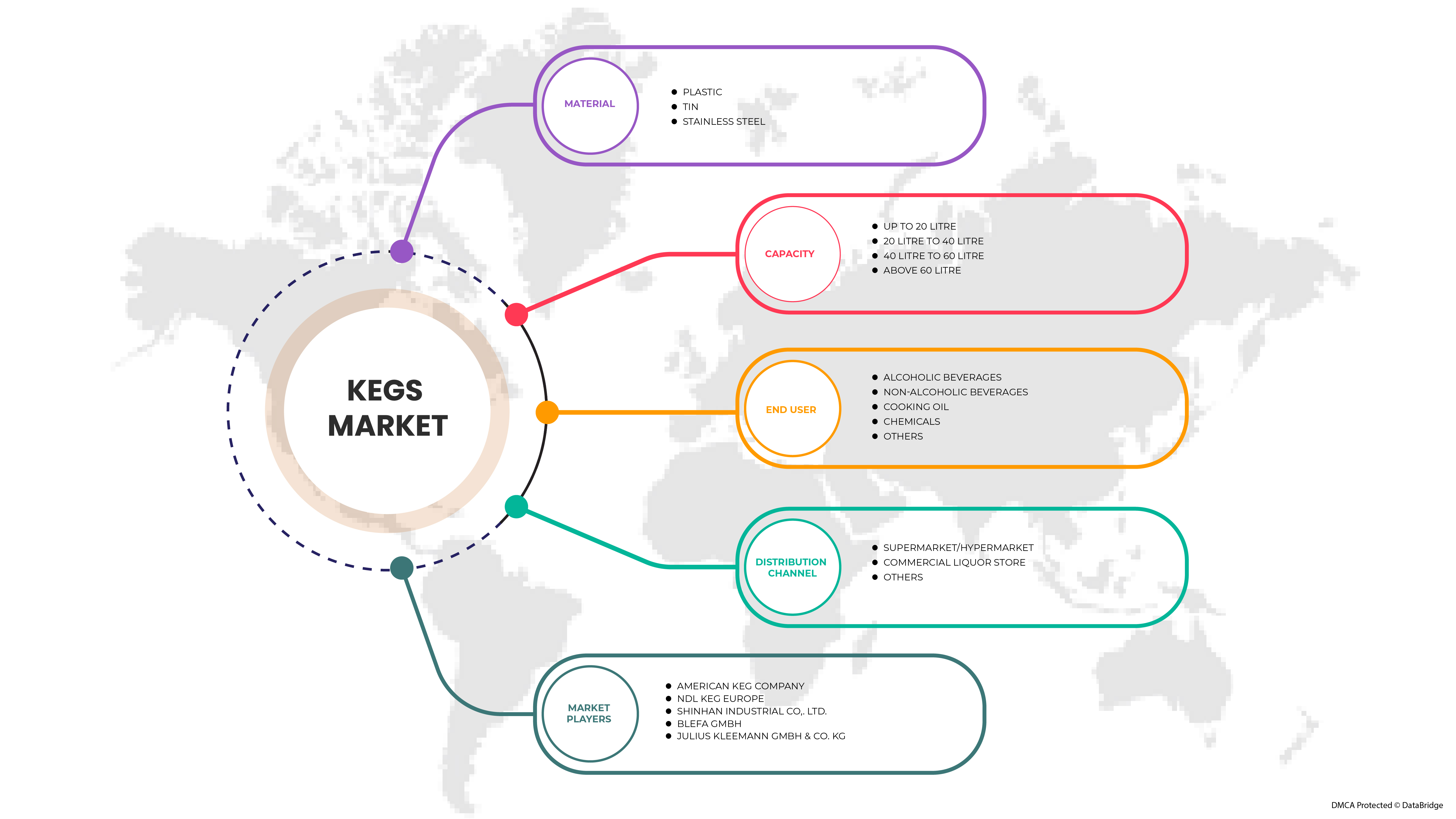

Europe Kegs Market, By Material (Plastic, Tin, and Stainless Steel), Capacity (Up To 20 Litre, 20 Litre To 40 Litre, 40 Litre To 60 Litre, and Above 60 Litre), End User (Alcoholic Beverages, Non- Alcoholic Beverages, Cooking Oil, Chemicals, and Others), Distribution Channel (Supermarket/Hypermarket, Commercial Liquor Store, and Others) Industry Trends and Forecast to 2029.

Europe Kegs Market Analysis and Size

The Europe kegs market is being driven by the increase in applications for kegs across industries. Additionally, the growth of the market is fueled by rising demand for alcoholic and non-alcoholic beverages. However, the primary factors limiting the market growth are the high costs associated with commercial kegs. As a result of the rising demand for kegs, manufacturers are putting more effort into launching new products with cut-edge technology and certified by authorized institutes. The market's expansion is ultimately aided by these choices.

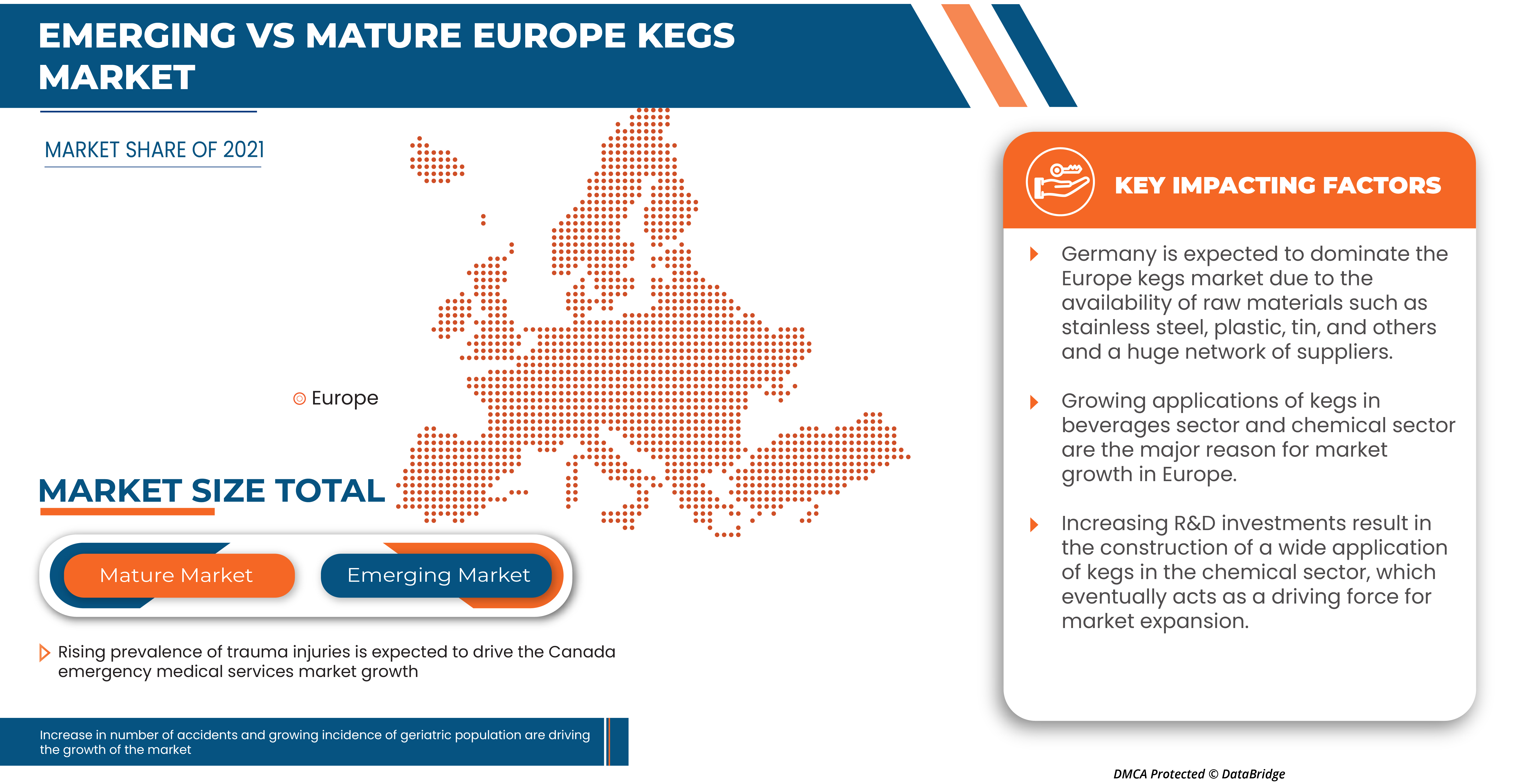

Some of the factors driving the market growth are growing applications of kegs in chemical sector and food & beverages sector and increasing consumption of beverages due to gradual lifestyle changes. However, limitations in terms of slow replacement of kegs due to their prolonged lifespan are expected to hamper the market growth.

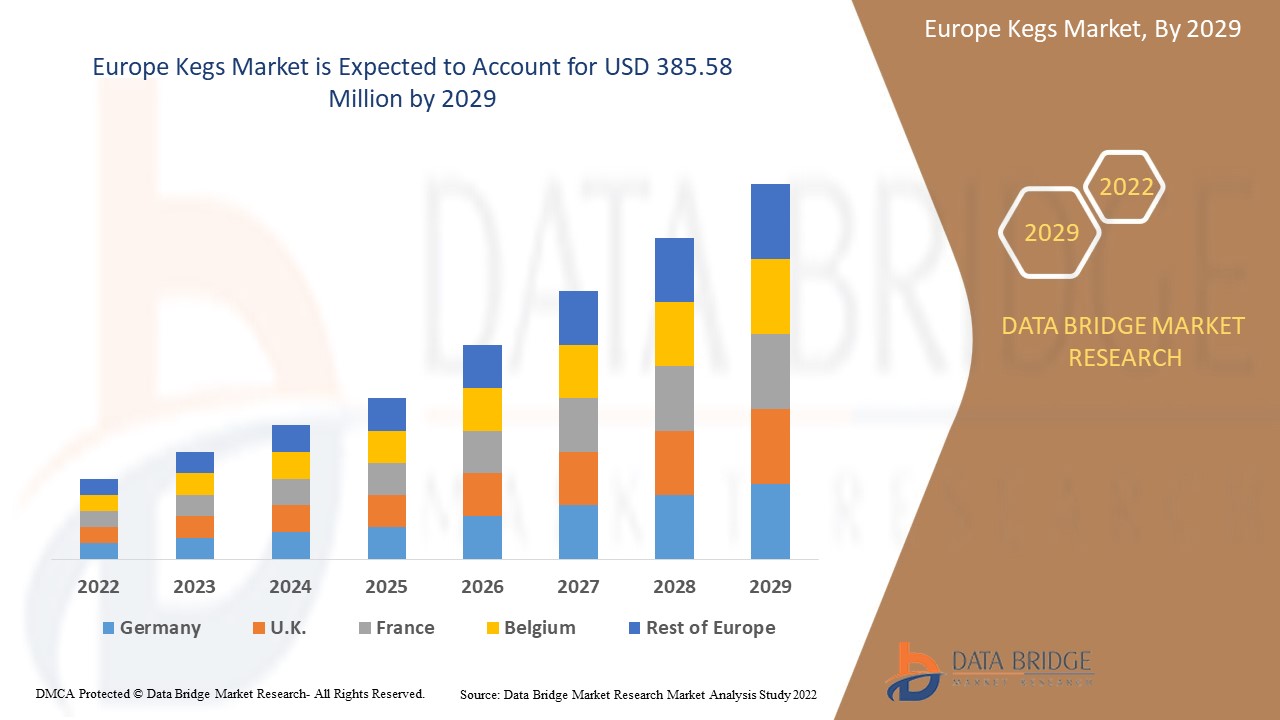

Data Bridge Market Research analyzes that the Europe kegs market is expected to reach a value of USD 385.58 million by 2029, at a CAGR of 4.2% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volume in Million Units, and Pricing in USD |

|

Segments Covered |

By Material (Plastic, Tin, and Stainless Steel), Capacity (Up To 20 Litre, 20 Litre To 40 Litre, 40 Litre To 60 Litre, and Above 60 Litre), End User (Alcoholic Beverages, Non-Alcoholic Beverages, Cooking Oil, Chemicals, and Others), Distribution Channel (Supermarket/Hypermarket, Commercial Liquor Store, and Others). |

|

Countries Covered |

U.K., Germany, France, Netherlands, Belgium, Spain, Switzerland, Italy, Russia, Turkey, and rest of Europe. |

|

Market Players Covered |

NDL Keg Europe, BLEFA GmbH, Julius Kleemann GmbH & Co.KG, The Metal Drum Company, Petainer Ltd., NEW MAISONNEUVE KEG, Schaefer Container Systems, Supermonte Group Italy, Inc., and KeyKeg |

Market Definition

Kegs are little barrels. Beverages, chemicals, oils, and various liquids are transported and stored in kegs constructed with various raw materials. A keg is generally often made of stainless steel, however, aluminum can also be used if it has an interior plastic coating. Beer is frequently transported, served, and stored in it. A keg can also hold additional alcoholic and non-alcoholic beverages that are carbonated or not. It is common practice to maintain the pressure of carbonated beverages to keep carbon dioxide in the solution and prevent the beverage from going flat.

Europe Kegs Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

- Growing application of kegs in chemical sectors

A chemical storage keg is a high-quality storage container used by a wide range of industries to hold various types of chemical substances. They are available in a range of forms and sizes and have always been popular. An industrial chemical storage keg is a significant chemical storage system. Because chemicals are corrosive, they must be stored in a secure location. Chemical kegs are chemical storage containers that are frequently utilized in the chemical industry. They are available in a range of sizes and shapes and are used for static storage, processing, mixing, and transportation of both raw materials and finished chemical products.

Nowadays, most keg and chemical enterprises are investing in R&D, which leads to a surge in the applications of kegs in the chemical sector.

Increasing R&D investments result in the construction of a wide application of kegs in the chemical sector, which eventually acts as a driving force for market expansion.

- Rising trend of long-term packaging and preserving solutions

The use of kegs as a packaging solution in the beverage industry is anticipated to have a promising future. Plastic kegs can be recycled and cost less to send back. On the other hand, keg adoption has expanded as a result of the popularity of kegs encouraging manufacturers to offer kegs for leasing. Single-use kegs are a more economical and effective alternative to traditional steel kegs, and it is anticipated that they will become widely used in the near future. Additionally, the microbrew sector is expanding due to consumer enthusiasm for craft ales, which has bolstered the global keg industry. Keg use is anticipated to be encouraged by legislative constraints that favor lower package weight limits. Kegs are also used for preserving the solutions like beverages, oil, and chemicals to preserve the quality and flavor of the product.

For instance,

- In September 2021, Newsmatics Inc. published an article titled “Kegs have Become More Popular as a Promising, Long-term Packaging Solution” and tells that as a packaging option for beverages, kegs are anticipated to have a promising future

- In September 2020, Hospitality Net™ published an article titled “Keg Wine On Tap: A Swiss Sustainable Innovation” and tells that one thing was keg wine, which flawlessly protects wine quality while also being practicable, eco-friendly, and cost-effective

Rising end-user awareness of keg applications such as long-term packaging and preserving solutions is driving market growth.

RESTRAINTS

- Slow replacement of kegs due to their prolonged lifespan

Kegs have a longer lifespan, so customers purchase the product less frequently. Since it takes a lot of time to switch from old kegs to new ones, this time lag could act as a barrier to market expansion.

For instance,

- In March 2020, Keg Works published an article entitled “How Long Does a Keg Stay Fresh?” It mentioned that a keg of pasteurized beer has a shelf life of around 90-120 days (or 3-4 months) and unpasteurized draught beer has a shelf life of about 45-60 days (or 6-8 weeks) when stored at the right temperature.

Life span of various kegs is mentioned in the table given below:

|

Product name |

Life span |

|

Wine Keg |

6-8 weeks |

|

Unpasteurized Beer Keg |

6-8 weeks |

|

Pasteurized Keg |

3-4 weeks |

|

Cocktail Kegs |

Approx. 2 months |

|

Cider Kegs |

6-8 weeks |

Although kegs with a longer lifespan may assist end users, the slowdown replacement of kegs may function as a barrier to the market growth.

- High cost associated with commercial kegs

A price decline will almost certainly result in new consumers or keg sales. A high price, on the other hand, encourages buyers to buy less products, resulting in a loss of sales for the company. The high cost of commercial kegs is a market barrier since end-users cannot afford to continue investing in these commercial kegs. It eventually acts as a barrier to market growth.

For instance,

|

Product name |

Price |

|

Commercial Beer Dispenser Kegerator - 4 Tap Store 4 Kegs |

INR 44,000 |

|

Ball Lock Corny Keg: Home Brew Fermenter |

INR 5,824 |

|

Stainless Steel Beer Barrel Commercial Keg 50 Liters Euro Standard |

USD 55-65/piece |

|

1 galloon, 30 Liters Commercial Brewing Beer Keg with CO2 Regulator |

USD 54.59-56.69/piece |

|

Empty Commercial Brew Customized Keg 30l Stainless Steel Beer Barrel 30l Beer Keg |

USD 44.48-57.65/piece |

The pricing of commercial kegs indicated above is higher, and they are beyond the reach of end consumers. As a result, the market expansion will eventually slow down.

OPPORTUNITY

- Increasing advancements in technologies in kegs such as cutting-edge technology

Automation and technological developments have made keg manufacturing more efficient. These facilities may better manage their costs and key systems, thanks to smart keg tracking sensors linked to the Internet of Things (IoT) using both GPS and RFID technology, and temperature controls among other things. Keg automation technologies include smart sensors, mobile tablets and smartphones, software, APIs, and cloud databases. Technology-driven automation in kegs among other things enhances fulfillment and improves storage and transportation of alcoholic or non-alcoholic drinks, carbonated or non-carbonated, and other beverages.

The quick increase in R&D and technological progress in keg manufacturing will help in providing an opportunity for market growth and expansion.

As a result, opportunities in the market are anticipated to arise from ongoing technological developments in keg manufacturing.

CHALLENGE

- Growing stiff competition among players

Since there is intense competition among the current kegs industry players, this will result in lower prices and less overall profitability for the sector. Kegs is a highly competitive packaging and container market. The organization's total long-term profitability is affected by this competition. Due to the intense rivalry, businesses primarily concentrate on increasing the number of product releases, campaigns, and marketing to attract consumers. So, this competition among the players will be a challenge for the market.

Companies that produce and supply comparable goods are more competitive with one another, which could threaten the market due to large supply and low demand.

Post-COVID-19 Impact on Europe Kegs Market

Post-pandemic, the demand for kegs increased as there were no restrictions on movement, hence, the supply of products was easy. The persistence of COVID-19 for a longer period affected the supply chain as it got disrupted, and it became difficult to supply the food products to the consumers, initially increasing the demand for products. However, post-COVID-19, the demand for kegs increased significantly owing to good nutrient content and other nutritional availability.

Recent Developments

- In June, 2022, Ara Partners ("Ara"), a private equity firm specializing in industrial decarburization investments, announced the acquisition of Petainer Ltd. ("Petainer" or the "Company"), a UK-based global producer of sustainable beverage packaging solutions. Ara acquired Petainer in collaboration with Petainer Management and Next Wave Partners LLP affiliates.

- In May 2022, BLEFA joined forces with other leading global keg supply chain companies to launch the new Steel Keg Association (SKA) to give benefits of steel kegs to breweries and beverage companies, as well as bars and restaurants, a unified voice.

Europe Kegs Market Scope

The Europe kegs market is segmented into four notable segments based on material, capacity, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Plastic

- Tin

- Stainless Steel

Based on material, the market is segmented into plastic, tin, and stainless steel.

Capacity

- Up To 20 Litre

- 20 Litre To 40 Litre

- 40 Litre To 60 Litre

- Above 60 Litre

Based on capacity, the market is segmented into up to 20 litre, 20 litre to 40 litre, 40 litre to 60 litre, and above 60 litre.

End User

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Cooking Oil

- Chemicals

- Others

Based on end user, the market is segmented into alcoholic beverages, non-alcoholic beverages, cooking oil, chemicals, and others.

Distribution Channel

- Supermarket/Hypermarket

- Commercial Liquor Store

- Others

Based on distribution channel, the market is segmented into supermarket/hypermarket, commercial liquor store, and others.

Europe Kegs Market Regional Analysis/Insights

The Europe kegs market is analyzed and market size insights and trends are provided by country, material, capacity, end user, and distribution channel as referenced above.

The countries covered in this market report are U.K., Germany, France, Netherlands, Belgium, Spain, Switzerland, Italy, Russia, Turkey, and rest of Europe.

Germany is dominating the kegs market in Europe. Growing demand for beverages is the major reason for market growth in Europe. Moreover, the beverages market is growing progressively in the Europe region. The growth of this market will directly impact the growth of kegs market. However, high cost of commercial kegs is likely to restrict market growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Kegs Market Share Analysis

The Europe kegs market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the market are NDL Keg Europe, BLEFA GmbH, Julius Kleemann GmbH & Co.KG, The Metal Drum Company, Petainer Ltd., NEW MAISONNEUVE KEG, Schaefer Container Systems, Supermonte Group Italy, Inc., and KeyKeg among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE KEGS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MATERIAL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.3 IMPORT-EXPORT ANALYSIS

4.4 LIST OF KEY BUYERS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 CLIMATE CHANGE SCENARIO

7 SUPPLY CHAIN ANALYSIS

7.1 RAW MATERIAL

7.2 SUPPLYING/MANUFACTURING

7.3 DISTRIBUTION

7.4 END-USERS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING TREND OF LONG-TERM PACKAGING AND PRESERVING SOLUTIONS

8.1.2 INCREASING CONSUMPTION OF BEVERAGES DUE TO CHANGE IN GRADUAL LIFESTYLE

8.1.3 GROWING APPLICATION OF KEGS IN CHEMICAL SECTORS

8.2 RESTRAINTS

8.2.1 HIGH COST ASSOCIATED WITH COMMERCIAL KEGS

8.2.2 SLOW REPLACEMENT OF KEGS DUE TO THEIR PROLONGED LIFESPAN

8.3 OPPORTUNITIES

8.3.1 INCREASED DEMAND FOR ECO-FRIENDLY KEGS AS A RESULT OF THE SUSTAINABILITY TREND

8.3.2 INCREASING ADVANCEMENTS IN TECHNOLOGIES IN KEGS SUCH AS CUTTING-EDGE TECHNOLOGY

8.4 CHALLENGES

8.4.1 WIDE FLUCTUATIONS IN PRICE OF RAW MATERIAL

8.4.2 GROWING STIFF COMPETITION AMONG PLAYERS

9 EUROPE KEGS MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 STAINLESS STEEL

9.3 PLASTIC

9.4 TIN

10 EUROPE KEGS MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 40 LITRE TO 60 LITRE

10.3 20 LITRE TO 40 LITRE

10.4 ABOVE 60 LITRE

10.5 UP TO 20 LITRE

11 EUROPE KEGS MARKET, BY END USER

11.1 OVERVIEW

11.2 ALCOHOLIC BEVERAGES

11.2.1 BEER

11.2.2 WINE

11.2.3 SPIRITS

11.2.4 CIDER

11.3 NON-ALCOHOLIC BEVERAGES

11.3.1 SOFT-DRINKS

11.3.2 RTD-BEVERAGES

11.3.3 JUICES

11.3.4 OTHERS

11.4 CHEMICALS

11.5 COOKING OIL

11.6 OTHERS

12 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 COMMERCIAL LIQUOR STORE

12.3 SUPERMARKET / HYPERMARKET

12.4 OTHERS

13 EUROPE KEGS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 SPAIN

13.1.3 U.K.

13.1.4 ITALY

13.1.5 FRANCE

13.1.6 NETHERLANDS

13.1.7 BELGIUM

13.1.8 SWITZERLAND

13.1.9 RUSSIA

13.1.10 TURKEY

13.1.11 REST OF EUROPE

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 BLEFA GMBH

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 PETAINER LTD.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 JULIUS KLEEMANN GMBH & CO. KG

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 NDL KEG EUROPE

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 NEW MAISONNEUVE KEG

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 AMERICAN KEG COMPANY

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 KEYKEG

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 SCHAEFER CONTAINER SYSTEMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 SHINHAN INDUSTRIAL CO,. LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 SUPERMONTE GROUP ITALY, INC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 THE METAL DRUM COMPANY

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 IMPORT OF KEGS, 2020-2021, IN USD MILLION

TABLE 2 EXPORT OF KEGS (CASKS, BARRELS, VATS, TUBS AND OTHER COOPERS' PRODUCTS PARTS THEREOF, OF WOOD, INCL. STAVES), 2020-2021, IN USD MILLION

TABLE 3 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 4 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 5 EUROPE STAINLESS STEEL IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE STAINLESS STEEL IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 7 EUROPE PLASTIC IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE PLASTIC IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 9 EUROPE TIN IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TIN IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 11 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 12 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 13 EUROPE 40 LITRE TO 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE 40 LITRE TO 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 15 EUROPE 20 LITRE TO 40 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE 20 LITRE TO 40 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 17 EUROPE ABOVE 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ABOVE 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 19 EUROPE UP TO 20 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE UP TO 20 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 21 EUROPE KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 22 EUROPE KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 23 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 25 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 27 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 29 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 31 EUROPE CHEMICALS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE CHEMICALS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 33 EUROPE COOKING OIL IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE COOKING OIL IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 35 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 37 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 39 EUROPE COMMERCIAL LIQUOR STORE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE COMMERCIAL LIQUOR STORE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 41 EUROPE SUPERMARKET / HYPERMARKET IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE SUPERMARKET / HYPERMARKET IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 43 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 45 EUROPE KEGS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 EUROPE KEGS MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 47 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 48 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 49 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 50 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 51 EUROPE KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 EUROPE KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 53 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 55 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 57 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 59 GERMANY KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 GERMANY KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 61 GERMANY KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 62 GERMANY KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 63 GERMANY KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 GERMANY KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 65 GERMANY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 GERMANY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 67 GERMANY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 GERMANY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 69 GERMANY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 GERMANY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 71 SPAIN KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 72 SPAIN KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 73 SPAIN KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 74 SPAIN KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 75 SPAIN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 SPAIN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 77 SPAIN ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 SPAIN ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 79 SPAIN NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 SPAIN NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 81 SPAIN KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 SPAIN KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 83 U.K. KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 84 U.K. KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 85 U.K. KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 86 U.K. KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 87 U.K. KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 88 U.K. KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 89 U.K. ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 U.K. ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 91 U.K. NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 U.K. NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 93 U.K. KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 U.K. KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 95 ITALY KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 ITALY KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 97 ITALY KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 98 ITALY KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 99 ITALY KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 ITALY KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 101 ITALY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 ITALY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 103 ITALY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 ITALY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 105 ITALY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 ITALY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 107 FRANCE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 108 FRANCE KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 109 FRANCE KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 110 FRANCE KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 111 FRANCE KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 112 FRANCE KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 113 FRANCE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 FRANCE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 115 FRANCE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 FRANCE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 117 FRANCE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 118 FRANCE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 119 NETHERLANDS KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 120 NETHERLANDS KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 121 NETHERLANDS KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 122 NETHERLANDS KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 123 NETHERLANDS KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 NETHERLANDS KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 125 NETHERLANDS ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 126 NETHERLANDS ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 127 NETHERLANDS NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 128 NETHERLANDS NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 129 NETHERLANDS KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 NETHERLANDS KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 131 BELGIUM KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 132 BELGIUM KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 133 BELGIUM KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 134 BELGIUM KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 135 BELGIUM KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 BELGIUM KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 137 BELGIUM ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 BELGIUM ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 139 BELGIUM NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 141 BELGIUM KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 BELGIUM KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 143 SWITZERLAND KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 144 SWITZERLAND KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 145 SWITZERLAND KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 146 SWITZERLAND KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 147 SWITZERLAND KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 SWITZERLAND KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 149 SWITZERLAND ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 150 SWITZERLAND ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 151 SWITZERLAND NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 152 SWITZERLAND NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 153 SWITZERLAND KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 SWITZERLAND KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 155 RUSSIA KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 157 RUSSIA KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 158 RUSSIA KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 159 RUSSIA KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 RUSSIA KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 161 RUSSIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 163 RUSSIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 RUSSIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 165 RUSSIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 166 RUSSIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 167 TURKEY KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 168 TURKEY KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 169 TURKEY KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 170 TURKEY KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 171 TURKEY KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 TURKEY KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 173 TURKEY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 TURKEY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 175 TURKEY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 TURKEY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 177 TURKEY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 178 TURKEY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 179 REST OF EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 EUROPE KEGS MARKET: SEGMENTATION

FIGURE 2 EUROPE KEGS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE KEGS MARKET : DROC ANALYSIS

FIGURE 4 EUROPE KEGS MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE KEGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE KEGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE KEGS MARKET: DBMR POSITION GRID

FIGURE 8 EUROPE KEGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE KEGS MARKET: SEGMENTATION

FIGURE 10 RISING TREND OF LONG-TERM PAKAGING&PRESERVING SOLUTIONS IS EXPECTED TO DRIVE THE EUROPE KEGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 STAINLESS STEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE KEGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SUPPLY CHAIN OF EUROPE KEGS MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE KEGS MARKET

FIGURE 14 EUROPE KEGS MARKET, BY MATERIAL, 2021

FIGURE 15 EUROPE KEGS MARKET, BY CAPACITY, 2021

FIGURE 16 EUROPE KEGS MARKET, BY END USER, 2021

FIGURE 17 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 18 EUROPE KEGS MARKET: SNAPSHOT (2021)

FIGURE 19 EUROPE KEGS MARKET: BY COUNTRY (2021)

FIGURE 20 EUROPE KEGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 EUROPE KEGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 EUROPE KEGS MARKET: BY MATERIAL (2022-2029)

FIGURE 23 EUROPE KEGS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.