Canada Fleet Management Market, By Offering (Solutions and Services), Lease Type (On-Lease and Without Lease), Mode of Transport (Automotive, Marine, Rolling Stock, and Aircraft), Vehicle Type (Internal Combustion Engine and Electric vehicle), Hardware (GPS Tracking Devices, Dash Cameras, Bluetooth Tracking Tags, Data Loggers, and Others), Fleet Size (Small Fleets (1-5 Vehicles), Medium Fleets (5-20 Vehicles) and Large & Enterprise Fleets (20-50+ Vehicles), Communication Range (Short Range Communication and Long Range Communication), Deployment Model (On-Premise, Cloud, and Hybrid), Technology (GNSS, Cellular Systems, Electronic Data Interchange (EDI), Remote Sensing, Computational Method & Decision Making, RFID, and Others), Functions (Monitoring Driver Behavior, Fuel Consumption, Asset Management, ELD Complaint, Route Management, Vehicle Maintenance Updates, Delivery Schedule, Accident Prevention, Real Time Vehicle Location, Mobile Apps, and Others), Operations (Private and Commercial), Business Type (Small Business and Large Business), End User (Automotive, Transportation & Logistics, Retail, Manufacturing, Food & Beverages, Energy & Utilities, Mining, Government, Healthcare, Agriculture, Construction, and Others) – Industry Trends and Forecast to 2030.

Canada Fleet Management Market Analysis and Size

Major factors expected to boost the growth of the fleet management market in the forecast period are the rise in several industrial applications, including aerospace, steel, power, chemical, and others. Furthermore, the increased resistance to load variations is the benefit of fleet management, which is further anticipated to propel the growth of the fleet management market.

Data Bridge Market Research analyses that the Canada fleet management market is expected to reach the value of USD 2,204,927.30 thousand by 2030, at a CAGR of 8.1% during the forecast period. The fleet management market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 - 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Offering (Solutions and Services), Lease Type (On-Lease and Without Lease), Mode of Transport (Automotive, Marine, Rolling Stock, and Aircraft), Vehicle Type (Internal Combustion Engine and Electric vehicle), Hardware (GPS Tracking Devices, Dash Cameras, Bluetooth Tracking Tags, Data Loggers, and Others), Fleet Size (Small Fleets (1-5 Vehicles), Medium Fleets (5-20 Vehicles) and Large & Enterprise Fleets (20-50+ Vehicles), Communication Range (Short Range Communication and Long Range Communication), Deployment Model (On-Premise, Cloud, and Hybrid), Technology (GNSS, Cellular Systems, Electronic Data Interchange (EDI), Remote Sensing, Computational Method & Decision Making, RFID, and Others), Functions (Monitoring Driver Behavior, Fuel Consumption, Asset Management, ELD Complaint, Route Management, Vehicle Maintenance Updates, Delivery Schedule, Accident Prevention, Real Time Vehicle Location, Mobile Apps, and Others), Operations (Private and Commercial), Business Type (Small Business and Large Business), End User (Automotive, Transportation & Logistics, Retail, Manufacturing, Food & Beverages, Energy & Utilities, Mining, Government, Healthcare, Agriculture, Construction, and Others) |

|

Country Covered |

Canada |

|

Market Players Covered |

Element Fleet Management Corp. (U.S.), Verizon. (U.S.), Geotab Inc. (Canada), Motive Technologies, Inc. (U.S.), Jim Pattison Lease (Canada), Holman, Inc. (U.S.), Cisco Systems, Inc. (U.S.), Donlen (U.S.), Omnitracs (a part of Solera) (U.S.), Wheels Inc. (U.S.), DENSO CORPORATION (Japan), AT&T (U.S.), Continental AG (Germany), ORBCOMM (U.S.), Summit Fleet Leasing and Management (Canada), Siemens (Germany), ADDISON LEASING OF CANADA LTD (Canada), Robert Bosch GmbH (Germany), RAM Tracking (U.K.), TRANSFLO (U.S.), Foss National Leasing Ltd. (Canada), Samsara Inc. (U.S.), Sierra Wireless. (U.S.), Mendix Technology BV (Netherlands), ALD Automotive (France), IBM (U.S.), ADDISON LEASING OF CANADA LTD (Canada), Robert Bosch GmbH (Germany), RAM Tracking (U.K.), TRANSFLO (U.S.) among others |

Market Definition

차량 관리란 회사의 차량대를 관리하는 데 관련된 프로세스와 관행입니다. 차량 관리에는 자동차, 트럭, 밴 및 기타 비즈니스 목적으로 사용되는 차량이 포함됩니다. 또한 차량 취득, 유지 관리, 연료 관리, 운전자 관리, 안전 및 규정 준수와 같은 많은 관행이 포함됩니다. 차량 관리의 목표는 효율성을 개선하고 비용을 절감하며 안전을 강화하기 위해 회사 차량 사용을 최적화하는 것입니다. 효과적인 차량 관리를 통해 회사는 생산성을 높이고 가동 중지 시간을 줄이며 차량의 사용 수명을 연장할 수 있습니다. 또한 운전자 행동을 개선하고 사고를 줄이며 규정 및 정책을 준수하는 데 도움이 될 수 있습니다. 차량 관리는 운송, 물류, 배달 서비스 및 건설을 포함한 다양한 산업에서 사용됩니다. GPS 추적 및 텔레매틱스와 같은 첨단 기술로 인해 최근 몇 년 동안 차량 관리가 더욱 효과적이고 효율적으로 이루어졌습니다.

캐나다 함대 관리 시장 동향

이 섹션에서는 시장 동인, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전자

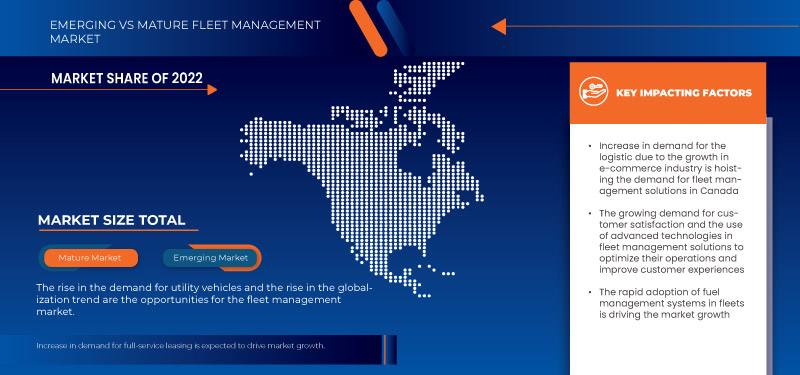

- 전자상거래 산업으로 인한 물류 수요 증가

차량 관리란 조직이 최적의 효율성을 달성하고 비용을 절감하기 위해 배달 차량을 관리하고 조정할 수 있도록 하는 관행입니다. 차량 관리 관행은 택배 및 배달 인력을 모니터링하고 기록하는 데 사용됩니다. 차량 관리자가 연료 관리에서 경로 계획에 이르기까지 활동을 조정하기 쉽게 해주는 기술 시스템이 필요하며 차량 관리 소프트웨어를 사용하여 쉽게 관리할 수 있습니다. 전자 상거래 산업의 확장은 물류 산업에 상당한 영향을 미쳤습니다. 물류는 계획된 운영, 창고 및 생산 네트워크 조직에 즉시 영향을 미치기 때문에 전자 상거래 산업의 중추로 간주되었습니다. 이들은 인터넷 비즈니스 부분 개발과 관련된 증가하는 요청을 처리하기 위해 점진적으로 재평가에 의존할 것입니다. 마지막 마일 운송이나 요청 만족을 위해 이 과정을 채택하면 예측 가능하고 신뢰할 수 있으며 생산적이며 오발 없는 운송을 보장할 수 있습니다. 따라서 이는 전자 상거래 비즈니스 산업의 예상 성장으로 인한 압력을 관리하고 확장하는 데 큰 요인이 될 수 있습니다.

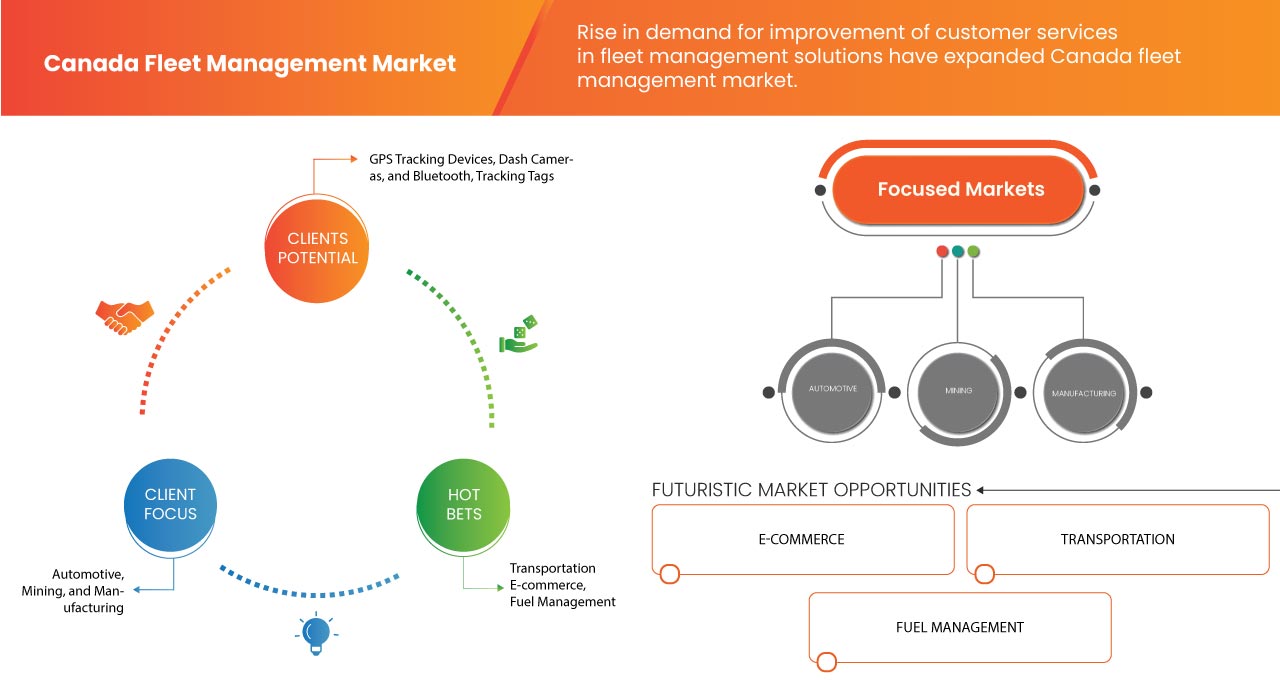

- 고객 서비스 개선에 대한 수요 증가

오늘날의 고객은 그 어느 때보다 더 똑똑하고 기대치가 높습니다. 고객 만족과 행복은 모든 회사에 가장 중요한 고려 사항 중 하나입니다. 사업 부문에 관계없이 불만족스러운 고객은 오래 고객이 되지 않을 것이므로 고객을 행복하게 유지하고 소중하게 여기는 것이 중요합니다. 이는 물류 및 차량 관리에도 해당되며, 고객 유지가 장기적인 성공의 핵심입니다. 차량 관리 성과를 개선하여 고객 서비스와 만족도를 개선하는 것은 캐나다 차량 관리 시장을 활성화할 것으로 예상되는 핵심 요소입니다. 오늘날의 경쟁 시장에서 기업은 고객 만족의 중요성을 인식하고 차량 관리 솔루션에서 첨단 기술을 사용하여 운영을 최적화하고 고객 경험을 개선합니다.

기회

- 유틸리티 차량 수요 증가

유틸리티 차량은 상품이나 승객을 운반하도록 설계 및 사용되는 차량입니다. 이러한 차량에는 트럭, 밴, 버스 및 상업적 목적으로 사용되는 유사한 차량이 포함됩니다. 유틸리티 차량 시장은 캐나다 자동차 산업의 중요한 구성 요소이며 지난 수십 년 동안 상당한 성장을 목격했습니다. 유틸리티 차량에 대한 수요 증가는 전자 상거래 산업의 성장, 도시화 증가, 효율적인 운송 시스템에 대한 필요성을 포함한 여러 요인에 기인할 수 있습니다. 점점 더 많은 기업이 운송 요구에 유틸리티 차량에 의존함에 따라 차량 관리 서비스 및 소프트웨어에 대한 수요도 증가할 것으로 예상됩니다. 유틸리티 차량에 대한 수요가 증가한 이유 중 하나는 전자 상거래 산업의 성장입니다. 온라인 쇼핑 플랫폼의 수가 증가함에 따라 운송 서비스에 대한 수요가 증가했습니다. 유틸리티 차량의 사용이 더 일반화되었고 차량 관리가 더욱 중요해졌습니다.

제약/도전

- 연결성 효율성 저하

물류 및 운송 산업은 최근 몇 년 동안 크게 변화했습니다. 디지털화, 빅데이터의 등장, 연결성과 같은 개념이 도입되었고, 많은 차량대가 이제 이러한 새로운 기술의 초기 버전을 사용하고 있습니다. 많은 경우, 차량대 관리자가 매일 운영하는 방식을 바꾸고 있습니다. 연결성은 가장 중요하고 효과적인 개념 중 하나입니다. 여기서 차량대 관리자는 전체 차량대를 개괄적으로 살펴보고 온보드 장치에서 실행 가능한 데이터를 제공하는 자동화된 프로세스를 통해 운전자, 트럭 및 트레일러와 연락을 유지할 수 있습니다. 텔레매틱스 장치와 연결된 소프트웨어 솔루션을 통해 차량대 문제는 발생하는 대로 사소한 차량 문제에 대한 경고를 받을 수 있으므로 문제를 더 빨리 해결하고 고장이 발생하기 전에 문제를 처리할 수 있습니다. 이를 통해 미리 수리 또는 예정된 유지 관리를 실행할 수 있는 유연성이 제공되어 트럭이 더 자주 도로에 머물러 상품을 배달하는 데 더 많은 시간을 할애할 수 있습니다.

- 경로 활성화를 위한 부적절한 안내

차량 추적 시스템은 차량 관리 시스템의 일부로 정의할 수 있으며, 차량 운영자는 시간에 따라 차량의 이동 경로 전반에 걸쳐 차량의 위치를 파악할 수 있습니다. 차량 추적 시스템에서 생성된 데이터를 버스 일정을 시행하는 데 활용하는 것 외에도 이 데이터는 의사 결정을 위한 중요한 입력을 제공합니다. 이 시스템은 주어진 기간 동안 이동한 정확한 거리 계산, 주어진 위치에서 버스 속도 계산, 차량이 특정 거리를 이동하는 데 걸리는 시간 분석 등을 용이하게 합니다. 운영 기관의 경우 매우 강력한 도구가 됩니다.

최근 개발 사항

- 2023년 6월, Siemens Xcelerator와 Helixx의 파트너십은 전기 자동차 제조에 혁명을 일으키려는 그들의 노력에서 중요한 단계를 나타냅니다. Siemens의 산업 소프트웨어와 서비스를 통합함으로써 Helixx는 혁신적인 EV 제조 시스템을 전 세계적으로 신속하게 구축하고 접근 가능한 제로 에미션 도시 모빌리티 솔루션을 통해 지속 가능한 경제 성장을 촉진하는 것을 목표로 합니다. 이 협업은 Helixx의 획기적인 Helixx Mobility Hubs 개념을 강조하는데, 이를 통해 글로벌 라이선스 공장에서 다양한 전기 자동차를 생산하여 초기 생산 예측을 훨씬 넘어서 그 영향력을 증폭할 수 있습니다.

- 2023년 6월, Foss National Leasing Ltd.는 Foss EV Pilot Program의 1년 업데이트를 통해 전기 자동차(EV)를 차량에 통합하여 통찰력 있는 운영 데이터를 얻었으며, 이를 통해 고객이 EV 도입 여정을 도울 수 있었습니다. 이 프로그램은 불확실성을 해결하여 지속 가능한 차량 관리 솔루션으로의 원활한 전환에 효과적으로 기여합니다. 결론적으로, 회사의 지속적인 노력은 보다 녹색하고 효율적인 미래를 위한 정보에 입각한 의사 결정을 촉진하는 데 있어 이 프로그램이 중요한 역할을 한다는 것을 보여줍니다.

캐나다 함대 관리 시장 범위

캐나다 차량 관리 시장은 제공, 임대 유형, 운송 수단, 차량 유형, 하드웨어, 차량 규모, 통신 범위, 배포 모델, 기술, 기능, 운영, 사업 유형 및 최종 사용자를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

헌금

- 솔루션

- 서비스

제공 항목을 기준으로 시장은 솔루션과 서비스로 세분화됩니다.

임대 유형

- 임대 중

- 임대 없음

임대 유형을 기준으로 시장은 임대형과 비임대형으로 구분됩니다.

운송 수단

- 자동차

- 선박

- 차량

- 항공기

운송 수단을 기준으로 시장은 자동차, 해상, 철도 차량, 항공기로 구분됩니다.

차량 유형

- 내연 기관

- 전기 자동차

자동차 유형을 기준으로 시장은 내연 기관 자동차와 전기 자동차로 구분됩니다.

하드웨어

- GPS 추적 장치

- 대시 카메라

- 블루투스 추적 태그

- 데이터 로거

- 기타

하드웨어를 기준으로 보면 시장은 GPS 추적 장치, DASH 카메라, 블루투스 추적 태그, 데이터 로거 등으로 구분됩니다.

함대 규모

- 소규모 차량대(1-5대)

- 중형 함대(5-20대)

- 대형 및 기업용 차량대(20~50대 이상)

차량 규모를 기준으로 시장은 소규모 차량대(1~5대), 중규모 차량대(5~20대), 대규모 및 기업용 차량대(20~50대 이상)로 구분됩니다.

통신 범위

- 단거리 통신

- 장거리 통신

통신 범위를 기준으로 시장은 단거리 통신과 장거리 통신으로 구분됩니다.

배포 모델

- 온프레미스

- 구름

- 잡종

배포 모델을 기준으로 시장은 온프레미스, 클라우드, 하이브리드로 구분됩니다.

기술

- 위성항법시스템(GNSS)

- 셀룰러 시스템

- 전자 데이터 교환(EDI)

- 원격 감지

- 계산 방법 및 의사 결정

- 무선 주파수 식별(RFID)

- 기타

기술 기준으로 보면 시장은 GNSS, 셀룰러 시스템, 전자 데이터 교환(EDI), 원격 감지, 계산 방법 및 의사 결정, RFID 및 기타로 구분됩니다.

기능

- 자산 관리

- 경로 관리

- 연료 소비량

- 실시간 차량 위치

- 배송 일정

- 사고 예방

- 모바일 앱

- 운전자 행동 모니터링

- 차량 유지 관리 업데이트

- ELD 준수

- 기타

기능은 자산 관리, 경로 관리, 연료 소비, 실시간 차량 위치, 배달 일정, 사고 방지, 모바일 앱, 운전자 행동 모니터링, 차량 유지 관리 업데이트, ELD 준수 등으로 구분됩니다.

운영

- 사적인

- 광고

운영을 기준으로 시장은 민간시장과 상업시장으로 구분됩니다.

사업 유형

- 중소기업

- 대기업

사업 유형을 기준으로 시장은 소규모 사업체와 대규모 사업체로 구분됩니다.

최종 사용자

- 자동차

- 운송 및 물류

- 소매

- 조작

- 음식 & 음료

- 에너지 및 유틸리티

- 채광

- 정부

- 헬스케어

- 농업

- 건설

- 기타

최종 사용자를 기준으로 시장은 자동차, 운송 및 물류, 소매, 제조, 식품 및 음료, 에너지 및 유틸리티, 광업, 정부, 의료, 농업, 건설 및 기타로 세분화됩니다.

경쟁 환경 및 캐나다 차량 관리 시장 점유율 분석

캐나다 차량 관리 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 국가적 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 위에 제공된 데이터 포인트는 차량 관리 시장과 관련된 회사의 초점에만 관련이 있습니다.

시장에서 활동하는 주요 기업으로는 Element Fleet Management Corp.(미국), Verizon.(미국), Geotab Inc.(캐나다), Motive Technologies, Inc.(미국), Jim Pattison Lease(캐나다), Holman, Inc.(미국), Cisco Systems, Inc.(미국), Donlen(미국), Omnitracs(Solera의 일부)(미국), Wheels Inc.(미국), DENSO CORPORATION(일본), AT&T(미국), Continental AG(독일), ORBCOMM(미국), Summit Fleet Leasing and Management(캐나다), Siemens(독일), ADDISON LEASING OF CANADA LTD(캐나다), Robert Bosch GmbH(독일), RAM Tracking(영국), TRANSFLO(미국), Foss National Leasing Ltd.(캐나다), Samsara Inc.(미국), Sierra Wireless가 있습니다. (미국), Mendix Technology BV(네덜란드), ALD Automotive(프랑스), IBM(미국), ADDISON LEASING OF CANADA LTD(캐나다), Robert Bosch GmbH(독일), RAM Tracking(영국), TRANSFLO(미국) 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE CANADA FLEET MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 MARKET END-USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR LOGISTICS DUE TO THE E-COMMERCE INDUSTRY

5.1.2 RISE IN DEMAND FOR IMPROVEMENT OF CUSTOMER SERVICES

5.1.3 RAPID ADOPTION OF FUEL MANAGEMENT SYSTEMS IN FLEETS

5.1.4 INCREASE IN DEMAND FOR FULL-SERVICE LEASING

5.2 RESTRAINTS

5.2.1 LOWER EFFICIENCY IN CONNECTIVITY

5.2.2 IMPROPER GUIDANCE FOR ENABLING THE ROUTE

5.3 OPPORTUNITIES

5.3.1 RISE IN THE DEMAND FOR UTILITY VEHICLES

5.3.2 RISE IN THE TREND OF GLOBALIZATION

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.4 INCREASE IN DATA-DRIVEN MODELS IN MOBILITY

5.4 CHALLENGES

5.4.1 ACCUMULATION OF HUGE DATA VOLUME

5.4.2 RISE IN CYBER THREATS

6 CANADA FLEET MANAGEMENT MARKET, BY FUNCTIONS

6.1 OVERVIEW

6.2 ASSET MANAGEMENT

6.3 ROUTE MANAGEMENT

6.4 FUEL CONSUMPTION

6.5 REAL TIME VEHICLE LOCATION

6.6 DELIVERY SCHEDULE

6.7 ACCIDENT PREVENTION

6.8 MOBILE APPS

6.9 MONITORING DRIVER BEHAVIOR

6.1 VEHICLE MAINTENANCE UPDATES

6.11 ELD COMPLIANCE

6.12 OTHERS

7 CANADA FLEET MANAGEMENT MARKET, BY OPERATIONS

7.1 OVERVIEW

7.2 COMMERCIAL

7.3 PRIVATE

8 CANADA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE

8.1 OVERVIEW

8.2 LARGE BUSINESS

8.2.1 FLORIST & GIFT DELIVERY BUSINESS

8.2.2 CATERING & FOOD DELIVERING COMPANY

8.2.3 CLEANING SERVICE COMPANY

8.2.4 ELECTRICIAN/PLUMBING/HVAC COMPANY

8.2.5 LANDSCAPING BUSINESS

8.3 SMALL BUSINESS

8.3.1 RENTAL CAR/TRUCK COMPANY

8.3.2 MOVING COMPANY

8.3.3 TAXI COMPANY

8.3.4 DELIVERY COMPANY

8.3.5 LONG HAUL SEMI-TRUCK COMPANY

9 CANADA FLEET MANAGEMENT MARKET, BY LEASE TYPE

9.1 OVERVIEW

9.2 ON-LEASE

9.3 WITHOUT LEASE

9.3.1 OPEN ENDED

9.3.2 CLOSE ENDED

10 CANADA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT

10.1 OVERVIEW

10.1.1 AUTOMOTIVE

10.1.2 LIGHT COMMERCIAL VEHICLE

10.1.2.1 PICK UP TRUCKS

10.1.2.2 VANS

10.1.2.2.1 PASSENGER VAN

10.1.2.2.2 CARGO VAN

10.1.2.3 MINI BUS

10.1.2.4 OTHERS

10.1.3 PASSENGER CARS

10.1.3.1 SUV

10.1.3.2 HATCHBACK

10.1.3.3 SEDAN

10.1.3.4 COUPE

10.1.3.5 CROSSOVER

10.1.3.6 CONVERTIBLE

10.1.3.7 OTHERS

10.1.4 HEAVY COMMERCIAL VEHICLE

10.1.4.1 TRUCKS

10.1.4.2 TRAILERS

10.1.4.3 FORKLIFTS

10.1.4.4 SPECIALIST VEHICLES (SUCH AS MOBILE CONSTRUCTION MACHINERY)

10.1.5 MARINE

10.1.6 ROLLING STOCK

10.1.7 AIRCRAFT

11 CANADA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 INTERNAL COMBUSTION ENGINE

11.2.1 PETROL

11.2.2 DIESEL

11.2.3 CNG

11.2.4 OTHERS

11.3 ELECTRIC VEHICLE

11.3.1 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2 PLUG-IN ELECTRIC VEHICLE (PEV)

11.3.3 HYBRID ELECTRIC VEHICLES (HEVS)

12 CANADA FLEET MANAGEMENT MARKET, BY HARDWARE

12.1 OVERVIEW

12.2 GPS TRACKING DEVICES

12.3 DASH CAMERAS

12.4 BLUETOOTH TRACKING TAGS

12.5 DATA LOGGERS

12.6 OTHERS

13 CANADA FLEET MANAGEMENT MARKET, BY FLEET SIZE

13.1 OVERVIEW

13.2 SMALL FLEETS (1-5 VEHICLES)

13.3 MEDIUM FLEETS (5-20 VEHICLES)

13.4 LARGE & ENTERPRISE FLEETS (20-50+ VEHICLES)

14 CANADA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE

14.1 OVERVIEW

14.2 SHORT RANGE COMMUNICATION

14.3 LONG RANGE COMMUNICATION

15 CANADA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL

15.1 OVERVIEW

15.2 ON-PREMISE

15.3 CLOUD

15.4 HYBRID

16 CANADA FLEET MANAGEMENT MARKET, BY OFFERING

16.1 OVERVIEW

16.2 SOLUTIONS

16.2.1 ETA PREDICTIONS

16.2.1.1 STREAMLINED ROUTES

16.2.1.2 DETAILED LOCATION DATA

16.2.1.3 BREAKDOWN NOTIFICATION

16.2.2 OPERATIONS MANAGEMENT

16.2.2.1 FLEET TRACKING & GEO-FENCING

16.2.2.2 ROUTING & SCHEDULING

16.2.2.3 REAL & IDLE TIME MONITORING

16.2.3 PERFORMANCE MANAGEMENT

16.2.3.1 DRIVER MANAGEMENT

16.2.3.1.1 TRACKING

16.2.3.1.2 ROADSIDE/EMERGENCY ASSISTANCE FOR DRIVERS

16.2.3.1.3 MONITORING OF MISUSE (HARD BRAKING)

16.2.3.2 FLEET MANAGEMENT & TRACKING

16.2.3.2.1 REAL TIME ROUTING

16.2.3.2.2 SPEED/IDLING REAL TIME FEEDBACK

16.2.3.2.3 ENGINE DATA VIA ON-BOARD SENSORS

16.2.4 VEHICLE MAINTENANCE & DIAGNOSTICS

16.2.5 SAFETY & COMPLIANCE MANAGEMENT

16.2.6 FLEET ANALYTICS AND REPORTING

16.2.7 CONTRACT MANAGEMENT

16.2.7.1 BY STRUCTURE

16.2.7.1.1 LEASING

16.2.7.1.2 FUEL MANAGEMENT AND EV CHARGING

16.2.7.1.3 MAINTENANCE SPEND PLANNING

16.2.7.1.4 ACCIDENT MANAGEMENT

16.2.7.1.5 VEHICLE REGISTRATION

16.2.7.1.6 ADMINISTRATIVE COST

16.2.7.1.7 OTHERS

16.2.7.2 BY MODEL

16.2.7.2.1 LONG TERM CONTRACT

16.2.7.2.2 SHORT TERM CONTRACT

16.2.8 RISK MANAGEMENT

16.2.9 ELECTRIFICATION

16.2.10 REMARKETING

16.2.11 OTHERS

16.3 SERVICES

16.3.1 PROFESSIONAL SERVICES

16.3.1.1 SUPPORT & MAINTENANCE

16.3.1.2 IMPLEMENTATION

16.3.1.3 CONSULTING

16.3.2 MANAGED SERVICES

17 CANADA FLEET MANAGEMENT MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 GNSS

17.3 CELLULAR SYSTEMS

17.4 ELECTRONIC DATA INTERCHANGE (EDI)

17.5 REMOTE SENSING

17.6 COMPUTATIONAL METHOD & DECISION MAKING

17.7 RFID

17.8 OTHERS

18 CANADA FLEET MANAGEMENT MARKET, BY END USER

18.1 OVERVIEW

18.2 AUTOMOTIVE

18.2.1 SOLUTIONS

18.2.1.1 ETA PREDICTIONS

18.2.1.2 OPERATIONS MANAGEMENT

18.2.1.3 PERFORMANCE MANAGEMENT

18.2.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.2.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.2.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.2.1.7 CONTRACT MANAGEMENT

18.2.1.8 RISK MANAGEMENT

18.2.1.9 ELECTRIFICATION

18.2.1.10 REMARKETING

18.2.2 SERVICES

18.2.2.1 PROFESSIONAL SERVICES

18.2.2.2 MANAGED SERVICES

18.3 TRANSPORTATION & LOGISTICS

18.3.1 SOLUTIONS

18.3.1.1 ETA PREDICTIONS

18.3.1.2 OPERATIONS MANAGEMENT

18.3.1.3 PERFORMANCE MANAGEMENT

18.3.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.3.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.3.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.3.1.7 CONTRACT MANAGEMENT

18.3.1.8 RISK MANAGEMENT

18.3.1.9 ELECTRIFICATION

18.3.1.10 REMARKETING

18.3.2 SERVICES

18.3.2.1 PROFESSIONAL SERVICES

18.3.2.2 MANAGED SERVICES

18.4 RETAIL

18.4.1 SOLUTIONS

18.4.1.1 ETA PREDICTIONS

18.4.1.2 OPERATIONS MANAGEMENT

18.4.1.3 PERFORMANCE MANAGEMENT

18.4.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.4.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.4.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.4.1.7 CONTRACT MANAGEMENT

18.4.1.8 RISK MANAGEMENT

18.4.1.9 ELECTRIFICATION

18.4.1.10 REMARKETING

18.4.2 SERVICES

18.4.2.1 PROFESSIONAL SERVICES

18.4.2.2 MANAGED SERVICES

18.5 MANUFACTURING

18.5.1 SOLUTIONS

18.5.1.1 ETA PREDICTIONS

18.5.1.2 OPERATIONS MANAGEMENT

18.5.1.3 PERFORMANCE MANAGEMENT

18.5.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.5.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.5.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.5.1.7 CONTRACT MANAGEMENT

18.5.1.8 RISK MANAGEMENT

18.5.1.9 ELECTRIFICATION

18.5.1.10 REMARKETING

18.5.2 SERVICES

18.5.2.1 PROFESSIONAL SERVICES

18.5.2.2 MANAGED SERVICES

18.6 FOOD & BEVERAGES

18.6.1 SOLUTIONS

18.6.1.1 ETA PREDICTIONS

18.6.1.2 OPERATIONS MANAGEMENT

18.6.1.3 PERFORMANCE MANAGEMENT

18.6.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.6.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.6.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.6.1.7 CONTRACT MANAGEMENT

18.6.1.8 RISK MANAGEMENT

18.6.1.9 ELECTRIFICATION

18.6.1.10 REMARKETING

18.6.2 SERVICES

18.6.2.1 PROFESSIONAL SERVICES

18.6.2.2 MANAGED SERVICES

18.7 ENERGY & UTILITIES

18.7.1 SOLUTIONS

18.7.1.1 ETA PREDICTIONS

18.7.1.2 OPERATIONS MANAGEMENT

18.7.1.3 PERFORMANCE MANAGEMENT

18.7.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.7.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.7.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.7.1.7 CONTRACT MANAGEMENT

18.7.1.8 RISK MANAGEMENT

18.7.1.9 ELECTRIFICATION

18.7.1.10 REMARKETING

18.7.2 SERVICES

18.7.2.1 PROFESSIONAL SERVICES

18.7.2.2 MANAGED SERVICES

18.8 MINING

18.8.1 SOLUTIONS

18.8.1.1 ETA PREDICTIONS

18.8.1.2 OPERATIONS MANAGEMENT

18.8.1.3 PERFORMANCE MANAGEMENT

18.8.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.8.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.8.1.6 FLEET ANALYTICS AND REPORTING

18.8.1.7 CONTRACT MANAGEMENT

18.8.1.8 RISK MANAGEMENT

18.8.1.9 ELECTRIFICATION

18.8.1.10 REMARKETING

18.8.2 SERVICES

18.8.2.1 PROFESSIONAL SERVICES

18.8.2.2 MANAGED SERVICES

18.9 GOVERNMENT

18.9.1 SOLUTIONS

18.9.1.1 ETA PREDICTIONS

18.9.1.2 OPERATIONS MANAGEMENT

18.9.1.3 PERFORMANCE MANAGEMENT

18.9.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.9.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.9.1.6 FLEET ANALYTICS AND REPORTING

18.9.1.7 CONTRACT MANAGEMENT

18.9.1.8 RISK MANAGEMENT

18.9.1.9 ELECTRIFICATION

18.9.1.10 REMARKETING

18.9.2 SERVICES

18.9.2.1 PROFESSIONAL SERVICES

18.9.2.2 MANAGED SERVICES

18.1 HEALTHCARE

18.10.1 SOLUTIONS

18.10.1.1 ETA PREDICTIONS

18.10.1.2 OPERATIONS MANAGEMENT

18.10.1.3 PERFORMANCE MANAGEMENT

18.10.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.10.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.10.1.6 FLEET ANALYTICS AND REPORTING

18.10.1.7 CONTRACT MANAGEMENT

18.10.1.8 RISK MANAGEMENT

18.10.1.9 ELECTRIFICATION

18.10.1.10 REMARKETING

18.10.2 SERVICES

18.10.2.1 PROFESSIONAL SERVICES

18.10.2.2 MANAGED SERVICES

18.11 AGRICULTURE

18.11.1 SOLUTIONS

18.11.1.1 ETA PREDICTIONS

18.11.1.2 OPERATIONS MANAGEMENT

18.11.1.3 PERFORMANCE MANAGEMENT

18.11.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.11.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.11.1.6 FLEET ANALYTICS AND REPORTING

18.11.1.7 CONTRACT MANAGEMENT

18.11.1.8 RISK MANAGEMENT

18.11.1.9 ELECTRIFICATION

18.11.1.10 REMARKETING

18.11.2 SERVICES

18.11.2.1 PROFESSIONAL SERVICES

18.11.2.2 MANAGED SERVICES

18.12 CONSTRUCTION

18.12.1 SOLUTIONS

18.12.1.1 ETA PREDICTIONS

18.12.1.2 OPERATIONS MANAGEMENT

18.12.1.3 PERFORMANCE MANAGEMENT

18.12.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.12.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.12.1.6 FLEET ANALYTICS AND REPORTING

18.12.1.7 CONTRACT MANAGEMENT

18.12.1.8 RISK MANAGEMENT

18.12.1.9 ELECTRIFICATION

18.12.1.10 REMARKETING

18.12.2 SERVICES

18.12.2.1 PROFESSIONAL SERVICES

18.12.2.2 MANAGED SERVICES

18.13 OTHERS

19 CANADA FLEET MANAGEMENT MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: CANADA

20 SWOT ANALYSIS

21 COMPANY PROFILE

21.1 ELEMENT FLEET MANAGEMENT CORP.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 SOLUTION PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 VERIZON

21.2.1 COMPANY SNAPSHOT

21.2.3 SOLUTION PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 GEOTAB INC.

21.3.1 COMPANY SNAPSHOT

21.3.2 SOLUTION PORTFOLIO

21.3.3 RECENT DEVELOPMENTS

21.4 MOTIVE TECHNOLOGIES, INC.

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 RECENT DEVELOPMENTS

21.5 JIM PATTISON LEASE (A SUBSIDIARY OF THE JIM PATTISON GROUP)

21.5.1 COMPANY SNAPSHOT

21.5.2 SOLUTION PORTFOLIO

21.5.3 RECENT DEVELOPMENT

21.6 ADDISON LEASING OF CANADA LTD

21.6.1 COMPANY SNAPSHOT

21.6.2 SOLUTION PORTFOLIO

21.6.3 RECENT DEVELOPMENT

21.7 ALD AUTOMOTIVE

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 SOLUTION PORTFOLIO

21.7.4 RECENT DEVELOPMENTS

21.8 AT&T INTELLECTUAL PROPERTY

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 SOLUTION PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 CISCO SYSTEMS, INC.

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 SOLUTION PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 CONTINENTAL AG

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 SOLUTION PORTFOLIO

21.10.4 RECENT DEVELOPMENTS

21.11 DENSO CORPORATION

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 SOLUTION PORTFOLIO

21.11.4 RECENT DEVELOPMENTS

21.12 DONLEN

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 SOLUTION PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 FOSS NATIONAL LEASING LTD.

21.13.1 COMPANY SNAPSHOT

21.13.2 SOLUTION PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 HOLMAN, INC.

21.14.1 COMPANY SNAPSHOT

21.14.2 SOLUTION PORTFOLIO

21.14.3 RECENT DEVELOPMENTS

21.15 IBM CORPORATION

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 SOLUTION PORTFOLIO

21.15.4 RECENT DEVELOPMENT

21.16 MENDIX TECHNOLOGY BV

21.16.1 COMPANY SNAPSHOT

21.16.2 SOLUTION PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 OMNITRACS

21.17.1 COMPANY SNAPSHOT

21.17.2 SOLUTION PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 ORBCOMM

21.18.1 COMPANY SNAPSHOT

21.18.2 SOLUTION PORTFOLIO

21.18.3 RECENT DEVELOPMENT

21.19 RAM TRACKING

21.19.1 COMPANY SNAPSHOT

21.19.2 SOLUTION PORTFOLIO

21.19.3 RECENT DEVELOPMENTS

21.2 ROBERT BOSCH GMBH

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 SOLUTION PORTFOLIO

21.20.4 RECENT DEVELOPMENTS

21.21 SAMSARA INC.

21.21.1 COMPANY SNAPSHOT

21.21.2 SOLUTION PORTFOLIO

21.21.3 RECENT DEVELOPMENTS

21.22 SIEMENS

21.22.1 COMPANY SNAPSHOT

21.22.2 REVENUE ANALYSIS

21.22.3 SOLUTION PORTFOLIO

21.22.4 RECENT DEVELOPMENTS

21.23 SIERRA WIRELESS

21.23.1 COMPANY SNAPSHOT

21.23.2 REVENUE ANALYSIS

21.23.3 SOLUTION PORTFOLIO

21.23.4 RECENT DEVELOPMENT

21.24 SUMMIT FLEET LEASING AND MANAGEMENT LEASING AND MANAGEMENT

21.24.1 COMPANY SNAPSHOT

21.24.2 SOLUTION PORTFOLIO

21.24.3 RECENT DEVELOPMENTS

21.25 TRANSFLO

21.25.1 COMPANY SNAPSHOT

21.25.2 SOLUTION PORTFOLIO

21.25.3 RECENT DEVELOPMENTS

21.26 WHEELS INC.

21.26.1 COMPANY SNAPSHOT

21.26.2 SOLUTION PORTFOLIO

21.26.3 RECENT DEVELOPMENTS

22 QUESTIONNAIRE

23 RELATED REPORTS

표 목록

TABLE 1 CANADA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 2 CANADA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 3 CANADA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 CANADA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 CANADA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 CANADA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 CANADA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 CANADA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 9 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 CANADA LIGHT COMMERCIAL VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 CANADA VANS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 CANADA PASSENGER CARS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 CANADA HEAVY COMMERCIAL VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 CANADA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 CANADA INTERNAL COMBUSTION ENGINE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 CANADA ELECTRIC VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 CANADA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 18 CANADA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 19 CANADA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 20 CANADA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 21 CANADA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 22 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 CANADA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 CANADA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 CANADA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 CANADA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 CANADA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 29 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 30 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 CANADA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 CANADA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 33 CANADA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 34 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 35 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 36 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 CANADA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND)

TABLE 39 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 CANADA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 CANADA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 44 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 CANADA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 CANADA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 53 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 54 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 57 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 59 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 60 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 63 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 65 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 66 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

그림 목록

FIGURE 1 CANADA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 CANADA FLEET MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 CANADA FLEET MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 CANADA FLEET MANAGEMENT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 CANADA FLEET MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CANADA FLEET MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 CANADA FLEET MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 CANADA FLEET MANAGEMENT MARKET: MULTIVARIATE MODELING

FIGURE 9 CANADA FLEET MANAGEMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 10 CANADA FLEET MANAGEMENT MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 CANADA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 12 INCREASE IN DEMAND OF FULL SERVICE LEASING IS EXPECTED TO DRIVE THE CANADA FLEET MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CANADA FLEET MANAGEMENT MARKET IN 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF CANADA FLEET MANAGEMENT MARKET

FIGURE 15 CANADA FLEET MANAGEMENT MARKET: BY FUNCTIONS, 2022

FIGURE 16 CANADA FLEET MANAGEMENT MARKET: BY OPERATIONS, 2022

FIGURE 17 CANADA FLEET MANAGEMENT MARKET: BY BUSINESS TYPE, 2022

FIGURE 18 CANADA FLEET MANAGEMENT MARKET: BY LEASE TYPE, 2022

FIGURE 19 CANADA FLEET MANAGEMENT MARKET: BY MODE OF TRANSPORT, 2022

FIGURE 20 CANADA FLEET MANAGEMENT MARKET: BY VEHICLE TYPE, 2022

FIGURE 21 CANADA FLEET MANAGEMENT MARKET: BY HARDWARE, 2022

FIGURE 22 CANADA FLEET MANAGEMENT MARKET: BY FLEET SIZE, 2022

FIGURE 23 CANADA FLEET MANAGEMENT MARKET: BY COMMUNIATION RANGE, 2022

FIGURE 24 CANADA FLEET MANAGEMENT MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 CANADA FLEET MANAGEMENT MARKET: BY OFFERING, 2022

FIGURE 26 CANADA FLEET MANAGEMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 27 CANADA FLEET MANAGEMENT MARKET: END USER, 2022

FIGURE 28 CANADA FLEET MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.