아시아 태평양 수중 로봇 시장, 유형별(원격 조종 차량(ROV) 및 자율 주행 수중 차량(AUV)), 작업 깊이(얕은 물, 깊은 물 및 초심해), 작업 유형(관찰, 조사 , 검사, 건설 , 개입, 매설 및 참호 파기 및 기타), 깊이(1,000m 미만, 1,000m~5,000m 및 5,000m 초과), 구성 요소(조명, 카메라 , 프레임, 추진기, 고정 장치, 조종 장치 및 기타), 응용 분야( 석유 및 가스, 상업 탐사, 방위 및 보안 , 과학 연구 및 기타) - 산업 동향 및 2029년까지의 예측.

시장 분석 및 규모

시장 분석 및 규모

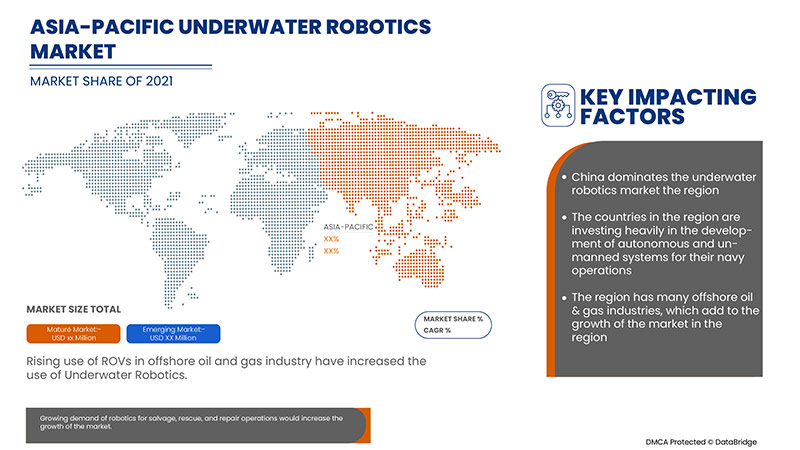

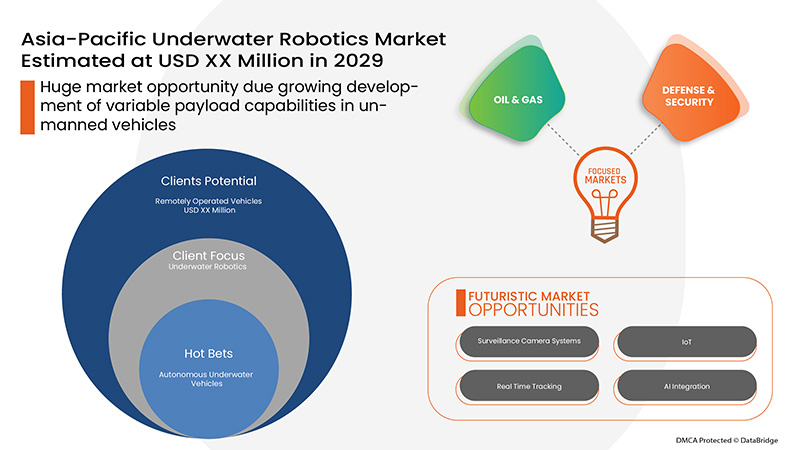

아시아 태평양 수중 로봇 시장은 주로 해상 석유 및 가스 산업에서 ROV에 대한 수요 증가와 해양 탐사 및 과학 연구에 대한 필수적인 필요성에 의해 주도됩니다. 또한, 인양, 구조 및 수리 작업을 위한 수중 로봇의 적용은 시장 성장을 급속도로 촉진하고 있습니다. 그러나 사이버 보안과 관련된 추가 기능과 위협 이후 ROV 및 AUV의 높은 비용은 아시아 태평양 수중 로봇 시장 성장을 제한할 수 있습니다. 또한 강한 해류와 얼음 아래 시트에서 AUV 및 ROV의 항해 및 통신에 대한 기술적 장벽은 시장 성장에 도전할 수 있습니다. 또한 센서 기술의 느린 발전과 수중 로봇의 높은 기술적 복잡성은 시장 성장을 방해할 수 있습니다. 그러나 수중 차량의 가변 탑재량 기능의 개발 증가와 수중 로봇의 효율성과 작동을 높이기 위한 첨단 기술의 통합은 아시아 태평양 수중 로봇 시장에 수익성 있는 기회를 제공합니다.

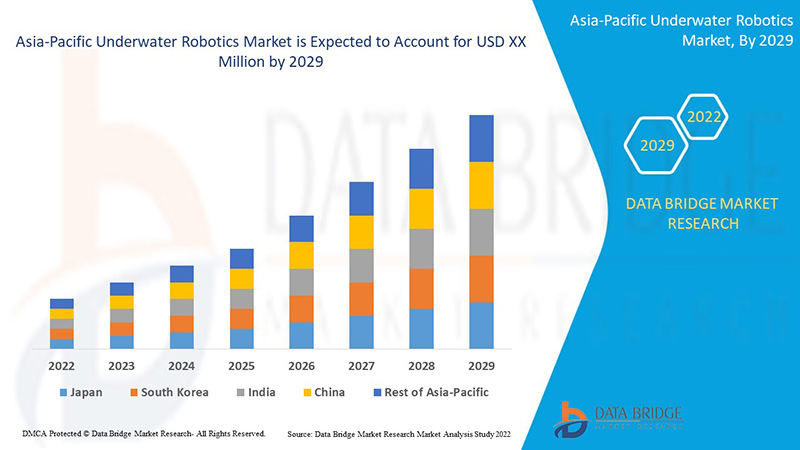

Data Bridge Market Research는 아시아 태평양 수중 로봇 시장이 2029년까지 XX백만 달러에 도달할 것으로 예상하며, 예측 기간 동안 CAGR은 14.1%라고 분석했습니다. "원격 조종 차량(ROV)"은 해당 시장에서 가장 두드러진 유형 세그먼트를 차지합니다. Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석 및 기후 사슬 시나리오가 포함되어 있습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

유형별(원격 조종 차량(ROV) 및 자율 수중 차량(AUV)), 작업 깊이(얕은 물, 깊은 물 및 초심해), 작업 유형(관찰, 조사, 검사, 건설, 개입, 매몰 및 참호 파기 및 기타), 깊이(1000m 미만, 1000m ~ 5000m 및 5000m 초과), 구성 요소(조명, 카메라, 프레임, 추진기, 고정 장치, 조종 장치 및 기타), 응용 분야(석유 및 가스, 상업 탐사, 방위 및 보안, 과학 연구 및 기타) |

|

적용 국가 |

중국, 일본, 인도, 한국, 싱가포르, 말레이시아, 호주 및 뉴질랜드, 태국, 인도네시아, 필리핀 및 기타 아시아 태평양(APAC) |

|

시장 참여자 포함 |

ATLAS ELEKTRONIK GmbH, General Dynamics Mission Systems, Inc., ECA GROUP, Eddyfi, Boeing, Soil Machine Dynamics Ltd., MacArtney A/S, Oceaneering International, Inc., Saab AB, Forum Energy Technologies, Inc., TechnipFMC plc, SUBSEA 7, Fugro, Total Marine Technology Pty Ltd, Teledyne Marine, KONGSBERG, Mitsui E&S Holdings Co., Ltd. |

시장 정의

수중 로봇공학은 수중 환경에서 작동하는 로봇의 연구 개발, 설계, 제조 및 응용을 포괄하는 로봇공학의 한 분야입니다. 이 용어는 수위 또는 수위 아래에서 작동하는 모든 로봇(해양 로봇 시스템)을 지칭할 수 있습니다. 그래도 일반적으로 수중에서 사용하도록 설계된 자율 주행차를 지칭합니다. 자율 수중 차량이라고도 하는 수중 로봇은 원격으로 작동할 수 있는 기계입니다. 지속적인 해양 감시를 위해 수중에서 작동하도록 설계되었습니다. 로봇공학은 지난 몇 년 동안 제조에 활용되었습니다. 놀라운 확장으로 군사 및 법률 구현 애플리케이션에 더욱 문화적이고 신뢰할 수 있게 되었습니다. 수중 로봇은 해외 산업의 확장에 중요한 역할을 합니다. 또한 해양 생물학, 수중 고고학 및 해양 보안에 수많은 구현이 있습니다.

아시아 태평양 수중 로봇 시장의 시장 역학은 다음과 같습니다.

- 군사 및 보안 목적으로 수중 로봇 사용 증가

아시아 태평양 지역은 다양한 군사 임무 및 작전과 항구 및 해상의 보안 목적으로 사용되면서 수중 로봇 사용이 빠르게 증가했습니다. 감시 및 정보 수집은 군사 및 보안 목적으로 수중 로봇 사용을 촉진한 두 가지 요인입니다.

- 석유 및 가스 산업에서 ROV 사용 증가

인도양과 남중국해에서 새로운 해상 석유 및 가스 산업이 발견되면서 석유 및 가스 산업에서 ROV에 대한 수요가 증가했습니다. 안전하고 더 큰 효율성과 대규모로 작업을 처리할 수 있습니다.

- 수중 탐사 및 과학 연구를 위한 AUV에 대한 수요 증가

AUV의 기능성이 증가하고 원격으로 작동할 수 있는 능력으로 인해 아시아 태평양 지역에서 수중 탐사와 과학 연구에 대한 수요가 증가했습니다. 통신 시스템을 위한 광물과 기반 케이블의 발견은 아시아 태평양 수중 로봇 시장을 위한 추가 부스터입니다.

아시아 태평양 수중 로봇 시장이 직면한 제약/과제

- 수중 로봇/차량의 높은 비용

수중 차량의 사용과 필요성은 다양한 산업에서 빠르게 증가하고 있습니다. 여전히 많은 기업이 수중 차량과 관련된 높은 비용으로 인해 필요한 작업과 과제에 수중 차량을 구매할 수 없습니다. 수중 차량의 높은 구매 비용과 높은 유지 관리 비용은 아시아 태평양 수중 로봇 시장에 제약으로 작용할 수 있습니다.

- 사이버 보안 및 운영 보안에 대한 위협 및 우려

이러한 AUV를 작동하고 운영 센터에서 데이터를 수집하는 데 사용되는 통신 시스템은 해킹될 수 있습니다. 이는 AUV 운영자에게 보안 위험과 우려를 안겨주며 군사, 해양 생물학, 석유 및 가스, 해상 에너지 부문과 같은 산업을 포함합니다. 수중 차량의 사이버 보안 및 운영 보안에 대한 이러한 위협과 우려는 아시아 태평양 수중 로봇 시장의 성장을 제한할 수 있습니다.

최근 개발 사항

- 2021년 2월, Eddyfi는 MaggHD와 OnSpec Robot 두 제품을 산업적 준비성을 위해 테스트했습니다. 두 제품 모두 제빙 솔루션 및 기타 원격 작업과 같은 다중 산업 응용 분야에서 성공적으로 테스트되었습니다. 이 회사는 전 세계 해양 감시 및 과학 연구 분야의 운영자에게 이러한 제품을 마케팅하는 데 중점을 두고 있습니다.

- 2018년 9월, International Submarine Engineering Limited와 China Ocean Mineral Resource R&D Association(COMRA)은 회사가 자사의 Explorer AUV를 해당 기관에 판매하는 계약을 체결했습니다. AUV의 작업 깊이는 6,000m이며 연말까지 인도되었습니다. 이를 통해 회사는 아시아 태평양 지역에서 수중 로봇 시장을 확대할 수 있었습니다.

아시아 태평양 수중 로봇 시장 범위

아시아 태평양 수중 로봇 시장은 유형, 작업 깊이, 작업 유형, 깊이, 구성 요소 및 응용 프로그램을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 원격 조종 차량(ROV)

- 자율 수중 차량(AUV)

아시아 태평양 수중 로봇 시장은 유형을 기준으로 원격 조종 차량(ROV)과 자율 주행 수중 차량(AUV)으로 구분됩니다.

작업 깊이

- 얕은

- 깊은 물

- 초심해수

작업 깊이를 기준으로 아시아 태평양 수중 로봇 시장은 얕은 물, 깊은 물, 초깊은 물로 구분됩니다.

작업 유형

- 관찰

- 조사

- 점검

- 건설

- 간섭

- 매장 및 참호 파기

- 기타

작업 유형을 기준으로 아시아 태평양 수중 로봇 시장은 관찰, 조사, 검사, 건설, 개입, 매설 및 참호 파기, 기타로 구분됩니다.

깊이

- 1000Mts 미만

- 1000mts ~ 5000mts

- 5000m 이상

아시아 태평양 수중 로봇 시장은 깊이를 기준으로 1,000mt 미만, 1,000mt ~ 5,000mt, 5,000mt 이상으로 구분됩니다.

요소

- 빛

- 카메라

- 액자

- 추진기

- 테더

- 파일럿 컨트롤

- 기타

아시아 태평양 수중 로봇 시장은 구성 요소를 기준으로 조명, 카메라, 프레임, 추진기, 고정 장치, 조종사 제어 장치 및 기타로 구분됩니다.

애플리케이션

- 석유 및 가스

- 상업 탐사

- 방위 및 보안

- 과학 연구

- 기타

아시아 태평양 수중 로봇 시장은 응용 분야를 기준으로 석유 및 가스, 상업 탐사, 방위 및 보안, 과학 연구 및 기타로 구분됩니다.

수중 로봇 시장 지역 분석/통찰력

아시아 태평양 수중 로봇 시장을 분석하고, 위에 참조된 대로 유형, 작업 깊이, 작업 유형, 깊이, 구성 요소 및 응용 프로그램별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

아시아 태평양 수중 로봇 시장 보고서에서 다루는 국가는 중국, 일본, 인도, 한국, 싱가포르, 말레이시아, 호주 및 뉴질랜드, 태국, 인도네시아, 필리핀, 기타 아시아 태평양(APAC)입니다.

중국은 수중 로봇 시장을 지배하고 있는데, 이 지역은 선도적인 제조업체의 엄청난 존재감을 목격했기 때문입니다. 게다가 이 지역은 수색 및 구조, 군사, 레크리에이션 및 탐험, 양식, 해양 생물학, 석유, 가스, 해상 에너지, 운송, 수중 인프라 등을 위한 장비에 대한 많은 투자를 보았습니다. 중국은 해상 로봇 장비에 대한 투자가 증가함에 따라 2022년에서 2029년 사이의 예측 기간 동안 상당한 성장을 목격할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 하류 및 상류 가치 사슬 분석, 기술 추세, 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 아시아 태평양 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 아시아 태평양 수중 로봇 시장 점유율 분석

아시아 태평양 수중 로봇 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 아시아 태평양 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 아시아 태평양 수중 로봇 시장에 대한 회사의 초점과만 관련이 있습니다.

아시아 태평양 수중 로봇 시장의 주요 기업으로는 ATLAS ELEKTRONIK GmbH, General Dynamics Mission Systems, Inc., ECA GROUP, Eddyfi, Boeing, Soil Machine Dynamics Ltd., MacArtney A/S, Oceaneering International, Inc., Saab AB, Forum Energy Technologies, Inc., TechnipFMC plc, SUBSEA 7, Fugro, Total Marine Technology Pty Ltd, Teledyne Marine, KONGSBERG, Mitsui E&S Holdings Co., Ltd. 등이 있습니다.

연구 방법론: 아시아 태평양 수중 로봇 시장

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용을 알아보려면 분석가 전화를 요청하거나 문의 사항을 드롭 다운하세요.

DBMR 연구팀이 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석, 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석, 기후 체인 시나리오, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 남겨 산업 전문가에게 문의하세요.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC UNDERWATER ROBOTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 GENERAL DYNAMICS AND MIT PARTNERED DURING THE U.S. NAVY'S BIENNIAL ICE EXERCISE (ICEX 2020) TO TEST THE BLUEFIN-21 UNMANNED UNDERWATER VEHICLE (UUV) UNDER THE ICE AT THE ARCTIC CIRCLE

4.3.2 OCEANEERING INTERNATIONAL, INC. DEVELOPED ISURUS ROV, WHICH REDUCES COST AND CARBON FOOTPRINT WHILE SHORTENING THE PROJECT SCHEDULE

4.3.3 RESULTS:

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 EUROPE

5.3 ASIA-PACIFIC

5.4 SOUTH AMERICA

5.5 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES

6.1.2 RISING USE OF ROVS IN THE OIL AND GAS INDUSTRY

6.1.3 INCREASING DEMAND FOR AUVS FOR UNDERWATER EXPLORATION AND SCIENTIFIC RESEARCH

6.1.4 GROWING DEMAND FOR UNDERWATER ROBOTICS FOR SEARCH, RESCUE, AND REPAIR OPERATIONS

6.2 RESTRAINTS

6.2.1 HIGH COST OF UNDERWATER ROBOTS/VEHICLES

6.2.2 THREATS AND CONCERNS FOR CYBER SECURITY AND OPERATIONAL SECURITY

6.3 OPPORTUNITIES

6.3.1 GROWING DEVELOPMENT OF VARIABLE PAYLOAD CAPABILITIES IN UNDERWATER VEHICLE

6.3.2 INCREASING DEVELOPMENTS IN UNDERWATER ROBOTICS SYSTEMS

6.3.3 INTEGRATION OF ADVANCED TECHNOLOGIES IN UNDERWATER VEHICLES

6.3.4 INCREASING WORKING DEPTH OF UNDERWATER ROBOTS

6.4 CHALLENGES

6.4.1 THE TECHNICAL BARRIER IN NAVIGATION AND COMMUNICATION OF AUV

6.4.2 SLOW TECHNICAL PROGRESS IN UNDERWATER ROBOT SENSING TECHNOLOGIES

6.4.3 HIGH TECHNICAL COMPLEXITY IN UNDERWATER ROBOTICS

7 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 REMOTELY OPERATED VEHICLES (ROV)

7.2.1 BY CONFIGURATION

7.2.1.1 OPEN OR BOX FRAME ROVS

7.2.1.2 TORPEDO SHAPED TOVS

7.2.2 BY CLASS TYPE

7.2.2.1 CLASS III (WORK CLASS VEHICLES)

7.2.2.2 CLASS II (OBSERVATION WITH PAYLOAD OPTIONS)

7.2.2.3 CLASS IV (SEABED-WORKING VEHICLES)

7.2.2.4 CLASS I (PURE OBSERVATION)

7.2.2.5 CLASS V (PROTOTYPE OR DEVELOPMENT VEHICLES)

7.3 AUTONOMOUS UNDERWATER VEHICLES

7.3.1 BY SHAPE

7.3.1.1 TORPEDO

7.3.1.2 STREAMLINED RECTANGULAR STYLE

7.3.1.3 LAMINAR FLOW BODY

7.3.1.4 MULTI-HULL VEHICLE

8 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH

8.1 OVERVIEW

8.2 DEEP WATER

8.3 SHALLOW

8.4 ULTRA-DEEP WATER

9 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY TASK TYPE

9.1 OVERVIEW

9.2 INSPECTION

9.3 SURVEY

9.4 INTERVENTION

9.5 OBSERVATION

9.6 BURIAL AND TRENCHING

9.7 CONSTRUCTION

9.8 OTHERS

10 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY DEPTH

10.1 OVERVIEW

10.2 1,000 MTS TO 5,000 MTS

10.3 LESS THAN 1,000 MTS

10.4 MORE THAN 5,000 MTS

11 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY COMPONENT

11.1 OVERVIEW

11.2 THRUSTERS

11.3 TETHERS

11.4 CAMERA

11.4.1 HIGH-RESOLUTION DIGITAL STILL CAMERA

11.4.2 DUAL-EYE CAMERAS

11.5 LIGHTS

11.6 FRAME

11.7 PILOT CONTROLS

11.8 OTHERS

12 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 OIL & GAS

12.3 DEFENCE & SECURITY

12.4 SCIENTIFIC RESEARCH

12.5 COMMERCIAL EXPLORATION

12.6 OTHERS

13 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY GEOGRAPHY

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 SOUTH KOREA

13.1.4 INDIA

13.1.5 AUSTRALIA AND NEW ZEALAND

13.1.6 SINGAPORE

13.1.7 THAILAND

13.1.8 MALAYSIA

13.1.9 INDONESIA

13.1.10 PHILIPPINES

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 OCEANEERING INTERNATIONAL, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SAAB AB

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GENERAL DYNAMICS MISSION SYSTEMS, INC. (A SUBSIDIARY OF GENERAL DYNAMICS CORPORATION)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCTS PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SUBSEA 7

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCTS PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 TELEDYNE TECHNOLOGIES INCORPORATED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ATLAS ELEKTRONIK GMBH

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCTS PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BOEING

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCTS PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DEEP TREKKER INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCTS PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 ECA GROUP (A SUBSIDIARY OF GROUPE GORGÉ COMPANY)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCTS PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 EDDYFI

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCTS PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FORUM ENERGY TECHNOLOGY, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCTS PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 FUGRO

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE AND PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 HUNTINGTON INGALLS INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 INTERNATIONAL SUBMARINE ENGINEERING LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCTS PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 KONGSBERG MARITIME

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 MACARTNEY AS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCTS PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MITSUI E&S HOLDINGS CO., LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 ROVCO LTD

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 SEAROBOTICS CORP.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SOIL MACHINE DYNAMICS LTD

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCTS PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 TECHNIPFMC PLC

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCTS PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 TOTAL MARINE TECHNOLOGY PTY LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 PHOENIX INTERNATIONAL HOLDINGS, INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCTS PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VIDEORAY LLC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCTS PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 COMPARATIVE CHARACTERISTICS OF AUV

TABLE 2 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY REGION 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC SHALLOW IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ULTRA-DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC INSPECTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC SURVEY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC INTERVENTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC OBSERVATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC BURIAL AND TRENCHING IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC CONSTRUCTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC 1,000 MTS TO 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC LESS THAN 1,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC MORE THAN 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC THRUSTERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC TETHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC CAMERA IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC LIGHTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC FRAME IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC PILOT CONTROLS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC OIL & GAS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC DEFENSE & SECURITY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC SCIENTIFIC RESEARCH IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC COMMERCIAL EXPLORATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 CHINA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 CHINA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 53 CHINA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 55 CHINA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 56 CHINA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 57 CHINA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 58 CHINA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CHINA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 JAPAN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 JAPAN REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 62 JAPAN REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 63 JAPAN AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 64 JAPAN UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 65 JAPAN UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 66 JAPAN UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 67 JAPAN UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 68 JAPAN CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 JAPAN UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 INDIA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 INDIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 82 INDIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 83 INDIA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 84 INDIA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 85 INDIA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 86 INDIA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 87 INDIA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 88 INDIA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 INDIA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA AND NEW ZEALAND REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA AND NEW ZEALAND REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA AND NEW ZEALAND AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA AND NEW ZEALAND CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA AND NEW ZEALAND UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 104 SINGAPORE UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 107 SINGAPORE UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 108 SINGAPORE CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 SINGAPORE UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 THAILAND UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 THAILAND REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 112 THAILAND REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 113 THAILAND AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 114 THAILAND UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 115 THAILAND UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 116 THAILAND UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 117 THAILAND UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 118 THAILAND CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 THAILAND UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 MALAYSIA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 123 MALAYSIA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 124 MALAYSIA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 INDONESIA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 PHILIPPINES UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 REST OF ASIA-PACIFIC UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: END-USER COVERAGE GRID

FIGURE 10 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: CHALLENGE MATRIX

FIGURE 11 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 12 THE INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES IS EXPECTED TO BE A KEY DRIVER FOR THE ASIA PACIFIC UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 REMOTELY OPERATED VEHICLES (ROVS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD 2022 & 2029

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC UNDERWATER ROBOTICS MARKET

FIGURE 16 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY TYPE, 2021

FIGURE 17 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY WORKING DEPTH, 2021

FIGURE 18 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY TASK TYPE, 2021

FIGURE 19 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY DEPTH, 2021

FIGURE 20 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY COMPONENT, 2021

FIGURE 21 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: BY APPLICATION, 2021

FIGURE 22 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC UNDERWATER ROBOTICS MARKET: BY TYPE (2022-2029)

FIGURE 27 ASIA PACIFIC UNDERWATER ROBOTICS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.