>아시아 태평양 온도 조절 포장 솔루션 시장, 유형(수동 및 능동 시스템), 제품 및 서비스(서비스, 제품), 사용성(단일 사용, 재사용), 응용 분야(냉동, 냉장 및 주변), 최종 용도(식품 및 음료, 의료, 화학, 연구 실험실 및 기타)별 산업 동향 및 2029년까지의 예측.

아시아 태평양 온도 조절 포장 솔루션 시장 분석 및 통찰력

아시아 태평양 온도 조절 포장 솔루션 시장은 드라이 아이스, 액체 질소 , 폼 브릭 등 다양한 유형으로 인해 상당한 성장을 이루고 있습니다. 이들은 일반적으로 의약품, 부패하기 쉬운 제품, 혈액 샘플 및 수많은 임상 시험을 운반하는 데 사용됩니다. 온도 조절 포장 솔루션은 스트레칭 폴리스티렌, 폴리우레탄 및 진공 단열 패널로 제조됩니다. 의료 분야의 수요 증가와 제약 분야의 온도 제어에 대한 필요성 증가는 시장 성장을 크게 촉진할 것으로 예상됩니다. 냉장 체인, 부패하기 쉬운 식품 및 편의 식품의 온도 조절 포장 솔루션에 대한 수요는 시장 성장에 기여합니다.

따라서 정부 기관의 기준과 규제가 높아지면 제조업체는 제품을 판매하고 소비자 수요가 시장 성장을 촉진하도록 해야 합니다. 소규모 기업의 기술 전문성 부족은 이 지역의 시장 성장을 제한할 가능성이 높습니다.

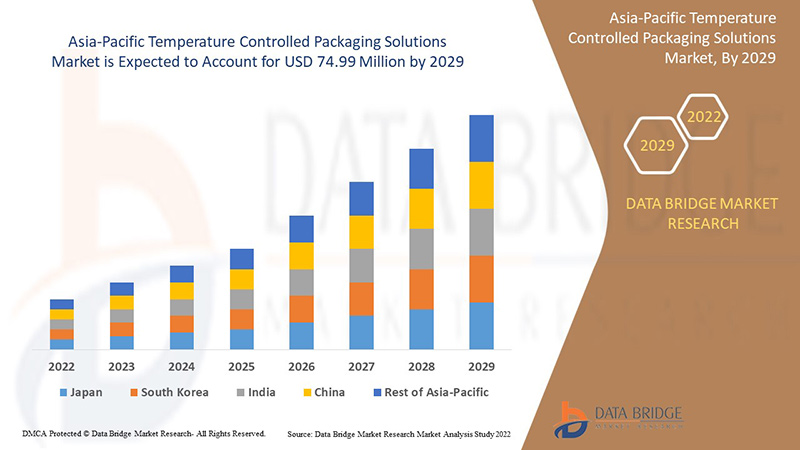

Data Bridge Market Research에 따르면 아시아 태평양 온도 조절 포장 솔루션 시장은 2022년부터 2029년까지의 예측 기간 동안 연평균 성장률 6.4%로 성장할 것으로 분석됩니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2015로 사용자 정의 가능) |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

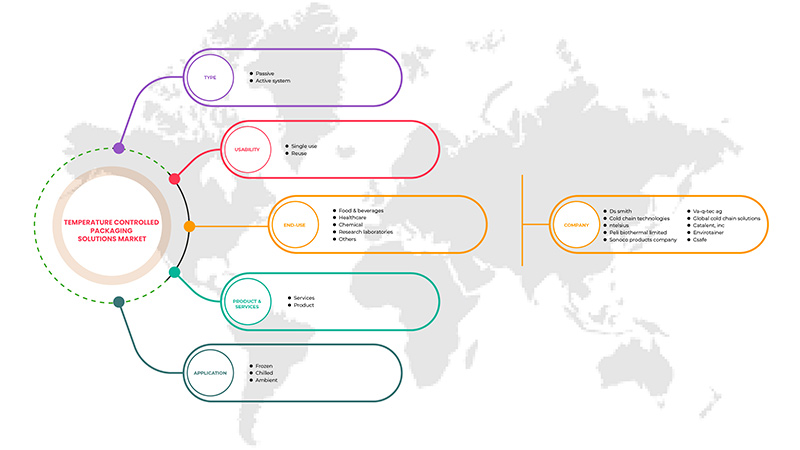

유형(수동 및 능동 시스템), 제품 및 서비스(서비스, 제품), 사용성(단일 사용, 재사용), 응용 분야(냉동, 냉장 및 주변), 최종 용도(식품 및 음료, 의료, 화학 , 연구 실험실 및 기타). |

|

적용 지역 |

중국, 일본, 호주 및 뉴질랜드, 인도, 필리핀, 인도네시아, 싱가포르, 한국, 말레이시아, 태국, 그리고 아시아 태평양의 나머지 지역. |

|

시장 참여자 포함 |

DS Smith, Cold Chain Technologies, Intelsius, Peli BioThermal Limited, Sonoco Products Company, va-Q-tec AG, Global Cold Chain Solutions, Catalent, Inc, Envirotainer, CSafe 등이 있습니다. |

시장 정의

Temperature controlled packaging is mainly done to ship products, substances, or specimens that require a certain temperature throughout their transport process. The shippers rely on temperature controlled packaging, which allows them to maintain the temperature of the shipping product according to the shipper requirements. The temperature controlled packaging is used in numerous industries comprising medical, food and beverages, clinical trial, research and developments, and blood transportation.

The temperature controlled packaging solutions come in two forms, namely, active system and passive system. Active packaging solutions have dry ice cooling or electrical heating and cooling systems. On the other side, passive solutions consist of insulated boxes or containers with no active temperature control. As a result, passive packaging does not change in response to ambient temperatures. Active packaging solutions are widely used because they enable transportation of any size packets to longer distances without damaging the products; due to their reusability property and high technology level, temperature controlled packaging solutions have made their mark in the Asia-Pacific market in storage applications.

Asia-Pacific Temperature Controlled Packaging Solutions Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

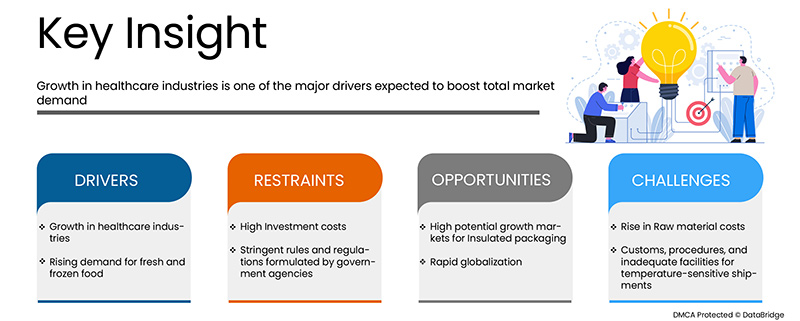

Drivers

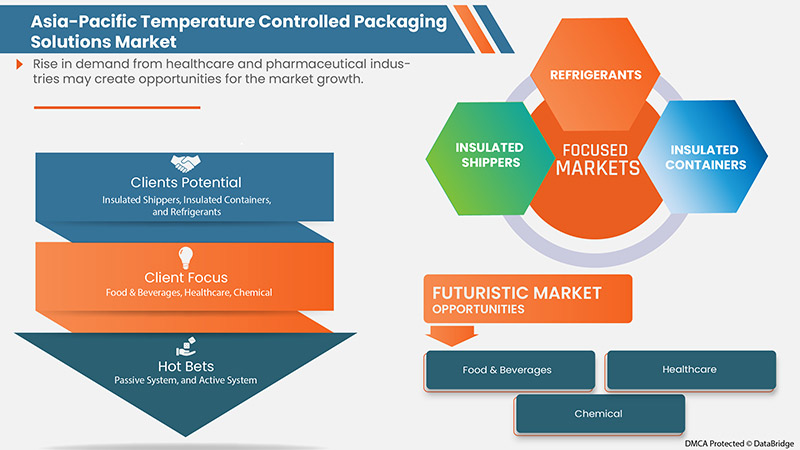

Growth in healthcare industries

The healthcare industry is one of the fastest-growing industries around the globe. The industry is helping discover developments of drugs or pharmaceutical drugs used as medications. Recent growth in the healthcare and pharmaceutical industries enables the demand for medical products to be shipped safely. Pharmaceutical packaging is a cost-effective way to provide protection, identification information, containment, convenience, and compliance to a product during storage, carriage, and display until the product is consumed. The packaging must protect against various climatic conditions, including biological, physical, and chemical, and be economical for manufacturers. In addition, the packaging must maintain the stability of the products throughout the shelf-life. The two types of packaging systems in the healthcare industry are passive and active. The quality of healthcare products directly affects patient safety and the efficiency of the product in patient therapies. Temperature excursions make a massive difference in transporting finished products, transporting clinical trial materials, or delivering sample drugs. One of the major solutions associated with this issue is temperature controlled packaging solutions, which will help the market to expand in the upcoming years.

For instance,

- In July 2020, Softbox announced the launch of Tempcell ECO. Tempcell ECO is made from 100 percent corrugated cardboard and utilizes. This ECO packaging solution is designed to transport wide-stability temperature-sensitive pharmaceutical products.

Thus, the increased need for temperature controlled packaging solutions for medicine transportation across the globe is expected to drive the Asia-Pacific temperature controlled packaging solutions market in the forecast period.

Rising Demand for Fresh and Frozen Food

Frozen foods are commercially processed to make them convenient for storage and require less preparation. Fresh food is usually perishable in nature. Perishable food has two categories, perishable food, and semi-perishable food. The perishable food includes meat, poultry, fish, milk, eggs, and many raw fruits and vegetables and needs to be refrigerated. The semi-perishable food stored at optimum temperature remains unspoiled for six months to one year. The cold chain is a significant way to preserve and transport perishable food within the proper temperature range. These preservation methods slow the biological decay processes and increase safe and high-quality food to consumers. Asian countries such as China and India show an increasing interest in consuming imported, frozen and fresh foods. The products of temperature controlled packaging solutions provide a range of boxes and various other products to serve the same industries. The increasing trend in consumers consuming fresh and frozen food enables the Asia-Pacific temperature controlled packaging solutions to expand globally.

For instance,

- In June 2020, Smurfit Kappa launched a new paper-based alternative that can keep meat and non-meat food products sterile and cold for longer. The pack also offers greater flexibility than EPS as it can be stored flat therefore reducing warehouse costs.

Due to the changing consumer profile, the food industry has changed significantly. This increase in the market's growth increases the need for temperature controlled packaging material to retain the quality of the food for a long time and is expected to drive the Asia-Pacific temperature controlled packaging solutions market in the forecast period.

Opportunities

- High potential growth markets for insulated packaging

Temperature controlled packaging is specifically designed to maintain the appropriate temperature of sensitive products. This packaging acts as a shield and protects products from damage or getting spoiled. Temperature controlled packaging has applications in various fields, such as pharmaceuticals, food and beverages, and many others. The increase in the use of temperature controlled packaging in pharmaceuticals is due to increased drug monitoring authorities across geographies focused on framing stringent legislation for the handling and distributing pharmaceutical products and increasing the demand for biologics. Various key players, such as Intelsius - A DGP Company (U.K.), provide cold chain packaging solutions for the pharmaceuticals sector. FedEx (U.S.), a leading courier company, provides insulated packaging to various pharmaceuticals, food and beverages, and clinical trials worldwide. The insulated packaging is costly as it keeps the products in their original form and helps sustain the product's shelf-life.

The food and beverages market is one of the growing markets in insulated packaging material. The packaging materials preserve the food's physical properties and increase the products' shelf-life. The company, namely Coca-Cola (U.S.), manufactures bottled water, juices, and iced tea. Unilever (U.K.), one of the biggest manufacturers of ready meals, sauces, and teas, use insulated packaging materials. As the significant companies earn significant profits, the food and beverages market is expected to grow and will significantly bring opportunities for the Asia-Pacific temperature controlled packaging solutions market.

Restraints/Challenges

- Rise in raw material costs

Various types of raw materials are used to manufacture temperature controlled packaging solutions, such as expanded polystyrene, polyurethane, and liquid nitrogen. Cold Chain Technologies (U.S.), Intelsius - A DGP Company (U.K.) company provides cold chain packaging solutions to maintain the thermal integrity of the products while in transit until they reach their destination. Materials such as polyurethane and liquid nitrogen are used to manufacture box liners, pouches, mailers, and pallets.

The price of raw materials is increasing, and manufacturers face cascading challenges through the supply chains as prices continue their upward climb, slowing supplier deliveries and labor availability.

- In July 2022, according to an article published by Agro & Food Processing, the market is becoming increasingly uncertain due to rising demand, capacity, and supply issues, the restricted availability of transport choices, and feedstock costs rising exponentially daily. The price of polyurethane resins, solvents, and other petrochemical raw ingredients and derivatives has recently increased significantly.

Therefore, the increasing prices of the raw materials used in the manufacturing of temperature controlled packaging solutions, such as polystyrene and polyurethane, are expected to challenge the Asia-Pacific temperature controlled packaging solutions market.

Post-COVID-19 Impact on Asia-Pacific Temperature Controlled Packaging Solutions Market

Post the pandemic, the demand for temperature controlled packaging solutions has increased as there won't be any more restrictions on movement, so the supply of products would be easy. In addition, companies developed their packaging system for shipping vaccines and medicines across the globe, and the demand for temperature controlled packaging for perishable goods has also increased may propel the market's growth.

The increased demand for temperature controlled packaging solutions enables manufacturers to launch innovative and multifunctional temperature controlled packaging products, which ultimately increases the demand for temperature controlled packaging solutions and has helped the market grow.

Moreover, the high demand for temperature controlled packaging products will drive the market's growth. Furthermore, the demand for packaging solutions for temperature-sensitive medicines after the COVID-19 pandemic has increased as high demand from the healthcare and pharmaceutical sector resulted in market growth. Additionally, consumers' interest in new technologies and multipurpose products is expected to fuel the growth of the Asia-Pacific temperature controlled packaging solutions market.

Recent Developments

- In September 2022, va-Q-tec launched a va-Q-one 300P transport container in Euro pallet size, a temperature-controlled transport option. The box is especially well suited for cross-country shipments in areas without return transportation options. This launch will help the company to expand globally.

- In July 2022, DS Smith collaborated with the Valencian Company and developed innovative packaging for their new line of Soul Series 2 juicers. The packaging is 100% recyclable. This launch will help the company to expand in the market.

Asia-Pacific Temperature Controlled Packaging Solutions Market Scope

The Asia-Pacific temperature controlled packaging solutions market is segmented based on type, product & services, usability, application, and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Passive

- Active System

On the basis of type, the Asia-Pacific temperature controlled packaging solutions market is segmented into passive, and active system.

Product & Services

- Services

- Product

On the basis of product & services, the Asia-Pacific temperature controlled packaging solutions market is segmented into product and services

Usability

- Single Use

- Reuse

사용성을 기준으로 아시아 태평양 온도 조절 포장 솔루션 시장은 일회용과 재사용으로 구분됩니다.

애플리케이션

- 언

- 냉장

- 주변환경

아시아 태평양 온도 조절 포장 솔루션 시장은 응용 분야를 기준으로 냉동, 냉장 및 상온으로 구분됩니다.

최종 사용

- 음식 & 음료

- 헬스케어

- 화학적인

- 연구실

- 기타

아시아 태평양 온도 조절 포장 솔루션 시장은 응용 분야를 기준으로 식품 및 음료, 의료, 화학, 연구실 및 기타로 구분됩니다.

아시아 태평양 온도 조절 포장 솔루션 시장 지역 분석/통찰력

아시아 태평양 온도 조절 포장 솔루션 시장을 분석하고, 위에 언급된 국가, 유형, 제품 및 서비스, 유용성, 응용 분야, 최종 용도를 기반으로 시장 규모에 대한 통찰력과 추세를 제공합니다.

아시아 태평양 온도 조절 포장 솔루션 시장에 포함되는 국가로는 중국, 호주 및 뉴질랜드, 일본, 한국, 싱가포르, 말레이시아, 인도네시아, 태국, 필리핀, 인도 및 기타 아시아 태평양 지역 국가가 있습니다.

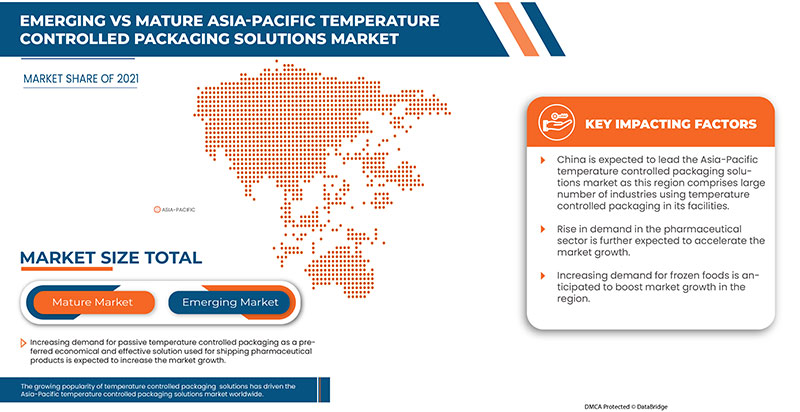

중국은 시장 점유율과 수익 측면에서 아시아 태평양 온도 조절 포장 솔루션 시장을 지배할 것으로 예상됩니다. 아시아 태평양 지역에서 강력한 시장 참여자와 제약 제품에 대한 높은 수요로 인해 예측 기간 동안 지배력을 유지할 것으로 예상됩니다.

보고서의 지역 섹션은 또한 시장의 현재 및 미래 추세에 영향을 미치는 개별 시장 영향 요인과 규정 변경 사항을 제공합니다. 신규 및 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 아시아 태평양 브랜드의 존재 및 가용성과 국내 및 국내 브랜드와의 치열한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 아시아 태평양 온도 조절 포장 솔루션 시장 점유율 분석

경쟁적인 아시아 태평양 온도 조절 포장 솔루션 시장은 경쟁자에 대한 세부 정보를 제공합니다. 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 아시아 태평양 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우위가 포함됩니다. 위의 데이터 포인트는 아시아 태평양 온도 조절 포장 솔루션 시장에 대한 회사의 초점과만 관련이 있습니다.

아시아 태평양 온도 조절 포장 솔루션 시장의 주요 기업으로는 DS Smith, Cold Chain Technologies, Intelsius, Peli BioThermal Limited, Sonoco Products Company, va-Q-tec AG, Global Cold Chain Solutions, Catalent, Inc, Envirotainer, CSafe 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 아시아 태평양 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가에게 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.4 VENDOR SELECTION CRITERIA

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.6 REGULATION COVERAGE

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 GOVERNMENT'S ROLE

5.3 PRE COVID AND POST COVID ANALYSIS

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWTH IN HEALTHCARE INDUSTRIES

7.1.2 RISING DEMAND FOR FRESH AND FROZEN FOOD

7.2 RESTRAINTS

7.2.1 HIGH INVESTMENT COSTS

7.2.2 STRINGENT RULES AND REGULATIONS FORMULATED BY GOVERNMENT AGENCIES

7.3 OPPORTUNITIES

7.3.1 RAPID GLOBALIZATION

7.3.2 HIGH POTENTIAL GROWTH MARKETS FOR INSULATED PACKAGING

7.4 CHALLENGES

7.4.1 RISE IN RAW MATERIAL COSTS

7.4.2 CUSTOMS, PROCEDURES, AND INADEQUATE FACILITIES FOR TEMPERATURE-SENSITIVE SHIPMENTS

8 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE

8.1 OVERVIEW

8.2 PASSIVE

8.3 ACTIVE SYSTEM

9 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES

9.1 OVERVIEW

9.2 SERVICES

9.2.1 AIRWAYS

9.2.2 ROADWAYS

9.2.3 WATERWAYS

9.3 PRODUCT

9.3.1 INSULATED CONTAINERS

9.3.1.1 EXPANDED POLYSTYRENE

9.3.1.2 POLYURETHANE

9.3.1.3 VACUUM INSULATED PANELS

9.3.2 INSULATED SHIPPERS

9.3.3 REFRIGERANTS

9.3.3.1 DRY ICE

9.3.3.2 GEL PACKS

9.3.3.3 ADVANCED PHASE CHANGE MATERIALS

9.3.3.4 LIQUID NITROGEN

9.3.3.5 FOAM BRICKS

9.3.3.6 OTHERS

10 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FROZEN

10.3 CHILLED

10.4 AMBIENT

11 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY

11.1 OVERVIEW

11.2 REUSE

11.3 SINGLE USE

12 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE

12.1 OVERVIEW

12.2 FOOD & BEVERAGES

12.2.1 PASSIVE SYSTEM

12.2.2 ACTIVE SYSTEM

12.3 HEALTHCARE

12.3.1 HEALTHCARE, BY END USE

12.3.1.1 PHARMACEUTICAL AND BIOTECHNOLOGY

12.3.1.2 BLOOD TRANSPORTATION

12.3.1.3 R&D AND CLINICAL TRIALS

12.3.1.4 MEDICAL DEVICES

12.3.1.5 OTHERS

12.3.2 HEALTHCARE, BY TYPE

12.3.2.1 PASSIVE

12.3.2.2 ACTIVE SYSTEM

12.4 CHEMICAL

12.4.1 PASSIVE

12.4.2 ACTIVE SYSTEM

12.5 RESEARCH LABORATORIES

12.5.1.1 PASSIVE

12.5.1.2 ACTIVE SYSTEM

12.6 OTHERS

12.6.1 PASSIVE

12.6.2 ACTIVE SYSTEM

13 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY COUNTRY

13.1 ASIA PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 SOUTH KOREA

13.1.5 THAILAND

13.1.6 SINGAPORE

13.1.7 INDONESIA

13.1.8 AUSTRALIA & NEW ZEALAND

13.1.9 PHILIPPINES

13.1.10 MALAYSIA

13.1.11 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.2 EXPANSION

14.3 PRODUCT LAUNCHES

14.4 ACQUISITION

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 DS SMITH

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 VA-Q-TEC AG

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 SONOCO PRODUCTS COMPANY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 CATALENT, INC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 ENVIROTAINER

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 COLD CHAIN TECHNOLOGIES

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 CSAFE

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 GLOBAL COLD CHAIN SOLUTIONS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 INTELSIUS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 PELI BIOTHERMAL LIMITED

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 ( KILO TONS)

TABLE 4 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 5 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 6 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 ASIA-PACIFIC REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, USABILITY, 2020-2029 (USD MILLION)

TABLE 11 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 12 ASIA-PACIFIC FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA-PACIFIC HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 14 ASIA-PACIFIC HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA-PACIFIC CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 ASIA-PACIFIC RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 20 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 22 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 23 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 24 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 25 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 CHINA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 CHINA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 29 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 CHINA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 31 CHINA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 CHINA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 33 CHINA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 CHINA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 CHINA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 CHINA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 39 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 40 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 41 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 42 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 INDIA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 44 INDIA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 46 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 INDIA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 48 INDIA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 INDIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 50 INDIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 INDIA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 INDIA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 INDIA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 56 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 57 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 58 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 59 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 JAPAN INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 JAPAN REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 63 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 JAPAN IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 65 JAPAN FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 JAPAN HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 67 JAPAN HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 JAPAN CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 JAPAN RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 JAPAN OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 74 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 90 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 91 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 92 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 93 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 THAILAND INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 THAILAND REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 96 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 97 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 THAILAND IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 99 THAILAND FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 THAILAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 101 THAILAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 THAILAND CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 THAILAND RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 THAILAND OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 107 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 108 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 109 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 110 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 111 SINGAPORE INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 112 SINGAPORE REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 114 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 SINGAPORE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 116 SINGAPORE FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SINGAPORE HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 124 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 125 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 126 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 127 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 128 INDONESIA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 141 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 142 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 143 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 144 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 AUSTRALIA & NEW ZEALAND INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 AUSTRALIA & NEW ZEALAND REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 148 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 149 AUSTRALIA & NEW ZEALAND IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 150 AUSTRALIA & NEW ZEALAND FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 AUSTRALIA & NEW ZEALAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 152 AUSTRALIA & NEW ZEALAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 AUSTRALIA & NEW ZEALAND CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 AUSTRALIA & NEW ZEALAND RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 AUSTRALIA & NEW ZEALAND OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 158 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 159 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 160 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 169 PHILIPPINES HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 PHILIPPINES CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 PHILIPPINES RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 PHILIPPINES OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 175 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 176 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 177 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 178 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 179 MALAYSIA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 180 MALAYSIA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 181 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 182 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 MALAYSIA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 184 MALAYSIA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 MALAYSIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 186 MALAYSIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 MALAYSIA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 MALAYSIA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 MALAYSIA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 REST OF ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 REST OF ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

그림 목록

FIGURE 1 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: SEGMENTATION

FIGURE 11 RISING TREND OF FRESH AND FROZEN FOOD AND GROWING HEALTHCARE INDUSTRIES ARE EXPECTED TO DRIVE THE ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET IN THE FORECAST PERIOD

FIGURE 12 PASSIVE SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET

FIGURE 14 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE, 2021

FIGURE 15 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY PRODUCT & SERVICES, 2021

FIGURE 16 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY APPLICATION, 2021

FIGURE 17 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY USABILITY, 2021

FIGURE 18 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY END-USE, 2021

FIGURE 19 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: SNAPSHOT (2020)

FIGURE 20 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY COUNTRY (2020)

FIGURE 21 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE (2022 & 2029)

FIGURE 22 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE (2021 & 2029)

FIGURE 23 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE (2022-2029)

FIGURE 24 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.