>아시아 태평양 벼 껍질 재 시장, 형태(팔레트, 분말, 플레이크, 결절/과립), 실리콘 함량(80-84%, 85-89%, 90-94%, 95% 이상), 하류 응용 분야(콘크리트 혼합물, 건축용 블록, 내화 벽돌, 금속판, 지붕용 싱글, 절연체, 방수 화학 물질 , 살충제, 기타)별 산업 동향 및 2029년까지의 전망.

시장 분석 및 통찰력

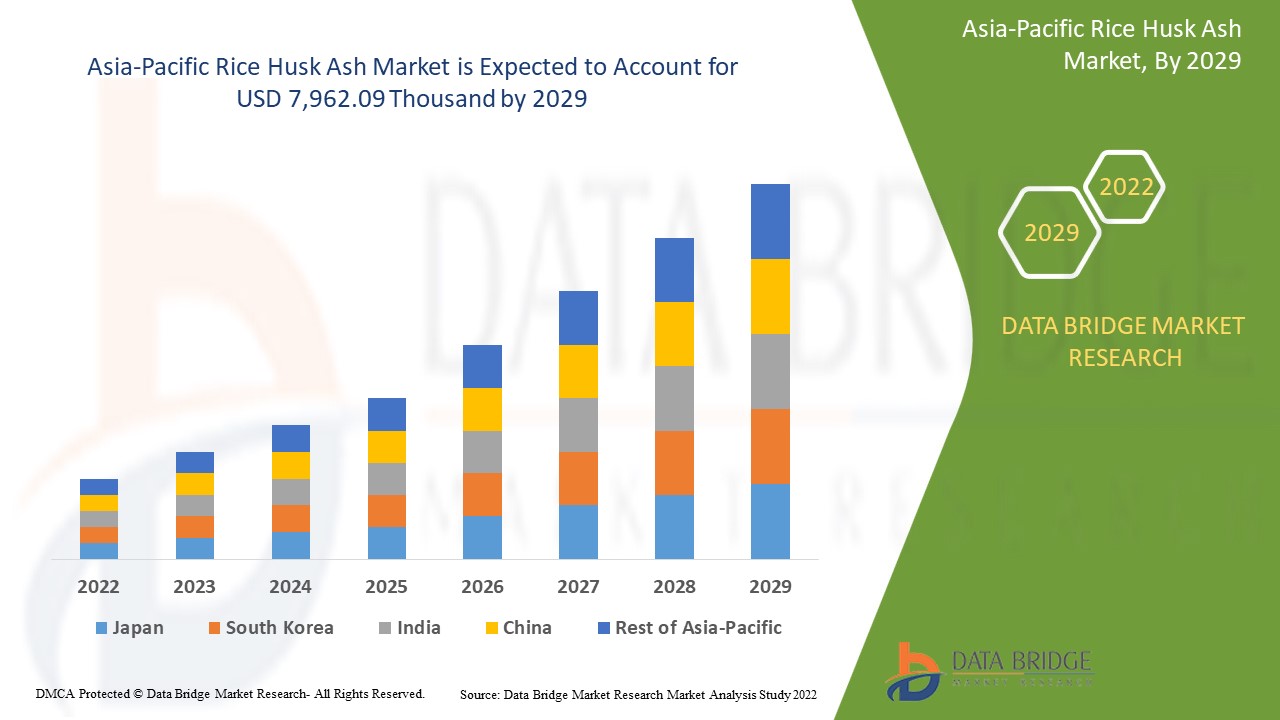

아시아 태평양 벼 껍질 재 시장은 2022년부터 2029년까지의 예측 기간 동안 상당한 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년부터 2029년까지의 예측 기간 동안 5.9%의 CAGR로 성장하고 있으며 2029년까지 7,962.09천 달러에 도달할 것으로 예상된다고 분석합니다. 아시아 태평양 벼 껍질 재 시장 성장을 주도하는 주요 요인은 실리카 함량이 높아 건설 산업에서 광범위한 제품 범위입니다.

높은 실리카 함량으로 인해 건설 산업에서 광범위한 제품 범위가 아시아 태평양 벼 껍질 재 시장을 주도할 것으로 예상됩니다. 벼 껍질 재 사용의 기술적 이점에 대한 인식이 높아짐에 따라 아시아 태평양 벼 껍질 재 시장의 성장이 촉진될 것으로 예상됩니다.

아시아 태평양 벼 껍질재 시장에 부정적인 영향을 미칠 수 있는 주요 제약 요인으로는 벼 껍질재를 사용하는 데 따른 물/시멘트 비율 문제와 대체재의 강력한 시장 도달 범위가 있습니다.

환경 규제 기준을 준수하고 원자재 비용과 제조 비용이 낮아짐에 따라 수요 증가에 따라 아시아 태평양 벼 껍질 재 시장에 기회가 생길 것으로 예상됩니다.

그러나 벼 껍질 재와 관련된 폐기 문제와 벼 논 생산에 대한 높은 의존도는 아시아 태평양 벼 껍질 재 시장 성장에 어려움을 줄 것으로 예상됩니다.

아시아 태평양 벼 껍질 재 시장 보고서는 시장 점유율, 새로운 개발, 국내 및 지역 시장 참여자의 영향에 대한 세부 정보를 제공하고, 새로운 수익 주머니, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서 기회를 분석합니다. 분석 및 시장 시나리오를 이해하려면 분석가 브리핑을 위해 저희에게 연락하세요. 저희 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드릴 것입니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

매출은 천 달러, 볼륨은 킬로톤, 가격은 달러로 표시 |

|

다루는 세그먼트 |

형태별(팔레트, 분말, 플레이크, 결절/과립), 실리콘 함량(80-84%, 85-89%, 90-94%, 95% 이상), 하류 적용(콘크리트 혼합물, 건축 블록, 내화 벽돌, 금속 시트, 지붕 널, 절연체, 방수 화학 물질, 살충제, 기타) |

|

적용 국가 |

일본, 중국, 한국, 인도, 싱가포르, 태국, 인도네시아, 말레이시아, 필리핀, 호주 및 뉴질랜드, 그리고 아시아 태평양의 나머지 지역 |

|

시장 참여자 포함 |

Astrra Chemicals, Global Recycling, K V Metachem, Brisil, Rice Husk Ash (Thailand), Guru Corporation, JASORIYA RICE MILL, PIONEER Carbon, among others. |

Market Definition

Rice husk ash is a natural by-product recovered from the paddy rice field after rice husking. The casing of rice husk is generally composed of 30% lignin, 20% silica, and 50% cellulose, and if incinerated by controlled thermal decomposition, it turns the residue into ashes.

Rice husk ash is produced after controlled rice husk combustion and possesses a high pozzolanic property and reactivity. It is considered a suitable cementing material in the construction industry, either as a substitute for cement or an admixture. As an admixture, rice husk ash produces high-strength concrete, while substituting cement with rice husk ash produces low-cost building blocks. Rice husk ash is used for producing lightweight construction material as RHA addition makes concrete lighter.

Asia-Pacific Rice Husk Ash Market Dynamics

Drivers

- Extensive Product Scope in the Construction Industry due to High Silica Content

In the Asia-Pacific region, due to the growing building and construction industry, the application of rice husk ash is gaining dominance as it is widely being used as a pozzolan, a filler, additive, abrasive agent, oil adsorbent, sweeping component, and a suspension agent for porcelain enamels. In the cement industry, rice husk ash is used for its amorphous silica to manufacture concrete. It is used to substitute ordinary Portland cement (OPC), a highly expensive and major concrete component. The use of rice husk ash helps produce low-cost building blocks. Low-cost building blocks are highly preferred in the Asia-Pacific region.

Thus, the growing use of rice husk ash in the construction industry to make concrete and concrete products and other products used, such as bathroom floors, is expected to drive the Asia-Pacific rice husk ash market.

- Rising Awareness About the Technical Benefits of Rice Husk Ash

The main use for rice husk ash stands in the building and construction industry as a supplementary cementitious material (SCM) in blended cement as rice husk ash is added to Portland cement to improve some aspects of the performance of the resulting blend

In addition, rice husk ash-based concrete mixture offers superior resistance against chloride ion penetration in the marine environment. As a result, the application of these concrete mixtures is growing for construction activities in the marine environment. Besides these applications, rice husk ash is used in other sectors such as roofing shingles, waterproofing chemicals, oil spill absorbents, specialty paints, flame retardants, insecticides, and bio-fertilizers may fuel the growth of the Asia-Pacific rice husk ash market.

- Growth in Production of High-Quality Silica

Rising demand for silica from various end-use industries in this region and the high rate of paddy field cultivation in Asia-Pacific increases the usage of rice husk ash. Growing utilization of high-quality silica obtained from rice husk ash in the building and construction, steel, ceramic, and refractory industries, among many others. This gives a positive outlook on the market growth. The increase in the preference for rice husk ash instead of silica fume and fly ash in the cement and construction industry will influence the market. In addition to environmental and economic advantages, low-energy and simpler methods to obtain pure silica are expected to drive the market while creating new opportunities to develop new industrial applications of rice husk ash.

Opportunities

- Growing Demand Owing to Adherence to Environmental Regulatory Norms

Rice husk is organic waste and is produced in large quantities. It is a major by-product of the rice milling and agro-based biomass industry. Therefore, the use of rice husk ash by-product by other industries help in the reduction of waste, and rice husk ash is used as an additive in many materials and applications, such as refractory brick, manufacturing of insulation, and materials for flame retardants. In addition, rice husk ash is gaining popularity and getting approval from regulatory bodies due to its favorable soil effects in terms of acidity correction. Therefore, the adherence to rice husk ash for various other purposes is expected to provide lucrative opportunities for growth in the Asia-Pacific rice husk ash market.

- Increasing Use of Rice Husk Ash To Produce Rubber Tires

Using silica extracted from rice husk ash has other benefits as well. The energy consumed in extracting silica from the traditional source, such as sand, is much higher. It needs to be heated to 1,400 degrees Celsius to extract silica from sand. In comparison, the temperature required for extracting silica from rice husk ash is only 100 degrees Celsius. In addition, silica from rice husk ash gives the tread much better strength and stiffness and provides lower rolling resistance. This is expected to provide an opportunity for the growth of the Asia-Pacific rice husk ash market.

Restraints/Challenges

- Problems Associated with Water/Cement Ratio by Using Rice Husk Ash

Rice husk ash improves the properties of concrete when used in a specific amount, but as the amount of rice husk ash increases, the strength of the cement and concrete tends to decrease as rice husk ash is finer than the cement requires more quantity of water to settle down. This greatly impacts the strength, which is expected to limit the use of rice husk ash in the Asia-Pacific rice husk ash market

- Strong Market Reach of Substitutes

The need for silica cannot be fulfilled only by producing silica from the rice husk ash. The conventional methods for silica production are still preferred and employed to cover the increasing need for raw materials in various industries. In addition, the combustion of rice husk to produce rice husk ash produces a lot of pollution, impacting its growth and limiting its use in the forecast period. This will intensify and make the substitutes' market stronger.

- Disposal Issues Associated with Rice Husk Ash

Adoption of hi-tech technologies to tackle waste like rice husk ash and water, while some rice millers are also using the husk ash for good ecological use such as soil rejuvenation and increasing fertility. In addition, to solve this, rice husk ash is used in different applications for safe disposal. Several ways are being thought of for disposing of rice husk ash by making its commercial use more feasible and efficient. However, the improper disposal of rice husk ash and the lack of facilities in various rice mills is a serious challenge that may hinder the market's growth in the forecast period.

- High Dependency on the Production of Rice Paddy

The percentage of rice husk ash production also depends on the milling rate of rice and what type of rice is available. In addition, rice is a Kharif or winter crop and grows only at a specific time of the year, during the winters. Therefore, it may not be available in bulk quantities throughout the year, which may affect the availability of rice husk ash for other applications in other industries such as the cement industry, silica producing industry, tire industry, and many more. This is coupled with another problem that Asia's share is more than 90% in the world of paddy production. Rice paddy is a primary food grain crop in many Asian countries such as India and China. In 2018, India only accounted for about 21% of the world's rice production. Therefore, it becomes difficult for other parts to have good access to the resources, including the raw material and the finished products. Therefore, the limited geographical presence and total dependency on rice husk in paddy rice is a serious challenge that the Asia-Pacific rice husk ash market needs to overcome to register significant growth in the forecast period.

COVID-19 had a Minimal Impact on Asia-Pacific Rice Husk Ash Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, a significant impact was noticed on rice husk ash in the global operations and supply chain, with multiple manufacturing facilities still operating. The service providers continued offering rice husk ash following sanitation and safety measures in the post-COVID scenario.

Recent Developments

- Brisil has been awarded various national and international awards and recognitions for its technology that addresses one of the problems of waste utilization. These include recognition from the Leaders in Innovation Fellowship, Global Cleantech Innovation Programme, and The Economic Times, among others

- PIONEER Carbon's production facilities have been fully certified with the ISO 14001 and BS OHSAS 1800 certifications. These certifications ensure the company's strong quality check protocols for its products and adherence to environmental management systems

- Guru Corporation has been certified with ISO 9001: 2008 and ISO 14001: 2004 certifications for its quality control procedures and manufacturing process. This has enhanced the company's reputation in the Asia-Pacific rice husk ash market

Asia-Pacific Rice Husk Ash Market Scope

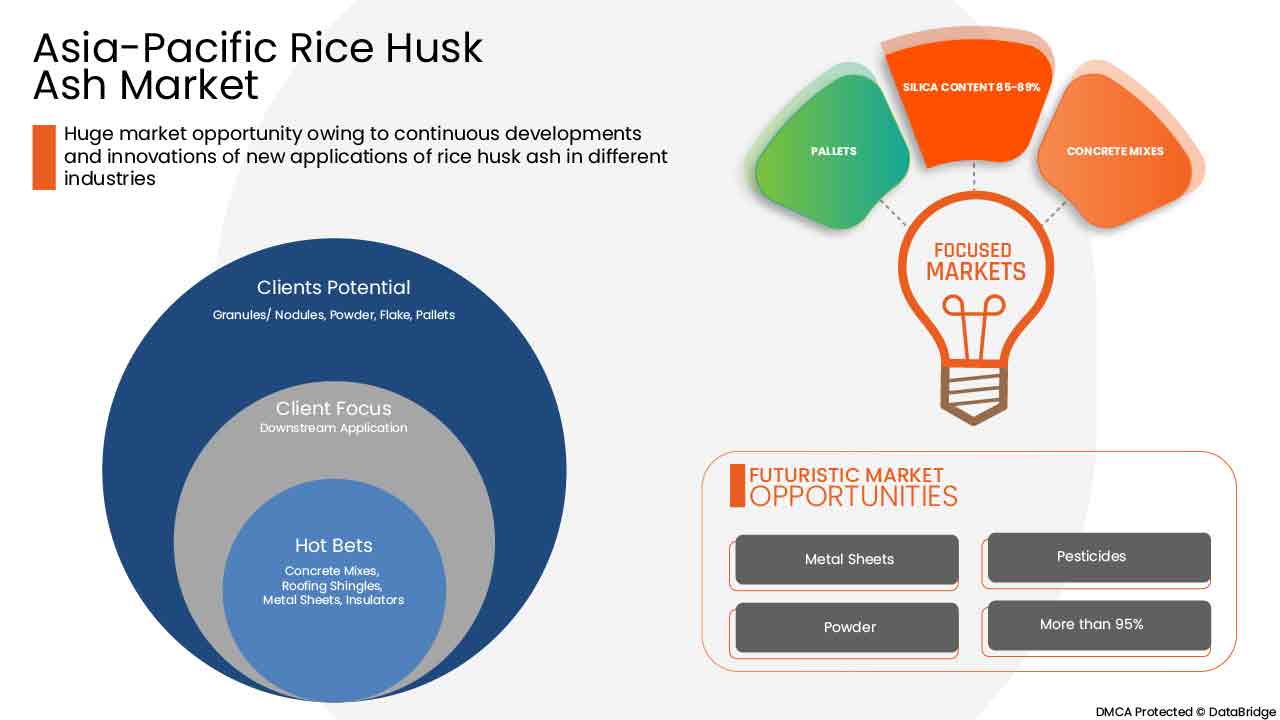

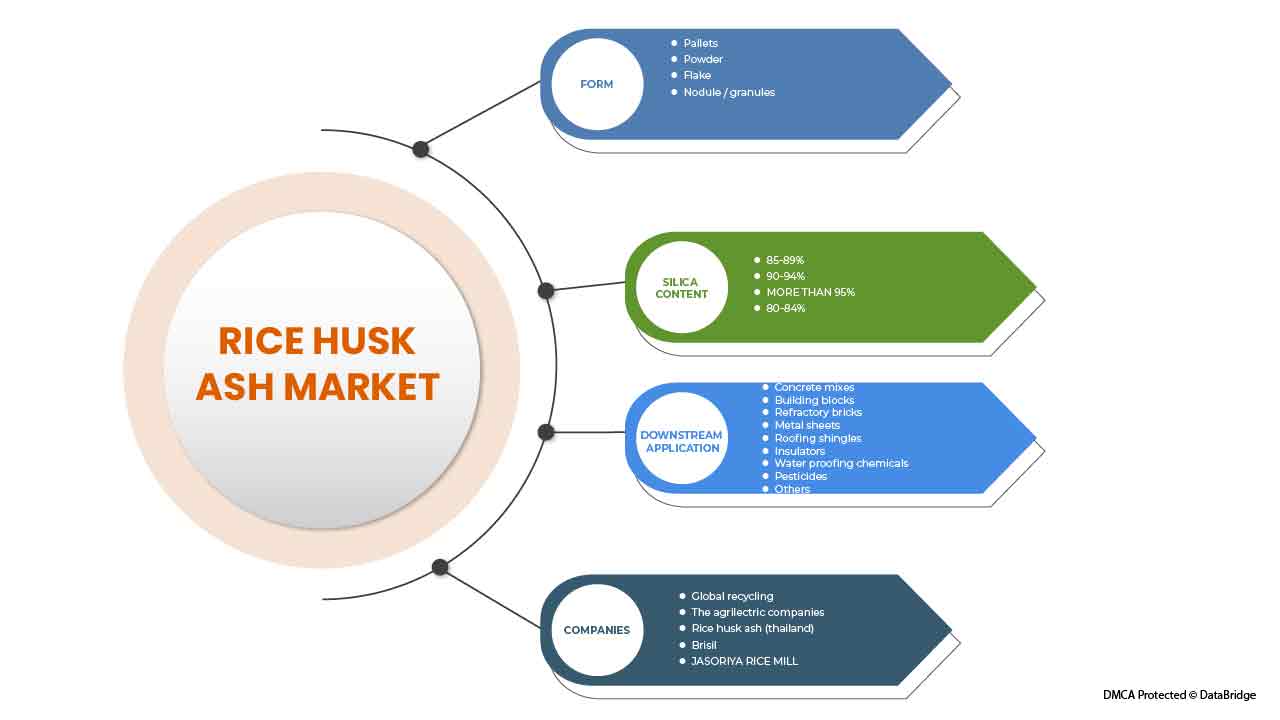

Asia-Pacific rice husk ash market is categorized based on form, silicon content, and downstream application. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Form

- Granule/ Nodules

- Pallets

- Flake

- Powder

On the basis of form, the Asia-Pacific rice husk ash market is classified into granule/ nodules, pallets, flake, and powder.

Silicon Content

- 80-84%

- 85-89%

- 90-94%,

- More Than 95%

On the basis of silica content, the Asia-Pacific rice husk ash market is classified into 80-84%, 85-89%, 90-94%, and more than 95%.

Downstream Application

- Concrete Mixes

- Roofing Shingles

- Building Blocks

- Refractory Bricks

- Metal Sheets

- Insulators

- Water Proofing Chemicals

- Pesticides

- Others

On the basis of downstream application, the Asia-Pacific rice husk ash market is classified into concrete mixes, roofing shingles, building blocks, refractory bricks, metal sheets, insulators, water proofing chemicals, pesticides, and others.

Asia-Pacific Rice Husk Ash Regional Analysis/Insights

Asia-Pacific rice husk ash market is categorized based on country, form, silicon content, and downstream application. Asia-Pacific rice husk ash market is segmented into Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the Rest of Asia-Pacific.

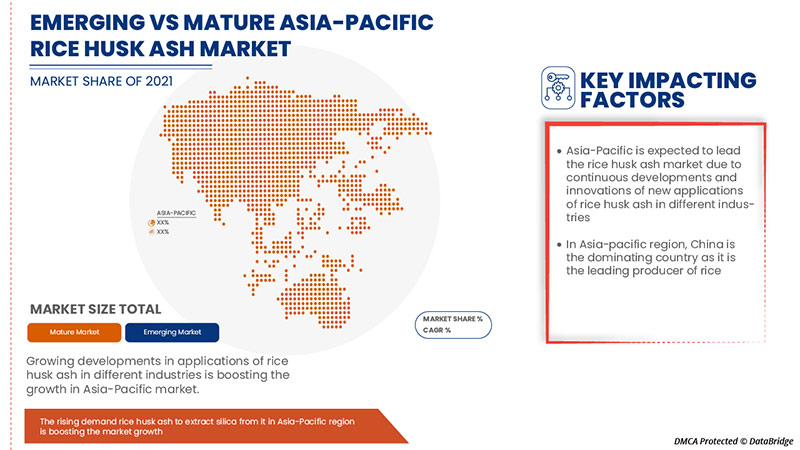

China is expected to dominate the Asia-Pacific rice husk ash market due to raising awareness about the technical benefits of using rice husk ash in the region.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규정의 변화를 제공합니다. 신규 및 교체 판매, 국가 인구 통계, 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 아시아 태평양 브랜드의 존재 및 가용성과 국내 및 국내 브랜드와의 치열한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 아시아 태평양 벼 껍질 재 시장 점유율 분석

아시아 태평양 벼 껍질 재 시장 경쟁 구도는 경쟁사별 세부 정보를 제공합니다. 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 폭, 응용 분야 우세, 기술 수명선 곡선이 포함됩니다. 위의 데이터 포인트는 아시아 태평양 벼 껍질 재 시장에 대한 회사의 초점과만 관련이 있습니다.

아시아 태평양 벼 껍질 재 시장에서 활동하는 대표적인 기업으로는 Astrra Chemicals, Global Recycling, KV Metachem, Brisil, Rice Husk Ash(Thailand), Guru Corporation, JASORIYA RICE MILL, PIONEER Carbon 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가에게 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC RICE HUSK ASH MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET DOWNSTREAM APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT’S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 ASIA PACIFIC IMPORT EXPORT SCENARIO

4.3 LIST OF KEY BUYERS

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS

4.4.2 ECONOMIC FACTORS

4.4.3 SOCIAL FACTORS

4.4.4 TECHNOLOGICAL FACTORS

4.4.5 LEGAL FACTORS

4.4.6 ENVIRONMENTAL FACTORS

4.5 PORTER’S FIVE FORCES:

4.6 PRODUCTION CONSUMPTION ANALYSIS- ASIA PACIFIC RICE HUSK ASH MARKET

4.6.1 RICE HUSK ASH PRODUCTION BY INCINERATION OF RICE HUSK

4.7 RAW MATERIAL PRODUCTION COVERAGE – ASIA PACIFIC RICE HUSK ASH MARKET

RICE PADDY/RICE HUSK 59

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKAGING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATORY COVERAGE

4.11.1 INDIA’S CENTRAL POLLUTION CONTROL BOARD

4.11.2 EUROPEAN COMMISSION (EC)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXTENSIVE PRODUCT SCOPE IN THE CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT

5.1.2 RISING AWARENESS ABOUT THE TECHNICAL BENEFITS OF RICE HUSK ASH

5.1.3 GROWTH IN PRODUCTION OF HIGH-QUALITY SILICA

5.2 RESTRAINTS

5.2.1 PROBLEMS ASSOCIATED WITH WATER/CEMENT RATIO BY USING RICE HUSK ASH

5.2.2 STRONG MARKET REACH OF SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND OWING TO ADHERENCE TO ENVIRONMENTAL REGULATORY NORMS

5.3.2 INCREASING USE OF RICE HUSK ASH TO PRODUCE RUBBER TIRES

5.3.3 ABUNDANT AVAILABILITY OF RICE HUSK ASH

5.4 CHALLENGES

5.4.1 DISPOSAL ISSUES ASSOCIATED WITH RICE HUSK ASH

5.4.2 HIGH DEPENDENCY ON THE PRODUCTION OF RICE PADDY

6 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM

6.1 OVERVIEW

6.2 PALLETS

6.3 POWDER

6.4 FLAKE

6.5 NODULE / GRANULES

7 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT

7.1 OVERVIEW

7.2 85-89%

7.3 90-94%

7.4 MORE THAN 95%

7.5 80-84%

8 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION

8.1 OVERVIEW

8.2 CONCRETE MIXES

8.2.1 CONCRETE MIXES, BY TYPE

8.2.1.1 GREEN CONCRETE

8.2.1.2 HIGH PERFORMANCE CONCRETE

8.2.1.3 OTHERS

8.3 BUILDING BLOCKS

8.4 REFRACTORY BRICKS

8.5 METAL SHEETS

8.6 ROOFING SHINGLES

8.7 INSULATORS

8.8 WATER PROOFING CHEMICALS

8.9 PESTICIDES

8.1 OTHERS

9 ASIA PACIFIC RICE HUSK ASH MARKET, BY GEOGRAPHY

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 INDIA

9.1.3 JAPAN

9.1.4 SOUTH KOREA

9.1.5 THAILAND

9.1.6 INDONESIA

9.1.7 AUSTRALIA & NEW ZEALAND

9.1.8 PHILIPPINES

9.1.9 MALAYSIA

9.1.10 SINGAPORE

9.1.11 REST OF ASIA-PACIFIC

10 ASIA PACIFIC RICE HUSK ASH MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 ASIA PACIFIC RECYCLING

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATE

12.2 THE AGRILECTIC COMPANIES

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATE

12.3 RICE HUSK ASH (THAILAND)

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATE

12.4 JASORIYA RICE MILL

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATE

12.5 BRISIL

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATE

12.6 PIONEER CARBON

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATE

12.7 ASTRRA CHEMICALS

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATE

12.8 GURU CORPORATION

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 K V METACHEM

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATE

13 QUESTIONNAIRE

14 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 3 COMPRESSION STRENGTH OF CONCRETE WITH DIFFERENT PERCENTAGES OF RICE HUSK ASH

TABLE 4 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 6 ASIA PACIFIC PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 8 ASIA PACIFIC POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 10 ASIA PACIFIC FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 12 ASIA PACIFIC NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 14 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 16 ASIA PACIFIC 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 18 ASIA PACIFIC 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 20 ASIA PACIFIC MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 22 ASIA PACIFIC 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 24 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 26 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 28 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 30 ASIA PACIFIC BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 32 ASIA PACIFIC REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 34 ASIA PACIFIC METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 36 ASIA PACIFIC ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 38 ASIA PACIFIC INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA PACIFIC INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 40 ASIA PACIFIC WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA PACIFIC WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 42 ASIA PACIFIC PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA PACIFIC PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 44 ASIA PACIFIC OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA PACIFIC OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 46 ASIA-PACIFIC RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (KILO TONNE)

TABLE 48 ASIA-PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 50 ASIA-PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 52 ASIA-PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 54 ASIA-PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 56 CHINA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 57 CHINA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 58 CHINA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 59 CHINA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 60 CHINA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 CHINA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 62 CHINA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 CHINA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 64 INDIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 65 INDIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 66 INDIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 67 INDIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 68 INDIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 INDIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 70 INDIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 INDIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 72 JAPAN RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 73 JAPAN RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 74 JAPAN RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 75 JAPAN RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 76 JAPAN RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 JAPAN RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 78 JAPAN CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 JAPAN CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 80 SOUTH KOREA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH KOREA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 82 SOUTH KOREA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH KOREA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 84 SOUTH KOREA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 SOUTH KOREA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 86 SOUTH KOREA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 SOUTH KOREA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 88 THAILAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 89 THAILAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 90 THAILAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 91 THAILAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 92 THAILAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 THAILAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 94 THAILAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 THAILAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 96 INDONESIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 97 INDONESIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 98 INDONESIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 99 INDONESIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 100 INDONESIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 INDONESIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 102 INDONESIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 INDONESIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 104 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 106 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 107 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 108 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 110 AUSTRALIA & NEW ZEALAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 AUSTRALIA & NEW ZEALAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 112 PHILIPPINES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 113 PHILIPPINES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 114 PHILIPPINES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 115 PHILIPPINES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 116 PHILIPPINES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 117 PHILIPPINES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 118 PHILIPPINES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 PHILIPPINES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 120 MALAYSIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 121 MALAYSIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 122 MALAYSIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 123 MALAYSIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 124 MALAYSIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 MALAYSIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 126 MALAYSIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 MALAYSIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 128 SINGAPORE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 129 SINGAPORE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 130 SINGAPORE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 131 SINGAPORE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 132 SINGAPORE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 SINGAPORE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 134 SINGAPORE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 SINGAPORE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 136 REST OF ASIA-PACIFIC RICE HUSK ASH, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 137 REST OF ASIA-PACIFIC RICE ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

그림 목록

FIGURE 1 ASIA PACIFIC RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC RICE HUSK ASH MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC RICE HUSK ASH MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC RICE HUSK ASH MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC RICE HUSK ASH MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC RICE HUSK ASH MARKET: THE FORM LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC RICE HUSK ASH MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC RICE HUSK ASH MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC RICE RUSK ASH MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC RICE HUSK ASH MARKET: DOWNSTREAM APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC RICE HUSK ASH MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC RICE HUSK ASH MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE ASIA PACIFIC RICE HUSK ASH MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 EXTENSIVE PRODUCT SCOPE IN CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT IS EXPECTED TO DRIVE ASIA PACIFIC RICE HUSK ASH MARKET IN THE FORECAST PERIOD

FIGURE 16 PALLETS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC RICE HUSK ASH MARKET IN 2022 & 2029

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 SUPPLY CHAIN ANALYSIS- ASIA PACIFIC RICE HUSK ASH MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC RICE HUSK ASH MARKET

FIGURE 20 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM, 2021

FIGURE 21 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2021

FIGURE 22 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2021

FIGURE 23 ASIA-PACIFIC RICE HUSK ASH MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC RICE HUSK ASH MARKET: BY FORM (2022 - 2029)

FIGURE 28 ASIA PACIFIC RICE HUSK ASH MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.