>아시아 태평양 미세 침습성 녹내장 수술(MIGS) 장치 시장, 제품별(MIGS 스텐트, MIGS 션트 및 기타), 대상(섬유주망막상 맥락막상 공간 결막하 여과 및 방수 생성 감소), 수술 유형(백내장과 관련된 녹내장 및 단독 녹내장 , 최종 사용자(병원 외래 환자 부서(HOPD), 안과 진료소, 외래 수술 센터(ASCS) 및 기타), 유통 채널(직접 입찰 및 소매 판매) - 업계 동향 및 2029년까지의 예측.

아시아 태평양 미세 침습성 녹내장 수술(MIGS) 장치 시장 분석 및 규모

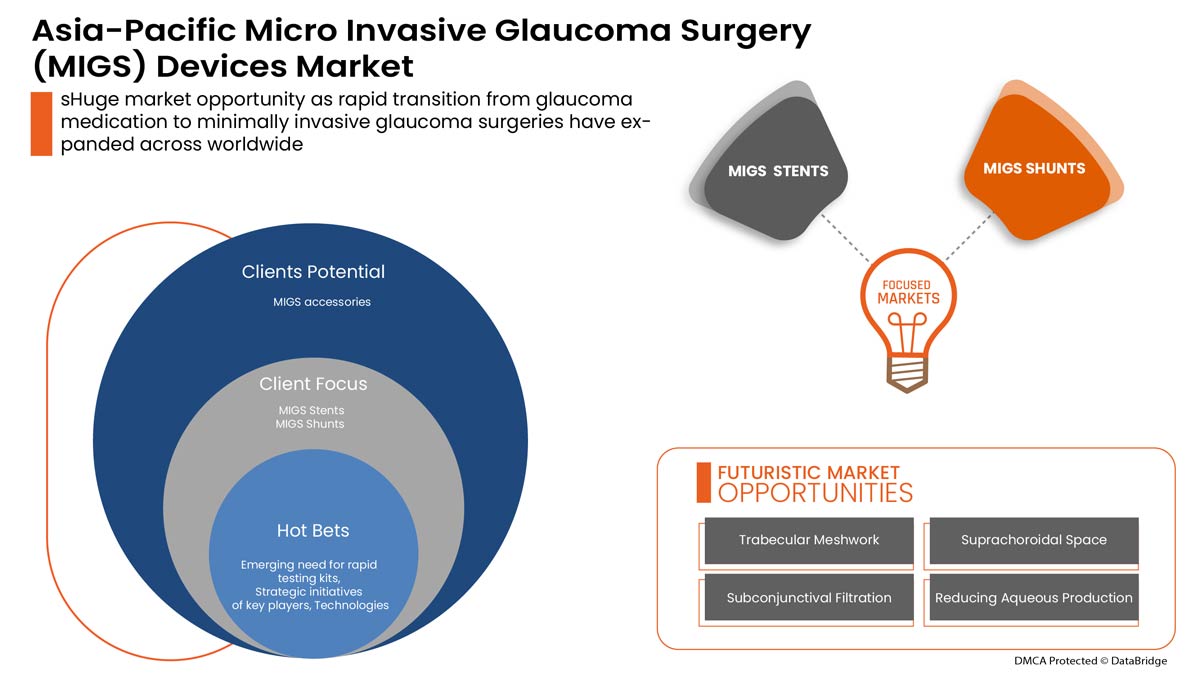

미세 침습성 녹내장 수술은 개방각 녹내장을 치료하는 데 사용됩니다. 처음에는 OAG를 치료하기 위해 방수 생성을 줄이거나 방수 유출을 늘리는 약물을 투여했습니다. 경증에서 중등도의 OAG의 경우 전통적으로 약물 치료와 레이저 치료를 시행했습니다. 미세 침습성 녹내장 수술(MIGS) 시술이 등장하면서 기존 수술에 적합하지 않은 사람들을 위한 새로운 옵션이 만들어졌습니다. 노인 인구가 증가하고 실명을 예방하기 위한 정부 이니셔티브가 증가함에 따라 시장이 활성화될 것으로 예상됩니다. 녹내장 약물에서 최소 침습성 녹내장 수술로의 빠른 전환은 MIGS 장치 제조업체에 기회를 창출할 수 있습니다. 그러나 환불 시설이 부족하면 시장에 장애물이 될 수 있습니다.

미세 침습 수술에 대한 수요 증가는 눈 질환의 증가, 미세 침습 수술에 대한 수요 증가, 수술적 외상 감소로 인해 예측 기간 동안 시장에 대한 수요가 증가했기 때문입니다. 그러나 높은 설치 비용과 숙련된 전문가의 부족은 예측 기간 동안 최소 침습 수술 시장 성장을 방해할 수 있습니다.

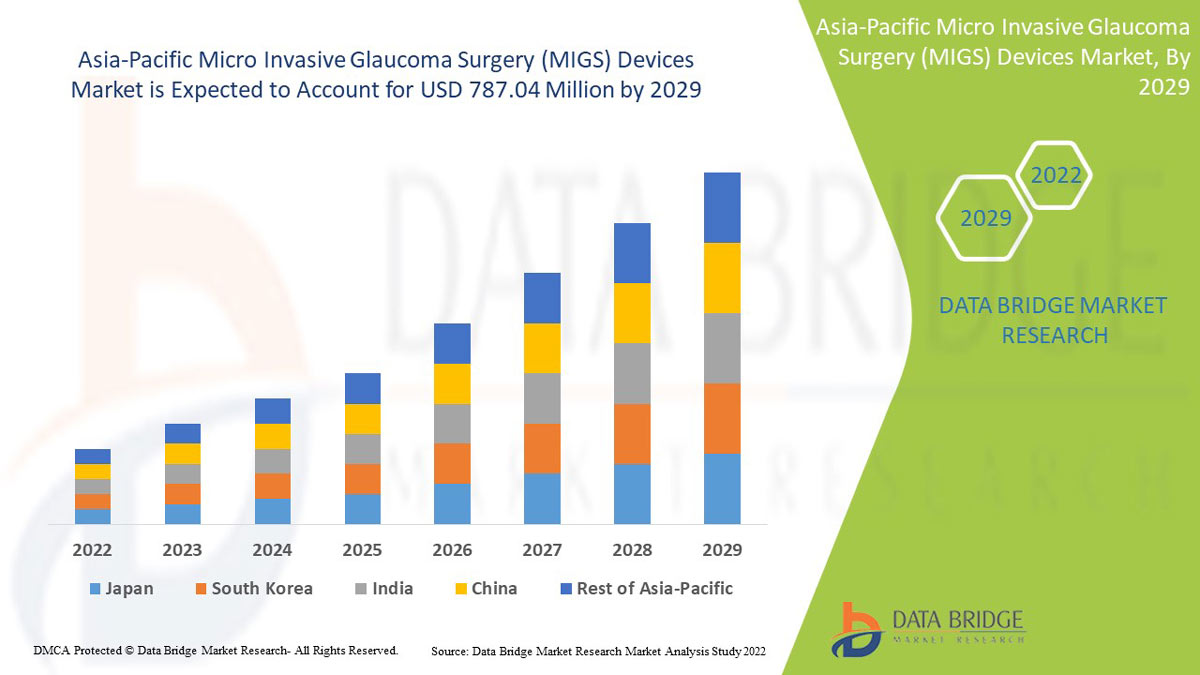

Data Bridge Market Research는 미세 침습성 녹내장 수술(MIGS) 장치 시장이 2029년까지 7억 8,704만 달러 규모에 도달할 것으로 예상하고 있으며, 예측 기간 동안 CAGR은 30.6%입니다. "MIGS 스텐트"는 미세 침습성 녹내장 수술(MIGS) 장치 사용을 상용화하기 위한 기술 경로의 빠른 발전으로 인해 미세 침습성 녹내장 수술(MIGS) 장치 시장에서 가장 큰 기술 부문을 차지합니다. 미세 침습성 녹내장 수술(MIGS) 장치 시장 보고서는 또한 심층적인 기술 발전을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익 (단위: USD 백만) |

|

다루는 세그먼트 |

제품별(MIGS 션트, MIGS 스텐트 및 기타), 대상(트라베큘라 메시워크, 맥락막상 공간, 결막하 여과 및 방수 생성 감소), 수술(백내장과 관련된 녹내장, 단독 녹내장), 최종 사용자(병원, 안과 진료소, 외래 수술 센터(ASCS) 및 기타), 유통 채널(직접 입찰 및 소매 판매) |

|

적용 국가 |

China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, Rest of Asia-Pacific in Asia-Pacific |

|

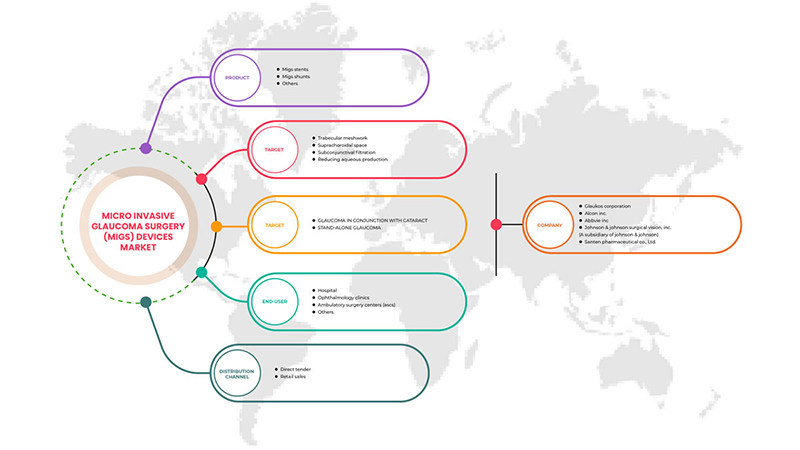

Market Players Covered |

AbbVie, BVI, Ellex, Glaukos Corporation, Johnson and Johnson, Alcon, Microsurgical technology, New World Medical, Santen Pharmaceutical, Nova Eye Medical Limited, Belkin Vision, and Sight Scientific among others. |

Market Definition

MIGS stands for micro invasive glaucoma surgery, which helps treat glaucoma. It is a breakthrough technology in the treatment of mild to moderate glaucoma. It is an alternative to the medications given earlier, and it also prevents the complications of conventional surgery. These procedures are used to lower the intra-ocular pressure of the eye to avoid damage to the optic nerve. These procedures are safer and have a very rapid recovery time compared to conventional surgery. The various MIGS devices implanted are shunts and stents to lower the IOP.

Micro Invasive Glaucoma Surgery (MIGS) Devices Market Dynamics

- Increase in the geriatric population

A significant health-related issue among the elderly is vision loss. According to the American Academy of Family Physicians, by age 65, one in three people suffer from vision-reducing eye disease. The elderly population is increasing rapidly. Therefore this creates a demand for advanced technologies to treat glaucoma amongst older adults. Hence, an increase in the geriatric population is a driver for the market.

- Rise in incidence of glaucoma across the world

The cause of irreversible global blindness is majorly glaucoma. A glaucoma is a group of eye disorders that have very little to no symptoms in the initial stage but afterward lead to damage of optic nerves, which can lead to vision loss or blindness. The prevalence of glaucoma has been increasing. Therefore this creates a demand for MIGS devices; hence an increasing incidence of glaucoma is expected to act as a driver for the market.

- Government initiatives to increase awareness about the prevention of blindness

According to WHO, at least 2.2 billion people have visual impairment and blindness, out of which at least 1 billion have a vision impairment that could have been prevented. To prevent these, the government of several countries across the globe have taken initiatives. This creates a demand for advanced treatments such as micro-invasive glaucoma surgery, which boosts the MIGS device market. Hence, it is expected to act as a driver for the market.

- Introduction of technological advanced product

Glaucoma is a severe eye disease that can lead to vision loss if not controlled. It generally does not lead to blindness as it can be controlled by modern treatment and many options for preventing further damage. With the increased scientific developments, there has been a revolutionary change in the treatment of glaucoma. With the advent of micro-invasive glaucoma surgery, there is a paradigm shift in medicine as it can help in the treatment of glaucoma at an early stage and avoid the dependency on filtration surgeries like trabeculectomy. This also overcomes the risks associated with these incisional surgeries. There are various advancements in the treatment of glaucoma with MIGS.

Restraints/Challenges faced by the Market

- Stringent regulations for MIGS devices

There are at least 7 regulations that any device manufacturer must completely fulfill in the U.S., namely Establishment Registration & Medical Device Listing, Premarket Notification 510(k), Premarket Approval (PMA)(only for class three devices), Investigational Device Exemption (IDE) for clinical studies, Quality System (QS) regulation, Labeling requirements, and Medical Device Reporting (MDR). These highest-risk devices need a more stringent premarket application regulatory process to demonstrate valid evidence of safety and efficacy. Lengthy timelines result in delayed access, which might restrict the market for MIGS devices.

- High cost of surgical procedures

Though glaucoma treatments have modest results and are safer than traditional filtration surgeries, they have very high costs. Also, people may require subsequent surgeries if the intra-ocular pressure is not effectively lowered at once. All these considerations make these procedures highly costly and inaccessible to most people and hence, high surgical procedure costs might be a restraint on the market.

Recent Developments

- In January 2022, Glaukos announced GLK=301's first patient enrolment in the Phase II clinical trial for dry eye disease. After the successful approval from the regulatory body, this drug will help the company grow its business segment.

- In January 2022, Alcon acquired Ivantis, developer of the novel Hydrus Microstent, a minimally invasive glaucoma surgery (MIGS) device. This surgical device is designed to lower eye pressure for open-angle glaucoma patients. This acquisition will enhance the company’s portfolio in eye surgery segment.

Micro Invasive Glaucoma Surgery (MIGS) Devices Market Scope

The micro invasive glaucoma surgery (MIGS) devices market is segmented on the basis of product, target, surgery, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- MIGS stents

- MIGS shunts

- Others

On the basis of product, the micro invasive glaucoma surgery (MIGS) devices market is segmented into MIGS shunts, MIGS stents, and others.

Target

- Trabecular meshwork

- Suprachoroidal space

- Subconjunctival filtration

- Reducing aqueous production

On the basis of target, the micro invasive glaucoma surgery (MIGS) devices market is segmented into the trabecular meshwork, suprachoroidal space, subconjunctival filtration, and reducing aqueous production.

Surgery

- Glaucoma in conjunction with cataract

- Stand-alone glaucoma

On the basis of surgery, the micro invasive glaucoma surgery (MIGS) devices market is segmented into glaucoma in conjunction with cataract and stand-alone glaucoma.

End User

- Hospital outpatient departments (HOPD)

- Ophthalmology clinics

- Ambulatory surgery centers (ASCS)

- Others

On the basis of end-user, the micro invasive glaucoma surgery (MIGS) devices market is segmented into hospital outpatient departments (HOPD), ophthalmology clinics, ambulatory surgery centers (ASCS), and others.

Distribution Channel

- Direct tender

- Retail sales

On the basis of distribution channel, the micro invasive glaucoma surgery (MIGS) devices market is segmented into direct tender and retail sales.

Micro Invasive Glaucoma Surgery (MIGS) Devices Market Regional Analysis/Insights

The micro invasive glaucoma surgery (MIGS) devices market is analysed and market size insights and trends are provided by country, product, target, surgery, end user, and distribution channel as referenced above.

The countries covered in the micro invasive glaucoma surgery (MIGS) devices market report are China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines and Rest of Asia-Pacific.

China dominates the Asia-Pacific micro invasive glaucoma surgery (MIGS) devices market. The demand in this region is projected to be driven by market players who are focusing on expanding their regional product offerings and enhancing their presence in emerging markets through various growth strategies, such as, expansions, partnerships, and collaborations among others.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Micro Invasive Glaucoma Surgery (MIGS) Devices Market Share Analysis

미세 침습성 녹내장 수술(MIGS) 장치 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 지역적 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우위가 있습니다. 위에 제공된 데이터 포인트는 미세 침습성 녹내장 수술(MIGS) 장치 시장에 대한 회사의 초점과만 관련이 있습니다.

미세 침습적 녹내장 수술(MIGS) 장비 시장의 주요 기업으로는 AbbVie, BVI, Ellex, Glaukos Corporation, Johnson and Johnson, Alcon, Microsurgical technology, New World Medical, Santen Pharmaceutical, Nova Eye Medical Limited, Belkin Vision, Sight Scientific 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INTERNATIONAL STANDARDS

4.2 REGIONAL STANDARDS

4.3 MARKET VIEWPOINT OF KEY OPINION LEADERS

4.4 EXPECTATIONS OF FUTURE MARKET SCENARIOS

4.5 FINDINGS AND REGIONAL TRENDS

4.6 COMPETITIVE GROUPING

5 COUNTRY WISE- NO OF PROCEDURES

5.1 NORTH AMERICA

5.2 EUROPE

5.3 ASIA-PACIFIC

5.4 SOUTH AMERICA

5.5 MIDDLE EAST AND AFRICA

6 REGULATION

6.1 UNITED STATES

6.2 EUROPE

6.3 CHINA

6.4 AUSTRALIA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN THE GERIATRIC POPULATION

7.1.2 RISE IN INCIDENCE OF GLAUCOMA ACROSS THE WORLD

7.1.3 GOVERNMENT INITIATIVES TO INCREASE AWARENESS ABOUT THE PREVENTION OF BLINDNESS

7.1.4 GROWTH IN POPULARITY OF MINIMALLY INVASIVE SURGERY ACROSS THE GLOBE

7.2 RESTRAINTS

7.2.1 INADEQUATE REIMBURSEMENT SCENARIO

7.2.2 STRINGENT REGULATIONS FOR MIGS DEVICES

7.2.3 HIGH COST OF SURGICAL PROCEDURES

7.3 OPPORTUNITIES

7.3.1 RAPID TRANSITION FROM GLAUCOMA MEDICATION TO MINIMALLY INVASIVE GLAUCOMA SURGERIES

7.3.2 INTRODUCTION OF TECHNOLOGICAL ADVANCED PRODUCT

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS WITH ADEQUATE KNOWLEDGE

7.4.2 RISKS ASSOCIATED WITH THE MICRO INVASIVE GLAUCOMA SURGERY

8 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 MIGS STENTS

8.3 MIGS SHUNTS

8.4 OTHERS

9 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET

9.1 OVERVIEW

9.2 TRABECULAR MESHWORK

9.3 SUPRACHOROIDAL SPACE

9.4 SUBCONJUNCTIVAL FILTRATION

9.5 REDUCING AQUEOUS PRODUCTION

10 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE

10.1 OVERVIEW

10.2 GLAUCOMA IN CONJUNCTION WITH CATARACT

10.3 STAND-ALONE GLAUCOMA

11 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITAL

11.3 OPHTHALMOLOGY CLINICS

11.4 AMBULATORY SURGERY CENTERS (ASCS)

11.5 OTHERS

12 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 SINGAPORE

13.1.7 THAILAND

13.1.8 MALAYSIA

13.1.9 INDONESIA

13.1.10 PHILIPPINES

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 GLAUKOS CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.4.1 RECENT DEVELOPMENT

16.2 ALCON INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.4.1 RECENT DEVELOPMENTS

16.3 ABBVIE INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.4.1 RECENT DEVELOPMENT

16.4 JOHNSON & JOHNSON SURGICAL VISION, INC. (A SUBSIDIARY OF JOHNSON & JOHNSON)

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.4.1 RECENT DEVELOPMENT

16.5 SANTEN PHARMACEUTICAL CO., LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.4.1 RECENT DEVELOPMENTS

16.6 BELKIN VISION, ISRAEL

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 BVI

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.2.1 RECENT DEVELOPMENTS

16.8 ELLEX INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.2.1 RECENT DEVELOPMENTS

16.9 IOPTIMA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 MICROSURGICAL TECHNOLOGY. (A SUBSIDIARY OF HALMA PLC)

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.2.1 RECENT DEVELOPMENT

16.11 NEW WORLD MEDICAL, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.2.1 RECENT DEVELOPMENTS

16.12 NOVA EYE MEDICAL LIMITED

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.3.1 RECENT DEVELOPMENTS

16.13 SIGHT SCIENCES.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.3.1 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 NUMBER OF PEOPLE (AGED 40-80 YEARS, IN MILLIONS) WITH GLAUCOMA IN 2013 AND PROJECTION OF THE NUMBER OF PEOPLE HAVING GLAUCOMA IN 2020 AND 2040

TABLE 2 NEW OPTIONS FOR GLAUCOMA TREATMENT

TABLE 3 NUMBER OF PHYSICIANS/ THOUSAND POPULATIONS

TABLE 4 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC MIGS STENTS IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MIGS SHUNTS IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC OTHERS IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC TRABECULAR MESHWORK IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC SUPRACHOROIDAL SPACE IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC SUBCONJUNCTIVAL FILTRATION IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC REDUCING AQUEOUS PRODUCTION IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC GLAUCOMA IN CONJUNCTION WITH CATARACT IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC STAND-ALONE GLAUCOMA IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC HOSPITAL IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC OPHTHALMOLOGY CLINICS IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC AMBULATORY SURGERY CENTERS (ASCS) IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC OTHERS IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC DIRECT TENDER IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC RETAIL SALES IN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 CHINA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 31 CHINA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 32 CHINA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 33 CHINA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 CHINA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 JAPAN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 36 JAPAN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 37 JAPAN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 38 JAPAN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 39 JAPAN MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 INDIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 INDIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 42 INDIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 INDIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 INDIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 SOUTH KOREA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 46 SOUTH KOREA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 47 SOUTH KOREA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH KOREA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 SOUTH KOREA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 AUSTRALIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 AUSTRALIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 52 AUSTRALIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 53 AUSTRALIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 AUSTRALIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 SINGAPORE MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 56 SINGAPORE MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 57 SINGAPORE MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 58 SINGAPORE MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 SINGAPORE MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 THAILAND MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 THAILAND MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 62 THAILAND MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 63 THAILAND MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 THAILAND MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 MALAYSIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 MALAYSIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 67 MALAYSIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MALAYSIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 MALAYSIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 INDONESIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 INDONESIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 72 INDONESIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 73 INDONESIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 INDONESIA MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 PHILIPPINES MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 76 PHILIPPINES MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY TARGET, 2020-2029 (USD MILLION)

TABLE 77 PHILIPPINES MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 78 PHILIPPINES MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 PHILIPPINES MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 REST OF ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: MARKET END USER GRID

FIGURE 9 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASING GERIATRIC POPULATIONAND RISING PREVALENCE OF GLAUCOMA IS EXPECTED TO DRIVE THE ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLAUCOMA SURGERY (MIGS) DEVICES MARKET

FIGURE 14 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY PRODUCT, 2021

FIGURE 15 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY TARGET, 2021

FIGURE 19 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY TARGET, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY TARGET, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY TARGET, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY SURGERY TYPE, 2021

FIGURE 23 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY SURGERY TYPE, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY END USER, 2021

FIGURE 27 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 31 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: SNAPSHOT (2021)

FIGURE 35 ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY COUNTRY (2021)

FIGURE 36 ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 ASIA-PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: BY PRODUCT (2022-2029)

FIGURE 39 ASIA PACIFIC MICRO INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.