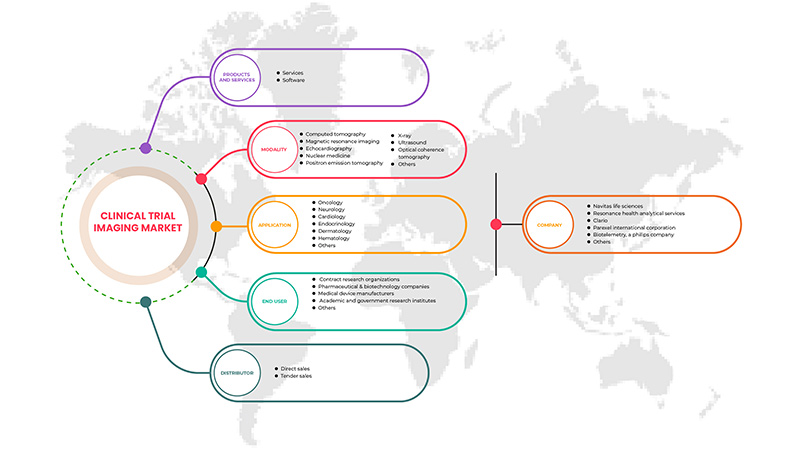

아시아 태평양 임상 시험 영상 시장, 제품 및 서비스(서비스 및 소프트웨어), 방식( 컴퓨터 단층촬영 , 자기공명영상, 심장초음파, 핵의학, 양전자 방출 단층촬영 , 엑스선, 초음파, 광간섭 단층촬영 및 기타), 응용 분야(종양학, 신경학, 내분비학, 심장학, 피부과, 혈액학 및 기타), 최종 사용자(제약 및 생명공학 회사, 계약 연구 기관, 의료 기기 제조업체, 학계 및 정부 연구 기관 및 기타), 유통업체(직접 판매 및 입찰 판매) - 업계 동향 및 2029년까지의 전망.

아시아 태평양 임상 시험 영상 시장 분석 및 통찰력

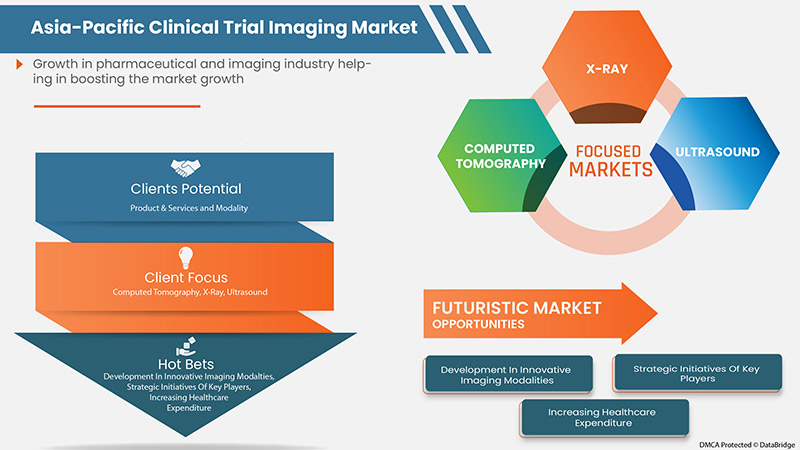

영상 기술에 대한 수요 증가, 노인 인구 증가로 인한 만성 질환 유병률 증가, 제품 출시, 개발, 인수 및 계약과 같은 시장 참여자의 전략적 이니셔티브가 시장 성장을 촉진할 것으로 예상되는 요소입니다.

그러나 영상 장비에 대한 부적절하고 불리한 환불 시나리오와 임상 시험 영상 장비에 대한 잘 정의된 표준이 부족하여 시장 성장이 제한될 것으로 예상됩니다.

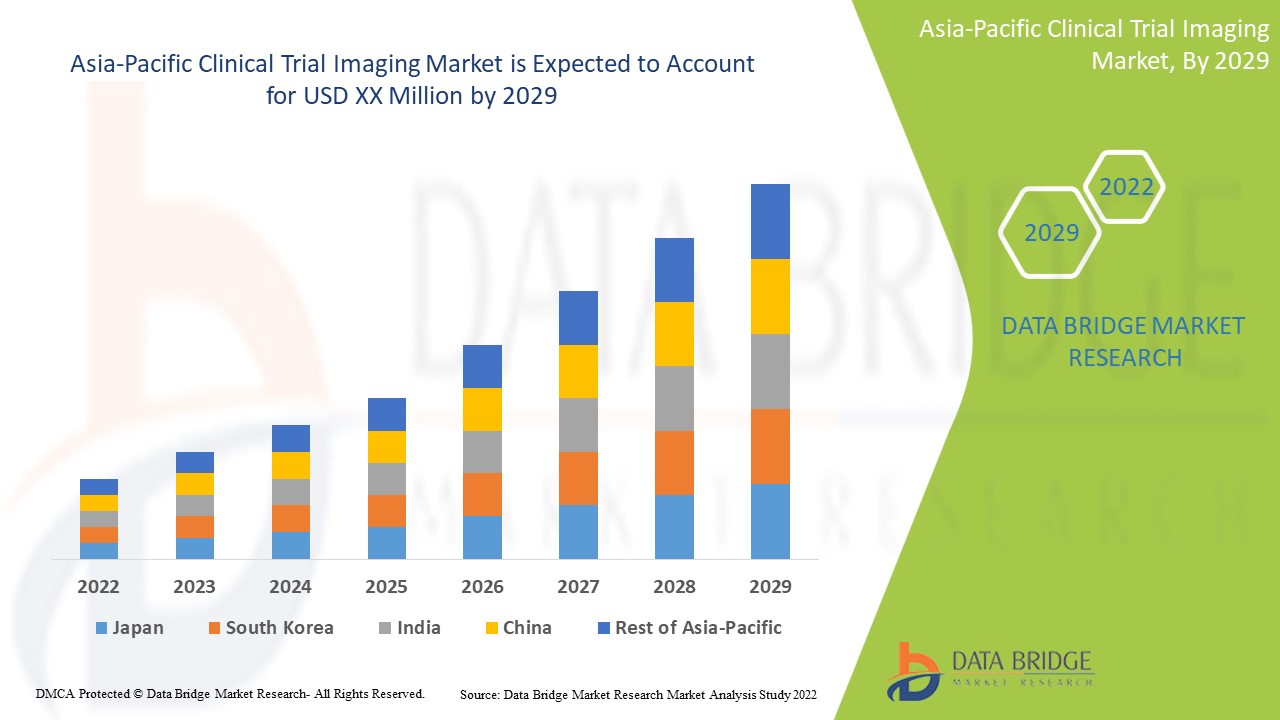

만성 질환의 진단 및 치료를 위한 임상 시험 영상 분야에서 기술적 진보가 증가함에 따라 시장 성장이 촉진될 것으로 예상됩니다. Data Bridge Market Research는 아시아 태평양 임상 시험 영상 시장이 2022년에서 2029년까지의 예측 기간 동안 8.8%의 CAGR로 성장할 것으로 분석했습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014로 사용자 정의 가능) |

|

양적 단위 |

매출은 백만 달러이고 가격은 미화입니다. |

|

다루는 세그먼트 |

제품 및 서비스(서비스 및 소프트웨어), 모달리티(컴퓨터 단층촬영, 자기공명영상, 심장초음파, 핵의학, 양전자 방출 단층촬영, X선, 초음파, 광 간섭 단층촬영 및 기타), 애플리케이션(종양학, 신경학, 내분비학, 심장학, 피부과, 혈액학 및 기타), 최종 사용자(제약 및 생명공학 회사, 계약 연구 기관, 의료 기기 제조업체, 학술 및 정부 연구 기관 및 기타), 유통업체(직접 판매 및 입찰 판매) |

|

적용 국가 |

중국, 일본, 한국, 인도, 호주, 싱가포르, 태국, 말레이시아, 인도네시아, 필리핀 및 아시아 태평양의 나머지 지역 |

|

시장 참여자 포함 |

Navitas Life Sciences, Resonance Health Analytical Services, ICON plc, Image Core Lab, Radiant Sage LLC, WORLDCARE CLINICAL, Clario, Paraxel International Corporation, Median Technologies, Perspectum, Calyx, WIRB-Copernicus Group 및 Invicro.LLC 등 |

시장 정의

Clinical trial is a process of developing new drugs. It is designed for potential treatment and its effects on humans. Before the commercialization of new drugs, extensive clinical testing is done to identify promising compounds and safety tests are conducted to determine the possible risks.

In clinical trials, medical imaging plays a significant role in more accurate and effective results. Different imaging technologies may be used to elucidate and demonstrate the mechanistic actions of drugs. Clinical trial imaging is the process of clinical analysis and medical intervention by creating image representations of inner parts of the body. It has several different technologies which are used to view the human body to monitor, treat and diagnose medical conditions.

In the coming future, important decisions related to clinical trial imaging on drug discovery will be made by individuals who not only understand the biopsy but can also use the clinical trial imaging tools and the knowledge they release to develop hypotheses and identify quality targets.

Asia-Pacific Clinical Trial Imaging Market Dynamics

Drivers

- Rising R&D Expenditure

Imaging and pharma companies are continuously investing in R&D to offer innovative services for clinical trial imaging to customers and enhance their market presence. Medical imaging plays a dynamic role in clinical development. While the medical imaging industry is in a constant state of fluctuation due to implementation of new technologies in the market, the pharmaceutical and imaging industries continue to increase. This is attributed to enhanced investment in medical imaging companies along with mergers and acquisitions as well as the adoption of innovation in imaging technologies to support clinical trials for medical devices. Increasing R&D expenditure in pharmaceutical and biotechnological companies is fuelling market growth.

This has encouraged the development of new products and high research-oriented programs organized in biopharmaceutical industries and a high preference for the studies of human genome. Rising expenditure on R&D activities also develops new drugs and therapies to treat chronic diseases that boost market growth. This helps the pharmaceutical and biotechnological companies in the development of new technologies in the category of imaging clinical trials therefore, rising R&D expenditure is expected to drive the market growth.

- Increasing Number of Contract Research Organizations (CROs)

Contract Research Organization (CRO) is an organization that gives support for clinical trials and other research services to imaging and pharmaceutical industries in the form of outsourced pharmaceutical research services in terms of both drugs and medical devices. CRO helps imaging and pharmaceutical industries with the drug development process to reduce the cost and initiate the process of bringing clinical trials to develop the drug for a particular disease segment by using clinical trial imaging and other processes to overcome capacity gaps of the in-house research team for pharmaceutical and clinical research.

A huge number of CROs are engaged in monitoring the drug development process such as PAREXEL (U.S.), PRA Health Sciences (U.S.), Labcorp (U.S.), PPD (U.S.), Syneos Health (U.S.), ICON plc (Ireland), Envigo (U.K.), Charles River (U.S.) and SGS (Switzerland) among others. These are some CROs that are engaged to give support for clinical trials and other research services to the imaging and pharmaceutical industries. The increasing number of CROs is expected to drive market growth.

Opportunities

- Rise in Healthcare Expenditure

Healthcare expenditure has increased across the world as people's disposable income in various countries is increasing. Moreover, to accomplish the population requirements, government bodies and healthcare organizations are taking the initiative by virtue of accelerating healthcare expenditure.

For instance,

- National Health Expenditure Accounts (NHEA) published a report which stated that the U.S. healthcare expenditure grew by 4.6% in 2019. This estimates USD 3.80 trillion for the overall U.S. population reported by U.S. Centers for Medicare (CMS) and GDP health, spending in the U.S. is accounted to reach 17.7%.

Growing healthcare expenditure is also beneficial for further growth in the economic and healthcare sector and it is primarily fruitful as it significantly affects the development of better and advanced medical products in the market. Therefore, the surge in healthcare expenditure is expected to create a greater opportunity for the market.

- Strategic Initiatives by Market Players

The demand for clinical trial imaging is increasing in the market owing to the increased levels of R&D along with the growth of clinical trial imaging market aided by the desire for innovative medications. Thus, the top market players have implemented a new strategy by developing new products and collaborating with other market players to improve business operations and profitability.

For instance,

- In February 2020, ICON plc acquired MedPass International, a European medical devices CRO, reimbursement and regulatory consultancy. This acquisition has reportedly helped in the expansion of the medical device and diagnostic research services of ICON in Europe.

These strategic initiatives by the market players, including acquisition, conferences and focused segment product launches, are helping them grow and improve the company's product portfolio, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players may act as an opportunity for market growth.

Restraints/Challenges

- High-Risk Radiation Causing Diseases

In clinical medical imaging, radiation is absorbed by the body which can harm molecular structures inside the patient’s body. High doses of radiation can affect human cells including loss of hair, skin burns and increased incidence of cancer. The estimated risk of developing fatal cancer is one in 2000 after going through a radiation dose of 10 mSv in a CT scan.

For instance,

- According to Radiological Society of America (RSNA), 1% to 2% of all cancers in the U.S. are caused by CT scans and the American Cancer Society identified CT scans and X-rays as one of the reasons for breast cancer, brain cancer and other cancers

- According to the Center for Disease Control and Prevention, exposure to high levels of radiation results in acute radiation syndrome. The amount of radiation that a person's body absorbs is called the radiation dose.

The high-risk radiation that occurs, would decrease the usage and sale of clinical trial imaging devices, thereby affecting the credibility of manufacturers involved in this market. Therefore, the high-risk radiation-causing diseases are expected to restrain the market growth.

- Strict Regulatory Policies

The healthcare industry is regulated by a structure of laws, rules & regulations that are extensive and complex.

For instance,

- In April 2018, the U.S. FDA released updated Guidance for Clinical Trial Imaging Endpoint Process Standards for the industry which includes the quality of imaging data obtained in clinical trials

- Biotechnology and pharmaceutical industries need to take first approval from the FDA for the process of drug development. They have to submit an Investigational New Drug (IND) application to the FDA before beginning clinical research.

COVID-19 Impact on the Asia-Pacific Clinical Trial Imaging Market

Diagnostic imaging services have been time-consuming and complicated by the need for strict infection control and prevention practices developed to contain the risk of transmission and protect healthcare personnel. Hence, the decision to image suspected patients or COVID-19-positive patients is based on their impact on the improvement of patient status. There have definitely been reduced volumes in outpatient medical imaging clinics due to social distancing regulations and lockdowns in Asia-Pacific region. This reduced the available appointments which led to longer waiting lists for exams such as ultrasound and interventional procedures.

Recent Developments

- In January 2022, Clario partnered with XingImaging, a radiopharmaceutical production and Positron Emission Tomography (PET) acquisition company, to deliver PET imaging clinical trials for testing novel therapeutics in China. The partnership offers to share the joint resources and neuroscience experts of Clario and XingImaging to expedite the startup of clinical trials and drug discovery in China.

- In November 2021, Clario was formed. ERT and Bioclinica, merged to form Clario. The formation of a new company resulted in the distribution of clinical imaging software and services and rise in sales.

Asia-Pacific Clinical Trial Imaging Market Scope

Asia-Pacific clinical trial imaging market is segmented into five segments based on product and services, modality, application, end user and distributor. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product and Services

- Services

- Software

Based on product and services, the market is segmented into services and software.

Modality

- Computed Tomography

- Magnetic Resonance Imaging

- Echocardiography

- Nuclear Medicine

- Positron Emission Tomography

- X-ray

- Ultrasound

- Optical Coherence Tomography

- Others

Based on modality, the market is segmented into computed tomography, magnetic resonance imaging, echocardiography, nuclear medicine, positron emission tomography, X-ray, ultrasound, optical coherence tomography and others.

Application

- Oncology

- Neurology

- Cardiology

- Endocrinology

- Dermatology

- Hematology

- Others

Based on application, the market is segmented into oncology, neurology, cardiology, endocrinology, dermatology, hematology and others.

End user

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Medical Device Manufacturers

- Academic and Government Research Institutes

- Others

Based on end user, the market is segmented into contract research organizations, pharmaceutical & biotechnology companies, medical device manufacturers, academic and government research institutes and others.

Distributor

- Direct Sales

- Tender Sales

Based on distributor, the market is segmented into direct sales and tender sales.

Asia-Pacific Clinical Trial Imaging Market Regional Analysis/Insights

Asia-Pacific clinical trial imaging market is analyzed and market size insights and trends are provided by regions, product and services, modality, application, end user and distributor as referenced above.

이 시장 보고서에서 다루는 국가는 중국, 일본, 한국, 인도, 호주, 싱가포르, 태국, 말레이시아, 인도네시아, 필리핀 및 기타 아시아 태평양 지역입니다. 중국은 임상 영상이 안전하고 사용하기 편리하기 때문에 시장을 지배할 것으로 예상됩니다. 중국 정부가 중국 내 진단 영상 분야에서 국내 공급업체를 설립하고 확립하는 데 있어 중요한 역할을 하는 것은 시장 성장을 견인할 것으로 예상되는 주요 요인 중 하나입니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 아시아 태평양 브랜드의 존재 및 가용성과 지역 및 국내 브랜드의 대규모 또는 희소한 경쟁으로 인해 판매 채널에 미치는 영향으로 인해 직면한 과제는 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 아시아 태평양 임상 시험 영상 시장 점유율 분석

아시아 태평양 임상 시험 영상 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, R&D 투자, 새로운 시장 이니셔티브, 아시아 태평양 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 아시아 태평양 임상 시험 영상 시장과 관련된 회사의 초점에만 관련이 있습니다.

이 시장에서 활동하는 주요 기업으로는 Navitas Life Sciences, Resonance Health Analytical Services, ICON plc, Image Core Lab, Radiant Sage LLC, WORLDCARE CLINICAL, Clario, Paraxel International Corporation, Median Technologies, Perspectum, Calyx, WIRB-Copernicus Group, Invicro.LLC 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS AND SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING R&D EXPENDITURE

6.1.2 INCREASING NUMBER OF CONTRACT RESEARCH ORGANIZATIONS (CROS)

6.1.3 INCREASING INCIDENCE OF CHRONIC DISEASES

6.1.4 GROWTH IN THE PHARMACEUTICAL AND IMAGING INDUSTRIES

6.2 RESTRAINTS

6.2.1 HIGH-RISK RADIATION CAUSING DISEASES

6.2.2 HIGH IMPLEMENTATION COST OF IMAGING SYSTEMS

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 DEVELOPMENT OF INNOVATIVE IMAGING MODALITIES AND CONTRAST AGENTS

6.4 CHALLENGES

6.4.1 STRICT REGULATORY POLICIES

6.4.2 COST OF CLINICAL TRIALS

7 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCTS & SERVICES

7.1 OVERVIEW

7.2 SERVICES

7.2.1 OPERATIONAL IMAGING SERVICES

7.2.2 READ ANALYSIS SERVICES

7.2.3 TRIAL DESIGN CONSULTING SERVICES

7.2.4 SYSTEM AND TECHNICAL SUPPORT SERVICES

7.3 SOFTWARE

8 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY MODALITY

8.1 OVERVIEW

8.2 COMPUTED TOMOGRAPHY

8.3 MAGENTIC RESONANCE IMAGING

8.4 ECHOCARDIOGRAPHY

8.5 NUCLEAR MEDICINE

8.6 POSITRON EMISSION TOMOGRAPHY

8.7 X-RAY

8.8 ULTRASOUND

8.9 OPTICAL COHERENCE TOMOGRAPHY

8.1 OTHERS

9 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ONCOLOGY

9.2.1 X-RAY

9.2.2 ULTRASOUND

9.2.3 COMPUTED TOMOGRAPHY

9.2.4 MAGNETIC RESONANCE IMAGING

9.2.5 NUCLEAR MEDICINE

9.2.6 POSITRON EMISSION TOMOGRAPHY

9.2.7 OPTICAL COHERENCE TOMOGRAPHY

9.2.8 ECHOCARDIOGRAPHY

9.2.9 OTHERS

9.3 NEUROLOGY

9.3.1 COMPUTED TOMOGRAPHY

9.3.2 MAGNETIC RESONANCE IMAGING

9.3.3 POSITRON EMISSION TOMOGRAPHY

9.3.4 NUCLEAR MEDICINE

9.3.5 X-RAY

9.3.6 ULTRASOUND

9.3.7 OPTICAL COHERENCE TOMOGRAPHY

9.3.8 ECHOCARDIOGRAPHY

9.3.9 OTHERS

9.4 CARDIOLOGY

9.4.1 ECHOCARDIOGRAPHY

9.4.2 MAGNETIC RESONANCE IMAGING

9.4.3 COMPUTED TOMOGRAPHY

9.4.4 POSITRON EMISSION TOMOGRAPHY

9.4.5 NUCLEAR MEDICINE

9.4.6 X-RAY

9.4.7 ULTRASOUND

9.4.8 OPTICAL COHERENCE TOMOGRAPHY

9.4.9 OTHERS

9.5 ENDOCRINOLOGY

9.5.1 COMPUTED TOMOGRAPHY

9.5.2 MAGNETIC RESONANCE IMAGING

9.5.3 ECHOCARDIOGRAPHY

9.5.4 POSITRON EMISSION TOMOGRAPHY

9.5.5 NUCLEAR MEDICINE

9.5.6 X-RAY

9.5.7 ULTRASOUND

9.5.8 OPTICAL COHERENCE TOMOGRAPHY

9.5.9 OTHERS

9.6 DERMATOLOGY

9.6.1 ULTRASOUND

9.6.2 X-RAY

9.6.3 MAGNETIC RESONANCE IMAGING

9.6.4 COMPUTED TOMOGRAPHY

9.6.5 OPTICAL COHERENCE TOMOGRAPHY

9.6.6 POSITRON EMISSION TOMOGRAPHY

9.6.7 NUCLEAR MEDICINE

9.6.8 ECHOCARDIOGRAPHY

9.6.9 OTHERS

9.7 HEMATOLOGY

9.7.1 ULTRASOUND

9.7.2 COMPUTED TOMOGRAPHY

9.7.3 MAGNETIC RESONANCE IMAGING

9.7.4 X-RAY

9.7.5 POSITRON EMISSION TOMOGRAPHY

9.7.6 NUCLEAR MEDICINE

9.7.7 OPTICAL COHERENCE TOMOGRAPHY

9.7.8 ECHOCARDIOGRAPHY

9.7.9 OTHERS

9.8 OTHERS

10 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY END USER

10.1 OVERVIEW

10.2 CONTRACT RESEARCH ORGANIZATION

10.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

10.4 MEDICAL DEVICE MANUFACTURERS

10.5 ACADEMIC AND GOVERNMENT RESEARCH INSTITUTES

10.6 OTHERS

11 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR

11.1 OVERVIEW

11.2 DIRECT SALES

11.3 TENDER SALES

12 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 NAVITAS LIFE SCIENCES

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 RESONANCE HEALTH ANALYTICAL SERVICES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 CLARIO

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 PARAXEL

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 BIOTELEMETRY, A PHILIPS COMPANY

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ICON PLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 MEDIAN TECHNOLOGIES

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 PERSPECTUM

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ANAGRAM 4 CLINICAL TRIALS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 CALYX

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 IMAGE CORE LAB

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 INVICRO. LLC. (A SUBSIDIARY OF KONICA MINOLTA)

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 IXICO PLC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 QUOTIENT SCIENCES

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 RADIANT SAGE LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 WIRB-COPERNICUS GROUP

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 WORLDCARE CLINICAL

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 COST OF CLINICAL TRIAL PHASE 2 AND PHASE 3

TABLE 2 HUGE R&D COST IN THE U.S. FOR DIFFERENT PHASES

TABLE 3 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC SOFTWARE IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC COMPUTED TOMOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC MAGNETIC RESONANCE IMAGING IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC ECHOCARDIOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC NUCLEAR MEDICINE IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC POSITRON EMISSION TOMOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC X-RAY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ULTRASOUND IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC OPTICAL COHERENCE TOMOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC OTHERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATION IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC MEDICAL DEVICE MANUFACTURERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC ACADEMIC AND GOVERNMENT RESEARCH INSTITUTES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC OTHERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC DIRECT SALES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC TENDER SALES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC NEUROLOGY CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION,2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 53 CHINA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 54 CHINA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 55 CHINA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 56 CHINA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 CHINA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 CHINA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 CHINA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 CHINA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 CHINA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 CHINA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CHINA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 CHINA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 65 JAPAN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 66 JAPAN SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 67 JAPAN CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 68 JAPAN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 JAPAN ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 JAPAN NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 JAPAN ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 JAPAN CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 JAPAN DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 JAPAN HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 JAPAN CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 JAPAN CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 88 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 89 INDIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 90 INDIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 91 INDIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 92 INDIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 INDIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 INDIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 INDIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 INDIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 INDIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 INDIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 INDIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 INDIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 AUSTRALIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 113 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 114 SINGAPORE SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 115 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 116 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 SINGAPORE ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 125 THAILAND CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 126 THAILAND SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 127 THAILAND CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 128 THAILAND CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 THAILAND ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 THAILAND NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 THAILAND ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 THAILAND CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 THAILAND DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 THAILAND HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 THAILAND CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 THAILAND CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 137 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 138 MALAYSIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 139 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 140 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 MALAYSIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 MALAYSIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 MALAYSIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 144 MALAYSIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 MALAYSIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 149 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 150 INDONESIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 151 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 152 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 INDONESIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 INDONESIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 155 INDONESIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 INDONESIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 INDONESIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 INDONESIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 PHILIPPINES DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 PHILIPPINES HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 171 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 173 REST OF ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: SEGMENTATION

FIGURE 11 THE INCREASING NUMBER OF CONTRACT RESEARCH ORGANIZATION AND RISING R&D EXPENDITURE ARE EXPECTED TO DRIVE THE ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET

FIGURE 14 WORLDWIDE BIOPHARMA COMPANIES R&D EXPENDITURE (IN USD MILLION)

FIGURE 15 THE MARKET GROWTH IN CLINICAL CRO (IN USD MILLIONS)

FIGURE 16 THE FUNCTION OF CRO

FIGURE 17 ESTIMATED NEW CANCER CASES, 2022

FIGURE 18 VALUE OF THE PHARMACEUTICAL SECTOR, WORLDWIDE, 2021 BY COUNTRY (IN MILLION U.S. DOLLARS)

FIGURE 19 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, 2021

FIGURE 20 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, 2021

FIGURE 24 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, 2021

FIGURE 28 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, 2021

FIGURE 32 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, 2021

FIGURE 36 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, LIFELINE CURVE

FIGURE 39 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET SNAPSHOT (2021)

FIGURE 40 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY COUNTRY (2021)

FIGURE 41 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCT & SERVICES (2022-2029)

FIGURE 44 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.