Asia Pacific Class B Bench Top Dental Autoclaves Market

시장 규모 (USD 10억)

연평균 성장률 :

%

| 2022 –2029 | |

| USD 12.52 Billion | |

| USD 17.22 Billion | |

|

|

|

아시아 태평양 클래스 B 벤치탑 치과용 오토클레이브 시장, 제품별(시스템, 액세서리), 재료(스테인리스 스틸 , 구리), 부하 유형(다공성 재료, 고체 재료, 기타), 용량(24L), 최종 사용자( 병원 및 치과 진료소, 치과 연구소, 학술 및 연구 기관, 기타) 산업 동향 및 2029년까지의 예측.

아시아 태평양 클래스 B 벤치탑 치과용 오토클레이브 시장 분석 및 통찰력

시장 성장을 주도하는 요인은 치과 질환 유병률 증가, 여러 치과 의사와 치과 병원의 증가, 미용 치과 시술 수요 증가, 병원 감염 유병률입니다. 그러나 엄격한 규제와 부적절한 환불 시나리오가 시장 성장을 억제할 것으로 예상됩니다.

반면, 시장 참여자들의 전략적 이니셔티브, 치과 건강 문제의 유병률 증가, 모든 연령대에 걸친 인식 증가, 의료비 지출 증가는 시장 성장의 기회로 작용할 수 있습니다. 그러나 숙련된 전문성의 필요성, 치과 연구소에서 클래스 B 벤치탑 치과용 오토클레이브를 구현하는 데 따른 과제, 규제 승인은 시장에 과제를 안겨줄 수 있습니다.

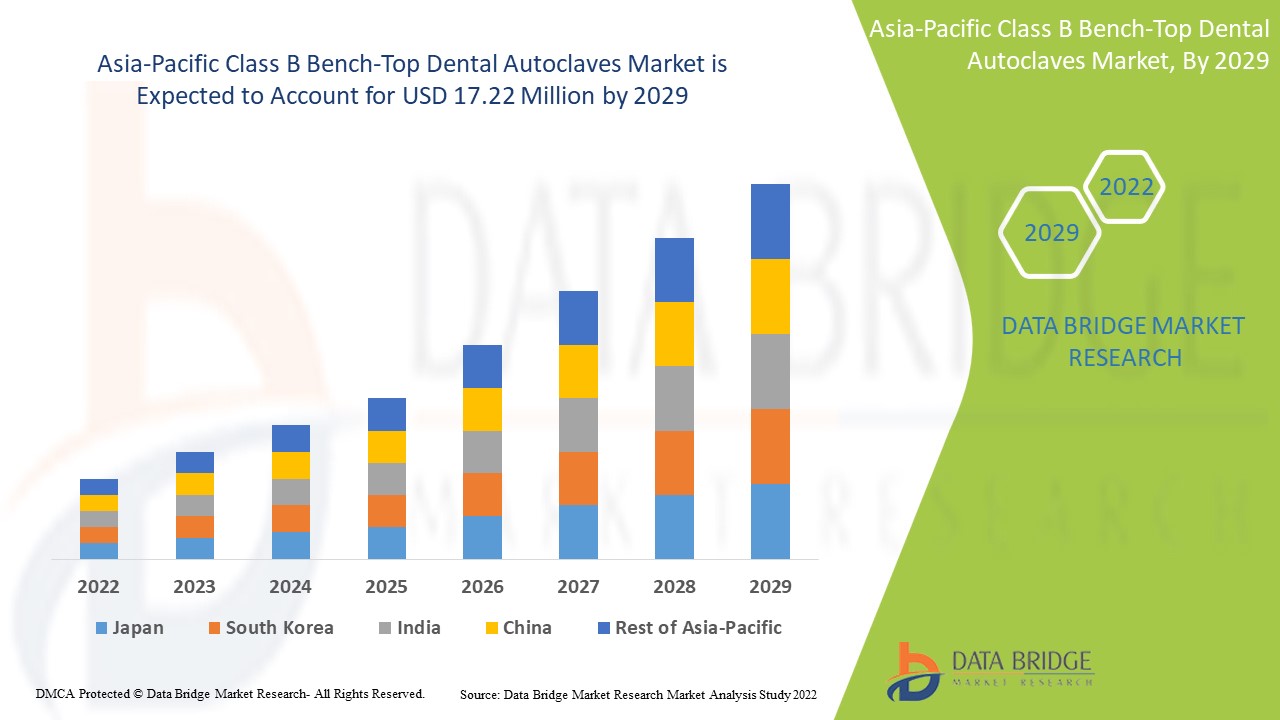

아시아 태평양 클래스 B 벤치탑 치과용 오토클레이브 시장은 2022년부터 2029년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년부터 2029년까지의 예측 기간 동안 4.0%의 CAGR로 성장하고 있으며 2021년 1,252만 달러에서 2029년까지 1,722만 달러에 도달할 것으로 예상한다고 분석합니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014로 사용자 정의 가능) |

|

양적 단위 |

매출(백만 달러), 볼륨(단위) |

|

다루는 세그먼트 |

제품(시스템, 부속품), 재질(스테인리스 강 , 구리), 하중 유형(다공성 재료, 고체 재료, 기타), 용량(<10L, 10L-16L, 16L-18L, 18L-24L, >24L), 최종 사용자( 병원 및 치과, 치과 연구소, 학술 및 연구 기관, 기타) |

|

적용 국가 |

중국, 일본, 한국, 호주, 싱가포르, 태국, 말레이시아, 인도네시아 및 아시아 태평양의 나머지 지역 |

|

시장 참여자 포함 |

NSK/Nakanishi Inc., W&H DENTALWERK INTERNATIONAL, Dentsply Sirona, Celitron Medical Technologies Kft, MELAG Medizintechnik GmbH & Co. KG, STURDY INDUSTRIAL CO., LTD., ZEALWAY Instrument Inc., LTE Scientific Ltd, 2022, FONA srl, Tuttnauer, Tecno-Gaz SpA, NEWMED 등 |

시장 정의

The class B bench-top dental autoclaves are defined by a pre-sterilization vacuum cycle. Class B is considered the highest autoclave class and can be used to sterilize all loads, including solids, type A hollow instruments, type B hollow instruments, porous loads, and wrapped instruments. The class B bench-top autoclaves should clear the Helix test as per standard EN 13060 outlined by EN 867-5:2001. This can only be achieved by the use of a pre-sterilization fractionated vacuum. Post sterilization vacuum drying ensures complete drying of all loads after the entire sterilization process. A class B Sterilizer is a must have autoclave in every dental clinic. It provides highly effective and safe sterilization for instruments. STERICOX class b autoclaves meet EN13060 standard and come in 23 liters' capacity, which is the most preferred brand at an economical price. Class B dental sterilizers are extensively used in medical and dentistry to safeguard the security of doctors, staff, and patients. Various types of loads such as porous materials, textiles, products in pouches, turbines, wands, and tips can be effectively sterilized in a Class B dental autoclave.

Asia-Pacific Class B Bench-Top Dental Autoclaves Market Dynamics

Drivers

-

INCREASED PREVALENCE OF DENTAL DISORDERS

Oral health refers to the healthy gums, teeth, and oral facial system that enables speaking, chewing, and smiling. The most common dental disorders include tooth decay, periodontal diseases, and oral cancer, among others. According to World Health Organization's report, around 2.3 billion people in the world are suffering from caries of a permanent tooth, among which around 530 million children suffer from caries of the primary tooth.

Tooth decay results from a complex interplay of variables, including bacteria, host susceptibility, time, food, and others. Unhygienic practices, such as poor oral health, can cause tooth decay that will have an impact on the growth and maturity of permanent teeth, and widespread consumption of sugary foods causes teeth cavitation. Sterilization is an essential step in reusable dental instruments that have become contaminated due to all the biological fluids.

As the number of dental disorders increases, the chance of infection or cross-contamination through dental equipment also increases. Thus, the availability and use of class B bench-top dental autoclaves are projected to drive market expansion due to the rise in dental disorders.

Thus, increasing cases of dental disorders such as dental caries, tooth decay, and oral cancers are expected to boost the growth of the Asia-Pacific class B bench-top dental autoclaves market.

-

INCREASED NUMBER OF DENTAL PRACTITIONERS AND DENTAL CLINICS

As the number of dental problems is increasing globally, the need for dental professionals and dental clinics is also increasing. As the usage of advanced instruments demands trained dental professionals, there is a surge in the number of dental practitioners in developing and developed countries.

Thus, the increased dentist population and dental labs number is expected to drive the market growth in the forecasted period.

-

INCREASED DEMAND FOR COSMETIC DENTAL PROCEDURES

Cosmetic dentistry enhances the idea of oral health by producing a complete sense of well-being that includes both feeling and looking excellent. New dental materials yield superior results, as cosmetic dentistry has advanced over time. The development of cosmetic dentistry has paved the door for greater, more long-lasting changes to the face that go far beyond simply correcting teeth. Thus, the demand for cosmetic dental procedures has increased the market growth of class B bench top autoclaves as they include a powerful vacuum pump to remove all the air from their chamber, which allows them to sterilize every part of the instruments needed for dental procedures effectively. Its speed and user-friendly interface have raised its demand among health practitioners.

Opportunities

-

RISING PREVALENCE OF DENTAL HEALTH ISSUES AND AWARENESS ACROSS ALL AGE GROUPS

Dental issues are sometimes overlooked, which leads to major dental problems. Increasing cases of oral or dental infections are prevalent according to various age groups. Hence, government bodies have imposed various dental health-related guidelines. Moreover, government bodies and healthcare organizations are spreading awareness to control infections through various health resolutions and programs.

Growing dental health programs significantly affect the development of better and advanced dental products in the market. Thereby surge in dental issues and awareness across all age groups is a greater opportunity for the Asia-Pacific class B bench-top dental autoclaves market growth.

Restraints/Challenges

-

LACK OF AWARENESS ABOUT DENTAL HYGIENE

The development of the worldwide dental autoclave market is anticipated to be hampered by developing nations' lack of dental hygiene awareness.

For instance, oral disorders are commonplace worldwide and negatively impact people's health and the global economy.

The majority of countries continue to see an increase in the prevalence of oral diseases, which is mostly a result of people's poor access to oral health care facilities and lack of knowledge about dental hygiene (which leads to people being unaware of the importance of dental hygiene).

-

INAPPROPRIATE REIMBURSEMENT SCENARIO

Reimbursement is one of the crucial scenarios for the expansion of this market. Various agencies are involved in providing refunds for it.

However, some issues exist, such as inappropriate coverage and lack of transparency in reimbursement procedures. These limitations restrict dental professionals from accessing products at affordable costs, decreasing product developers' incentives.

For instance,

- In April 2019, Endeavor Business Media LLC. reported that the reimbursement rate on dental healthcare is declining. Chasing down reimbursements, understanding the intricacies of exclusions, waiting periods, and preapprovals, submitting appropriate documentation, and filing claims for refund are just a few of the many responsibilities required for each patient visit which makes it hard for reimbursement processes to go smooth and convenient

- According to the NCBI article, the barriers included in dental coverage such as lack of coverage, insufficient coverage, inability to find a dentist who accepts the insurance, poor quality of care for the uninsured, and having to wait for coverage to take effect, among others

The current coverage evaluation procedure lacks transparency and differs among different payers, leading to inconsistent coverage decisions and limiting healthcare professionals' access to the best instruments.

These limitations lead to delays in the development and investment of novel devices. As per the publication of NCBI, this has been projected that lack of dental reimbursement is a significant barrier to seeking dental care, which is expected to restrain the market's growth.

Recent Development

- In October 2021, W&H announced that it could cover the entire workflow for minimally invasive oral surgery with a modular solution that will simplify clinical work and open up new prospects for treatment. Thus, it will help the company in generating more revenue

Asia-Pacific Class B Bench-Top Dental Autoclaves Market Scope

Asia-Pacific class B bench-top dental autoclaves market is segmented into product, material, load type, capacity, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Systems

- Accessories

On the basis of products, the Asia-Pacific class B bench-top dental autoclaves market is segmented into systems and accessories.

Material

- Stainless Steel

- Copper

On the basis of material, the Asia-Pacific class B bench-top dental autoclaves market is segmented into stainless steel and copper.

Load Type

- Solid Materials

- Porous Materials

- Others

On the basis of load type, the Asia-Pacific class B bench-top dental autoclaves market is segmented into solid materials, porous materials, and others.

Capacity

- <10L

- 10L-16L

- 16L-18L

- 18L-24L

- >24L

On the basis of capacity, the Asia-Pacific class B bench-top dental autoclaves market is segmented into <10L, 10L-16L, 16L-18L, 18L-24L, and >24L.

End User

- Hospitals and Dental Clinics

- Dental Laboratories

- Academic and Research Institutes

- Others

On the basis of end user, the Asia-Pacific class B bench-top dental autoclaves market is segmented into hospitals and dental clinics, dental laboratories, academic and research institutes, and others.

Asia-Pacific Class B Bench-Top Dental Autoclaves Market Regional Analysis/Insights

Asia-Pacific class B bench-top dental autoclaves market is analyzed, and market size insights and trends are provided by country, product, material, load type, capacity, and end user.

Asia-Pacific class B bench-top dental autoclaves market is divided into China, Japan, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia and Rest of the Asia-Pacific.

China is expected to lead the class B bench-top dental autoclaves lab due to a rise in research and development and funding from public and private market players in the development of class B bench-top dental autoclaves and a rise in the number of dental practitioners

The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Asia-Pacific brands, the challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing a forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Class B Bench-Top Dental Autoclaves Market Share Analysis

Asia-Pacific class B bench-top dental autoclaves market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focusing on the Asia-Pacific class B bench-top dental autoclaves market.

Some of the major players operating in the Asia-Pacific class B bench-top dental autoclaves market are NSK/Nakanishi Inc., W&H DENTALWERK INTERNATIONAL, Dentsply Sirona, Celitron Medical Technologies Kft, MELAG Medizintechnik GmbH & Co. KG, STURDY INDUSTRIAL CO., LTD., ZEALWAY Instrument Inc., LTE Scientific Ltd, 2022, FONA s.r.l., Tuttnauer, Tecno-Gaz S.p.A., NEWMED, among others.

Research Methodology

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 아시아 태평양 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가에게 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 RESEARCH METHODOLOGY

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 THE CATEGORY VS TIME GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF DENTAL DISORDERS

6.1.2 INCREASED NUMBER OF DENTAL PRACTITIONERS AND DENTAL CLINICS

6.1.3 INCREASED DEMAND FOR COSMETIC DENTAL PROCEDURES

6.1.4 INCREASED PREVALENCE OF HOSPITAL-ACQUIRED INFECTION

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS

6.2.2 INAPPROPRIATE REIMBURSEMENT SCENARIO

6.2.3 INSUFFICIENT ATTENTION TO PROCESS

6.3 OPPORTUNITIES

6.3.1 RISING PREVALENCE OF DENTAL HEALTH ISSUES AND AWARENESS ACROSS ALL AGE GROUPS

6.3.2 STRATEGIC INITIATIVES OF KEY PLAYERS

6.3.3 RISING HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 HIGH COST OF BENCH-TOP DENTAL AUTOCLAVES

6.4.2 LACK OF AWARENESS ABOUT DENTAL HYGIENE

7 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 SYSTEMS

7.2.1 AUTOMATIC

7.2.2 SEMI-AUTOMATIC

7.2.3 MANUAL

7.3 ACCESSORIES

8 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 STAINLESS STEEL

8.3 OTHERS

9 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE

9.1 OVERVIEW

9.2 SOLID MATERIAL

9.2.1 TYPE A SOLID LOADS WITH HOLLOW SECTIONS

9.2.2 TYPE B SOLID LOADS WITH HOLLOW SECTIONS

9.3 POROUS MATERIAL

9.4 OTHERS

10 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 18L-24L

10.3 16L-18L

10.4 >24L

10.5 >10L-16L

10.6 <10L

11 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & DENTAL CLINICS

11.3 DENTAL LABORATORIES

11.4 ACADEMIC & RESEARCH INSTITUTES

11.5 OTHERS

12 ASIA PACIFIC CLASS B BENCH TOP DENTAL AUTOCLAVE MARKET BY COUNTRY

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 AUSTRALIA

12.1.5 SINGAPORE

12.1.6 THAILAND

12.1.7 MALAYSIA

12.1.8 INDONESIA

12.1.9 REST OF ASIA-PACIFIC

13 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY LANDSCAPE

14 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 W&H DENTALWERK INTERNATIONAL

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENT

16.2 NSK/NAKANISHI INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 MELAG MEDIZINTECHNIK GMBH & CO. KG

16.3.1 COMPANY SNAPSHOT

16.3.2 1.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENTS

16.4 FARO

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 EURONDA SPA

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 CELITRON MEDICAL TECHNOLOGIES KFT

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 DENTSPLY SIRONA

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 FLIGHT DENTAL SYSTEM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 FONA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 LTE SCIENTIFIC LTD, 2022

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 LABOMIZ SCIENTIFIC

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 MEDICAL TRADING S.R.L.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MATACHANA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 NEU-TEC GROUP INC.

16.15 COMPANY SNAPSHOT

16.15.1 PRODUCT PORTFOLIO

16.15.2 RECENT DEVELOPMENT

16.16 NEWMED

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PRIORCAVE LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 STURDY INDUSTRIAL CO., LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 TUTTNAUER

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 TECNO-GAZ S.P.A.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 ZEALWAY INSTRUMENT INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 ASIA-PACIFIC SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 4 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA-PACIFIC SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 8 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY, BY VOLUME 2020-2029 (UNITS)

TABLE 10 CHINA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 CHINA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 CHINA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 CHINA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 14 CHINA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 15 CHINA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 16 CHINA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 17 JAPAN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 18 JAPAN SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 JAPAN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 20 JAPAN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 21 JAPAN SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 22 JAPAN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 23 JAPAN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 SOUTH KOREA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 SOUTH KOREA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 SOUTH KOREA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 27 SOUTH KOREA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 28 SOUTH KOREA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 29 SOUTH KOREA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 30 SOUTH KOREA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 AUSTRALIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 32 AUSTRALIA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 AUSTRALIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 34 AUSTRALIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 35 AUSTRALIA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 36 AUSTRALIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 37 AUSTRALIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 SINGAPORE CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 39 SINGAPORE SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 SINGAPORE CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 41 SINGAPORE CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 42 SINGAPORE SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 43 SINGAPORE CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 44 SINGAPORE CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 THAILAND CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 46 THAILAND SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 THAILAND CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 48 THAILAND CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 49 THAILAND SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 50 THAILAND CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 51 THAILAND CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 MALAYSIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 MALAYSIA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 MALAYSIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 55 MALAYSIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 56 MALAYSIA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 57 MALAYSIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 58 MALAYSIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 INDONESIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 INDONESIA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 INDONESIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 62 INDONESIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 63 INDONESIA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 64 INDONESIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 65 INDONESIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 REST OF ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: GEOGRAPHIC SCOPE

FIGURE 3 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: DATA TRIANGULATION

FIGURE 4 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: SNAPSHOT

FIGURE 5 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 6 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: INTERVIEWS: BY REGION AND DESIGNATION

FIGURE 8 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC, CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: END USER COVERAGE GRID

FIGURE 10 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: THE CATEGORY VS TIME GRID

FIGURE 11 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET SEGMENTATION

FIGURE 12 GROWING APPLICATIONS OF CLASS B BENCH-TOP DENTAL AUTOCLAVES, RISE IN PREVALENCE OF DENTAL DISORDERS AND RISE IN DENTAL PRACTITIONERS, AND INCREASED SAFETY OF HYGIENE AND MAINTENANCE ARE EXPECTED TO DRIVE THE MARKET FOR ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET IN 2019 AND 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE CLASS B BENCH-TOP DENTAL AUTOCLAVE MARKET

FIGURE 15 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, 2021

FIGURE 16 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 17 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 18 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, 2021

FIGURE 20 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, 2022-2029 (USD MILLION)

FIGURE 21 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, CAGR (2022-2029)

FIGURE 22 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 23 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, 2021

FIGURE 24 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, 2022-2029 (USD MILLION)

FIGURE 25 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, CAGR (2022-2029)

FIGURE 26 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, LIFELINE CURVE

FIGURE 27 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, 2021

FIGURE 28 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, 2022-2029 (USD MILLION)

FIGURE 29 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, CAGR (2022-2029)

FIGURE 30 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, LIFELINE CURVE

FIGURE 31 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, 2021

FIGURE 32 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET : SNAPSHOT (2021)

FIGURE 36 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET : BY COUNTRY (2021)

FIGURE 37 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET : BY COUNTRY (2022 & 2029)

FIGURE 38 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET : BY COUNTRY (2021 & 2029)

FIGURE 39 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET : BY PRODUCT (2022-2029)

FIGURE 40 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.